- Home

- »

- Next Generation Technologies

- »

-

Quality Management Software Market, Industry Report, 2030GVR Report cover

![Quality Management Software Market Size, Share & Trends Report]()

Quality Management Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution, By Deployment (On-Premise, Cloud), By Enterprise Size (Small & Medium Enterprise (SMEs), Large Enterprise), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-331-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Quality Management Software Market Summary

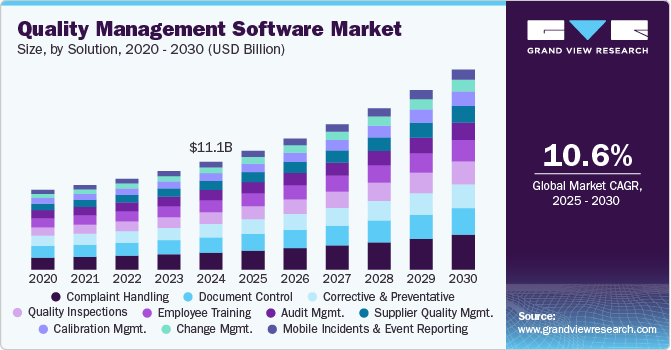

The global quality management software market size was estimated at USD 11.14 billion in 2024 and is projected to reach USD 20.66 billion by 2030, growing at a CAGR of 10.6% from 2025 to 2030. The rising demand for streamlining and centralizing business processes is driving market growth.

Key Market Trends & Insights

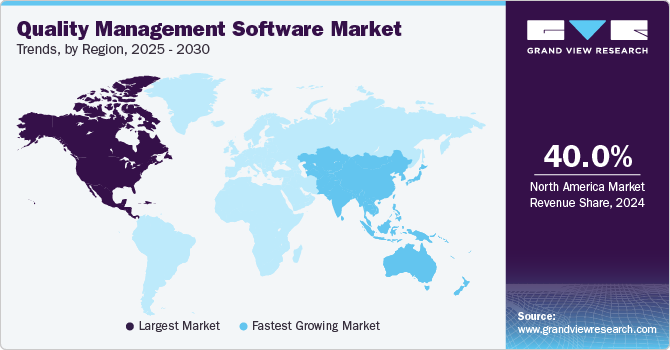

- North America held the highest market share of more than 40.0% in 2024.

- The U.S. dominated the quality management software industry in 2024.

- Based on solution, the complaint-handling segment held the largest revenue share of over 15.0% in 2024.

- Based on deployment, the on-premise segment dominated the quality management software industry with a revenue share of over 51.0% in 2024.

- Based on enterprise size, the large enterprises segment accounted for the largest revenue share of over 58.0% in 2024.

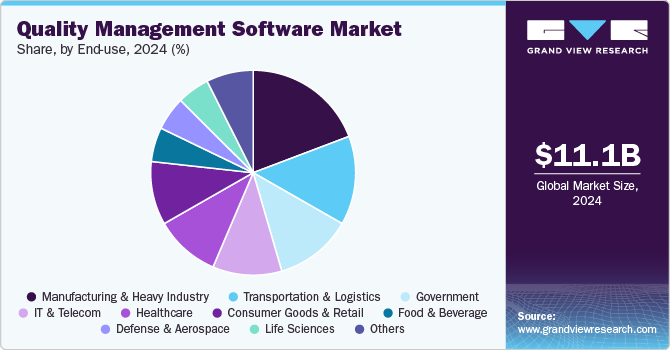

- Based on end-use, the manufacturing & heavy industry segment held the highest market share of 19.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.14 Billion

- 2030 Projected Market Size: USD 20.66 Billion

- CAGR (2025-2030): 10.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, the market is poised to expand, owing to the rising penetration of smart devices, the internet of things (IoT), and the industrial internet of things (IIoT). The integration of the Six Sigma approach in quality management software (QMS) is predicted to create new avenues for industrial expansion. Quality management software integrates numerous business processes into a single solution, such as audit management, document control, non-conformance management, environmental health and safety, training management, or supplier quality management. Enterprises and modern-day project managers are emphasizing implementing and inducing quality standards in their business processes to enhance the efficacy of the business. These factors are expected to drive the demand in the quality management software industry over the forecast period.

QMS offers benefits such as better visibility into enterprise data, reduction in manufacturing costs, mobility & flexibility in document control, and resolving non-conformance issues. Cloud-based QMS facilitates a connected system to transfer quality data in and out of a QMS solution. In April 2023, Greenlight Guru, a cloud-based software solutions developer for MedTech companies, announced the launch of Export API. The new feature enabled customers to export data from the QMS solution to third-party software, such as CRM, ERP, and business intelligence solutions. The new API functionality helped users drive efficiently. Such developments are expected to drive market growth over the forecasted period.

QMS allows businesses to manage their quality compliance processes better and align their operations with industry laws and standards. These solutions also allow organizations to align quality management strategies with their business objectives. Businesses are widely adopting quality management techniques such as Six Sigma and ISO standards to improve productivity, process effectiveness, and customer satisfaction. As a result, QMS is expected to play a vital role in enabling organizations to focus on quality process automation, supplier quality assurance, and compliance management during the forecasted period. Integrating real-time quality data with quality management software (QMS) is a powerful strategy to improve a company's ability to monitor, analyze, and improve its quality processes.

QMS facilitates end use enterprises to enhance product development by collecting people, product information, and processes into a single solution. QMS provides a closed-loop quality system by linking processes and quality records with product design, allowing manufacturers of medical devices and biotechnology to develop safe and compliant products. In September 2023, Arena Solutions, Inc. launched the Arena cloud native QMS and Product Lifecycle Management (PLM) software solutions in China. PTC Inc., the parent company of Arena Solutions, also partnered with VST ECS, a management services provider, and Amazon Web Services (AWS) to make Arena PLM and QMS available in China to meet the increasing demand for SaaS solutions.

Solution Insights

The complaint-handling segment held the largest revenue share of over 15.0% in 2024. Effective management of complaints helps organizations meet customer expectations. Conventional tools and processes for complaint handling help businesses handle customer complaints effectively and efficiently, enabling them to remain successful in the long run. However, changing consumer behavior and purchasing preferences, coupled with the rising demand for customized solutions, are compelling organizations to focus more on enhancing customer satisfaction to engage customers for longer periods. Subsequently, a robust complaint management system can help handle distinct and complex customer queries, resolve their issues, and offer them a satisfactory experience.

The change management segment is anticipated to register a CAGR of 11.9% over the forecast period. Advancements in artificial intelligence (AI) and automation are also propelling the growth of change management within QMS software. AI-powered predictive analytics help organizations anticipate potential risks associated with process changes, enabling proactive decision-making. Automation streamlines repetitive tasks such as impact assessments, risk analysis, and approvals, reducing the time required to implement changes while minimizing human intervention. This not only accelerates operational efficiency but also enhances accuracy in managing changes, leading to improved product quality and customer satisfaction.

Deployment Insights

The on-premise segment dominated the quality management software industry with a revenue share of over 51.0% in 2024. The demand for on-premise software is increasing as several businesses are transitioning from manual systems to automated systems. On-premise deployment of QMS facilitates the customization of the software to the client's business requirements. Businesses emphasizing high levels of data protection prefer on-premise QMS deployment to mitigate the risks associated with the loss of sensitive information and critical company data. Due to high data security, end users are increasingly implementing on-premise quality management software.

The cloud segment is expected to witness a significant CAGR over the forecast period. Cybersecurity and data integrity have also become critical concerns, prompting QMS providers to invest heavily in cloud security measures. With the increasing number of cyber threats, businesses need assurance that their quality data remains protected. Leading cloud QMS providers offer advanced security features such as end-to-end encryption, multi-factor authentication, and role-based access controls to safeguard sensitive information. These security enhancements build trust and encourage industries handling confidential data, such as healthcare and finance, to adopt cloud-based quality management solutions.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share of over 58.0% in 2024. Large organizations require consolidated resources to manage their business activities on a single solution. QMS solutions offer them the option to maintain control over procedures and help implement enterprise-wide deployment. Cost-effectiveness is one of the major factors driving the adoption of QMS solutions among large enterprises. Many QMS suppliers offer dedicated software suites for large enterprises. These suites perform a vital role in the selection process since they are created to address the precise needs of the clients.

The small and medium enterprise (SME) segment is anticipated to expand at the fastest CAGR during the forecast period. QMS solutions help SMEs reduce the overall cost of a finished product by streamlining processes. The demand for QMS solutions from SMEs is typically high since SMEs are highly focused on cost efficiency. SMEs prefer robust quality management software to scale their operations and ensure regulatory compliance. Moreover, QMS can play a critical role by helping SMEs eliminate waste, mitigate errors, and minimize inefficiencies. All such factors are driving the adoption of QMS among SMEs.

End-use Insights

The manufacturing & heavy industry segment held the highest market share of 19.2% in 2024. The rise of smart manufacturing, as well as the application of Information and Communication Technology (ICT) in every manufacturing aspect, is expected to shape the modern manufacturing sector in the coming years. Industrial robotics, data analytics, 3D printing, and machine learning are some of the leading technologies that would boost segment growth. Increasing awareness among manufacturers regarding the benefits of QMS in curbing downtimes and asset failure rates is further anticipated to propel the segment over the forecast period.

The healthcare segment is expected to register a highest CAGR from 2025 to 2030. The healthcare industry has undergone major changes in the past few years, forcing pharma companies to focus on improving their internal efficiency to stay competitive in the market. QMS solutions help pharma companies enhance the quality and availability of medicines by developing effective monitoring controls. For the healthcare industry, QMS solutions help enhance the quality of the healthcare system by prioritizing the quality of products. Healthcare QMS also allows pharma companies to develop quality products, exercise control over suppliers, support data integrity, and maintain overall compliance. The adoption of standardized Quality Management Software (QMS) (QMS) procedures is increasing as pharmaceutical businesses expand globally. This practice ensures consistency in quality standards across various locations, aligning with various international regulations. This trend contributes to the growth of the pharmaceutical quality management software market.

Regional Insights

North America held the highest market share of more than 40.0% in 2024. Medical and hospital associations in North America are widely demanding compliance-based products and services. QMS is used in various healthcare programs and organizations in the U.S., such as home care organizations, nursing homes, and ambulatory care providers. Moreover, many quality management software providers are introducing new products, thus driving the market demand of the segment in the region.

U.S. Quality Management Software Market Trends

The U.S. dominated the quality management software industry in 2024. The U.S. quality management software (QMS) market is experiencing robust growth, driven by the increasing need for organizations to ensure compliance, improve operational efficiency, and enhance product quality. With industries such as healthcare, manufacturing, pharmaceuticals, and automotive facing stringent regulatory requirements, businesses are investing in advanced QMS solutions to streamline their quality control processes. The U.S. Food and Drug Administration (FDA), International Organization for Standardization (ISO), and Occupational Safety and Health Administration (OSHA) impose strict guidelines on product quality, safety, and documentation.

Europe Quality Management Software Market Trends

The quality management software industry in Europe is anticipated to register considerable growth from 2025 to 2030. Europe’s complex and highly regulated supply chains are driving the need for advanced QMS solutions. With businesses sourcing materials and manufacturing products across multiple countries, ensuring consistent quality and compliance throughout the supply chain is a challenge. QMS solutions enable real-time supplier monitoring, quality audits, and collaboration across various production sites. This capability is crucial for industries like aerospace, automotive, and pharmaceuticals, where maintaining strict quality standards is essential to regulatory compliance and customer satisfaction.

Germany quality management software market dominated in 2024. Companies in Germany are widely demanding integrated QMS solutions to improve communication among customers, suppliers, and stakeholders. This has created a demand for better customer service with in-country presence and local language support, enabling companies to provide implementation and consulting services to support customers seamlessly.

Quality management software market in France is expected to grow significantly during the forecast period. QMS market players in France are carrying out various strategic initiatives, such as partnerships and collaborations, to introduce QMS software across the country and stay competitive in the market. For instance, in October 2022, Dassault Systemes SE, a developer of Product Lifecycle Management (PLM) software, partnered with Sanofi S.A., a pharmaceutical company based in France, to optimize the EVolutive Facility production at Sanofi S.A.’s modular manufacturing facilities in Singapore and France.

Asia Pacific Quality Management Software Market Trends

Asia Pacific is expected to register the fastest CAGR of more than 12.7% over the forecast period. Asia Pacific has observed a rising number of SMEs that are widely adopting cloud computing technology. This, in turn, has created opportunities for the adoption of cloud QMS solutions. COVID-19 has also prompted the countries in the Asia Pacific to emphasize pharmaceutical manufacturing, transportation, and logistics while ensuring optimum quality. This has increased the demand for pharma QMS solutions, particularly in the emerging economies of the region. The growing awareness of quality management compliance and standards has also led to the increased demand for QMS in the manufacturing and transportation & logistics industries across the region. Similarly, there is an increased emphasis on robust supplier quality management within QMS software. Ensuring the quality of raw materials and components supplied by external vendors is critical for overall product quality. The increasing adoption of quality management system software in the manufacturing industry will help with the overall market growth.

China quality management software market’s growth is driven by the rapidly expanding manufacturing sector in the country. As the country transitions from low-cost manufacturing to high-tech and high-quality production, the need for advanced quality control solutions is increasing. The integration of Industry 4.0 technologies, such as the Internet of Things (IoT), robotics, and digital twins, is pushing manufacturers to adopt QMS solutions that offer real-time monitoring, predictive maintenance, and automated quality inspections. These technologies help reduce defects, improve efficiency, and enhance product consistency, making them essential for maintaining competitiveness in both domestic and international markets.

Middle East & Africa Quality Management Software Market Trends

The quality management software industry in the Middle East and Africa (MEA) region is anticipated to reach USD 0.63 billion by 2030. The growth of the QMS market in MEA is attributed to the stringent regulations and standards followed by the Gulf countries in their major petroleum and oil & gas industries. Moreover, the need to comply with standards such as ISO 9001:2015, DIN EN 15224, and ISO 14001:2015 in most Middle Eastern & African countries has increased the demand for QMS solutions in the manufacturing, healthcare, and transportation industries.

Quality management software market in Saudi Arabia is anticipated to grow significantly in the coming years. The healthcare industry in Saudi Arabia is highly developed with advanced medical facilities serving both residents and medical tourists. Furthermore, due to stringent government regulations, the need for quality management certifications in countries such as Saudi Arabia and the UAE has been considered the biggest challenge by enterprises and investors. As such, the demand for QMS solutions is expected to increase in the healthcare industry to overcome regulatory hindrances.

Key Quality Management Software Company Insights

Some of the key players operating in the market include Microsoft Corporation, SAP SE, and MasterControl, Inc.

-

Microsoft Corporation is a technology, cloud computing, software solutions, and AI-driven enterprise tools company. Microsoft’s key enterprise offerings include Quality Management Software (QMS) (QMS), which help organizations ensure compliance, efficiency, and continuous improvement in product and service quality. While Microsoft does not offer a dedicated QMS, it provides a powerful ecosystem of tools through Microsoft Dynamics 365, Power Solution, and Azure AI that enable businesses to implement and manage quality control processes seamlessly.

-

SAP SE is a global provider of enterprise software solutions, cloud computing, and business process automation. As part of its enterprise offerings, SAP provides a robust Quality Management Software (QMS) (QMS) solution integrated within its SAP S/4HANA and SAP ERP solutions. The SAP Quality Management (SAP QM) module is designed to help businesses ensure product quality, regulatory compliance, and continuous process improvement across manufacturing, supply chain, and service operations. By automating quality control processes, SAP QM enables organizations to reduce defects, enhance traceability, and optimize production workflows.

MasterControl, Inc.; EtQ Management Consultants, Inc.; and Arena Solutions, Inc. are the emerging participants operating in the quality ma[p-nagement software market.

-

MasterControl Inc. provides an integrated Quality Management System (QMS) solution tailored for regulated industries, aiming to optimize and simplify quality processes. The solution includes features such as document control, training management, audit management, and other essential functionalities crucial for effective quality management in regulated sectors.

-

Arena Solutions, Inc. provides a product-focused quality management system, which helps connect product designs and quality into a secure single system. This feature helps maintain regulatory compliance while introducing new products into the market.

Key Quality Management Software Companies:

The following are the leading companies in the quality management software market. These companies collectively hold the largest market share and dictate industry trends.

- Arena Solutions, Inc.

- Cority Software Inc.

- Dassault Systemes SE

- EtQ Management Consultants, Inc.

- Ideagen Plc

- Intelex Technologies

- MasterControl, Inc.

- MetricStream, Inc.

- Microsoft Corporation

- Oracle Corporation

- Pilgrim Quality Solution

- Plex Systems, Inc.

- SAP SE

- Siemens AG

- Sparta Systems Inc.

- uniPoint Software, Inc.

- Veeva Systems

Recent Developments

-

In September 2023, Ideagen acquired DevonWay, Inc., a provider of compliance and operations management software, to broaden the solutions offerings in regulated and high-compliance industry companies. DevonWay, Inc. provides a fully integrated, configurable product suited across health and safety, environmental quality management, workforce management, and enterprise asset management.

-

In May 2023, Greenlight Guru launched Risk Solutions, a complete risk management software that pairs AI-generated insights with risk management workflows. The solutions provide a better way for Medtech companies to manage risk for their businesses. Moreover, the software includes numerous features such as in-line editing for creating and documenting risk activities and auto-calculated estimated risk probabilities.

-

In April 2023, Greenlight Guru, a cloud-based software solutions developer for MedTech companies, announced the launch of its Export API. The new feature enabled customers to export the data from the QMS solution to third-party software, such as CRM, ERP, and business intelligence solutions. Furthermore, the new API functionality helped users drive efficiently.

-

In April 2023, Qualityze, a quality management software provider, unveiled Qualityze EQMS, a cloud-based quality management software for the telecommunications industry. The software was built on Salesforce, Inc.’s cloud solution to help telecommunications enterprises achieve various quality objectives with greater security, reliability, and flexibility.

Quality Management Software Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 12.26 billion

Revenue Forecast in 2030

USD 20.66 billion

Growth rate

CAGR of 10.6% from 2025 to 2030

Actual Data

2018 - 2024

Forecast Period

2025 - 2030

Quantitative Units

Revenue in USD billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Solution, deployment, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key Companies Profiled

Arena Solutions, Inc.; Cority Software Inc.; Dassault Systemes SE; EtQ Management Consultants, Inc.; Ideagen Plc.; Intelex Technologies; MasterControl, Inc.; MetricStream, Inc.; Microsoft Corporation; Oracle Corporation; Pilgrim Quality Solution; Plex Systems, Inc.; SAP SE; Siemens AG; Sparta Systems Inc.; uniPoint Software, Inc.; Veeva Systems

Customization Scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Quality Management Software Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global quality management software market report based on solution, deployment, enterprise size, end-use, and region:

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Document Control

-

Non-Conformances/Corrective & Preventative

-

Complaint Handling

-

Employee Training

-

Quality Inspections (PPAP & FAI)

-

Audit Management

-

Supplier Quality Management

-

Calibration Management

-

Change Management

-

Mobile Incidents and Event Reporting

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-Premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small and Medium Enterprise (SME)

-

Large Enterprise

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecom

-

Life Sciences

-

Transportation & Logistics

-

Aviation

-

Maritime

-

Railways

-

-

Consumer Goods & Retail

-

Food & Beverage

-

Defense & Aerospace

-

Manufacturing & Heavy Industry

-

Utilities

-

Government

-

Federal

-

State

-

Local

-

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global quality management software market size was estimated at USD 11.14 billion in 2024 and is expected to reach USD 12.26 billion in 2025.

b. The global quality management software market is expected to witness a compound annual growth rate of 11.0% from 2025 to 2030 to reach USD 20.66 billion by 2030.

b. North America held the largest share of over 40.9% in 2024 and is expected to dominate the global quality management software market. Increasing use of artificial intelligence, machine learning, and data analytics by the major vendors in the region will foster the demand for QMS solutions.

b. Arena Solutions, Inc., Cority Software Inc., Dassault Systemes SE, EtQ Management Consultants, Inc., Ideagen Plc., Intelex Technologies, MasterControl, Inc., MetricStream, Inc., Microsoft Corporation, Oracle Corporation, Pilgrim Quality Solution, Plex Systems, Inc., SAP SE, Siemens AG, Sparta Systems Inc., uniPoint Software, Inc., and Veeva Systems are some of the other players driving the market growth.

b. Factors such as the increasing importance of quality assurance, customer-centric production, and changes in standards and regulations are driving the growth of the quality management software market. Moreover, increasing demand and applications of QMS software across various industry sectors will also boost the market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.