- Home

- »

- Consumer F&B

- »

-

Protein Bar Market Size, Share, Growth, Trends Report, 2030GVR Report cover

![Protein Bar Market Size, Share & Trends Report]()

Protein Bar Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Sports Nutritional Bars, Meal Replacement Bars), By Protein Source, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-434-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Protein Bar Market Summary

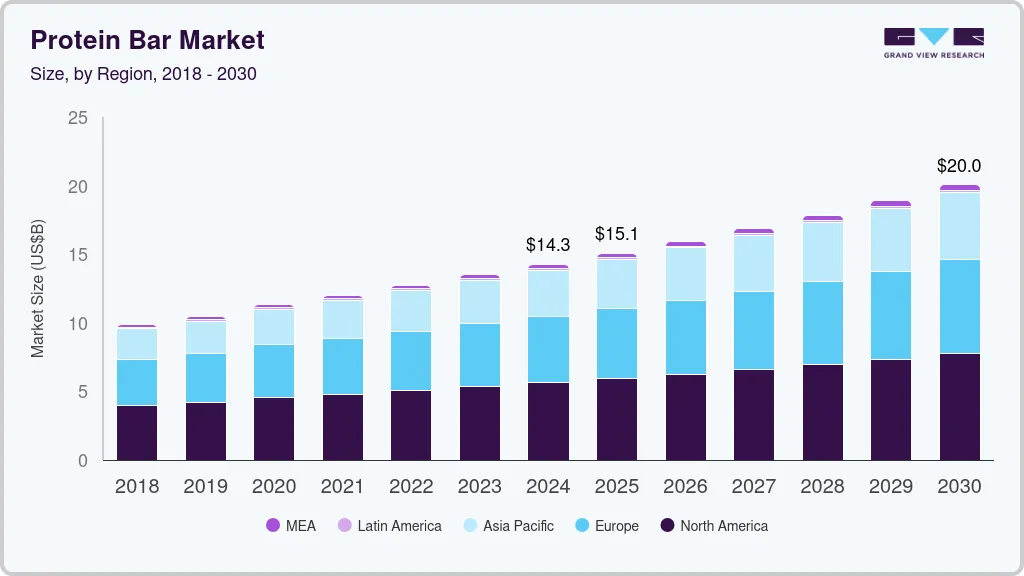

The global protein bar market size was estimated at USD 14.26 billion in 2024 and is projected to reach USD 20.05 billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. The demand for protein bars among consumers is rapidly increasing due to several compelling factors and trends.

Key Market Trends & Insights

- North America protein bar market accounted for a revenue share of 37.6% in 2023 of the global market.

- The protein bar market in the U.S. is expected to growt at a significant CAGR over the forecast period.

- By type, the sports nutritional bars segment accounted for a share of 49.2% in 2023.

- By protein source, the animal-based protein bars segment accounted for a revenue share of 75.3% in 2023.

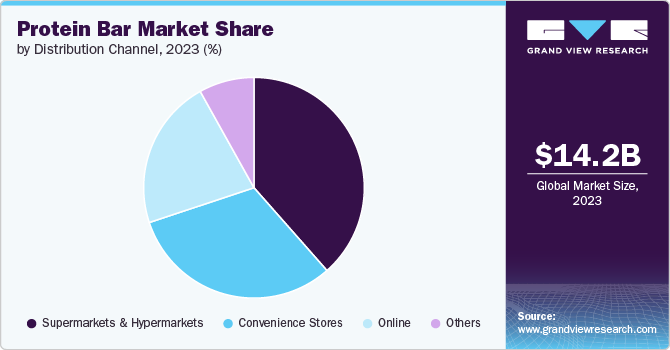

- By distribution channel, the supermarkets & hypermarkets accounted for a revenue share of 38.5% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 14.26 Billion

- 2030 Projected Market Size: USD 20.05 Billion

- CAGR (2025-2030): 5.9%

- North America: Largest market in 2023

One major driver is the growing awareness of health and fitness, with more individuals seeking convenient ways to meet their nutritional needs. Protein bars are widely recognized for their ability to offer a quick protein boost essential for muscle recovery, weight management, and overall health, making them especially popular among athletes and fitness enthusiasts. Additionally, the modern lifestyle's emphasis on convenience plays a significant role. With busy schedules, consumers are increasingly opting for portable and easy-to-consume options that fit seamlessly into their daily routines.TThe rise in health-conscious eating further fuels this trend, as people become more selective about their food choices, preferring products high in protein and low in sugar or artificial ingredients. Innovations in the protein bar market have also contributed to its growth, with a wide array of flavors, formulations, and dietary options available. This diversity caters to various dietary preferences and health needs, such as plant-based or gluten-free options, expanding the appeal of protein bars to a broader audience. The burgeoning fitness and wellness culture also plays a role, as protein bars are increasingly integrated into fitness routines and wellness practices.

Diet trends such as high-protein and ketogenic diets are gaining popularity, driving demand for protein bars that align with these nutritional strategies. Furthermore, the increasing focus on personalized nutrition, with consumers seeking tailored health solutions, has further boosted the market for protein bars that offer specific benefits like muscle recovery or weight management. Together, these factors create a robust demand for protein bars, reflecting contemporary consumer preferences for health, convenience, and personalized nutrition.

Type Insights

Sports nutritional bars led the market and accounted for a share of 49.2% in 2023. The rising interest in fitness and sports activities has driven the demand for products that support athletic performance and recovery. Sports nutritional protein bars are specifically designed to meet the protein needs of athletes and active individuals, helping them achieve their fitness goals and improve overall performance. As more people engage in regular exercise and sports, the need for effective nutritional support has increased.

Meal replacement bars are expected to grow at the highest CAGR of 6.1% from 2024 to 2030. As consumers become more health-conscious and seek healthier alternatives to traditional fast food or high-calorie snacks, meal-replacement protein bars have gained popularity. They offer a convenient and healthier option that aligns with various dietary goals, including high-protein diets, low-carb diets, and balanced nutrition, appealing to those who are focused on maintaining a healthy lifestyle.

Protein Source Insights

Animal-based protein bars led the market and accounted for a revenue share of 75.3% in 2023. Animal-based protein sources, such as whey, casein, and egg protein, are known for their complete amino acid profiles and high biological value. This means they provide all the essential amino acids required for muscle growth, recovery, and overall health. Consumers, particularly those focused on fitness and muscle building, prefer animal-based protein bars for their effectiveness in meeting high protein needs and supporting optimal performance.

Plant-based protein bars are expected to grow at a CAGR of 6.0% from 2024 to 2030. The increase in dietary preferences and restrictions, such as veganism, vegetarianism, and lactose intolerance, has driven the demand for plant-based protein bars. These bars offer a suitable protein source for individuals who avoid animal products or have specific dietary needs, providing an inclusive option that meets a wide range of consumer requirements.

Distribution Channel Insights

Sales through supermarkets & hypermarkets accounted for a revenue share of 38.5% in 2023. Supermarkets and hypermarkets offer a wide selection of protein bar brands, flavors, and formulations under one roof. This variety allows consumers to compare products easily and choose according to their preferences, dietary needs, or health goals. The availability of different options increases consumer satisfaction and encourages repeat purchases.

The online segment is expected to grow at a CAGR of 6.3% from 2024 to 2030. Online platforms offer competitive pricing due to reduced overhead costs compared to brick-and-mortar stores. Additionally, consumers can easily compare prices across multiple retailers and take advantage of discounts, promotional codes, or subscribe-and-save options, which can make purchasing protein bars online more cost-effective than traditional retail channels.

Regional Insights

North America protein bar market accounted for a revenue share of 37.6% in 2023 of the global market. North American consumers lead busy lives, balancing work, family, and personal commitments. Protein bars offer a convenient, portable, and quick solution for on-the-go nutrition. They serve as an easy meal replacement or snack that fits into hectic schedules, meeting the needs of individuals who require a quick and nutritious option without compromising their health goals.

U.S. Protein Bar Market Trends

The protein bar market in the U.S. is facing intense competition due to massive innovation in protein bars. There is a growing awareness of the importance of nutrition and dietary choices among American consumers. Many people are actively seeking out healthier food options, including high-protein products, to support their health and wellness goals. Protein bars, especially those that are high in protein and low in sugar, appeal to health-conscious individuals looking to make better dietary choices.

Europe Protein Bar Market Trends

The protein bar market in Europe is expected to grow at a CAGR of 5.9% during the forecast period. European consumers are becoming more health-conscious and are seeking convenient, nutritious snacks that align with their fitness and wellness goals. Protein bars offer a convenient way to increase protein intake while on the go. European consumers are increasingly drawn to the diverse and innovative protein sources and types being introduced in protein bars, which makes them an appealing choice for those looking to explore new and exciting food options.

Asia Pacific Protein Bar Market Trends

The protein bar market in Asia Pacific is expected to grow at a CAGR of 6.5% from 2024 to 2030. Rapid urbanization and busy lifestyles in many Asia-Pacific countries drive the need for convenient food solutions. Protein bars offer a quick and portable snack or meal option for individuals with hectic schedules. As Western dietary trends influence eating habits in the Asia-Pacific region, the popularity of protein bars is increasing. The appeal of these products is growing among consumers who are adopting Western-style diets and looking for high-protein snacks.

Key Protein Bar Company Insights

The protein bar market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality product.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the types used while strictly adhering to international regulatory standards.

Key Protein Bar Companies:

The following are the leading companies in the protein bar market. These companies collectively hold the largest market share and dictate industry trends.

- Clif Bar & Company

- Quest Nutrition

- Kellogg Company (RXBAR)

- General Mills (Nature Valley)

- MusclePharm

- GNC (General Nutrition Corporation)

- ThinkThin (Think Products)

- Larabar (General Mills)

- Orgain

- PowerBar

Recent Developments

-

In May 2024, Gelita introduced Optibar, a new ingredient designed for creating soft and sugar-free protein bars. This blend allows for higher protein content while maintaining a long-lasting, indulgent texture and acts as a sugar-free binder, enabling claims of "low sugar" and "no sugar."

-

In April 2024, Ready, a leading active nutrition company, launched its new Kids Whole Grain Protein Bars, expanding its commitment to providing healthy and delicious snack options for families. The bars are designed to meet the nutritional needs of active children, offering 6 grams of protein, 8 grams of whole grains, and 20% less sugar than other leading kids' whole grain snack bars.

Protein Bar Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.07 billion

Revenue forecast in 2030

USD 20.05 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, protein source, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Clif Bar & Company, Quest Nutrition, Kellogg Company (RXBAR), General Mills (Nature Valley), MusclePharm, GNC (General Nutrition Corporation), ThinkThin (Think Products), Larabar (General Mills), Orgain, PowerBar

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Protein Bar Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global protein bar market report based on type, protein source, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Nutritional Bars

-

Meal Replacement Bars

-

Others

-

-

Protein Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Animal-Based Protein Bars

-

Plant-Based Protein Bars

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global protein bar market size was estimated at USD 14.18 billion in 2023 and is expected to reach USD 14.97 billion in 2024.

b. The global protein bar market is expected to grow at a compounded growth rate of 5.7% from 2024 to 2030 to reach USD 20.87 billion by 2030.

b. Sports nutritional bars accounted for a share of 49.2% in 2023. With busy lifestyles, athletes and active individuals seek convenient and portable nutrition solutions. Sports nutritional protein bars offer a quick and easy way to meet protein and energy needs without the hassle of meal preparation. Their portability makes them ideal for consumption before or after workouts, during travel, or between meals, aligning with the fast-paced lives of many consumers.

b. Some key players operating in protein bar market include Clif Bar & Company, Quest Nutrition, Kellogg Company (RXBAR), General Mills (Nature Valley), MusclePharm and others.

b. Key factors that are driving the market growth include rising inclination towards health and fitness and increasing trends for on the go meals among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.