- Home

- »

- Consumer F&B

- »

-

Propolis Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Propolis Market Size, Share & Trends Report]()

Propolis Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Capsules & Tablets, Liquids, Others), By Distribution Channel (Retail Store, Online, Others), By Region, Segment Forecasts

- Report ID: GVR-4-68039-932-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Propolis Market Summary

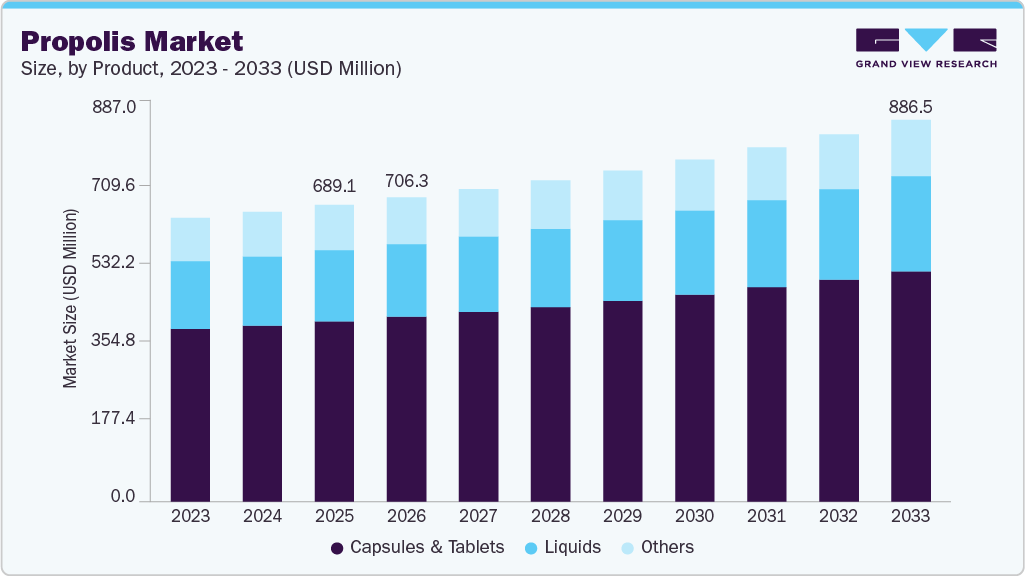

The global propolis market size was estimated at USD 689.1 million in 2025 and is projected to reach USD 886.5 million by 2033, growing at a CAGR of 3.3% from 2026 to 2033. The market for propolis is witnessing sustained growth, driven primarily by rising consumer awareness of preventive healthcare and strong shift toward natural and functional ingredients.

Key Market Trends & Insights

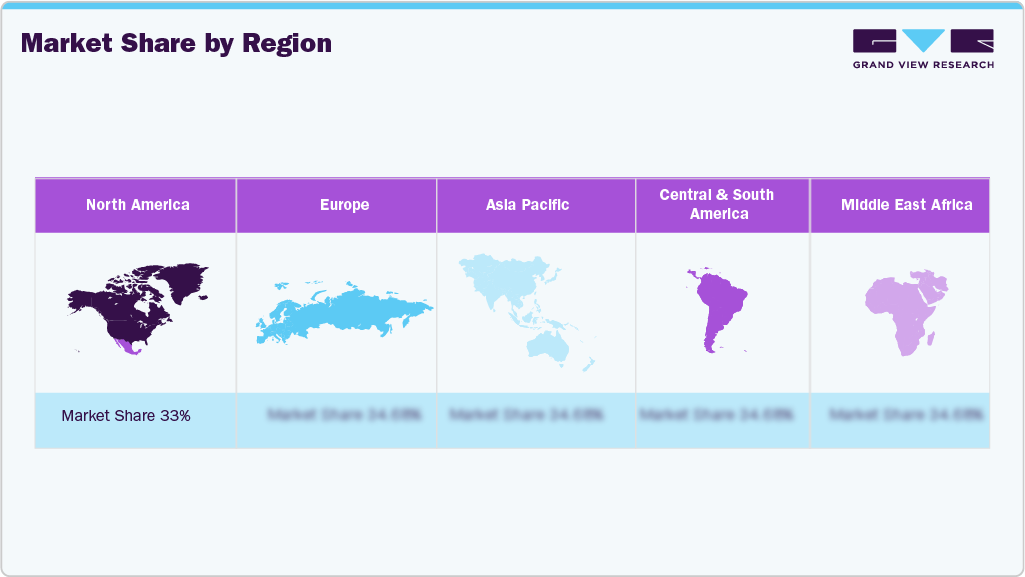

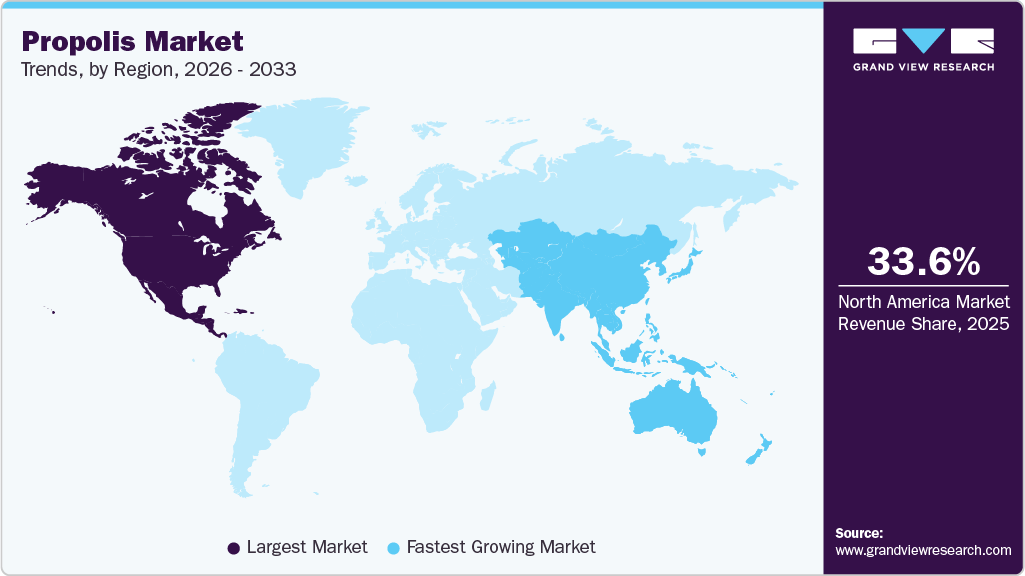

- North America dominates the global propolis market with the largest revenue share of 33.6% in 2025.

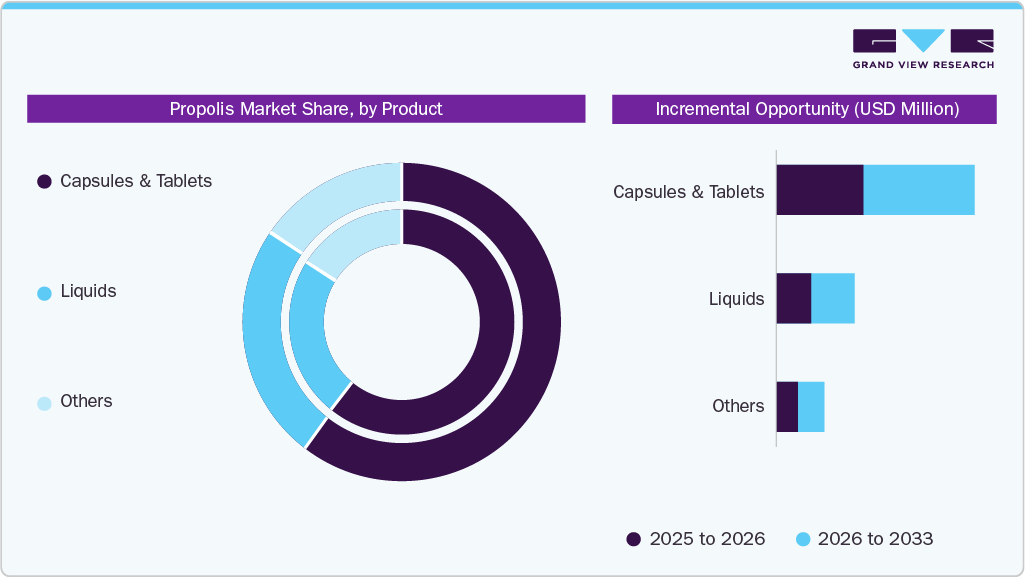

- By product, the capsules & tablets segment led the market with the largest revenue share of 60.8% in 2025.

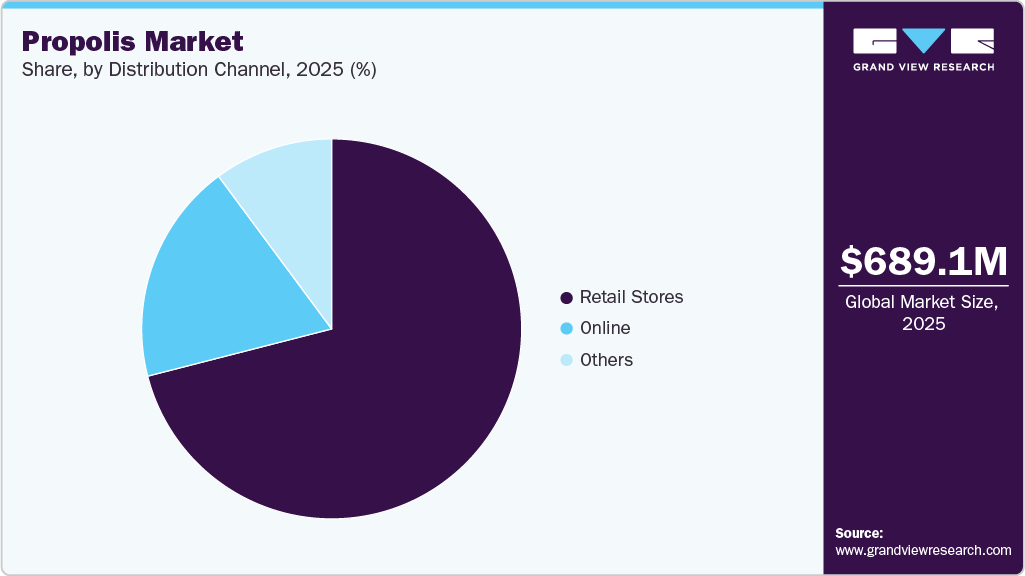

- By distribution channel, the retail stores segment led the market with the largest revenue share of 71.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 689.1 Million

- 2033 Projected Market Size: USD 886.5 Million

- CAGR (2026-2033): 3.3%

- North America: Largest market in 2025

- Asia Pacific: Fastest market share

Consumers across both developed and emerging markets are increasingly seeking immunity-boosting and wellness-oriented products, especially in the post-pandemic environment. Propolis, known for its antimicrobial, anti-inflammatory, antioxidant, and immune-support properties, aligns well with this preference, positioning it as a favored ingredient in daily health and wellness regimens.

Another key factor supporting market expansion is the growing incorporation of propolis into dietary supplements and pharmaceutical formulations. It is widely used in products targeting respiratory health, oral care, wound healing, and digestive wellness. As healthcare systems and consumers place greater emphasis on preventive care and self-medication through nutraceuticals, propolis-based capsules, sprays, lozenges, and tinctures are gaining wider acceptance, particularly among aging populations and health-conscious consumers.

Shifting consumer preferences toward organic, clean-label, and sustainably sourced products further reinforces market growth. Propolis benefits from a strong natural and traditional medicine positioning, which resonates well with consumers seeking transparency, minimal processing, and plant- or bee-based bioactive compounds. This trend is particularly evident in Europe, North America, and parts of Asia, where demand for certified natural and organic products continues to rise.

In addition, the expansion of online retail and direct-to-consumer channels has improved product accessibility and visibility. E-commerce platforms enable brands to educate consumers on the functional benefits of propolis, offer a wide range of formats, and reach niche wellness audiences more efficiently. This has accelerated adoption, especially among younger, digitally engaged consumers who actively seek functional health products online.

Product Insights

The capsule & tables propolis segment led the market with the largest revenue share of 60.8% in 2025. Capsule and tablet formats, in particular, are gaining preference due to their ease of consumption, precise dosage, longer shelf life, and portability, making them well suited for daily supplementation. This trend is further supported by growing consumer trust in standardized, clinically positioned nutraceutical formats, especially among urban and working populations seeking simple, consistent ways to support immune and respiratory health.

The liquid propolis segment is expected to grow at the fastest CAGR of 3.8% from 2026 to 2033. Consumers increasingly prefer liquid formats because they are easy to consume, fast-absorbing, and convenient to mix with water, teas, or wellness drinks, aligning well with daily preventive health routines. In addition, heightened awareness of propolis’ antibacterial, antioxidant, and anti-inflammatory properties, often associated with immune support, oral health, and respiratory wellness, has strengthened demand, particularly following the pandemic.

Distribution Channel Insights

The retail stores segment led the market with the largest revenue share of 71.0% in 2025. Sales of propolis through retail stores are rising as consumers increasingly seek natural, immune-supporting products that are easily accessible and trusted. Propolis is gaining visibility in pharmacies, health food stores, and supermarkets due to growing awareness of its antimicrobial and antioxidant properties, particularly following heightened focus on preventive health and immunity. Retail channels also allow consumers to physically examine products, compare formulations, and rely on a pharmacist or in-store recommendations, which builds confidence for first-time buyers.

The online segment is expected to grow at the fastest CAGR of 3.7% from 2026 to 2033. E-commerce platforms enable consumers to easily compare formulations, concentrations, and brands, while providing access to detailed product information, reviews, and usage guidance factors that are particularly important for wellness-oriented and first-time buyers. In addition, online channels allow niche and premium propolis brands to reach a wider audience beyond pharmacies and specialty stores, supported by subscription models, targeted digital marketing, and cross-border availability.

Regional Insights

North America dominated the global propolis market with the largest revenue share of 33.6% in 2025. Propolis is gaining traction as consumers shift toward clean-label, plant-based, and functional products, supported by growing usage in dietary supplements, throat sprays, oral care, and topical formulations. The expansion of the natural and organic products industry, along with higher acceptance of traditional and alternative remedies, has further supported demand. In addition, strong retail penetration through health stores and e-commerce platforms, combined with rising interest in immune health following the pandemic, continues to drive market growth across the region.

U.S. Propolis Market Trends

The propolis market in the U.S. accounted for the largest market revenue share in North America in 2025. The propolis industry in the U.S. is experiencing growth primarily due to increasing consumer demand for natural, immune-supporting, and functional health products. Propolis, known for its antimicrobial, antioxidant, and anti-inflammatory properties, is increasingly used in dietary supplements, throat sprays, oral care products, and immune-boosting formulations. Additionally, the growing interest in preventive healthcare, natural alternatives to antibiotics, and functional ingredients in nutraceuticals and personal care products is driving the wider adoption of propolis across mainstream retail and e-commerce channels in the U.S.

Europe Propolis Market Trends

The propolis market in Europe is projected to grow rapidly over the forecast period, as awareness of the immune-boosting, anti-inflammatory, and antimicrobial properties of propolis increases, demand is expanding in supplements, oral care, skincare, and functional foods. The shift toward clean-label and natural remedies, combined with rising health consciousness and aging populations across Europe, has further boosted market growth. In addition, the increasing availability of propolis-based products in pharmacies, health stores, and e-commerce platforms is supporting broader consumer access and adoption.

Asia Pacific Propolis Market Trends

The propolis market in the Asia Pacific is projected to grow at the fastest CAGR of 3.7% from 2026 to 2033. The propolis industry in the Asia Pacific is rising due to growing consumer awareness of natural health remedies, increasing demand for immunity-boosting products, and expanding applications of propolis in functional foods, cosmetics, and pharmaceuticals. Countries like China, Japan, and South Korea are seeing a surge in health-conscious populations seeking alternative and traditional wellness solutions. In addition, rising disposable incomes and the popularity of e-commerce platforms are making propolis-based products more accessible across urban and semi-urban areas.

Key Propolis Company Insight

Manufacturers' main focus is on innovating new products to meet the increasing demand for propolis. New players are entering the market owing to low market entry barriers and higher market potential. The increasing demand for propolis offers an opportunity for product development in the regions of high demand.

Key Propolis Companies:

The following are the leading companies in the propolis market. These companies collectively hold the largest market share and dictate industry trends.

- Apis Flora

- Herb Pharm LLC

- Bee Health Limited

- YS Organic Bee Farms

- Comvita Ltd

- Wax Green

- Apiary Polenecter

- Uniflora Health Foods

- Sunyata Pon Lee

- NOW Foods

Propolis Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 706.3 million

Revenue Forecast in 2033

USD 886.5 million

Growth rate

CAGR of 3.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain: China; Japan; India; Australia; Brazil; Argentina; South Africa

Key companies profiled

Apis Flora; Herb Pharm LLC; Bee Health Limited; YS Organic Bee Farms; Comvita Ltd.; Wax Green; Apiary Polenecter; Uniflora Health Foods; Sunyata Pon Lee; NOW Foods

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Propolis Market Report Segmentation

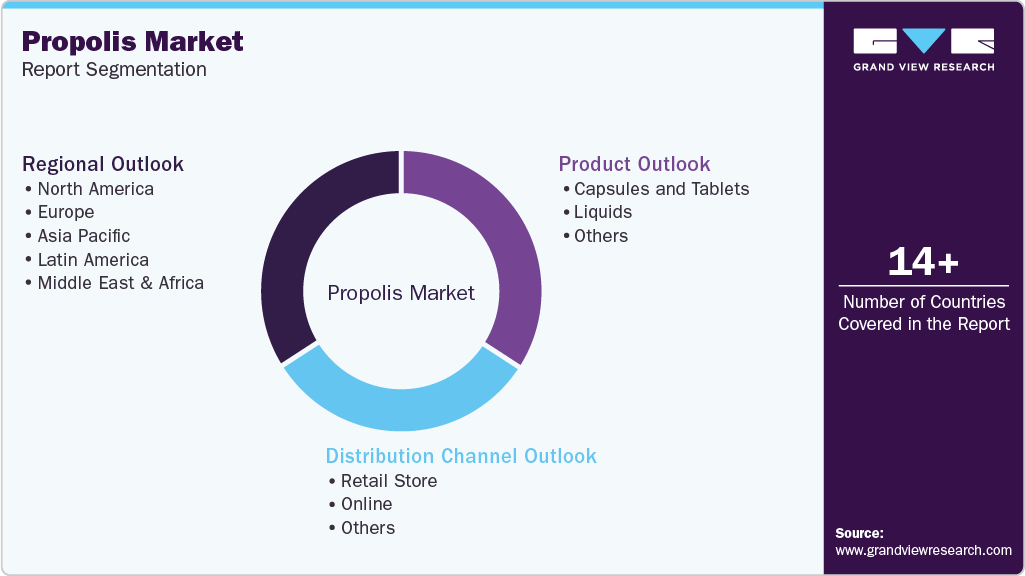

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global propolis market report based on the product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Capsules and Tablets

-

Liquids

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global propolis market size was estimated at USD 636.6 million in 2021 and is expected to reach USD 647.4 million in 2022.

b. The global propolis market is expected to grow at a compound annual growth rate of 2.3% from 2022 to 2028 to reach USD 746.4 million by 2028.

b. North America dominated the propolis market with a share of 33.3% in 2021. This is attributable to increasing cases of genital herpes and rising import demand in the industry.

b. Some key players operating in the propolis market include Apis Flora; Herb Pharm LLC; Bee Health Limited; YS Organic Bee Farms; Comvita Ltd, Wax Green; Apiary Polenecter; Uniflora Health Foods; Sunyata Pon Lee; and NOW Foods.

b. Key factors that are driving the propolis market growth include Increasing demand of propolis in the pharmaceutical and healthcare industry and the Increasing rate of herpes simplex virus type 1 and type 2.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.