- Home

- »

- Plastics, Polymers & Resins

- »

-

PVC Additives Market Size & Share, Industry Report, 2030GVR Report cover

![PVC Additives Market Size, Share & Trends Report]()

PVC Additives Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Stabilizers, Impact Modifiers, Processing Aids, Lubricants, Plasticizers), By End-use (Building & Construction, Transportation, Packaging), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-538-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

PVC Additives Market Summary

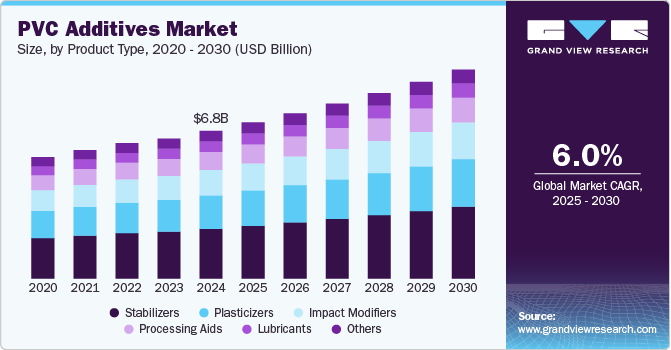

The global PVC additives market size was estimated at USD 6.80 billion in 2024 and is projected to reach USD 9.62 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. The construction industry remains one of the primary drivers of demand for PVC additives.

Key Market Trends & Insights

- The Asia Pacific dominated the PVC additives market and accounted for the largest revenue share of over 43.8% in 2024 and is projected to grow at the fastest CAGR of 6.3% during the forecast period.

- The PVC additives industry in the U.S. is driven by the growth of the construction and housing markets.

- Based on product type, the stabilizers product segment recorded the largest revenue share of over 33.7% in 2024.

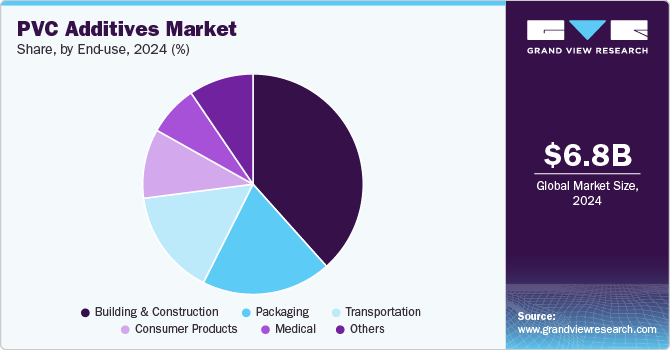

- Based on end-use, the building and construction segment recorded the largest market revenue share of over 38.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.80 Billion

- 2030 Projected Market USD 9.62 Billion

- CAGR (2025-2030): 6.0%

- Asia Pacific: Largest market in 2024

As urbanization accelerates in emerging economies-particularly in regions like Asia Pacific, Africa, and Latin America-there is an increasing need for affordable, durable, and versatile building materials. PVC, being cost-effective, lightweight, and durable, is a preferred material in End Uses like pipes, window profiles, flooring, roofing, and siding. PVC, when combined with stabilizers, impact modifiers, and other additives, offers enhanced performance in terms of UV stability, durability, and weather resistance. This makes it an ideal material for construction projects that require longevity and reduced maintenance

The growing demand for high-performance, long-lasting construction materials means that additives such as stabilizers, impact modifiers, and lubricants are becoming more important to enhance the performance of PVC products. For instance, stabilizers improve the resistance of PVC to UV degradation, allowing it to withstand harsh outdoor conditions for longer periods, a key feature in construction projects.

Globally, the packaging industry remains a significant consumer of PVC additives. PVC is widely used in both rigid and flexible packaging end uses, including food and beverage packaging, medical packaging, and consumer goods packaging. Additives like plasticizers, stabilizers, and lubricants play a key role in improving the flexibility, clarity, durability, and processability of PVC films, sheets, and containers. The increasing demand for high-quality packaging materials that provide safety, protection, and aesthetic appeal is driving the market for PVC additives.

With growing consumer concerns over product safety, shelf life, and environmental sustainability, PVC packaging solutions are becoming increasingly popular. Additives that improve the recyclability of PVC, or reduce toxic emissions during manufacturing and disposal, are in demand, particularly in developed regions where environmental regulations are stricter. The rise in e-commerce and packaged food consumption, especially in regions like North America and Europe, is contributing to the growing demand for PVC additives in packaging.

Additionally, the rise of sustainable packaging materials, combined with technological innovations to create more eco-friendly and efficient packaging solutions, has made PVC additives essential to improve the performance of PVC-based packaging. This trend is expected to continue as global brands aim to reduce their environmental footprint.

Advances in PVC additive formulations are enabling manufacturers to tailor additives for specific End Uses across different industries. The customization of PVC additives to meet the performance requirements of various sectors-such as automotive, medical devices, and electronics-has expanded the use of PVC in diverse markets. Innovations in additives are also improving the processing efficiency of PVC, enabling manufacturers to produce more durable and cost-effective products.

As governments around the world implement stricter environmental regulations, industries are seeking safer and more sustainable materials. The growing focus on the environmental impact of PVC, particularly regarding plasticizers and stabilizers, has led to the development of additives that improve the recyclability of PVC and reduce harmful emissions during production. This trend toward sustainability is helping to drive the demand for more eco-friendly PVC additives that comply with global environmental standards.

With the global push for a circular economy, PVC’s ability to be recycled has become an important factor in its adoption. Additives that improve PVC recyclability, such as those that reduce the release of toxic substances during the recycling process, are becoming increasingly important. As industries move toward more sustainable and recyclable solutions, the demand for additives that support these efforts is rising.

Product Type Insights

The stabilizers product segment recorded the largest revenue share of over 33.7% in 2024 and is expected to grow at the fastest CAGR during the forecast period. One of the primary factors for the growing demand for stabilizers in the PVC additives market is their role in improving the durability and longevity of PVC products. PVC is highly susceptible to degradation when exposed to UV radiation, heat, and oxygen over time. This degradation can lead to discoloration, brittleness, and a reduction in the material’s overall strength. Stabilizers help mitigate these issues by protecting PVC from thermal and UV degradation.

Stabilizers prevent the breakdown of PVC at high temperatures during manufacturing, ensuring that the material retains its mechanical properties after the production process. This is particularly important in industries such as construction, automotive, and electrical wiring, where PVC components need to maintain their performance in high-temperature environments.

Another key factor driving the demand for stabilizers in PVC additives is the growing emphasis on regulatory compliance and safety standards. Various industries, particularly construction and medical End Uses, are subject to strict regulatory guidelines regarding the materials used in their products. PVC, being a synthetic polymer, can release harmful substances when it degrades or during manufacturing processes. This has led to increased demand for stabilizers that ensure PVC remains safe, stable, and compliant with environmental and health regulations.

Stringent regulations in the automotive and medical sectors require PVC to be free from harmful substances and to meet high-performance standards. As a result, manufacturers are increasingly relying on stabilizers to ensure their PVC products comply with these regulations. The demand for stabilizers that enable PVC to meet these stringent standards is growing, particularly in developed regions with strict regulatory frameworks such as Europe and North America.

End-use Insights

The building and construction end use segment recorded the largest market revenue share of over 38.4% in 2024. The demand for PVC stabilizers in the building and construction industry is growing significantly due to a combination of factors related to performance, durability, sustainability, and regulatory compliance. PVC (polyvinyl chloride) is widely used in various construction End Uses such as pipes, window profiles, siding, flooring, roofing, and electrical conduits due to its versatility, cost-effectiveness, and long service life. Stabilizers play a crucial role in enhancing these properties, making them essential for the continued growth of PVC in construction.

Another key driver for the growing demand for stabilizers in the building and construction industry is the need for PVC to resist weathering and perform optimally in various environmental conditions. PVC is frequently used in outdoor End Uses, such as piping, window profiles, siding, and roofing, where it is exposed to elements like moisture, temperature fluctuations, and pollutants. Additionally, PVC is inherently resistant to water, making it ideal for use in pipes and siding. However, without proper stabilization, moisture over time can still impact the material's surface, leading to discoloration and surface degradation. Stabilizers help to maintain the material's resistance to moisture and prevent damage caused by prolonged exposure to wet conditions.

Furthermore, governments and regulatory bodies worldwide have implemented stringent fire safety standards for building materials. For example, the EU and North America have regulations that require construction materials to pass specific fire performance tests. Stabilizers that enhance fire resistance are essential for ensuring PVC products meet these standards. As fire safety regulations become stricter, demand for flame-retardant stabilizers in PVC products used in construction End Uses is growing.

PVC is one of the most cost-effective materials used in construction, and its widespread use is driven by its affordability compared to other materials such as metal or wood. However, PVC needs to meet certain performance criteria to be competitive in the construction sector. Stabilizers are essential in achieving the desired performance attributes of PVC, such as flexibility, impact resistance, and processability.

Region Insights

Asia Pacific dominated the PVC additives market and accounted for the largest revenue share of over 43.8% in 2024 and is projected to grow at the fastest CAGR of 6.3% during the forecast period. This region has dominated the global market due to a combination of factors including strong industrial growth, increasing urbanization, the presence of leading manufacturing hubs, and the expanding demand from various end use industries. The APAC region, comprising countries like China, India, Japan, South Korea, and Southeast Asia, has witnessed tremendous economic growth over the past few decades, which has made it a key player in the market.

China PVC Additives Market Trends

China's PVC additives marketgrowthis primarily driven by the major global manufacturing hubs, producing a wide range of PVC products. The availability of cheap labor, favorable government policies, and robust infrastructure have led to the expansion of manufacturing facilities. As PVC is used in a variety of industries, such as electrical cables, pipes, flooring, and window profiles, the demand for PVC additives that improve the performance of these products is high. Additionally, the increasing disposable income of the middle class in countries like China and India is also fueling the demand for better housing, infrastructure, and consumer goods. This translates into a higher demand for PVC-based products, such as pipes, flooring, and insulation materials. The demand for high-quality, long-lasting PVC products, which rely on additives for enhanced properties, continues to grow.

North America PVC Additives Market Trends

In North America, the demand for PVC additives is growing due to the robust construction and infrastructure development, alongside advancements in manufacturing processes. With the region's focus on sustainable building materials and improved energy efficiency, the demand for high-performance PVC products, such as pipes, window profiles, and flooring, is increasing. Additionally, stricter environmental regulations are encouraging the use of eco-friendly PVC additives, driving innovation and higher adoption rates within industries like construction, automotive, and packaging.

The PVC additives industry in the U.S. is driven by the growth of the construction and housing markets, where PVC is favored for its durability, cost-effectiveness, and versatility. With an increasing emphasis on infrastructure modernization and the expansion of residential and commercial buildings, the need for high-performance PVC products is rising. Additionally, the shift toward sustainable building materials, supported by green construction initiatives and government policies, is pushing the demand for eco-friendly PVC additives, making them crucial for meeting regulatory standards and achieving energy-efficient construction goals.

Europe PVC Additives Market Trends

In Europe, the demand for PVC additives is expanding as a result of stringent environmental regulations and a growing emphasis on sustainability. The region's commitment to green building standards and reducing carbon footprints has led to increased demand for eco-friendly PVC products in the construction and infrastructure sectors. Additionally, the automotive industry's shift toward lightweight and durable materials, combined with innovations in the packaging industry, is pushing the need for additives that enhance PVC's performance. Europe's focus on recycling and circular economy practices also drives demand for additives that improve the recyclability and environmental footprint of PVC materials.

PVC Additives market in Germany is boosted by the country’s strong automotive and construction sectors, where high-performance materials are required to meet stringent regulations and quality standards. The automotive industry in Germany relies on PVC for lightweight and durable components, and additives are crucial for ensuring the material's functionality in this context. Furthermore, Germany's commitment to environmental sustainability and the circular economy has led to a greater focus on recycling, with additives playing a key role in improving the recyclability and eco-friendliness of PVC products, particularly in the construction and packaging industries.

Key PVC Additives Company Insights

The competitive landscape of the PVC additives industry is characterized by the presence of several key global and regional players that dominate the production and supply of various additives such as stabilizers, plasticizers, impact modifiers, lubricants, and processing aids. Major companies are prominent in the market, offering a wide range of high-performance products to meet the diverse needs of industries like construction, automotive, packaging, and healthcare. These players focus on innovation, expanding product portfolios, and developing eco-friendly and sustainable additives to comply with growing environmental regulations.

Additionally, regional players are actively investing in production facilities to strengthen their market position and expand their geographic reach. Strategic partnerships, acquisitions, and collaborations are common as companies seek to enhance their technological capabilities, enter new markets, and cater to evolving customer demands for high-quality and environmentally friendly PVC additives. As the demand for PVC additives grows, particularly in emerging economies, competition is intensifying, with companies focusing on differentiation through R&D, sustainability initiatives, and product customization to maintain a competitive edge in the global market.

-

In September 2023, BASF SE launched the industry’s first biomass balance offerings for plastic additives. This new range of plastic additives contributes to the replacement of fossil feedstock with renewable raw materials according to a certified biomass balance approach.

-

In October 2022, Clariant launched new additives at K 2022 to support plastics sustainable evolution. This anti-scratch additive for PP & TPO formulations boosts reuse potential of plastics used in consumer End Uses.

Key PVC Additives Companies:

The following are the leading companies in the PVC additives market. These companies collectively hold the largest market share and dictate industry trends.

- AkzoNobel

- Clariant

- SABIC

- Solvay

- LyondellBasell

- Formosa Plastics

- Ineos

- BASF

- Lanxess

- DuPont

- LG Chem

- Mitsubishi Chemical

- Chevron Phillips Chemical

- Dow

- Evonik

PVC Additives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.19 billion

Revenue forecast in 2030

USD 9.62 billion

Growth rate

CAGR of 6.0% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, end-use, region

States scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Key companies profiled

AkzoNobel; Clariant; SABIC; Solvay; LyondellBasell; Formosa Plastics; Ineos; BASF; Lanxess; DuPont; LG Chem; Mitsubishi Chemical; Chevron Phillips Chemical; Dow; Evonik

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global PVC Additives Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global PVC additives market report based on product type, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stabilizers

-

Impact Modifiers

-

Processing Aids

-

Lubricants

-

Plasticizers

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Building and Construction

-

Transportation

-

Packaging

-

Consumer Products

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global PVC additives market was estimated at around USD 6.80 billion in the year 2024 and is expected to reach around USD 7.19 billion in 2025.

b. The global PVC additives market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2030 to reach around USD 9.62 billion by 2030.

b. Building & construction end use segment emerged as the dominating application in the PVC Additives market due to a combination of factors related to performance, durability, sustainability, and regulatory compliance.

b. The key players in the PVC additives market include AkzoNobel, Clariant, SABIC, Solvay, LyondellBasell, Formosa Plastics, Ineos, BASF, Lanxess, DuPont, LG Chem, Mitsubishi Chemical, Chevron Phillips Chemical, Dow, and Evonik Industries.

b. The PVC Additives market is driven by flourishing construction on a global level. As urbanization accelerates in emerging economies—particularly in regions like Asia-Pacific, Africa, and Latin America—there is an increasing need for affordable, durable, and versatile building materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.