- Home

- »

- Next Generation Technologies

- »

-

Project Portfolio Management Market, Industry Report, 2030GVR Report cover

![Project Portfolio Management Market Size, Share, & Trends Report]()

Project Portfolio Management Market (2025 - 2030) Size, Share, & Trends Analysis Report By Solution, By Platform (Software, Services), By Enterprise Size, By Deployment, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-911-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Project Portfolio Management Market Summary

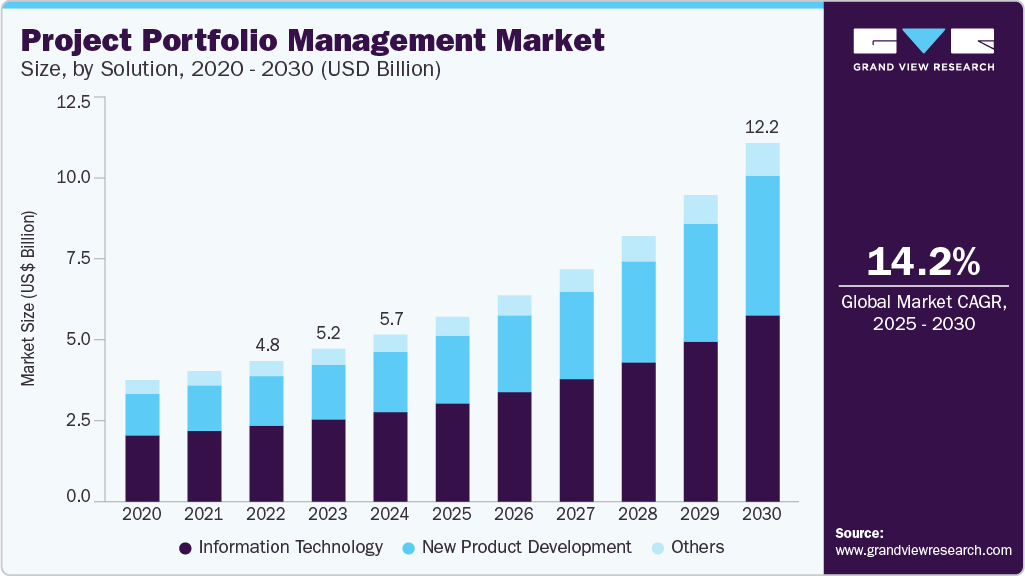

The global project portfolio management market size was estimated at USD 5,712.7 million in 2024 and is projected to reach USD 12,252.6 million by 2030, growing at a CAGR of 14.2% from 2025 to 2030. The growing adoption of services-based services for the remote monitoring of assignments is an essential factor that is expected to contribute significantly to market expansion.

Key Market Trends & Insights

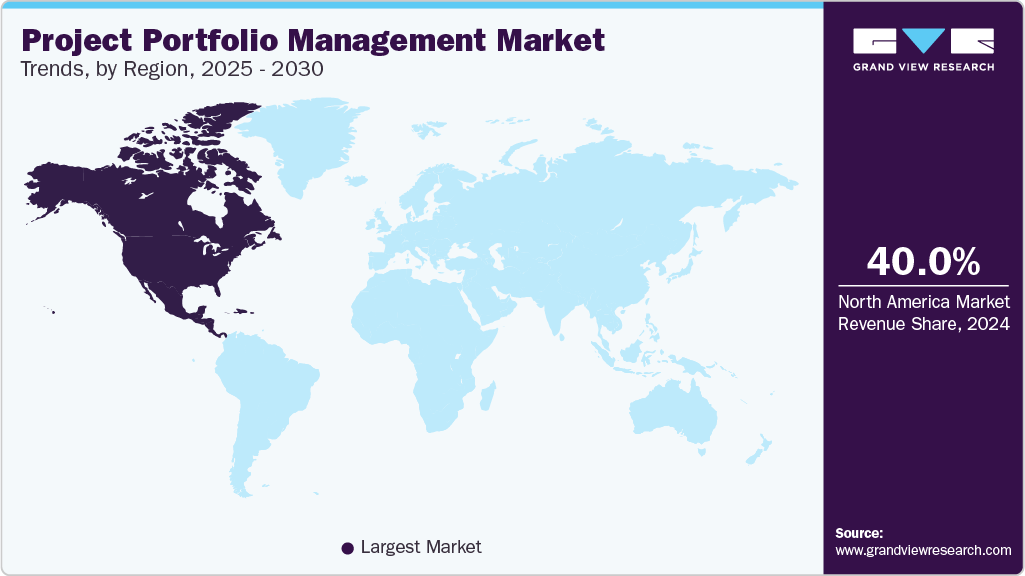

- The North America held the major share of over 40.0% of the project portfolio management industry in 2024.

- The Asia Pacific is expected to register the highest CAGR of 17.3% from 2025 to 2030.

- By solution, the information technology segment accounted for the largest market share of over 53.0% in 2024.

- By platform, the software segment dominated the market and accounted for a revenue share of over 67.0% in 2024

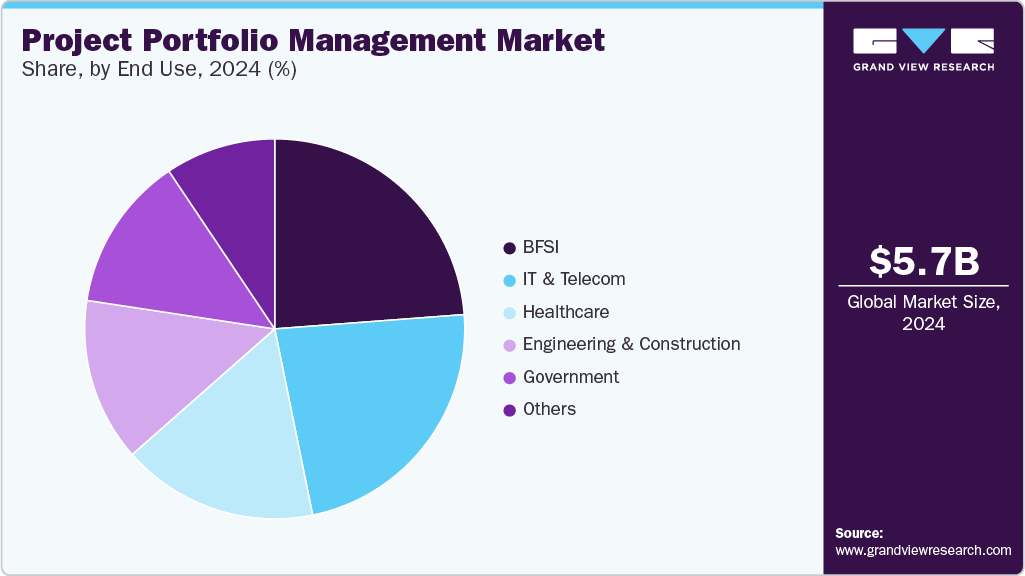

- By end-use, the BFSI segment accounted for the largest market share of over 23.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5,712.7 Million

- 2030 Projected Market Size: USD 12,252.6 Million

- CAGR (2025-2030): 14.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

A surge in activities such as automation and digitalization across industries, including healthcare, government, BFSI, telecom, and engineering and construction, has stimulated the need for monitoring and analytical information technology to increase productivity and business efficiency. It is significantly encouraging the implementation of project portfolio management (PPM) information technology.The growing complexities in projects and the need for timely and efficient management are expected to drive market growth over the forecast period. Furthermore, the need to gain a 360-degree view of project operations and resource management is driving the demand for PPM information technology. The software helps in collaborative scheduling, planning, and faster and more efficient decision-making. In addition, a surge in the trend of bringing your device, coupled with the growing focus of organizations on attaining faster Return on Investment (ROI), are the key factors driving the market growth.

The project portfolio management software assists businesses in improving productivity, increasing the pace of innovation, and adapting to the rapidly shifting economic scenario and competitive dynamics. In addition, the PPM software offers capabilities such as time tracking, data analytics, and cost management. Increasing penetration of connected devices in emerging economies such as Brazil, China, and India is expected to keep the industry's growth prospects upbeat. Increasing investments in research and development activities have encouraged the development of innovative information technologies, such as mobile application-based project portfolio management information technology, enabling access to an extensive consumer base. All these factors are propelling the growth of the PPM market.

Project portfolio management is a useful information technology as it improves the organization's adaptability toward change and makes it easy to introduce new projects. In addition, review and monitoring techniques are introduced to track projects for anomalies and delays and invoke necessary steps to streamline them and subsequently achieve higher returns. Furthermore, with the help of PPM information technology, the companies can emphasize more on achieving targets by focusing on strategies instead of the project operations themselves. In addition, it provides techniques such as scoring techniques, heuristic models, and visual or mapping techniques for the assessment of different projects.

Growing competition worldwide is pushing companies to lessen project costs, which in turn is boosting the use of project portfolio management. However, security and privacy issues, especially in the case of services deployment, are the major challenges faced by companies while executing PPM information technology. Furthermore, complexity and cost issues involved with project portfolio management information technology are also among the major hurdles to its widespread adoption. These factors are anticipated to impact the adoption of PPM information technology adversely.

Rising digitization and the growing popularity of automation have propelled the demand for analytical & monitoring information technology in multi-regional businesses, supporting the market growth. The Project Portfolio Management (PPM) market is poised to grow considerably in the forecast period due to the rising need for project management software & services to manage and reduce project complexities effectively. Furthermore, rising public & private investments in R&D activities have boosted innovative information technologies development, including mobile application-based project portfolio management information technologies, allowing firms to reach an extensive consumer base.

The increasing usage of PPM information technology in data management services and the growing trend of Bring Your Device (BYOD) among multiple business sectors are some vital factors driving project portfolio management growth. PPM information technology assist firms in budget alignment, reduces project delivery downtime, and enable efficient resource utilization. Due to these benefits, PPM information technology are adopted in various sectors such as BFSI, engineering & construction, IT & telecom, and government. Integration of AI technologies in PPM software for multiple tasks automation enables the project managers to focus on other essential duties and achieve the project's strategic goals. Various companies are digitizing their operations with increasing internet penetration for the expansion of their business network as well as client base, enhancing industry statistics.

The rising integration of services-based information technology due to their various benefits, such as improved productivity & collaboration, easy accessibility, and low maintenance, is creating a positive market outlook across the globe. Moreover, different business firms highly emphasize elevating project cost efficiency without compromising functionality, creating robust market opportunities for services-based information technology. Various market players are investing in their R&D to develop services-based project portfolio management information technology. For instance, in May 2022, DigitalOcean Holdings, Inc. launched serverless services-based project management information technology, enabling scalable, cost-effective, and fast-computing information technology for startups and small businesses.

Changing business needs and significant industry rivalry force companies to modify their business operations to meet evolving market demands. For this, companies from various sectors prefer project portfolio management services to increase the productivity of their business operations and acquire a higher market share. Industry participants are adopting diverse business strategies to enhance their service offerings in the market and attract potential business clients. For instance, in December 2021, Planisware Inc., a project portfolio management provider, partnered with EOS Software to incorporate the EOS Integrated Technology Portfolio Management (ITPM) information technology in Planisware Inc.'s business operations.

Security risks associated with services-based platforms are key market factors restricting market growth. Increasing unauthorized access activities for data breaching & data stealing results in significant data & financial losses to the organizations. These activities have challenged enterprises in managing privacy & digital security, such as risk management, compliance issues, and rigid technical infrastructure. Market players are enhancing their in-house software development process and implementing various security protocols to improve the security of their project portfolio management software & services. Industry participants are launching security updates frequently for their existing customers to improve their project portfolio management software & services capabilities to defend against evolving digital threats.

Solution Insights

The information technology segment accounted for the largest market share of over 53.0% in 2024 in the project portfolio management market. It is attributed to the increasing demand for more sophisticated and user-friendly PPM software that can help businesses manage their IT projects more effectively. IT projects are often complex and require the coordination of multiple teams and resources. It can make it difficult to track the progress of projects and ensure that they are completed on time and within budget. PPM software can help IT project managers track the progress of their projects, identify and manage risks, and allocate resources more effectively.

The new product development segment is anticipated to grow at the highest CAGR during the forecast period. NPD is a complex process that involves a wide range of activities, and PPM software can help NPD project managers track the progress of their projects, identify and manage risks, and allocate resources more effectively.

Platform Insights

The software segment dominated the market and accounted for a revenue share of over 67.0% in 2024 in the project portfolio management market, owing to the increasing demand for more sophisticated and user-friendly PPM software that can help businesses manage their projects more effectively. In addition, small and medium-sized businesses are increasingly adopting PPM software to improve their project management processes and efficiency. The rise of agile project management and the need for better decision-making are also contributing to the growth of the software segment.

The services segment is expected to register the highest CAGR from 2025 to 2030. The services segment comprises integration and deployment, support and consulting, and training and education services. The surging demand can be attributed to the innovative services offered by the market players, such as process assessment, process improvement, and reporting and analysis. Developments in project portfolio management services, such as on-the-job communication facilities, assignment governing policies, and program facilitation services, help organizations in comparing macro-environmental factors that lead to increased productivity and ROI.

Enterprise Size Insights

The large enterprises segment dominated the market and accounted for a revenue share of over 61.0% in 2024 in the project portfolio management industry. It can be attributed to the availability of high capital and affordability, allowing large organizations to adopt PPM solutions. Large enterprises are investing heavily in participating in today’s competitive industry and are continually undertaking several projects to add innovative product lines or replace and improve existing processes/products. Thus, in a bid to gain a competitive edge, a large enterprise segment is expected to drive the adoption of project portfolio management solutions over the forecast period.

The small and medium enterprises (SMEs) segment is expected to register the highest CAGR of 15.2% from 2025 to 2030. The growth in foreign investments toward SMEs is expected to drive the growth of the segment. The growing SMEs in emerging economies and increasing penetration of information technology services are further contributing to the segment's growth. These solutions offer effective monitoring and control of business functions and help in business optimization and decision-making for SMEs.

Deployment Insights

The cloud segment dominated the market and accounted for a revenue share of over 54.0% in 2024 in the project portfolio management industry. Cloud-based solutions offer cost efficiency and flexibility, due to which the user preference for the adoption of these solutions is higher. Cloud systems offer a greater level of scalability, reduced cost of implementation, and continual development. The deployment of cloud-based solutions stimulates the ease of service delivery due to their virtual presence, which makes organizations access data across connected devices at any point in time. Moreover, cloud-based PPM solutions facilitate higher control over operations across multiple business channels. These benefits are expected to drive the adoption of cloud PPM solutions across verticals.

The on-premise segment is expected to register the significant CAGR from 2025 to 2030. It has been a classical approach that has existed since the beginning of the computer age. The on-premise solution offers total control over the software as all sensitive data is stored internally, and there is no risk of exposing it to a third party. On-premise deployment further enables more options for customization. However, companies are increasingly shifting toward the use of cloud-based solutions as on-premise solutions have higher operational costs. The other factor is the high maintenance requirements, as it becomes the organization's responsibility to upgrade and scale the solution when required.

End Use Insights

The BFSI segment accounted for the largest market share of over 23.0% in 2024 in the project portfolio management industry. Project portfolio management solutions facilitate the BFSI industry in managing customer transaction data due to its complex multi-regional operation. Technological proliferation in the BFSI industry, such as mobile banking and e-banking, has encouraged the implementation of project portfolio management solutions. Furthermore, the usage of other services by banks, such as debit, credit, and centralized fund managing systems, has led to the usage of these solutions for database monitoring. These solutions facilitate monitoring transactional & customer information and subsequently help in providing high transparency.

The IT & telecom segment is anticipated to register the highest CAGR during the forecast period. The growth in the IT and telecom segment is attributed to the increasing complexity of IT and telecom projects, the need for real-time data and insights, the growing popularity of cloud computing, and the increasing demand for digital transformation. PPM software can help IT and telecom companies manage their projects more effectively in all of these areas.

Regional Insights

North America held the major share of over 40.0% of the project portfolio management industry in 2024. The region is expected to continue its dominance over the projected timeline owing to the considerable infrastructure advancements and propagation of startup companies. Different industrial companies operating in the region are implementing business intelligence & analytics solutions, and analytics-based strategies are playing a vital role in driving the market growth. Moreover, companies with digital infrastructure are using PPM solutions to initiate collaborative decision-making to enhance their project success rate in the region.

U.S. Project Portfolio Management Market Trends

The U.S. project portfolio management market is projected to grow during the forecast period. In the U.S., various end use sectors such as healthcare, manufacturing, BFSI, and construction are adopting project portfolio management services to manage overall business operations and eliminate extra costs efficiently. It has created a favorable environment for market expansion in the U.S. Industry players operating in the region are adopting business strategies such as mergers & acquisitions to enhance their service offerings and client base. For instance, in May 2023, Planview, a platform for connected work from delivery to portfolio planning, collaborated with NTT DATA. As a part of the collaboration, the Planview Tasktop Viz and Planview Tasktop Hub are part of NTT DATA’s global ecosystem of technology solutions and offer organizations improved efficiency and time-to-market predictability.

Europe Project Portfolio Management Market Trends

The project portfolio management market in Europe is expected to register a CAGR of 13.5% during the forecast period. The rise of agile methodologies and the need for continuous innovation in European markets are further accelerating the adoption of PPM tools. Organizations are seeking flexibility to adapt quickly to changing market conditions, customer demands, and technological advancements. Modern PPM platforms offer support for agile, hybrid, and traditional project management approaches, allowing teams to work collaboratively while aligning with the strategic direction of the business. This flexibility is a key factor in the growing reliance on project portfolio management across Europe.

The Germany project portfolio management market is expected to grow during the forecast period. The project portfolio management (PPM) market in Germany is expanding steadily, driven by the country's strong industrial base and increasing demand for structured project execution across sectors. As Germany continues to invest in Industry 4.0, automation, and digital transformation, businesses are managing a growing number of complex projects simultaneously. This has led to a heightened need for PPM solutions that provide visibility, governance, and prioritization across diverse project portfolios. Companies in automotive, engineering, IT, and manufacturing are especially reliant on PPM tools to streamline workflows, allocate resources efficiently, and align projects with strategic business goals.

Asia Pacific Project Portfolio Management Trends

The demand for project portfolio management in the Asia Pacific is expected to register the highest CAGR of 17.3% from 2025 to 2030. The rise of start-ups and small to mid-sized enterprises (SMEs) in Asia Pacific is also fueling PPM market growth. As these companies scale up and pursue innovation-driven projects, they require tools that offer visibility and control over expanding portfolios without the need for large IT infrastructures. Cloud-based PPM solutions are gaining popularity in this segment due to their cost-effectiveness and scalability. Moreover, the hybrid work culture, accelerated by the COVID-19 pandemic, has increased the need for digital tools that facilitate coordination and oversight across distributed teams and regions.

The project portfolio management market in China is projected to grow during the forecast period. The shift towards innovation-driven development and smart manufacturing in China is prompting companies to invest in portfolio-level visibility and control. Enterprises are focusing on R&D, digital products, and smart technologies, all of which involve multiple, interdependent projects. By using PPM software, firms are able to monitor progress, manage risks, and ensure that each project contributes to broader innovation objectives. Cloud-based PPM solutions are especially gaining traction among mid-sized companies that need scalable, cost-effective platforms to manage growing project demands.

Key Project Portfolio Management Company Insights

Some of the key companies operating in the market include Microsoft Corporation, and HP Development Company, L.P., among others are some of the leading participants in the project portfolio management market.

-

Microsoft Corporation, a global company specializing in software and cloud services, offers comprehensive project portfolio management (PPM) solutions through its Microsoft Project suite. Designed to assist organizations in planning, prioritizing, and managing project and portfolio investments, Microsoft's PPM tools integrate seamlessly with other Microsoft products, providing a cohesive environment for project management activities.

-

HP Development Company, L.P., a subsidiary of Hewlett-Packard, has historically offered robust project portfolio management (PPM) solutions through its HP Project and Portfolio Management (PPM) Center. The HP PPM Center provided a comprehensive suite of modules, including demand management, project management, resource management, and financial management. These modules enabled organizations to capture project requests, prioritize initiatives based on strategic value, and monitor project execution in real-time.

Workfront, Inc., and ServiceNow, Inc are some of the emerging market participants in the project portfolio management market.

-

Workfront, Inc., is a web-based work management and project portfolio management (PPM) software provider. The company rebranded to Workfront in 2015 and was subsequently acquired by Adobe Inc. in December 2020, integrating its capabilities into Adobe's suite of enterprise solutions. Workfront's PPM solution offered a comprehensive suite of tools that enabled organizations to plan, prioritize, and manage a portfolio of projects effectively. The platform's intuitive interface and customizable workflows allowed teams to adapt the system to their specific methodologies, whether agile, waterfall, or hybrid.

-

ServiceNow, Inc., is an American software company specializing in cloud-based platforms that automate enterprise IT operations. The company offers a range of services, including IT service management, IT operations management, and IT business management, all built on its proprietary Now Platform. ServiceNow's PPM solution is designed to manage outcomes and create value by aligning portfolio strategy, investments, and team structures to meet business goals. It embraces uncertainty with flexible planning, allowing organizations to adapt plans, refocus teams, and continuously prioritize. The platform also supports hybrid ways of working, providing flexibility to manage both traditional and agile methods for greater visibility.

Key Project Portfolio Management Companies:

The following are the leading companies in the project portfolio management market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom

- Celoxis Technologies Pvt. Ltd.

- Changepoint Corporation

- HP Development Company, L.P.

- ServiceNow, Inc.

- Planview, Inc.

- Planisware

- Microsoft Corporation

- Oracle Corporation

- Workfront, Inc.

Recent Developments

-

In February 2025, Planview, Inc. acquired Sciforma, reinforcing its position as the clear leader in enterprise portfolio management. This strategic move expands Planview’s ability to deliver top-tier solutions to organizations across all levels of project and portfolio management (PPM) maturity. The acquisition also enhances Planview’s footprint in Europe, where Sciforma has established a strong market presence. Customers can anticipate uninterrupted service from Sciforma’s existing teams, now further supported by Planview’s global customer success organization.

-

In April 2025, Planisware has partnered with ClearPlan Consulting to bolster support for the IT & Telecom industry. Through this partnership, ClearPlan Consulting gains access to Planisware’s advanced solutions, enabling them to broaden their services and better meet the diverse Project and Portfolio Management (PPM) needs of their clients.

-

In March 2023, UiPath, an enterprise automation software company, partnered with Planview to integrate Planview Tasktop Hub with UiPath Business Automation Platform. This partnership aimed to improve the automation of time-consuming and repetitive tasks and also to accelerate the delivery of products and reduce manual errors.

Project Portfolio Management Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.31 billion

Revenue forecast in 2030

USD 12.25 billion

Growth rate

CAGR of 14.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, platform, enterprise size, deployment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Broadcom; Celoxis Technologies Pvt. Ltd.; Changepoint Corporation; HP Development Company, L.P.; ServiceNow, Inc.; Planview, Inc.; Planisware; Microsoft; Oracle; Workfront, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Project Portfolio Management Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the project portfolio management market report based on solution, platform, deployment, enterprise size, end use, and region.

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Information Technology

-

New Product Development

-

Others

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

Integration and Deployment

-

Support and Consulting

-

Training and Education

-

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government

-

Engineering & Construction

-

Healthcare

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the project portfolio management market include Broadcom; Celoxis Technologies Pvt. Ltd.; Changepoint Corporation; HP Development Company, L.P.; ServiceNow; Planview, Inc.; Planisware; Microsoft; Oracle; and Workfront, Inc.

b. The global project portfolio management market size was estimated at USD 5.71 billion in 2024 and is expected to reach USD 6.31 billion in 2025.

b. The global project portfolio management market is expected to grow at a compound annual growth rate of 14.2% from 2025 to 2030 to reach USD 12.25 billion by 2030.

b. North America dominated the project portfolio management market, with the largest revenue share of 40.0% in 2024. The region is expected to continue its dominance over the projected timeline owing to the considerable infrastructure advancements and propagation of startup companies, which are the key factors expected to strengthen the market growth.

b. . The growing adoption of services-based services for the remote monitoring of assignments is an essential factor that is expected to contribute significantly to market expansion. A surge in activities such as automation and digitalization across industries, including healthcare, government, BFSI, telecom, and engineering and construction, has stimulated the need for monitoring and analytical information technology to increase productivity and business efficiency. It is significantly encouraging the implementation of project portfolio management (PPM) information technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.