- Home

- »

- Plastics, Polymers & Resins

- »

-

Printed Vinyl Market Size And Share, Industry Report, 2030GVR Report cover

![Printed Vinyl Market Size, Share & Trends Report]()

Printed Vinyl Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Monomeric Vinyl, Polymeric Vinyl), By Application (Advertising, Vehicle Warps & Graphics, Interior Decoration), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-538-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Printed Vinyl Market Size & Trends

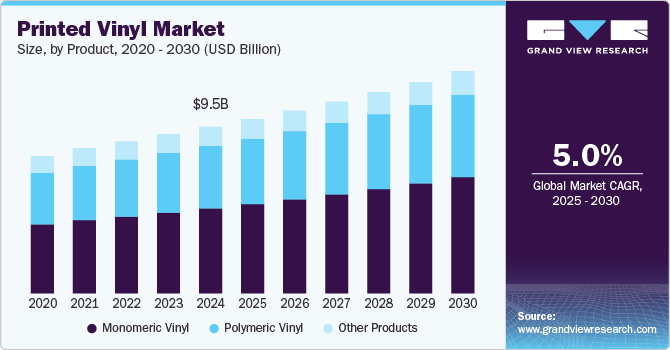

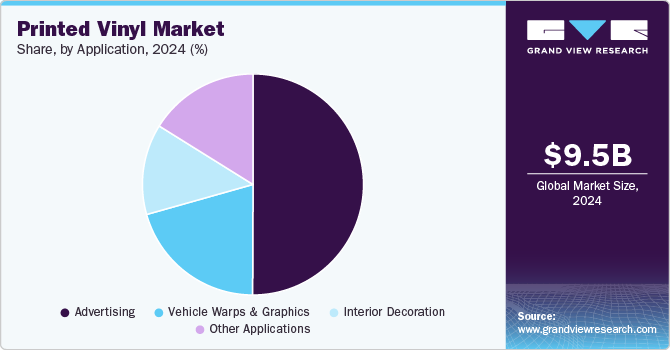

The global printed vinyl market size was estimated at USD 9.53 billion in 2024 and is expected to expand at a CAGR of 5.0% from 2025 to 2030. The market is primarily driven by the rapid advertising and promotional industry growth. Due to its durability, versatility, and vibrant print quality, printed vinyl is widely used for banners, billboards, vehicle wraps, and signage. The rise of digital printing technologies has further enhanced the appeal of printed vinyl, enabling high-resolution graphics and customized designs at lower costs.

Furthermore, increasing the adoption of vehicle wraps and graphics for advertising and branding purposes is projected to boost product demand. Businesses are leveraging vehicle wraps as a cost-effective and mobile advertising solution to reach a broader audience. Printed vinyl's ability to adhere seamlessly to vehicle surfaces while resisting weather conditions and UV exposure makes it the material of choice for this application.

The growing popularity of fleet branding among logistics, transportation, and delivery companies further fuels demand. Moreover, advancements in vinyl materials, such as removable and eco-friendly options, are expanding its use in both commercial and personal vehicle customization. Sustainability trends are also shaping the market, with a growing emphasis on eco-friendly materials and practices. Manufacturers are developing recyclable and biodegradable vinyl films to meet the increasing demand for sustainable advertising solutions.

In addition, the shift toward water-based and solvent-free inks in printing processes reduces the environmental impact of printed vinyl products. These innovations align with global regulations and consumer preferences for greener alternatives, driving the adoption of printed vinyl in industries such as retail, events, and interior decoration. As sustainability continues to gain importance, the market is expected to see further growth and innovation.

However, environmental concerns associated with PVC-based vinyl materials pose a major challenge to product growth. Traditional printed vinyl is made from polyvinyl chloride (PVC), which is non-biodegradable and difficult to recycle, leading to significant environmental challenges. The production and disposal of PVC vinyl contribute to plastic waste and release harmful chemicals, raising sustainability concerns among consumers and regulatory bodies. In addition, the increasing adoption of digital advertising and alternative eco-friendly materials, such as biodegradable films and paper-based solutions, poses competition to traditional printed vinyl.

Product Insights

The monomeric vinyl segment recorded the largest market revenue share of over 50.51% in 2024 and is projected to grow at the fastest CAGR of 5.3% during the forecast period. It is made from a softer, more pliable form of PVC, making it ideal for short- to medium-term applications such as promotional banners, window graphics, and vehicle wraps. Monomeric vinyl's ability to conform easily to curved surfaces and its excellent printability make it a popular choice for businesses seeking affordable and versatile advertising solutions.

However, its softer composition makes it less durable compared to polymeric vinyl, particularly in outdoor environments where it is more prone to shrinking, cracking, and fading over time. Despite these limitations, monomeric vinyl remains a preferred option for temporary signage and indoor applications due to its lower cost and ease of installation.

Polymeric vinyl is a premium product valued for its superior durability and performance. Made from a higher molecular weight PVC, polymeric vinyl is more rigid and stable, making it ideal for long-term outdoor applications such as vehicle wraps, billboards, and building signage.

Moreover, the demand for polymeric vinyl is driven by its extensive use in the automotive, construction, and outdoor advertising industries, where longevity and performance are critical. Its ability to withstand prolonged exposure to sunlight, rain, and temperature fluctuations makes it ideal for fleet branding, architectural wraps, and outdoor displays. While polymeric vinyl is more expensive than monomeric vinyl, its extended lifespan and lower maintenance requirements often justify the higher upfront cost.

Application Insights

The advertising segment recorded the largest market share of 50.06% in 2024and is projected to grow at the fastest CAGR of 5.2% during the forecast period. Printed vinyl is widely used for banners, billboards, posters, and signage, offering businesses an effective way to promote their brands and messages. The rise of digital printing technologies has further enhanced its appeal, enabling high-resolution graphics and customized designs at lower costs. Furthermore, the expansion of outdoor advertising and the growing popularity of temporary installations for events and promotions fuel demand.

Vehicle wraps and graphics represent a rapidly growing application segment for printed vinyl, driven by the need for mobile and cost-effective advertising solutions. Printed vinyl is extensively used for full or partial vehicle wraps, fleet branding, and personal vehicle customization. The material's durability, UV resistance, and ease of removal make it ideal for both commercial and personal use. The rise of e-commerce and delivery services has further boosted demand as businesses leverage vehicle wraps to enhance brand visibility. Innovations in removable and eco-friendly vinyl films also expand this segment's opportunities.

The interior decoration segment is gaining traction in the market, driven by the material's versatility and aesthetic appeal. Printed vinyl is used for wall murals, decorative graphics, window films, and floor graphics, offering a cost-effective way to transform indoor spaces. Its ability to mimic textures like wood, stone, and fabric, combined with easy installation and removal, makes it a popular choice for residential, commercial, and retail environments. The growing trend of personalized and customizable interiors is further boosting product demand.

Region Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 39.32% in 2024 and is anticipated to grow at the fastest CAGR of 4.5% over the forecast period. Countries like China, India, and Southeast Asian nations are witnessing increased demand for printed vinyl in advertising, vehicle wraps, and interior decoration, fueled by growing disposable incomes and infrastructure development. The region's booming retail and automotive sectors further contribute to market growth.

China printed vinyl market accounted for a substantial share of regional demand in 2024. The country's massive advertising industry and growing automotive and retail sectors propel the need for printed vinyl in applications like billboards, vehicle wraps, and decorative graphics. Government initiatives promoting urbanization and infrastructure development are further boosting demand.

North America Printed Vinyl Market Trends

The printed vinyl market in North America is mature yet steadily growing, driven by the region's advanced advertising, automotive, and retail industries. The rise of e-commerce and the need for eye-catching retail displays further accelerate market growth. Sustainability trends and stringent environmental regulations are shaping the market, with manufacturers focusing on recyclable and eco-friendly printed vinyl products to meet consumer and regulatory demands.

The U.S. printed vinyl market is largely driven by its robust advertising, automotive, and retail sectors. The country's focus on vehicle wraps, fleet branding, and promotional signage is a major growth driver, supported by advancements in digital printing technologies. The rise of e-commerce and the need for innovative retail displays also contribute to demand.

Europe Printed Vinyl Market Trends

The printed vinyl market in Europe is characterized by stringent environmental regulations and a strong focus on sustainability. The region's well-established advertising, automotive, and retail industries are key demand drivers, particularly for vehicle wraps, interior decoration, and promotional signage. The European Union's circular economy initiatives and bans on single-use plastics are pushing manufacturers to adopt eco-friendly printed vinyl solutions. Despite these challenges, the market continues to grow, driven by innovations in recyclable and biodegradable vinyl films.

Germany printed vinyl market is primarily driven by its advanced manufacturing sector and a strong focus on sustainability. The country's advertising, automotive, and retail industries are key end-users of printed vinyl, particularly for vehicle wraps, interior decoration, and promotional displays. Germany's stringent environmental regulations and commitment to reducing plastic waste shape the market, with manufacturers investing in eco-friendly and high-performance vinyl solutions. The country's leadership in technological advancements and R&D is further driving market growth.

Middle East & Africa Printed Vinyl Market Trends

The printed vinyl market in the Middle East & Africa region is experiencing moderate growth, driven by increasing urbanization, infrastructure development, and the rise of retail and e-commerce. Countries like the UAE and South Africa are key markets, with growing demand for advertising, vehicle wraps, and interior decoration. However, the region's market growth is relatively slower compared to other regions due to economic challenges and limited industrial infrastructure.

Key Printed Vinyl Company Insights

The market is highly competitive, with key players such as 3M, Avery Dennison Corporation, ORAFOL Europe GmbH, and Hexis S.A. dominating the landscape. These companies focus on product innovation, strategic partnerships, and mergers to expand their product portfolios and geographic reach. The market is witnessing a surge in demand for eco-friendly and high-performance printed vinyl solutions, driven by sustainability trends and stringent environmental regulations.

Key Printed Vinyl Companies:

The following are the leading companies in the printed vinyl market. These companies collectively hold the largest market share and dictate industry trends:

- 3M

- Avery Dennison Corporation

- ORAFOL Europe GmbH

- Hexis S.A.

- Arlon Graphics LLC

- Mactac Performance Adhesives Group

- KPMF Limited

- Vvivid Vinyl Inc.

- Metamark (UK) Ltd.

- General Formulations Inc.

Recent Development

-

In November 2024, Avery Dennison Corporation announced the expansion of its digital overlaminate (DOL) product line with the addition of two new DOL Max series finishes: DOL 1370 Max, a 1.3 mil luster finish, and DOL1380 Max, a 1.3 mil matte finish. These pressure-sensitive films enhance the durability and longevity of printed vinyl, especially in exterior applications such as fleet graphics, vehicle wraps, marine wraps, and outdoor signage.

Printed Vinyl Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.98 billion

Revenue forecast in 2030

USD 12.72 billion

Growth rate

CAGR of 5.0% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in million square meters, revenue in USD million/billion, and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments Covered

Product, application, region

States scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Key companies profiled

3M; Avery Dennison Corporation; ORAFOL Europe GmbH; Hexis S.A.; Arlon Graphics LLC; Mactac Performance Adhesives Group; KPMF Limited; Vvivid Vinyl Inc.; Metamark (UK) Ltd.; General Formulations Inc.

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Printed Vinyl Market Report Segmentation

This report forecasts volume & revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global printed vinyl market report based on product, application, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Monomeric Vinyl

-

Polymeric Vinyl

-

Other Products

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Advertising

-

Vehicle Warps & Graphics

-

Interior Decoration

-

Other Applications

-

-

Region Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

China

-

-

Asia Pacific

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global printed vinyl market was estimated at around USD 9.53 billion in the year 2024 and is expected to reach around USD 9.98 billion in 2025.

b. The global printed vinyl market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2030 to reach around USD 12.72 billion by 2030.

b. The monomeric vinyl segment recorded the largest market revenue share of over 50.51% in 2024 owing to monomeric vinyl’s ability to conform easily to curved surfaces and its excellent printability make it a popular choice for businesses seeking affordable and versatile advertising solutions.

b. The key players in the printed vinyl market include 3M, Avery Dennison Corporation, ORAFOL Europe GmbH, Hexis S.A., Arlon Graphics LLC, Mactac Performance Adhesives Group, KPMF Limited, Vivid Vinyl Inc., Metamark Ltd., and General Formulations Inc.

b. The key players in the printed vinyl market include 3M, Avery Dennison Corporation, ORAFOL Europe GmbH, Hexis S.A., Arlon Graphics LLC, Mactac Performance Adhesives Group, KPMF Limited, Vivid Vinyl Inc., Metamark Ltd., and General Formulations Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.