- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Probiotics In Animal Feed Market Size & Share Report, 2030GVR Report cover

![Probiotics In Animal Feed Market Size, Share & Trends Report]()

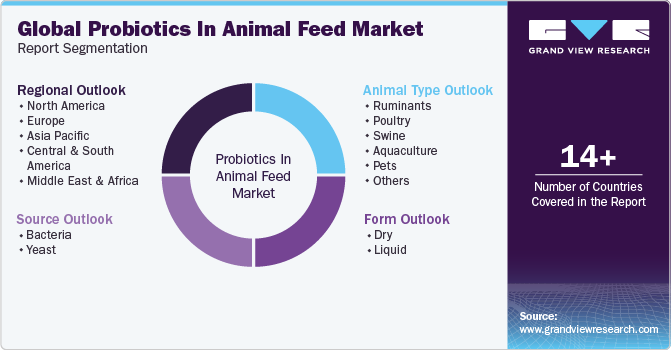

Probiotics In Animal Feed Market Size, Share & Trends Analysis Report By Form (Dry, Liquid), By Source (Bacteria, Yeast), By Animal Type (Ruminants, Poultry), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-226-9

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Probiotics In Animal Feed Market Trends

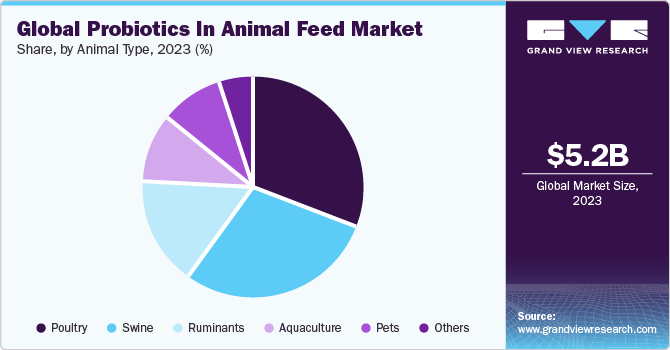

The global probiotics in animal feed market size was estimated at USD 5,181.7 million in 2023 and is projected to grow at the CAGR of 8.6% from 2024 to 2030. Commercially produced probiotics for animal nutrition are typically available in liquid or solid formats and are categorized as bacteria, yeast, or fungi. Among the widely utilized probiotic bacteria in animal feeds are Lactobacillus, Bacillus, Streptococcus, Pediococcus, Enterococcus, Bifidobacterium, and Propionibacterium. Many commercially accessible probiotics, including these, are formulated with multiple species to enhance effectiveness, with some also incorporating fungi and yeast into their compositions.

As global demand for protein-rich diets continues to rise, major stakeholders are enhancing the manufacturing of probiotics for animal feed. Furthermore, in efforts to mitigate outbreaks of diseases in cattle and poultry, consumers are increasingly embracing the use of these probiotics. Moreover, leading companies are strengthening their research and development activities to seize opportunities arising from this expanding demand.

In August 2023, two leading biotechnology companies, Austrianova, and ProAgni, announced a partnership to revolutionize the animal type industry. Through their collaboration, they aim to develop and commercialize probiotic additives for cattle feed and other farm animals using the innovative 'Bac-in-a-Box' technology. This licensing and manufacturing agreement has the potential to bring about significant improvements in production efficiency, reduced methane emissions, and less antibiotic use in the animal type sector by introducing novel, ethical, and sustainable products.

Moreover, the growing preference for organic animal type and advancements in animal feed development is anticipated to fuel the demand for probiotics. Major manufacturers like Chr. Hansen A/S, Evonik Industries AG, Kerry Group plc, and DSM are prioritizing the creation of novel probiotics for their beneficial impact on digestive ailments.

Over the past few years, a significant transformation has started in animal agriculture with the rise of probiotics as substitutes for conventional antibiotics. Driven by challenges surrounding antibiotic resistance, environmental consequences, and consumer preferences for sustainable methods, the adoption of probiotics is restructuring the realm of animal type and poultry husbandry.According to the Centers for Disease Control and Prevention (CDC's) 2022 report, there has been a significant increase in the percentage of cases of nontyphoidal Salmonella that are resistant to ciprofloxacin. The numbers have risen from 3% in 2011 to 9% in 2020. This alarming trend is a cause for concern and calls for immediate action to address this issue.

Governments and regulatory authorities are increasingly acknowledging the significance of probiotics in animal nutrition. The establishment of guidelines and regulations authorizing the utilization of probiotics in animal feed has facilitated market expansion. For example,the Food and Drug Administration (FDA) takes its responsibility for regulating animal food seriously, and it does so by working closely with its State and local partners. This collaboration is achieved through various mechanisms, such as cooperative agreements, contracts, grants, memoranda of understanding, and partnerships. One of the primary partnerships that the FDA has established is with the Association of American Feed Control Officials (AAFCO) and the states.

With increasing concerns regarding antibiotic resistance and a growing emphasis on sustainable farming methods, probiotics have emerged as a promising substitute for conventional antibiotics. Probiotics play a role in preventing diseases and have the potential to decrease the dependence on antibiotics in animal type. The worldwide demand for animal protein, encompassing meat, milk, and eggs, is steadily increasing. Probiotics play a crucial role in optimizing productivity and upholding the quality of animal-derived goods, fulfilling the rising demand driven by an expanding global population.

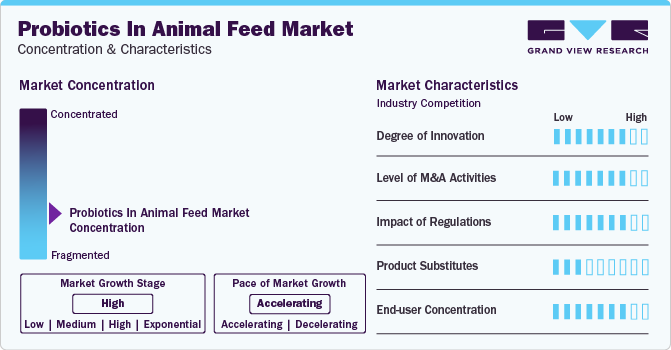

Market Concentration & Characteristics

The degree of innovation in the market is high, as manufacturers are constantly innovating, improving, and diversifying their product offerings to meet the changing demands of consumers worldwide.

Companies focus on strategic acquisitions and expansion to strengthen their presence overseas and reinforce their position in the market. Over the next few years, internationally reputed companies are likely to acquire small and medium-sized companies operating in the industry in a bid to facilitate regional expansion. For example, in January 2022,Danisco Animal Nutrition, a division of IFF's Health & Biosciences, made significant developments in its ruminant portfolio. In line with its mission to provide top-quality nutritional solutions for farmers and broaden its global presence, the company introduced the Bovizyme GA enzyme to the U.S. market and two Omni-Bos probiotics to the Middle East. These developments are a testament to the company's dedication to advancing the health and well-being of ruminants.

Regulatory bodies often set guidelines for health claims and labeling requirements. The approval and use of specific health claims on probiotics in animal feed can significantly impact consumer perception and market acceptance.

Substitutes for probiotics in animal feed are growth promoters. Various growth-promoting substances such as hormones, enzymes, organic acids, and antimicrobial peptides have been used in animal feed to enhance growth and feed efficiency.

Form Insights

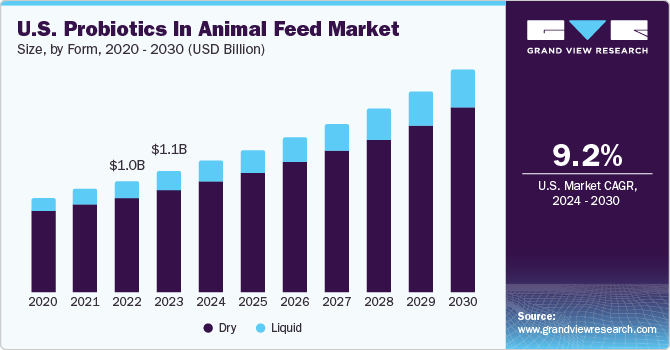

Based on form, the dry segment led the market with the largest revenue share of 84.7% in 2023. Dry probiotics are easier to handle and store compared to liquid formulations. They are less prone to spoilage and contamination, making them more convenient for transportation and storage, especially in large-scale animal farming operations. Dry probiotics have a longer shelf life compared to liquid probiotics. The drying process helps to preserve the viability of the probiotic microorganisms, ensuring that they remain active until they are consumed by the animals. Also, they are easier to handle and store compared to liquid formulations. They are less prone to spoilage and contamination, making them more convenient for transportation and storage, especially in large-scale animal farming operations.

The liquid segment is projected to grow at the fastest CAGR of 10.1% from 2024 to 2030. The liquid state allows for quicker absorption and utilization of probiotic microorganisms by the animal's gut microbiota, resulting in more rapid improvements in gut health and performance.Increasing consumer awareness of the benefits of probiotics in animal nutrition is driving demand for innovative and convenient probiotic solutions. Liquid probiotics, with their ease of use and potential advantages, are well-positioned to capitalize on this growing market demand.

Source Insights

Based on source, the bacteria segment led the market with the largest revenue share of 79.9% in 2023. Bacterial strains such as Lactobacillus, Bacillus, Streptococcus, and others have been extensively studied and proven to confer various health benefits to animals. These bacteria can colonize and thrive in the animal's gastrointestinal tract, where they help maintain gut health, enhance digestion, and support the immune system. Also, these bacterial probiotics are versatile and can be used across various animal species, including poultry, swine, cattle, and aquaculture. Their broad applicability makes them suitable for different production systems and farming practices, contributing to their widespread adoption.

The yeast segment is projected to grow at the fastest CAGR of 9.4% from 2024 to 2030. Yeast probiotics have been found to have a positive impact on the environment. Animal Type farming is a major contributor to greenhouse gas emissions, and the use of antibiotics in animal feed can further exacerbate this issue. Yeast probiotics offer a more sustainable alternative to antibiotics, as they do not contribute to the development of antimicrobial resistance.

Animal Type Insights

Based on animal type, the poultry segment led the market with the largest revenue share of 30.8% in 2023. Poultry farming, including chicken and turkey production, is one of the leading sectors in the animal agriculture industry. As a result, there is a substantial demand for feed additives, including probiotics, to support the health and performance of poultry flocks. With increasing consumer demand for antibiotic-free and naturally raised poultry products, there is growing interest among poultry producers in adopting alternative strategies for maintaining poultry health and welfare, including probiotic supplementation.

Nowadays, companies are placing a priority on introducing probiotic solutions tailored to reduce the incidence of diseases affecting the intestinal health of poultry. In July 2022, Kemin Industries has introduced ENTEROSURE, a novel probiotic solution designed to mitigate the occurrence of diseases impacting the intestinal health of poultry and animal type. This next-generation probiotic aims to enhance global efforts in safeguarding animal well-being.

The pets segment is projected to grow at the fastest CAGR of 10.3% from 2024 to 2030. Pet owners are increasingly prioritizing the health and well-being of their furry companions. They are seeking pet food products that offer nutritional benefits beyond basic sustenance, including ingredients that support aquaculture, immune function, and overall wellness. Probiotics are recognized for their potential to promote gut health and enhance the immune system in pets, driving their popularity in the pet food market.

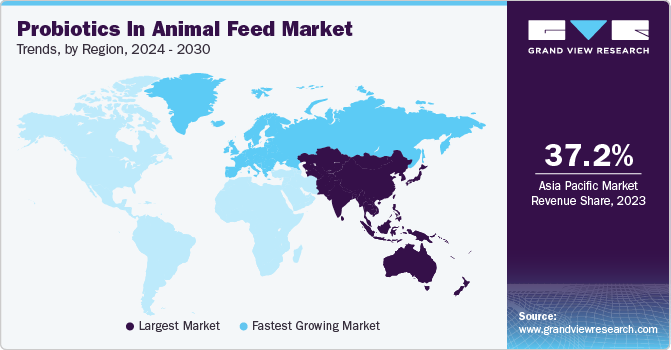

Regional Insights

North America held the market with the revenue share of 27.4% in 2023. The trend towards consuming protein-rich diets in North America has indeed been on the rise, leading to increased demand for animal feed probiotics. These probiotics play a crucial role in improving the overall health and productivity of animal type, particularly cattle and poultry, which are major sources of protein for the region.

Major Probiotic suppliers are partnering with global distribution solutions providers to expand their product portfolios in the North American region. In January 2024, BIO-CAT, Inc., a well-known probiotic manufacturer, collaborated with Caldic North America, a renowned global provider of distribution solutions. This collaboration is focused on introducing BIO-CAT & unique probiotic strains and OPTIFEED-branded solutions to the companion animal health and nutrition market throughout North America.

U.S. Probiotics in Animal Feed Market Trends

The probiotics in animal feed market in the U.S. is expected to grow at a CAGR of 9.2% from 2024 to 2030. In the U.S., the use of probiotics in animal feed is increasingly recognized as a vital strategy for preventing disease outbreaks and promoting overall animal health, particularly in intensive farming operations. The regulatory environment in the U.S. is supportive of the use of probiotics in animal feed. The U.S. Food and Drug Administration (FDA) has recognized certain probiotic strains as generally recognized as Safe (GRAS) for use in animal feed, providing a level of assurance for producers and consumers alike.

Asia Pacific Probiotics in Animal Feed Market Trends

Asia Pacific held the market with the revenue share of 37.2% in 2023. The Asia-Pacific region is home to a significant proportion of the global poultry population. Countries such as China, India, Indonesia, and Vietnam have large commercial poultry industries, as well as a substantial backyard poultry sector. The high poultry population in the region drives the demand for probiotics in poultry feed to enhance gut health, improve feed efficiency, and promote overall productivity. Poultry meat is a popular protein source in the region due to its affordability, versatility, and relatively low environmental footprint. To meet the growing demand for high-quality meat and end-products, poultry producers are turning to probiotics to optimize animal health, growth, and meat quality.

The probiotics in animal feed market in China is expected to grow at a CAGR of 8.5% from 2024 to 2030. The probiotics in animal feed market in China is expected to grow at a CAGR of from 2024 to 2030. Key companies are prioritizing the establishment of joint ventures in China to improve the gastrointestinal health of farmed animals. These companies are committed to merging their respective gut health operations. In October 2023, Evonik, and Shandong Vland Biotech established a joint venture in China to enhance farmed animals' gastrointestinal well-being. Both companies have pledged to integrate their gut health operations, including probiotics and formulated products, into the joint venture, which will serve the China, Hong Kong, Macau, and Taiwan territories. This geographical area represents over 20% of the worldwide feed additives market.

India probiotics in animal feed market is expected to grow at a CAGR of 8.4% from 2024 to 2030. Livestock and poultry have been an integral part of India's agricultural economy for centuries. The rearing of animals for milk, meat, and other by-products has been a traditional occupation in rural India, which has driven the demand for animal feed probiotics for better animal health.

Europe Probiotics in Animal Feed Market Trends

Europe held the market with the revenue share of 23.4% in 2023. Europe is home to some of the largest and most advanced feed mills in the world. These facilities have the infrastructure and technological capabilities to produce high-quality animal feed formulations, including those containing probiotics. The presence of major feed mills facilitates the widespread availability and distribution of probiotic-containing feeds to animal type and poultry producers across the region.

The probiotics in animal feed market in the U.K. is expected to grow at a CAGR of 9.0% from 2024 to 2030. The UK. has strict regulations and standards for animal welfare, leading to a growing emphasis on promoting the health and well-being of animal type. The UK government and regulatory authorities, such as the Department for Environment, Food & Rural Affairs (DEFRA) and the Food Standards Agency (FSA), provide guidelines and regulations to ensure the safety and efficiency of probiotics used in animal feed. This regulatory support promotes confidence among farmers and promotes the responsible use of probiotics in animal type production.

Spain probiotics in animal feed market is expected to grow at a CAGR of 9.2% from 2024 to 2030. In 2022, feed production in Spain amounted to 37.5 million tons, as indicated by the most recent feed production report sourced from Autonomous Communities, feed manufacturers, additive producers, and premix manufacturers, which also encompasses farms producing feed for internal use. Although there was a 2.6% decline from 2021, Spain has reaffirmed its position as the primary feed producer in the EU.

Key Probiotics In Animal Feed Company Insights

The probiotics in animal feed industry is fragmented owing to the presence of a large number of domestic as well as international players. However, key players capture the majority of the industry share. Companies have been expanding their source portfolios by incorporating new and innovative probiotics in animal feed to widen their consumer base, which will have an impact on the industry growth over the forecast period.

Key Probiotic In Animal Feed Companies:

The following are the leading companies in the probiotics in animal feed market. These companies collectively hold the largest market share and dictate industry trends.

- Alltech Inc.

- Land O'Lakes, Inc.

- Chr. Hansen A/S

- Evonik Industries AG

- Kerry Group plc

- DSM

- Provita Animal Health

- Mitsui & Co. (U.S.A.), Inc.

- Novus International, Inc.

- Lallemand Inc.

Recent Developments

-

In February 2023, Chr. Hansen A/S has launched a novel product in the U.S. market called Bovamine Defend Plus. This product features four carefully chosen bacterial strains, selected for their unique modes of action and their mutually beneficial symbiotic interactions

-

In February 2023, Evonik Industries AG introduced a new plant-based solution, ‘PhytriCare IM’ that comprises specifically chosen plant extracts abundant in flavonoids. PhytriCare IM is a fusion of meticulously selected plant extracts spanning various subclasses of flavonoids. This combination is designed to address a diverse array of inflammatory pathways, aiming to regulate the inflammatory response without inhibiting it entirely

-

In September 2022, BASF and Evonik jointly declared a partnership and signed an agreement, through which Evonik has been awarded non-exclusive rights to Opteinics. This collaboration aims to diminish the environmental impact of the probiotics industry in animal feed by introducing a digital, readily deployable sustainability platform

Probiotics In Animal Feed Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.60 billion

Revenue forecast in 2030

USD 9.18 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment covered

Form, source, animal type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia; South Africa

Key companies profiled

Alltech Inc.; Land O'Lakes, Inc.; Chr. Hansen A/S; Evonik Industries AG; Kerry Group plc; DSM; Provita Animal Health; Mitsui & Co. (U.S.A.), Inc.; Novus International, Inc.; Lallemand Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Probiotics In Animal Feed Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global probiotics in animal feed market report based on form, source, animal type, and region:

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry

-

Liquid

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Bacteria

-

Yeast

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ruminants

-

Poultry

-

Swine

-

Aquaculture

-

Pets

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global probiotics in animal feed market size was estimated at USD 5,181.7 million in 2023 and is expected to reach USD 5.60 billion in 2024.

b. The global probiotics in animal feed market is expected to grow at a compounded growth rate of 8.6% from 2024 to 2030 to reach USD 9.18 billion by 2030.

b. The dry segment dominated the probiotics in animal feed market with a share of 84.7% in 2023. Dry probiotics are easier to handle and store compared to liquid formulations. They are less prone to spoilage and contamination, making them more convenient for transportation and storage, especially in large-scale animal farming operations. Dry probiotics have a longer shelf life compared to liquid probiotics.

b. Some key players operating in the probiotics in animal feed market include Alltech, Land O'Lakes, Inc., Chr. Hansen A/S, Evonik Industries AG, Kerry Group plc, DSM.

b. Key factors that are driving the market growth include the the growing preference for organic livestock and advancements in animal feed development and a growing emphasis on sustainable farming methods.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."