- Home

- »

- Pharmaceuticals

- »

-

Pulmonary Arterial Hypertension Market Size Report, 2033GVR Report cover

![Pulmonary Arterial Hypertension Market Size, Share & Trends Report]()

Pulmonary Arterial Hypertension Market (2025 - 2033) Size, Share & Trends Analysis Report By Drug Class, By Type (Branded, Generics), By Route of Administration (Oral, Intravenous/Subcutaneous, Inhalational), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-855-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pulmonary Arterial Hypertension Market Summary

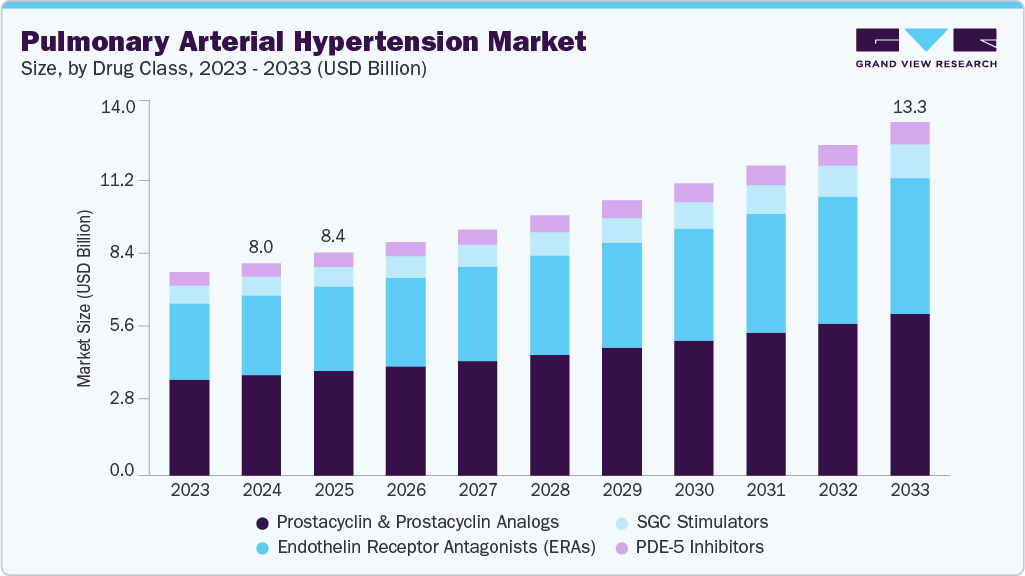

The global pulmonary arterial hypertension market size was estimated at USD 8.02 billion in 2024 and is projected to reach USD 13.34 billion by 2033, growing at a CAGR of 5.9% from 2025 to 2033. The market growth is majorly attributed to increasing support from government & healthcare authorities for new drug development, rising prevalence of pulmonary arterial hypertension, and favorable reimbursement policies.

Key Market Trends & Insights

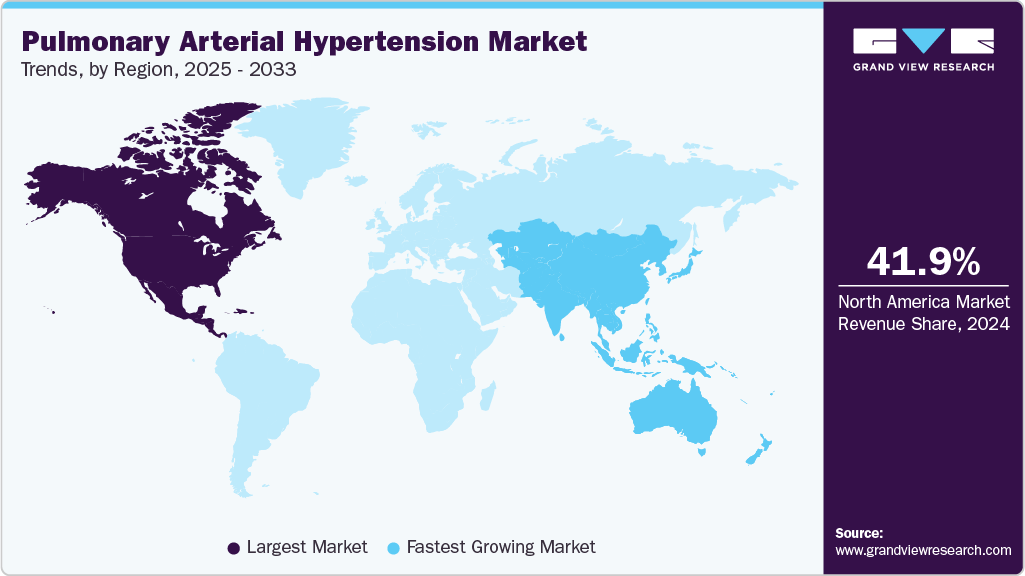

- North America maintains the largest share of 41.85% in 2024, due to superior healthcare and awareness.

- Asia Pacific grows fastest with CAGR 7.3%, driven by population and healthcare advancements.

- By drug class, prostacycl in and analogs segment dominated the PAH market, holding a 47.11% revenue share in 2024

- By type, the branded segment dominated the PAH market in 2024, capturing a revenue share of 87.99%, Branded drugs prevail, yet generics are rapidly expanding.

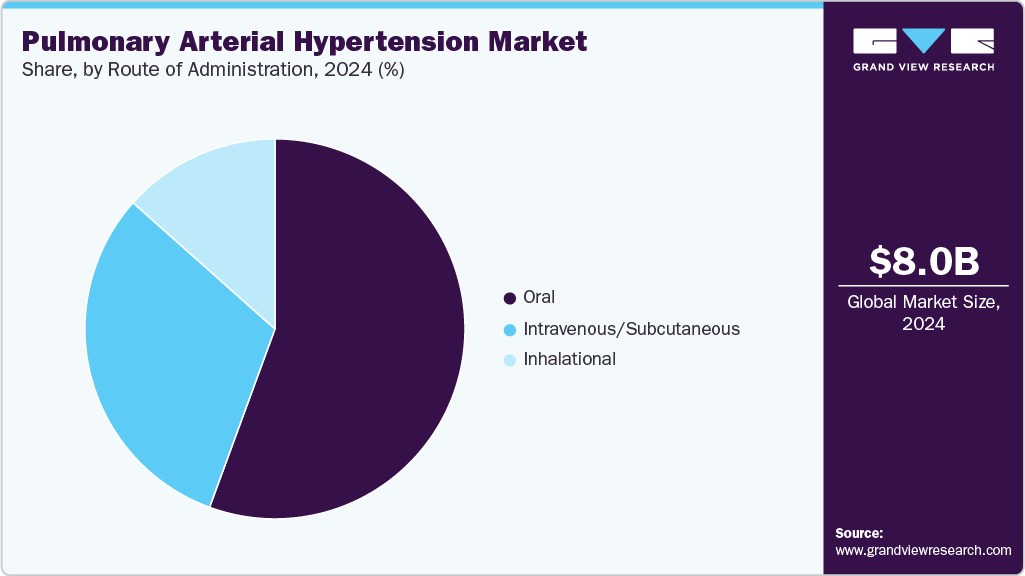

- By route of administration, the oral segment dominated the PAH market with a revenue share of 55.59% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.02 Billion

- 2033 Projected Market Size: USD 13.34 Billion

- CAGR (2025-2033): 5.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, substantial research and development activities in the field of pulmonary arterial hypertension are also projected to have a positive impact on the market’s growth. For instance, in December 2023, a group of researchers form Cedars-Sinai revealed that unique-cell based approach is well suited for treatment of pulmonary arterial hypertension. Currently, the study in phase I of clinical trials.The PAH market thrives on significant investments from industry leaders and governments, targeting the unmet needs of this rare condition. Growth is driven by increasing PAH incidence linked to lifestyle factors such as smoking and HIV, alongside aging populations. Government policies, such as the U.S. Orphan Drug Act, incentivize drug development, boosting market expansion. Enhanced diagnostic capabilities and awareness further accelerate demand for effective therapies.

Prostacyclin and analogs, holding 47.11% of 2024 revenue, remain pivotal, with drugs such as epoprostenol and selexipag offers vasodilation benefits. Their ability to improve pulmonary blood flow and patient quality of life underpins their market leadership. Innovations like oral formulations enhance accessibility, and drive segment growth through improved patient adherence.

Sotatercept (Winrevair) has been FDA approved in March 2024 for the treatment of adults with pulmonary arterial hypertension (PAH). It is the first activin signaling inhibitor approved for PAH, shown to increase exercise capacity, improve WHO functional class, and reduce the risk of clinical worsening events.

Emerging technologies, such as the Remunity Pump launched in 2021, revolutionize drug delivery, offering subcutaneous treprostinil administration. Digital health tools, including wearables, enable real-time monitoring, personalizing PAH management. These advancements, paired with a strong R&D pipeline, promise to reshape treatment paradigms and sustain market momentum through 2033.

Pipeline Analysis

The PAH R&D pipeline remains dynamic, with therapies such as seralutinib (Gossamer Bio), an inhaled tyrosine kinase inhibitor in Phase III, showing promise in reducing pulmonary vascular resistance in the TORREY trial. CS1 (Cereno Scientific), a Phase II epigenetic modulator, targets vascular remodeling, with interim data suggesting improved hemodynamics. These therapies, emphasizing novel mechanisms and patient-friendly delivery, could expand the market by addressing severe PAH cases, with potential approvals by 2027-2028, supporting the market by 2033. Ongoing trials focus on precision therapies to enhance efficacy and quality of life.

PAH Patent and Exclusivity Summary

Region

Protection Type

Expiry Year

Notes

U.S.

Exclusivity

2027

Winrevair (sotatercept): Orphan Drug Exclusivity for PAH treatment, approved March 2024.

EU

Patent

2026

Remodulin (treprostinil): Covers formulation for subcutaneous delivery.

Japan

Exclusivity

2028

Adcirca (tadalafil): Regulatory exclusivity for PAH indication.

U.S.

Patent

2029

Tyvaso (treprostinil): Patent for inhalation device (Tyvaso DPI).

EU

Exclusivity

2027

Adempas (riociguat): Orphan Drug Exclusivity for PAH and CTEPH indications.

U.S.

Patent

2025

Orenitram (treprostinil): Covers oral formulation for PAH treatment.

Global

Patent

2026

Uptravi (selexipag): Patent for oral prostacyclin receptor agonist.

U.S.

Patent

2034

Adempas (riociguat): Patent for tablet formulation, extended by legal activities.

Source: USPTO, EMA, FDA

Market Concentration & Characteristics

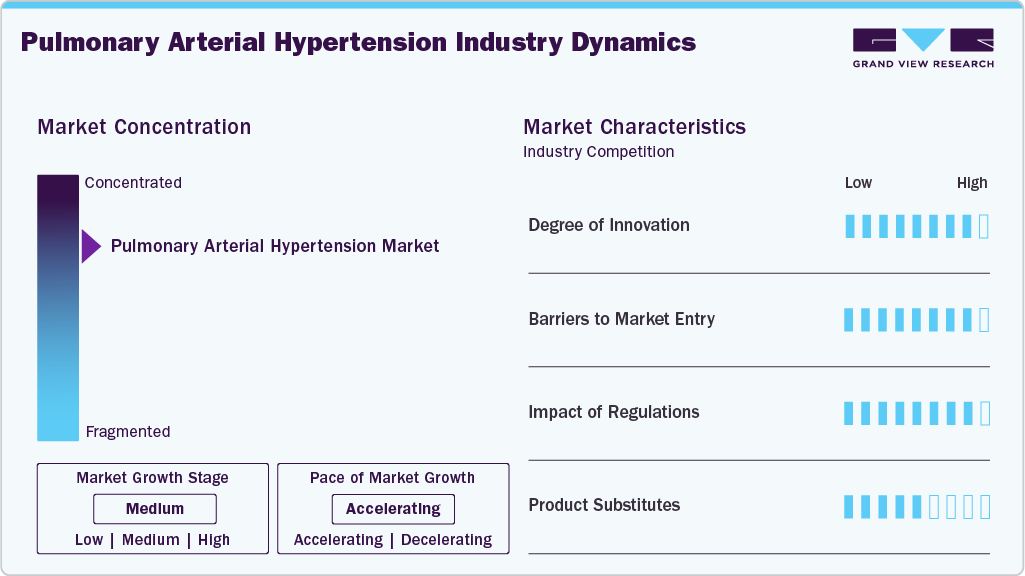

The PAH market is moderately concentrated, dominated by key players such as United Therapeutics, Johnson & Johnson (Actelion), and Bayer, who leverage robust portfolios and R&D investments to maintain leadership. The market is in a mature growth stage, with steady expansion driven by rising PAH prevalence and recent approvals such as Winrevair (sotatercept, March 2024). High entry barriers, including complex clinical trials and regulatory requirements, limit new entrants, though generics are gaining traction post-patent expires. Strategic partnerships, such as Imperial College London’s collaboration with Apollo Therapeutics (May 2025), accelerate innovation, enhancing market competitiveness and addressing unmet needs through novel therapies.

Government support significantly boosts PAH drug development, with agencies such as the FDA and EMA offering fast-track designations and Orphan Drug status to expedite approvals. For instance, the UK’s MHRA approved sotatercept in December 2024, strengthening the therapeutic landscape. Funding from the NIH, such as USD 2.7 million to Eko in September 2022 for PAH diagnostic algorithms, supports R&D. These initiatives, combined with patient registries for real-world data, enhance post-marketing surveillance and drive market growth by ensuring innovative therapies reach patients efficiently.

The PAH market is characterized by high innovation, driven by demand for advanced therapeutics such as inhaled and oral formulations. Recent advancements, such as United Therapeutics’ Tyvaso DPI (2022) and Tenax Therapeutics’ oral levosimendan (IND approved November 2024), improve patient compliance and outcomes. Research into novel pathways, such as SPHK2 at Indiana University (2023), underscores ongoing efforts to target vascular remodeling. These innovations, supported by collaborations with academic institutions, are expanding treatment options and addressing severe PAH cases, fostering sustained market growth through 2033.

Drug Class Insights

Prostacycl in and analogs segment dominated the PAH market, holding a 47.11% revenue share in 2024, driven by their potent vasodilatory effects. Produced via the cyclooxygenase pathway in pulmonary endothelial cells, prostacyclins like epoprostenol and treprostinil activate G protein-coupled receptors, promoting smooth muscle relaxation and vasodilation. Selexipag, an oral prostacyclin receptor agonist, reduced morbidity/mortality in the GRIPHON trial (NCT01106014), with real-world data from the SPHERE registry (NCT03278002) confirming its efficacy in reducing hospitalizations. Ongoing trials, such as United Therapeutics’ Phase I study of a novel oral prostacyclin agonist (2025), underscore continued innovation.

Soluble guanylate cyclase (sGC) stimulators segment led by riociguat (Adempas), are the fastest-growing segment, projected to achieve a 5.5% CAGR through 2033. sGC, a nitric oxide receptor, addresses impaired NO-sGC-cGMP signaling in PAH, which causes endothelial dysfunction and vascular remodeling. Riociguat’s efficacy in improving 6-minute walk distance and hemodynamics was validated in the PATENT-1 trial (NCT00810693), with sustained benefits in real-world studies. Recent data from a 2024 ESC/ERS guideline update highlight sGC stimulators’ role in combination therapies, driving market growth.

Type Insights

The branded segment dominated the PAH market in 2024, capturing a revenue share of 87.99%, driven by robust R&D investments and recent approvals such as Merck’s Winrevair (sotatercept), an activin signaling inhibitor approved in March 2024 (FDA, 2024). Strong clinical efficacy, as seen in Winrevair’s STELLAR trial, which improved bolsters branded drug demand. Partnerships, such as Chiesi Group and Gossamer Bio’s May 2024 collaboration for seralutinib, further strengthen pipelines. Orphan drug designations and extended patents (e.g., Adempas until 2034) sustain branded dominance, though patent expiries like Uptravi’s in 2025 challenge future growth.

The generics segment is projected to grow at the fastest CAGR of 6.6% over the forecast period, fueled by patent expiries and cost-effective alternatives. For instance, Granules’ generic Revatio (sildenafil) received FDA approval in December 2023, enhancing affordability. Expiries of key drugs such as Orenitram (2025) and Adcirca (2027) enable generic penetration, particularly in cost-sensitive markets such as Asia-Pacific. Companies such as Lupin and Dr. Reddy’s are expanding generic offerings, with Dr. Reddy’s launching generic treprostinil in April 2023. This trend, supported by increasing healthcare access, drives generics’ rapid growth, reshaping market dynamics by 2033.

Route of Administration Insights

The oral segment dominated the PAH market with a revenue share of 55.59% in 2024, driven by patient preference for non-invasive, convenient administration and the expanding portfolio of oral therapies. Drugs such as Letairis, Opsumit, Adcirca, and Uptravi improve adherence, crucial for managing chronic PAH. The FDA’s approval of OPSYNVI (macitentan and tadalafil) in March 2024, the first once-daily oral combination therapy, significantly boosted the segment by simplifying treatment regimens and enhancing efficacy. Increasing R&D investments in oral formulations, such as United Therapeutics’ Phase I trial for a novel oral prostacyclin agonist (2025), further solidify the segment’s lead.

Inhaled and injectable routes, while effective, trail due to complexity and invasiveness, making oral therapies the preferred choice. The oral segment’s growth is fueled by innovations addressing severe PAH cases, with drugs like selexipag reducing hospitalization rates in real-world SPHERE registry data (JHLT, 2024). Patent expiries, such as Uptravi’s in 2025, may shift some demand to generics, but branded oral drugs maintain dominance through superior efficacy and physician trust. Collaborations, such as Chiesi Group’s with Gossamer Bio (May 2024), support pipeline development, ensuring the oral segment’s sustained expansion in cost-sensitive markets like Asia-Pacific.

Regional Insights

North America leads the PAH market with share of 41.85%, driven by the U.S.’s advanced healthcare and high diagnosis rates. The Orphan Drug Act of 1983 incentivizes innovation, with Merck’s Winrevair approval (March 2024) expanding treatment options. The American Lung Association’s 2025 awareness campaign boosts early detection. Strong clinical trial networks, like NIH-funded studies, support R&D, while Canada’s rare disease framework enhances access. Patient support programs, such as United Therapeutics’ 2024 initiatives, improve adherence. The region’s specialized PAH centers ensure quality care, solidifying its dominance.

U.S. Pulmonary Arterial Hypertension Market Trends

The U.S. dominates North America’s PAH market, fueled by advanced diagnostics and regulatory support like the Orphan Drug Act. The FDA’s 2024 approval of Winrevair and Tyvaso DPI (2022) enhances therapy options. The American Lung Association’s 2025 campaign drives awareness, increasing diagnosis rates. Patient support programs, like Pfizer’s 2024 PAH education initiative, improve outcomes. Challenges include rural access gaps, though telehealth advancements address this. Over 50 active clinical trials in 2024 ensure continued innovation.

Strategic partnerships, such as Johnson & Johnson’s 2024 biotech acquisition, accelerate R&D for combination therapies. The NIH’s 2025 rare disease funding supports novel treatments, while digital tools such as remote monitoring enhance adherence. Rural healthcare disparities persist, but 2024 telehealth expansions mitigate barriers. The U.S.’s robust trial ecosystem, with Bayer’s Phase III success in October 2024, drives market leadership. Specialized PAH centers and patient registries, such as the REVEAL Registry, ensure personalized care, positioning the U.S. as a global PAH innovation hub.

Europe Pulmonary Arterial Hypertension Market Trends

Europe holds a significant PAH market share led by Germany and France, driven by robust healthcare systems and regulatory support. The European Medicines Agency (EMA) streamlined orphan drug approvals in 2024, with Bayer’s inhaled prostacyclin analog approved in June, enhancing treatment options. Germany’s clinical research ecosystem, supported by the German Heart Foundation’s 2023 PAH funding, fosters innovation. France’s INSERM-led trials for combination therapies (2024) advance precision medicine. The EU’s Rare Disease Strategy 2023-2030 promotes cross-country collaboration, boosting diagnosis rates. Patient support networks, such as the European Pulmonary Hypertension Association’s 2025 awareness campaign, improve early detection across the region. Challenges include regulatory complexity, with EMA’s stringent requirements delaying some therapy launches. Telemedicine adoption, accelerated by 2024 EU digital health policies, enhances rural access, particularly in Eastern Europe. Specialized PAH centers in Germany and France ensure high-quality care, while the UK’s National Health Service expanded PAH clinics in 2024. Collaborative research, such as Janssen’s 2024 partnership with EU institutes, drives novel therapy development, positioning Europe as a key market.

Generic adoption, spurred by patent expiries such as Remodulin’s in 2028, increases therapy access, particularly in cost-sensitive regions like Southern Europe. Patient registries, such as the European Society of Cardiology’s PAH database, improve treatment personalization. Challenges include varying healthcare infrastructure, with Eastern Europe lagging in diagnostic capabilities. The EU’s 2025 digital health initiative promotes remote monitoring, enhancing adherence. Strategic partnerships, like Actelion’s 2024 collaboration with German research centers, accelerate R&D. Europe’s focus on patient-centric care and regulatory advancements ensures steady market growth, with innovations like inhaled therapies and digital tools shaping future trends.

Asia Pacific Pulmonary Arterial Hypertension Market Trends

Asia Pacific is the fastest-growing region with CAGR of 7.3% driven by large populations and healthcare advancements in China, India, and Japan. India’s National Policy for Rare Diseases (2021) expanded access to diagnostics, increasing PAH detection. Cipla’s FDA-approved Ambrisentan Tablets (2023) bolster affordable options. Japan’s advanced healthcare infrastructure, with Mochida Pharmaceutical’s Treprost launch (2023), enhances therapy availability. China’s 2024 health reforms prioritize rare diseases, supporting to PAH clinical trials. The Asian Pulmonary Hypertension Association’s 2025 awareness campaign improves early diagnosis. Challenges include low awareness in rural areas, though urban centers like Shanghai and Mumbai host specialized PAH clinics. Telemedicine, backed by Japan’s 2024 digital health policy, improves patient monitoring, driving market expansion.

Strategic partnerships, Generics adoption, particularly in India and Southeast Asia, addresses affordability, Patient support programs, like China’s 2023 rare disease registry, improve treatment personalization. Challenges include diagnostic delays in rural regions, but government initiatives, like India’s 2024 rare disease funding, support screening programs.

Latin America Pulmonary Arterial Hypertension Market Trends

Latin America’s PAH market, led by Brazil and Mexico, grows due to rising healthcare investments. Brazil’s SUS expanded PAH drug access in 2024, boosting diagnosis rates (15 per million, 2023). The Pan American Health Organization’s 2023 awareness campaign enhances early detection. Regulatory advancements, like Mexico’s 2024 orphan drug policy, accelerate approvals. Rural infrastructure gaps challenge growth, but urban PAH centers in São Paulo drive adoption. Patient support initiatives, like Brazil’s 2025 PAH registry, improve outcomes.

Global pharma partnerships, like Pfizer’s 2024 collaboration with Brazilian institutes, enhance R&D. Telemedicine, supported by 2023 PAHO digital health initiatives, improves rural access. Challenges include uneven diagnostic capabilities, but generics and 2024 regional health reforms address barriers. Specialized clinics and patient education programs, such as Mexico’s 2024 PAH campaign, support growth, positioning Latin America for steady market expansion.

Middle East & Africa Pulmonary Arterial Hypertension Market Trends

The Middle East & Africa PAH market grows with healthcare investments in Saudi Arabia and South Africa. The UAE’s 2024 rare disease initiative enhances therapy access. WHO’s 2023 program boosts awareness, increasing diagnosis. Regulatory advancements, like Saudi Arabia’s 2024 orphan drug framework, support approvals. Low awareness and infrastructure gaps challenge growth, but urban PAH centers drive adoption.

South Africa’s 2023 health reforms and Bayer’s 2024 drug supply agreement improve access. Telemedicine, backed by 2024 NGOs, enhances monitoring. Patient support programs, like Saudi Arabia’s 2025 PAH campaign, improve outcomes. Challenges include diagnostic delays, but regional investments and generics signal growth potential.

Key Pulmonary Arterial Hypertension Company Insights

The PAH market thrives on innovation, with leaders such as United Therapeutics and Johnson & Johnson (Actelion) driving advancements through robust R&D and strategic partnerships. United Therapeutics enhances patient care with novel delivery systems like Tyvaso DPI, while Actelion pursues new therapy combinations. Bayer focuses on cutting-edge research, and emerging players like Gossamer Bio expand pipelines via global collaborations, such as their recent Chiesi partnership. Generic firms, including Sandoz and Lupin, broaden access as patents lapse, fostering competition. These companies prioritize patient outcomes, leveraging regulatory approvals and digital health tools to strengthen market presence.

Key Pulmonary Arterial Hypertension Companies:

The following are the leading companies in the pulmonary arterial hypertension market. These companies collectively hold the largest market share and dictate industry trends.

- United Therapeutics Corporation

- Johnson & Johnson (Actelion Pharmaceuticals)

- Bayer AG

- Gilead Sciences, Inc.

- Viatris Inc.

- GlaxoSmithKline plc

- Sandoz Inc. (Novartis)

- Lupin Pharmaceuticals, Inc.

- Sun Pharmaceutical Industries, Inc.

- Teva Pharmaceuticals Industries Ltd.

Recent Developments

-

In July 2024: United Therapeutics collaborated with a biotech firm to develop advanced PAH therapies, focusing on precision medicine.

-

In March 2024, FDA approved Merck’s Winrevair, a novel PAH therapy, enhancing treatment efficacy. The drug targets unmet needs, strengthening patient care and market dynamics. Impact: Drives therapeutic innovation.

-

In May 2023, Janssen Pharmaceutical Companies submitted new drug application to FDA for approval for its combination therapy of tadalafil 40mg and macitentan 10mg for the treatment of pulmonary arterial hypertension.

Pulmonary Arterial Hypertension Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.41 billion

Revenue forecast in 2033

USD 13.34 billion

Growth rate

CAGR of 5.9% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, type, route of administration, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

United Therapeutics Corporation; Johnson & Johnson (Actelion Pharmaceuticals); Bayer AG; Gilead Sciences, Inc.; Viatris Inc.; GlaxoSmithKline plc; Sandoz Inc. (Novartis); Lupin Pharmaceuticals, Inc.; Sun Pharmaceutical Industries, Inc.; Teva Pharmaceuticals Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pulmonary Arterial Hypertension Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pulmonary arterial hypertension market report based on drug class, type, route of administration, and region:

-

Drug Class Outlook (Revenue, USD Million, 2021 - 2033)

-

Endothelin Receptor Antagonists (ERAs)

-

PDE-5 Inhibitors

-

Prostacyclin and Prostacyclin Analogs

-

SGC Stimulators

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Branded

-

Generics

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Oral

-

Intravenous/ subcutaneous

-

Inhalational

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LA

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the pulmonary arterial hypertension market include United Therapeutics Corporation; Johnson & Johnson (Actelion Pharmaceuticals); Bayer AG; Gilead Sciences, Inc.; Viatris Inc.; GlaxoSmithKline plc; Sandoz Inc. (Novartis); Lupin Pharmaceuticals, Inc.; Sun Pharmaceutical Industries, Inc.; Teva Pharmaceuticals Industries Ltd.

b. Growing initiatives by key market players, high prevalence of PAH, adoption rate, availability of reimbursement, and entry of generics are some of the key drivers of this market.

b. The global pulmonary arterial hypertension market size was estimated at USD 8.02 billion in 2024 and is expected to reach USD 8.41 billion in 2025.

b. The global pulmonary arterial hypertension market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2033 to reach USD 13.34 billion by 2033.

b. North America held 41.85% share of the pulmonary arterial hypertension market in 2024. The large share of the North American region is due to the developed healthcare infrastructure in the U.S. and Canada that facilitates access to advanced therapeutics. Also, increased awareness, a high diagnosis rate, and supportive government initiatives support the market growth in this region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.