- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Probiotics Dietary Supplements Market Size Report, 2030GVR Report cover

![Probiotics Dietary Supplements Market Size, Share & Trends Report]()

Probiotics Dietary Supplements Market Size, Share & Trends Analysis Report By Form (Chewables & Gummies, Capsules, Powders, Tablets & Softgels), By End-use, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-380-5

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2028

- Industry: Consumer Goods

Market Size & Trends

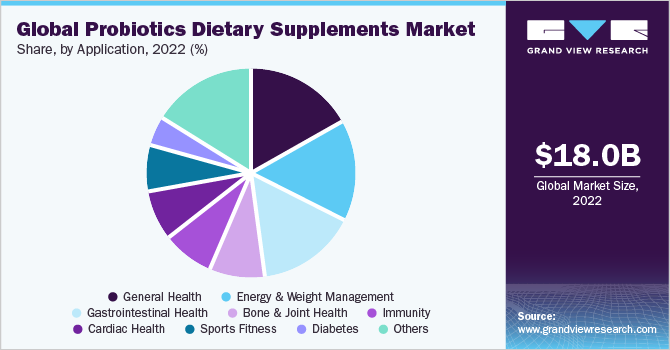

The global probiotics dietary supplements market size was valued at USD 18.04 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.1% from 2023 to 2030. The incidence of digestive ailments is rapidly rising, which is anticipated to drive up the demand for probiotic products. These products combat harmful bacteria in the gut and are effective in treating conditions like intestinal inflammation, antibiotic-associated diarrhea, and urogenital infections. As consumers become more knowledgeable about preventative healthcare, the global probiotic market is expected to grow. Probiotics work by promoting gut health and enhancing immunity. Yogurt is a commonly consumed source of probiotics.

The popularity of probiotic dietary supplements has been steadily increasing due to the convenience of consuming powders and chewable tablets in a variety of appealing end-users like apple, orange, and raspberry. These supplements contain lactic acid bacteria, particularly Streptococcus thermophilus and Lactobacillus, which aid in regulating the digestive system and enhancing immune responses. Lactobacillus is also effective in treating a range of conditions such as diarrhea, high cholesterol, skin disorders, irritable bowel syndrome, and lung infections.

To address various health issues, manufacturers are actively developing new probiotic formulations using beneficial bacteria. For example, in June 2021, Lonza collaborated with Kaged Muscle, a California-based sports nutrition company, to introduce its sports supplements containing Lonza's new probiotic ingredient, TWK10, in the U.S. market. Derived from Taiwanese kimchi, TWK10 is a strain of L. Plantarum that is expected to enhance exercise endurance by up to 75%.

Despite the challenge of higher product prices, consumers are willing to pay more for better health, which is expected to support market growth. Furthermore, the significant increase in health expenditure in emerging economies like China, Italy, Brazil, and India is projected to boost the demand for probiotic supplements and drive market growth.

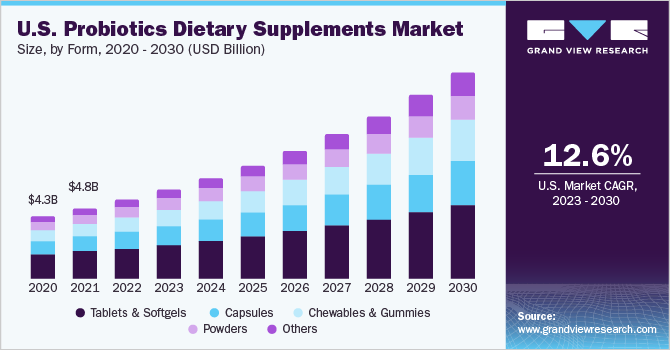

Form Insights

In terms of form, tablets & softgels dominated the global market with the largest market share of the total revenue in 2022, holding 40.2% of the total market in 2022. The demand for natural health supplements in tablet form is expected to increase during the forecast period, driven by various factors such as high-quality excipients that aid in tablet absorption and disintegration. Tablets offer convenience, making them an ideal option for individuals with busy lifestyles. In addition, Tablets can be developed to provide an accurate dosage which is crucial for supplements that require specific dosing for efficacy and safety. Although natural coating may offer better dissolution, other factors such as efficacy and quality also determine the absorption rate. Overall, these benefits are expected to contribute to segmental growth over the forecast period.

In addition, the robust presence of gelatin production units, along with the increasing demand for nutraceutical products, is expected to provide new opportunities for manufacturers of softgel probiotic dietary supplements globally. The applications of softgels have become highly popular due to their smooth texture and taste-masking capabilities. These factors will aid in significant market growth over the forecast period.

End-use Insights

In terms of end-use, adults dominated the global market with the largest market share of the total revenue in 2022, holding 56.83% of the total market in 2022. Rising cases of gastrointestinal problems in adults have pushed the development of probiotic supplements. For instance, in April 2021, Bausch Health launched its OTC probiotic supplement, ENVIVE in the U.S. It can be consumed daily by adults and aids in reducing the frequency of five gastrointestinal symptoms including diarrhea, constipation, gas, bloating, and discomfort.

Infants are expected to pace at a growth rate of 18.2% during the forecast period. The infant probiotic supplement market typically provides tasteless powders or liquids that can be seamlessly mixed with various liquids fed to babies, including breast milk and formula. As the market grows, there is a growing demand for personalized products that cater to the unique metabolic and intestinal requirements of infants.

Application Insights

General health is expected to hold a market share of 16.9% of the total market in 2022. Probiotic supplements help restore the balance of microorganisms in the gut by introducing beneficial bacteria, such as Lactobacillus and Bifidobacterium strains, which have been shown to support healthy digestion and immune function. These supplements can help relieve symptoms of digestive issues such as inflammatory bowel disease (IBD), irritable bowel syndrome (IBS), and antibiotic-associated diarrhea. Probiotics have also been shown to support immune function, reducing the risk of infections and allergies.

Consumers are becoming more interested in personalized nutrition, they are turning to probiotic dietary supplements as a way to address their specific health concerns. A 2021 survey conducted by the Council for Responsible Nutrition (CRN), found that 80% of Americans were incorporating dietary supplements into their routines, indicating a 7% rise from the preceding year. The main driving force behind this trend is the growing emphasis on health and wellness.

During the forecast period, others segment is anticipated to experience a significant growth rate with a CAGR of 16.6%. The others segment includes probiotic supplements for insomnia, sexual wellness, improving mood, vision, and urinary and nervous system functions.

Some probiotic supplements are marketed to improve mood by promoting the growth of beneficial bacteria in the gut, which has been linked to a positive effect on mental health. Probiotics also help reduce symptoms of anxiety and depression by influencing the production of neurotransmitters like serotonin.

Probiotics are also beneficial for improving sleep quality by reducing inflammation and oxidative stress in the body, as well as by increasing the production of melatonin, a hormone that regulates sleep. Supplements for sexual wellness are also available, which contain probiotics to support healthy vaginal or urinary tract flora. This can help reduce the risk of infections, which can interfere with sexual function and satisfaction. All these factors would aid the segment to grow in the forecast period.

Regional Insights

North America dominated the market with a share of over 34.4% in 2022. The increasing number of health-conscious consumers, coupled with the growing demand for gut health products, is the major factor driving the demand for probiotic supplements in North America. Manufacturers operating in the region are introducing unique supplements to cater to the growing demand. Furthermore, several manufacturers offer customized probiotic supplements as per consumers’ needs.

In addition, consumers prioritize gut health and have become aware of the health benefits of probiotic supplements. In 2022, according to the International Food Information Council, about 32% of Americans are actively trying to consume probiotics, from which 24% try to consume probiotics multiple times a day.

Middle East and Africa is emerging as a potential market for probiotic dietary supplements. The region is expected to accelerate with a CAGR of 17.6% during the forecast period. The region is witnessing a significant shift in demographics, with an increasingly young and working population that places a greater emphasis on health and well-being. This younger demographic tends to prioritize spending on products that can enhance their health and overall quality of life, including probiotic supplements.

Key Companies & Market Share Insights

The leading companies in the probiotic dietary supplements market are heavily investing in research and development to enhance their product offerings and create innovative formulations with superior properties to meet the growing demand. For instance, in January 2021, DuPont Nutrition & Biosciences, launched HOWARU Calm, a probiotic strain that can be used in dietary supplements to promote mental well-being and reduce stress.

To expand their market presence, industry players are also adopting partnership and expansion strategies. For instance, in June 2021, Probi, collaborated with Oriflame to develop probiotic supplements using Probi Digestis, a scientifically-proven probiotic strain that improves overall gut health. Some of the key players operating in the global probiotics dietary supplements market include:

-

Vitakem Nutraceuticals Inc

-

Lesaffre

-

DuPont de Nemours, Inc.

-

H&H Group

-

Symrise

-

ProbioFerm

-

Dietary Pros, Inc.

-

Chr. Hansen Holding A/S

-

Dr. Joseph Mercola (Mercola Market)

-

BASF SE

-

ADM

-

Amway

-

Abbott

-

Bayer AG

-

Glanbia Plc

-

Pfizer Inc.

-

BioGaia

-

GSK Plc

-

DSM

Probiotics Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 20.53 billion

Revenue forecast in 2030

USD 51.84 billion

Growth rate

CAGR of 14.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, end-use, applications, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; Colombia South Africa; UAE; Saudi Arabia

Key companies profiled

Vitakem Nutraceuticals Inc.; Lesaffre; DuPont de Nemours, Inc.; H&H Group; Symrise; ProbioFerm; Dietary Pros, Inc; Chr. Hansen Holding A/S; Dr. Joseph Mercola (Mercola Market); BASF SE; ADM; Amway; Abbott; Bayer AG; Glanbia Plc; Pfizer Inc.; BioGaia; GSK Plc; DSM

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Probiotics Dietary Supplements Market Report Segmentation

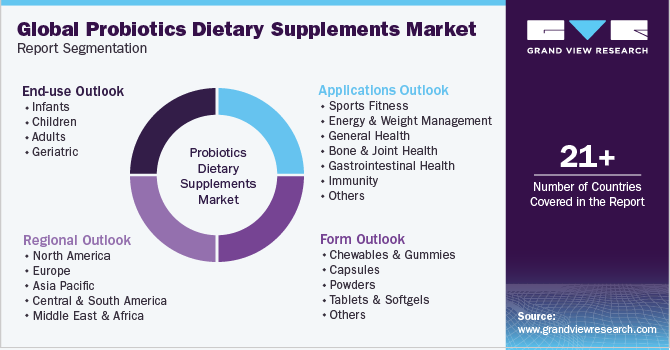

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global probiotic dietary supplements market report based on form, end-use, applications, and region:

-

Form Outlook (Revenue, USD Million, 2017 - 2030)

-

Chewables & Gummies

-

Capsules

-

Powders

-

Tablets & Softgels

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Infants

-

Children

-

Adults

-

Geriatric

-

-

Applications Outlook (Revenue, USD Million, 2017 - 2030)

-

Sports Fitness

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Skin/Hair/Nails

-

Brain/Mental Health

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 -2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

- South Korea

-

-

Central & South America

-

Brazil

-

Argentina

- Colombia

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global probiotics dietary supplements market size was estimated at USD 18.04 billion in 2022 and is expected to reach USD 20.53 billion in 2023.

b. The global probiotics dietary supplements market is expected to grow at a compound annual growth rate of 14.1% from 2023 to 2030 to reach USD 51.84 billion by 2030.

b. Tablets & softgels dominated the market with a share of over 40% in 2022, owing to the presence of high-quality excipients that aid in tablet absorption and disintegration.

b. Some of the key players operating in the global probiotics dietary supplements market include Vitakem Nutraceuticals Inc., Lesaffre, DuPont de Nemours, Inc., H&H Group, Symrise, ProbioFerm, Dietary Pros, Inc, Chr. Hansen Holding A/S, Dr. Joseph Mercola (Mercola Market), BASF SE, ADM, Amway, Abbott, Bayer AG, Glanbia Plc, Pfizer Inc., BioGaia, GSK Plc, and DSM.

b. The key factors that are driving the global probiotics dietary supplements market include the rising prevalence of digestive disorders, increasing focus on preventive healthcare, and growing consumer spending on health and wellbeing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."