- Home

- »

- Pharmaceuticals

- »

-

Prostate Cancer Therapeutics Market, Industry Report, 2030GVR Report cover

![Prostate Cancer Therapeutics Market Size, Share & Trends Report]()

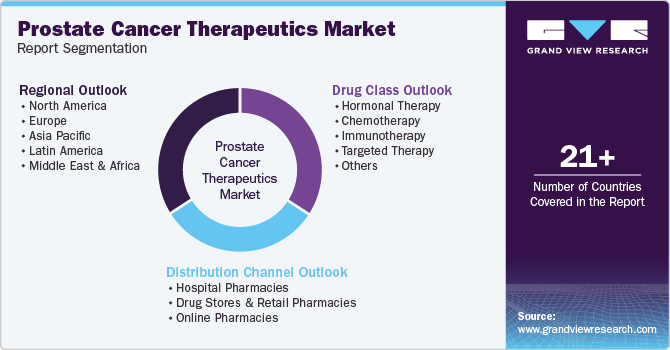

Prostate Cancer Therapeutics Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Class (Hormonal Therapy, Chemotherapy, Immunotherapy, Targeted Therapy), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-925-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Prostate Cancer Therapeutics Market Summary

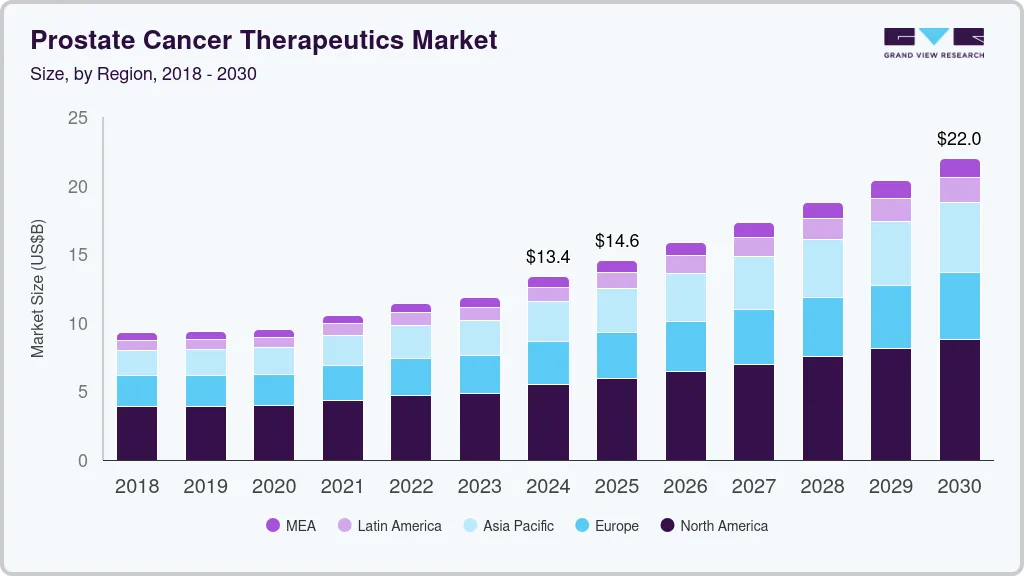

The global prostate cancer therapeutics market size was estimated at USD 17.0 billion in 2024 and is projected to reach USD 31.99 billion by 2030, growing at a CAGR of 10.9% from 2025 to 2030. This growth is driven by factors such as the rising cases of prostate cancer, advancements in screening and diagnostic methods, and government initiatives supporting new treatments.

Key Market Trends & Insights

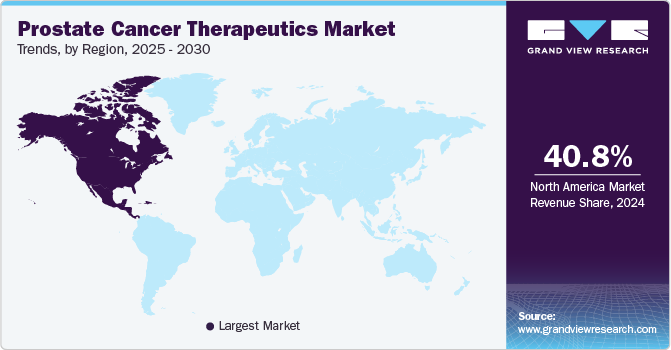

- North America prostate cancer therapeutics market dominated the global market with a revenue share of 40.8% in 2024.

- The U.S. prostate cancer therapeutics market dominated North America with the largest revenue share in 2024.

- By drug class, the hormonal therapy drug class dominated the market in 2024, accounting for an 88.6% revenue share.

- By distribution channel, the hospital pharmacies segment dominated the market and accounted for the largest revenue share of 48.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.0 billion

- 2030 Projected Market Size: USD 31.99 billion

- CAGR (2025-2030): 10.9%

- North America: Largest market in 2024

The use of modern technologies such as bioinformatics and computational biology is contributing toward therapy development. The market players are deploying techniques such as proteome profiling and genome sequencing to create better treatments. For instance, in 2022, a phase III trial for Olaparib involved over 4,000 men, using tumor genomic testing to identify suitable patients.The global pandemic had a significant impact on the prostate cancer therapeutics market, disrupting doctor-patient interactions, limiting access to treatments, and influencing clinical decisions. It also contributed to broader social and economic challenges, worsening healthcare disparities. These disruptions negatively affected prostate cancer outcomes, while patients with the disease faced a higher risk of severe complications and mortality from COVID-19 compared to those without cancer.

Major players operating in the market are focusing on developing novel and advanced products. Many companies have products in their product pipeline that are expected to launch in the market during the forecast period. For instance, in March 2022, Merck announced keylynk-010, a trial for evaluating Keytruda in combination with Lynparza in patients with metastatic castration-resistant prostate cancer.

Government support for new therapies to cure prostate cancer is propelling market growth. For instance, in March 2022, the US FDA approved 177Lu-PSMA-617, a new metastatic prostate cancer treatment. The Society of Nuclear Medicine and Molecular Imaging developed this new therapy, which has been shown to reduce the risk of death by 38 percent. This new treatment is based on the use of PET scans to identify and treat patients with metastatic prostate cancer that express PSMA (prostate-specific membrane antigen).

Targeted therapy is expensive, making it unaffordable to the general public. For instance, the American Society of Clinical Oncology published a report in May 2021 concluding that the U.S. has the highest cancer medicine prices, more than two times higher than in Europe and two to six times higher than the rest of the globe.

Drug Class Insights

The hormonal therapy drug class dominated the market in 2024, accounting for an 88.6% revenue share. This therapy mainly includes luteinizing hormone-releasing hormone (LHRH) antagonists and anti-androgens. Xtandi is one of the most widely used drugs, not only due to an increase in prostate cancer treatments but also because patients are using it for longer periods, averaging nine months. In 2021, the drug generated over 3 billion in revenue, and this trend is expected to continue as more urologists recommend the therapy, supporting Xtandi’s long-term revenue growth.

The immunotherapy drug class is expected to grow notably in the prostate cancer therapeutics market. Advancements in immune checkpoint inhibitors and personalized treatment approaches drive this growth. PROVENGE (Sipuleucel-T), the first and only FDA-approved therapeutic cancer vaccine for prostate cancer, has paved the way for further innovation. It represents a breakthrough in immunotherapy by stimulating the body's immune response against cancer cells. The strong pipeline for prostate cancer includes ongoing trials in gene therapy, stem cell therapy, small molecules, and vaccines, highlighting the segment's potential for new treatment options.

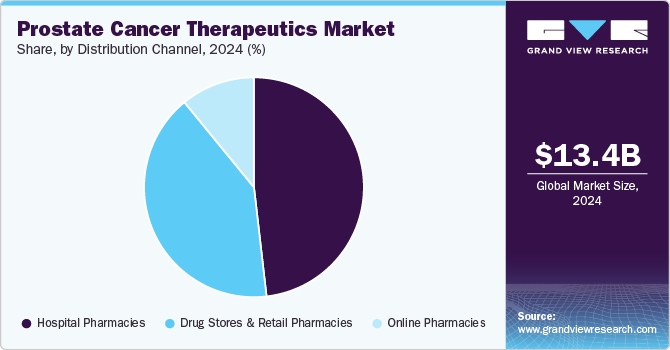

Distribution Channel Insights

The hospital pharmacies segment dominated the market and accounted for the largest revenue share of 48.2% in 2024. Hospital pharmacies and pharmacists are important market participants because they manage pharmaceuticals in a critical hospital setting that necessitates quick access to drugs and supplies. In addition, these pharmacies provide both in-patient and out-patient services, making it simple for patients to treat various illnesses. Moreover, these pharmacies also strive to lower clinical decision-making errors and concentrate on generating income from medicine purchases while aiming to reduce the overall cost of prescriptions.

In August 2022, Royal Surrey became the first to introduce Lutetium 177 treatment for prostate cancer patients under the Early Access Medicine Scheme (EAMS). The move was taken after the Medicines and Healthcare Products Regulatory Agency (MHRA) granted the product a marketing authorization. Nuclear medicine requires special assistance, thereby enhancing the role of hospitals.

Online pharmacies are expected to witness a lucrative growth rate of 8.8% over the forecast period, attributable to easier access to the internet and increasing awareness among people about over-the-counter medicines; online pharmacies have gained popularity quickly. In addition, COVID-19 has positively impacted the sector, propelling the market at an exponential rate, which is related to the constraints on people's freedom of movement. Moreover, the growth of the market is also linked to e-prescriptions, and as this trend gains traction, it could help the situation with online pharmacies.

Regional Insights

North America prostate cancer therapeutics market dominated the global market with a revenue share of 40.8% in 2024 due to an increase in the disease's prevalence and a strong need for prostate cancer therapeutic products in the region. However, the advent of promising new medicines in the biologics and hormone therapy divisions is attributable to expansion in North America. During the projection period, the planned introduction of some pipeline drugs is predicted to drive the market in the area. For instance, In March 2022, the US FDA approved an advanced accelerator application for Pluvicto drug, which is being used to treat adult patients with prostate cancer. The presence of a strong pipeline and government support for the innovation is anticipated to drive the market over the forecast period.

U.S. Prostate Cancer Therapeutics Market Trends

The U.S. prostate cancer therapeutics market dominated North America with the largest revenue share in 2024. This is driven by the high prevalence of prostate cancer, strong healthcare infrastructure, and widespread adoption of advanced treatment options. Government initiatives, favorable reimbursement policies, and ongoing research into novel therapies further support market expansion. The presence of key industry players and increasing clinical trials focusing on immunotherapy, gene therapy, and targeted treatments contribute to the market growth. For instance, in March 2022, the U.S. FDA approved Pluvicto (lutetium Lu 177 vipivotide tetraxetan) for treating metastatic castration-resistant prostate cancer (mCRPC), highlighting advancements in targeted radioligand therapy.

Asia Pacific Prostate Cancer Therapeutics Market Trends

The Asia Pacific prostate cancer therapeutics market is expected to grow at the fastest CAGR of 9.9% over the forecast period. Affordable treatment options, personalized medicines, technological advancements, and the increasing number of prostate cancer cases drive this growth. For instance, Xtandi (enzalutamide), co-licensed by Japan’s Astellas Pharma and the U.S.-based Pfizer, is available at a significantly lower price in the region compared to the U.S. The combination of cost-effective treatments and technological advancements is expected to further support the growth of the prostate cancer therapeutics industry in the coming years.

Japan prostate cancer therapeutics market is expected to register the fastest growth rate over the forecast period. This growth is driven by an aging population, rising prostate cancer cases, and the increasing adoption of advanced treatment options. Government initiatives supporting early diagnosis and access to innovative therapies further expand the market. Research efforts in precision medicine and immunotherapy are gaining traction, with ongoing clinical trials evaluating novel treatment approaches. In February 2023, the Japanese Ministry of Health, Labour, and Welfare (MHLW) approved darolutamide (marketed as Nubeqa) in combination with androgen deprivation therapy (ADT) and docetaxel for the treatment of metastatic prostate cancer, reflecting advancements in therapeutic options for patients in the country.

Europe Prostate Cancer Therapeutics Market Trends

Europe prostate cancer therapeutics market is projected to experience significant growth over the forecast period. This expansion is driven by the rising incidence of prostate cancer, increasing awareness initiatives, and the adoption of advanced treatment options. Supportive government policies and advancements in precision medicine further contribute to market development. Immunotherapy research and targeted therapies continue progressing, with multiple clinical trials exploring novel approaches. In July 2024, the National Institute for Health and Care Excellence (NICE) in the UK recommended relugolix (Orgovyx), an oral hormone therapy, for advanced hormone-sensitive prostate cancer, highlighting a key advancement in patient-centered treatment. These factors collectively support the growth of the prostate cancer therapeutics industry.

Key Prostate Cancer Therapeutics Company Insights

Some of the key companies operating in prostate cancer therapeutics are Johnson & Johnson Services, Inc., Astellas Pharma Inc., and Eli Lilly and Company. These companies are growing their market presence by launching new products, collaborating, and adopting various other strategies.

-

Johnson & Johnson Services, Inc. is a key player in the prostate cancer therapeutics market, offering advanced treatment options focused on improving patient outcomes. The company’s portfolio includes innovative hormone therapies and targeted treatments designed for different stages of prostate cancer. With a strong emphasis on research and development, Johnson & Johnson explores novel therapeutic approaches, such as next-generation androgen receptor inhibitors and combination therapies. Its commitment to advancing oncology treatments supports the development of new options for prostate cancer care worldwide.

-

Astellas Pharma Inc. provides treatments designed to address various stages of the disease. The company develops androgen receptor inhibitors and targeted therapies to improve treatment outcomes. Focusing on research, Astellas Pharma conducts clinical trials to evaluate new therapeutic combinations and personalized approaches. Its work in oncology research contributes to the availability of advanced options for prostate cancer treatment.

Key Prostate Cancer Therapeutics Companies:

The following are the leading companies in the prostate cancer therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc.

- Astellas Pharma Inc.

- Eli Lilly and Company

- Sanofi

- Ipsen Pharma

- Bayer AG

- AstraZeneca

- Bausch Health Companies Inc.

- Merck & Co., Inc.

- Pfizer Inc.

Recent Developments

-

In April 2024, Astellas Pharma Inc. received approval from the European Commission to extend XTANDI (enzalutamide) use. The decision permits its use alone or with androgen deprivation therapy in adult men with high-risk biochemical recurrent non-metastatic hormone-sensitive prostate cancer who are not suitable for salvage radiotherapy.

-

In February 2023, Pfizer announced positive results from the Phase 3 TALAPRO-2 trial evaluating TALZENNA (talazoparib) combined with XTANDI (enzalutamide) in men with metastatic castration-resistant prostate cancer (mCRPC). The combination significantly reduced the risk of disease progression or death by 37% compared to placebo plus XTANDI. These findings suggest that adding TALZENNA to XTANDI may offer a promising treatment option for patients with mCRPC, addressing an unmet need in advanced prostate cancer therapy.

Prostate Cancer Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.10 billion

Revenue forecast in 2030

USD 31.99 billion

Growth rate

CAGR of 10.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Johnson & Johnson Services, Inc.; Astellas Pharma Inc.; Eli Lilly and Company; Sanofi; Ipsen Pharma; Bayer AG; AstraZeneca; Bausch Health Companies Inc.; Merck & Co., Inc.; Pfizer Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Prostate Cancer Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global prostate cancer therapeutics market report based on drug class, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Hormonal Therapy

-

Chemotherapy

-

Immunotherapy

-

Targeted Therapy

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Drug Stores & Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.