- Home

- »

- Next Generation Technologies

- »

-

Procurement Software Market Size, Industry Report, 2033GVR Report cover

![Procurement Software Market Size, Share & Trends Report]()

Procurement Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Software Type (Spend Analysis, E-Sourcing, E-Procurement, Contract Management, Supplier Management, Others), By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-795-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Procurement Software Market Summary

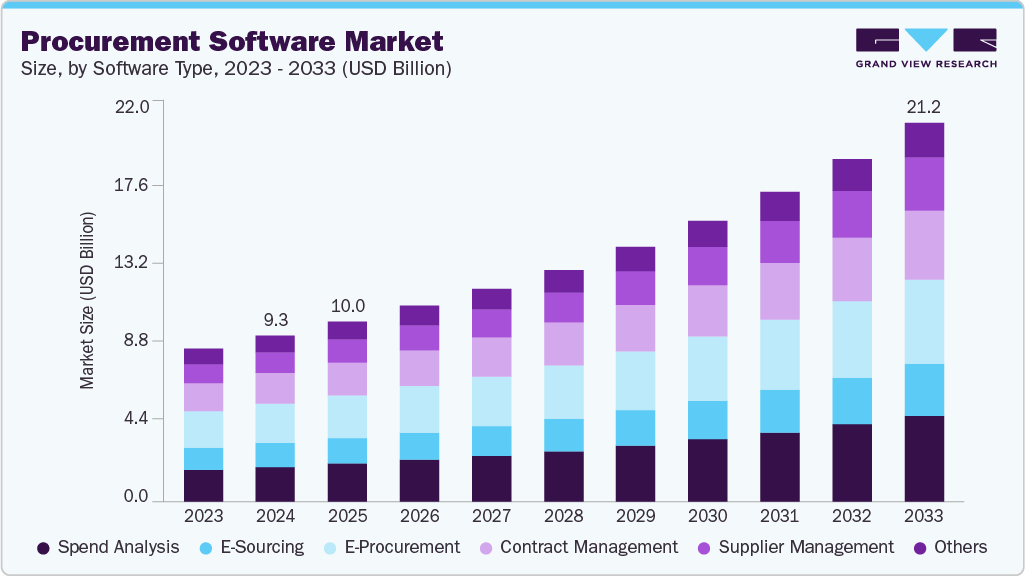

The global procurement software market size was estimated at USD 9,273.6 million in 2024 and is projected to reach USD 21,169.2 million by 2033, growing at a CAGR of 9.7% from 2025 to 2033. It enables organizations to automate, streamline, and control various procurement activities such as sourcing, purchasing, contract management, and supplier collaboration.

Key Market Trends & Insights

- North America procurement software dominated the global market with the largest revenue share of over 35.0% in 2024.

- The procurement software industry in U.S. is expected to grow significantly over the forecast period.

- By Software Type, e-procurement segment led the market and held the largest revenue share of 24.00% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9,273.6 Million

- 2033 Projected Market Size: USD 21,169.2 Million

- CAGR (2025-2033): 9.7%

- North America: Largest market in 2024

As businesses increasingly prioritize cost optimization, compliance, and agility, procurement platforms have evolved from simple transaction-based tools into intelligent, AI-powered ecosystems that deliver real-time visibility and strategic insights. Cloud adoption is a major driver of the procurement software market, as it eliminates the need for costly on-premise infrastructure and offers flexible scalability. Cloud-based procurement platforms allow organizations, particularly SMEs, to access advanced procurement, sourcing, and analytics tools through subscription models, reducing upfront capital investments. These systems also ensure faster deployment, regular updates, and enhanced accessibility across distributed teams. Moreover, cloud-based procurement software seamlessly integrates with enterprise systems such as ERP, CRM, and financial management solutions, ensuring unified data flow and improved decision-making. This integration enhances visibility into spend patterns, supplier performance, and contract compliance key factors for optimizing procurement efficiency. As digital transformation accelerates globally, the shift toward cloud-based models enables organizations to enhance operational agility, streamline workflows, and adapt quickly to changing market conditions while maintaining cost efficiency and security compliance.

The integration of emerging technologies such as Artificial Intelligence (AI) is significantly fueling the growth of the procurement software market. AI enhances automation, enabling intelligent spend analysis, supplier risk assessment, and demand forecasting. Machine learning algorithms analyze large datasets to identify cost-saving opportunities and improve sourcing decisions. Additionally, AI-driven chatbots and virtual assistants streamline purchase requests, approvals, and vendor communication, enhancing efficiency and accuracy. Predictive analytics powered by AI also support proactive procurement strategies by anticipating market fluctuations and supplier performance issues. As organizations prioritize data-driven decision-making, AI integration is transforming procurement from a transactional function into a strategic business enabler.

Vendor fragmentation and lack of standardization present major challenges to procurement software adoption. The market includes numerous providers offering diverse functionalities, pricing models, and integration capabilities, making it difficult for enterprises to identify solutions that align with their procurement maturity and business goals. This fragmentation often results in interoperability issues when integrating with existing enterprise systems. Moreover, managing multiple vendor relationships can increase administrative complexity, create data inconsistencies, and lead to higher operational costs, ultimately hindering the efficiency and scalability of procurement digitalization efforts.

Software Type Insights

The e-procurement segment dominated the market and accounted for the revenue share of 24.00% in 2024. Organizations are increasingly replacing manual, paper-based purchasing processes with automated, digital systems that streamline workflows such as requisitioning, approvals, purchase orders, and payments. This automation reduces human error, accelerates procurement cycles, and enhances overall process transparency. By digitizing supplier management and invoicing, companies gain better control over spending and improve operational efficiency. Automation also enables real-time data capture and reporting, supporting informed decision-making and compliance. As enterprises focus on efficiency, cost savings, and agility, automated e-procurement solutions are becoming essential to modern procurement strategies and digital business transformation.

The supplier management segment is anticipated to grow at the highest CAGR of 11.1% during the forecast period. The growing demand for real-time visibility and performance tracking is driving the adoption of supplier management software. Businesses need continuous insight into supplier operations to ensure product quality, cost efficiency, and on-time delivery. Modern platforms offer performance dashboards, scorecards, and automated audit features that monitor key metrics such as lead times, compliance, and service quality. This real-time tracking enables organizations to detect and resolve issues proactively, improving supplier reliability, reducing operational risks, and strengthening overall supply chain resilience and transparency.

Deployment Insights

The cloud segment dominated the market and accounted for the largest revenue share in 2024. Cloud-based procurement solutions offer significant cost efficiency by removing the need for expensive on-premise infrastructure, hardware, and associated maintenance. Organizations no longer have to invest heavily in servers, storage, or IT personnel to manage procurement systems. Subscription-based Software-as-a-Service (SaaS) models allow companies to pay only for the features and scale they require, converting large capital expenditures into manageable operational costs. This flexibility is particularly beneficial for small and medium-sized enterprises (SMEs), enabling them to access enterprise-grade procurement tools without a large upfront investment. Overall, cloud procurement reduces IT overheads, optimizes budget allocation, and enhances financial predictability while supporting scalable, modern procurement operations.

The on-premise segment is expected to grow at a significant CAGR during the forecast period. On-premise procurement solutions are favored by organizations in highly regulated industries because they provide full control over sensitive data. By hosting the software internally, companies can enforce strict security protocols, monitor access closely, and ensure compliance with industry-specific regulations. This control reduces the risk of data breaches or regulatory penalties, making on-premise systems a reliable choice for businesses that prioritize security, confidentiality, and adherence to legal and compliance standards.

Enterprise Size Insights

The large enterprises segment dominated the market and accounted for the largest revenue share in 2024. This growth is driven by the rising demand for advanced procurement management solutions that can efficiently handle complex supply chains. Such solutions help reduce operational complexity, streamline processes, and provide transparent, real-time information, enabling better decision-making. By improving visibility across procurement activities, large organizations can optimize supplier performance, control costs, and support strategic business growth, making smart procurement software an essential tool for managing large-scale operations effectively.

The SMEs segment is expected to grow at a significant CAGR during the forecast period. Cloud-based procurement solutions provide SMEs with a cost-effective way to access advanced procurement tools without large upfront investments. These platforms typically operate on subscription-based models, allowing businesses to pay only for the features and scale they require. The scalability of cloud solutions ensures that SMEs can easily expand their usage as their operations grow, without the burden of purchasing and maintaining expensive on-premise infrastructure. By lowering entry costs and offering flexible pricing, cloud procurement platforms make it feasible for smaller organizations to implement modern, efficient procurement processes.

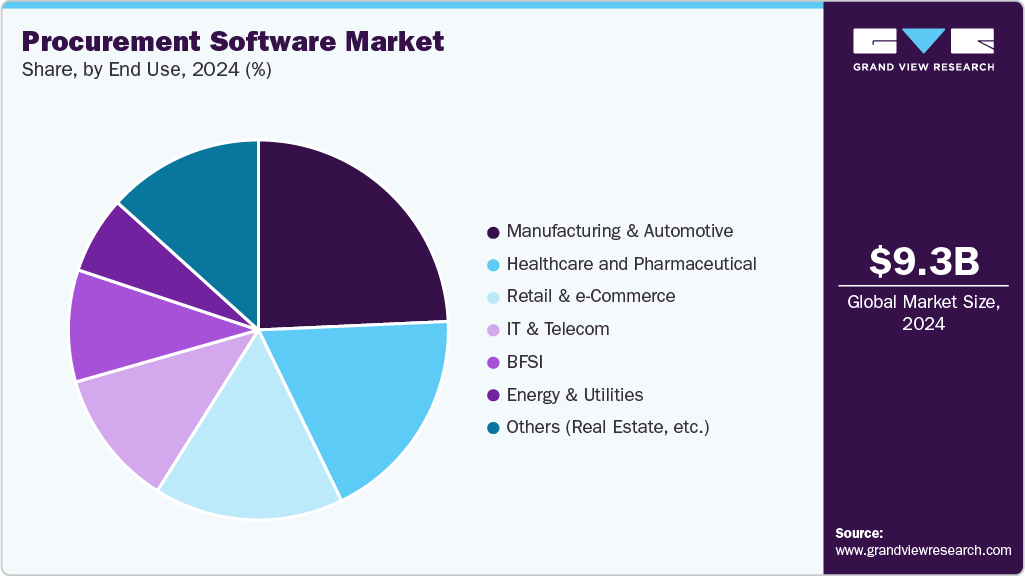

End Use Insights

The manufacturers and automotive segment dominated the market and accounted for the largest revenue share in 2024. Manufacturers and automotive companies often manage highly complex, multi-tiered supply chains that span multiple countries, suppliers, and production stages. Coordinating procurement across these layers involves tracking raw materials, components, logistics, and supplier performance simultaneously. Robust procurement software helps streamline these operations by providing real-time visibility, automated workflows, and data-driven insights, which reduce errors, delays, and operational risks. By centralizing procurement processes, companies can optimize inventory, ensure timely deliveries, and respond quickly to disruptions such as supplier delays or demand fluctuations. This efficiency not only minimizes costs but also strengthens supply chain resilience, supporting consistent production and competitive advantage in global markets.

The retail & e-commerce segment is expected to grow at a significant CAGR during the forecast period. Retailers are embracing digital procurement platforms to modernize and streamline their procurement processes. These platforms automate key activities such as supplier negotiations, contract management, and procurement analytics, reducing manual effort and human errors. Automation accelerates decision-making, ensures compliance, and provides real-time insights into spending patterns, supplier performance, and inventory needs. By integrating digital tools, retailers can optimize costs, improve operational efficiency, and maintain better control over their supply chains. This shift toward digital procurement is essential for staying competitive in the fast-paced retail and e-commerce environment.

Regional Insights

North America dominated the global market with the largest revenue share of 35.48% in 2024. Across North America, businesses are rapidly embracing digital procurement solutions as part of broader digital transformation strategies. These platforms automate routine procurement tasks, streamline supplier management, and enhance data accuracy. By integrating analytics and real-time reporting, organizations can make faster, more informed decisions. The shift to digital procurement improves operational efficiency, reduces manual effort, and supports agile, data-driven purchasing strategies that strengthen competitiveness across diverse industries.

U.S. Procurement Software Market Trends

The procurement software market in the U.S. is expected to grow significantly at a CAGR of 11.1% from 2025 to 2033. The U.S. hosts a thriving ecosystem of SMEs and startups that increasingly adopt affordable, cloud-native SaaS procurement solutions. These modular platforms provide advanced capabilities once limited to large enterprises, enabling smaller firms to streamline purchasing, improve efficiency, and compete effectively fueling substantial growth in the North American procurement software market.

Europe Procurement Software Market Trends

The procurement software market in Europe is anticipated to register considerable growth from 2025 to 2033. Europe’s strong regulatory environment, driven by EU-wide laws like GDPR and public procurement reforms, compels organizations to maintain transparency, data security, and fairness in supplier management. Additionally, government mandates promoting digital procurement processes such as e-Invoicing, e-Submission, and standardized procurement documents are accelerating the adoption of compliant and secure procurement software solutions across the region.

The UK procurement software market is expected to grow rapidly in the coming years. The The UK’s Procurement Act 2023, coming into effect in February 2025, is a major growth driver for the procurement software market. It mandates enhanced transparency, supplier diversity, and KPI reporting for large contracts. The establishment of a Central Digital Platform for public procurement simplifies bid submissions, centralizes supplier registration, and ensures compliance accelerating adoption of digital and automated procurement solutions across both public and private sectors.

The Germany procurement software market held a substantial market share in 2024. Germany’s sophisticated, digitally mature economy especially in its leading automotive and manufacturing sectors generates vast data from connected devices, production lines, and customer interactions. Using DMP-like platforms, these industries segment audiences for targeted B2B marketing, personalized experiences, and enhanced after-sales services, driving demand for advanced data management and analytics solutions.

Asia Pacific Procurement Software Market Trends

Asia Pacific procurement software held a significant share in the global market in 2024. Rapid industrialization across Asia Pacific, particularly in countries like China, India, and Vietnam, is driving the need for efficient procurement systems. As manufacturing bases expand, companies face increasingly complex supply chains involving multiple suppliers, raw materials, and production stages. Robust procurement software helps streamline sourcing, manage supplier relationships, optimize inventory, and ensure timely delivery, enabling manufacturers to enhance operational efficiency, reduce costs, and maintain competitiveness in a rapidly growing and evolving industrial landscape.

The Japan procurement software market is expected to grow rapidly in the coming years. Japanese organizations are increasingly adopting digital procurement solutions to enhance efficiency, reduce costs, and improve decision-making processes. The integration of AI, automation, and analytics into procurement workflows is becoming more prevalent, enabling businesses to streamline operations and gain deeper insights into their supply chains.

The China procurement software market held a substantial market share in 2024. China’s extensive manufacturing and logistics sectors are driving demand for procurement software. As companies focus on supply chain optimization, advanced procurement solutions help streamline sourcing, manage suppliers, improve efficiency, and reduce costs, enabling large-scale manufacturers and logistics providers to enhance competitiveness and maintain operational excellence.

Key Procurement Software Company Insights

Key players operating in the procurement software industry are SAP SE, Proactis Holdings PLC, Epicor Software Corporation, Ginesys (Ginni Systems Limited), Coupa Software Inc., Zycus Inc., GT Nexus (Infor Inc.), Ivalua Inc., Microsoft Corporation, Oracle Corporation, Basware AS, Mercateo AG, GEP Corporation, and Jaggaer Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In December 2024, Ivalua introduced an AI-powered Intake Management solution designed to streamline procurement processes. This tool features an intuitive chat interface that guides employees through submitting requests ranging from supplier inquiries to contract needs ensuring compliance with procurement policies. Key functionalities include AI-driven assistance, seamless system integration, a collaborative tracking dashboard, and a no-code configuration platform, enabling procurement teams to efficiently manage intake requests and enhance operational scalability

-

In July 2024, GEP Corporation acquired OpusCapita, a Helsinki-based provider of e-invoicing and accounts payable automation solutions. This acquisition combines GEP's AI-driven procurement and supply chain software with OpusCapita's expertise, enhancing GEP's presence in the Nordic region. OpusCapita will operate as a standalone subsidiary, expanding GEP's global operations and customer base. Financial terms of the acquisition were not disclosed.

-

In April 2024, IRIS Software Group partnered with Amazon Business to integrate e-procurement capabilities into IRIS Financials, enabling over 5,000 UK schools to streamline purchasing processes. This collaboration allows schools to access Amazon Business's digital catalog directly within their IRIS Financials system, facilitating the purchase of items like textbooks, stationery, and equipment. The integration automates purchase orders, approvals, and reconciliations, reducing manual tasks and enhancing efficiency for educational institutions.

Key Procurement Software Companies:

The following are the leading companies in the procurement software market. These companies collectively hold the largest market share and dictate industry trends.

- SAP SE

- Proactis Holdings PLC

- Epicor Software Corporation

- Ginesys (Ginni Systems Limited)

- Coupa Software Inc.

- Zycus Inc.

- GT Nexus (Infor Inc.)

- Ivalua Inc.

- Microsoft Corporation

- Oracle Corporation

- Basware AS

- Mercateo AG

- GEP Corporation

- Jaggaer Inc.

Procurement Software Report Scope

Report Attribute

Details

Market size in 2025

USD 10,057.2 million

Revenue forecast in 2033

USD 21,169.2 million

Growth Rate

CAGR of 9.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2033

Report Application

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Software Type, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

SAP SE; Proactis Holdings PLC; Epicor Software Corporation; Ginesys (Ginni Systems Limited); Coupa Software Inc.; Zycus Inc.; GT Nexus (Infor Inc.); Ivalua Inc.; Microsoft Corporation; Oracle Corporation; Basware AS; Mercateo AG; GEP Corporation; Jaggaer Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Procurement Software Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the procurement software market report based on software type, functionality, deployment, enterprise size, end use, and region.

-

Software Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Spend Analysis

-

E-Sourcing

-

E-Procurement

-

Contract Management

-

Supplier Management

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Energy & Utilities

-

BFSI

-

IT & Telecom

-

Manufacturing & Automotive

-

Healthcare & Pharmaceuticals

-

Retail & E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global procurement software market size was estimated at USD 9,273.6 million in 2024 and is expected to reach USD 10,057.2 million in 2025.

b. The global procurement software market is expected to grow at a compound annual growth rate of 9.7% from 2025 to 2033 to reach USD 21,169.2 million by 2033.

b. The large enterprises segment dominated the market and accounted for the largest revenue share in 2024. This growth is driven by the rising demand for advanced procurement management solutions that can efficiently handle complex supply chains. Such solutions help reduce operational complexity, streamline processes, and provide transparent, real-time information, enabling better decision-making. By improving visibility across procurement activities, large organizations can optimize supplier performance, control costs, and support strategic business growth, making smart procurement software an essential tool for managing large-scale operations effectively

b. Key players operating in the procurement software industry are SAP SE, Proactis Holdings PLC, Epicor Software Corporation, Ginesys (Ginni Systems Limited), Coupa Software Inc., Zycus Inc., GT Nexus (Infor Inc.), Ivalua Inc., Microsoft Corporation, Oracle Corporation, Basware AS, Mercateo AG, GEP Corporation, and Jaggaer Inc.

b. The integration of emerging technologies such as Artificial Intelligence (AI) is significantly fueling the growth of the procurement software market. AI enhances automation, enabling intelligent spend analysis, supplier risk assessment, and demand forecasting. Machine learning algorithms analyze large datasets to identify cost-saving opportunities and improve sourcing decisions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.