- Home

- »

- Homecare & Decor

- »

-

Pressure Relief Mattress Market Report, 2021-2028GVR Report cover

![Pressure Relief Mattress Market Size, Share & Trends Report]()

Pressure Relief Mattress Market Size, Share & Trends Analysis Report By Type (Solid-filled Mattress, Air-filled Mattress, Fluid-filled Mattress), By Distribution Channel (Direct Sales, Indirect Sales), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-730-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

Report Overview

The global pressure relief mattress market size was valued at USD 1.66 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.0% from 2021 to 2028. The market growth is dependent on the increasing prevalence of pressure ulcers globally and substantial investment in healthcare facilities. In addition, the growing geriatric population in various countries is driving the market. The market observed positive growth in 2020 owing to the hospitalization of a large number of people. The demand was high in both hospital and consumer applications. Home isolation and treatment of COVID-19 patients at home created a significant demand for these mattresses. The demand for pressure relief mattresses is high from the geriatric population and this population was majorly affected by COVID-19 due to their weak immune system.

Pressure ulcers are localized injuries to the skin; the underlying tissue may or may not be affected as well. Pressure ulcers are also known as decubitus ulcers, bedsores, pressure sores, and pressure injuries. Various types of support mechanisms are used in the pressure reduction or pressure relief of ulcers. Among them, mattresses are one of the supports that are predominantly used. These mattresses can be categorized as per the material that they contain, the theory on which they function (active, reactive, hybrid), and whether they are powered or non-powered. To understand pressure relief mattresses, there are grades of pressure ulcers that are worth considering. Grade 1 - reddening of the skin, grade 2 - blisters, grade 3 - underlying tissue damage, and grade 4 - underlying tissue and skin extensively damaged together with muscle, bone, joints, and tendons.

Various economies globally are taking adequate steps in infrastructure development, and the healthcare sector is one of the key development areas. Countries such as India and China have opened up the gates for foreign direct investment (FDI) in the healthcare sector. Several companies are trying to build their positions in these regions. This has resulted in increased demand for pressure relief mattresses as the number of hospitals is increasing. Pressure ulcers can be treated and prevented with proper management and care. Various campaigns have been launched over the recent years for increasing awareness among the consumers. Some active campaigns engaged in pressure ulcer prevention include - Stop The Pressure, Your Turn: Campaigning to Prevent Pressure Ulcers, and Zero Pressure.

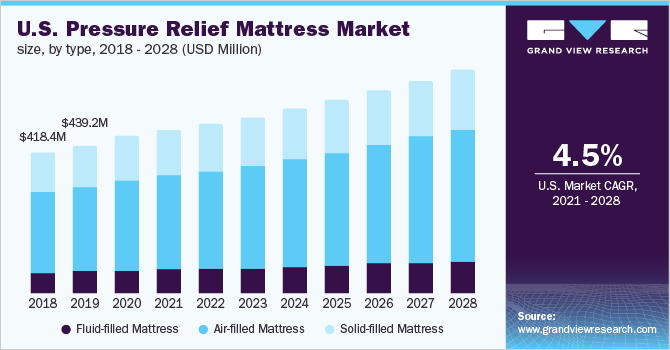

Type Insights

The air-filled mattress segment dominated the market and held a revenue share of over 55.0% in 2020. The segment is expected to expand at the fastest CAGR over the forecast period in terms of revenue. Air-filled mattresses are one of the most used mattresses for the prevention of pressure sores. The pressure is distributed over larger areas, which creates a better interface. Air mattresses typically have alternating cells that allow a part of the body to be in contact with the mattress at a time. Alternating cell pressure relief mattresses are generally recommended for Grade 3 and Grade 4 ulcers. Governments of various nations have taken the issue of pressure injuries into significant consideration and are trying to keep up with the quality of hospitals around. According to the CEO of Bruin Biometrics LLC (a medical technology company), in the U.S., over 2.5 million people acquire pressure injury or pressure ulcers every year. Air filled-mattresses are expected to curb this.

The solid-filled mattress segment held the second-largest revenue share in 2020. Solid-filled mattresses are usually static mattresses made-up of foam or fiber. Some foam mattresses such as memory foam mattresses are helpful in preventing pressure injuries. In the solid-filled mattress, the foam remains in the static position and relieves pressure by equally distributing load at steady low pressure. Solid-filled mattresses such as foam mattresses and fiber mattresses are the most common mattresses. Foam-filled mattresses are normally recommended for the grade-1 type of pressure ulcers as long as there is room for turning the patient. They have a textured upper surface or cross-cut for conformity. It also ensures raising skin temperature as foam acts as an insulator. This mattress is usually preferred for patients with a high risk of developing sores but still have mobility.

Distribution Channel Insights

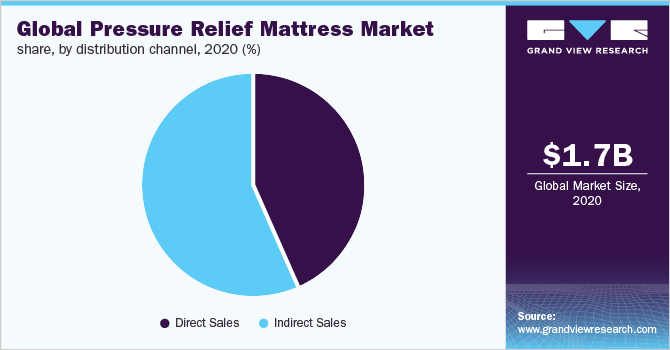

The indirect sales segment held the largest revenue share of over 55.0% in 2020. The indirect sales channel includes distributors, retail stores, and third-party e-commerce platforms. Buyers usually buy these products through third-party stores, distributors, and online platforms owing to their convenience and easy availability. The companies operating in the market can set up ties with third-party distributors and retail stores to increase their sales. The online channels can also be utilized by the companies as a part of the indirect sales channel to enhance the customer base. The sales of innovative and differentiated products are driven by well-versed salespersons that uptick the sales. To ensure a high-quality buying experience, the players are focusing on improving sales capabilities by expanding their distribution network across the globe.

The direct sales segment is expected to expand at a CAGR of 4.6% over the forecast period in terms of revenue. The direct sales channel eliminates the meddling of any third-party distributor as the products are directly shipped to the customers. The manufacturers can directly sell their products through an online or offline platform. Moreover, the firms or organizations that use direct channels require their logistics and transport vehicles. The direct channel allows manufacturers to communicate with the client personnel to develop a suitable product directly. Additionally, it helps the manufacturers to provide aftersales support and maintain the customer-manufacturer relationship.

Regional Insights

North America dominated the market and accounted for over 35.0% share of the global revenue in 2020. Decubitus ulcers, bedsores, or pressure ulcers are the most common diseases that occur in the U.S. According to the Agency for Healthcare Research and Quality (AHRQ), in the U.S., over 2.5 million people suffer from decubitus ulcers every year. This indicates high potential for the market in the country as pressure relief mattress is crucial in the treatment and prevention of pressure ulcers. The prevalence of pressure ulcers is higher in Canada compared to the U.S. and Mexico. According to the National Center for Biotechnology Information (NCBI), the prevalence of pressure ulcers was recorded at around 26.0% in all healthcare institutions of Canada.

Asia Pacific is anticipated to expand at the highest CAGR of 7.0% over the forecast period in terms of revenue. The presence of a large geriatric population in Japan is one of the key factors for market growth. A 2017 study conducted by the NCBI, in Goto, Japan, showed that out of 1126 participants, close to 10% had one or more pressure injuries, which is a relatively high number for a rural setting. The prevalence rate of pressure ulcers in Japan is higher due to its older population. As the number of pressure injuries rises, the case for the prevention of pressure injuries becomes stronger, thereby increasing the demand for pressure relief mattresses.

Key Companies & Market Share Insights

The global market is highly concentrated. Few major companies accounted for over 60% share in the market in 2020. The players operating in the market offer a wide range of products including air-filled mattresses, gel-filled mattresses, water-filled mattresses, and hybrid air-foam-filled mattresses. The competition among players is based on numerous parameters including quality, product offerings, innovation, corporate reputation, and price. New product launches, innovations, geographical expansions, distribution network expansion, joint ventures, and mergers & acquisitions are some of the key strategies adopted by the players to strengthen their position in the market and gain a greater market share.

For instance, in January 2017, Drive Devilbiss Healthcare Limited announced the acquisition of Sidhil Group Limited (a healthcare products manufacturing company). Through this acquisition, Drive Devilbiss enhanced its product portfolio of pressure relief mattresses among other products. Similarly, in February 2020, Permobil signed an agreement to acquire Supportec B.V. to speed up its production process and strengthen its seating and positioning footprint in the EMEA region. In November 2019, Rober Limited introduced a new product in its AirFlex series, the AirFlex TRIO Junior mattress, a pressure mattress replacement system designed to support children aged 0-13 years. Some prominent players in the global pressure relief mattress market include:

-

Hill-Rom Holdings, Inc.

-

Invacare Corporation

-

Paramount Bed Co. Ltd.

-

Stryker

-

Abecca

-

ADL GmbH

-

Arjo

-

Span America

-

FazziniSrl

-

Lifeline Corporation

-

Talley Group Ltd.

-

Linet

-

Apex Medical Corp.

-

Drive DeVilbiss Healthcare

-

Malvestio Spa

-

Permobil

-

Carilex Medical

-

Rober Limited

-

EHOB

-

Benmor Medical

-

Lloyds Pharmacy Limited

Pressure Relief Mattress Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 1.74 billion

Revenue forecast in 2028

USD 2.45 billion

Growth rate

CAGR of 5.0% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Hill-Rom Holdings, Inc.; Invacare Corporation; Paramount Bed Co. Ltd.; Stryker; Abecca; ADL GmbH; Arjo; Span America; FazziniSrl; Lifeline Corporation; Talley Group Ltd.; Linet; Apex Medical Corp.; Drive DeVilbiss Healthcare; Malvestio Spa; Permobil; Carilex Medical; Rober Limited; EHOB; Benmor Medical; Lloyds Pharmacy Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global pressure relief mattress market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Solid-filled Mattress

-

Air-filled Mattress

-

Fluid-filled Mattress

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Direct Sales

-

Indirect Sales

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pressure relief mattress market was estimated at USD 1.66 billion in 2020 and is expected to reach USD 1.74 billion in 2021.

b. The global pressure relief mattress market is expected to grow at a compound annual growth rate of 4.7% from 2021 to 2028 to reach USD 2.45 billion by 2028.

b. North America dominated the pressure relief mattress market with a share of 37.3% in 2020. This is attributed to the high prevalence of decubitus ulcer, bedsores, or pressure ulcers in the region.

b. Some key players operating in the pressure relief mattress market include Hill-Rom Holdings, Inc.; Invacare Corporation; Paramount Bed Co. Ltd.; Stryker; Abecca; ADL GmbH; Arjo; Span America; Fazzini Srl; Lifeline Corporation; Talley Group Ltd.; Linet; Apex Medical Corp; Drive DeVilbiss Healthcare; Malvestio Spa; Permobil; Carilex Medical; Rober Limited; EHOB; Benmor Medical; and Lloyds Pharmacy Limited.

b. Key factors that are driving the pressure relief mattress market growth include the increasing prevalence of pressure ulcers globally and substantial investment in healthcare facilities across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."