- Home

- »

- Consumer F&B

- »

-

Protein Crisps Market Size & Share, Industry Report, 2030GVR Report cover

![Protein Crisps Market Size, Share & Trends Report]()

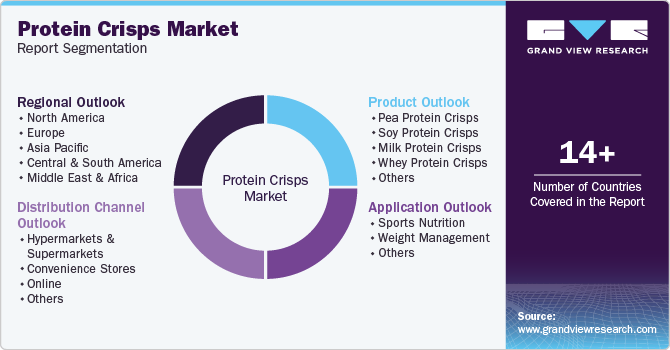

Protein Crisps Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Pea Protein Crisps, Whey Protein Crisps), By Application (Sports Nutrition, Weight Management), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-520-4

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Protein Crisps Market Summary

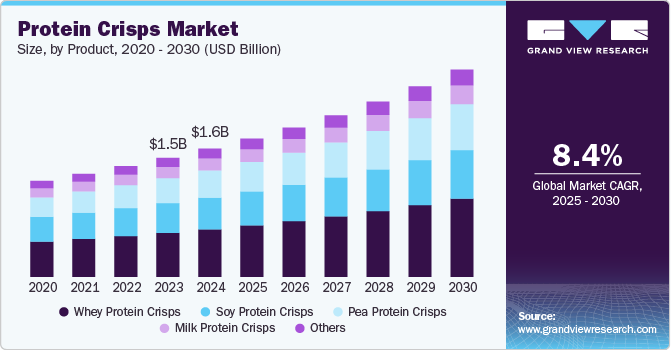

The global protein crisps market size was estimated at USD 1.61 billion in 2024 and is projected to reach USD 2.60 billion by 2030, growing at a CAGR of 8.4% from 2025 to 2030. A key trend is the rising consumer awareness of the importance of protein in muscle building, weight management, and overall well-being.

Key Market Trends & Insights

- North America held over 37.4% of the global revenue in 2024.

- The U.S. protein crisps market is expected to grow at a CAGR of 8.1% from 2025 to 2030.

- Based on product, the whey protein crisps segment accounted for a revenue share of 37.08% in 2024.

- Based on application, the sports nutrition segment accounted for a revenue share of 53.0% in 2024.

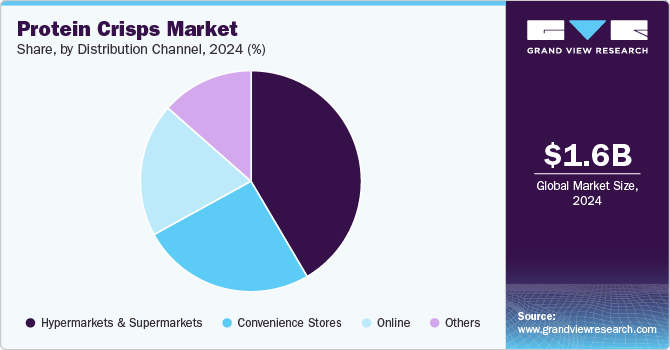

- Based on distribution channel, the sales of protein crisps market through hypermarkets & supermarkets segment accounted for a revenue share of 41.52% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.61 Billion

- 2030 Projected Market Size: USD 2.60 Billion

- CAGR (2025-2030): 8.4%

- North America: Largest market in 2024

This awareness has spurred a demand for convenient and accessible protein sources that fit modern, on-the-go lifestyles. Consumers are increasingly seeking alternatives to traditional protein sources, such as meat and dairy, and protein crisps offer a palatable and easily portable option for boosting protein intake throughout the day, driving market expansion across various product categories.

Beyond general health benefits, the increasing popularity of fitness and active lifestyles is a significant demand driver. Individuals engaging in regular exercise are proactively seeking protein-rich snacks and meals to support muscle recovery and performance. Protein crisps, often marketed with specific athletic benefits, cater directly to this demographic. Moreover, the rise of specialized diets like ketogenic and paleo, which emphasize higher protein consumption, has further fueled the demand for protein-enhanced snacks and breakfast options. Companies are responding by formulating crisps with specific macronutrient profiles catering to these niche dietary needs, broadening the market appeal and encouraging experimentation.

Consumers are increasingly conscious of the nutritional content of their snacks and are actively seeking products that are lower in sugar, fat, and artificial ingredients while still providing satiety and nutritional value. Protein crisps, often positioned as a healthier alternative to traditional sugary or processed snacks, effectively address this demand. Manufacturers are incorporating clean-label ingredients, such as plant-based proteins, natural sweeteners, and whole grains, to align with consumer preferences and further enhance the perceived healthfulness of their products.

Moreover, product innovation and diversification are playing a crucial role in driving demand. Beyond basic protein bars, manufacturers are experimenting with diverse flavors, textures, and formats to cater to evolving consumer preferences. This includes savory protein crisps, protein-enriched breakfast cereals, and even protein-infused confectionery items. Furthermore, the inclusion of functional ingredients, such as vitamins, minerals, and probiotics, adds value and further differentiates products in a competitive market. This constant innovation allows manufacturers to capture new consumer segments and maintain market momentum by offering compelling and differentiated nutrient crisps options.

Product Insights

The whey protein crisps accounted for a revenue share of 37.08% in 2024. The demand for whey protein crisps is driven by the increasing consumer awareness of whey protein's benefits in muscle building, recovery, and weight management. This awareness, coupled with the palatable texture and neutral flavor profile of many whey protein crisp formulations, makes them an appealing ingredient for a variety of nutrients-enhanced products such as protein bars, snack bars, cereals, and even confectionery items. A key driver is also the existing infrastructure for whey protein production; with ample supply chains supporting their incorporation, food manufacturers can readily access and integrate them into new and existing product lines, ensuring cost-effectiveness and consistent availability for consumers.

The pea protein crisps are anticipated to witness a growth rate of 9.3% from 2025 to 2030, driven by the escalating consumer demand for vegan, vegetarian, and allergen-friendly options. The growth of the global vegan and vegetarian population, combined with the increasing number of consumers seeking to reduce their meat consumption for environmental and health reasons, is creating a significant market opportunity for pea protein crisps. The fact that pea protein is naturally gluten-free, dairy-free, and soy-free positions it as an ideal ingredient for products targeting consumers with specific dietary restrictions or sensitivities. Earlier generations of pea protein crisps were often criticized for their distinctive "pea" flavor and sometimes gritty texture. However, new extraction and extrusion techniques have successfully mitigated these issues, resulting in crisps with a more neutral flavor and a satisfyingly crunchy texture.

Application Insights

The sports nutrition application accounted for a revenue share of 53.0% in 2024. Fueled by the increasing awareness of protein's crucial role in muscle recovery, repair, and growth, athletes and fitness enthusiasts are actively seeking convenient and palatable protein sources. Protein bars, snack bars, and cereals fortified with protein crisps offer a convenient on-the-go option for pre- and post-workout fueling. Demand is further driven by the rise in popularity of high-intensity interval training (HIIT), CrossFit, and other demanding exercise regimens that necessitate efficient protein intake. Trends in this area include the development of protein crisps with enhanced amino acid profiles, the incorporation of natural sweeteners and flavors, and the creation of products that cater to specific dietary needs, such as vegan or gluten-free athletes. Manufacturers are innovating with textures and flavors to create truly enjoyable and performance-enhancing snacks, moving beyond the often-chalky texture traditionally associated with high-nutrient products.

The weight management segment is estimated to grow at a CAGR of 9.2% from 2025 to 2030. Protein crisps are increasingly incorporated into weight management products like meal replacement bars, low-calorie snacks, and high-protein cereals. The demand is driven by the escalating global obesity epidemic and the growing awareness of the importance of dietary protein in maintaining lean muscle mass during weight loss. Trends in this application include the development of protein crisps with low carbohydrate and sugar content, the use of natural fiber sources to enhance satiety, and the creation of products that appeal to specific weight management strategies, such as ketogenic or low-carb diets. Incorporating protein crisps into a variety of snack options helps to alleviate the monotony often associated with restrictive diets, making them more appealing to those looking to manage their weight.

Distribution Channel Insights

The sales of protein crisps market through hypermarkets & supermarkets accounted for a revenue share of 41.52% in 2024. A key trend in this channel is the strategic placement of these products within high-traffic areas. Endcaps, checkout aisles, and dedicated health food sections are increasingly utilized to capture impulse purchases and cater to health-conscious shoppers who actively seek out protein-rich options. Consumers can easily incorporate protein crisps into their regular grocery shopping trips, either as a planned purchase or a spontaneous addition. Furthermore, the wide variety of brands, flavors, and formats available within these large retail spaces from individual bars to multi-packs caters to diverse needs and preferences, encouraging trial and repeat purchases.

The online segment is estimated to grow at a CAGR of 10.0% from 2025 to 2030, fueled by convenience, extensive product selection, and targeted marketing. Consumers are drawn to the ease of browsing a vast array of brands, flavors, and formats from the comfort of their homes. A significant trend is the rise of subscription services, which offer regular deliveries of favorite protein crisp products at a discounted rate, promoting loyalty and recurring revenue. Online retailers also leverage data analytics to personalize recommendations and target advertisements based on individual dietary preferences and purchase history, effectively driving demand by delivering tailored options to potential customers. Furthermore, online platforms often host promotional events, discounts, and bundled offers that incentivize purchases, contributing to higher sales volumes and market growth.

Regional Insights

The protein crisps market in North America held over 37.4% of the global revenue in 2024, fueled by a surge in health-conscious consumers and the rising popularity of convenient, high-protein snacks. Demand is driven by the increased awareness of protein's role in muscle building, weight management, and satiety. Moreover, the growing millennial and Gen Z populations, which are more likely to opt for convenient and on-the-go snacks, further contribute to the demand. The expansion of retail channels, including online platforms and specialty stores, is also making protein crisps more accessible to a wider consumer base. Besides, consumers are actively seeking convenient and portable snacks that align with their fitness goals, fueling the demand for high-protein, low-sugar options. Innovation in flavors and textures, with an emphasis on "clean label" ingredients and plant-based proteins, is further propelling the market.

U.S. Protein Crisps Market Trends

The U.S. protein crisps market is expected to grow at a CAGR of 8.1% from 2025 to 2030, fueled by the growing popularity of weight management programs and fitness challenges. Trends in the U.S. market include a focus on natural and organic ingredients, with consumers increasingly seeking clean-label products free from artificial additives and preservatives. Brands are differentiating themselves by offering protein crisps with a variety of health-boosting ingredients, such as probiotics, vitamins, and fiber. There's also a growing emphasis on sustainable sourcing and ethical production practices, appealing to environmentally conscious consumers. Furthermore, the demand for protein crisps in the U.S. is being fueled by the increasing prevalence of busy lifestyles and the desire for quick and nutritious meal replacements.

Europe Protein Crisps Market Trends

The protein crisps market in Europe is expected to grow at a CAGR of 8.4% from 2025 to 2030, driven by increasing health awareness and a rising interest in sports nutrition. A key trend is the growing adoption of plant-based protein sources as consumers become more conscious of the environmental and ethical implications of animal-based products. This has led to an increase in protein crisps made from ingredients like soy, peas, lentils, and chickpeas. Furthermore, consumers are displaying a preference for crisps with lower levels of salt, sugar, and fat as they become more health-conscious. Moreover, the demand for protein crisps in Europe is further propelled by the rising prevalence of active lifestyles and the growing number of fitness enthusiasts.

The demand for the protein crisps UK market is fueled by the growing fitness culture and the increasing number of individuals seeking convenient ways to meet their protein needs. A key trend is the rising popularity of vegan protein crisps, reflecting the growing adoption of plant-based diets in the UK Brands are focusing on innovative flavors and textures to appeal to a diverse consumer base. The drive towards healthier snacking options is a major factor influencing the demand for protein crisps in the UK. Consumers are seeking snacks that are low in sugar and fat and high in fiber. The increasing availability of protein crisps in major supermarkets and online retailers is also making them more accessible to consumers.

The Germany protein crisps market is experiencing steady growth, driven by a heightened awareness of the importance of nutrition and a rising interest in sports and fitness. A prominent trend is the growing demand for organic and sustainable protein crisps, reflecting a broader consumer focus on environmental responsibility. Consumers are also seeking clean-label products with minimal processing and natural ingredients. The use of local suppliers is gaining popularity to meet the demand for environmentally friendly products. The demand for protein crisps in Germany is also being propelled by the increase in health-conscious individuals, especially among the younger generation.

Asia Pacific Protein Crisps Market

The protein crisps market in Asia Pacific is set to grow at a CAGR of about 9.6% from 2025 to 2030, driven by increasing disposable incomes, urbanization, and a growing awareness of health and wellness. A key trend is the adaptation of flavors to suit local palates, with brands incorporating traditional spices and ingredients popular in different Asian cuisines. The market is also witnessing a rise in innovative product formats, such as protein crisps enhanced with vitamins and minerals. Besides, the growing awareness of the importance of protein for health and fitness is also contributing to the growth of the market. Moreover, the increasing number of fitness centers and gyms across the region is creating a demand for nutrient-rich snacks among fitness enthusiasts.

The Japanese protein crisps market is characterized by a sophisticated consumer base that values quality, innovation, and functionality. A prominent trend is the focus on incorporating traditional Japanese flavors and ingredients, such as soy sauce, seaweed, and matcha, to appeal to local tastes. The market is also seeing a rise in protein crisps that offer additional health benefits, such as immune support or improved digestion. The demand for functional foods is increasing among the aging population. Furthermore, the innovative packaging and presentation of protein crisps are appealing to Japanese consumers who value aesthetics and attention to detail. Marketing efforts emphasizing the health benefits, flavor, and convenience of protein crisps are also contributing to their popularity.

The protein crisps market in China is set to grow at a CAGR of about 9.0% from 2025 to 2030, driven by a large and increasingly health-conscious population and a growing interest in Western dietary trends. A key trend is the rise of e-commerce as a primary channel for protein crisps sales, with online platforms offering a wide range of brands and products to consumers across the country. Brands are also focusing on customizing their products to cater to local tastes and preferences. Moreover, the growing number of fitness enthusiasts and the influence of social media on health trends are also contributing to the growth of the market. Besides, the government's efforts to promote healthy eating habits are also supporting the growth of the protein crisps market in China.

Key Protein Crisps Company Insights

Key companies, including General Mills Inc., WK Kellogg Co, PepsiCo, Post Holdings, Inc., Quest Nutrition & WorldPantry.com LLC, ProtiDiet, Power Crunch, Premier Nutrition Company, LLC, MYPROTEIN (The Hut Group), and Nestle hold significant positions due to their established distribution networks, extensive product portfolios, and strong brand recognition. These companies employ various strategies to capture market share, including aggressive marketing campaigns targeting health-conscious consumers, expanding distribution networks to reach both online and brick-and-mortar retailers, and focusing on product innovation to create unique flavor profiles and textures. Strategic partnerships with fitness influencers and endorsements from athletes also play a significant role in boosting brand visibility and consumer trust.

To maintain a competitive edge, companies in the protein crisps market actively engage in strategic mergers, acquisitions, and partnerships. For example, Simply Good Foods' acquisition of Quest Nutrition was a move to consolidate market share and leverage Quest's strong brand recognition within the protein-focused segment. New product launches are also frequent, driven by the demand for novel flavors and products catering to dietary restrictions, such as gluten-free and vegan. By constantly innovating and adapting to evolving consumer preferences, these key players are driving growth and solidifying their position in the dynamic protein crisps market.

Key Protein Crisps Companies:

The following are the leading companies in the protein crisps market. These companies collectively hold the largest market share and dictate industry trends.

- General Mills Inc.

- WK Kellogg Co

- PepsiCo

- Post Holdings, Inc.

- Quest Nutrition & WorldPantry.com LLC

- ProtiDiet

- Premier Nutrition Company, LLC

- Power Crunch

- MYPROTEIN (The Hut Group)

- Nestle

Recent Developments

-

In December 2024, General Mills Inc. announced the expansion of its protein product line with the launch of Cheerios Protein. This new cereal variety features 8 grams of protein per serving and is available in Strawberry and Cinnamon. Cheerios Protein was launched to cater to the growing consumer demand for nutritious breakfast options that emphasize higher protein content. This launch was a part of the company’s broader strategy to innovate and enhance its portfolio in response to evolving consumer preferences for health-focused food products.

-

In November 2024, Quest Nutrition & WorldPantry.com LLC announced a partnership with USA Rugby, becoming the official protein snack partner for the national teams, including the USA Eagles and the Women's Sevens Team. This partnership aimed to provide athletes with protein-rich products, such as bars, cookies, and chips, to help them maintain energy levels during rigorous training schedules and global competitions.

-

In November 2024, MYPROTEIN announced the release of limited-edition flavors for its protein crisps during the holiday season to attract consumers seeking healthier snack options while celebrating. These flavors were introduced to provide a nutritious alternative to traditional holiday snacks, aligning with the brand's commitment to offering high-protein products that cater to health-conscious individuals. MYPROTEIN's protein crisps are baked rather than fried, ensuring they remain a low-calorie, high-protein snack.

Protein Crisps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.74 billion

Revenue forecast in 2030

USD 2.60 billion

Growth rate

CAGR of 8.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa; Saudi Arabia

Key companies profiled

General Mills Inc.; WK Kellogg Co; PepsiCo; Post Holdings, Inc.; Quest Nutrition & WorldPantry.com LLC; ProtiDiet; Power Crunch; Premier Nutrition Company, LLC; MYPROTEIN (The Hut Group); and Nestle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protein Crisps Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global protein crisps market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pea Protein Crisps

-

Soy Protein Crisps

-

Milk Protein Crisps

-

Whey Protein Crisps

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Nutrition

-

Weight Management

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. North America dominated the protein crisps market with a share of 36.50% in 2024, fueled by a surge in health-conscious consumers and the rising popularity of convenient, high-protein snacks. Demand is driven by the increased awareness of protein's role in muscle building, weight management, and satiety.

b. Some of the key market players in the protein crisps market are WK Kellogg Co, PepsiCo, Post Holdings, Inc., Quest Nutrition & WorldPantry.com LLC, ProtiDiet, Power Crunch, Premier Nutrition Company, LLC, MYPROTEIN (The Hut Group), and Nestle

b. The protein crisps market has experienced significant growth in recent years, driven by the rising consumer awareness of the importance of protein in muscle building, weight management, and overall well-being. Moreover, the rise of specialized diets like ketogenic and paleo, which emphasize higher protein consumption, has further fueled the demand for protein-enhanced snacks and breakfast options.

b. The global protein crisps market was estimated at USD 1.61 billion in 2024 and is expected to reach USD 1.74 billion in 2025.

b. The global protein crisps market is expected to grow at a compound annual growth rate of 8.4% from 2025 to 2030 to reach USD 2.60 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.