- Home

- »

- Next Generation Technologies

- »

-

Quantum Cryptography Market Size And Share Report, 2030GVR Report cover

![Quantum Cryptography Market Size, Share & Trends Report]()

Quantum Cryptography Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Hardware, Software, Services), By End-use, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-264-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Quantum Cryptography Market Summary

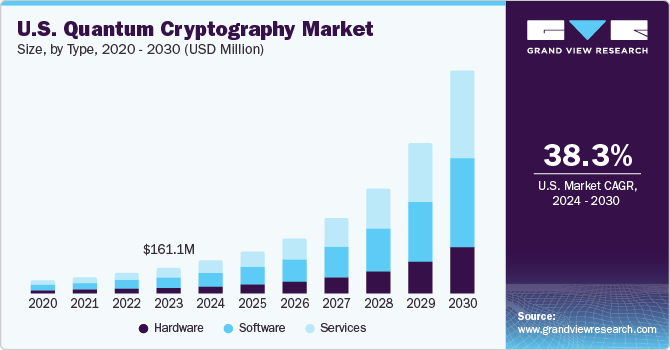

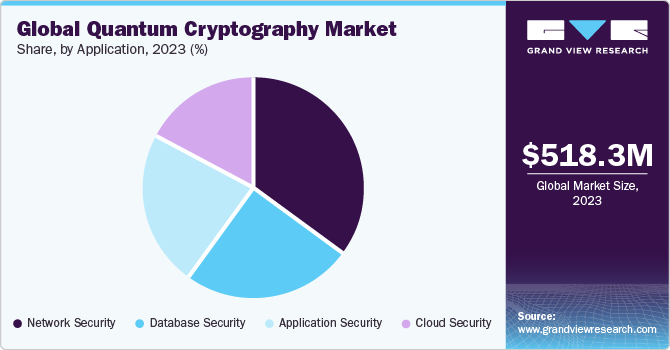

The global quantum cryptography market size was estimated at USD 518.3 million in 2023 and is projected to reach USD 4,623.2 million by 2030, growing at a CAGR of 38.3% from 2024 to 2030. The increase in cybersecurity threats and the advent of quantum computing are driving the demand for quantum cryptography.

Key Market Trends & Insights

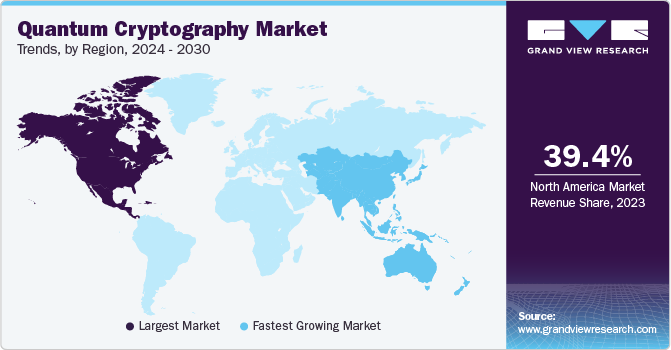

- North America dominated the quantum cryptography market with a revenue share of 39.4% in 2023.

- The quantum cryptography market in U.S. accounted for revenue share of 24.5% in 2023.

- Based on type, the software segment led the market with the largest revenue share of 43.8% in 2023.

- Based on end-use, the healthcare segment held the market with the largest revenue share of 24.2% in 2023..

- Based on application, the network security segment led the market with the largest revenue share of 34.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 518.3 Million

- 2030 Projected Market Size: USD 4,623.2 Million

- CAGR (2024-2030): 38.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

It is an innovative technology that utilizes the principles of quantum mechanics to safeguard communication channels. Quantum cryptography is an advanced technology that exploits the fundamental principles of quantum mechanics to secure communication channels. The technology works by using quantum states to transmit information, ensuring that any attempt to intercept or observe the communication will inevitably disturb the quantum state, alerting the parties involved. As such, quantum cryptography offers a highly secure and reliable solution for the protection of sensitive data and information. One of the key aspects that underpin its effectiveness is the principle of quantum key distribution (QKD), which enables the generation of encryption keys that are theoretically impossible to hack due to the laws of quantum physics. This enhanced security and the ability to actively monitor its state is propelling the market growth.

The proliferation of quantum computers poses a significant threat to contemporary encryption systems. Shor's algorithm, one of the most crucial quantum computing algorithms, has the potential to compromise virtually all encryption systems currently employed to secure internet traffic against interception. Encryption supports a significant proportion of cybersecurity measures. In August 2021, the U.S. National Security Agency announced that adversarial use of a quantum computer could have devastating effects on National Security Systems and the nation as a whole. The enhanced security measures employed by quantum cryptography make it virtually difficult to breach and tackle this situation, offering a level of protection that far exceeds traditional encryption methods, driving the market growth.

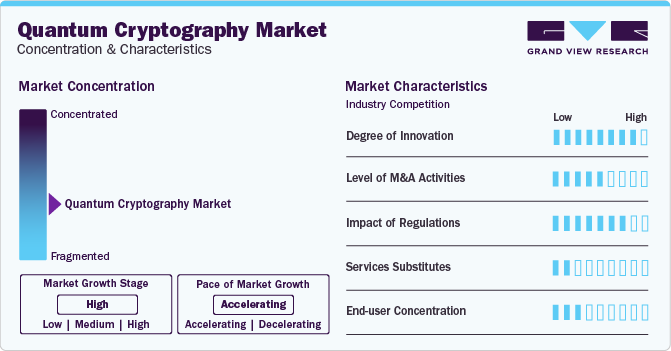

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The degree of innovation is high due to continuous advancements in quantum technologies, cryptographic algorithms, and quantum-resistant encryption methods that contribute to a dynamic landscape. Companies are collaborating with governmental organizations to aid the penetration of quantum cryptography. For instance, in February 2024, the Linux Foundation initiated the Post-Quantum Cryptography Alliance (PQCA) with the goal of promoting the adoption of post-quantum cryptography. The PQCA seeks to facilitate cryptographic flexibility throughout the ecosystem in alignment with the timeframes outlined in the U.S. National Security Agency’s Cybersecurity Advisory regarding the Commercial National Security Algorithm Suite 2.0.

The market is fragmented, featuring several global and regional players,due to the presence of diverse market players, technological approaches, global reach, and ongoing research and development activities. Furthermore, the level of mergers and acquisitions (M&A) activities in the market is moderate. While there is collaboration and partnerships among companies and research institutions to leverage collective expertise, large-scale acquisitions are relatively limited.

Regulations play a significant role in shaping the global market. Data protection and privacy regulations, such as GDPR in Europe, influence the adoption of quantum-resistant encryption methods, especially in sectors dealing with sensitive information. Governments may also introduce regulatory frameworks to encourage or mandate the use of quantum-safe cryptographic solutions. Compliance with evolving regulations is a factor influencing market dynamics and driving innovation.

Type Insights

Based on type, the software segment led the market with the largest revenue share of 43.8% in 2023 and is expected to continue to dominate the industry over the forecast period. The development of efficient quantum algorithms for cryptographic tasks is driving the demand for specialized software solutions that can leverage these algorithms to enhance security. Software developers are focusing on creating algorithms that effectively utilize the unique properties of quantum mechanics to strengthen encryption techniques. Furthermore, Software vendors are focusing on developing scalable and interoperable quantum cryptographic solutions that can meet the diverse needs of organizations across different industries. Scalable software platforms allow for the efficient deployment of quantum cryptography on varying scales, while interoperable solutions ensure compatibility with existing IT infrastructure and security systems.

Companies are launching novel software solutions to ensure data privacy for their consumers. For instance, in February 2024, Apple launched a major security enhancement in iMessage through the implementation of the PQ3 protocol, offering resilient encryption and robust defenses against advanced quantum attacks. This advancement elevates iMessage to Level 3 security, making it the leading messaging protocol globally, with the strongest security features among all widely-used messaging platforms.

The services segment is expected to grow at the fastest CAGR during the forecast period. The complexity of deploying quantum cryptographic solutions often requires specialized expertise for successful implementation and integration. Service providers offer support in deploying quantum key distribution (QKD) systems, integrating quantum security protocols with existing IT infrastructure, and ensuring seamless operation of quantum cryptographic solutions. In addition, there is a need for training and education services to help organizations and professionals develop the necessary skills and knowledge in quantum security practices. Service providers offer training programs, workshops, and certifications to educate users on the principles and applications of quantum cryptography.

End-use Insights

Based on end-use, the healthcare segment held the market with the largest revenue share of 24.2% in 2023. Quantum cryptography offers a highly secure method for protecting healthcare data from cyber threats, data breaches, and unauthorized access, driving the adoption of quantum cryptographic solutions in the healthcare sector. For instance, the security of medical imaging data, including MRI scans, X-rays, and CT scans, which are essential for diagnosis and treatment planning, can be improved by quantum cryptography. By safeguarding medical imaging data using quantum encryption techniques, healthcare providers can prevent unauthorized access and ensure the integrity of diagnostic information.

The government & defense segment is anticipated to grow at the fastest CAGR during the forecast period. Government agencies and defense organizations handle classified and sensitive information critical to national security. They also collect and store vast amounts of sensitive data, including citizen information, intelligence reports, and strategic plans. Quantum cryptography provides high protection against cyber threats and espionage, making it an essential technology for protecting classified data, communications, and critical infrastructure from unauthorized access and interception.

Application Insights

Based on application, the network security segment led the market with the largest revenue share of 34.6% in 2023 and is projected to grow at a significant CAGR over the forecast period. Quantum key distribution (QKD) enables the secure exchange of encryption keys between communicating parties using quantum principles, driving the market growth. Quantum cryptographic solutions provide robust key distribution and management mechanisms that prevent key interception and ensure secure communication channels for network security applications. Moreover, Quantum cryptographic solutions are designed to integrate seamlessly with existing network security infrastructure, such as firewalls, intrusion detection systems, and security protocols. Integration capabilities enable organizations to enhance their overall cybersecurity posture by deploying quantum cryptographic techniques alongside traditional security measures for comprehensive protection.

The cloud security segment is expected to witness at the fastest CAGR during the forecast period, owing the increasing need for secure cloud communication channels. These channels are crucial for transmitting data between cloud servers, client devices, and users. Cloud computing often involves multiple parties processing and sharing data in distributed environments. Quantum cryptographic techniques support secure multi-party computation by enabling secure data sharing and processing among multiple entities in the cloud while preserving data confidentiality and privacy.

Regional Insights

North America dominated the quantum cryptography market with a revenue share of 39.4% in 2023. The region faces evolving and sophisticated cyber challenges, prompting both government and private entities to seek advanced solutions to safeguard sensitive information. This increased awareness catalyzes the adoption of quantum cryptographic technologies as organizations recognize the need for quantum-resistant encryption to counter emerging cyber threats.

U.S. Quantum Cryptography Market Trends

The quantum cryptography market in U.S. accounted for revenue share of 24.5% in 2023. This can be attributed to the strong focus on national security. The U.S. government actively invests in cutting-edge technologies to secure communication channels critical for national defense. Quantum cryptography, with its potential to offer unparalleled security, becomes a strategic imperative.

Asia Pacific Quantum Cryptography Market Trends

The quantum cryptography market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. The Asia Pacific region is witnessing a surge in the adoption of quantum cryptography driven by a growing demand for secure communication. With the proliferation of cyber threats and the increasing importance of protecting sensitive information, countries in the region are investing significantly in quantum technologies. The rise in cyber is driving the adoption of quantum-resistant encryption methods by organizations, positioning the Asia Pacific as a prominent market for quantum cryptographic solutions.

The China quantum cryptography market is expected to grow at a significant CAGR over the forecast period.China market is notably propelled by the country's significant investments in quantum research and development. Pioneering projects such as quantum communication satellites underscore China's commitment to achieving leadership in quantum technology. Government initiatives and policies create a favorable environment for the rapid market growth in China.

The quantum cryptography market in India is expected to grow at a significant CAGR over the forecast period. India promotes this market through government initiatives, particularly within the IT & telecommunications sector. As the Indian government actively promotes the adoption of secure communication methods, quantum-resistant encryption becomes integral. The government's strategic investment and directives drive the market, positioning India as a key market for quantum cryptographic solutions, with the IT & telecommunications sector at the forefront of adoption.

Middle East and Africa (MEA) Quantum Cryptography Market Trends

The quantum cryptography market in Middle East & Africa is expected to grow at a rapid CAGR during the forecast period. The rising demand for secure communication solutions in government and defense sectors drives the adoption of quantum cryptography in the MEA region. Governments and defense organizations require highly secure communication channels to protect classified information, sensitive communications, and national security interests. Quantum cryptography offers unrivaled security assurances for these applications, providing tamper-proof encryption keys and communication channels that are resistant to interception and decryption by unauthorized parties. As governments in the MEA region prioritize national security investments, the demand for quantum cryptography solutions for secure communication networks rises, stimulating market growth.

The UAE quantum cryptography market is projected to grow at a significant CAGR over the forecast period, driven by its technological advancements and collaborative quantum research initiatives with international entities. As the region becomes increasingly aware of the need for secure communication solutions, the UAE positions itself as a key player in adopting and promoting quantum cryptographic technologies.

Key Quantum Cryptography Company Insights

Some of the key players operating in the market include ID Quantique, QuintessenceLabs Pty. Ltd., and Toshiba Corporation.

-

ID Quantique is a cryptography company based in Switzerland that specializes in quantum-safe products and services. They use the principles of quantum mechanics to provide secure communication channels to various industries including government and defense, financial services, and healthcare. Some of their offerings include Clarion KX, Clavis XG QKD, Cerberis XG QKD, XGR Series - QKD Platform, Clavis300 Quantum Cryptography Platform, and Centauris CN9000 Series

-

QuintessenceLabs specializes in quantum cybersecurity solutions, particularly in the field of quantum cryptography. QuintessenceLabs offers quantum cybersecurity solutions, including qCrypt system, which provides secure key generation and distribution using QKD. They also provide other quantum-safe security solutions, such as key management systems and random number generators

Agnostiq, Qrypt are some of the other market participants in the global market.

-

Agnostiq is a quantum computing company that focuses on developing quantum-safe solutions for data security and privacy. The company specializes in quantum cryptography, which leverages the principles of quantum mechanics to create secure communication channels that are resistant to attacks from quantum computers

-

Qrypt is a company that specializes in quantum-safe cryptography solutions. They focus on providing cutting-edge quantum-resistant encryption technologies to protect sensitive data from potential threats posed by quantum computers. Qrypt offers a range of products and services designed to secure communications and data in a post-quantum computing era. The company provides QKD, Post-Quantum Cryptography Solutions, and Quantum-Safe Encryption Tools

Key Quantum Cryptography Companies:

The following are the leading companies in the quantum cryptography market. These companies collectively hold the largest market share and dictate industry trends.

- Crypta Labs

- IBM

- ID Quantique

- Infineon Technologies AG

- MagiQ Technologies, Inc.

- NEC Corporation

- QNu Labs

- QuantumCTek Co., Ltd.

- QuintessenceLabs Pty. Ltd.

- Toshiba Corporation

- Agnostiq, Inc.

- Qrypt

Recent Developments

-

In May 2023, Agnostiq launched Covalent Cloud, the retail version of Covalent, an open-source project. Covalent Cloud is a highly abstracted, managed, and on-demand platform that provides high-performance computing and quantum computing resources for optimization, machine learning, simulation, and quantum computing. The platform makes it easy for computational engineers and researchers to access advanced computing resources utilizing Python without being hardware experts. Covalent Cloud offers a unified interface for all computing resources, enables customers to swap out compute resources seamlessly, and helps migrate from on-premises to cloud-based high performance computing

-

In January 2023, Qrypt and Megaport, a Network as a Service (NaaS) solutions provider, launched a secure data transmission technology employing quantum-secure cryptography powered by Qrypt quantum key generation technology. This technology eliminates the key exchange and independently generates encryption keys in real-time, ensuring data safety from harvest now and decrypting later attacks via quantum computers. The technology is available on all major cloud providers worldwide, including AWS, Azure, and Google Cloud

-

In November 2022, QuintessenceLabs launched qOptica QKD technology, which provides enhanced security against cyber-attacks. It uses continuous-variable quantum key distribution (CV-QKD) to distribute keys securely over an optical link, which is assured by the laws of quantum physics. CV-QKD is an innovative technology compared to discrete variable quantum key distribution (DV-QKD) and offers similar performance levels with a superior cost and performance path forward

Quantum Cryptography Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 661.3 million

Revenue forecast in 2030

USD 4,623.2 million

Growth rate

CAGR of 38.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Crypta Labs; IBM; ID Quantique; Infineon Technologies AG; MagiQ Technologies, Inc.; NEC Corporation; QNu Labs; QuantumCTek Co., Ltd.; QuintessenceLabs Pty. Ltd.; Toshiba Corporation; Agnostiq, Inc.; Qrypt

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Quantum Cryptography Market Report Segmentation

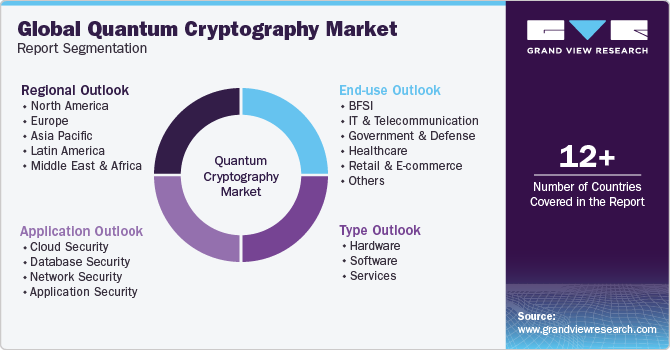

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the quantum cryptography market research report based on the type, end-use, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecommunication

-

Government & Defense

-

Healthcare

-

Retail & E-commerce

-

Others (Smart Infrastructure, Energy & Utilities, etc.)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud Security

-

Database Security

-

Network Security

-

Application Security

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global quantum cryptography market size was estimated at USD 518.3 million in 2023 and is expected to reach USD 661.3 million in 2024

b. The global quantum cryptography market is expected to grow at a compound annual growth rate of 38.3% from 2024 to 2030, reaching USD 4,623.2 million by 2030

b. North America dominated the quantum cryptography market with a revenue share of 39.4% in 2023. Regional growth is attributed to the increasing demand from government and private entities for advanced solutions to safeguard sensitive information

b. Some key players operating in the quantum cryptography market include Crypta Labs; IBM; ID Quantique; Infineon Technologies AG; MagiQ Technologies, Inc.; NEC Corporation; QNu Labs; QuantumCTek Co., Ltd.; QuintessenceLabs Pty. Ltd.; Toshiba Corporation; Agnostiq, Inc.; Qrypt

b. Factors such as the increase in cybersecurity threats and the advent of quantum computing are driving the growth of the quantum cryptography market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.