- Home

- »

- Next Generation Technologies

- »

-

Property And Casualty Insurance Market Size Report, 2030GVR Report cover

![Property And Casualty Insurance Market Size, Share & Trends Report]()

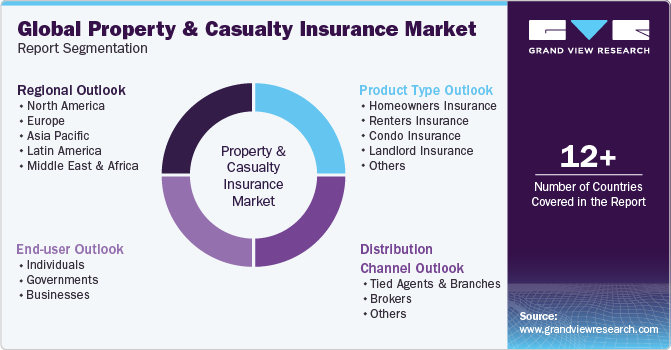

Property And Casualty Insurance Market Size, Share & Trends Analysis Report By Product Type, By Distribution Channel (Tied Agents and Branches, Brokers), By End-user, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-182-0

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The global property and casualty insurance market size was estimated at USD 3,674.46 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.9% from 2024 to 2030. Insurers are increasingly adopting Artificial Intelligence (AI) and machine learning to enhance risk assessment, underwriting processes, and claims management. This technological integration enables more accurate pricing models, streamlined operations, and proactive risk mitigation. Insurers leveraging data-driven insights are better positioned to respond swiftly to changing market dynamics and emerging risks, providing a competitive edge in the industry. AI is proven to be a significant revolutionary element of the upcoming digital era.

Insurers are increasingly replacing conventional manual approaches for First Notice of Loss (FNOL) with the integration of imaging and video-capable drones and robotics, aiming to enhance property & casualty underwriting and inspection procedures while identifying changes in risk during renewal. By utilizing video imagery, insurers can effectively detect significant exposure alterations and assess property damage claims, all without exposing staff to potential risks or requiring extensive preparation. For instance, Farmers Insurance, an insurance service provider, partnered with Boston Dynamics, an MIT sandbox spinoff, to develop Spot, a robotic dog designed for catastrophe inspections. Equipped with 360-degree cameras and site documentation software, Spot collects information from spaces inaccessible to humans.

AI-powered drones enable the capture of precise images and videos of damages, transmitting real-time assessments to mobile devices. This technology accelerates the property review process for claims adjusters, surpassing the often hazardous delays associated with manual inspections.

Early adoption of robotic technologies in the U.S. by major insurers like Allstate Insurance Company, Erie Insurance, Farmers Insurance Group of Companies, Liberty Mutual Insurance Company, and The Travelers Indemnity Company has paved the way for broader usage by both established insurance companies and InsurTech startups. These advancements signify a strategic shift towards leveraging automation and innovative technologies to streamline insurance processes effectively.

Insurers are revolutionizing underwriting processes by implementing automation, technology, and data-driven analytics across every stage of the lifecycle. This strategic approach aims to accelerate workflows, optimize growth, enhance profitability, and secure a competitive edge. For instance, in December 2021, Allianz SE, an insurance service provider, announced its agreement with Cytora, an insurtech firm based in London. This agreement empowers commercial insurers to establish digital workflows by digitizing, assessing, and routing risks. By leveraging this technology, Allianz SE underwriters gain access to relevant insights, facilitating improved customer service and faster response times.

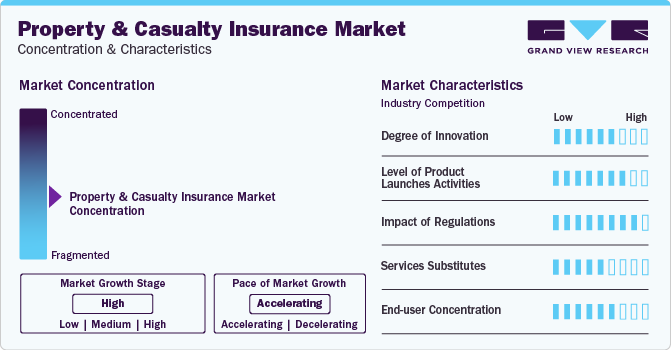

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The market showcases a high level of innovation, spurred by rapid technological advancements. This innovation is driven by factors such as the evolution of risk assessment models, increased data analytics capabilities, and the integration of technology in underwriting processes. These advancements are transforming traditional practices in the industry, leading to more sophisticated risk management strategies. The market benefits from the availability of extensive datasets and advanced analytics tools, enabling insurers to refine pricing models, offer personalized coverage and improve overall operational efficiency.

The market is also characterized by a high level of product launches by the leading players. This trend is motivated by various factors, including the drive to introduce innovative insurance solutions, tap into emerging market segments, and respond to evolving customer needs.

The market is increasingly facing heightened regulatory scrutiny, prompted by concerns surrounding potential adverse effects. Issues such as fair underwriting practices, privacy considerations, and the impact on employment are becoming focal points of regulatory attention. Governments globally are actively developing and implementing regulations to oversee the development and utilization of technologies within the property & casualty insurance sector.

In the global market, while there are limited direct substitutes, alternative technologies such as automation, rule-based systems, and expert systems can be employed to achieve similar outcomes in specific applications. However, these alternatives often lack the same level of performance and adaptability as advanced AI solutions.

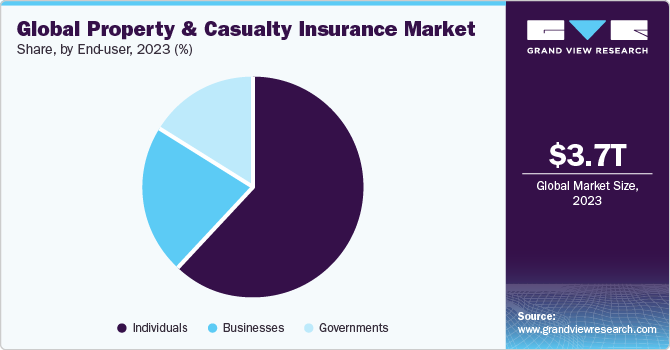

End-user concentration plays a pivotal role in the market, given the diverse demands from individuals, governments, and businesses. While companies specializing in tailored insurance solutions for these end-user segments find opportunities for growth, the competitive landscape becomes challenging due to the varied needs within a crowded market.

Product Type Insights

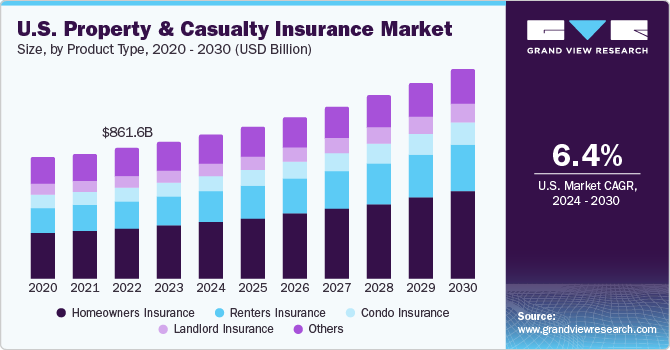

Homeowners insurance led the market and accounted for 37.4% of the global revenue in 2023. The ability of homeowners insurance to provide essential protection to homeowners against unforeseen risks and potential financial losses is a significant factor contributing to the growth of the segment. This type of insurance typically covers damages to the insured property caused by events such as fire, theft, vandalism, and natural disasters. Moreover, it extends liability coverage, shielding homeowners from legal and medical expenses in the event of injuries or property damage for which they may be held responsible.

The significance of homeowners insurance lies not only in its capacity to safeguard individuals' most valuable asset their homes but also in its ability to foster financial resilience and stability. In a dynamic and ever-changing environment, where unforeseen events can disrupt lives and livelihoods, homeowners insurance serves as a crucial safety net promoting better security.

Renters insurance holds a fundamental means of safeguarding the possessions and financial interests of tenants. This type of insurance provides coverage for personal belongings within a rented dwelling, offering protection against perils such as fire, theft, and natural disasters. In addition to property coverage, renters insurance often includes liability protection, shielding policyholders from potential legal and medical expenses arising from incidents within the rented premises.

The significance of renters insurance lies in its role in promoting financial security for individuals who lease their homes. By mitigating the financial burden associated with unexpected events, renters insurance contributes to the overall stability of the market.

Distribution Channel Insights

Brokers segment accounted for the largest market revenue share in 2023. The ability of brokers serving as a vital intermediary that facilitates the connection between insurers and policyholders is a significant factor contributing to the growth of the segment. Brokers play a crucial role in providing personalized guidance and expertise, helping individuals navigate the complex landscape of insurance options to find coverage that aligns with their unique needs.

This channel fosters a sense of trust and transparency by offering clients a comprehensive understanding of available policies, coverage details, and potential risks. Moreover, brokers often act as advocates for policyholders in the event of claims, ensuring a smoother and more efficient resolution process. The broker distribution channel's significance lies in its ability to bridge the gap between insurance providers and consumers, enhancing accessibility, and facilitating informed decision-making.

Tied agents and branches segment is anticipated to register the fastest CAGR during the forecast period. The tied agents and branches offer a direct and tangible link between insurers and policyholders. Tied agents, who exclusively represent a specific insurance company, and branch offices serve as localized points of contact, providing a physical presence for insurers within communities. This channel facilitates a more personalized and accessible approach to insurance, allowing for face-to-face interactions and building trust between agents and clients. Tied agents and branches often have an in-depth understanding of the local market dynamics, enabling them to tailor insurance solutions to the unique needs and risks of the community they serve. This localized approach enhances customer engagement, promotes brand loyalty, and ensures a seamless communication channel for policyholders.

End-user Insights

Individual’s end-user segment led the market in 2023. The individual end user segment holds significant importance in the market, as it represents the diverse and varied needs of individual policyholders. This segment encompasses a wide range of consumers seeking insurance coverage for personal assets, including homes, automobiles, and personal liability. Individuals in this segment rely on insurance to protect their financial well-being and assets against unforeseen events, such as accidents, natural disasters, or theft. The importance of the individual end-user segment lies in its sheer scale and the critical role it plays in driving demand for insurance products. As insurers tailor policies to cater to the unique requirements and preferences of individual consumers, they contribute to the overall resilience and stability of the market.

The businesses segment is projected to witness the fastest CAGR over the forecast period. The business segment stands as a cornerstone in the market, serving as a linchpin for the protection of commercial enterprises. This segment encompasses a diverse array of businesses seeking insurance coverage to mitigate risks associated with property damage, liability, and business interruption. Businesses, ranging from small enterprises to large corporations, depend on insurance to safeguard their assets, operations, and financial stability. The importance of the business end user segment is evident in its role in fostering economic resilience. By providing coverage tailored to the unique risks faced by businesses, insurers contribute to the continuity of operations and financial security for enterprises, thereby supporting broader economic stability.

Regional Insights

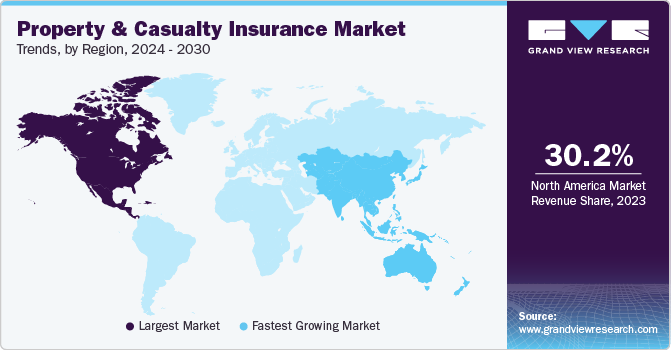

North America dominated the market and accounted for a 30.2% share in 2023. This high share is attributable to property & casualty insurance plays a pivotal role in safeguarding homes, businesses, and assets against an array of risks, including natural disasters, accidents, and liabilities. The economic vitality of the region relies heavily on the resilience of businesses, and property & casualty insurance provides a crucial safety net to ensure their continuity in the face of unforeseen events. Moreover, the insurance industry contributes significantly to the overall economic stability by absorbing and mitigating the financial impact of disasters and accidents.

Asia Pacific is anticipated to witness the fastest CAGR in the global market. With a vast geographical expanse and varying economic landscapes, the importance of robust insurance coverage is underscored by the region's susceptibility to natural disasters such as earthquakes, typhoons, and floods. For instance, in China, the world's most populous country, property & casualty insurance is integral to safeguarding homes and businesses against a wide range of risks, contributing to the resilience of its rapidly growing economy.

Moreover, in India and Japan, where economic development is on the rise, insurance serves as a critical tool for mitigating risks associated with industrial and commercial activities. Collectively, these nations in the Asia Pacific region rely on property & casualty insurance to navigate the intricate web of risks, contributing not only to individual financial security but also to the overall stability and growth of their economies.

Key Companies & Market Share Insights

Some of the key players operating in the market include State Farm Mutual Automobile Insurance Company; Berkshire Hathaway Specialty Insurance, Progressive Casualty Insurance Company.; and Liberty Mutual Insurance Company.

-

State Farm Mutual Insurance Company, one of the prominent company, offers a comprehensive range of insurance and financial services. The company utilizes advanced technologies such as artificial intelligence to enhance its offerings, including online platforms and mobile applications that streamline the insurance process for customers.

-

Berkshire Hathaway Specialty Insurance is recognized for providing specialized commercial insurance products and services across various sectors. Berkshire Hathaway Specialty Insurance emphasizes a customer-centric approach, leveraging advanced technologies and innovative solutions to deliver value to its clientele.

-

Lemonade Insurance Company (LIC), Root Insurance, Hippo, and Kin Insurance Technology Hub, LLC are some of the emerging market participants in the global market.

-

Lemonade Insurance Company (LIC) is an insurance company known for its use of artificial intelligence and chatbots to streamline the insurance process. It initially focused on renters and homeowners insurance and expanded its offerings to include pet insurance and more.

- Root Insurance utilizes telematics and smartphone technology to personalize auto insurance rates based on individual driving behavior. This technology-driven approach appeals to a tech-savvy customer base.

Key Property And Casualty Insurance Companies:

- State Farm Mutual Automobile Insurance Company

- Berkshire Hathaway Specialty Insurance

- Progressive Casualty Insurance Company

- Allstate Insurance Company

- Chubb

- Liberty Mutual Insurance Company

- The Travelers Indemnity Company

- USAA Insurance Company

- CNA Financial Corp.

- Farmers Insurance Group of Companies

Recent Developments

-

In November 2023, Chubb, launched a new media insurance product for customers in the UK Concurrently, Chubb has rebranded its current UK Technology Industry Practice to the Technology and Media Practice, aligning with its updated focus. The media insurance offering encompasses customizable coverages that include cyber, media liability, terrorism, casualty, property, and legal expenses. Clients have the flexibility to opt for specific covers that suit their individual needs. Additionally, the product provides various value-added services, such as a complimentary legal advice helpline staffed by experienced media lawyers. This product is aimed at middle-market and multinational media companies, as well as consultants in advertising, graphic design, public relations, brand development, encompassing magazines, newspaper, radio, and television.

-

In November 2023, Futuristic Underwriters LLC, announced the public launch of its services committed to mitigating risks and enhancing profitability for insurers, agents, and insured parties. Futuristic Underwriters aims to provide innovative solutions to address challenges within various sectors, including manufacturers/distributors, contractors, professional service organizations, real estate, auto, and other property and casualty lines.

-

In November 2023, One Inc., and J.P. Morgan, announced their partnership to serve the insurance sector. This partnership empowers insurance carriers to utilize J.P. Morgan's extensive liquidity and payment capabilities within One Inc.'s digital platform for claim payouts, thereby enhancing the digitization and enriching the overall claims experience. Through this partnership, the combined expertise of both organizations in the insurance industry is leveraged, enabling insurers to provide comprehensive end-to-end solutions for a wide range of payment requirements in the Property and Casualty (P&C) insurance claims process.

Property And Casualty Insurance Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3,916.99 billion

Revenue forecast in 2030

USD 6,180.14 billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product type, distribution channel, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

State Farm Mutual Automobile Insurance Company; Berkshire Hathaway Specialty Insurance; Progressive Casualty Insurance Company; Allstate Insurance Company; Chubb; Liberty Mutual Insurance Company; The Travelers Indemnity Company; USAA Insurance Company; CNA Financial Corp.; Farmers Insurance Group of Companies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Property And Casualty Insurance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global property and casualty insurance market report based on product type, distribution channel, end-user, and region.

-

Product Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Homeowners Insurance

-

Renters Insurance

-

Condo Insurance

-

Landlord Insurance

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Tied Agents and Branches

-

Brokers

-

Others

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Individuals

-

Governments

-

Businesses

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global property and casualty insurance market size was estimated at USD 3,674.46 billion in 2023 and is expected to reach USD 3,916.99 billion in 2024.

b. The global property and casualty insurance market is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 to reach USD 6,180.14 billion by 2030.

b. North America dominated the property and casualty insurance market with a share of 30.22% in 2023. This high share is attributable as property & casualty insurance plays a pivotal role in safeguarding homes, businesses, and assets against an array of risks, including natural disasters, accidents, and liabilities.

b. Some key players operating in the property and casualty insurance market include State Farm Mutual Automobile Insurance Company; Berkshire Hathaway Specialty Insurance; Progressive Casualty Insurance Company; Allstate Insurance Company; Chubb; Liberty Mutual Insurance Company; The Travelers Indemnity Company; USAA Insurance Company; CNA Financial Corp.; Farmers Insurance Group of Companies.

b. Key factors that are driving the market growth include the growing intensity of natural disasters such as floods, hurricanes, earthquakes, and wildfires and the digitalization of the insurance industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."