- Home

- »

- Medical Devices

- »

-

Pulse Lavage Market Size And Share, Industry Report, 2030GVR Report cover

![Pulse Lavage Market Size, Share & Trends Report]()

Pulse Lavage Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Pulse Lavage Devices, Components & Accessories), By Usability, By Power Source, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-307-5

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pulse Lavage Market Size & Trends

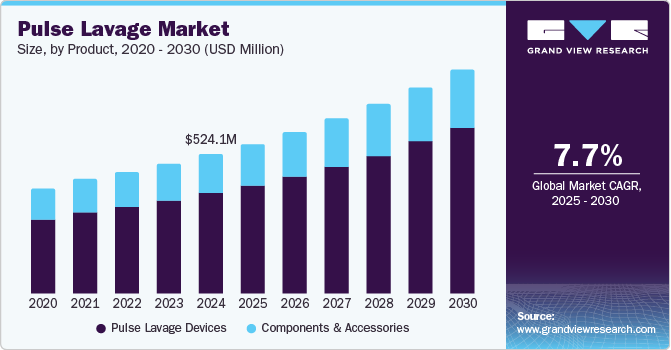

The global pulse lavage market size was estimated at USD 524.14 million in 2024 and is projected to grow at a CAGR of 7.68% from 2025 to 2030. The increasing number of orthopedic surgeries globally is expected to drive market growth. According to data published by the University of California in October 2024, nearly 1.3 million knee replacements and up to 760,000 hip replacements are performed in America each year. As per a report by the Baishideng Publishing Group Inc., in August 2023, China performs over 50,000 hip or knee joint replacement surgeries annually. Moreover, as per a report by the Canadian Institute for Health Information, in 2020-2021, about 110,000 joint replacement surgeries were performed in Canada.

Pulse lavage is used to clean and debride wounds or surgical sites, particularly in orthopedic operations, by delivering pressurized saline. This technique is crucial for preventing infections and ensuring the success of surgical interventions, especially in procedures involving implants or complex reconstructions. Moreover, the rising prevalence of orthopedic conditions, such as Osteoarthritis (OA), rheumatoid arthritis, and trauma-related injuries, is expected to drive the demand for orthopedic surgeries.

According to a March 2024 study conducted by the Osteoarthritis (OA) Action Alliance in collaboration with the CDC, approximately 45% of individuals with osteoarthritis are aged 65 and older, while 88% of all cases occur in those aged 45 and above. The annual incidence of knee OA is highest among individuals aged 55 to 64 in the U.S. This increase in surgeries is expected to improve the need for effective wound-cleaning methods to enhance surgical outcomes and minimize postoperative complications. Pulse lavage systems, known for their efficiency in removing debris, blood, & contaminants and reducing infection risks, have become increasingly indispensable in orthopedic operating rooms.

Furthermore, as the number of accidents & trauma cases increases globally, the demand for effective wound cleaning and management solutions, like pulse lavage systems, is expected to grow. These incidents often result in complex fractures and injuries requiring surgical intervention. During these procedures, surgeons rely heavily on pulse lavage systems to ensure thorough debridement. This helps minimize the chances of postoperative infections and improves the outcomes of surgical interventions. In December 2024, the National Highway Traffic Safety Administration (NHTSA) released preliminary estimates for traffic fatalities during the first nine months of 2024, reporting a decline for the 10th consecutive quarter; approximately 29,135 fatalities occurred in traffic crashes. As per a report by the WHO, in December 2023, around 1.19 million individuals lost their lives due to road traffic accidents annually. In addition, around 20 to 50 million people sustain nonfatal injuries from these incidents, with a significant number of them resulting in disabilities. These factors are predicted to drive the demand for wound cleaning and management solutions, such as pulse lavage systems.

With the increase in the aging population, there is a higher prevalence of conditions that require surgical interventions and subsequent wound care, propelling the pulse lavage industry growth. According to the WHO, by 2050, the global population aged 60 years and above is estimated to total 2 billion. Moreover, 80% of the elderly population will live in low - middle-income nations by 2050. Older adults are more prone to falls and fractures due to decreased bone density, balance issues, and other age-related health concerns. These incidents often lead to traumatic injuries requiring surgical intervention, where pulse lavage systems are crucial for debridement and cleaning of the surgical site, reducing the risk of infection and improving surgical outcomes.

The aging population is more susceptible to chronic conditions, such as osteoarthritis and diabetes, which can lead to complications requiring surgical treatment. In such cases, pulse lavage systems are utilized to ensure thorough cleaning of wounds and surgical areas to promote healing and prevent infections. These factors are expected to drive market growth over the forecast period.

Technological advancements in pulse lavage systems have significantly influenced market dynamics, driving demand and adoption across healthcare settings. These advancements cater primarily to enhancing surgical outcomes, reducing infection rates, and improving the efficiency of surgical procedures. Modern pulse lavage systems are designed for optimal debridement efficiency. They offer adjustable pressure settings to cater to different surgical needs, allowing for the gentle removal of necrotic tissue, bacteria, & contaminants from wounds and surgical sites without damaging healthy tissue. This precision contributes to better surgical outcomes and a reduced risk of infection.

Moreover, the introduction of battery-operated and cordless pulse lavage systems has enhanced their portability & convenience, allowing for their use in various settings, including emergency rooms, field hospitals, and in situations where mobility is crucial. This flexibility has broadened the utility and appeal of pulse lavage systems. For instance, in August 2022, Heraeus Medical launched the innovative palaJet pulse lavage system, a powerful, battery-powered, disposable device designed to clean bone beds effectively. The palaJet system offers simple operation, with adjustable irrigation pressure to enhance cleaning outcomes. In addition, its suction feature facilitates the removal of surplus tissue and fluids.

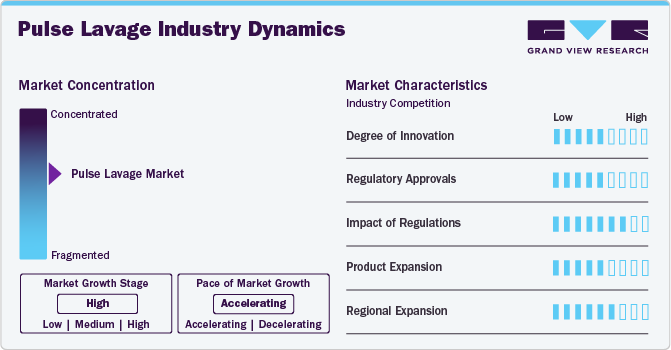

Market Concentration & Characteristics

The market growth stage is high, with an accelerating pace. The market is characterized by a high degree of growth owing to rising cases of road accidents and the increasing prevalence of orthopedic diseases coupled with technological advancements. The market caters to various specialties and patient needs, leading to a wide range of product offerings. Many small-scale businesses operate in specific areas, targeting local markets or providing budget-friendly options. These businesses often align with local rules, cultural preferences, and pricing strategies, leading to a fragmented market landscape.

Key strategies implemented by players in the market are new product launches, expansion, acquisitions, partnerships, and other strategies. Smaller companies or startups that innovate in the pulse lavage space but struggle with the regulatory landscape may become acquisition targets for larger, established companies. This can concentrate innovation within larger entities that have the resources to navigate the regulatory process. Players might utilize 3D printing technology to create patient-specific components, such as custom-designed handpieces or anatomically shaped irrigation probes, for optimal fitness, comfort, and efficacy.

Innovation in this sector focuses on improving clinical outcomes, operational efficiency, and patient safety. This includes the development of devices with adjustable pressure settings to allow for customized treatment that can gently yet effectively remove debris and bacteria from the wound without damaging healthy tissue. The ability to adjust settings based on the specific needs of a wound represents a significant innovation over older, more static systems. The incorporation of smart technology, such as sensors, connectivity, and data analytics, into pulse lavage systems enables real-time monitoring, feedback, and optimization of treatment parameters.

Pulse lavage products are medical devices subject to strict regulatory standards. Regulatory bodies, such as the U.S. FDA in the United States or CE (Conformité Européene) marking in Europe, set guidelines and standards to ensure the safety, effectiveness, and quality of these devices. Regulatory requirements in other countries can vary significantly. For example, Canada requires Medical Device Licensing for pulse lavage systems, while Australia requires inclusion in the Australian Register of Therapeutic Goods (ARTG) managed by the Therapeutic Goods Administration (TGA).

The impact of regulations on the market is significant, shaping every stage of product development, market entry, and post-market activities. Regulatory requirements ensure that pulse lavage systems are developed with patient safety and efficacy in mind.Meeting regulatory standards can significantly increase both the cost and time required for product development. Clinical trials, extensive documentation, and the regulatory approval process itself can delay market entry and increase upfront investment.

Product expansion in the pulse lavage industry focuses on introducing advanced devices with enhanced features and expanding their applications. New systems now offer adjustable pressure settings for diverse surgical needs, improved ergonomics for user comfort, and battery-operated models for portability. The scope of applications has grown beyond traditional wound care to include orthopedic procedures, trauma surgeries, and minimally invasive interventions.

Regional expansion scenarios in the market are propelled by factors such as population growth, healthcare expenditure, regulatory environments, and the overall development of healthcare infrastructure.

Product Insights

The pulse lavage device segment dominated the market in 2024. The rising prevalence of chronic wounds, such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, is expected to drive the demand for effective wound care solutions, including pulse lavage devices. For instance, a research article published in March 2021 by ScienceDirect stated that diabetic foot ulcers occur in over 25% of patients with diabetes. In 50% of cases, infection occurs, and 20% of patients require amputation. As per data published by the American Medical Association in 2023, diabetic foot ulcers affect approximately 18.6 million people worldwide each year and are associated with increased rates of amputation and death.

In addition, the rising rate of hospital admissions due to crucial trauma & sports injuries and road accidents is expected to improve the adoption of pulse lavage devices for improving patient health outcomes. As per the latest WHO report published in December 2023, the annual number of road traffic is around 1.19 million annually. Hence, the rising number of accidents is expected to boost the demand for pulse lavage devices, leading to considerable market growth over the forecast period.

The components and accessories segment is expected to register growth at a considerable CAGR during the forecast period. They facilitate the desired functioning of a pulse lavage system during a wound irrigation or debridement procedure. It mainly contains, by way of example, the main console or unit, handpiece, disposable tips or nozzles, probes, irrigation tubing, irrigation tips, reservoir or bottle, foot switch, batteries, waste pipe, irrigation bag, adaptors, splash shields, nozzles, power wire, clamps, etc. In wound care management, these components & accessories are crucial for better performance, safety, and effectiveness of pulse lavage systems. In addition, the increasing adoption of single-use disposable components is another factor expected to propel market growth by ensuring patient safety and reducing infection risk.

Usability Insights

The disposable pulse lavage systems segment dominated the market in 2024. Disposable pulse lavage systems comprise single-use components, such as irrigation tubing, suction tubing, and wound irrigation tips. These systems provide numerous advantages over traditional reusable pulse lavage systems, leading to high adoption. Moreover, the risk of cross-contamination between patients is significantly reduced as each component is used only once and discarded. Hence, their significant contribution to infection control is expected to surge the adoption, driving market growth.

Moreover, these systems offer convenience and efficiency for healthcare providers. Clinicians can easily conduct wound irrigation and debridement procedures without requiring extensive setup or cleanup using prepackaged, single-use components. This aids in streamlining the process, saving time and resources for healthcare facilities to treat more patients effectively. In addition, these systems reduce the necessity for equipment maintenance and sterilization protocols, improving operational efficiency.

The reusable pulse lavage system segment is expected to register a significant CAGR during the forecast period. These systems provide cost-effectiveness, sustainability, adaptability, durability, reliability, and integration with current infrastructure. Reusable pulse lavage systems provide a financially viable option for medical facilities with large volumes of procedures. In the long run, the ability to reuse components over multiple procedures might result in significant cost savings, even though the initial investment might be higher than with disposable systems. Hence, reusable systems are a desirable choice for healthcare facilities trying to maximize their budgetary allocation without compromising the standard of patient care. Moreover, these systems often offer greater customizability and flexibility than disposable systems.

Application Insights

The orthopedics segment dominated the market in 2024.Pulse lavage systems are commonly used in orthopedic procedures, particularly in managing open fractures and contaminated wounds. Orthopedic surgeons use pulse lavage to thoroughly clean and debride the wound before fixation or closure, reducing the risk of infection and promoting optimal bone healing. Pulse lavage systems are frequently used during total joint arthroplasty procedures, such as hip and knee replacements. As per the data published by the American College of Rheumatology, around 790,000 total knee replacements and 544,000 hip replacements occur annually in the U.S. Thereby, this factor aids the market growth.

The wound care segment is expected to register the fastest CAGR during the forecast period. AC-powered pulse lavage systems are integral to wound care management in healthcare settings. These systems connect directly to an electrical outlet, providing consistent power to drive the irrigation and suction functions necessary for wound debridement procedures. In addition, AC-powered pulse lavage systems offer reliable and consistent performance during wound debridement procedures. Since they are directly connected to a power source, these systems ensure continuous operation without needing battery replacements or charging cycles. Unlike battery-powered or portable pulse lavage systems, AC-powered systems can sustain prolonged procedure durations without interruption. This capability is particularly advantageous for complex or extensive wound debridement procedures that require extended operating times.

End Use Insights

The hospitals segment dominated the market in 2024.Hospitals are significant end users of pulse lavage systems, and their adoption is expected to drive market growth over the forecast period. Hospitals encounter a wide range of wound care scenarios, from trauma cases to surgical procedures. Pulse lavage systems are valuable for wound irrigation and debridement across various departments, including emergency departments, operating rooms, orthopedic units, and wound care clinics. The clinical need for effective wound management drives hospitals to invest in pulse lavage systems to ensure optimal patient outcomes and reduce the risk of complications, such as infections.

Hospitals perform several surgical procedures yearly, requiring wound irrigation and debridement as part of the postoperative care protocol. Orthopedic surgeries, including joint replacements and fracture repair, necessitate thorough wound cleansing to promote healing and prevent infections. Hospitals are incorporating advanced wound care technologies, such as pulse lavage systems, with the increasing volume of surgical procedures being performed globally.

The ambulatory surgery centers segment is expected to register the fastest CAGR during the forecast period and serve as end users of pulse lavage systems, utilizing these devices for wound irrigation and debridement during surgical procedures. Pulse lavage systems are well-suited for minimally invasive surgeries, where precise wound irrigation and debridement are essential for optimal outcomes. As ASCs perform many minimally invasive procedures, the demand for pulse lavage systems increases as part of their surgical equipment portfolio.

Pulse lavage systems offer a cost-effective wound irrigation and debridement solution, allowing ASCs to perform these procedures efficiently within the outpatient setting. Disposable pulse lavage systems eliminate the need for equipment maintenance and sterilization, saving time and resources for ASC staff. The efficiency and cost-effectiveness of pulse lavage systems make them an attractive option for ASCs seeking to optimize their operational workflows. Thereby, these factor fuels the industry growth.

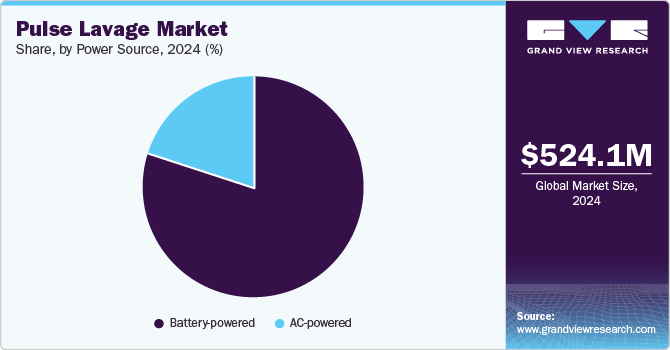

Power Source Insights

The battery-powered segment dominated the market in 2024.Battery-powered pulse lavage systems are designed to provide portable, cordless operation, allowing for greater flexibility & convenience in wound irrigation and debridement procedures. These systems offer enhanced mobility compared to traditional corded models. Healthcare providers can easily maneuver the device around the patient without being restricted by power cords or outlets. This versatility is particularly beneficial in clinical settings where space may be limited or when treating patients in nontraditional environments, such as outpatient clinics, ambulatory surgical centers, or field-based medical missions.

Moreover, the portability of battery-powered pulse lavage systems enables healthcare providers to perform wound irrigation and debridement procedures in diverse settings, such as the operating room, emergency department, or at the patient’s bedside; clinicians have the flexibility wherever needed. In addition, technological advancements such as variable flow rates, adjustable irrigation pressure, and user-friendly interfaces enhance procedural control & precision, which aids market growth.

The AC powered pulse lavage systems segment is expected to register the fastest CAGR of 8.8% during the forecast period. AC-powered pulse lavage systems are integral to wound care management in healthcare settings. These systems connect directly to an electrical outlet, providing consistent power to drive the irrigation and suction functions necessary for wound debridement procedures. In addition, AC-powered pulse lavage systems offer reliable and consistent performance during wound debridement procedures.

Since they are directly connected to a power source, these systems ensure continuous operation without needing battery replacements or charging cycles. Unlike battery-powered or portable pulse lavage systems, AC-powered systems can sustain prolonged procedure durations without interruption. This capability is particularly advantageous for complex or extensive wound debridement procedures that require extended operating times.

Furthermore, AC-powered pulse lavage systems offer long-term cost-effectiveness compared to disposable or battery-powered alternatives. While the initial investment may be higher, AC-powered systems require minimal ongoing maintenance and operational expenses. AC-powered pulse lavage systems remain a preferred choice among healthcare providers due to their reliability, performance, and versatility. As healthcare facilities prioritize patient safety, efficiency, & clinical efficacy, the demand for AC-powered systems continues to grow. Manufacturers continue innovating and enhancing AC-powered pulse lavage systems to meet evolving market demands, driving further adoption and expansion.

Regional Insights

The North America pulse lavage market accounted for 40.64% globally in 2024 and is expected to continue its dominance over the forecast period. Increased awareness within the healthcare community and the patients regarding the importance of early diagnosis & treatment for orthopedic disorders and chronic wounds positively influences the demand for pulse lavage. For instance, the Centers for Medicare & Medicaid Services (CMS) projected that health spending in the U.S. was 7.5% in 2022. In 2023, it was expected to surpass USD 1 trillion for the first time. In addition, high disposable income in developed economies & skilled professionals are some factors responsible for the large share of the market of the country. Hence, the increasing healthcare infrastructure and better healthcare facilities are expected to boost market growth for pulse lavage in this region.

U.S. Pulse Lavage Market Trends

The pulse lavage industry in the U.S. is expected to grow significantly over the forecast period. The increasing number of orthopedic procedures is anticipated to drive market growth. For instance, as per the statistical data published in McLeod Health, in 2022, the number of orthopedic procedures performed in the U.S. was around 18,577,953. In addition, the rising burden of chronic wounds is expected to propel market growth. For instance, as per data published by Frontiers Media S.A. in January 2022, about 8.2 million people suffered wounds in the U.S., which cost USD 28.1 to USD 96.8 billion to the health system. Moreover, the rising geriatric population is further contributing to the market growth. For instance, according to the Population Reference Bureau (PRB), the number of Americans aged 65 and over is expected to increase by 47%, from 58 million in 2022 to 82 million in 2050. The older population is more susceptible to orthopedic and wound disorders, propelling the demand for pulse lavage systems.

Europe Pulse Lavage Market Trends

The Europe pulse lavage industry is driven by high disposable income, well-established healthcare infrastructure, and the accessibility of skilled professionals. Moreover, favorable reimbursement coverage has augmented the adoption of surgical procedures. In addition, the increasing geriatric population and rising cases of burns & trauma are also estimated to drive the market growth. Furthermore, the market in this region is mainly dominated by global players such as Mölnlycke Health Care AB, Heraeus Holding, Smith & Nephew plc, Judd Medical Limited, etc. Thus, the Europe pulse lavage industry is anticipated to witness significant growth over the forecast period.

The pulse lavage market in the UK exhibits high competition as the government is the key customer for market players offering treatment for sports injuries, chronic diseases, and other disorders in the UK. The country operates a universal healthcare system that extends free healthcare services to most of its population through national healthcare centers. Furthermore, free healthcare services offered by the government have resulted in high demand for advanced wound care treatments in the UK. The increasing elderly demographic in the UK is anticipated to drive market expansion.

The France pulse lavage industry is expected to grow over the forecast period owing to rising geriatric population in this region propelling the market growth. For instance, as of January 1, 2024, 21.5% of the population of France, or 14.7 million people, were over the age of 65. This is a rise from 2006, when about 10 million people were over 65. Therefore, back pain and other structural joint problems are a growing concern for older patients. Thus, an increase in geriatric population is expected to drive the market growth for pulsed lavage systems in France.

The pulse lavage industry in Germany has a lucrative environment for technologically innovative startups. Around 80% of the medical device manufacturers, including companies operating in wound care products, are SMEs in the country. Moreover, many companies are entering into strategic alliances, such as partnerships, mergers, agreements, and product launches. For instance, in August 2022, Heraeus Medical launched palaJet, a new pulse lavage system for efficient bone bed cleaning. Such factors are expected to boost the pulse lavage market in Germany and increase the competition over the forecast period.

Asia Pacific Pulse Lavage Market Trends

Asia Pacific pulse lavage industry is anticipated to grow at the fastest CAGR over the forecast period. The presence of developing economies, such as China, India, and Japan, is anticipated to boost the market in the region. This can be attributed to the presence of major market players and increasing road traffic accidents and trauma cases. In addition, technological advancements, an increasing geriatric population, a growing prevalence of chronic wounds, rising orthopedic procedures, and an increasing number of surgeries are anticipated to boost the regional pulse lavage market. Moreover, medical tourism in this region is contributing to an increased demand for wound care products.

The pulse lavage industry in China is expected to witness considerable growth over the forecast period due to growing geriatric population. For instance, in 2024, around 22% of China's population, or approximately 310.3 million people, are aged 60 or older, signifying a rapidly aging population and a continued decline in the overall population for the third consecutive year. Older people are more susceptible to developing chronic wounds, as they are most likely to suffer from chronic illnesses.

The India pulse lavage industry has been making significant investments in healthcare infrastructure. The expansion and development of hospitals and healthcare facilities are likely to contribute to the growing demand for modern and advanced pulse lavage.Moreover, the presence of several local players in the country helps multinational market players secure a strong market position. Multiple companies are entering into partnerships & collaborations in the region to gain a competitive advantage. Thus, such factors are expected to enhance competition in India pulse lavage industry.

The pulse lavage industry in Japan is expected to grow over the forecast period. The rising geriatric population is one of the major factors driving market growth in Japan. In 2024, Japan's elderly population reached a record high of 36.25 million people, which is almost one-third of the country's population. As the geriatric population is at a higher risk of orthopedic disorders, demand for pulse lavage systems is expected to surge in the coming years. In addition, with increasing healthcare spending, the market is expected to grow substantially in Japan.

Middle East And Africa Pulse Lavage Market Trends

Middle East and Africa pulse lavage industry is expected to witness considerable growth in the coming years. The countries with significant growth rate in this region are South Africa, Saudi Arabia, UAE, and Kuwait. Factors that can be attributed to the growth of MEA market are growing geriatric population, increasing number of surgeries, and rising incidence of sports-related injuries. In addition, with increasing government initiatives to develop healthcare infrastructure, the region is expected to witness a rise in number of surgeries, leading to an increase in demand for wound care products for postoperative care.

The pulse lavage industry in Saudi Arabia is expected to grow over the forecast period. Saudi Arabia market is expected to witness steady growth in the coming years due to increasing investments in healthcare infrastructure, and growing prevalence of chronic wounds.

The Kuwait pulse lavage industry is expected to grow over the forecast period. The anticipated growth in market is driven by factors such as the increasing prevalence of chronic disorders, a growing number of surgical procedures, and investments in the private healthcare sector. These elements contribute to a favorable investment outlook and present significant opportunities for key players in the country's healthcare market.

Study 1 - Research Study Published in Springer Nature Journal, Cureus, in January 2024:

Reducing Carbon Footprint of Disposable Pulse Lavage Systems in Total Hip and Knee Arthroplasty

There are several distinct disposable pulse lavage devices on the market. The primary differences between them are in terms of cost, plastic/carbon footprint, and power source (battery versus AC). According to data from the National Joint Registry (NJR), district general hospital in UK, completed more than 1800 arthroplasty cases in 2019. By 2035, there will likely be between 215,000 and 440,000 hip and knee replacements performed nationwide. Thousands of disposable pulse lavage devices are therefore used and disposed away every year. Hence, it is imperative to consider the noteworthy ecological and financial ramifications for pulse lavage systems, which are frequently employed in these procedures.

Factors used in carbon footprint analysis

Factors used in carbon footprint analysis

Pulse lavage system

Main components of the instrument

Emissions Factor (KgCO2e/T)

Ecopulse

Pulsvac (Battery)

Pulsvac (AC)

Hard plastic main body

3413.08

Yes

Yes

Yes

Batteries

4633.48

No

Yes

No

Tubing

3760.00

Yes

Yes

Yes

Inner Packaging

4032.39

Yes

Yes

Yes

Outer packaging

919.4

Yes

Yes

Yes

Transport

Distance from distribution center to Hospital

Ferry = 0.016142 ; HGV = 0.22916

Yes

Yes

Yes

Comparison of carbon emissions from disposable pulse lavage system based on the 1800 arthroplasty cases we performed in 2019

Pulse lavage system

Carbon Emissions (Tonnes CO2e)

Ecopulse (De Soutter, Aylesbury, UK)

3.0

Pulsvac Plus Battery (Zimmer-Biomet, Warsaw, US)

7.8

Pulsvac Plus AC (Zimmer-Biomet, Warsaw, US)

5.2

Notably, compared to the battery-operated system, the AC-powered system produced around one-third fewer carbon emissions. Once more, the absence of batteries and the model's decreased weight are probably to blame. Among all the pulse lavage models, it emphasizes that battery-powered versions are the least eco-friendly.

Study 2 - Research Study Published in NCBI in November 2022:

Retrospective Study from a Single Center on the Efficacy of Pulsed Lavage Following Excision of Burns ≥30% of the Total Body Surface Area in 63 Patients

The study showcased the advantages of pulsed lavage for the treatment of burn wounds are summarized as follows:

-

The pulse irrigator's pulsed fluid flow may swiftly and completely cleanse the wound area, concentrating on getting rid of any remaining necrotic tissue and germs.

-

The waste liquid can accumulate over time as the pulsed irrigators clean the area, removing dirt and germs fast and lowering the chance of illness. In the meanwhile, the operation's danger can be decreased by cutting down on both the rinse and overall times.

-

Pulsed lavage is a safe, dependable procedure with surgeons having control over the pressure. The subsequent injury to the surrounding normal tissue is lessened by pulsed lavage.

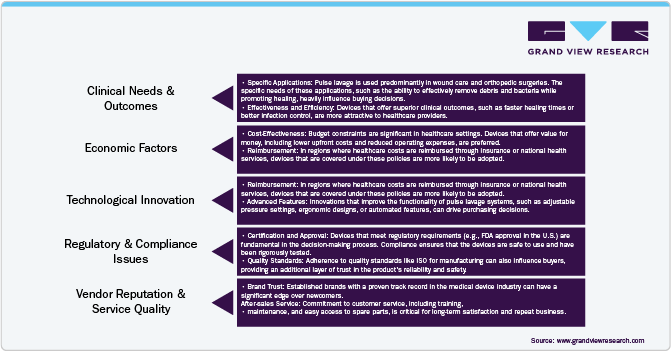

Consumer Behavior In The Pulse Lavage Industry: GVR Research Analysis

Analyzing consumer behavior in the market involves understanding the diverse factors that influence healthcare providers' decisions when purchasing medical devices. These factors include clinical needs, cost-effectiveness, technological advancements, regulatory compliance, and vendor reputation. Below figure represents a breakdown of the primary considerations that shape consumer behaviors in this specialized market:

Understanding these complex layers of consumer behavior helps manufacturers and vendors in the industry strategically position their products, ensuring they meet the nuanced needs of their target audiences effectively.

Key Pulse Lavage Company Insights

Stryker Corporation; Zimmer Biomet Holdings, Inc.; Heraeus Holding are some of the major players in the pulse lavage industry. These established players have a broad range of products and a global distribution network. Emerging players and startups are also entering the market with innovative solutions, challenging the status quo, and pushing for technological advancements.

Companies are investing in R&D to introduce systems with enhanced features such as adjustable pressure settings, ergonomic designs, portable units, and systems that integrate seamlessly with other surgical tools. Innovations also include disposable options to ensure sterility and reduce the risk of infection, as well as environmentally friendly options that minimize waste.

Key Pulse Lavage Companies:

The following are the leading companies in the pulse lavage market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker

- Zimmer Biomet Holdings, Inc.

- Mölnlycke Health Care AB

- BD

- Summit Medical Group Ltd (VillageMD)

- Apex Tools & Orthopedics Co., a Colson Medical

- MicroAire Surgical Instruments LLC

- Judd Medical Ltd.

- Heraeus Medical GmbH

- Summit Medical Group Ltd (VillageMD)

- De Soutter Medical

- Caleb

Recent Developments

-

In October 2024, Sonoma Pharmaceuticals announced an expanded partnership with a leading global healthcare distributor to market and distribute its wound care products in Canada. This amendment to their agreement, which previously covered distribution in the U.S., now includes over-the-counter wound care products for sale in both countries.

-

In August 2024, Irrimax Corporation introduced two new kits to its IRRISEPT product line: the 'IRRISEPT Accessory Kit' and the 'IRRISEPT Wound Solution Kit.' These kits are designed to enhance the flexibility of the IRRISEPT Antimicrobial Wound Lavage system, allowing clinicians to choose between manual compression for irrigation or connecting the solution to powered irrigation systems, such as suction irrigation, pulse lavage, and negative pressure wound therapy.

-

In June 2024, Stryker announced a partnership with IRCAD North America, an affiliate of Atrium Health, to advance surgical training and education. This collaboration aims to equip IRCAD North America's training center with Stryker's advanced medical devices, focusing on robotics, virtual and augmented reality, surgical artificial intelligence, and simulation training. While the partnership primarily emphasizes innovative surgical technologies, it has potential implications for the pulse lavage system market.

-

In November 2023, Sonoma Pharmaceuticals, Inc. launched its next generation advanced intraoperative pulse lavage irrigation treatment in the U.S

-

In August 2022, Heraeus Medical introduced the innovative palaJet, a battery-operated, single-use pulse lavage system designed for efficient and effective bone bed cleaning. Particularly in arthroplasty procedures, this crucial step contributes to improved long-term outcomes by thoroughly removing fat residues, bone debris, marrow, and blood from cement-receiving surfaces.

Pulse Lavage Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 559.78 million

Revenue forecast in 2030

USD 810.37 million

Growth rate

CAGR of 7.68% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, usability, power source, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico: UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stryker; Zimmer Biomet Holdings, Inc.; Mölnlycke Health Care AB; BD; Summit Medical Group Ltd. (VillageMD); Apex Tools & Orthopedics Co., a Colson Medical; MicroAire Surgical Instruments LLC; Judd Medical Ltd.; Heraeus Medical GmbH; De Soutter Medical; Caleb

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pulse Lavage Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pulse lavage market report based on product, usability, power source, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pulse Lavage Devices

-

Components and Accessories

-

-

Usability Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable Pulse Lavage Systems

-

Reusable Pulse Lavage Systems

-

Semi-Disposable Pulse Lavage Systems

-

-

Power Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Battery-powered

-

AC-powered

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedics

-

Trauma

-

Wound care

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgery Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The increasing number of orthopedic surgeries globally is expected to drive the pulse lavage market growth. Furthermore, as the number of accidents & trauma cases increases globally, the demand for effective wound cleaning and management solutions, like pulse lavage systems, is expected to grow.

b. The global pulse lavage market size was estimated at USD 524.14 million in 2024 and is expected to reach USD 559.78 million in 2025.

b. The global pulse lavage market is expected to grow at a compound annual growth rate of 7.68% from 2025 to 2030 to reach USD 810.37 million by 2030.

b. The pulse lavage device segment dominated the market in 2024. The rising prevalence of chronic wounds, such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, is expected to drive the demand for effective wound care solutions, including pulse lavage devices.

b. Some key players operating in the global pulse lavage market include Stryker, Zimmer Biomet Holdings, Inc. , Mölnlycke Health Care AB, BD, Summit Medical Group Ltd (VillageMD), Apex Tools & Orthopedics Co., a Colson Medical, MicroAire Surgical Instruments LLC, Judd Medical Ltd., Heraeus Medical GmbH, Summit Medical Group Ltd (VillageMD), De Soutter Medical, Caleb.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.