- Home

- »

- Pharmaceuticals

- »

-

Pulmonary Arterial Hypertension Market Size Report, 2030GVR Report cover

![Pulmonary Arterial Hypertension Market Size, Share & Trends Report]()

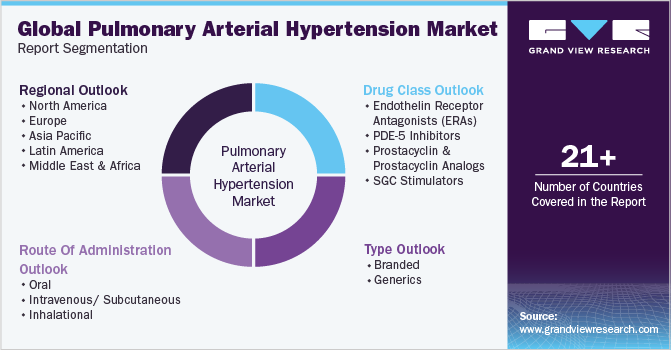

Pulmonary Arterial Hypertension Market Size, Share & Trends Analysis Report By Drug Class, By Type (Branded, Generics), By Route of Administration (Oral, Intravenous/ subcutaneous, Inhalational), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-855-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

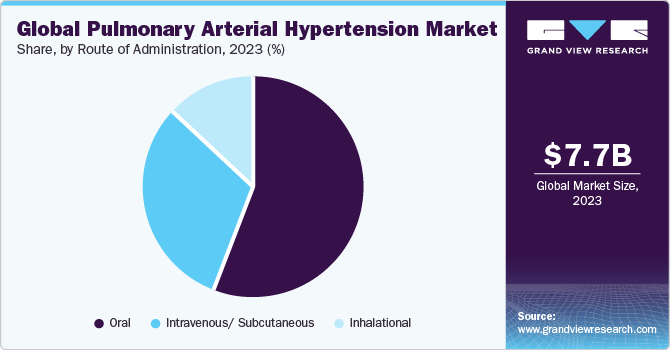

The global pulmonary arterial hypertension market size was valued at USD 7.66 billion in 2023 and is estimated to grow at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030. The growth of market is majorly attributed to increasing support from government & healthcare authorities for new drug development, rising prevalence of pulmonary arterial hypertension, and favorable reimbursement policies. In addition, substantial research and development activities in field of pulmonary arterial hypertension are also projected to have positive impact on the market growth. For instance, in December 2023, a group of researchers form Cedars-Sinai revealed that unique-cell based approach is well suited for treatment of pulmonary arterial hypertension. Currently, the study in phase I of clinical trials.

Government support for drug development in the field of Pulmonary Arterial Hypertension (PAH) plays a crucial role in advancing research and ensuring the availability of effective treatments. PAH is a rare but severe condition characterized by high blood pressure in arteries of the lungs, leading to symptoms such as shortness of breath and fatigue. Growing prevalence of PAH is one of the factors encouraging the governments to boost drug discovery and development. According to a data published by American Journal of Managed Care in March 2021, pulmonary arterial hypertension occurs in 32.5 per million population in the U.S. and Europe.

Governments often collaborate with pharmaceutical companies, research institutions, and healthcare organizations to provide financial support, regulatory guidance, and incentives for drug development in PAH. Funding initiatives, such as grants and subsidies, enable researchers to conduct preclinical and clinical trials, facilitating the exploration of novel therapies and the enhancement of existing ones. For instance, in September 2022, Eko received funding of around USD 2.7 million from NIH for development of advanced algorithms and integrated technologies to deal with pulmonary arterial hypertension.

Regulatory agencies, like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), work closely with developers to streamline approval processes for PAH drugs. Fast-track designations, orphan drug status, and priority review pathways are some mechanisms through which governments expedite the development and approval of treatments for rare diseases like PAH. For instance, in September 2023, Merck received FDA priority review status for its Sotatercept for the treatment of pulmonary arterial hypertension in adults.

Moreover, governments may establish patient registries and databases to collect real-world data on PAH, aiding in post-marketing surveillance and long-term efficacy assessments. Collaborative efforts between public and private sectors enhance the overall landscape of PAH drug development, ensuring that innovative therapies reach patients in a timely and safe manner. Such government support is essential to addressing the unmet medical needs of individuals affected by PAH and improving their quality of life.

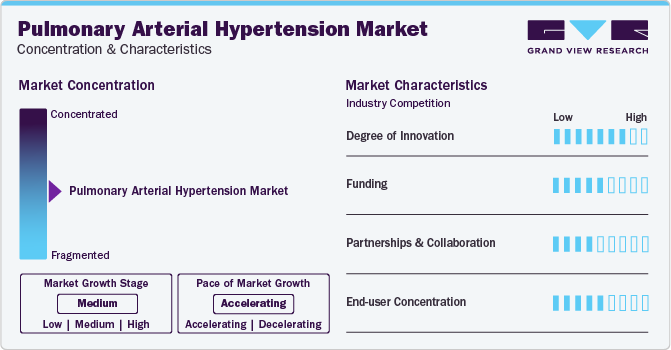

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The pulmonary arterial hypertension market is characterized by a high degree of innovation owing to the growing demand for advanced therapeutics and continual research & development activities. In addition, government support for drug discovery for PAH is expected to have positive impact on the market growth.

The pulmonary arterial hypertension market is also characterized by a high level funding and investments activity by the leading players, government organizations, and healthcare authorities. Such grants and funds are playing critical role in drug discovery for PAH which will eventually boost the market during the forecast period.

The market players in pulmonary arterial hypertension market are focusing on partnerships and collaborations with an aim to consolidate their position in the market. In addition, partnerships and collaborations are aiding the companies to strengthen their supply chain channels as well as technological base.

End-user concentration in context of pulmonary arterial hypertension market refers to the limited patient population, making government support crucial for drug development to address this rare and severe condition effectively.

Drug Class Insights

Prostacyclin and prostacyclin analogs led the market and accounted for 47.2% of the global revenue in 2023.Prostacyclin is a potent vasodilator and one of the most effective drugs for the treatment of PAH. It is produced from arachidonic acid through the Cyclooxygenase (COX) pathway and is released by endothelial cells in pulmonary artery. Prostacyclin binds to the prostaglandin receptors to promote relaxation of smooth muscles and vasodilation through the activation of G protein and protein kinase. According to a study published by the researchers at the American College of Cardiology in October 2023, the oral prostacyclin receptor agonist selexipag has shown promising results for treatment of PAH. Currently, the group is working on investigating the efficacy of prostacyclin for pulmonary arterial hypertension.

SGC Stimulators are estimated to register fastest CAGR during the forecast period. Soluble Guanylate Cyclase (sGC) is a core enzyme in cardiovascular system. It is also the receptor for Nitric Oxide (NO). It has emerged as a therapeutic target in cardiopulmonary diseases, such as PAH, which is associated with impaired NO synthesis. It also results in endothelial dysfunction and inadequate stimulation of the NO-sGC-cGMP pathway. This hinders vasorelaxation and smooth muscle proliferation in PAH patients.

Type Insights

Branded segment accounted for the largest share of the pulmonary arterial hypertension market in 2023. Increasing number of product approvals, strong pipeline, and heavy investments by market players are responsible for largest share of branded segment. In addition, growing number of product launches are also expected to have positive impact on the segment growth during the forecast period. For instance, in June 2022, United Therapeutics Corporation received FDA approval for its Tyvaso DPI powder for the treatment of pulmonary arterial hypertension market.

Generic type segment is estimated to register fastest CAGR during the forecast period. Certain factors such as cost, patent expiry, and availability of generics is likely to boost the growth of generic segment by 2030. In September 2022, Lupin announced launch of generic Sildenafil for the treatment of pulmonary arterial hypertension in the U.S. marketplace.

Route of Administration Insights

By Route of administration, oral segment held the largest share in pulmonary arterial hypertension market in 2023. This is attributable to growing availability of oral formulations for PAH and patient preference for oral route of administration. Letairis, Opsumit, Adcirca, and Revatio are some examples of oral PAH drugs. In addition, increasing approvals for new oral formulations are also estimated to offer favorable opportunity for segment growth during the forecast period. For instance, in November 2023, Tenax Therapeutics, Inc. received FDA approval for its TNX-103 IND application. The company is investigating oral levosimendan for the treatment of pulmonary arterial hypertension.

The intravenous/ subcutaneous segment is anticipated to register the fastest growth over the forecast period. Intravenous drugs offer notable benefits in the treatment of Pulmonary Arterial Hypertension (PAH). Administered directly into the bloodstream, these drugs can rapidly achieve therapeutic levels, providing prompt relief of symptoms. Intravenous delivery ensures consistent absorption and bioavailability, crucial for managing the complex pathophysiology of PAH. Moreover, this method allows for precise dosage adjustments, optimizing therapeutic outcomes.

Regional Insights

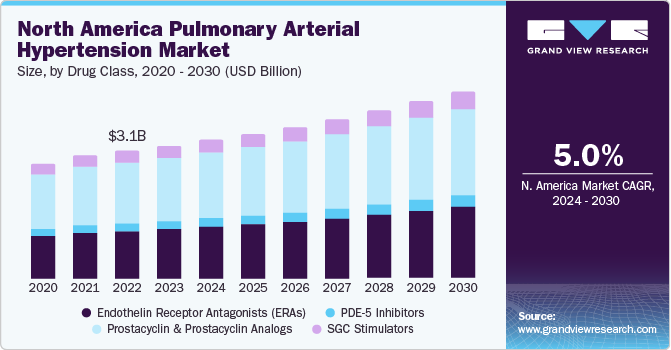

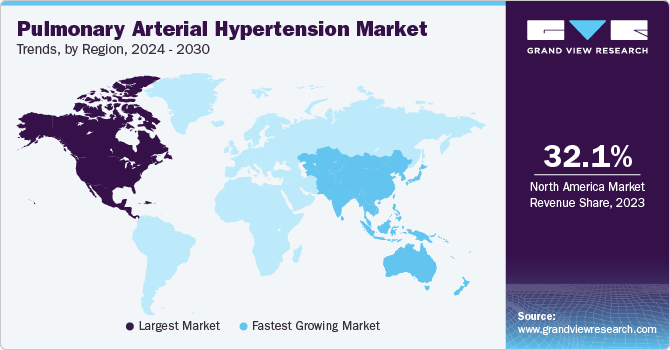

North America dominated the market and accounted for 32.1% share in 2023. Developed healthcare infrastructure in U.S. enabled access to advanced therapeutics which contributed to the growth of this region. Moreover, availability of reimbursement on PAH therapies supported the growth of North American PAH market. Growing awareness, high diagnosis rate and supportive government initiatives governed the growth of this region. Sedentary lifestyle habits such as smoking, alcohol and junk food are vital risk factors for development of PAH.

Asia Pacific is anticipated to witness significant growth in the pulmonary arterial hypertension market. Economic developments in countries such as India and China are expected to help market growth. High population and low per capita income led to rise in demand for affordable treatment options. MNCs are focused on investing in developing countries such as India and China. Thus, many partnerships and strategic alliances are being undertaken by organizations in this region. Further, rapid development in Asia Pacific region, high population, and improving healthcare systems are anticipated to aid in lucrative growth of the region. The Organization for Rare Diseases India (ORDI) serves as a prominent organization for all rare disease patients in India. The government has proposed substantial financial support, amounting to USD 0.18 million through the Rashtriya Arogaya Nidhi. This funding is intended for individuals needing one-time treatment under the Rare Diseases Policy 2020. Such initiative undertaken by India government are likely to play a major role in market growth.

Key Pulmonary Arterial Hypertension Company Insights

In the Pulmonary Arterial Hypertension (PAH) market, prominent players like Actelion Pharmaceuticals, a Janssen Pharmaceutical Company, engage in research, development, and commercialization of innovative PAH therapies. Their strategy includes strategic collaborations, clinical trials, and regulatory approvals to enhance their market presence. Focused on addressing unmet medical needs, these players contribute to advancements in PAH treatment, emphasizing patient outcomes and market growth.

Emerging players in the Pulmonary Arterial Hypertension (PAH) market, such as Arena Pharmaceuticals, are actively involved in developing novel therapies and expanding their portfolios. Their strategies often encompass strategic partnerships, research collaborations, and participation in clinical trials. By focusing on innovation and establishing a strong pipeline, these emerging players aim to carve a niche in the competitive PAH market, contributing to the evolution of treatment options for patients.

Key Pulmonary Arterial Hypertension Companies:

The following are the leading companies in the pulmonary arterial hypertension market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these pulmonary arterial hypertension companies are analyzed to map the supply network.

- United Therapeutics Corporation

- Bayer

- Gilead Sciences, Inc.

- Johnson & Johnson

- Viatris Inc.

- GlaxoSmithKline

- Sandoz Inc.

- Lupin Pharmaceuticals, Inc.

- Sun Pharmaceutical Industries, Inc.

- Teva Pharmaceutical Industries Ltd.

Recent Developments

-

In August 2023, Keros Therapeutics held a conference to present positive results for its KER-012 phase 2 clinical trial which is being conducted for investigating efficacy of the drug for treatment of pulmonary arterial hypertension.

-

In May 2023, Janssen Pharmaceutical Companies submitted new drug application to FDA for approval for its combination therapy of tadalafil 40mg and macitentan 10mg for the treatment of pulmonary arterial hypertension.

-

In April 2023, Mochida Pharmaceutical Co., Ltd. announced launch of its Treprost inhalation solution for the treatment of pulmonary arterial hypertension. The company introduced drug in Japan market.

Pulmonary Arterial Hypertension Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.02 billion

Revenue forecast in 2030

USD 11.02 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Base year for estimation

2023

Actual years

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug Class, Type, Route Of Administration, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

United Therapeutics Corporation; Bayer; Gilead Sciences, Inc.; Johnson & Johnson; Viatris Inc.; GlaxoSmithKline; Sandoz Inc. (Novartis); Lupin Pharmaceuticals, Inc.; Sun Pharmaceutical Industries, Inc.; Teva Pharmaceuticals Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pulmonary Arterial Hypertension Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pulmonary arterial hypertension market report based on drug class, type, route of administration, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Endothelin Receptor Antagonists (ERAs)

-

PDE-5 Inhibitors

-

Prostacyclin and Prostacyclin Analogs

-

SGC Stimulators

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Branded

-

Generics

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Intravenous/ subcutaneous

-

Inhalational

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the pulmonary arterial hypertension market include United Therapeutics Corporation; Bayer; Gilead Sciences, Inc.; Johnson & Johnson; Viatris Inc.; GlaxoSmithKline; Sandoz Inc. (Novartis); Lupin Pharmaceuticals, Inc.; Sun Pharmaceutical Industries, Inc.; and Teva Pharmaceuticals Inc.

b. Growing initiatives by key market players, high prevalence of PAH, adoption rate, availability of reimbursement, and entry of generics are some of the key drivers of this market.

b. The global pulmonary arterial hypertension market size was estimated at USD 7.3 billion in 2022 and is expected to reach USD 7.6 billion in 2023.

b. The global pulmonary arterial hypertension market is expected to grow at a compound annual growth rate of 5.32% from 2023 to 2030 to reach USD 11.0 billion by 2030.

b. North America held over 40% share of the pulmonary arterial hypertension market in 2022. The large share of the North American region is due to the developed healthcare infrastructure in the U.S. and Canada that facilitates access to advanced therapeutics. Also, increased awareness, a high diagnosis rate, and supportive government initiatives support the market growth in this region.

Table of Contents

Chapter 1. Pulmonary Arterial Hypertension Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.2.1. Information Analysis

1.2.2. Market Formulation & Data Visualization

1.2.3. Data Validation & Publishing

1.3. Research Assumptions

1.4. Information Procurement

1.4.1. Primary Research

1.5. Information or Data Analysis

1.6. Market Formulation & Validation

1.7. Market Model

1.8. Global Market: CAGR Calculation

1.9. Objective

1.9.1. Objective 1

1.9.2. Objective2

Chapter 2. Pulmonary Arterial Hypertension Market: Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Pulmonary Arterial Hypertension Market: Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Notable burden of pulmonary arterial hypertension

3.2.1.2. Supportive initiatives by public and private organizations

3.2.1.3. Supportive reimbursement policies

3.2.2. Market Restraint Analysis

3.2.2.1. Patent expiry of key drugs

3.2.2.2. Drug-related side effects

3.2.3. Market opportunity analysis

3.2.4. Market Challenge analysis

3.3. Industry Analysis Tools

3.3.1. Porter’s Five Forces Analysis

3.3.2. PESTEL Analysis

3.4. Disease Prevalence Analysis

3.5. Pipeline Analysis

3.6. Patent Expiry

3.7. Pricing Analysis

Chapter 4. Product & Service Business Analysis

4.1. Segment Dashboard

4.2. Pulmonary Arterial Hypertension Market: Drug Class Movement Analysis, 2023 & 2030 (USD Million)

4.3. Endothelin Receptor Antagonists (ERAs)

4.3.1. Endothelin Receptor Antagonists (ERAs) Market, 2018 - 2030 (USD Million)

4.4. PDE-5 Inhibitors

4.4.1. PDE-5 Inhibitors Market, 2018 - 2030 (USD Million)

4.5. Prostacyclin and Prostacyclin Analogs

4.5.1. Prostacyclin and Prostacyclin Analogs Market, 2018 - 2030 (USD Million)

Chapter 5. Type Business Analysis

5.1. Segment Dashboard

5.2. Pulmonary Arterial Hypertension Market: Type Movement Analysis, 2023 & 2030 (USD Million)

5.3. Branded

5.3.1. Branded Market, 2018 - 2030 (USD Million)

5.4. Generic

5.4.1. Generic Market, 2018 - 2030 (USD Million)

Chapter 6. Route of Administration Business Analysis

6.1. Segment Dashboard

6.2. Pulmonary Arterial Hypertension Market: Route of Administration Movement Analysis, 2023 & 2030 (USD Million)

6.3. Oral

6.3.1. Oral Market, 2018 - 2030 (USD Million)

6.4. Intravenous/ Subcutaneous

6.4.1. Intravenous/ Subcutaneous Market, 2018 - 2030 (USD Million)

6.5. Inhalational

6.5.1. Inhalational Market, 2018 - 2030 (USD Million)

Chapter 7. Regional Business Analysis

7.1. Pulmonary Arterial Hypertension Market Share By Region, 2023 & 2030

7.2. North America

7.2.1. North America Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.2.2. U.S.

7.2.2.1. Key Country Dynamics

7.2.2.2. Competitive Scenario

7.2.2.3. Regulatory Framework

7.2.2.4. U.S. Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.2.3. Canada

7.2.3.1. Key Country Dynamics

7.2.3.2. Competitive Scenario

7.2.3.3. Regulatory Framework

7.2.3.4. Canada Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.3. Europe

7.3.1. Europe Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.3.2. UK

7.3.2.1. Key Country Dynamics

7.3.2.2. Competitive Scenario

7.3.2.3. Regulatory Framework

7.3.2.4. UK Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.3.3. Germany

7.3.3.1. Key Country Dynamics

7.3.3.2. Competitive Scenario

7.3.3.3. Regulatory Framework

7.3.3.4. Germany Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.3.4. France

7.3.4.1. Key Country Dynamics

7.3.4.2. Competitive Scenario

7.3.4.3. Regulatory Framework

7.3.4.4. France Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.3.5. Italy

7.3.5.1. Key Country Dynamics

7.3.5.2. Competitive Scenario

7.3.5.3. Regulatory Framework

7.3.5.4. Italy Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.3.6. Spain

7.3.6.1. Key Country Dynamics

7.3.6.2. Competitive Scenario

7.3.6.3. Regulatory Framework

7.3.6.4. Spain Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.3.7. Sweden

7.3.7.1. Key Country Dynamics

7.3.7.2. Competitive Scenario

7.3.7.3. Regulatory Framework

7.3.7.4. Sweden Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.3.8. Norway

7.3.8.1. Key Country Dynamics

7.3.8.2. Competitive Scenario

7.3.8.3. Regulatory Framework

7.3.8.4. Norway Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.3.9. Denmark

7.3.9.1. Key Country Dynamics

7.3.9.2. Competitive Scenario

7.3.9.3. Regulatory Framework

7.3.9.4. Denmark Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.4.2. Japan

7.4.2.1. Key Country Dynamics

7.4.2.2. Competitive Scenario

7.4.2.3. Regulatory Framework

7.4.2.4. Japan Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.4.3. China

7.4.3.1. Key Country Dynamics

7.4.3.2. Competitive Scenario

7.4.3.3. Regulatory Framework

7.4.3.4. China Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.4.4. India

7.4.4.1. Key Country Dynamics

7.4.4.2. Competitive Scenario

7.4.4.3. Regulatory Framework

7.4.4.4. India Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.4.5. Australia

7.4.5.1. Key Country Dynamics

7.4.5.2. Competitive Scenario

7.4.5.3. Regulatory Framework

7.4.5.4. Australia Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.4.6. Thailand

7.4.6.1. Key Country Dynamics

7.4.6.2. Competitive Scenario

7.4.6.3. Regulatory Framework

7.4.6.4. Thailand Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.4.7. South Korea

7.4.7.1. Key Country Dynamics

7.4.7.2. Competitive Scenario

7.4.7.3. Regulatory Framework

7.4.7.4. South Korea Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.5. Latin America

7.5.1. Latin America Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.5.2. Brazil

7.5.2.1. Key Country Dynamics

7.5.2.2. Competitive Scenario

7.5.2.3. Regulatory Framework

7.5.2.4. Brazil Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.5.3. Mexico

7.5.3.1. Key Country Dynamics

7.5.3.2. Competitive Scenario

7.5.3.3. Regulatory Framework

7.5.3.4. Mexico Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.5.4. Argentina

7.5.4.1. Key Country Dynamics

7.5.4.2. Competitive Scenario

7.5.4.3. Regulatory Framework

7.5.4.4. Argentina Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.6. MEA

7.6.1. MEA Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.6.2. South Africa

7.6.2.1. Key Country Dynamics

7.6.2.2. Competitive Scenario

7.6.2.3. Regulatory Framework

7.6.2.4. South Africa Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.6.3. Saudi Arabia

7.6.3.1. Key Country Dynamics

7.6.3.2. Competitive Scenario

7.6.3.3. Regulatory Framework

7.6.3.4. Saudi Arabia Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.6.4. UAE

7.6.4.1. Key Country Dynamics

7.6.4.2. Competitive Scenario

7.6.4.3. Regulatory Framework

7.6.4.4. UAE Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

7.6.5. Kuwait

7.6.5.1. Key Country Dynamics

7.6.5.2. Competitive Scenario

7.6.5.3. Regulatory Framework

7.6.5.4. Kuwait Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Company Categorization

8.2. Strategy Mapping

8.3. Company Market Share Analysis, 2023

8.4. Company Profiles/Listing

8.4.1. United Therapeutics Corporation

8.4.1.1. Overview

8.4.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.1.3. Product Benchmarking

8.4.1.4. Strategic Initiatives

8.4.2. Bayer AG

8.4.2.1. Overview

8.4.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.2.3. Product Benchmarking

8.4.2.4. Strategic Initiatives

8.4.3. Gilead Sciences, Inc.

8.4.3.1. Overview

8.4.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.3.3. Product Benchmarking

8.4.3.4. Strategic Initiatives

8.4.4. Johnson & Johnson Services Inc.

8.4.4.1. Overview

8.4.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.4.3. Product Benchmarking

8.4.4.4. Strategic Initiatives

8.4.5. Viatris Inc.

8.4.5.1. Overview

8.4.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.5.3. Product Benchmarking

8.4.5.4. Strategic Initiatives

8.4.6. GlaxoSmithKline

8.4.6.1. Overview

8.4.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.6.3. Product Benchmarking

8.4.6.4. Strategic Initiatives

8.4.7. Novartis AG

8.4.7.1. Overview

8.4.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.7.3. Product Benchmarking

8.4.7.4. Strategic Initiatives

8.4.8. Lupin Pharmaceuticals Inc.

8.4.8.1. Overview

8.4.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.8.3. Product Benchmarking

8.4.8.4. Strategic Initiatives

8.4.9. Sun Pharmaceutical Industries, Inc.

8.4.9.1. Overview

8.4.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.9.3. Product Benchmarking

8.4.9.4. Strategic Initiatives

8.4.10. Teva Pharmaceuticals Industries Ltd.

8.4.10.1. Overview

8.4.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.10.3. Product Benchmarking

8.4.10.4. Strategic Initiatives

List of Tables

Table 1. List of secondary sources

Table 2. Average selling prices for approved PAH agents in the U.S. (2023)

Table 3. Summary of pipeline analysis for Early Phase I & Phase I PAH agents

Table 4. Summary of pipeline analysis for Phase II PAH agents

Table 5. Summary of pipeline analysis for Phase III PAH agents

Table 6. Summary of pipeline analysis for Phase IV PAH agents

Table 7. Summary of pipeline analysis for Phase IV PAH agents

Table 8. Global Pulmonary Arterial Hypertension (PAH) market, by Region, 2018 - 2030 (ASP in USD)

Table 9. Global Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 10. Global Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 11. Global Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 12. Global Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (Average Selling Price in USD)

Table 13. Global Pulmonary Arterial Hypertension (PAH) market, by Drug Class, 2018 - 2030 (Million Units)

Table 14. North America Pulmonary Arterial Hypertension market, by Country, 2018 - 2030 (USD Million)

Table 15. North America Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 16. North America Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 17. North America Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (Average Selling Price in USD)

Table 18. North America Pulmonary Arterial Hypertension (PAH) market, by Drug Class, 2018 - 2030 (Million Units)

Table 19. U.S. Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 20. U.S. Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 21. U.S. Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 22. Canada Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 23. Canada Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 24. Canada Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 25. Europe Pulmonary Arterial Hypertension market, by country, 2018 - 2030 (USD Million)

Table 26. Europe Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 27. Europe Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 28. Europe Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (Average Selling Price in USD)

Table 29. Europe Pulmonary Arterial Hypertension (PAH) market, by Drug Class, 2018 - 2030 (Million Units)

Table 30. U.K. Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 31. U.K. Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 32. U.K. Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 33. Germany Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 34. Germany Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 35. Germany Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 36. France Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 37. France Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 38. France Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 39. Italy Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 40. Italy Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 41. Italy Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 42. Spain Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 43. Spain Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 44. Spain Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 45. Sweden Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 46. Sweden Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 47. Sweden Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 48. Denmark Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 49. Denmark Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 50. Denmark Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 51. Norway Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 52. Norway Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 53. Norway Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 54. Asia Pacific Pulmonary Arterial Hypertension market, by country, 2018 - 2030 (USD Million)

Table 55. Asia Pacific Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 56. Asia Pacific Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 57. Asia Pacific Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (Average Selling Price in USD)

Table 58. Asia Pacific Pulmonary Arterial Hypertension (PAH) market, by Drug Class, 2018 - 2030 (Million Units)

Table 59. China Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 60. China Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 61. China Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 62. Japan Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 63. Japan Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 64. Japan Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 65. India Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 66. India Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 67. India Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 68. Australia Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 69. Australia Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 70. Australia Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 71. South Korea Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 72. South Korea Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 73. South Korea Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 74. Thailand Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 75. Thailand Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 76. Thailand Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 77. Latin America Pulmonary Arterial Hypertension market, by country, 2018 - 2030 (USD Million)

Table 78. Latin America Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 79. Latin America Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 80. Latin America Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (Average Selling Price in USD)

Table 81. Latin America Pulmonary Arterial Hypertension (PAH) market, by Drug Class, 2018 - 2030 (Million Units)

Table 82. Brazil Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 83. Brazil Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 84. Brazil Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 85. Mexico Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 86. Mexico Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 87. Mexico Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 88. Argentina Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 89. Argentina Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 90. Argentina Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 91. MEA Pulmonary Arterial Hypertension market, by Country, 2018 - 2030 (USD Million)

Table 92. MEA Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 93. MEA Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 94. MEA Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (Average Selling Price in USD)

Table 95. MEA Pulmonary Arterial Hypertension (PAH) market, by Drug Class, 2018 - 2030 (Million Units)

Table 96. South Africa Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 97. South Africa Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 98. South Africa Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 99. Saudi Arabia Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 100. Saudi Arabia Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 101. Saudi Arabia Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 102. UAE Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 103. UAE Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 104. UAE Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

Table 105. Kuwait Pulmonary Arterial Hypertension market, by Type, 2018 - 2030 (USD Million)

Table 106. Kuwait Pulmonary Arterial Hypertension market, by Route of Administration, 2018 - 2030 (USD Million)

Table 107. Kuwait Pulmonary Arterial Hypertension market, by Drug Class, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Pulmonary Arterial Hypertension Market segmentation

Fig. 2 Market research process

Fig. 3 Data triangulation techniques

Fig. 4 Primary research pattern

Fig. 5 Primary research pattern

Fig. 6 Market research approaches

Fig. 7 Value-chain-based sizing & forecasting

Fig. 8 QFD modeling for Market share assessment

Fig. 9 Market formulation & validation

Fig. 10 Commodity flow analysis

Fig. 11 Market snapshot, 2023 (USD Million)

Fig. 12 Patent term expiry of the key Pulmonary Arterial Hypertension brands

Fig. 13 Ancillary Market analysis

Fig. 14 Penetration & growth prospect mapping

Fig. 15 Consumer behavior analysis

Fig. 16 Market influencer analysis

Fig. 17 Market variables

Fig. 18 Market driver analysis

Fig. 19 Global prevalence of Pulmonary Arterial Hypertension

Fig. 20 Global geriatric population

Fig. 21 Market restraint analysis

Fig. 22 Market participant categorization

Fig. 23 Company Market position analysis: Heat map analysis

Fig. 24 Strategy mapping

Fig. 25 Market entry strategies

Fig. 26 Pulmonary Arterial Hypertension Market: Drug class dashboard

Fig. 27 Pulmonary Arterial Hypertension Market: Drug class movement analysis

Fig. 28 Prostacyclin pathway

Fig. 29 Prostacyclin and prostacyclin analogs Market, 2018 - 2030 (USD Million)

Fig. 30 Nitric oxide pathway

Fig. 31 SGC stimulators Market, 2018 - 2030 (USD Million)

Fig. 32 Endothelial pathway

Fig. 33 ERA Market, 2018 - 2030 (USD Million)

Fig. 34 PDE-5 Market, 2018 - 2030 (USD Million)

Fig. 35 Pulmonary Arterial Hypertension Market, by regions, 2018 - 2030 (USD Million)

Fig. 36 Pulmonary Arterial Hypertension Market: Type movement analysis, 2023 & 2030

Fig. 37 Pulmonary Arterial Hypertension Market Type outlook: Key takeaways

Fig. 38 Branded Market, 2018 - 2030 (USD Million)

Fig. 39 Generics Market, 2018 - 2030 (USD Million)

Fig. 40 Pulmonary Arterial Hypertension Market: Route of Administration movement analysis 2023 & 2030

Fig. 41 Pulmonary Arterial Hypertension Market Route of Administration outlook: Key takeaways

Fig. 42 Oral Market, 2018 - 2030 (USD Million)

Fig. 43 Intravenous/ subcutaneous Market, 2018 - 2030 (USD Million)

Fig. 44 Inhalational Market, 2018 - 2030 (USD Million)

Fig. 45 Intravenous/ subcutaneous Market, 2018 - 2030 (Units)

Fig. 46 Inhalational Market, 2018 - 2030 (Units)

Fig. 47 Regional Marketplace: Key takeaways

Fig. 48 Regional outlook, 2023 & 2030

Fig. 49 North America Pulmonary Arterial Hypertension Market, 2018 - 2030(USD Million)

Fig. 50 U.S. Pulmonary Arterial Hypertension Market, 2018 - 2030(USD Million)

Fig. 51 Canada Pulmonary Arterial Hypertension Market, 2018 - 2030(USD Million)

Fig. 52 Europe Pulmonary Arterial Hypertension Market, 2018 - 2030(USD Million)

Fig. 53 UK Pulmonary Arterial Hypertension Market, 2018 - 2030(USD Million)

Fig. 54 Germany Pulmonary Arterial Hypertension Market, 2018 - 2030(USD Million)

Fig. 55 France Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 56 Italy Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 57 Spain Pulmonary Arterial Hypertension Market, 2017- 2030 (USD Million)

Fig. 58 Sweden Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 59 Denmark Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 60 Norway Pulmonary Arterial Hypertension Market, 2017- 2030 (USD Million)

Fig. 61 Asia Pacific Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 62 Japan Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 63 China Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 64 India Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 65 South Korea Pulmonary Arterial Hypertension Market, 2017- 2030(USD Million)

Fig. 66 Australia Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 67 Thailand Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 68 Latin America Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 69 Brazil Pulmonary Arterial Hypertension Market, 2017 - 2086 (USD Million)

Fig. 70 Mexico Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 71 Argentina Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 72 MEA Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 73 South Africa Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 74 Saudi Arabia Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 75 UAE Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)

Fig. 76 Kuwait Pulmonary Arterial Hypertension Market, 2018 - 2030 (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Pulmonary Arterial Hypertension Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030) (Average Selling Price in USD ) (Volume in Million Units)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- North America Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- North AmericaPulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- U.S.

- U.S. Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- U.S. Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- U.S. Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- U.S. Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Canada

- Canada Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Canada Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Canada Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Canada Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- North America Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030) (Average Selling Price in USD ) (Volume in Million Units)

- Europe

- Europe Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030) (Average Selling Price in USD ) (Volume in Million Units)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Europe Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Europe Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Germany

- Germany Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Germany Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Germany Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Germany Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- UK

- UK Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- UK Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- UK Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- UK Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- France

- France Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- France Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- France Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- France Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Italy

- Italy Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Italy Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Italy Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Italy Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Spain

- Spain Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Spain Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Spain Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Spain Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Denmark

- Denmark Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Denmark Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Denmark Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Denmark Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Sweden

- Sweden Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Sweden Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Sweden Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Sweden Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Norway

- Norway Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Norway Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Norway Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Norway Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Europe Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030) (Average Selling Price in USD ) (Volume in Million Units)

- Asia Pacific

- Asia Pacific Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030) (Average Selling Price in USD ) (Volume in Million Units)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Asia Pacific Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Asia Pacific Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- China

- China Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- China Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- China Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- China Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- India

- India Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- India Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- India Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- India Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Japan

- Japan Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Japan Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Japan Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Japan Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Australia

- Australia Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Australia Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Australia Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Australia Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- South Korea

- South Korea Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- South Korea Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- South Korea Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- South Korea Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Thailand

- Thailand Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Thailand Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Thailand Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Thailand Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Asia Pacific Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030) (Average Selling Price in USD ) (Volume in Million Units)

- Latin America

- Latin America Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030) (Average Selling Price in USD ) (Volume in Million Units)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Latin America Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Latin America Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Brazil

- Brazil Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Brazil Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Brazil Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Brazil Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Mexico

- Mexico Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Mexico Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Mexico Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Mexico Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Argentina

- Argentina Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Argentina Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Argentina Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Argentina Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Latin America Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030) (Average Selling Price in USD ) (Volume in Million Units)

- MEA

- MEA Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030) (Average Selling Price in USD ) (Volume in Million Units)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- MEA Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- MEA Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- South Africa

- South Africa Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- South Africa Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- South Africa Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- South Africa Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Saudi Arabia

- South Africa Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- South Africa Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- South Africa Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- South Africa Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- UAE

- UAE Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- UAE Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- UAE Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- UAE Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Kuwait

- Kuwait Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

- Kuwait Pulmonary Arterial Hypertension Type Outlook (Revenue, USD Million, 2018 - 2030)

- Branded

- Generics

- Kuwait Pulmonary Arterial Hypertension Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Oral

- Intravenous/ subcutaneous

- Inhalational

- Kuwait Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- MEA Pulmonary Arterial Hypertension Drug Class Outlook (Revenue, USD Million, 2018 - 2030) (Average Selling Price in USD ) (Volume in Million Units)

- North America

Pulmonary Arterial Hypertension Market Dynamics

Drivers: Incidents Of Pulmonary Arterial Hypertension (PAH)

The global prevalence of PAH is very low, which is around 15 to 50 cases per million, hence, it is classified as a rare disorder. Cumulatively, the cases of PAH are in the range of 100,000 to 200,000 per year. However, in the past few years, the prevalence of this disorder has risen due to risk factors like sedentary lifestyle, HIV, smoking, alcohol/tobacco consumption, and other idiopathic conditions. PAH may occur in association with various diseases, such as lung and cardiac diseases. Frequently observed underlying causes include connective tissue disorders, congenital heart disorders, coronary artery disorder, blood clots, and high blood pressure.

Growing Geriatric Population

The presence of a large population over 60 years, which has lower immunity levels and is prone to PAH and associated diseases, is a high impact-rendering driver for the growth of the PAH market over the forecast period. Although the onset age for PAH is 45 years, it is frequently observed to occur in populations above 60 years of age. This population is expected to avail the best possible treatments, increasing the life span. The chart below forecasts the number of geriatric patients over the next 6 years who may form a routine target group contributing toward the increasing demand for PAH drugs.

Restraints: Patent Expiration Of Key Molecules

Loss of exclusivity has a direct impact on the market of branded pharmaceutical products. Also, with the Drug Price Competition and Patent Term Restoration Act, of 1984, informally known as the Hatch-Waxman Act, the development of generic drugs is encouraged, which impacts the sale of branded molecules. The license expiry of some blockbuster drugs is making way for generic drug penetration. The increased sales of generic drugs adversely affect the overall revenue generation of the market since it is 70 to 80 percent cheaper as compared to branded drugs. Cutting-edge therapies are developed for treating PAH. Therefore, the future of the pulmonary arterial hypertension market is presumed to be brighter in the years to come.

What Does This Report Include?

This section will provide insights into the contents included in this pulmonary arterial hypertension market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Pulmonary arterial hypertension market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Pulmonary arterial hypertension market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the pulmonary arterial hypertension market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for pulmonary arterial hypertension market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of pulmonary arterial hypertension market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Pulmonary Arterial Hypertension Market Categorization:

The pulmonary arterial hypertension market was categorized into four segments, namely drug class (Endothelin Receptor Antagonists, PDE-5 Inhibitors, Prostacyclin and Prostacyclin Analogs, SGC Stimulators), type (Branded, Generics), route of administration (Oral, Intravenous/ subcutaneous, Inhalational), and region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa).

Segment Market Methodology:

The pulmonary arterial hypertension market was segmented into drug class, type, route of administration, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The pulmonary arterial hypertension market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-three countries, namely, the U.S.; Canada; the UK; Germany; Italy; France; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Pulmonary arterial hypertension market companies & financials:

The pulmonary arterial hypertension market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

JOHNSON & JOHNSON SERVICES, INC. - Johnson & Johnson is a holding company that is involved in R&D, manufacturing, and sales of healthcare products. It operates through three reportable segments: Pharmaceuticals, Medical Devices, and Consumers. The pharmaceuticals segment focuses on infectious diseases & vaccines, immunology, neuroscience, cardiovascular, oncology, and pulmonary hypertension. The medical devices segment offers devices used in cardiovascular, orthopedic, diabetes care, surgery, and eye health fields. The consumer segment comprises oral care, baby care, beauty, women’s health, over-the-counter pharmaceuticals, and wound care. The company has an established line of pulmonary arterial hypertension treatment, owing to when it acquired the pulmonary arterial hypertension treatment line from Actelion Pharmaceuticals, Ltd. in June 2017.

-

GILEAD SCIENCES, INC. - Gilead Sciences, Inc. is a research-based biopharmaceutical company that caters to several life-threatening diseases such as liver diseases, HIV, cancer, inflammatory & respiratory disorders, and cardiovascular conditions. Atripla, Emtriva, Tybost, Travuda, Hepsera, Zydelig, Lexiscan, Ranexa, Tamiflu, Macugen, and Letairis are some of the key brands of the company. It has operations in North America, Europe, and Australia. The company’s cardiovascular programs and developments are managed from Fremont, California. It has manufacturing and R&D facilities across five states in the U.S.

-

UNITED THERAPEUTICS CORPORATION - United Therapeutics Corporation is a biotechnology company that develops, manufactures, and distributes innovative medications for chronic & life-threatening diseases. The product portfolio of the company includes pulmonary arterial hypertension and anticancer agents. It provides prostacyclin analogs and PDE-5 inhibitors, which are pulmonary arterial hypertension agents. The company is constantly innovating solutions to serve cardiovascular, pulmonary, cancer, and other orphan diseases. The company has additional facilities in North Carolina, Canada, Chertsey, Surrey, and the UK.

-

ACCELERON PHARMA, INC. - Acceleron Pharma, Inc. is dedicated to drug discovery, development, and marketing of therapeutics to treat rare & serious diseases. The company focuses its R&D efforts on pulmonary diseases, neuromuscular, and hematologic. The company collaborated with Celgene to develop a treatment for chronic anemia in myelodysplastic syndromes, myelofibrosis, and beta-thalassemia. The company is growing its reach in the pulmonary arterial hypertension market with its new approved drug, Sotatercept.

-

GLAXOSMITHKLINE PLC (GSK) - GlaxoSmithKline plc (GSK) is a healthcare company that develops, manufactures, and markets medicines, vaccines, & consumer healthcare products. In 2000, Glaxo Wellcome plc and SmithKline Beecham merged to form GSK. As of 2018, it had a presence in nearly 115 countries. The pharmaceutical segment of the company provides solutions for respiratory, oncology, immune-inflammation, and HIV. Moreover, the company has 86 manufacturing facilities across 36 countries.

-

PFIZER, INC. - Pfizer, Inc. is involved in the R&D and manufacturing of pharmaceutical products. It translates advanced science & technologies into efficient treatment regimens. The company focuses on major therapeutic areas such as cardiovascular diseases, vaccines, oncology, neurosciences, immunology, and rare diseases. Pfizer's R&D activities are categorized as BioTherapeutics R&D Group-involved in large-molecule research-and PharmaTherapeutics R&D Group-focused on small-molecules & related modalities discovery. The company is also engaged in investigator-initiated research and compound transfer programs for third-party agents to conduct studies.

-