- Home

- »

- Advanced Interior Materials

- »

-

Printer Market For LVT And Laminate Flooring Report, 2030GVR Report cover

![Printer Market For LVT And Laminate Flooring Size, Share & Trends Report]()

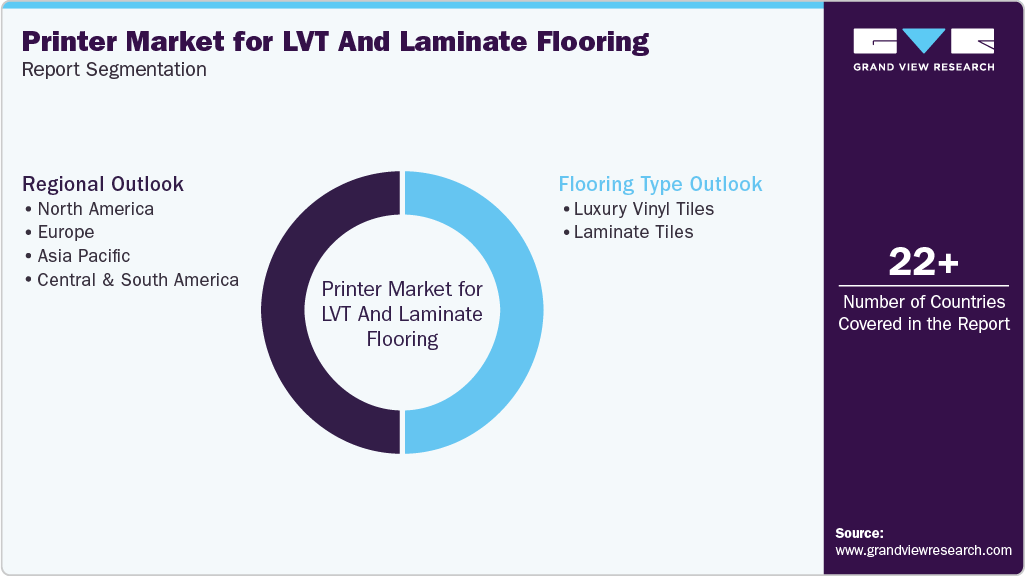

Printer Market (2025 - 2030) For LVT And Laminate Flooring Size, Share & Trends Analysis Report By Flooring Type (Luxury Vinyl Tiles, Laminate Tiles), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-657-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Printer Market For LVT And Laminate Flooring Summary

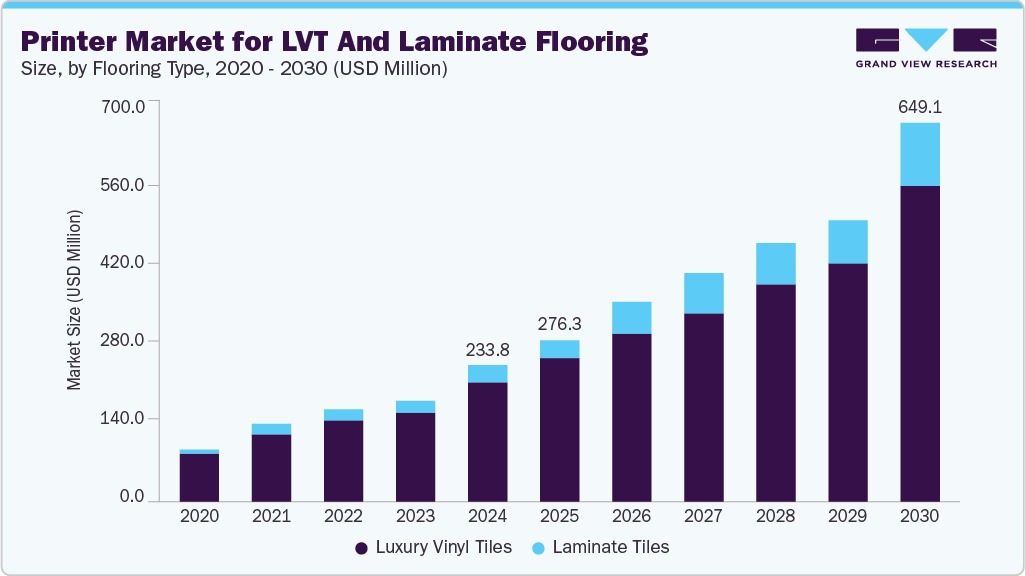

The global printer market for LVT and laminate flooring was estimated at USD 233.8 million in 2024 and is projected to reach USD 649.1 million by 2030, growing at a CAGR of 18.6% from 2025 to 2030. LVT and laminate flooring are favored in both residential and commercial constructions due to their versatility, durability, and ease of maintenance.

Key Market Trends & Insights

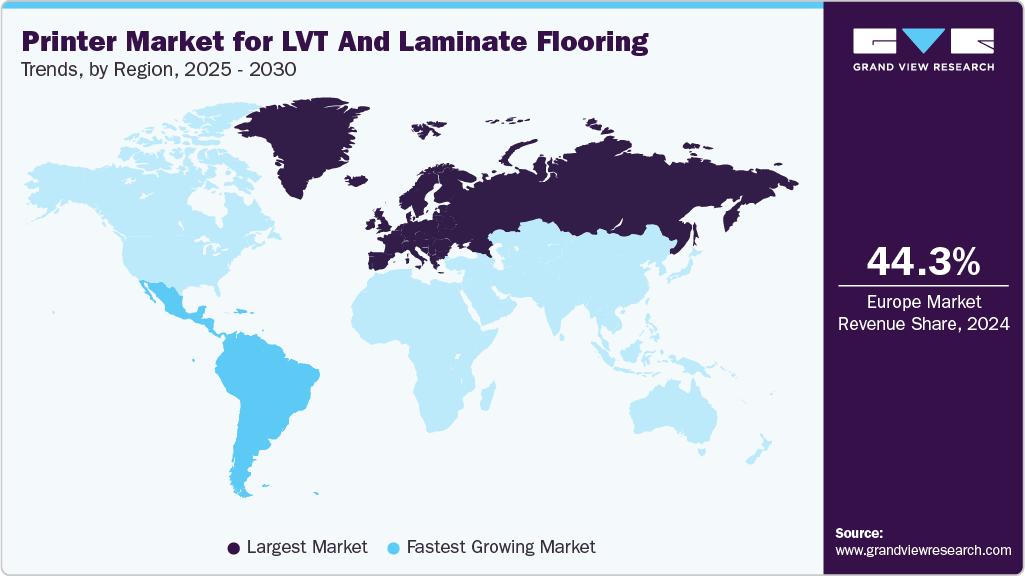

- Europe led the printer industry for LVT and laminate flooring and accounted for 44.3% of revenue share in 2024.

- The printer market for LVT and laminate flooring market in Spain is expected to expand at a CAGR of 20.1% over the forecast period.

- The luxury vinyl tiles segment dominated the market in 2024, accounting for 87.4% of the market share due to several factors.

Market Size & Forecast

- 2024 Market Size: USD 233.8 Million

- 2030 Projected Market Size: USD 649.1 Million

- CAGR (2025-2030): 18.6%

- Europe: Largest market in 2024

- Central & South America: Fastest growing market

These flooring types mimic the appearance of natural materials such as wood and stone but at a fraction of the cost, making them an attractive choice for budget-conscious consumers.Several key factors, including cost, efficiency, and market demand influence the adoption of new technologies in the LVT and laminate flooring industry. Cost considerations play a crucial role, as manufacturers must evaluate the initial investment in new printing technologies against potential long-term savings and increased productivity. Technologies such as digital printing machines promise significant reductions in production costs, waste, and energy consumption are more likely to be embraced. Additionally, companies often conduct thorough return-on-investment analyses to ensure that adopting new equipment will enhance their overall competitiveness.

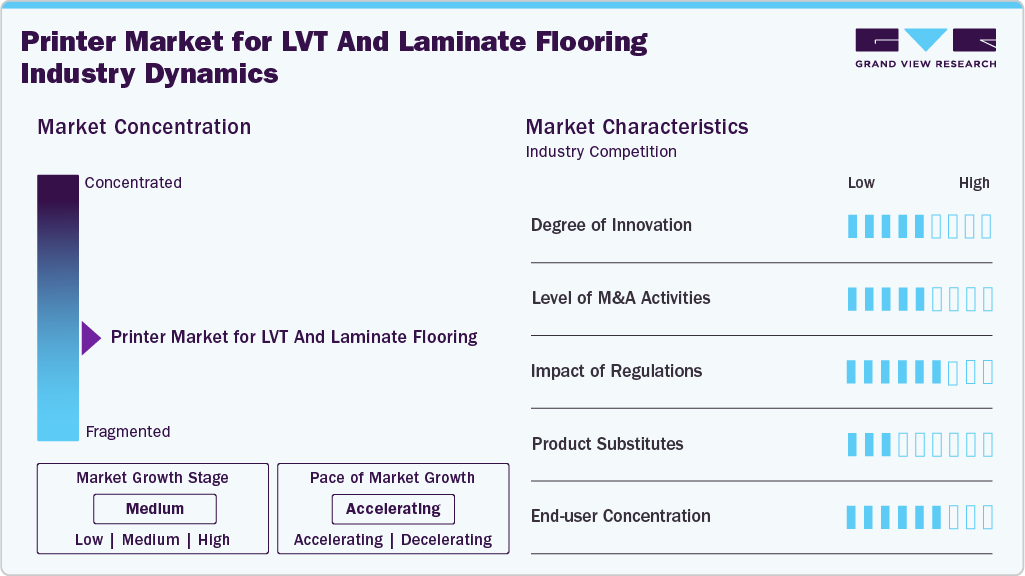

Market Concentration & Characteristics

The global printer market for LVT and laminate flooring exhibits a moderately consolidated structure, with a blend of global technology leaders and regionally dominant machinery manufacturers competing for share. Unlike more commoditized sectors, this market is shaped heavily by specialization in print quality, production scalability, and integration with digital and analog printing platforms. Major equipment types include direct single-pass printing machines, roll-to-roll digital printers, rotogravure systems, and flexographic presses, each catering to distinct stages of LVT and laminate tile production workflows.

Market concentration tends to favor companies with strong R&D capabilities and vertically integrated solutions, offering not just machines, but also software, inks, and substrate handling systems. These firms are leveraging the growing demand for high-definition surface textures, natural woodgrain replication, and tactile effects, which are now considered baseline expectations in premium LVT and laminate products. As a result, there is increased focus on print precision, color consistency, and registration accuracy, pushing innovation in both digital and analog formats.

Opportunities are expanding in emerging markets where the adoption of LVT and laminate flooring is accelerating due to their affordability and ease of installation. To capture these opportunities, machine manufacturers are focusing on scalable systems that balance performance and cost, while also introducing compact, modular printers tailored for small to mid-sized producers.

Leading players in the space are adopting a multipronged strategy: investing in digital workflow integration, forging OEM partnerships with ink and coating suppliers, and offering end-to-end technical support to reduce client production downtime. Innovations around AI-based print quality monitoring and remote machine diagnostics (often IoT-enabled) are beginning to reshape service models and operational efficiency.

As the demand for LVT and laminate flooring continues to grow, flooring manufacturers are increasingly focused on producing high-quality products that stand out in a competitive market. This demand drives their need for advanced printing technologies that can deliver intricate designs and realistic textures. Manufacturers are seeking machines that not only enhance the aesthetic appeal of their products but also improve production efficiency and reduce waste. The ability to customize designs quickly and easily is crucial, allowing flooring companies to respond swiftly to changing consumer trends and preferences.

Drivers, Opportunities & Restraints

The improvement in printing technologies has been pivotal in fostering the growth of the LVT and Laminate Flooring market. High-resolution printers capable of creating intricate and realistic patterns have made these flooring options more appealing to consumers seeking aesthetic appeal without compromising on durability. Additionally, the construction sector's growing focus on sustainable and eco-friendly building materials has further propelled the demand for LVT and Laminate Flooring.

The printer market for LVT and laminate flooring is experiencing challenges primarily due to the high costs associated with advanced printing technologies. For instance, the Jupiter digital printing line of Hymmen GmbH Machinery and Plant Engineering., costs around USD 8 Million. While these printers offer enhanced design capabilities and the capability to produce customized flooring solutions, the initial investment required for high-quality equipment can be substantial. Many manufacturers, especially smaller firms, find it difficult to allocate the necessary capital for acquiring state-of-the-art printers.

The rising popularity of LVT and laminate flooring, coupled with advancements in digital printing technology, presents an excellent opportunity for increased adoption of printers in the industry. As consumers increasingly choose LVT and laminate for their aesthetic appeal, durability, and cost-effectiveness, manufacturers are seeking innovative ways to differentiate their products. This growing demand creates a conducive environment for the integration of advanced printing solutions.

Flooring Type Insights

The luxury vinyl tiles segment dominated the market in 2024, accounting for 87.4% of the market share due to several factors. LVT flooring’s superior water resistance and durability are making it a popular choice for high-moisture areas and commercial spaces where performance and maintenance are significant concerns. Its versatility also extends to areas where aesthetics and realistic appearances are desired.

The laminate tiles segment is projected to grow at a rapid CAGR of 28.7% from 2025 to 2030 in terms of revenue. Laminate flooring mimics the appearance of wood better than LVT and is generally more affordable than natural materials. Laminate is known for its ease of installation and maintenance, making it a popular choice for residential applications, including living rooms, bedrooms, and hallways. While laminate flooring is more resistant to scratches and dents than traditional wood flooring, it is less resistant to moisture compared to LVT. Therefore, it is best suited for areas with lower humidity and occasional moisture exposure. Laminate is also often chosen for its budget-friendly nature and its ability to achieve a stylish look without the high cost of real wood or stone.

Regional Insights

Europe led the printer industry for LVT and laminate flooring and accounted for 44.3% of revenue share in 2024, shaped by a variety of unique regional dynamics and trends specific to the printing technologies used in this sector. A critical driver of this market is the increasing demand for sustainable printing practices, driven by stringent environmental regulations and consumer preferences. European manufacturers are under pressure to adopt eco-friendly inks and processes that minimize waste and energy consumption. This focus on sustainability not only aligns with regulatory requirements but also resonates with environmentally conscious consumers, creating a strong market opportunity for the market.

The printer market for LVT and laminate flooring market in Spain is expected to expand at a CAGR of 20.1% over the forecast period. The government’s commitment to support the development of new housing for social rent and affordable prices indicates a more optimistic outlook for the real estate sector, especially from 2025 onwards. This growth is likely to create opportunities for the printer market, as manufacturers will require advanced printing technologies to produce the detailed designs and textures that meet the evolving preferences of homeowners and builders alike.

The Netherlands printer market for LVT and laminate flooring is expected to grow at a CAGR of 20.2%, driven by the rising demand for stylish, versatile flooring aligned with minimalist interior trends. Growth in the hospitality and commercial sectors is also fueling demand for durable, high-quality designs enabled by advanced printing technologies.

North America Printer Market For LVT And Laminate Flooring Trends

The printer market for Luxury Vinyl Tile (LVT) and laminate flooring has been experiencing significant growth in North America due to a convergence of several key factors. One of the primary drivers is the increasing demand for customized and aesthetically appealing flooring solutions. As consumers and commercial spaces seek unique designs that reflect individual tastes, the ability to print intricate patterns and textures on flooring surfaces has become essential. This trend is particularly prevalent in residential renovations and commercial projects where branding and visual identity are significant variables.

U.S. Printer Market For LVT And Laminate Flooring Trends

The industry in the U.S. accounted for 72.7% of the regional market share in 2024. The U.S. construction and real estate markets are experiencing a resurgence, driven by increased residential and commercial developments. According to The Associated General Contractors (AGC) of America, Inc., there were over 919,000 construction businesses in the country as of the first quarter of 2023. As new housing projects and renovations gain momentum, the demand for stylish, durable flooring solutions continues to rise. This expansion creates significant opportunities for printers focused on LVT and laminate flooring, as builders and contractors seek reliable suppliers that can meet high-volume and diverse design needs and textures.

Asia Pacific Printer Market For LVT And Laminate Flooring Trends

The Asia Pacific printer market for LVT and laminate flooring is expected to witness significant growth, driven by the region’s strong position in the global flooring industry. Asia Pacific, primarily China, has become a vital source of flooring products globally, fueled by a booming construction market. This growth is mirrored in other significant markets such as India and Southeast Asia, creating a favorable and robust residential housing market that has notably propelled the development of the carpet industry and its entire supply chain. As these sectors expand, the demand for innovative flooring solutions increases, driving growth in the Printer Market for LVT and laminate flooring.

India’s printer market for LVT and laminate flooring is projected to grow at a CAGR of 17.8%, driven by a sharp rise in luxury home sales. With the real estate sector expanding rapidly, demand for premium flooring is rising, boosting the need for advanced printing technologies. Most domestic manufacturers rely on i4F-licensed technologies to meet LVT and laminate flooring requirements.

Central & South America Printer Market For LVT And Laminate Flooring Trends

The printer market for LVT and laminate flooring in Central and South America is growing steadily, driven by the expanding middle class and rising disposable incomes. This is fueling demand for affordable, visually appealing flooring options, especially in urbanizing countries like Brazil and Argentina, where home renovations and new housing developments are on the rise.

The printer market for LVT and laminate flooring in Argentina is projected to grow at a strong CAGR of 20.1% over the forecast period, driven by advancements in digital printing technologies. These innovations enable high-quality, customizable designs with quick turnaround times, aligning with rapidly shifting consumer preferences influenced by social media and design trends.

Key Printer Market For LVT And Laminate Flooring Company Insights

Some of the key players operating in the market include Cefla s.c. and Hymmen GmbH Machinery and Plant Engineering.

-

Cefla s.c. is engaged in multiple manufacturing areas. It has three business units - Cefla Engineering, Cefla Finishing, and Cefla Medical Equipment. Cefla Finishing produces industrial printing machines in addition to machines for coating, industrial digital printers, and systems for decoration and lamination.

-

Hymmen GmbH Machinery and Plant Engineering is primarily involved in the design and manufacture of production technology for the surface finish of web and panel materials, along with the large-scale manufacture of production technology.

Key Printer Market For LVT And Laminate Flooring Companies:

The following are the leading companies in the printer market for LVT and laminate flooring. These companies collectively hold the largest market share and dictate industry trends.

- Cefla s.c.

- Eastman Kodak Company

- HOPETECH DIGITAL CO., LTD (HOPETECH)

- Hymmen GmbH Machinery and Plant Engineering.

- Barberan S.A.

- Uteco Converting SpA

- Guangzhou KingTau machinery and electrical Co., Ltd.

- General Inkjet Printing Technology Co., Ltd.

- Wenzhou Guowei Printing Machinery Co., Ltd.

- ROMEROCA INDUSTRY CO., LTD.

Recent Developments

-

In February 2023, Unilin Technologies - Flooring Industries Limited, Barberan S.A., and ZEETREE reached a new agreement to expand access to their extensive patent portfolios for direct-to-board digital printing and texturing. This agreement provides greater operational freedom and legal certainty for those involved in digital printing and texturing for decorative panels.

-

In July 2024, Uteco announced a new partnership with Fotedar, which will function as its commercial agency for English-speaking customers of Central and East Africa. The latter will promote Uteco's innovative products and FlexCA (an alliance of companies through binding equity), helping to extend its market reach and enhance its presence in the region

Printer Market For LVT And Laminate Flooring Report Scope

Report Attribute

Details

Market size value in 2025

USD 276.3 million

Revenue forecast in 2030

USD 649.1 Million

Growth rate

CAGR of 18.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in units and CAGR from 2025 to 2030

Report coverage

Revenue forecast, revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Flooring type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; Türkiye; Netherlands; Sweden; Norway; China; India; Japan; South Korea; Thailand; Malaysia; Indonesia; Australia; Vietnam; Brazil; Argentina

Key companies profiled

Cefla s.c.; Eastman Kodak Company; HOPETECH DIGITAL CO., LTD (HOPETECH); Hymmen GmbH Machinery and Plant Engineering; Barberan S.A.; Uteco Converting SpA; Guangzhou KingTau Machinery and Electrical Co., Ltd.; General Inkjet Printing Technology Co., Ltd.; Wenzhou Guowei Printing Machinery Co., Ltd.; ROMEROCA INDUSTRY CO., LTD.; Colorjet Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Printer Market For LVT And Laminate Flooring Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global printer market for LVT and laminate flooring based on flooring type and region:

-

Flooring Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Luxury Vinyl Tiles

-

Direct Single Pass Printing Machines

-

Roll-to-roll Digital Printing Machines

-

Roll-to-roll Rotogravure Machines

-

Roll-to-roll Flexographic Machines

-

-

Laminate Tiles

-

Direct Single Pass Printing Machines

-

Roll-to-roll Digital Printing Machines

-

Roll-to-roll Rotogravure Machines

-

Roll-to-roll Flexographic Machines

-

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Italy

-

Spain

-

Türkiye

-

Netherlands

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Malaysia

-

Indonesia

-

Vietnam

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the printing market for LVT & laminate flooring are Cefla s.c., Eastman Kodak Company, HOPETECH DIGITAL CO., LTD (HOPETECH), Hymmen GmbH Machinery and Plant Engineering, Barberan S.A., Uteco Converting SpA, Guangzhou KingTau Machinery and Electrical Co., Ltd., General Inkjet Printing Technology Co., Ltd., Wenzhou Guowei Printing Machinery Co., Ltd., ROMEROCA INDUSTRY CO., LTD., and Colorjet Group.

b. Key factors driving the printing market for LVT & laminate flooring include increasing demand for aesthetic and durable flooring solutions among consumers. This surge is attributed to the growing awareness about the benefits of LVT and laminate flooring, such as their durability, ease of maintenance, and wide range of design options.

b. The global printing market for LVT & laminate flooring size was estimated at USD 233.8 million in 2024 and is expected to reach USD 276.3 million in 2025.

b. The global printing market for LVT & laminate flooring, in terms of revenue, is expected to grow at a compound annual growth rate of 18.6% from 2025 to 2030 to reach USD 649.1 million by 2030.

Which segment accounted for the largest market share in printing market for LVT & laminate flooring?b. The luxury vinyl tiles (LVT) segment dominated the market in 2024, accounting for 87.4% of the share. Its superior water resistance, durability, and realistic aesthetic make it ideal for high-moisture areas and commercial spaces.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.