- Home

- »

- Digital Media

- »

-

Programmatic Advertising Market Size, Industry Report, 2030GVR Report cover

![Programmatic Advertising Market Size, Share & Trends Report]()

Programmatic Advertising Market (2024 - 2030) Size, Share & Trends Analysis Report By Auction (Real-Time Bidding (RTB), Private Marketplace (PMP)), By Ad Format, By Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-319-3

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Programmatic Advertising Market Summary

The global programmatic advertising market size was estimated at USD 678.37 billion in 2023 and is projected to reach USD 2,753.03 billion by 2030, growing at a CAGR of 22.8% from 2024 to 2030. Programmatic advertising has revolutionized the digital advertisement landscape, enabling marketers to reach their target audiences with greater precision and efficiency.

Key Market Trends & Insights

- The programmatic advertising market in North America held the largest global market share of 32.6% in 2023.

- The Asia Pacific programmatic advertising market is projected to grow at the fastest CAGR of 24.4% over the forecast period.

- Based on channel, the mobile & tablets segment dominated the market with a revenue share of 49.4% in 2023.

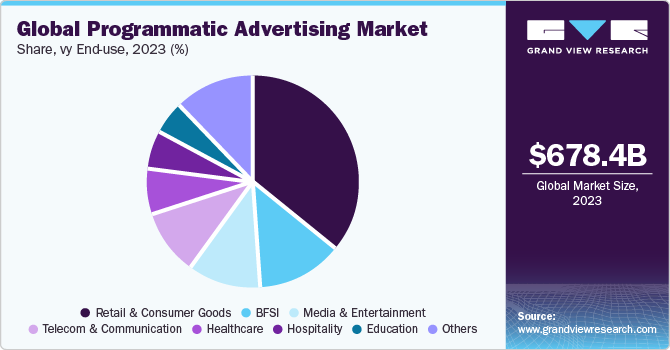

- Based on end use, the retail & consumer goods segment held the largest market share of 36.3% in 2023

- Based on Ad format, the video segment held the largest market share of 41.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 678.37 Billion

- 2030 Projected Market Size: USD 2,753.03 Billion

- CAGR (2024-2030): 22.8%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Utilizing automated technology and algorithms, programmatic advertising streamlines the buying and selling of online ad space in real time, making the process more efficient and data-driven. Traditional ad buying involves manual negotiations, orders, and placements, which are time-consuming and prone to errors. Programmatic technology uses algorithms and machine learning to automate these tasks, enabling advertisers to purchase ad inventory in real time. This reduces the need for human intervention, speeds up campaign deployment, and minimizes errors, allowing advertisers to focus on strategy and creative aspects.

Programmatic advertising extends beyond traditional desktop and mobile platforms to include various digital environments, such as connected TV (CTV), digital out-of-home (DOOH), and audio platforms like podcasts and streaming services. This cross-platform capability ensures that advertisers can reach their target audience across different devices and channels. For example, a user who sees an ad on their mobile device might later encounter a related ad on their smart TV or while listening to a podcast, reinforcing brand messaging and improving brand recall.

Technological advancements play a crucial role in the evolution and effectiveness of programmatic advertising. The integration of various technologies has streamlined operations, enhanced targeting precision, and improved overall campaign outcomes. Key technologies driving this evolution include artificial intelligence (AI), machine learning, big data analytics, real-time bidding (RTB), and blockchain. AI and ML are at the core of programmatic advertising, enabling more intelligent and efficient ad-buying processes. These technologies analyze extensive datasets to identify patterns and trends, which inform decision-making in real time. AI can forecast campaign performance, allowing advertisers to optimize bids and targeting strategies proactively. Moreover, machine learning algorithms personalize ad content based on individual user behavior and preferences, thereby increasing engagement and conversion rates.

Real-time bidding (RTB) is a fundamental component of programmatic advertising, enabling the purchase of ad space through automated, real-time auctions. This technology ensures that advertisers reach their desired audience at the optimal moment. RTB automates the ad buying process, reducing the need for manual negotiations and speeding up campaign deployment. In addition, big data analytics is essential for processing and analyzing the massive volumes of data generated by digital interactions. This data-driven approach allows for more accurate audience segmentation and targeting.

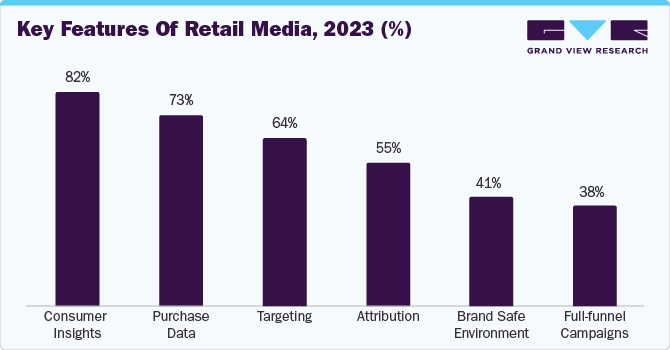

According to the report by Carousell Media Group and the Interactive Advertising Bureau Southeast Asia and India (IAB SEA+India), in 2023, first-party consumer insights (82%), purchase data (73%), targeting (64%), attribution (55%), and brand-safe environment (41%) are the five key features of retail media. By leveraging these features, retailers can create more personalized, efficient, and impactful advertisement campaigns that drive consumer engagement and enhance brand loyalty.

However, several market restraints exist within the programmatic advertisement landscape, impacting its growth and development. Ad fraud in programmatic advertising involves deceptive practices such as non-human traffic and click fraud, which artificially inflate ad metrics and waste advertiser budgets. Bots simulate user activity, leading to inaccurate campaign performance metrics and diminished ROI. In addition, fraudulent websites and networks mislead advertisers by offering ad inventory on low-quality or fake sites, further compromising campaign effectiveness. Addressing ad fraud requires vigilant monitoring, advanced fraud detection technologies, and industry collaboration to maintain transparency and accountability across the advertisement ecosystem.

Market Concentration & Characteristics

The target market is characterized by a high degree of innovation, driven by rapid advancements in technology and evolving market needs. This innovation enhances the efficiency, effectiveness, and reach of digital advertisement, providing advertisers with sophisticated tools and strategies to engage their target audiences. Programmatic advertising has also expanded into new channels. Over the years, programmatic ad spending has exploded on mobile and expanded into connected TV (CTV). This diversification of programmatic advertising channels has opened new opportunities for advertisers to reach their target audiences.

Data management platforms (DMPs) and customer data platforms (CDPs) have also played a crucial role in the growth of programmatic advertising. These platforms collect and analyze vast amounts of data from various sources, facilitating enhanced audience segmentation and personalization of ad experiences. They also enable cross-channel integration, ensuring that a consistent message is delivered to consumers across different ad platforms and devices. This integration is critical for creating cohesive and impactful advertising campaigns.

The level of product launches in the target market can be categorized as medium due to the significant advancements and innovations observed in the industry. One key factor contributing to the medium level of product launches is the continuous stream of new solutions and features introduced by AdTech companies and platforms. These innovations range from advanced targeting capabilities and dynamic creative optimization to cross-device attribution and real-time bidding strategies. With new product launches, advertisers gain access to enhanced tools and functionalities that allow them to achieve their marketing objectives more effectively.

The impact of regulation on the target market can be classified as medium. Stringent data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S., pose significant challenges to the target market. These regulations restrict how personal data can be collected, stored, and used, impacting the ability to deliver highly personalized ads. Compliance with these regulations requires substantial investment in data protection measures and can limit the availability of user data, reducing the effectiveness of advertisement targeting strategies. In addition, regulations such as the Children's Online Privacy Protection Act (COPPA) in the U.S. and the Digital Advertising Alliance (DAA) Self-Regulatory Principles further underscore the importance of responsible data handling in the advertisement industry. COPPA specifically addresses the collection of personal information from children under 13 years old, necessitating parental consent for such activities. Moreover, in regions like Australia and the UK, regulations such as the Telecommunications (Interception and Access) Act 1979 and the Data Protection Act 2018 (UK), respectively, impose additional compliance requirements on businesses operating in the programmatic ad space.

The impact of product substitutes on the target market can be classified as medium. Influence advertising is the primary substitute for programmatic advertising systems. It leverages individuals with large followings or influence within specific industries to promote products or services in a more authentic and relatable way. These alternatives offer different approaches to reaching target audiences within the industry, complementing or sometimes replacing programmatic advertising methods. In addition, traditional advertisement channels like TV, radio, print, and outdoor advertising offer broad reach and can be effective for reaching a wide audience. However, they often lack the targeting capabilities and real-time optimization features of programmatic advertising.

The end user concentration in the target market can be classified as moderate, with retail & consumer goods and IT & telecom sectors dominating the landscape. These sectors hold significant influence and investment in programmatic advertising, driving a considerable portion of the market's activity and revenue. The target market serves a variety of sectors, including media & entertainment, BFSI, education, retail & consumer goods, IT & telecom, healthcare, hospitality, transport & logistics, and others, resulting in a diverse customer base. This diversity in end use sectors contributes to the complexity and dynamism of the market, as businesses must cater to the specific needs and demands of each sector they serve.

Auction Insights

The real-time bidding (RTB) segment held the largest market share of 42.0% in 2023, primarily due to its efficiency and effectiveness in targeting specific audiences in real-time. Real-Time Bidding (RTB) allows advertisers to bid on individual ad impressions as they become available, facilitating precise and relevant audience targeting. This real-time auction-based approach attracts advertisers looking to optimize their ad spend and maximize the impact of their campaigns. In addition, the RTB model offers flexibility and scalability, making it a preferred choice for advertisers seeking to adapt quickly to changing market conditions and consumer behavior. Overall, the combination of targeting capabilities, cost-effectiveness, and adaptability has propelled the RTB segment to dominate the target market.

The private marketplace (PMP) segment is anticipated to register the fastest CAGR of 24.7% over the forecast period. PMPs offer advertisers access to high-quality, premium advertisement inventory. This inventory is often exclusive and not available in open auctions, making it highly desirable for brands seeking to maintain a certain standard and reputation. In addition, PMPs provide greater control over where ads appear. Advertisers can choose specific publishers and even specific placements on those publishers’ sites, ensuring that their ads are shown in a brand-safe environment.

Ad Format Insights

The video segment held the largest market share of 41.8% in 2023. This dominance can be attributed to the increasing popularity and effectiveness of video advertising across digital platforms. Video ads offer engaging and immersive content formats that capture users' attention and drive higher levels of interaction compared to traditional display ads. Moreover, the rise of online video consumption, particularly on social media platforms and streaming services, has created ample opportunities for advertisers to reach their target audiences through programmatic video advertisement. The ability to deliver personalized and targeted video ads based on user preferences and behavior further enhances the effectiveness of this segment.

The image segment is anticipated to register the fastest CAGR of 24.6% over the forecast period. This significant growth can be attributed to several factors, including the increasing use of visual content in digital advertising strategies, the rising demand for visually appealing ads across various digital platforms, and advancements in image recognition and targeting technologies. Image-based ads offer advertisers an effective way to capture users' attention and convey messages quickly and creatively.

Channel Insights

Based on channel, the market is classified into mobile & tablets, desktop, and others. The mobile & tablets segment dominated the market with a revenue share of 49.4% in 2023. The widespread adoption of smartphones and tablets has led to a substantial increase in the amount of time people spend on these devices. Consumers are using mobile devices for various activities such as browsing the internet, using social media, watching videos, and shopping online, making them important channels for advertisers. In addition, advertisers have increasingly adopted mobile-first strategies to reach consumers where they are most active. Mobile advertising allows for highly targeted and personalized campaigns based on user data, such as location, app usage, and browsing behavior.

The others segment, including connected TVs and commercial displays, is anticipated to register the fastest CAGR of 25.1% over the forecast period due to the increasing shift towards streaming services and smart home devices. Connected TVs are gaining popularity as consumers move away from traditional cable, offering advertisers the ability to reach highly engaged audiences with targeted, data-driven ads. Technological advancements have enhanced the quality and interactivity of ads on these platforms, leading to higher engagement rates. The integration of connected TVs and commercial displays into broader digital campaigns also allows for a seamless cross-platform advertising strategy, making this segment highly attractive for advertisers seeking to maximize their reach and impact.

End Use Insights

The retail & consumer goods segment held the largest market share of 36.3% in 2023. Retailers and consumer goods companies heavily invest in programmatic advertising to reach specific consumer demographics effectively and efficiently. The ability to leverage vast amounts of consumer data allows these businesses to deliver personalized and relevant ads, driving higher engagement and conversion rates. In addition, the rise of e-commerce and online shopping has further accelerated the adoption of programmatic advertising in this segment, as companies aim to capture the growing number of digital shoppers. The retail sector's commitment to staying competitive in a rapidly evolving digital landscape has solidified its leading position in the target market.

The media & entertainment segment is anticipated to register the fastest CAGR of 26.3% over the forecast period. The rapid increase in digital content consumption, particularly through streaming services, online gaming, and social media platforms, has created vast opportunities for targeted advertising. Programmatic advertising allows media and entertainment companies to deliver personalized ads based on user preferences and viewing habits, enhancing engagement and ad effectiveness. In addition, advancements in technology, such as enhanced data analytics and artificial intelligence, enable more precise audience targeting and real-time ad placement. This capability is crucial for the dynamic and fast-paced nature of the media and entertainment industry.

Regional Insights

The programmatic advertising market in North America held the largest global market share of 32.6% in 2023. North America has a highly developed digital infrastructure and a large, tech-savvy population, fostering a conducive environment for digital advertising. The region is home to many of the world's leading technology companies, digital advertising firms, including Alphabet Inc. (Google LLC) and Meta (Facebook), and platforms that drive innovation in programmatic advertising. In addition, high levels of investment in digital marketing by companies across various industries, coupled with a strong focus on personalized and targeted advertising, have further solidified North America's leading position in the programmatic advertising market.

U.S. Programmatic Advertising Market Trends

The programmatic advertising market in the U.S. is driven by several key factors. The increasing shift towards digital media consumption has prompted advertisers to allocate more of their budgets to online and mobile platforms. In addition, the competitive environment within the U.S. programmatic advertising industry encourages innovation and propels the ongoing development of advertising technologies and strategies.

Asia Pacific Programmatic Advertising Market

The Asia Pacific programmatic advertising market is projected to grow at the fastest CAGR of 24.4% over the forecast period. The Asia Pacific region is witnessing rapid economic growth and technological advancements, which are expected to fuel the growth of programmatic advertising solutions in the region. According to a new research report by Carousell Media Group and the Interactive Advertising Bureau Southeast Asia and India (IAB SEA+India) in 2023, 99% of Asia-based marketers plan to increase their retail media spend in 2024. Most respondents also intend to include retail media as part of their media plans in 2024.

The programmatic advertising market in China held the largest revenue share of 39.3% in the Asia Pacific region in 2023. China has one of the largest internet user bases in the world, with a significant portion of its population engaging in digital activities. This extensive digital audience creates a highly conducive environment for programmatic advertising, enabling advertisers to reach a wide and diverse range of consumers effectively.

Europe Programmatic Advertising Market Trends

The programmatic advertising market in Europe is experiencing significant growth in demand, driven by several key factors. European markets are adopting advanced technologies such as artificial intelligence (AI) and machine learning (ML), which are essential for optimizing programmatic advertising campaigns. These technologies enable more precise targeting, better audience segmentation, and real-time bidding, enhancing the effectiveness and efficiency of digital advertising efforts. In addition, Europe's regulatory framework, particularly the General Data Protection Regulation (GDPR), has influenced the programmatic advertising landscape. While it imposes strict data privacy requirements, it also encourages transparency and trust in digital advertising. This regulatory clarity has helped stabilize the market and build consumer confidence in programmatic ads.

The UK programmatic advertising market has seen a significant shift towards mobile advertising as it is particularly effective on mobile platforms due to the increasing smartphone penetration and mobile internet usage. It allows advertisers to reach users with personalized and location-based ads, which enhances user engagement and ad effectiveness.

Key Programmatic Advertising Company Insights

Some of the key companies operating in the market include Alphabet Inc. (Google LLC) and Meta (Facebook).

-

Alphabet Inc. is a U.S.-based multinational technology holding company that owns Google LLC and other subsidiaries. The company operates through three main segments including Google Services, Google Cloud, and other bets. The company's advertising business includes various services such as AdSense, Google Ads, Google Ad Manager, and AdMob. These services enable advertisers to reach their target audience across the company's network properties and partner websites. The company serves its customers globally with offices in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

-

Meta (Facebook) is one of the leading technology companies headquartered in California, U.S. The company owns and operates Instagram, Facebook, Threads, and WhatsApp, among other products and services. The advertising segment of Meta encompasses the sale of advertising space to marketers. Meta's advertising platform offers various tools and features to help businesses reach their target audience and optimize their ad campaigns. Meta leverages its vast user data to offer highly targeted advertising solutions to advertisers. This includes demographic information, interests, behaviors, and even offline activities (via partnerships and data integration).

The Trade Desk and Adobe are some of the emerging market companies in the target market.

-

The Trade Desk is a U.S.-based global technology company specializing in real-time programmatic marketing automation technologies, services, and products. It offers a self-service medium that allows advertisement buyers to execute data-driven digital advertisement campaigns across various formats, including display, video, and social, and on multiple devices, such as computers.

-

Adobe is a multinational computer software company renowned for its wide array of creativity and productivity software products. It offers a wide range of services, products, and solutions that enable teams, individuals, and enterprises to design, publish, and promote content. The company operates in three segments, including digital media, digital experience, and publishing & advertising. Adobe offers a comprehensive demand-side platform that facilitates the management of advertising campaigns across various digital formats. It streamlines the process of delivering video, display, and search advertisements across multiple channels and devices.

Key Programmatic Advertising Companies:

The following are the leading companies in the programmatic advertising market. These companies collectively hold the largest market share and dictate industry trends.

- Alphabet Inc. (Google LLC)

- Meta (Facebook)

- Amazon.com, Inc.

- Microsoft

- Alibaba Group Holding Limited

- Adobe

- The Trade Desk

- Criteo

- NextRoll, Inc. (Adroll)

- MediaMath

Recent Developments

-

In March 2024, Alphabet Inc. (Google LLC) announced the update for Google Analytics 4. The updates include more granular data controls, privacy-focused features, and enhanced integrations with Google Ads and other platforms. These improvements aim to help marketers better understand customer behavior, optimize advertising campaigns, and drive growth.

-

In December 2023, alkimi.org, a decentralized ad exchange provider, announced that it had launched mainnet, a blockchain-based programmatic advertising platform. The mainnet offers performance enhancements, complete transparency, and greater efficiency in the digital advertising ecosystem. By reducing fees from over 37% to 3-5%, the cost of purchasing advertisements decreased from USD 9.03 to USD 2.71.

-

In June 2023, MediaMath announced a strategic partnership with Waev Data. This collaboration aims to improve the scalability of seller-defined audiences, offering enhanced targeting capabilities to advertisers. The partnership leverages MediaMath's comprehensive suite of advertising tools and Waev Data's expertise in audience data management to empower advertisers with the ability to finely tailor their campaigns to specific audiences, thereby optimizing engagement and outcomes.

Programmatic Advertising Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 802.34 billion

Revenue forecast in 2030

USD 2,753.03 billion

Growth rate

CAGR of 22.8% from 2024 to 2030

Base year for estimation

2023

Actual Data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Auction, ad format, channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Alphabet Inc. (Google LLC); Meta (Facebook); Amazon.com, Inc.; Microsoft; Alibaba Group Holding Limited; Adobe; The Trade Desk; Criteo; NextRoll, Inc. (Adroll); MediaMath

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Programmatic Advertising Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global programmatic advertising market report based on auction, ad format, channel, end use, and region:

-

Auction Outlook (Revenue, USD Billion, 2017 - 2030)

-

Real-Time Bidding (RTB)

-

Private Marketplace (PMP)

-

Preferred Deals

-

Programmatic Direct

-

-

Ad Format Outlook (Revenue, USD Billion, 2017 - 2030)

-

Image

-

Video

-

Text

-

Others

-

-

Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Mobile & Tablets

-

Desktop

-

Others

-

-

End UseOutlook (Revenue, USD Billion, 2017 - 2030)

-

Media & Entertainment

-

BFSI

-

Education

-

Retail & Consumer Goods

-

Telecom & Communication

-

Healthcare

-

Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global programmatic advertising market size was estimated at USD 678.37 billion in 2023 and is expected to reach USD 802.34 billion in 2024.

b. The global programmatic advertising market is expected to grow at a compound annual growth rate of 22.8% from 2024 to 2030 to reach USD 2,753.03 billion by 2030.

b. The mobile & tablets segment claimed the largest market share of 49.6% in 2023 in the programmatic advertising market, driven by its widespread adoption and usage. The proliferation of smartphones and tablets has led to increased mobile internet usage, making these devices prime platforms for digital advertising.

b. Prominent players in the programmatic advertising market are Alphabet Inc. (Google LLC), Meta (Facebook), Amazon.com, Inc., Microsoft, Alibaba Group Holding Limited, Adobe, The Trade Desk, Criteo, NextRoll, Inc. (Adroll), and MediaMath.

b. The programmatic advertising market is driven by factors such as data-driven approach, increased efficiency and cost-effectiveness, integration with cross-channel campaigns, and real-time bidding (RTB). Programmatic advertising automates the buying process, reducing the need for manual interventions and streamlining transactions. This efficiency lowers costs and improves the return on investment for advertisers. Additionally, RTB allows advertisers to bid for ad impressions in real-time, ensuring that ads are shown to the most relevant audience at the most optimal times. This dynamic bidding process maximizes the effectiveness of ad spend.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.