- Home

- »

- Biotechnology

- »

-

Protein Purification & Isolation Market, Industry Report, 2033GVR Report cover

![Protein Purification And Isolation Market Size, Share & Trends Report]()

Protein Purification And Isolation Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Instruments, Consumables), By Application (Drug Screening, Diagnostics), By Technology (Ultrafiltration, Precipitation), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-881-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Protein Purification And Isolation Market Summary

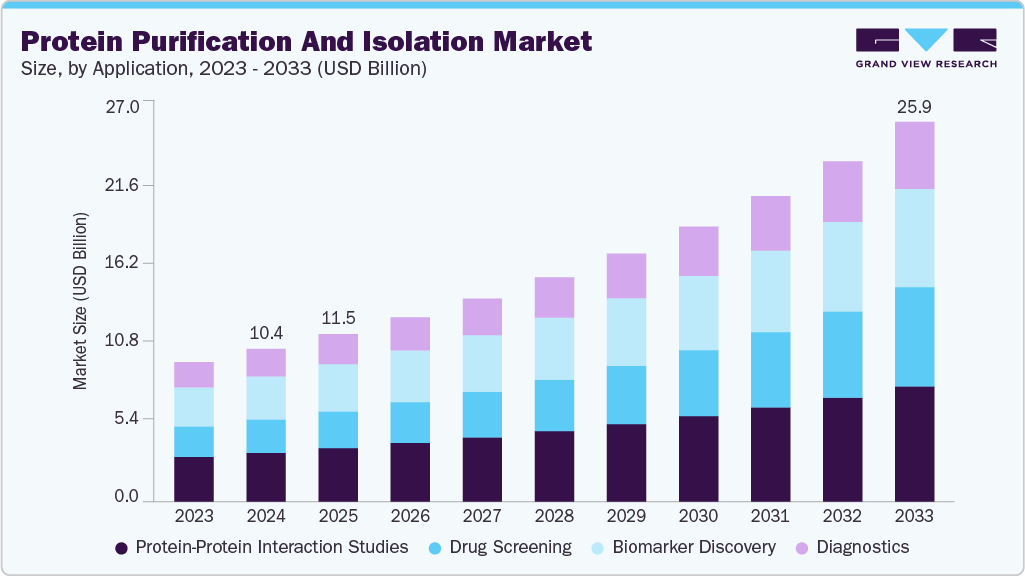

The global protein purification and isolation market size was estimated at USD 10.44 billion in 2024 and is projected to reach USD 25.96 billion by 2033, growing at a CAGR of 10.77% from 2025 to 2033. This growth is driven by increasing demand for biopharmaceuticals, advancements in purification technologies, and rising research in proteomics and drug development.

Key Market Trends & Insights

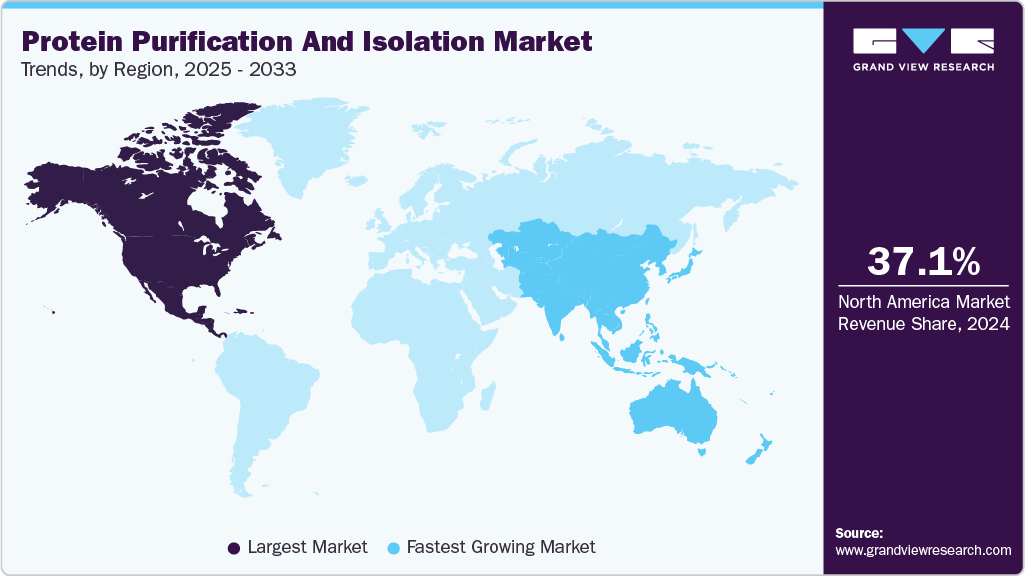

- North America protein purification and isolation market held the largest share of 37.10% of the global market in 2024.

- The protein purification and isolation industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the consumables segment held the highest market share in 2024.

- Based on technology, the chromatography segment held the highest market share of 29.46% in 2024.

- By application, the protein-protein interaction studies segment held the highest market share of 32.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.44 Billion

- 2030 Projected Market Size: USD 25.96 Billion

- CAGR (2025-2030): 10.77%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Plasma Biomarker Research: A Catalyst for Protein Purification and Isolation Market Expansion

The rising focus on plasma biomarkers in oncology and precision medicine is emerging as a significant growth driver in the global protein purification and isolation market. Plasma biomarkers-proteins circulating in the blood that reflect disease states-play a pivotal role in early diagnosis, prognosis, and monitoring of therapeutic responses, particularly in cancer. Identifying these proteins requires highly sensitive and precise purification technologies capable of isolating trace-level proteins from complex biological samples like plasma. As demand for biomarker-based diagnostics increases, so does the need for efficient and scalable protein purification systems, including chromatography, electrophoresis, and magnetic bead-based platforms.

Table 1 : Tumor-Associated Plasma Biomarkers with Clinical Relevance

Protein

Gene name

Gene ID

Kallikrein-6

KLK6

ENSG00000167755

Folate receptor alpha

FOLR1

ENSG00000110195

Matrilysin

MMP7

ENSG00000137673

Kallikrein-10

KLK10

ENSG00000129451

V-set domain-containing T-cell activation inhibitor 1

VTCN1

ENSG00000134258

Kinesin-like protein KIFC1

KIFC1

ENSG00000237649

Keratin, type I cytoskeletal 18

KRT18

ENSG00000111057

Ribonucleoside-diphosphate reductase subunit M2

RRM2

ENSG00000171848

Source: PubMed Central, Secondary Research, Grand View Research

Recent studies have identified several tumor-linked plasma proteins, such as KLK6, FOLR1, and MMP7, with significant gene expression correlations in tumor tissues, reinforcing their utility as plasma biomarkers. These proteins are now being extensively investigated for their potential use in clinical assays and drug development programs. Pharmaceutical companies and diagnostic labs are investing heavily in advanced purification kits to isolate these high-yield and high-purity proteins for R&D and commercial use. This trend will accelerate as the healthcare industry moves toward personalized and non-invasive diagnostics.

As a result, plasma biomarker discovery is advancing disease research and reshaping the operational dynamics of protein purification workflows. Integrating high-throughput proteomics with clinical biomarker validation opens new revenue streams for companies offering purification solutions. With increasing regulatory support for biomarker-based drug approvals and diagnostic tools, the demand for robust, reproducible, and rapid protein isolation methods is poised to surge, solidifying plasma biomarker research as a core application fueling long-term growth in the protein purification and isolation market.

Advancing Drug Discovery Accelerates Demand in Protein Purification and Isolation Market

The global protein purification and isolation market is experiencing robust growth, fueled mainly by expanding drug discovery and development activities. As pharmaceutical and biotechnology companies intensify efforts to identify novel therapeutic targets and develop biologics, the need for high-purity proteins for preclinical and clinical research has surged. Isolated proteins are critical reagents in drug screening, assay development, structural biology, and functional studies, making advanced purification technologies an essential component of the R&D pipeline.

Innovations in chromatography, electrophoresis, and magnetic bead-based systems enable researchers to isolate proteins with greater speed, specificity, and reproducibility. The growing complexity of biologics and biosimilars also demands purification solutions that can deliver high throughput without compromising quality. As drug pipelines expand and personalized medicine advances, the demand for scalable and efficient protein purification tools will continue to rise, solidifying drug discovery and development as a key driver in the global protein purification and isolation market.

Market Concentration & Characteristics

The degree of innovation in the protein purification and isolation industry is moderate, as advancements are primarily incremental, focused on improving efficiency, specificity, and scalability of existing techniques like chromatography and electrophoresis. While novel formats such as membrane-based and microfluidic purification are emerging, widespread adoption remains limited. Most innovation is driven by application-specific demands in drug development, proteomics, and diagnostics, rather than disruptive technological breakthroughs.

The increasing level of mergers and acquisitions (M&A) in the protein purification and isolation industry indicates a strategic shift toward portfolio expansion, technological integration, and market consolidation. Leading players are acquiring niche innovators to strengthen their capabilities, streamline supply chains, and gain a competitive advantage in high-growth application areas such as biopharmaceuticals and precision medicine. This trend reflects growing investor confidence and intensifying competition within the industry.

Regulations play a dual role in shaping demand within the protein purification and isolation industry by ensuring product quality and safety while also driving the adoption of advanced purification technologies. Compliance with stringent regulatory standards in biopharmaceutical manufacturing and clinical research encourages investment in high-precision purification systems, while also posing entry barriers that favor established players with validated processes and scalable, compliant solutions.

Product expansion is a major factor driving demand in the protein purification and isolation industry as companies continuously develop advanced kits, reagents, and automated systems tailored to emerging applications in drug discovery, diagnostics, and proteomics. This diversification addresses evolving end-user needs and enhances workflow efficiency, enabling broader adoption across research institutes, biopharma companies, and contract research organizations-ultimately fueling market growth and competitive differentiation.

Regional expansion is a significant demand driver in the protein purification and isolation industry, as key players target emerging markets with rising biopharmaceutical activity, growing R&D investments, and improving healthcare infrastructure. Expanding into the Asia Pacific and Latin America regions allows companies to tap into new customer bases, benefit from lower operational costs, and meet the increasing local demand for advanced purification solutions, accelerating global market penetration and revenue growth.

Product Insights

The consumables in the product segment dominated the protein purification and isolation market with the largest revenue share in 2024 and are anticipated to grow at the fastest CAGR over the forecast period. Increased R&D activity, the rise in recombinant protein production, and the need for high-throughput, efficient, and scalable purification workflows are boosting consumables consumption. Additionally, the shift toward single-use and automation-friendly formats drives innovation and frequent repurchase of consumables, further supporting market growth.

The instrument segment is expected to register a significant CAGR during the forecast period, driven by growing adoption of automated systems, increasing demand for high-throughput purification platforms, and continuous advancements in chromatography and electrophoresis technologies. Rising R&D activities in the biopharma and academic sectors further support the segment’s expansion.

Technology Insights

The technology segment's chromatography dominated the protein purification and isolation market with a revenue share of 29.46% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The dominance is attributed to its high efficiency, scalability, and precision in separating complex protein mixtures. Widely used across research, clinical, and industrial applications, chromatography remains the preferred method due to its reliability, versatility, and compatibility with downstream processing in biopharmaceutical production.

The electrophoresis segment in the protein purification and isolation market is expected to register a significant CAGR during the forecast period due to its effectiveness in analyzing protein size, purity, and expression levels. Its widespread use in academic research, clinical diagnostics, biopharmaceutical quality control, and ongoing advancements in gel and capillary electrophoresis technologies, fuels demand across various end-user segments.

Application Insights

Protein-protein interaction studies dominated the market with a revenue share of 32.0% in 2024. This is attributed to their critical role in understanding cellular mechanisms, disease pathways, and drug target validation. The growing focus on functional proteomics and rising investments in drug discovery and personalized medicine have significantly increased the demand for high-quality protein isolation tools supporting complex interaction analyses.

The drug screening application segment in the protein purification and isolation market is expected to register the fastest CAGR during the forecast period. This growth is driven by increasing demand for purified proteins in high-throughput screening assays, rising investment in targeted therapeutics, and the expanding biologics pipeline. Efficient protein isolation is critical for identifying drug-protein interactions, accelerating lead optimization, and improving the success rate of drug candidates.

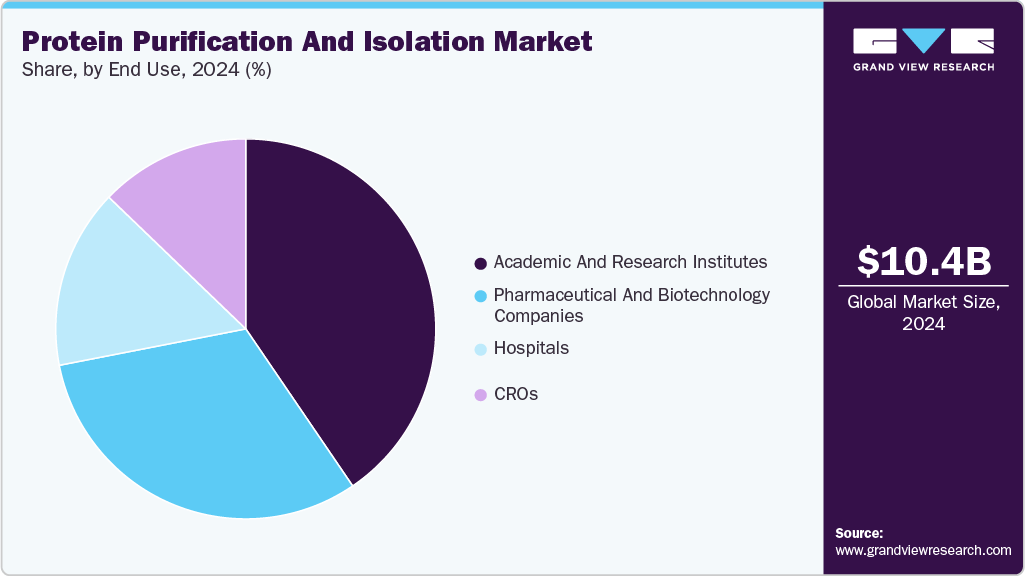

End Use Insights

Academic and research institutes led the market with a revenue share of 40.49% in 2024, driven by growing investments in proteomics, genomics, and molecular biology research. These institutions heavily rely on advanced protein purification and isolation techniques for studying protein functions, interactions, and disease mechanisms. Increased funding from the government and private sectors further supports their adoption of innovative technologies, reinforcing their dominant position in the market.

The hospitals in the end use segment of the protein purification and isolation industry are expected to register the fastest CAGR during the forecast period. This growth is driven by the rising adoption of protein-based diagnostics, the increasing use of biomarkers for disease monitoring, and the growing integration of personalized medicine in clinical settings. Hospitals are expanding their in-house capabilities to support advanced testing and targeted therapeutic development.

Regional Insights

North America dominated the global protein purification and isolation market, with a revenue share of 37.10% in 2024. The dominance can be attributed to the region's well-established biopharmaceutical industry, strong presence of key market players, and high R&D expenditure in drug discovery and proteomics. Additionally, favorable regulatory frameworks, advanced healthcare infrastructure, and increased adoption of cutting-edge purification technologies in academic and clinical research further reinforce North America’s leading position in the market.

U.S. Protein Purification And Isolation Market Trends

The U.S.'s protein purification and isolation market dominated the North American market in 2024. Advanced R&D capabilities, strong biopharma presence, and high investment in precision medicine and proteomics research drive this market.

Europe Protein Purification And Isolation Market Trends

The European protein purification and isolation market is expected to grow in the forecast period, driven by increasing investments in life sciences research, expanding biopharmaceutical production, and rising demand for personalized medicine. Supportive regulatory frameworks, strong academic research infrastructure, and growing collaborations between research institutes and industry players further contribute to market expansion across key countries such as Germany, the UK, and France.

The UK protein purification and isolation industry is expected to grow rapidly in the coming years due to increased government funding for biomedical research, a strong presence of academic institutions, and expanding biopharmaceutical manufacturing. Rising focus on precision medicine and growing demand for high-purity proteins in drug development and diagnostics are further accelerating market growth in the region.

The Germany protein purification and isolation market held a substantial market share in 2024. Germany is a prominent player due to its strong biotechnology sector, robust R&D infrastructure, and high drug discovery, proteomics, and academic research investments. It is a key contributor to Europe’s market growth.

Asia Pacific Protein Purification And Isolation Market Trends

The protein purification and isolation market in Asia Pacific is expected to register the fastest growth, with a CAGR of 12.87% during the forecast period. This growth is fueled by increasing investments in biopharmaceutical research, expanding healthcare infrastructure, and rising government support for life sciences in countries like China, India, and South Korea. Additionally, the growing presence of contract research organizations (CROs) and increasing demand for personalized medicine are driving the adoption of advanced purification technologies across the region.

The China protein purification and isolation market is expected to grow in the forecast period. This is attributed to the rising government investment in biotechnology, expanding pharmaceutical manufacturing, and increasing focus on precision medicine. The growth of academic research and a strong push for innovation and local production further accelerate demand for advanced purification technologies.

The Japan protein purification and isolation market is witnessing significant growth over the forecast period, driven by advancements in biomedical research, increasing demand for biologics, and strong government support for innovation in life sciences. The presence of leading pharmaceutical companies and academic institutions further contributes to the adoption of advanced purification technologies.

MEA Protein Purification And Isolation Market Trends

The MEA protein purification and isolation market is expected to grow exponentially over the forecast period. The region is witnessing significant growth due to increasing investment in healthcare infrastructure, rising focus on biotechnology and pharmaceutical research, and expanding academic collaborations. Government initiatives to boost R&D and growing demand for diagnostic and therapeutic applications further accelerate market adoption.

The Kuwait protein purification and isolation market is projected to grow steadily over the forecast period. This is attributed to the rising healthcare investments, increasing focus on biomedical research, and government initiatives to strengthen life sciences infrastructure and academic-industry collaborations.

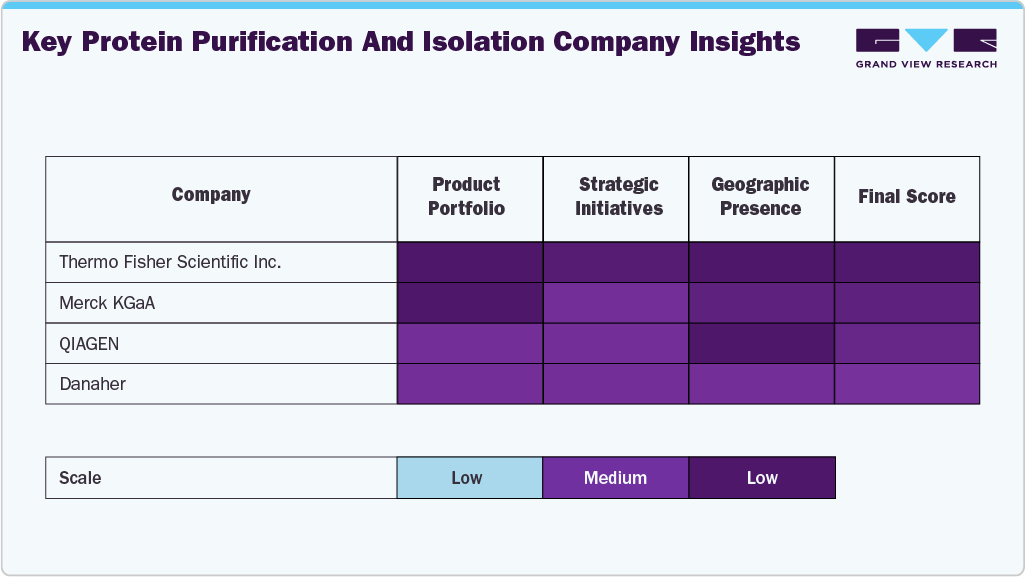

Key Protein Purification And Isolation Company Insights

The global protein purification and isolation market is moderately consolidated, with key players focusing on product innovation, strategic collaborations, and regional expansion to strengthen their market position. Major companies such as Thermo Fisher Scientific Inc., Merck KGaA, Bio-Rad Laboratories, Agilent Technologies, Cytiva (Danaher Corporation), and Qiagen dominate the competitive landscape, offering a wide range of instruments, reagents, and consumables tailored for pharmaceutical, academic, and diagnostic applications. These players consistently invest in R&D to enhance purification efficiency, throughput, and automation, particularly to support biopharmaceutical production and advanced proteomic studies.

Thermo Fisher Scientific and Merck KGaA hold notable market shares owing to their extensive product portfolios and global distribution networks. Thermo Fisher's emphasis on scalable purification platforms and integrated solutions has made it a preferred partner for large-scale bioproduction, while Merck's chromatography and filtration technologies have maintained strong traction across research and clinical settings. Companies such as Cytiva and Agilent Technologies are also reinforcing their positions by expanding into emerging markets and acquiring niche technology firms to broaden their capabilities in protein isolation, analytics, and automation.

Smaller players and regional companies are also gaining ground by targeting specific applications such as point-of-care diagnostics, high-throughput screening, and custom purification solutions for complex biologics. The increasing trend of mergers, acquisitions, and technology licensing agreements reflects the industry's focus on innovation, faster time-to-market, and broader application coverage. With the rising importance of precision medicine and biologics, companies offering flexible, high-purity, and scalable purification solutions are expected to gain a competitive advantage, ensuring steady growth and increased market share in the years ahead.

Key Protein Purification And Isolation Companies:

The following are the leading companies in the protein purification and isolation market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- QIAGEN

- Bio-Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Cube Biotech GmbH

- Promega Corporation

- Norgen Biotek Corp.

- Takara Bio. Inc.

- Danaher

Recent Developments

-

In January 2025, Quantum-Si Incorporated introduced Platinum Pro, its latest benchtop sequencer designed to revolutionize protein analysis by enhancing efficiency and versatility in proteomics research.

-

In March 2025, Momentum Biotechnologies Acquires OmicScouts to Enhance Proteomics-Driven Drug Discovery Efforts. The acquisition strengthens Momentum’s target identification and biomarker discovery capabilities by integrating OmicScouts’ advanced mass spectrometry platforms.

-

In June 2025, Ecolab Life Sciences introduced a new affinity chromatography resin at the Boston Biotechnology Innovation Organization (BIO) International Convention. The resin is designed to optimize operational efficiency in antibody manufacturing processes by enhancing purification performance and streamlining production workflows.

Protein Purification And Isolation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.46 billion

Revenue forecast in 2033

USD 25.96 billion

Growth rate

CAGR of 10.77% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Colombia; Peru; Chile; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; QIAGEN; Bio-Rad Laboratories, Inc.; Agilent Technologies, Inc.; Cube Biotech GmbH; Promega Corporation; Norgen Biotek Corp.; Takara Bio. Inc.; Danaher

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Protein Purification And Isolation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2021 to 2033. Grand View Research has segmented the global protein purification and isolation market report based on product, technology, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Consumables

-

Kits

-

Reagents

-

Columns

-

Magnetic Beads

-

Resins

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Ultrafiltration

-

Precipitation

-

Chromatography

-

Ion Exchange Chromatography

-

Affinity Chromatography

-

Reversed Phase Chromatography

-

Size Exclusion Chromatography

-

Hydrophobic Interaction Chromatography

-

-

Electrophoresis

-

Gel Electrophoresis

-

Isoelectric Focusing

-

Capillary Electrophoresis

-

-

Western Blotting

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug Screening

-

Biomarker Discovery

-

Protein-Protein Interaction Studies

-

Diagnostics

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic And Research Institutes

-

Hospitals

-

Pharmaceutical And Biotechnology Companies

-

CROs

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Peru

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global protein purification and isolation market size was estimated at USD 10.44 billion in 2024 and is expected to reach USD 11.46 billion in 2025.

b. The global protein purification and isolation market size is projected to reach USD 25.96 billion by 2033, growing at a CAGR of 10.77% from 2025 to 2033.

b. The technology segment's chromatography dominated the protein purification and isolation market with a revenue share of 29.46% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The dominance is attributed to its high efficiency, scalability, and precision in separating complex protein mixtures.

b. Some key players operating in the protein purification and isolation market include Thermo Fisher Scientific, Inc., Merck KGaA, QIAGEN, Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., Cube Biotech GmbH, Promega Corporation, Norgen Biotek Corp., Takara Bio. Inc., Danaher

b. Key factors driving the protein purification and isolation market growth include increasing demand for biopharmaceuticals, advancements in purification technologies, and rising research in proteomics and drug development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.