- Home

- »

- Healthcare IT

- »

-

Pharmaceutical Quality Management Software Market, 2030GVR Report cover

![Pharmaceutical Quality Management Software Market Size, Share & Trends Report]()

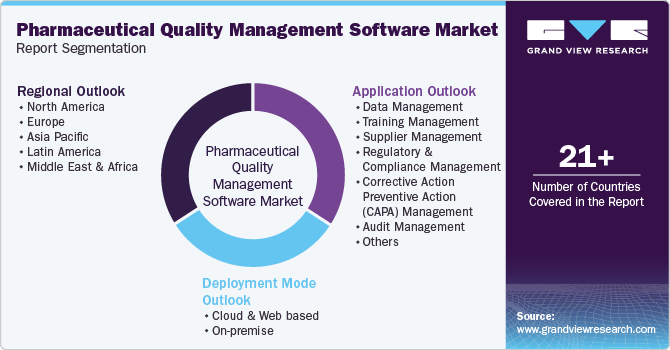

Pharmaceutical Quality Management Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Data Management, Risk Management, Audit Management), By Deployment Mode (Cloud & Web-based, On-premise), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-130-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Quality Management Software Market Summary

The global pharmaceutical quality management software market size was estimated at USD 1.87 billion in 2024 and is projected to reach USD 3.85 billion by 2030, growing at a CAGR of 12.99% from 2025 to 2030. The increasing use of digital technology in the pharmaceutical sector, the growing need to comply with regulatory guidelines, and the rising complexity of supply chains are factors contributing to market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, pharmaceutical quality management software market in the U.S. is experiencing significant growth.

- Based on applications, data management segment dominated the market in 2024.

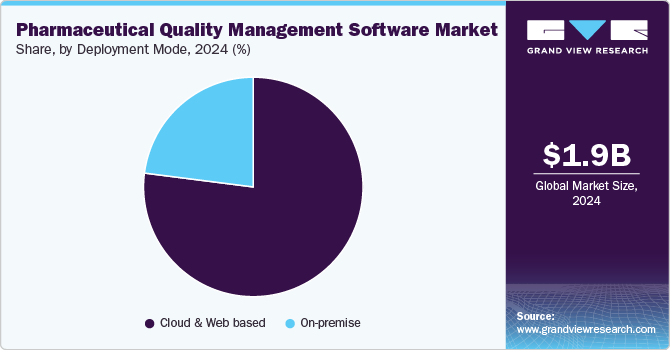

- Based on deployment mode, the cloud & web-based segment held the largest market share of 77.02% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.87 Billion

- 2030 Projected Market Size: USD 3.85 Billion

- CAGR (2025-2030): 12.99%

- North America: Largest market in 2024

In addition, increasing expenses in drug manufacturing are driving market growth further. Moreover, the increasing demand for compliance with regulatory guidelines significantly drives the adoption of quality management software (QMS) in the pharmaceutical industry. This shift is influenced by the need to ensure product safety, efficacy, and adherence to stringent regulations imposed by authorities, such as the FDA and ISO standards. The pharmaceutical sector is highly regulated, requiring companies to maintain high quality and safety standards. A robust QMS helps organizations meet these regulatory demands efficiently, ensuring that products are safe for public use and comply with necessary guidelines.Furthermore, the increasing number of clinical trials and significant financial challenges associated with managing trial data have led to the emergence of software-based quality management systems as a crucial solution for reducing drug development costs. For instance, according to ClinicalTrials.gov, more than half a million studies were registered on ClinicalTrials.gov as of February 2025. Companies are launching new products to enhance clinical trial studies. For instance, in January 2023, Palantir Technologies Inc. launched a fit-for-purpose Quality Management System for end-to-end analysis of clinical data and to meet GxP requirements.

In addition, technological advancements are also a significant factor in harnessing the adoption of QMS in the pharmaceutical industry. Advancements such as cloud computing, Internet-of-Things (IoT), analytics, and big data have greatly enhanced Quality Management Systems (QMS) regarding scalability, cost-effectiveness, flexibility, and platform independence. These innovations have significantly expanded QMS capabilities, making them more scalable, cost-efficient, adaptable, and platform-agnostic.

Moreover, modern QMS leverages data analytics to drive informed decision-making. By utilizing advanced technologies, such as Artificial Intelligence (AI) and Machine Learning (ML), organizations can predict potential issues before they arise and optimize manufacturing processes, leading to improved product quality & shorter development cycles. Several companies have recently launched innovative solutions in the life sciences sector, including pharmaceutical industry focusing on AI integration to enhance various operational aspects. For instance, in February 2025, ComplianceQuest collaborated with Salesforce to deliver LifeQuest 360, an AI-powered platform for the pharmaceutical and other life science industries.

Case Study & Insights: Transforming Pharmaceutical Clinical Trials with AI-powered platforms

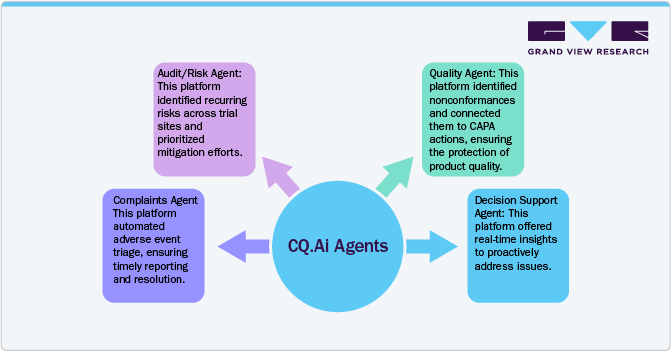

The case study from ComplianceQuest highlights the transformative impact of AI-powered QMS platform in managing clinical trials.

Business Challenges

In a Phase III clinical trial, a global pharmaceutical firm encountered difficulties handling adverse event reports, ensuring regulatory compliance, and optimizing operational efficiency. To address these issues, they revamped their processes by implementing Compliance Quest's LifeQuest 360 intelligence platform, CQ.AI, powered by Agentforce, a Salesforce platform.

Solution

The above pharmaceutical company used CQ.AI Agents to streamline its operations, ensure compliance, and accelerate the delivery of life-saving therapies.

Result

The integration of AI into Quality Management Systems (QMS) is transforming how companies handle quality control and assurance. By utilizing AI-driven insights, these QMS platforms enable organizations to anticipate risks, detect problems, monitor overall operational performance, and proactively address issues. This approach ensures continuous quality improvements and operational excellence.

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of merger & acquisitions activities, degree of innovation, impact of regulations, and regional expansion. The market is consolidated, with the presence of key providers dominating the market. The degree of innovation is high, and the level of merger & acquisitions activities is moderate. The impact of regulations on the industry is high, and the product expansion of the industry is moderate.

The pharmaceutical quality management software market experiences a high degree of innovation driven by technological advancements. Integrating artificial intelligence in QMS helps streamline drug development and manufacturing processes by automating repetitive tasks and reducing the risk of noncompliance. For instance, in April 2023, Dot Compliance launched an innovative, ready-to-use AI-based eQMS for life sciences, including the pharmaceutical industry. This system utilizes ChatGPT and proprietary algorithms to optimize quality processes, automate tasks, and enhance compliance, allowing quality assurance professionals to focus on critical priorities.

The industry is experiencing a moderate level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market.

The impact of regulations is high, with various local regulatory governing the market. Various regulatory authorities such as the U.S. FDA, MHRA, EMA, etc. establish the criteria under which electronic records are considered trustworthy and reliable, equivalent to traditional paper records, thereby ensuring compliance and safeguard product quality. For instance, in January 2024, FDA introduced the Quality Management System Regulation (QMSR) to update the Current Good Manufacturing Practice (CGMP) standards for medical devices, aligning them with the Quality System (QS) regulation.

The industry is witnessing moderate product expansion, driven by an increasing customer base for quality management software. Firms are aligning with technology providers and consulting agencies to enhance their product offerings and expand market reach. For instance, in April 2024, Clarivate Plc, a provider of transformative intelligence, announced the acquisition of Global QMS, Inc., commonly known as Global Q. This company offers cloud-based solutions that help pharmaceutical companies automate regulatory reporting and compliance management.

Application Insights

Based on applications, data management segment dominated the market in 2024 and accounted for the largest revenue share of 17.52%. The rising volume of inconsistent healthcare data and the increased demand from regulatory organizations for reports that adhere to exacting quality standards are the main factors influencing this growth. Big Data is frequently used by the pharmaceutical industry. These companies employ data for a variety of tasks, such as analyzing clinical findings and assessing the efficacy of medications based on actual health outcomes.

Furthermore, the regulatory and compliance management segment is expected to grow at the fastest CAGR from 2025 to 2030. The segment's growth is attributed to the increasing complexity of regulatory requirements, the need for enhanced data integrity and traceability, and the growing emphasis on patient safety. As sciences companies face increased scrutiny regarding product quality and safety, they must adopt robust QMS that integrate regulatory compliance features. These systems facilitate real-time compliance status monitoring, streamline audit processes, and ensure proper documentation practices.

Deployment Mode Insights

Based on deployment mode, the cloud & web-based segment held the largest market share of 77.02% in 2024 and is expected to register growth at the fastest CAGR during the forecast period. The adoption of web and cloud-based quality management software in the pharmaceutical industry is transforming how organizations manage compliance and quality assurance processes. By leveraging these technologies, companies are anticipated to enhance collaboration, ensure regulatory adherence, and ultimately deliver higher-quality products more efficiently. As industry continues to evolve, these systems are expected to be integral in navigating the complexities of modern life sciences operations.

On-premises software accounted for a significant revenue share in 2024. On-premise pharmaceutical QMS is designed to help organizations manage quality processes, ensure regulatory compliance, and enhance operational efficiency. These systems are installed locally on the organization's servers and require significant investment in hardware and maintenance. On-premise solutions are preferred by many healthcare entities due to their enhanced data security capabilities. These systems allow organizations to maintain control over sensitive data, minimizing the risk of breaches that could compromise patient safety and regulatory compliance.

Regional Insights

North America pharmaceutical quality management software market dominated with the largest revenue share of 38.63% in 2024. The pharmaceutical quality management software (QMS) market in North America is evolving rapidly, driven by the need for stringent compliance with regulatory standards, the increasing complexity of product development processes, and the increasing focus on quality control and quality assurance during the product lifecycle. Pharmaceutical companies seek to maintain high-quality standards while navigating regulations. The quality management software helps organizations manage documentation, ensure product safety, and facilitate compliance efforts across various product lifecycle stages.

U.S. Pharmaceutical Quality Management Software Market Trends

Pharmaceutical quality management software market in the U.S. is experiencing significant growth, driven by an increasing emphasis on regulatory compliance and the need for enhanced operational efficiency within the pharmaceutical and biopharmaceutical industry. The necessity for QMS arises from the complex regulatory landscape that governs these industries, where adherence to standards such as Good Manufacturing Practices (GMP), Food and Drug Administration (FDA) regulations, ISO 9001, ISO 15378, etc. are critical. Companies are increasingly adopting QMS solutions to facilitate processes, ensure product quality, and mitigate risks associated with non-compliance.

Europe Pharmaceutical Quality Management Software Market Trends

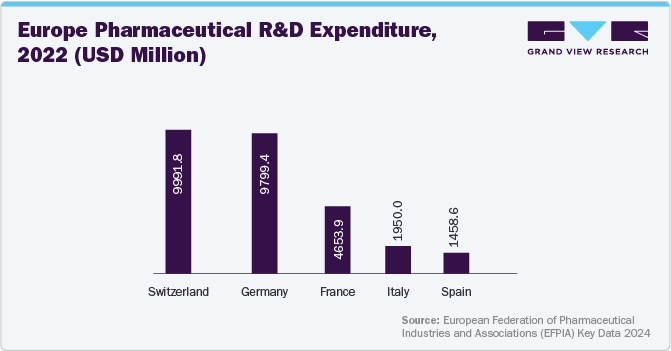

Europe pharmaceutical quality management software market observed lucrative growth in 2024, driven by growing requirements to comply with strict regulatory standards and the need for improved operational efficiency. As pharmaceutical firms strive to comply with strict regulations imposed by agencies such as the European Medicines Agency (EMA) and the FDA, the demand for robust QMS solutions has increased. In addition, the increasing expenditure on pharmaceutical R&D in the region contributes to market growth.

Pharmaceutical quality management software market in the UK is expected to grow over the forecast period, owing to the increasing regulatory demands and a strong emphasis on quality assurance. Moreover, stringent regulatory landscape has created a crucial need for effective quality management systems to facilitate processes and reduce risks associated with non-compliance.

Germany pharmaceutical quality management software market held the largest market share in 2024 in the European market. As pharmaceutical and biopharmaceutical industries face stringent regulations from authorities such as the European Medicines Agency (EMA) and the Federal Institute for Drugs and Medical Devices (BfArM), organizations adopt QMS solutions to ensure product quality and safety. Moreover, the robust presence of key pharmaceutical companies and growing R&D in the country propels market growth further.

Asia Pacific Pharmaceutical Quality Management Software Market Trends

Pharmaceutical quality management software market in Asia Pacific is poised to grow at the fastest CAGR from 2025 to 2030 due to the increasing regulatory requirements imposed by health authorities, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), and local regulatory agencies. Moreover, rapid technological advancements, including cloud computing and artificial intelligence has facilitated the development of more sophisticated QMS tools that enhance efficiency and data accuracy.

Pharmaceutical quality management software market in Japan is expected to grow significantly over the forecast period. The increasing regulatory requirements and the need for enhanced operational efficiency within the pharmaceutical and biopharmaceutical sectors have significantly influenced the growth of pharmaceutical QMS in Japan. Moreover, the market growth is further propelled by technological advancements, including cloud computing and data analytics, which enable organizations to streamline their quality processes, improve documentation management, and facilitate real-time monitoring of quality metrics.

India pharmaceutical quality management software market in has been significantly influenced by the rapid expansion of the pharmaceutical and biopharmaceutical industries. As India emerges as a global hub for drug manufacturing and clinical research, there is an improved need for robust quality management systems to streamline processes such as document control, audit management, and regulatory compliance. The Indian government's initiatives to promote digitalization in healthcare and life sciences have further accelerated this trend.

Latin America Pharmaceutical Quality Management Software Market Trends

Latin America pharmaceutical quality management software market is anticipated to grow at a significant CAGR over the forecast period, driven by the increasing regulatory demands and the need for enhanced operational efficiency. As the pharmaceutical sector in Latin America continues to evolve, the emphasis on quality management intensifies, further contributing to market growth.

Middle East and Africa Pharmaceutical Quality Management Software Market Trends

Middle East and Africa pharmaceutical quality management software market is expected to grow at a significant CAGR over the forecast period. The market is characterized by a dynamic landscape driven by increasing regulatory requirements and the need for enhanced compliance in the pharmaceutical sectors. Governments across the region are implementing stricter regulations to ensure product safety and efficacy, which has led to a rising demand for robust QMS solutions.

Key Pharmaceutical Quality Management Software Company Insights

Key players operating in the pharmaceutical quality management software market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key Pharmaceutical Quality Management Software Companies:

The following are the leading companies in the pharmaceutical quality management software market. These companies collectively hold the largest market share and dictate industry trends.

- MasterControl Solutions, Inc.

- AmpleLogic

- Qualio

- Pilgrim (IQVIA)

- QT9

- Sparta Systems (TrackWise)

- AssurX, Inc.

- Dassault Systèmes

- ETQ, LLC (Hexagon)

- Veeva Systems

- Qualityze Inc.

- Ideagen

Recent Developments

-

In February 2025, Yokogawa Electric Corporation launched the OpreX Quality Management System. This system is a cloud-based solution designed to expedite digital transformation in quality assurance processes.

-

In October 2022, Qualio - QMS for Life Sciences launched its Modern Validation Pack to enhance quality and compliance processes for the life sciences sector. This initiative is designed to help companies navigate the latest updates in Good Automated Manufacturing Practice (GAMP) and Computerized System Assurance (CSA) guidelines from the FDA, promoting a more efficient and less resource-intensive validation process.

-

In April 2022, Hexagon AB acquired the ETQ, a prominent provider of SaaS-based quality management systems (QMS), environmental health and safety (EHS), and compliance management software.

Pharmaceutical Quality Management Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.09 billion

Revenue forecast in 2030

USD 3.85 billion

Growth rate

CAGR of 12.99% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, deployment mode, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

MasterControl Solutions, Inc.; AmpleLogic; Qualio; Pilgrim (IQVIA); QT9; Sparta Systems (TrackWise); AssurX, Inc.; Dassault Systèmes; ETQ, LLC (Hexagon); Veeva Systems; Qualityze Inc.; Ideagen

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Quality Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical quality management software market report based on application, deployment mode, and region:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Camera

-

2D

-

3D

-

-

Frame Grabber

-

Optics/Lenses

-

LED Lighting

-

Processor

-

-

Software

-

Barcode Reading

-

Standard Algorithm

-

Deep Learning Software

-

-

Services

-

Integration

-

Solution Management

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

PC Based

-

Smart Camera Based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Quality Assurance and Inspection

-

Positioning and Guidance

-

Measurement

-

Identification

-

Predictive Maintenance

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Pharmaceuticals & Chemicals

-

Electronics & Semiconductor

-

Pulp & Paper

-

Printing & Labeling

-

Food & Beverage (Packaging and Bottling)

-

Glass & Metal

-

Postal & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Israel

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical quality management software market size was estimated at USD 1.87 billion in 2024 and is expected to reach USD 2.09 billion in 2025.

b. The global pharmaceutical quality management software market is expected to grow at a compound annual growth rate of 12.99% from 2025 to 2030 to reach USD 3.85 billion by 2030.

b. North America dominated the pharmaceutical quality management software market with a share of over 38% in 2024. This can be attributed to the growing need for better production and quality control standards, advanced healthcare infrastructure, stringent regulatory requirements, and increasing focus on drug safety.

b. Some key players operating in the pharmaceutical quality management software market include MasterControl Solutions, Inc., AmpleLogic, Qualio, Pilgrim (IQVIA), QT9, Sparta Systems (TrackWise), AssurX, Inc., Dassault Systèmes, ETQ, LLC (Hexagon), Veeva Systems, Qualityze Inc., and Ideagen.

b. Key factors that are driving the pharmaceutical quality management software market growth include increasing cost of drugs manufacturing, increasing technological adoption in pharmaceutical companies and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.