- Home

- »

- Next Generation Technologies

- »

-

Procure To Pay Solution Market Size, Industry Report, 2033GVR Report cover

![Procure To Pay Solution Market Size, Share & Trends Report]()

Procure To Pay Solution Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment, By Enterprise Size, By End Use (Manufacturing, BFSI), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-640-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Procure To Pay Solution Market Summary

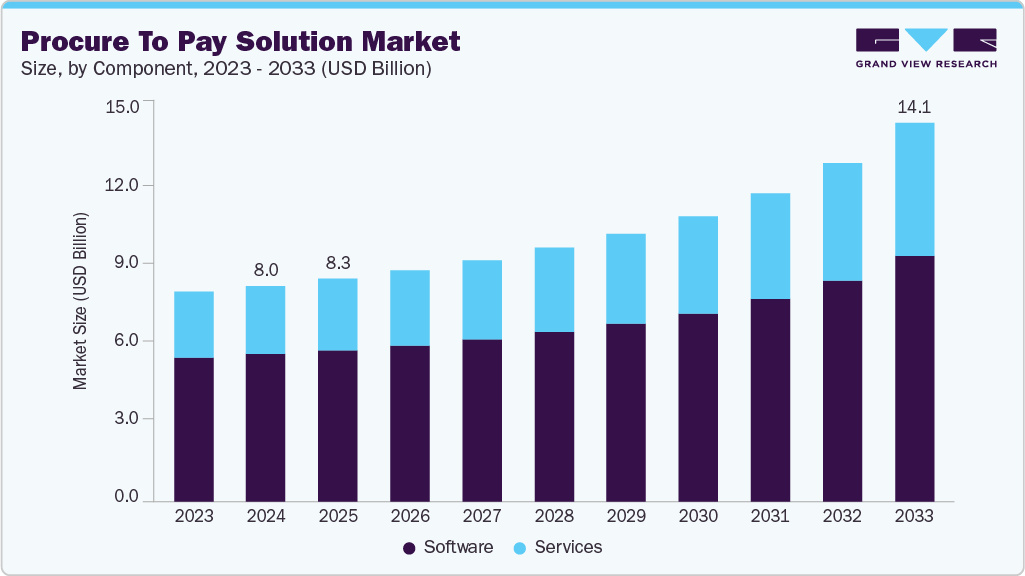

The global procure to pay solution market size was estimated at USD 8.02 billion in 2024, and is projected to reach USD 14.07 billion by 2033, growing at a CAGR of 6.8% from 2025 to 2033. Market growth is driven by the growing need for end-to-end automation of procurement workflows to enhance operational efficiency and cost control. In addition, integrating AI and analytics enables real-time spend visibility and smarter decision-making across enterprises.

Key Market Trends & Insights

- North America Procure to Pay Solution Market accounted for a 36.5% share of the overall market in 2024.

- The Procure to Pay Solution Industry in the U.S. held a dominant position in 2024.

- By Component, the Software segment accounted for the largest share of 55.6% in 2024.

- By Deployment, the cloud segment held the largest market share in 2024.

- By Enterprise Size, the large enterprises segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.02 Billion

- 2033 Projected Market Size: USD 14.07 Billion

- CAGR (2025-2033): 6.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest Market

Organizations increasingly focus on automating their procurement and payment workflows to eliminate inefficiencies and reduce manual errors. Traditional procurement processes are time-consuming and prone to delays, leading to lost productivity. P2P solutions offer a centralized platform to streamline sourcing, purchasing, invoicing, and payment. This automation not only speeds up transactions but also enhances compliance. The demand for operational efficiency is one of the primary drivers behind the growing adoption of P2P platforms.

Advanced technologies like artificial intelligence (AI), machine learning (ML), and predictive analytics are transforming the P2P landscape. These capabilities enable smart invoice matching, anomaly detection, and automated decision-making. With real-time data insights, organizations can better manage spending, identify cost-saving opportunities, and mitigate procurement risks. AI-powered assistants and bots are also being used to handle routine tasks, improving productivity. The ability to gain intelligent insights makes AI integration a must-have in modern P2P systems.

Cloud-based P2P platforms are gaining popularity due to their lower upfront costs, scalability, and faster implementation. Unlike legacy systems, cloud solutions support real-time collaboration across geographically dispersed teams. They offer seamless integration with ERP systems and provide users with access to data from anywhere. This particularly appeals to small and medium-sized enterprises (SMEs) that require flexible and cost-effective solutions. As a result, cloud deployment is rapidly becoming the preferred model across industries.

Effective supplier relationship management has become a top priority for businesses facing volatile supply chains. P2P platforms now include tools for onboarding, performance tracking, and compliance management. These features help organizations build stronger, more transparent relationships with vendors. Enhanced collaboration also supports early payment discounts and contract compliance. Companies leverage P2P systems to manage supplier risk and ensure continuity as global supply chains grow more complex.

Component Insights

The software segment accounted for the largest share of 68.2% in 2024. The software segment continues to dominate the market, driven by the growing need for integrated platforms that manage end-to-end procurement, invoicing, and payment processes. Organizations prioritize digital procurement suites that offer real-time data insights, customizable workflows, and seamless integration with ERP and financial systems. The dominance of the software segment is further supported by the rising adoption of AI-driven automation, enabling faster approvals, error reduction, and enhanced compliance tracking. As businesses scale, the demand for centralized and intelligent software platforms remains strong.

The services segment is expected to grow at the fastest CAGR during the forecast period. The services segment is emerging rapidly as companies seek specialized support for P2P implementation, integration, and maintenance. With evolving regulatory requirements and increasing system complexities, there is a growing reliance on consulting, training, and managed services to ensure optimal use of P2P solutions. Service providers also help businesses tailor platforms to specific operational needs, boosting user adoption and ROI. The rise of cloud deployments has further amplified the need for post-deployment support and system upgrades, making services a crucial component of long-term procurement transformation strategies.

Deployment Insights

The cloud segment held the dominating share in the market in 2024. Businesses increasingly opt for cloud-based platforms that offer real-time access, seamless updates, and better integration across global operations. The shift to remote and hybrid work models has accelerated cloud adoption, enabling secure access to procurement tools from any location. Moreover, cloud solutions facilitate faster implementation cycles, lower maintenance overhead, and continuous feature upgrades, making them a preferred choice for large enterprises and SMEs.

The on-premise segment is expected to grow significantly during the forecast period. Despite the growing popularity of cloud-based platforms, the on-premise segment is emerging in sectors with strict data security, compliance, and customization requirements. Defense, banking, and pharmaceutical industries often prefer on-premise solutions to maintain full control over sensitive procurement data. These deployments allow deeper customization and integration with legacy systems, essential for businesses with complex IT environments. As cybersecurity and data sovereignty concerns rise, some organizations revisit on-premise models for greater governance and internal control over procurement processes.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024. Large enterprises continue to dominate the market due to their complex procurement operations and higher transaction volumes, which demand scalable and integrated platforms. These organizations often operate across multiple geographies and require advanced features such as real-time analytics, compliance tracking, and multi-vendor management. Consolidating procurement functions across departments and ensuring global standardization drives significant investments in robust P2P systems. In addition, large enterprises have the resources and infrastructure to adopt advanced technologies like AI and machine learning within their procurement workflows.

The small & medium enterprises segment is projected to grow at the fastest CAGR over the forecast period. The small and medium enterprises (SMEs) segment is emerging as a key growth area in the P2P solutions market, fueled by increasing awareness of automation benefits and the availability of cost-effective, cloud-based tools. SMEs seek streamlined procurement processes to reduce operational costs, improve cash flow visibility, and compete with larger players. Vendors are responding with modular and user-friendly solutions tailored to SME needs, allowing for gradual scaling and quicker implementation. As digital adoption accelerates among smaller businesses, the demand for flexible and affordable P2P platforms is expected to rise steadily.

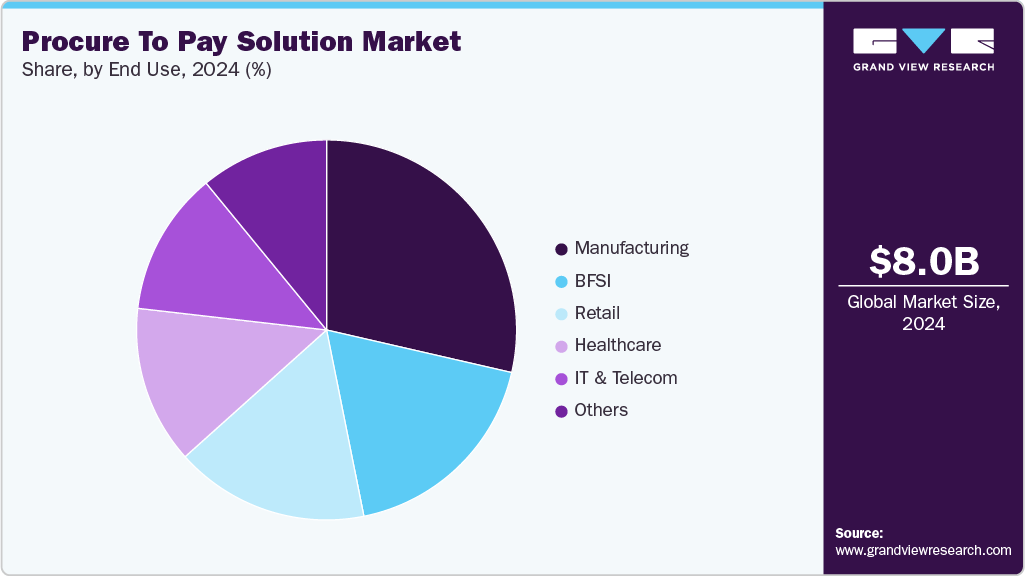

End Use Insights

The manufacturing segment dominated the market in 2024. The manufacturing sector continues to dominate the Procure-to-Pay (P2P) solutions market, driven by the increasing need for supply chain automation, cost efficiency, and compliance management. With complex procurement processes, high supplier volumes, and global operations, manufacturers are adopting AI-powered P2P platforms to streamline purchase orders, invoice processing, and payment workflows. The rise of Industry 4.0 and smart factories has further accelerated demand for real-time spend analytics, supplier collaboration tools, and ERP-integrated P2P systems. Furthermore, stringent regulatory requirements and the push for working capital optimization are compelling manufacturers to invest in end-to-end digital P2P solutions, making this segment a key revenue driver in the market.

The IT & Telecom segment is expected to register the fastest CAGR over the forecast period, driven by rising demand for managing decentralized procurement activities and recurring vendor services. With increasing reliance on outsourcing, software subscriptions, and third-party service providers, these companies need agile systems to manage complex procurement lifecycles. P2P platforms offer IT and telecom firms improved spend tracking, contract management, and automated approvals, aligning with their need for speed, flexibility, and digital-first operations. As the sector expands globally, P2P adoption is expected to rise steadily.

Regional Insights

The North America procure-to-pay solution market held the largest share in 2024. The regional growth can be attributed to the high level of digital maturity, strong enterprise IT infrastructure, and early adoption of procurement automation tools. Large manufacturing, retail, BFSI, and healthcare enterprises increasingly rely on integrated P2P platforms to improve compliance, reduce costs, and streamline supply chains. The presence of major solution providers and frequent technology upgrades in the region supports continuous innovation in procurement practices.

U.S. Procure to Pay Solution Market Trends

The procure-to-pay solution market in the U.S. held a dominant position in 2024, driven by widespread adoption of AI-driven procurement solutions and cloud-based platforms. The emphasis on operational efficiency, data-driven decision-making, and adherence to federal compliance regulations fuels demand across private and public sectors.

Europe Procure to Pay Solution Industry Trends

The procure-to-pay solution market in Europe was identified as a lucrative region in 2024. Europe remains a lucrative market, bolstered by strict regulatory frameworks around procurement transparency, data privacy (GDPR), and sustainable sourcing. Large enterprises across the region are modernizing legacy procurement systems in favor of cloud-native platforms with embedded analytics and ESG compliance features. Moreover, government initiatives promoting digital public procurement contribute to adoption growth, particularly in Western and Northern Europe.

The UK procure-to-pay solution market is expected to grow rapidly in the coming years. Government-led digital procurement initiatives propel market growth, particularly in the healthcare and education sectors. The push for paperless transactions, faster supplier onboarding, and real-time invoice tracking drives uptake among large and mid-sized firms.

Asia Pacific Procure to Pay Solution Industry Trends

The procure-to-pay solution market in Asia Pacific is expected to grow at the fastest CAGR of 7.6% over the forecast period. Market growth is rapid digitization, increased outsourcing, and expanding manufacturing operations. Countries like China, India, Japan, and Southeast Asian nations are increasingly investing in cloud procurement tools to reduce inefficiencies and strengthen vendor ecosystems. Local and multinational companies are moving toward automation to stay competitive and scale operations.

The Japan procure-to-pay solution market is expected to grow rapidly, with companies focusing on standardization and automation of procurement workflows to reduce errors and labor costs. The prevalence of hybrid procurement models mixing traditional methods with modern platforms requires flexible P2P systems with high configurability. The country’s emphasis on quality control, operational accuracy, and long-term supplier relationships aligns well with the capabilities of modern P2P solutions.

The procure-to-pay solution market in China held a substantial market share in 2024 due to large procurement activities and digital government initiatives. With the rise of e-invoicing mandates and smart city programs, enterprises across sectors are embracing P2P platforms for better spend control and tax compliance.

Key Procure To Pay Solution Company Insights

Some of the key companies in the market include SAP SE, Coupa Software Inc., Oracle Corporation, JAGGAER, Basware Corporation, and others. These organizations focus on expanding their customer base to gain a competitive edge. As a result, leading players engage in strategic initiatives such as mergers and acquisitions, partnerships, and technology upgrades to enhance platform capabilities and market reach.

-

SAP SE is an enterprise software leader offering SAP Ariba, a robust P2P platform that thousands of organizations use worldwide. With a strong presence across 180 countries, SAP leverages its extensive ERP ecosystem and the Ariba Network to streamline procurement and supplier collaboration.

-

Coupa Software Inc. provides a cloud-based Business Spend Management (BSM) platform that unifies procurement, invoicing, and expense management. It is known for its AI-driven insights, intuitive interface, and rapid deployment capabilities, and serves a broad spectrum of industries, including healthcare, retail, and logistics.

Key Procure To Pay Solution Companies:

The following are the leading companies in the procure to pay solution market. These companies collectively hold the largest market share and dictate industry trends.

- SAP SE

- Coupa Software Inc.

- Oracle Corporation

- JAGGAER

- Basware Corporation

- Zycus Inc.

- GEP

- Infor

- IBM Corporation

- Tradeshift

Recent Developments

-

In February 2025, Stampli announced the launch of its new procure to pay solution, designed to unify procurement processes, documents, and communications into a single workflow. The platform enables end-to-end management from purchase requests to payments, integrated directly with a company’s ERP system. Powered by Billy the Bot, Stampli’s AI copilot, the solution simplifies operations by converting unstructured employee requests into finance-ready data. Key features include real-time budget tracking, dynamic approval workflows, audit trails, and intelligent handling of purchase requests. The solution is expected to be fully available to Stampli’s AP automation customers in Q1 2025.

-

In March 2025, Vroozi was recognized as a Value Leader in Spend Matters’ Spring SolutionMap for Procure-to-Pay (P2P) in the mid-market category, earning honors in E-Procurement and AP Automation. Vroozi's AI-powered, mobile-first platform streamlines procurement and accounts payable processes, enabling fast deployment and significant ROI with minimal training. The company emphasizes integrating existing systems, allowing procurement and finance teams to automate workflows and reduce manual data handling.

Procure To Pay Solution Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.29 billion

Revenue forecast in 2033

USD 14.07 billion

Growth rate

CAGR of 6.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

SAP SE; Coupa Software Inc.; Oracle Corporation; JAGGAER; Basware Corporation; Zycus Inc.; GEP; Infor; IBM Corporation; Tradeshift

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Procure To Pay Solution Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global procure to pay solution market report based on component, deployment, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Manufacturing

-

BFSI

-

Retail

-

Healthcare

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global procure to pay solution market size was estimated at USD 8.02 billion in 2024 and is expected to reach USD 8.29 billion in 2025.

b. The global procure to pay solution market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2033 and is expected to reach USD 14.07 billion by 2033.

b. North America dominated the procure to pay solution market with a share of 36.5% in 2024. The regional growth can be attributed to the high level of digital maturity, strong enterprise IT infrastructure, and early adoption of procurement automation tools.

b. Some key players operating in the procure to pay solution market include SAP SE, Coupa Software Inc., Oracle Corporation, JAGGAER, Basware Corporation, Zycus Inc., GEP , Infor, IBM Corporation, Tradeshift.

b. The Procure to Pay solution market is driven by the growing demand for end-to-end automation and real-time spend visibility to enhance operational efficiency and cost control.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.