- Home

- »

- Biotechnology

- »

-

Protein A Resin Market Size, Share & Growth Report, 2030GVR Report cover

![Protein A Resin Market Size, Share & Trends Report]()

Protein A Resin Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Recombinant, Natural), By Product (Agarose-based, Glass/Silica-based), By Application, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-018-1

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global protein A resin market size was estimated at USD 1.36 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.49% from 2023 to 2030. Protein A resins are used for the purification and fragmentation of the immunoglobulins from biological fluids & cell culture media, immunoprecipitation of proteins, and antigens. The major application of the protein A resin is monoclonal antibody production. Furthermore, the global industry is expanding as a result of an increase in the drug development process by the biotechnology & biopharmaceutical industries, growing studies in monoclonal antibodies, and increased expenditure in synthetic biology. Moreover, there is an increase in the demand for the protein-engineered products used for vaccine and therapeutics development by the biopharmaceutical industries, which has a positive impact on the global industry and is one of the major driving factors.

The COVID-19 pandemic has adversely affected the world economy by negatively affecting the supply chain of biopharmaceutical products, medical devices, and biotechnology products. On the other hand, the R&D sector and the development of therapeutics have flourished. Development of therapeutics & drug discovery requires accurate study and understanding of the structure and role of protein resins in the treatment of SARS-CoV-2 virus progression. However, the imposed lockdown led to the shutdown of the research institute and hampered the research studies.

Furthermore, various strategic initiatives have been implemented by key players to develop mAbs to treat COVID-19 virus infection. Therefore, biopharmaceutical and biotechnology companies are also engaged in collaboration and mergers for the development of vaccines for the COVID-19 virus treatment. For instance, in May 2021, Repligen collaborated with Navigo Proteins for developing NGL COVID-19 Spike Protein Affinity Resins to purify the COVID-19 vaccine. The resins bind to the SARS-CoV-2 spike protein binding domain and help in the purification of the vaccine. In addition, in June 2020, Kaneka Corp. collaborated with the National Institute of Infectious Diseases for the production of antibodies for treating novel coronavirus infections. This accelerated the development of therapeutic drugs for treating COVID-19 infection.

Type Insights

The recombinant protein A resins segment dominated the industry in 2022 and accounted for the largest share of 58.15% of the overall revenue. It is used to increase the solubility and improve the sensitivity of alkaline solutions. The recombinant protein A resins ligand is coupled with agarose to give high binding capacity to immunoglobulin in immunoglobulin fragmentation. It has a more specific binding capacity. Therefore, the growing demand for recombinant protein resins in the pharmaceutical industry due to its enhancing technological advances for the drug discovery process will drive segment growth over the forecast years.

For instance, in March 2020, Avantor, Inc., launched a new recombinant protein-A affinity chromatography resin used to purity antibodies during monoclonal antibody production. On the other hand, natural protein A is the fastest-growing segment and is expected to drive demand even further. It is obtained from the species staphylococcus aureus and derived from the bacterial cell of this species used for the purification of mAbs. In addition, natural protein A resins have a wide range of applications in biomedical research for antibody purification, affinity chromatography, and vaccine and therapeutics production. Moreover, the segment is estimated to register the fastest from 2023 to 2030 due to its ability to minimize the ligand leaching process and stability problems of traditional protein A resins.

Product Insights

The agarose-based protein A segment dominated the industry in 2022 and accounted for the maximum share of more than 42.10% of the overall revenue. This is attributed to the high binding specificity for the attachment of ligands to the proteins as compared to other matrices. In addition, the agarose-based protein A resins have better longevity, improved mechanical strength, and a high ability to integrate metal dopant absorption at, suitable pH. This trend will continue to drive the growth of the segment over the forecast period. The organic polymer-based protein A segment is estimated to register the fastest growth rate during the projected period. This is attributable to its fast and large molecule separation properties. They also have high biocompatibility and biodegradability, including a wide range of applications in imaging, biosensors, drug delivery, and bioseparation. Moreover, organic polymer-based protein A matrix resins have high solubility, safety, and stability when applied with nanoparticles and can be used for targeted drug delivery processes by many biopharmaceutical and biotechnological research institutes. Thus, propelling the segment growth.

Application Insights

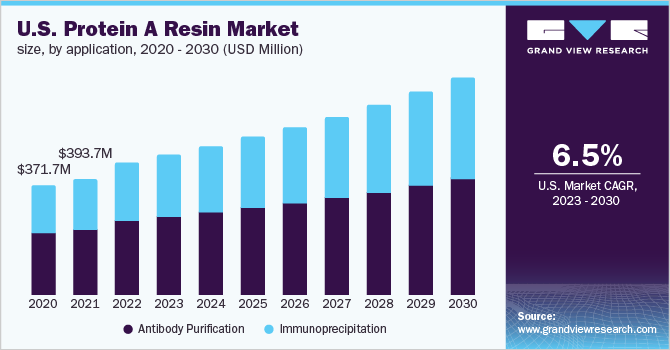

The antibody purification segment held the largest revenue share of more than 55.90% in 2022. There has been a constant demand for mAbs for therapeutic production for research as well as industrial purpose. Antibody purification includes isolation and enrichment of antibodies from polyclonal Abs, fluids of ascites, and cell culture supernatant of mAbs. This has driven the demand for commercial protein A resins production for the various downstream processes of antibody production. The increasing burden of chronic diseases has led to more demand for monoclonal antibodies for the treatment and cure of disease.

Moreover, the increasing awareness of the treatment of the aforementioned disease among people and healthcare professionals also drives the market. The immunoprecipitation application segment is estimated to register the fastest CAGR from 2023 to 2030. This is due to the application of immunoprecipitation in the R&D sector flourished by the biopharmaceutical and biotechnology industries. The segment will acquire a significant share and dominate the industry in the coming years.

End-user Insights

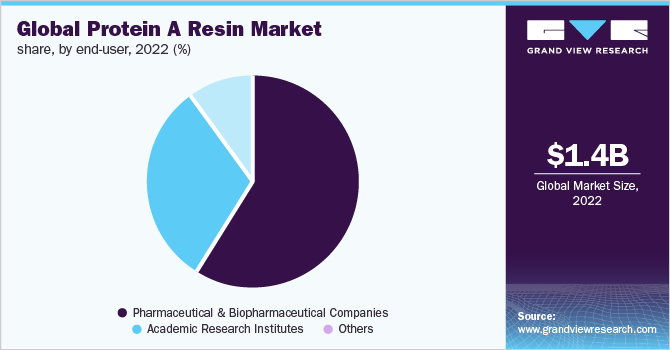

The pharmaceutical & biopharmaceutical companies segment captured the highest share of 58.90% in 2022. The increasing adoption of protein A resins in drug discovery, mAbs, vaccine, and therapeutics production procedures in biopharmaceutical manufacturing, as well as the rising usage of continuous manufacturing processes, account for a large share of this segment. The rising demand for protein engineering with technological advancements and new scientific advances fuels the segment's growth. Technological advancements in the pharmaceutical and biotechnology sectors, as well as the rapid growth of the biopharmaceutical sector globally, are expected to contribute to this segment’s revenue growth over the forecast period.

The government & academic institutions segment is expected to expand at a lucrative CAGR from 2023 to 2030. This isdue to a rise in healthcare expenditure and government funding for R&D globally and the increasing role of therapeutics, mAbs, and techniques for disease surveillance and prevention of outbreaks. Similarly, growth in hospital testing capacities post-pandemic and the availability of high throughput testing capabilities can considerably boost the market prospects for the protein A resins market.

Regional Insights

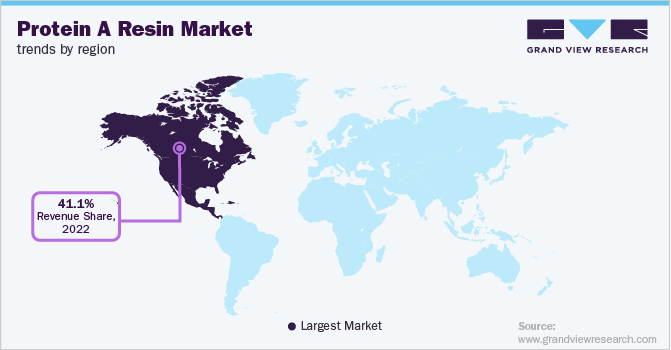

North America dominated the industry in 2022 and accounted for the highest share of 41.10% of the overall revenue. This is due to the increasing demand for protein-based therapeutics for the treatment of infectious diseases and the rising number of FDA-approved pharmaceutical and biotechnology companies in this region. Moreover, there is an increase in the number of collaborations, mergers, and acquisitions among the key players that propel the industry's growth. Furthermore, the government, as well as private entities, are also engaged in increasing R&D and healthcare development.

Rapid ongoing improvements in healthcare & R&D infrastructure and rising economic assistance from governments in the region can all be attributed to regional market growth. Moreover, the life science research activities involved in this region mainly focus on the use of resins for the drug discovery process propelling the market. Along with this, the increasing geriatric population, leading to a rise in the health issues like cancer and arthritis, will also support the region’s growth.

Key Companies & Market Share Insights

Key players are implementing various strategies including partnerships through mergers and acquisitions, geographical expansion, and strategic collaborations to expand their industry presence. For instance, in June 2022, Navigo Proteins GmbH launched an affinity resin derived from a baculovirus insect cell called glycoprotein gp64. Precision Capture technology was used to develop a Precision X ligand binding to glycoprotein gp64. This resin could be used for vaccine production n.Some of the key players in the global protein A resin market are:

-

GE Healthcare

-

Merck Millipore

-

PerkinElmer, Inc.

-

GenScript Biotech Corp.

-

Agilent Technologies

-

Repligen Corp.

-

Thermo Fisher Scientific Inc.

-

Bio-Rad Laboratories, Inc.

-

Abcam PLC.

-

Novasep Holdings SAS

Protein A Resin Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.44 billion

Revenue forecast in 2030

USD 2.24 billion

Growth rate

CAGR of 6.49% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Merck Millipore; PerkinElmer, Inc.; GenScript Biotech Corp.; Agilent Technologies; Repligen Corp.; Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; Abcam PLC; Novasep Holdings SAS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protein A Resin Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global protein A resin market report based on type, product, application, end-user, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Protein A

-

Recombinant Protein A

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Agarose-based Protein A

-

Glass/Silica-based Protein A

-

Organic Polymer-based Protein A

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Antibody Purification

-

Immunoprecipitation

-

-

End-users Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biopharmaceutical Companies

-

Academic Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global protein A resins market size was estimated at USD 1.36 billion in 2022 and is expected to reach USD 1.44 billion in 2023.

b. The global protein A resins market is expected to grow at a compound annual growth rate of 6.49% from 2023 to 2030 to reach USD 2.24 billion by 2030.

b. North America dominated the protein A resins market with a share of 41.10% in 2022. This is attributable to rising healthcare awareness coupled with advanced technologies acceptance and constant research and development initiatives.

b. Some key players operating in the protein A resins market market include GE Healthcare, Merck Millipore, PerkinElmer, GenScript Biotech Corporation, Agilent Technologies, Repligen Corporation, Thermo Fisher Scientific, Bio-Rad Laboratories, Abcam, and Novasep Holding SAS, among others

b. The major factor for the protein A resins market growth are increasing demand for disposable packed columns, growing R&D expenditure, therapeutics development, drug discovery, and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.