- Home

- »

- Consumer F&B

- »

-

Yogurt And Probiotic Drink Market Size & Share Report, 2030GVR Report cover

![Yogurt And Probiotic Drink Market Size, Share & Trends Report]()

Yogurt And Probiotic Drink Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Yogurt, Probiotic Drinks), By Distribution Channel (Online, Offline), By Region (North America, APAC), And Segment Forecasts

- Report ID: GVR-4-68039-964-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Yogurt And Probiotic Drink Market Summary

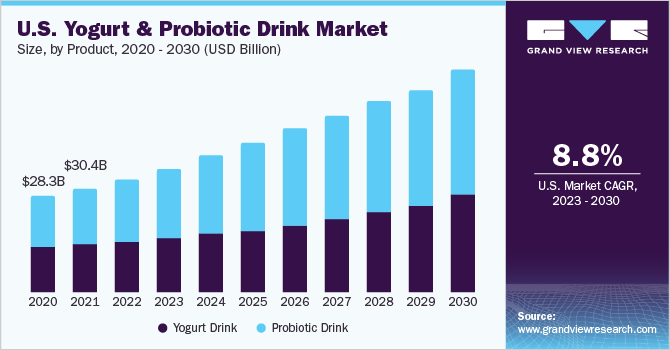

The global yogurt and probiotic drink market size was estimated at USD 86.87 billion in 2022 and is projected to reach USD 182.96 billion by 2030, growing at a CAGR of 9.8% from 2023 to 2030. Gut health has become a major concern for many consumers and increased research on science and innovation within this space has shifted consumer awareness from conventional to functional foods that are more nutritious and healthier.

Key Market Trends & Insights

- The North America accounted for the maximum share of more than 44.4% of the global revenue in 2022.

- The Asia Pacific is expected to witness the fastest CAGR of 11.1% during the forecast period.

- Based on product, the probiotic drink segment accounted for the largest revenue share of more than 55.1% in 2022.

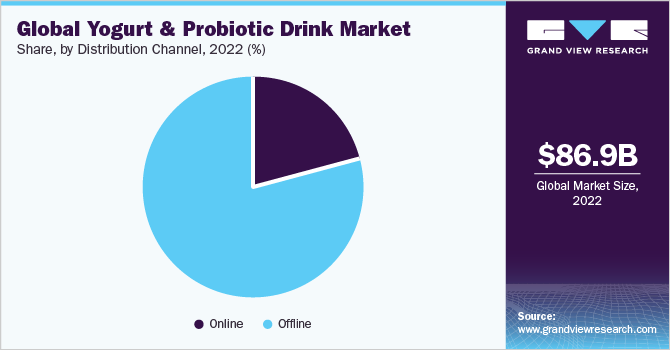

- Based on distribution channel, the offline segment accounted for the maximum revenue share of 78.8% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 86.87 Billion

- 2030 Projected Market Size: USD 182.96 Billion

- CAGR (2023-2030): 9.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

According to an article published in Food Dive, in June 2021, approximately 70% of consumers eat yogurt for general health and wellness and 60% for digestive/gut health. Such factors are expected to bode well with the growth of the industry.

The demand for healthy products that can be easily incorporated into everyday routines and lifestyles has opened new avenues for yogurt drinks. The positioning of these drinks as the basis of healthy nutrition and the increase in public awareness about the health benefits of these beverages are driving product demand across the globe.

Hence, key players are collaborating with other companiesto offer an extended line of products. For instance, in June 2021, KeVita, a leading brand of high-quality fermented beverages, collaborated with Amber Riley, an American actress, and singer to launch KeVita Prebiotic Shots, an on-the-go drink offered in a convenient two-ounce bottle to help support digestive health. Furthermore, to keep up with the competition presented by international brands, regional players are offering new products that support natural immune resistance and help in balancing digestive bacteria. For instance, in October 2020, Agriton U.K. launched a fermented probiotic drink called EDM Drink, which contains a mixture of naturally occurring organisms, such as lactic acid bacteria and yeasts.

The product also includes multiple nutrients like vitamin C, zinc, potassium, malic acid, and citric acid, which support digestion. Such product launches are anticipated to drive industry growth in the coming years. The snackification (replacing meals with snacks) of yogurt drinks as a breakfast item, a rise in the popularity of nutritional & immunity-boosting foods, and the increasing practice of eating food at home were among the major factors that drove the sales of yogurt drinks. According to an article published in Sosland Publishing, in January 2022, approximately 78% of consumers prefer snacking to ‘take care of their body’ and fulfill their ‘nutritional needs.

Hence, an increasing number of consumers are opting for yogurt drinks or beverages for breakfast as they are extremely convenient and easily fit into the on-the-go lifestyle. Rising healthcare costs and prolific use of the internet have brought preventive healthcare into focus. This has resulted in a substantial increase in the number of probiotic drinks available across the world in recent years. For instance, in July 2020, Danone launched a range of plant-based yogurt drinks. The dairy-free drinks are available in Mango & Passionfruit and Blueberry flavors. The manufacturers of probiotic drinks have been introducing innovative products with different flavors and attractive packaging, which is expected to increase product visibility among consumers and increase the market share of the brand.

Product Insights

On the basis of products, the industry is further bifurcated into yogurt drinks and probiotic drinks. The probiotic drink segment accounted for the largest revenue share of more than 55.1% in 2022 and is expected to maintain dominance over the forecast period. Increasing product launches by key players in this segment are favoring the growing demand for such beverages. For instance, in January 2020, Stonyfield Organic launched its probiotic yogurt drink, Daily Probiotics, in a 3.1-oz easy-to-drink format to support both immune and digestive health in the U.S. The drink was made available in two flavors, Blueberry Pomegranate and Strawberry Acai.

The ingredients of the drink include real fruits and organic low-fat milk, containing 60 calories per serving. The yogurt drink segment is projected to register the CAGR of 9.6% during the forecast period. The growing demand for healthier food products with improved nutrition is the key driver of the segment. It offers ready-to-drink convenience, contains low fat-yogurt and nutritional sources, such as lean protein, a branched chain of amino acids, calcium, and vitamin D. According to studies published by Grande Cheese Company, in July 2021, yogurt helps reduce the risk of high blood pressure, a major contributor to heart disease, by as much as 50%.

Distribution Channel Insights

The offline segment accounted for the maximum revenue share of 78.8% in 2022. The availability of yogurt and probiotic drinks in various stores, such as supermarkets and hypermarkets, is the primary factor for its growth in the year 2021. For instance, a leading U.K. supermarket chain, Sainsbury’s stocks vegan probiotic drinks, such as Biomel Yakult-style beverages, that boost gut health. The products are free from gluten and soy and are made with natural, plant-based ingredients. Furthermore, to ensure the in-store buying habits of customers are maintained, storeowners follow innovative marketing and promotional activities, which are expected to increase the sales of these products via the abovementioned stores.

The online segment is projected to register the fastest CAGR of 11.0% during the forecast period. The emergence of online shopping and the benefits of at-home delivery have persuaded consumers to shop for yogurt and probiotic drinks through online portals. The segment witnessed strong growth in 2020 owing to the COVID-19 pandemic as consumers were forced to shop online owing to the temporary or permanent closures of physical distribution channels worldwide. Amazon witnessed a dramatic increase in demand on multiple fronts throughout 2020, including the demand for value-added health-oriented probiotic products.

Regional Insights

North America accounted for the maximum share of more than 44.4% of the global revenue in 2022. The growing number of health-conscious consumers opting for a vegan diet in the region is expected to propel the growth of the vegan yogurt drink segment during the forecast period. According to an article published by Wellness Pro, in January 2021, approximately 6% of U.S. consumers were vegan - a 6x (500%) increase, compared to just 1% in 2014. Thus, an increasing number of consumers preferring a vegan diet will provide strong growth goals for the market.

Asia Pacific is expected to witness the fastest CAGR of 11.1% during the forecast period. Various initiatives, such as product launches, by key manufacturers, will complement the overall growth of the region. For instance, in March 2020, Japan’s Megmilk Snowbrand launched its first functional yogurt drink to relieve allergy symptoms. It contains Lactobacillus helveticus SBT2171, a lactic acid bacterium that is known for its effects on relieving symptoms of allergic reactions. Bacillus is also gaining traction among the producers as it can be utilized in most extreme production processes, which is projected to adapt well to the market growth in the region.

Key Companies & Market Share Insights

The industry is consolidated with the presence of many developed global players and many developing key market entrants. These players are engaging in the major acquisition and promotional activities to increase their customer base and brand loyalty. Some of the initiatives by the key players in the market include:

-

In June 2023 Chobani launched the Chobani Zero Sugar Drinks, a convenient and innovative drink option with no added sugars. This protein-packed on-the-go beverage is crafted from natural ingredients, providing consumers with a wholesome and nutritious choice.

-

In January 2022, So Delicious, a subsidiary of Danone S.A., launched a new line of coconut milk yogurt alternatives with botanical extracts, such as strawberry with elderberry extract, mango with ginger & turmeric extract, and mixed berry with chamomile extract. The product claims to contain live & active cultures, organic coconut, 7-8 gm of sugar, and no artificial sweeteners or preservatives.

Some of the key players operating in the global yogurt and probiotic drink market include:

-

Yakult Honsha Co., Ltd.

-

Chobani, LLC

-

Danone

-

Grupo Lala

-

Califia Farms

-

Lifeway Foods, Inc.

-

Bio-K+

-

Harmless Harvest

-

GoodBelly Probiotics

-

KeVita

Yogurt And Probiotic Drink Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 96.27 billion

Revenue forecast in 2030

USD 182.96 billion

Growth rate

CAGR of 9.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific;Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Yakult Honsha Co., Ltd.; Chobani, LLC; Danone; Grupo Lala; Califia Farms; Lifeway Foods, Inc.; Bio-K+; Harmless Harvest; GoodBelly Probiotics; KeVita

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Yogurt And Probiotic Drink Market Report Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global yogurt and probiotic drink market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Yogurt Drink

-

By Product

-

Vegan

-

Dairy-based

-

-

By Type

-

With Probiotics

-

Without Probiotics

-

-

-

Probiotic Drink

-

By Product

-

Vegan/Plant-based

-

Dairy-based

-

Water-based

-

-

By Type

-

Yogurt Drink (With Probiotics)

-

Kefir

-

Water

-

Juice

-

Others

-

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global yogurt and probiotic drink market size was estimated at USD 86.87 billion in 2022 and is expected to reach USD 96.27 billion in 2023.

b. The global yogurt and probiotic drink market is expected to grow at a compound annual growth rate of 9.8% from 2023 to 2030 to reach USD 182.96 billion by 2030.

b. North America dominated the yogurt and probiotic drink market with a share of 44.6% in 2022. This is attributable to the growing number of health-conscious consumers opting for a vegan diet in the region is expected to propel the growth of the vegan yogurt drink segment in the forecast period.

b. Some key players operating in the yogurt & probiotic drink market include Yakult Honsha Co., Ltd.; Chobani, LLC; Danone; Grupo Lala; Califia Farms; Lifeway Foods, Inc.; Bio-K+; Harmless Harvest; GoodBelly Probiotics; KeVita

b. Key factors that are driving the yogurt and probiotic drink market growth include sanctification (replacing meals with snacks) of yogurt drinks as a breakfast item, a rise in the popularity of nutritional & immunity-boosting foods, and the increasing practice of eating food at home were among the major factors that drove the sales of yogurt drinks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.