- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Protein Ingredients Market Size, Share & Trends Report 2030GVR Report cover

![Protein Ingredients Market Size, Share & Trends Report]()

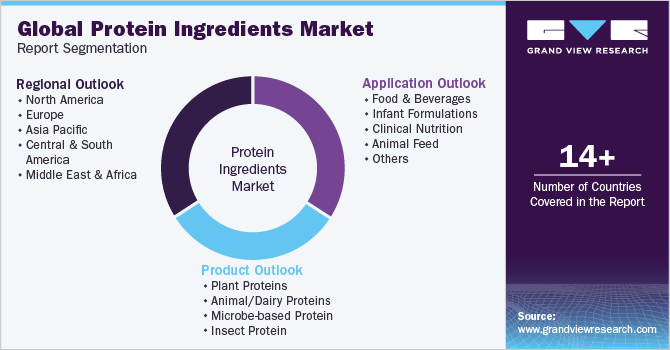

Protein Ingredients Market Size, Share & Trends Analysis Report By Product (Plant Proteins, Animal/Dairy Proteins, Microbe-based Protein, Insect Protein), By Application (Foods & Beverages), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-451-2

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global protein ingredients market size was valued at USD 77.69 billion in 2022 and is expected to grow at a revenue-based compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. The market is gaining momentum and witnessing a high demand owing to rising demand for food products, such as margarine, cold cuts, bakery products, spreads, yogurt, and milk sausages, which are produced using protein ingredients. Increasing consumption of these products among health-conscious and elderly consumers is also fueling the industry’s growth. Moreover, a rise in the innovation of several proteins by various manufacturers that constitute a wide range of amino acids and perform specific functions, including satiety, muscle repair, weight loss, and energy balance, is expected to present immense growth opportunities for the market.

The industry has witnessed a considerable increase in the consumption of animal-based products in the recent past. Animal protein is expected to witness further growth over the next few years in the U.S. Momentous demand for these products derived from animal sources in the domestic market is expected to ascend the product demand. The supply chain initiatives undertaken by the ingredient manufacturing companies to strengthen the distribution of products are further expected to drive the market over the forecast period.

Plant-based ingredients are manufactured from crops, including soy, canola, wheat, and pea. Soy protein has been growing at a significant rate and has had the largest share in the plant-based category. It is expected to expand at a high compound annual growth rate over the forecast period. Additionally, the Food and Drug Administration (FDA) authorized a health claim for the reduction of LDL cholesterol through dietary guidelines suggesting four servings of soy per day to help reduce the LDL cholesterol level by 10% in the body.

Product innovations and technological advancements are expected to be the major factor fueling the growth of the market. Protein ingredients are used in diverse applications, for instance, isolates have high dispersibility and very fine particle size so they are widely used in dairy applications. Consumers’ belief in the health benefits associated with these products has been the key growth driver over the past few years and the trend is anticipated to continue over the forecast period.

The flavoring characteristics associated with new and innovative protein sources including plants, insects, and fermented proteins act as a potential market challenge. Proteins derived from legumes such as peas are associated with a beany flavor. Other proteins such as soy protein isolates are also associated with an ‘off-flavor’. This has led to substantial research being conducted on the reduction of characteristic flavorings associated with plant-based protein sources.

The protein industry is moving towards alternative protein sources owing to environmental sustainability concerns. Microbes and insects are becoming increasingly popular as protein sources due to their high nutritional value, low environmental impact, and cost-effectiveness compared to traditional livestock farming. Insects and microbes also have a high feed conversion rate, meaning they require fewer resources to produce the same amount of protein as traditional livestock.

Product Insights

Based on product type, the animal/dairy protein segment is projected to account for a revenue share of 78.94% in 2022. The animal protein segment in the market is primarily driven by the demand for high-quality protein from various sectors such as food and beverage, animal feed, and personal care industries. Animal protein is considered a complete protein source as it contains all the essential amino acids required by the human body, making it a popular choice among consumers looking to maintain a healthy lifestyle.

Numerous health benefits offered by animal protein ingredients have been supported by strong scientific evidence and recognized by government food regulatory institutions. The high demand for animal-based ingredients is pushing their consumption further, thus propelling the growth of the segment over the forecast period. For example, whey increases glutathione (GSH) levels as well as enhances the nutritional status and immunity in cancer patients undergoing chemotherapy.

The animal proteins segment is projected to grow at a moderate CAGR of 4.4% by revenue during the forecast period. The animal feed industry is a significant consumer of animal protein ingredients, as it is used as a feed supplement to improve the health and growth of livestock. The personal care industry also uses animal protein as an ingredient in hair and skincare products, as it is known to improve the texture and appearance of hair and skin.

Among animal proteins, eggs are a prominent source of proteins and egg protein held a share of 43.28% among animal proteins in 2022. Eggs are a complete source of high-quality protein, with an average egg containing 6-7 grams of protein. Both egg whites and yolks contain protein, with egg whites having slightly more. Whole eggs, whether raw, boiled, or fried, contain roughly the same amount of protein.

Eggs are also low in calories and high in nutrients, including choline, iron, and vitamins A, D, E, and B12. Eating eggs for breakfast can promote feelings of fullness and aid in weight loss. Other good sources of protein include tempeh, tofu, lentils, chickpeas, beans, and almonds.

In addition, the versatility of egg protein is another driver of its popularity. Eggs can be used in a wide range of food products, such as baked goods, sauces, and dressings, and can also be consumed in various forms, including boiled, fried, and scrambled. This versatility makes eggs a convenient and accessible protein source for many consumers.

Plant proteins are projected to record a significant CAGR of 9.1% by revenue during the forecast period owing to increasing consumer preferences for plant-based diets. Plant proteins are relatively inexpensive compared to animal-derived variants, which is expected to fuel the growth of the plant segment over the forecast period. Additionally, the growing trend of veganism is fueling the consumption of plant-based ingredients in North America and Europe. The perception of plant-based products being healthier than animal-based counterparts has resulted in the increasing adoption of products derived from soy and wheat.

The demand for cereal-based ingredients is expected to witness significant growth on account of their application in the personal care and cosmetics industry. Corn-based products are used as a pacifying agent, skin & hair conditioning agent; abrasives and absorbents; and as binders in eye & facial makeup; fragrances; hair care, hair dye & hair coloring; nail care; and oral care applications.

Insect proteins recorded the fastest CAGR of 26.4% by revenue during the forecast period. Protein ingredients derived from insects, such as crickets, have found widespread applications, including bars. The protein from insects is typically used in powder form to enhance nutritional value as well as add flavor to the bars. Companies such as Crik Nutrition source these raw materials from farms that are inspected and designed to farm crickets that are suitable for human consumption. To ensure the high quality of raw materials, these farms follow strict guidelines and practices for the same.

Research conducted at Wageningen University suggests using the waste from insect-as-food-and-feed production to promote sustainable crops. Insect exoskeletons are rich in chitin, which can be metabolized by certain bacteria that help to make plants more resilient to pests and diseases. Insects are efficient to farm and can provide ten times as much edible protein per kilogram of grass than traditional livestock. Insect-rearing by the product can be used to close the circle of a circular food system in which there is very little waste.

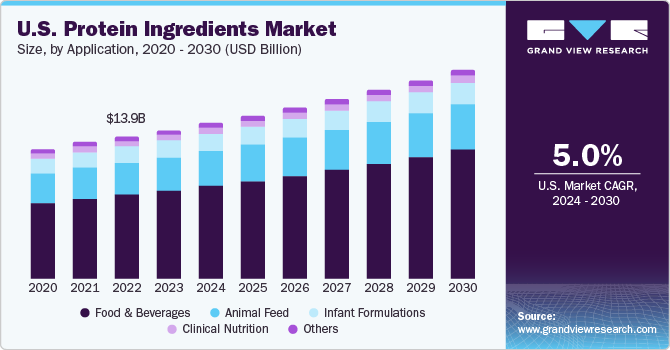

Application Insights

Based on application, the food & beverage segment dominated the market with a revenue share of 39.21% in 2022 and is expected to retain its dominance during the forecast period. Whey protein ingredients are an economical source of protein and are therefore extensively used in the bakery and confectionery industry. Furthermore, advancements in process design and technology have improved the quality of whey products that are highly refined, including demineralized whey, WPIs, and WPCs. The advancements have resulted in the increased incorporation of protein ingredients in various functional food products to make them nutrient-rich.

Animal feed is one of the other prominent applications of protein ingredients. The segment is projected to account for the fastest CAGR of 6.3% by revenue during the forecast period. The animal feed companies are encouraging reduced environmental emissions which is likely to promote the demand for alternative proteins in animal feed products. There is a growing need to optimize animal feed premixes with proteins, especially non-GMO proteins.

There is a high demand for protein ingredients in animal feed because many traditional sources of protein, such as soybean meal and fishmeal, have become more expensive due to factors such as increased demand, limited availability, and environmental concerns. As a result, there has been a shift towards alternative protein sources, such as insect meal, algae, and single-cell proteins, which can be more sustainable and cost-effective.

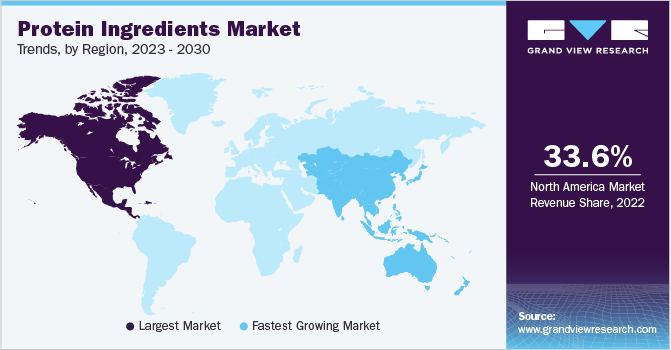

Regional Insights

North America dominated the market and accounted for more than 33.56% share of the global revenue in 2022. The growing demand for protein ingredients is a result of the increasing consumption of snacks, cold cereals, and energy bars. The introduction of new products, such as Enfamil Human Milk Fortifier Liquid High Protein, by companies including Mead Johnson and Cargill, Inc. to cater to the consumer needs for cholesterol-free and low saturated fat beverages is expected to augment the product demand further.

In 2022, Germany accounted for the largest revenue share in Europe. The rise in the geriatric population in Germany has fueled the demand for medical nutritional products helpful in bone and muscle maintenance. This has propelled the demand for these ingredients in the recent past. Moreover, the contribution of protein ingredients in treating Alzheimer’s disease has positively impacted the market in Germany.

Asia Pacific is expected to register the highest growth rate of 6.3% in terms of revenue during the forecast period due to emerging consumer markets in countries, such as China and India. The easy availability of raw materials has made China one of the biggest producers of plant and animal-based products.

Soy protein is widely consumed in China and soy accounts for more than 91% share of the plant-based protein segment in the country. Moreover, growing dependence on packaged foods and drinks is expected to propel the product demand in South Korea, Malaysia, Indonesia, India, and China over the next few years.

Key Companies & Market Share Insights

The protein ingredients market is fragmented and is expected to witness moderate to high competition among the companies owing to the presence of numerous players. The changing consumer preferences towards functional foods and sports nutrition products are projected to push manufacturers to incorporate protein ingredients from sources such as dairy, soy, pea, eggs, and insects.

Key players such as Cargill, Incorporated, ADM, and Roquette Frères, are characterized as market leaders owing to broad & diversified product portfolios, strong distribution networks, renowned brand presence, and strong financial strength.

Some of the most prominent strategies adopted by the key market participants include new product launches and expansions & investments. For instance, in December 2022, Roquette Frères launched two rice proteins under the NUTRALYS range to meet the growing demand for healthier food. The rice protein range offers a nutritious alternative protein with high production standards, popular for special diet foods, sports nutrition, and snacks. The launch supports Roquette's commitment to plant-based cuisine that supports healthier lifestyles.Some prominent players in the global protein ingredients market include:

-

DuPont

-

Rousselot

-

ADM

-

Burcon

-

Tessenderlo Group

-

Kewpie Corporation

-

Roquette Freres

-

The Scoular Company

-

CHS, Inc.

-

Mead Johnson & Company, LLC

-

CropEnergies AG

-

Fonterra Co-Operative Group

-

Bunge Limited

-

Cargill, Incorporated

-

MGP

-

Ingredion

-

Kerry Inc.

-

Givaudan

-

Axiom Foods

-

Tate & Lyle

-

Puris

-

DSM

-

Glanbia Plc

-

Louis Dreyfus Company

-

Barentz

-

Nutri-Pea

-

Prinova Group LLC

Recent Developments

-

At Vitafoods held in April 2023, Darling Ingredients’ health brand Rousselot showcased its collagen peptides solution PEPTAN® for holistic well-being benefits. The premium protein-based ingredient provides multiple science-backed health benefits with nifty formulation properties.

-

In June 2023, Roquette unveiled the new food innovation center, in Lestrem, France. This center will include a sensory analysis laboratory, a demonstration kitchen, and collaborative labs for pilot-scale testing of various plant-based ingredients.

-

In May 2023, Burcon NutraScience Corporation, a global manufacturer of plant-based proteins for the F&B industry, announced its strategic initiative called Burcon 2.0. The Burcon 2.0 strategy will offer pilot-scale plant protein processing as a service.

-

In April 2023, Burcon announced its plans to acquire Merit Functional Foods (Merit). Earlier in January 2023, Burcon was granted a patent for pea protein, which protected and maintained its pea protein licensee, Merit, with marketplace differentiation.

-

In February 2023, Roquette entered a collaborative project with Eurial, Agri Obtentions, Greencell, the Université Lumière Lyon 2, and INRAE to develop AlinOVeg, which French plant-based (fava bean and peas) protein extraction and product development. Furthermore, in January 2023 Roquette invested in DAIZ Inc. to develop disruptive solutions in the healthy plant protein foods sector.

-

In January 2022, Rousselot announced the expansion of its porcine collagen production capacity at the Ghent facility.

Protein Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 74.20 billion

Revenue forecast in 2030

USD 122.17 billion

Growth rate (Revenue)

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; Australia; Indonesia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

DuPont; Rousselot; ADM; Burcon; Tessenderlo Group; Kewpie Corporation; Roquette; Freres; The Scoular Company; CHS, Inc.; Mead Johnson & Company, LLC; CropEnergies AG; Fonterra Co-Operative Group; Bunge Limited; Cargill, Incorporated; MGP; Ingredion; Kerry Inc. Givaudan; Axiom Foods; Tate & Lyle; Puris; DSM; Glanbia Plc; Louis Dreyfus Company; Barentz; Nutri-Pea; Prinova Group LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protein Ingredients Market Report Segmentation

This report forecasts volume & revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global protein ingredients market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Plant Proteins

-

Cereals

-

Wheat

-

Wheat Protein Concentrates

-

Wheat Protein Isolates

-

Textured Wheat Protein

-

Hydrolyzed Wheat Protein

-

HMEC/HMMA Wheat Protein

-

-

Rice

-

Rice Protein Isolates

-

Rice Protein Concentrates

-

Hydrolyzed Rice Protein

-

Others

-

-

Oats

-

Oat Protein Concentrates

-

Oat Protein Isolates

-

Hydrolyzed Oat Protein

-

-

Others

-

-

Legumes

-

Soy

-

Soy Protein Concentrates

-

Soy Protein Isolates

-

Textured Soy Protein

-

Hydrolyzed Soy Protein

-

HMEC/HMMA Soy Protein

-

-

Pea

-

Pea Protein Concentrates

-

Pea Protein Isolates

-

Textured Pea Protein

-

Hydrolyzed Pea Protein

-

HMEC/HMMA Pea Protein

-

-

Lupine

-

Chickpea

-

Others

-

-

Roots

-

Potato

-

Potato Protein Concentrate

-

Potato Protein Isolate

-

- Maca

-

Others

-

-

Ancient Grains

-

Ancient Wheat

-

Quinoa

-

Sorghum

-

Amaranth

-

Chia

-

Millet

-

Others

-

-

Nuts & Seeds

-

Canola

-

Canola Protein Isolates

-

Hydrolyzed Canola Protein

-

Others

-

-

Almond

-

Flaxseeds

-

Others

-

-

Animal/Dairy Proteins

-

Egg Protein

-

Milk Protein Concentrates/Isolates

-

Whey Protein Concentrates

-

Whey Protein Hydrolysates

-

Whey Protein Isolates

-

Gelatin

-

Casein/Caseinates

-

Collagen Peptides

-

-

Microbe-based Protein

-

Algae

-

Bacteria

-

Yeast

-

Fungi

-

-

Insect Protein

-

Coleoptera

-

Lepidoptera

-

Hymenoptera

-

Orthoptera

-

Hemiptera

-

Diptera

-

Others

-

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Food & Beverages

-

Bakery & Confectionary

-

Beverages

-

Breakfast Cereals

-

Dairy Alternatives (cheese, desserts, snacks, others)

-

Dietary Supplements/Weight Management

-

Meat Alternatives & Extenders

-

Snacks

-

Sports Nutrition

-

Others

-

-

Infant Formulations

-

Clinical Nutrition

-

Animal Feed

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Indonesia

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global protein ingredients market is worth USD 77.69 billion by revenue in 2022 and is projected to reach USD 74.20 billion in 2030.

b. The global protein ingredients market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 122.17 billion by 2030.

b. Animal/dairy is the largest segment by source in the Protein Ingredient market. The animal/dairy proteins segment is projected to account for the largest share of 78.94% in 2022 owing to the high protein concentrations.

b. Some of the key players in the Protein Ingredients market are DuPont, Rousselot, ADM, Burcon, Tessenderlo Group, Kewpie Corporation, Roqutte, Freres, The Scoular Company, CHS, Inc., Mead Johnson & Company, LLC, CropEnergies AG, Fonterra Co-Operative Group, Bunge Limited, Cargill, Incorporated, MGP

b. Key factors that are driving the protein ingredients market growth is rising health consciousness, growing demand for sports nutrition products, and increasing environmental sustainability concerns.

Table of Contents

Chapter 1 Protein Ingredients Market: Methodology and Scope

1.1 Information Procurement

1.1.1 Purchased Database

1.1.2 GVR’s Internal Database

1.1.3 Secondary Sources

1.1.4 Third-Party Perspective

1.1.5 Primary Research

1.2 Information Analysis & Data Analysis Models

1.3 List of Data Sources

Chapter 2 Protein Ingredients Market: Executive Summary

2.1 Market Insights

2.2 Segmental Insights

2.3 Competitive Insights

Chapter 3 Protein Ingredients Market: Variables, Trends & Scope

3.1 Market Lineage Outlook

3.1.1 Parent Market Outlook

3.1.1.1 Nutraceuticals & Functional Foods

3.1.2 Related Market Outlook

3.1.2.1 Protein Supplements

3.1.2.2 Functional Proteins

3.2 Industrial Value Chain Analysis

3.2.1 IngrediEnt/Raw Material Trends

3.2.1.1 Major Raw Materials Analysis

3.2.1.1.1 Pea

3.2.1.1.2 Wheat

3.2.1.1.3 Canola

3.2.1.1.4 Egg

3.2.1.1.5 Milk, Whey, & Casein

3.2.2 Sales Channel Analysis

3.3 Technology Overview

3.3.1 Manufacturing Trends

3.3.2 digital trends

3.4 Regulatory Framework

3.4.1 Plant Protein Ingredients

3.4.2 Animal/Dairy Protein Ingredients

3.4.3 product classification codes

3.4.4 standards & Compliances, and Safety

3.5 Market Dynamics

3.6 Market Dynamics

3.6.1 Market Driver Analysis

3.6.1.1 Scientific Evidence Augmenting Health Benefits

3.6.1.2 Growing Technological Advancements In the Protein Ingredients Industry

3.6.1.3 Increasing Use In Novel Applications

3.6.2 Market Restraint Analysis

3.6.2.1 Volatile Soybean Prices

3.6.2.2 Low Acceptance Of Protein Sources Other Than Soy

3.6.3 Industry Challenge

3.6.3.1 Regulations On Food Allergens

3.7 Business Environment Analysis

3.7.1 Protein Ingredients Market: Porter’s Analysis

3.7.1.1 Bargaining Power Of Suppliers

3.7.1.2 Bargaining Power Of Buyers

3.7.1.3 Threat Of New Entrants

3.7.1.4 Threat Of Substitutes

3.7.1.5 Competitive Rivalry

3.7.2 Protein Ingredients Market: Pestel Analysis

3.7.3 PESTLE Analysis

3.7.3.1 Political Landscape

3.7.3.2 Environmental Landscape

3.7.3.3 Social Landscape

3.7.3.4 Technology Landscape

3.7.3.5 Economic Landscape

3.7.3.6 Legal Landscape

3.7.4 Major Deals & Strategic Alliances

3.7.4.1 Capacity Expansion

3.7.4.2 Product Innovation/Development

3.7.4.3 Joint Ventures

3.7.4.4 Mergers & Acquisitions

3.8 Market Entry Strategies

Chapter 4 Protein Ingredients Market: Product Estimates & Trend Analysis

4.1 Product Movement Analysis & Market Share, 2022 & 2030

4.2 Plant Proteins

4.2.1 Global Plant Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.3 Animal/Dairy Proteins

4.3.1 Global Animal/Dairy Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.3.2 Egg Protein

4.3.2.1 Global Egg Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.3.3 Milk Protein Concentrates/Isolates

4.3.3.1 Global Milk Protein Concentrates/Isolates Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.3.4 Whey Protein Concentrates

4.3.4.1 Global Whey Protein Concentrates Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.3.5 Whey Protein Hydrolysates

4.3.5.1 Global Whey Protein Hydrolysates Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.3.6 Whey Protein Isolates

4.3.6.1 Global Whey Protein Isolates Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.3.7 Gelatin

4.3.7.1 Global Gelatin Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.3.8 Casein/Caseinates

4.3.8.1 Global Casein/Caseinates Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.3.9 Collagen Peptides

4.3.10 Global Collagen Peptides Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.4 Microbe-based Protein

4.4.1 Global Microbe-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.4.2 Algae

4.4.2.1 Global Algae-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.4.3 Bacteria

4.4.3.1 Global Bacteria-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.4.4 Yeast

4.4.4.1 Global Yeast-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.4.5 Fungi

4.4.5.1 Global Fungi-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.5 Insect Protein

4.5.1 Global Insect Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.5.2 Coleoptera

4.5.2.1 Global Coleoptera Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.5.3 Lepidoptera

4.5.3.1 Global Lepidoptera Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.5.4 Hymenoptera

4.5.4.1 Global Hymenoptera Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.5.5 Orthoptera

4.5.5.1 Global Orthoptera Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.5.6 Hemiptera

4.5.6.1 Global Hemiptera Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.5.7 Diptera

4.5.7.1 Global Diptera Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

4.5.8 Others

4.5.8.1 Global Other-Insect-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

Chapter 5 Plant-based Protein Ingredients Market: Type Estimates & Trend Analysis

5.1 Type Movement Analysis & Market Share, 2022 & 2030

5.2 Cereals-based Proteins

5.2.1 Global Cereal-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

5.2.2 Global Cereal-based Protein Ingredients Market Estimates And Forecasts, By Type, 2017 - 2030 (Kilotons) (USD Million)

5.2.3 Global Wheat-based Protein Ingredients Market Estimates And Forecasts, By Type, 2017 - 2030 (Kilotons) (USD Million)

5.2.4 Global Rice-based Protein Ingredients Market Estimates And Forecasts, By Type, 2017 - 2030 (Kilotons) (USD Million)

5.2.5 Global Oat-based Protein Ingredients Market Estimates And Forecasts, By Type, 2017 - 2030 (Kilotons) (USD Million)

5.3 Legumes-based Proteins

5.3.1 Global Legumes-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

5.3.2 Global Legumes-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

5.3.3 Global Pea-based Protein Ingredients Market Estimates And Forecasts, By Type, 2017 - 2030 (Kilotons) (USD Million)

5.4 Root-based Proteins

5.4.1 Global Root-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

5.4.2 Global Root-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

5.4.3 Global Potato-based Protein Ingredients Market Estimates And Forecasts, By Type, 2017 - 2030 (Kilotons) (USD Million)

5.5 Nuts & Seeds-based Proteins

5.5.1 Global Nuts & Seeds-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

5.5.2 Global Nuts & Seeds -based Protein Ingredients Market Estimates And Forecasts, By Type, 2017 - 2030 (Kilotons) (USD Million)

5.5.3 Global Soy-based Protein Ingredients Market Estimates And Forecasts, By Type, 2017 - 2030 (Kilotons) (USD Million)

5.5.4 Global Canola-based Protein Ingredients Market Estimates And Forecasts, By Type, 2017 - 2030 (Kilotons) (USD Million)

5.6 Ancient Grain Proteins

5.6.1 Global Ancient Grain Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

5.6.2 Global Ancient Grain Protein Ingredients Market Estimates And Forecasts, By Type, 2017 - 2030 (Kilotons) (USD Million)

Chapter 6 Protein Ingredients Market: Application Estimates & Trend Analysis

6.1 Application Movement Analysis & Market Share, 2022 & 2030

6.2 Food & Beverages

6.2.1 Global Protein Ingredients Market Estimates And Forecasts, In Food & Beverages, 2017 - 2030 (Kilotons) (USD Million)

6.2.2 Bakery & Confectionery

6.2.2.1 Global Protein Ingredients Market Estimates And Forecasts, In Bakery & Confectionery, 2017 - 2030 (Kilotons) (USD Million)

6.2.3 Beverages

6.2.3.1 Global Protein Ingredients Market Estimates And Forecasts, In Beverages, 2017 - 2030 (Kilotons) (USD Million)

6.2.4 Breakfast Cereals

6.2.4.1 Global Protein Ingredients Market Estimates And Forecasts, In Breakfast Cereals, 2017 - 2030 (Kilotons) (USD Million)

6.2.5 Dairy Alternatives

6.2.5.1 Global Protein Ingredients Market Estimates And Forecasts, In Dairy Alternatives, 2017 - 2030 (Kilotons) (USD Million)

6.2.5.1.1 Global Protein Ingredients Market Estimates And Forecasts, In Dairy Alternatives, By Type, 2017 - 2030 (Kilotons) (USD Million)

6.2.6 Dietary Supplements/Weight Management

6.2.6.1 Global Protein Ingredients Market Estimates And Forecasts, In Dietary Supplements/Weight Management, 2017 - 2030 (Kilotons) (USD Million)

6.2.7 Meat Alternatives & Extenders

6.2.7.1 Global Protein Ingredients Market Estimates And Forecasts, In Meat Alternatives & Extenders, 2017 - 2030 (Kilotons) (USD Million)

6.2.7.1.1 Global Protein Ingredients Market Estimates And Forecasts, In Meat Alternatives & Extenders, By Type, 2017 - 2030 (Kilotons) (USD Million)

6.2.8 Snacks

6.2.8.1 Global Protein Ingredients Market Estimates And Forecasts, In Snacks, 2017 - 2030 (Kilotons) (USD Million)

6.2.9 Sports Nutrition

6.2.9.1 Global Protein Ingredients Market Estimates And Forecasts, In Sports Nutrition, 2017 - 2030 (Kilotons) (USD Million)

6.2.10 Others

6.2.10.1 Global Protein Ingredients Market Estimates And Forecasts, In Others, 2017 - 2030 (Kilotons) (USD Million)

6.3 Infant Formulations

6.3.1 Global Protein Ingredients Market Estimates And Forecasts, In Infant Formulations, 2017 - 2030 (Kilotons) (USD Million)

6.4 Clinical Nutrition

6.4.1 Global Protein Ingredients Market Estimates And Forecasts, In Clinical Nutrition, 2017 - 2030 (Kilotons) (USD Million)

6.5 Animal Feed

6.5.1 Global Protein Ingredients Market Estimates And Forecasts, In Animal Feed, 2017 - 2030 (Kilotons) (USD Million)

6.6 Others

6.6.1 Global Protein Ingredients Market Estimates And Forecasts, In Others, 2017 - 2030 (Kilotons) (USD Million)

Chapter 7 Protein Ingredients Market: Regional Estimates & Trend Analysis

7.1 Regional Market Snapshot

7.2 Regional Movement & Market Share Analysis, 2022 & 2030

7.3 North America

7.3.1 North America Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.3.1.1 North America Plant-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.3.1.2 North America Animal-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.3.1.3 North America Microbe-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.3.1.4 North America Insect-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.3.1.5 North America Protein Ingredients Market Estimates And Forecasts, By Application, 2017 - 2030 (Kilotons) (USD Million)

7.3.2 U.S.

7.3.2.1 U.S. Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.3.2.1.1 U.S. Plant-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.3.2.1.2 U.S. Animal-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.3.2.1.3 U.S. Microbe-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.3.2.1.4 U.S. Insect-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.3.2.1.5 U.S. Protein Ingredients Market Estimates And Forecasts, By Application, 2017 - 2030 (Kilotons) (USD Million)

7.4 Europe

7.4.1 Europe Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.1.1 Europe Plant-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.1.2 Europe Animal-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.1.3 Europe Microbe-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.1.4 Europe Insect-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.1.5 Europe Protein Ingredients Market Estimates And Forecasts, By Application, 2017 - 2030 (Kilotons) (USD Million)

7.4.2 Germany

7.4.2.1 Germany Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.2.1.1 Germany Plant-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.2.1.2 Germany Animal-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.2.1.3 Germany Microbe-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.2.1.4 Germany Insect-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.2.1.5 Germany Protein Ingredients Market Estimates And Forecasts, By Application, 2017 - 2030 (Kilotons) (USD Million)

7.4.3 U.K.

7.4.3.1 U.K. Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.3.1.1 U.K. Plant-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.3.1.2 U.K. Animal-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.3.1.3 U.K.Microbe-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.3.1.4 U.K. Insect-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.3.1.5 U.K. Protein Ingredients Market Estimates And Forecasts, By Application, 2017 - 2030 (Kilotons) (USD Million)

7.4.4 France

7.4.4.1 France Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.4.1.1 France Plant-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.4.1.2 France Animal-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.4.1.3 France Microbe-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.4.1.4 France Insect-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.4.4.1.5 France Protein Ingredients Market Estimates And Forecasts, By Application, 2017 - 2030 (Kilotons) (USD Million)

7.5 Asia Pacific

7.5.1 Asia Pacific Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.5.1.1 Asia Pacific Plant-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.5.1.2 Asia Pacific Animal-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.5.1.3 Asia Pacific Microbe-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.5.1.4 Asia Pacific Insect-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.5.1.5 Asia Pacific Protein Ingredients Market Estimates And Forecasts, By Application, 2017 - 2030 (Kilotons) (USD Million)

7.5.2 China

7.5.2.1 China Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.5.2.1.1 China Plant-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.5.2.1.2 China Animal-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.5.2.1.3 China Microbe-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.5.2.1.4 China Insect-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.5.2.1.5 China Protein Ingredients Market Estimates And Forecasts, By Application, 2017 - 2030 (Kilotons) (USD Million)

7.5.3 India

7.5.3.1 India Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.5.3.1.1 India Plant-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.5.3.1.2 India Animal-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.5.3.1.3 India Microbe-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.5.3.1.4 India Insect-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.5.3.1.5 India Protein Ingredients Market Estimates And Forecasts, By Application, 2017 - 2030 (Kilotons) (USD Million)

7.6 Central & South America

7.6.1 Central & South America Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.6.1.1 Central & South America Plant-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.6.1.2 Central & South America Animal-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.6.1.3 Central & South America Microbe-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.6.1.4 Central & South America Insect-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.6.1.5 Central & South America Protein Ingredients Market Estimates And Forecasts, By Application, 2017 - 2030 (Kilotons) (USD Million)

7.7 Middle East & Africa

7.7.1 Middle East & Africa Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.7.1.1 Middle East & Africa Plant-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.7.1.2 Middle East & Africa Animal-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.7.1.3 Middle East & Africa Microbe-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.7.1.4 Middle East & Africa Insect-based Protein Ingredients Market Estimates And Forecasts, 2017 - 2030 (Kilotons) (USD Million)

7.7.1.5 Middle East & Africa Protein Ingredients Market Estimates And Forecasts, By Application, 2017 - 2030 (Kilotons) (USD Million)

Chapter 8 Protein Ingredients Market: Competitive Landscape

8.1 Key global players, recent developments & their impact on the industry

8.2 Company Categorization

8.3 List of Key Distribution & Channel Partners

8.4 Ranking Analysis, 2022

8.5 Public Companies

8.5.1 Market Positioning Analysis

8.5.2 Ranking Analysis, 2022

8.5.3 Competitive Dashboard Analysis

8.5.4 Swot Analysis Of Public Companies

8.6 Private Companies

8.6.1 List Of Key Emerging Players

8.6.2 Geographical Presence

8.6.3 Market Positioning Analysis

8.6.4 Ranking Analysis, 2022

Chapter 9 Company Profiles

9.1 DuPont

9.1.1 Company Overview

9.1.2 Financial Performance

9.1.3 Product benchmarking

9.1.4 Strategic Initiatives

9.2 Rousselot

9.2.1 Company Overview

9.2.2 Financial Performance

9.2.3 Product benchmarking

9.2.4 Strategic Initiatives

9.3 Archer Daniels Midland Company

9.3.1 Company Overview

9.3.2 Financial Performance

9.3.3 Product benchmarking

9.3.4 Strategic Initiatives

9.4 Burcon

9.4.1 Company Overview

9.4.2 Financial Performance

9.4.3 Product benchmarking

9.4.4 Strategic Initiatives

9.5 Tessenderlo Group

9.5.1 Company Overview

9.5.2 Financial Performance

9.5.3 Product benchmarking

9.6 Kewpie Corporation

9.6.1 Company Overview

9.6.2 Financial Performance

9.6.3 Product benchmarking

9.7 Roquette Frères

9.7.1 Company Overview

9.7.2 Financial Performance

9.7.3 Product benchmarking

9.8 The Scoular Company

9.8.1 Company Overview

9.8.2 Financial Performance

9.8.3 Product benchmarking

9.8.4 Strategic Initiatives

9.9 CHS Inc.

9.9.1 Company Overview

9.9.2 Financial Performance

9.9.3 Product benchmarking

9.9.4 Strategic Initiatives

9.10 Mead Johnson & Company, LLC

9.10.1 Company Overview

9.10.2 Financial Performance

9.10.3 Product benchmarking

9.10.4 Strategic Initiatives

9.11 CropEnergies AG

9.11.1 Company Overview

9.11.2 Financial Performance

9.11.3 Product benchmarking

9.12 Fonterra Co-operative Group

9.12.1 Company Overview

9.12.2 Financial Performance

9.12.3 Product benchmarking

9.12.4 Strategic Initiatives

9.13 Bunge Limited

9.13.1 Company Overview

9.13.2 Financial Performance

9.13.3 Product benchmarking

9.13.4 Strategic Initiatives

9.14 Cargill, Incorporated

9.14.1 Company Overview

9.14.2 Financial Performance

9.14.3 Product benchmarking

9.14.4 Strategic Initiatives

9.15 MGP

9.15.1 Company Overview

9.15.2 Financial Performance

9.15.3 Product benchmarking

9.15.4 Strategic Initiatives

9.16 Ingredion

9.16.1 Company overview

9.16.2 Financial performance

9.16.3 Product benchmarking

9.16.4 Strategic initiatives

9.17 Kerry Inc.

9.17.1 Company overview

9.17.2 Financial performance

9.17.3 Product benchmarking

9.17.4 Strategic initiatives

9.18 Givaudan

9.18.1 Company overview

9.18.2 Financial performance

9.18.3 Product benchmarking

9.18.4 Strategic initiatives

9.19 Axiom Foods

9.19.1 Company overview

9.19.2 Financial performance

9.19.3 Product benchmarking

9.20 Tate & Lyle

9.20.1 Company overview

9.20.2 Financial performance

9.20.3 Product benchmarking

9.20.4 Strategic initiatives

9.21 Puris

9.21.1 Company overview

9.21.2 Financial performance

9.21.3 Product benchmarking

9.22 DSM

9.22.1 Company overview

9.22.2 Financial performance

9.22.3 Product benchmarking

9.22.4 Strategic initiatives

9.23 Glanbia Plc

9.23.1 Company overview

9.23.2 Financial performance

9.23.3 Product benchmarking

9.23.4 Strategic initiatives

9.24 Louis Dreyfus Company

9.24.1 Company overview

9.24.2 Financial performance

9.24.3 Product benchmarking

9.24.4 Strategic initiatives

9.25 Barentz

9.25.1 Company overview

9.25.2 Financial performance

9.25.3 Product benchmarking

9.25.4 Strategic initiatives

9.26 Nutri-Pea

9.26.1 Company overview

9.26.2 Financial performance

9.26.3 Product benchmarking

9.27 Prinova Group LLC

9.27.1 Company overview

9.27.2 Financial performance

9.27.3 Product benchmarking

9.27.4 Strategic initiatives

List of Tables

1. Global plant protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

2. Global animal/dairy protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

3. Global egg protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

4. Global milk protein concentrates/isolates market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

5. Global whey protein concentrates market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

6. Global whey protein hydrolysates market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

7. Global whey protein isolates market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

8. Global gelatin market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

9. Global casein/caseinates market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

10. Global collagen peptides market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

11. Global microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

12. Global algae-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

13. Global bacteria-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

14. Global yeast-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

15. Global fungi-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

16. Global insect protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

17. Global coleoptera protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

18. Global lepidoptera protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

19. Global hymenoptera protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

20. Global orthoptera protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

21. Global hemiptera protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

22. Global diptera protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

23. Global other-insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

24. Global cereal-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

25. Global cereal-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (Kilotons)

26. Global cereal-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (USD Million)

27. Global wheat-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (Kilotons)

28. Global wheat-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (USD Million)

29. Global rice-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (Kilotons)

30. Global rice-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (USD Million)

31. Global oat-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (Kilotons)

32. Global oat-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (USD Million)

33. Global legumes-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

34. Global legumes-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (Kilotons)

35. Global legumes-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (USD Million)

36. Global pea-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (Kilotons)

37. Global pea-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (USD Million)

38. Global root-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

39. Global root-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (Kilotons)

40. Global root-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (USD Million)

41. Global potato-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (Kilotons)

42. Global potato-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (USD Million)

43. Global nuts & seeds-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

44. Global nuts & seeds -based protein ingredients market estimates and forecasts, by type 2017 - 2030 (Kilotons)

45. Global nuts & seeds -based protein ingredients market estimates and forecasts, by type 2017 - 2030 (USD Million)

46. Global soy-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (Kilotons)

47. Global soy-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (USD Million)

48. Global canola-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (Kilotons)

49. Global canola-based protein ingredients market estimates and forecasts, by type 2017 - 2030 (USD Million)

50. Global ancient grain protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

51. Global ancient grain protein ingredients market estimates and forecasts, by type 2017 - 2030 (Kilotons)

52. Global ancient grain protein ingredients market estimates and forecasts, by type 2017 - 2030 (USD Million)

53. Global protein ingredients market estimates and forecasts, in food & beverages, 2017 - 2030 (Kilotons) (USD Million)

54. Global protein ingredients market estimates and forecasts, in bakery & confectionery, 2017 - 2030 (Kilotons) (USD Million)

55. Global protein ingredients market estimates and forecasts, in beverages, 2017 - 2030 (Kilotons) (USD Million)

56. Global protein ingredients market estimates and forecasts, in breakfast cereals, 2017 - 2030 (Kilotons) (USD Million)

57. Global protein ingredients market estimates and forecasts, in dairy alternatives, 2017 - 2030 (Kilotons) (USD Million)

58. Global protein ingredients market estimates and forecasts, in dairy alternatives, by type, 2017 - 2030 (Kilotons)

59. Global protein ingredients market estimates and forecasts, in dairy alternatives, by type, 2017 - 2030 (USD Million)

60. Global protein ingredients market estimates and forecasts, in dietary supplements/weight management, 2017 - 2030 (Kilotons) (USD Million)

61. Global protein ingredients market estimates and forecasts, in meat alternatives & extenders, 2017 - 2030 (Kilotons) (USD Million)

62. Global protein ingredients market estimates and forecasts, in meat alternatives & extenders, by type, 2017 - 2030 (Kilotons)

63. Global protein ingredients market estimates and forecasts, in meat alternatives & extenders, by type, 2017 - 2030 (USD Million)

64. Global protein ingredients market estimates and forecasts, in snacks, 2017 - 2030 (Kilotons) (USD Million)

65. Global protein ingredients market estimates and forecasts, in sports nutrition, 2017 - 2030 (Kilotons) (USD Million)

66. Global protein ingredients market estimates and forecasts, in others, 2017 - 2030 (Kilotons) (USD Million)

67. Global protein ingredients market estimates and forecasts, in infant formulations, 2017 - 2030 (Kilotons) (USD Million)

68. Global protein ingredients market estimates and forecasts, in clinical nutrition, 2017 - 2030 (Kilotons) (USD Million)

69. Global protein ingredients market estimates and forecasts, in animal feed, 2017 - 2030 (Kilotons) (USD Million)

70. Global protein ingredients market estimates and forecasts, in others, 2017 - 2030 (Kilotons) (USD Million)

71. North America protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

72. North America plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

73. North America plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

74. North America animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

75. North America animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

76. North America microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

77. North America microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

78. North America insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

79. North America insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

80. North America protein ingredients market estimates and forecasts, by application, 2017 - 2030 (Kilotons)

81. North America protein ingredients market estimates and forecasts, by application, 2017 - 2030 (USD Million)

82. U.S. protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

83. U.S. plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

84. U.S. plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

85. U.S. animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

86. U.S. animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

87. U.S. microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

88. U.S. microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

89. U.S. insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

90. U.S. insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

91. U.S. protein ingredients market estimates and forecasts, by application, 2017 - 2030 (Kilotons)

92. U.S. protein ingredients market estimates and forecasts, by application, 2017 - 2030 (USD Million)

93. Europe protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

94. Europe plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

95. Europe plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

96. Europe animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

97. Europe animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

98. Europe microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

99. Europe microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

100. Europe insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

101. Europe insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

102. Europe protein ingredients market estimates and forecasts, by application, 2017 - 2030 (Kilotons)

103. Europe protein ingredients market estimates and forecasts, by application, 2017 - 2030 (USD Million)

104. Germany protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

105. Germany plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

106. Germany plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

107. Germany animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

108. Germany animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

109. Germany microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

110. Germany microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

111. Germany insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

112. Germany insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

113. Germany protein ingredients market estimates and forecasts, by application, 2017 - 2030 (Kilotons)

114. Germany protein ingredients market estimates and forecasts, by application, 2017 - 2030 (USD Million)

115. U.K. protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

116. U.K. plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

117. U.K. plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

118. U.K. animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

119. U.K. animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

120. U.K. microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

121. U.K. microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

122. U.K. insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

123. U.K. insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

124. U.K. protein ingredients market estimates and forecasts, by application, 2017 - 2030 (Kilotons)

125. U.K. protein ingredients market estimates and forecasts, by application, 2017 - 2030 (USD Million)

126. France protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

127. France plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

128. France plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

129. France animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

130. France animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

131. France microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

132. France microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

133. France insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

134. France insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

135. France protein ingredients market estimates and forecasts, by application, 2017 - 2030 (Kilotons)

136. France protein ingredients market estimates and forecasts, by application, 2017 - 2030 (USD Million)

137. Asia Pacific protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

138. Asia Pacific plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

139. Asia Pacific plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

140. Asia Pacific animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

141. Asia Pacific animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

142. Asia Pacific microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

143. Asia Pacific microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

144. Asia Pacific insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

145. Asia Pacific insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

146. Asia Pacific protein ingredients market estimates and forecasts, by application, 2017 - 2030 (Kilotons)

147. Asia Pacific protein ingredients market estimates and forecasts, by application, 2017 - 2030 (USD Million)

148. China protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

149. China plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

150. China plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

151. China animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

152. China animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

153. China microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

154. China microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

155. China insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

156. China insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

157. China protein ingredients market estimates and forecasts, by application, 2017 - 2030 (Kilotons)

158. China protein ingredients market estimates and forecasts, by application, 2017 - 2030 (USD Million)

159. India protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

160. India plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

161. India plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

162. India animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

163. India animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

164. India microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

165. India microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

166. India insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

167. India insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

168. India protein ingredients market estimates and forecasts, by application, 2017 - 2030 (Kilotons)

169. India protein ingredients market estimates and forecasts, by application, 2017 - 2030 (USD Million)

170. Central & South America protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

171. Central & South America plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

172. Central & South America plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

173. Central & South America animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

174. Central & South America animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

175. Central & South America microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

176. Central & South America microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

177. Central & South America insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

178. Central & South America insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

179. Central & South America protein ingredients market estimates and forecasts, by application, 2017 - 2030 (Kilotons)

180. Central & South America protein ingredients market estimates and forecasts, by application, 2017 - 2030 (USD Million)

181. Middle East & Africa protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons) (USD Million)

182. Middle East & Africa plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

183. Middle East & Africa plant-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

184. Middle East & Africa animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

185. Middle East & Africa animal-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

186. Middle East & Africa microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

187. Middle East & Africa microbe-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

188. Middle East & Africa insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (Kilotons)

189. Middle East & Africa insect-based protein ingredients market estimates and forecasts, 2017 - 2030 (USD Million)

190. Middle East & Africa protein ingredients market estimates and forecasts, by application, 2017 - 2030 (Kilotons)

191. Middle East & Africa protein ingredients market estimates and forecasts, by application, 2017 - 2030 (USD Million)

192. Market share analysis of key companies in the industry

List of Figures

1. Information procurement

2. Primary research pattern

3. Primary research process

4. Primary research approaches

5. Protein ingredients market: Market insights

6. Protein ingredients market: Segmental insights

7. Protein ingredients market: Competitive insights

8. Protein ingredients market - Value chain analysis

9. Dry & green pea production, by key regions, 2022

10. Wheat production, by key regions, 2022

11. Canola production, by key regions, 2022

12. Global protein ingredients market: Product movement analysis, 2022 & 2030

13. Global plant-based protein ingredients market: Type movement analysis, 2022 & 2030

14. Global protein ingredients market: Application movement analysis, 2022 & 2030

15. Regional marketplace: Key takeaways

16. Protein Ingredients Market: Regional movement analysis, 2022 & 2030

17. Company Categorization

18. Company market position analysisWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Protein Ingredients Product Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

- Plant Proteins

- Cereals

- Wheat

- Wheat Protein Concentrates

- Wheat Protein Isolates

- Textured Wheat Protein

- Hydrolyzed Wheat Protein

- HMEC/HMMA Wheat Protein

- Rice

- Rice Protein Isolates

- Rice Protein Concentrates

- Hydrolyzed Rice Protein

- Others

- Oats

- Oat Protein Concentrates

- Oat Protein Isolates

- Hydrolyzed Oat Protein

- Others

- Wheat

- Legumes

- Soy

- Soy Protein Concentrates

- Soy Protein Isolates

- Textured Soy Protein

- Hydrolyzed Soy Protein

- HMEC/HMMA Soy Protein

- Pea

- Pea Protein Concentrates

- Pea Protein Isolates

- Textured Pea Protein

- Hydrolyzed Pea Protein

- HMEC/HMMA Pea Protein

- Lupine

- Chickpea

- Others

- Soy

- Roots

- Potato

- Potato Protein Concentrate

- Potato Protein Isolate

- Maca

- Others

- Potato

- Ancient Grains

- Ancient Wheat

- Quinoa

- Sorghum

- Amaranth

- Chia

- Millet

- Others

- Nuts & Seeds

- Canola

- Canola Protein Isolates

- Hydrolyzed Canola Protein

- Others

- Almond

- Flaxseeds

- Others

- Canola

- Animal/Dairy Proteins

- Egg Protein

- Milk Protein Concentrates/Isolates

- Whey Protein Concentrates

- Whey Protein Hydrolysates

- Whey Protein Isolates

- Gelatin

- Casein/Caseinates

- Collagen Peptides

- Microbe-based Protein

- Algae

- Bacteria

- Yeast

- Fungi

- Insect Protein

- Coleoptera

- Lepidoptera

- Hymenoptera

- Orthoptera

- Hemiptera

- Diptera

- Others

- Cereals

- Plant Proteins

- Protein Ingredients Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

- Food & Beverages

- Bakery & Confectionary

- Beverages

- Breakfast Cereals

- Dairy Alternatives (cheese, desserts, snacks, others)

- Dietary Supplements/Weight Management

- Meat Alternatives & Extenders

- Snacks

- Sports Nutrition

- Others

- Infant Formulations

- Clinical Nutrition

- Animal Feed

- Others

- Food & Beverages

- Protein Ingredients Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

- North America

- North America Protein Ingredients Market, by product

- Plant Protein

- Cereals

- Wheat

- Wheat Protein Concentrates

- Wheat Protein Isolates

- Textured Wheat Protein

- Hydrolyzed Wheat Protein

- HMEC/HMMA Wheat Protein

- Rice

- Rice Protein Isolates

- Rice Protein Concentrates

- Hydrolyzed Rice Protein

- Others

- Oats

- Oat Protein Concentrates

- Oat Protein Isolates

- Hydrolyzed Oat Protein

- Others

- Wheat

- Legumes

- Soy

- Soy Protein Concentrates

- Soy Protein Isolates

- Textured Soy Protein

- Hydrolyzed Soy Protein

- HMEC/HMMA Soy Protein

- Pea

- Pea Protein Concentrates

- Pea Protein Isolates

- Textured Pea Protein

- Hydrolyzed Pea Protein

- HMEC/HMMA Pea Protein

- Lupine

- Chickpea

- Others

- Soy

- Roots

- Potato

- Potato Protein Concentrate

- Potato Protein Isolate

- Maca

- Others

- Potato

- Ancient Grains

- Ancient Wheat

- Quinoa

- Sorghum

- Amaranth

- Chia

- Millet

- Others

- Nuts & Seeds

- Canola

- Canola Protein Isolates

- Hydrolyzed Canola Protein

- Others

- Almond

- Flaxseeds

- Others

- Canola

- Animal/Dairy Proteins

- Egg Protein

- Milk Protein Concentrates/Isolates

- Whey Protein Concentrates

- Whey Protein Hydrolysates

- Whey Protein Isolates

- Gelatin

- Casein/Caseinates

- Collagen Peptides

- Microbe-based Protein

- Algae

- Bacteria

- Yeast

- Fungi

- Insect Protein

- Coleoptera

- Lepidoptera

- Hymenoptera

- Orthoptera

- Hemiptera

- Diptera

- Others

- Cereals

- Plant Protein

- North America Protein Ingredients Market, by application

- Food & Beverages

- Bakery & Confectionary

- Beverages

- Breakfast Cereals

- Dairy Alternatives (cheese, desserts, snacks, others)

- Dietary Supplements/Weight Management

- Meat Alternatives & Extenders

- Snacks

- Sports Nutrition

- Others

- Infant Formulations

- Clinical Nutrition

- Animal Feed

- Others

- Food & Beverages

- U.S.

- U.S. Protein Ingredients Market, by product

- Plant Proteins

- Cereals

- Wheat

- Wheat Protein Concentrates

- Wheat Protein Isolates

- Textured Wheat Protein

- Hydrolyzed Wheat Protein

- HMEC/HMMA Wheat Protein

- Rice

- Rice Protein Isolates

- Rice Protein Concentrates

- Hydrolyzed Rice Protein

- Others

- Oats

- Oat Protein Concentrates

- Oat Protein Isolates

- Hydrolyzed Oat Protein

- Others

- Wheat

- Legumes

- Soy

- Soy Protein Concentrates

- Soy Protein Isolates

- Textured Soy Protein

- Hydrolyzed Soy Protein

- HMEC/HMMA Soy Protein

- Pea

- Pea Protein Concentrates

- Pea Protein Isolates

- Textured Pea Protein

- Hydrolyzed Pea Protein

- HMEC/HMMA Pea Protein

- Lupine

- Chickpea

- Others

- Soy

- Roots

- Potato

- Potato Protein Concentrate

- Potato Protein Isolate

- Maca

- Others

- Potato

- Ancient Grains

- Ancient Wheat

- Quinoa

- Sorghum

- Amaranth

- Chia

- Millet

- Others

- Nuts & Seeds

- Canola

- Canola Protein Isolates

- Hydrolyzed Canola Protein

- Others

- Almond

- Flaxseeds

- Others

- Canola

- Animal/Dairy Proteins

- Egg Protein

- Milk Protein Concentrates/Isolates

- Whey Protein Concentrates

- Whey Protein Hydrolysates

- Whey Protein Isolates

- Gelatin

- Casein/Caseinates

- Collagen Peptides

- Microbe-based Protein

- Algae

- Bacteria

- Yeast

- Fungi

- Insect Protein

- Coleoptera

- Lepidoptera

- Hymenoptera

- Orthoptera

- Hemiptera

- Diptera

- Other

- Cereals

- Plant Proteins

- U.S. Protein Ingredients Market, by application

- Food & Beverages

- Bakery & Confectionary

- Beverages

- Breakfast Cereals

- Dairy Alternatives (cheese, desserts, snacks, others)

- Dietary Supplements/Weight Management

- Meat Alternatives & Extenders

- Snacks

- Sports Nutrition

- Others

- Infant Formulations

- Clinical Nutrition

- Animal Feed

- Others

- Food & Beverages

- Canada

- Canada Protein Ingredients Market, by product

- Plant Proteins

- Cereals

- Wheat

- Wheat Protein Concentrates

- Wheat Protein Isolates

- Textured Wheat Protein

- Hydrolyzed Wheat Protein

- HMEC/HMMA Wheat Protein

- Rice

- Rice Protein Isolates

- Rice Protein Concentrates

- Hydrolyzed Rice Protein

- Others

- Oats

- Oat Protein Concentrates

- Oat Protein Isolates

- Hydrolyzed Oat Protein

- Others

- Wheat

- Legumes

- Soy

- Soy Protein Concentrates

- Soy Protein Isolates

- Textured Soy Protein

- Hydrolyzed Soy Protein

- HMEC/HMMA Soy Protein

- Pea

- Pea Protein Concentrates

- Pea Protein Isolates

- Textured Pea Protein

- Hydrolyzed Pea Protein

- HMEC/HMMA Pea Protein

- Lupine

- Chickpea

- Others

- Soy

- Roots

- Potato

- Potato Protein Concentrate

- Potato Protein Isolate

- Maca

- Others

- Potato

- Ancient Grains

- Ancient Wheat

- Quinoa

- Sorghum

- Amaranth

- Chia

- Millet

- Others

- Nuts & Seeds

- Canola

- Canola Protein Isolates

- Hydrolyzed Canola Protein

- Others

- Almond

- Flaxseeds

- Others

- Canola

- Animal/Dairy Proteins

- Egg Protein

- Milk Protein Concentrates/Isolates

- Whey Protein Concentrates

- Whey Protein Hydrolysates

- Whey Protein Isolates

- Gelatin

- Casein/Caseinates

- Collagen Peptides

- Microbe-based Protein

- Algae

- Bacteria

- Yeast

- Fungi

- Insect Protein

- Coleoptera

- Lepidoptera

- Hymenoptera

- Orthoptera

- Hemiptera

- Diptera

- Others

- Cereals

- Plant Proteins

- Canada Protein Ingredients Market, by application

- Food & Beverages

- Bakery & Confectionary

- Beverages

- Breakfast Cereals