- Home

- »

- Advanced Interior Materials

- »

-

Radiant Barrier Insulation Market Size, Industry Report, 2030GVR Report cover

![Radiant Barrier Insulation Market Size, Share & Trends Report]()

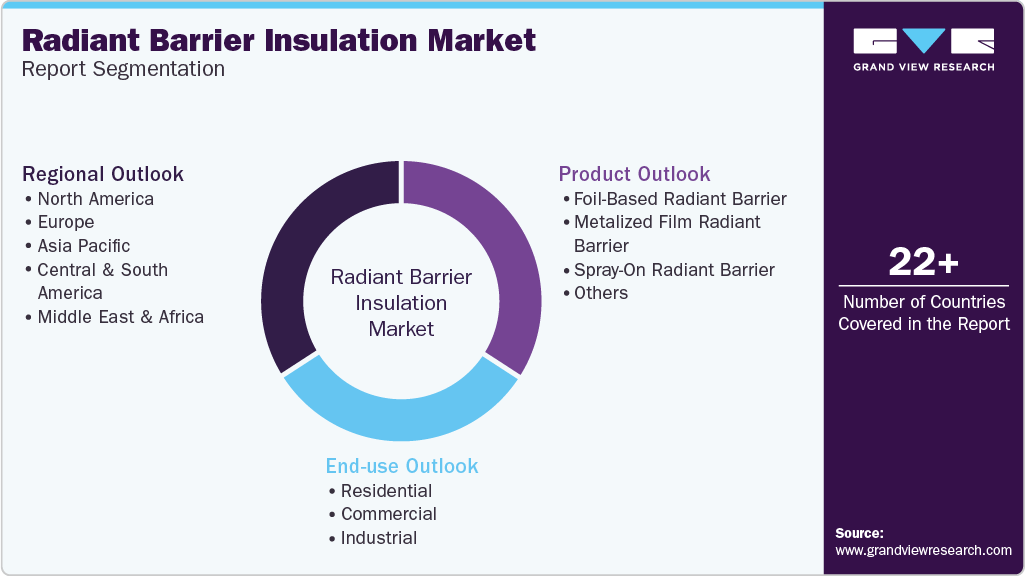

Radiant Barrier Insulation Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Foil-Based Radiant Barrier, Metalized Film Radiant Barrier, Spray-On Radiant Barrier), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-583-9

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Radiant Barrier Insulation Market Trends

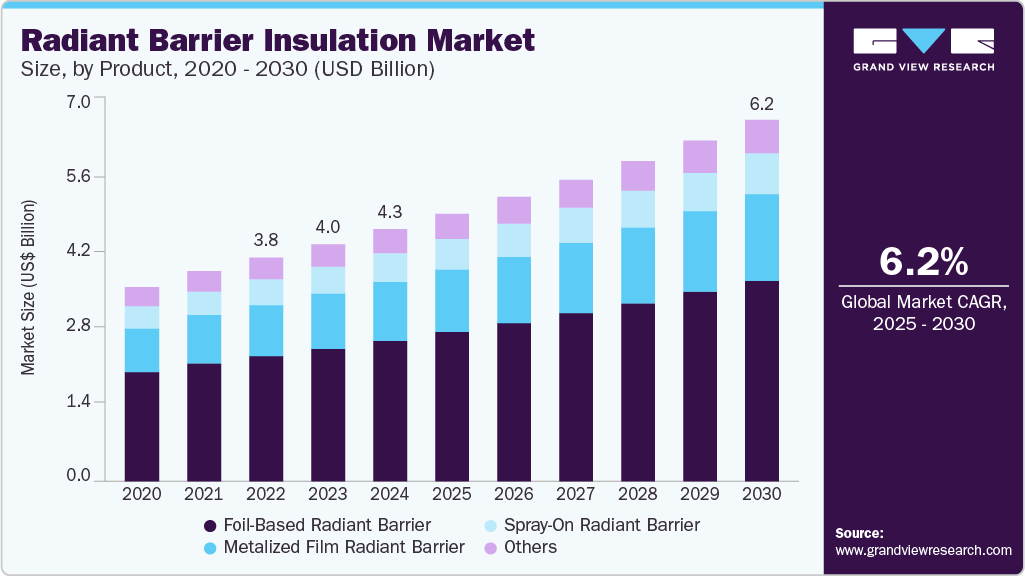

The global radiant barrier insulation market size was estimated at USD 4.29 billion in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2030, driven by the increasing global emphasis on energy conservation and sustainability. Governments and organizations worldwide are implementing stricter building codes and environmental regulations, pushing toward energy-efficient construction materials.

Key Highlights:

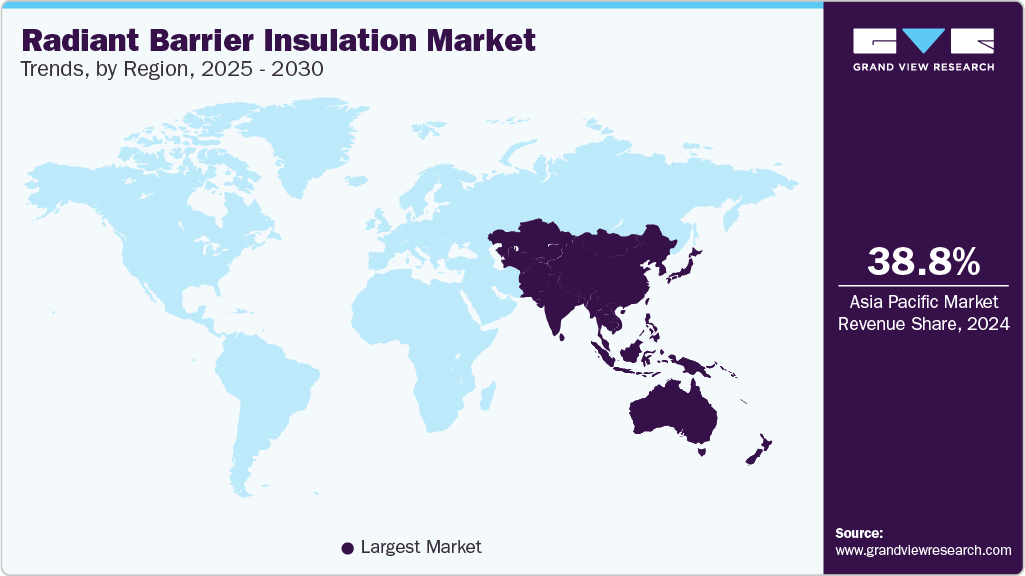

- Asia Pacific dominated the market and accounted for the largest revenue share of about 38.8% in 2024

- China is emerging as a key player in the radiant barrier insulation market due to its aggressive push for energy-efficient urban development and massive residential and commercial construction activity

- By product, the Foil-Based radiant barrier segment dominated the market and accounted for the largest revenue share of 55.9% in 2024

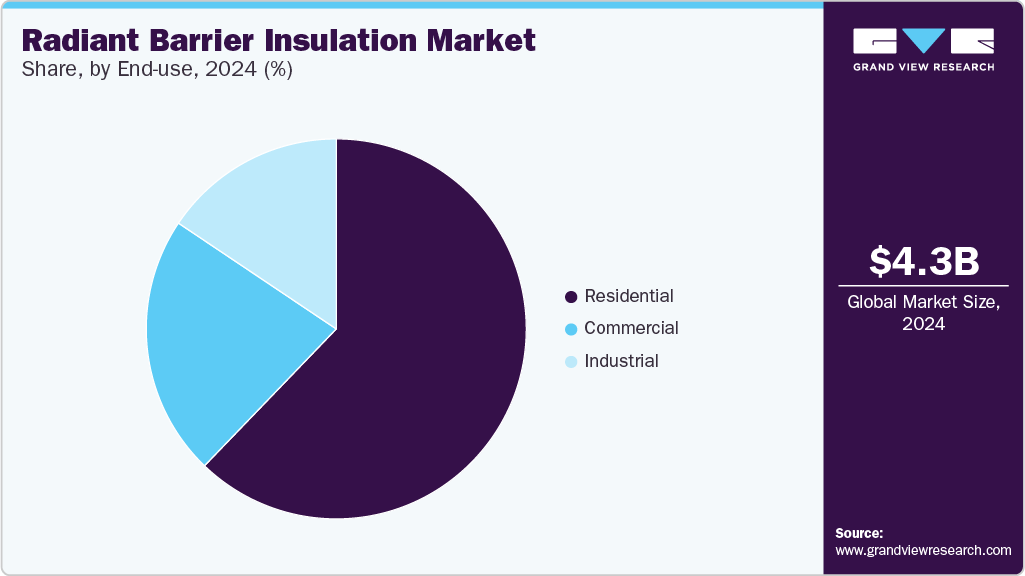

- By end use, the residential segment dominated the market and accounted for the largest revenue share of 62.2% in 2024

- By end use, the segment is experiencing robust growth in the radiant barrier insulation market

Radiant barriers significantly reduce heat gain in warmer months, lowering air conditioning demand and electricity bills. This becomes especially significant in regions with hot climates, with substantial energy savings potential. Additionally, the rise in disposable income, urbanization, and construction of residential and commercial buildings in emerging economies has led to an increased adoption of thermal insulation solutions like radiant barriers. Growing consumer awareness about the benefits of indoor thermal comfort and environmental responsibility also continues to fuel market growth.

Several macro and microeconomic factors influence the growth trajectory of the radiant barrier insulation market. Climate plays a major role, as radiant barriers are most effective in hot and sunny environments where solar heat gain is high. Market growth is also sensitive to trends in the construction sector-slowdowns or booms in infrastructure development directly impact demand. Additionally, initial installation costs and the cost of raw materials like aluminum foil or polyethylene-based substrates affect affordability and market penetration. Consumer awareness and education also act as key factors; while many are familiar with traditional insulation, fewer understand the specific advantages of radiant barriers. Furthermore, government policies offering tax credits, rebates, or incentives for energy-efficient retrofitting can significantly affect purchasing decisions and market demand.

The radiant barrier insulation market has seen several technological advancements aimed at improving performance, durability, and application efficiency. One key innovation is the development of multilayered reflective barriers, which combine radiant reflection with thermal resistance to increase overall energy savings. Manufacturers are also exploring the integration of phase-change materials (PCMs) and fire-retardant coatings to enhance thermal storage and safety. Some new products feature micro-perforations to improve breathability and reduce condensation risks without compromising reflective properties. In addition, the emergence of composite radiant barriers where foil is bonded with foam or bubble wrap-offers better rigidity, enhanced insulation, and easier handling. Advances in manufacturing technologies are also allowing for the production of lighter, stronger, and more environmentally friendly barrier materials. Digital tools like thermal imaging and smart sensors are being used to assess and optimize the placement and performance of radiant barriers, marking the beginning of smart insulation systems.

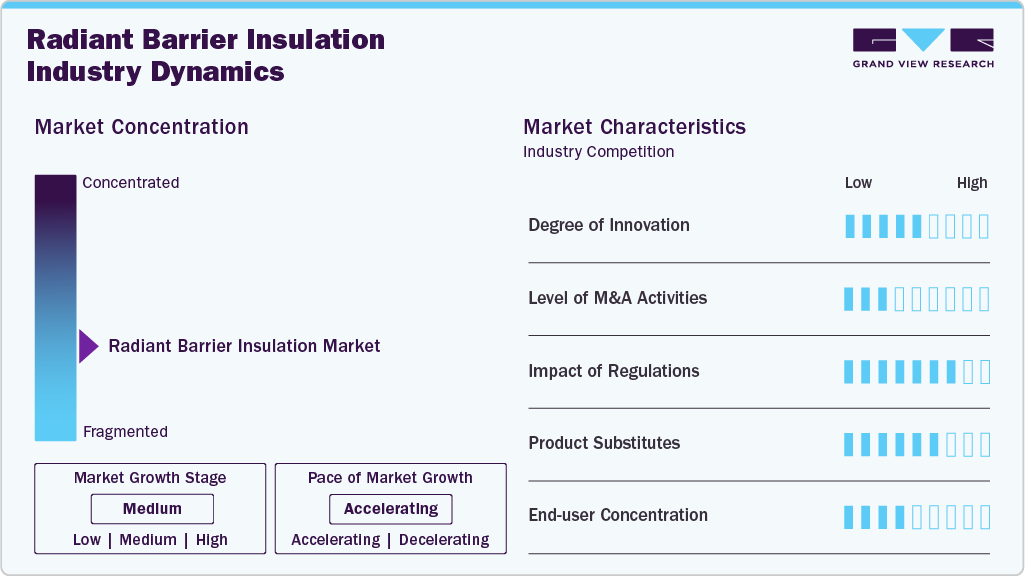

Market Concentration & Characteristics

The radiant barrier insulation market is moderately concentrated, with a mix of established global players and regional manufacturers competing for market share. Key players such as Reflectix Inc., Innovative Insulation, Inc., Fi-Foil Company, and Dunmore Corporation dominate due to their extensive distribution networks, strong brand recognition, and continuous investment in product innovation. However, the market also has a notable presence of smaller and local players who cater to regional construction demands, often offering cost-effective or customized solutions. Barriers to entry are relatively low, but achieving economies of scale, maintaining consistent product quality, and complying with evolving building codes and energy efficiency standards act as key differentiators that favor larger, more established companies.

The threat of substitutes in the radiant barrier insulation market is moderate to high, primarily due to alternative insulation materials offering different thermal benefits. Traditional insulation products such as fiberglass batts, spray foam, cellulose, and rigid foam boards are widely used and often preferred in colder climates where conductive and convective heat transfer dominate over radiant heat. These substitutes can offer superior performance in comprehensive thermal insulation but may not address radiant heat gain as effectively as radiant barriers. Moreover, some new hybrid insulation systems integrate radiant barriers within multi-layered materials, further blurring the lines between categories. While radiant barriers hold a clear advantage in hot climates, their reliance on specific environmental conditions for optimal performance makes them vulnerable to substitution in diverse or temperate climates.

Product Insights

The Foil-Based radiant barrier segment dominated the market and accounted for the largest revenue share of 55.9% in 2024, due to their superior reflectivity, which can bounce back up to 95-97% of radiant heat. They are typically made from highly reflective aluminum foil laminated to substrates like kraft paper, plastic film, or cardboard, offering a lightweight yet highly effective solution. The simplicity of their design allows for easy installation in attics, walls, and floors without the need for specialized labor, reducing both time and cost. They are also resistant to moisture, mold, and degradation, which adds to their durability and low maintenance requirements. Moreover, foil-based barriers are often used in conjunction with traditional insulation materials to enhance the overall thermal performance of a building, making them a versatile and cost-effective choice for both new construction and retrofit projects.

The Metalized Film Radiant Barrier segment is experiencing notable growth, driven by its superior thermal performance, cost-effectiveness, and alignment with sustainable building practices. These radiant barriers, typically composed of a thin layer of metal-often aluminum-deposited onto a polymer film, offer exceptional reflectivity and durability. This makes them highly effective in reducing radiant heat transfer, particularly in hot climates, thereby enhancing energy efficiency in buildings. Advancements in metallization techniques, such as vacuum deposition and sputtering, have further improved the barrier properties and longevity of these films, making them a preferred choice for modern insulation solutions.

End Use Insights

The residential segment dominated the market and accounted for the largest revenue share of 62.2% in 2024, The residential sector has historically led the radiant barrier insulation market, primarily due to the increasing demand for energy-efficient homes and the rising awareness among homeowners about the benefits of thermal insulation. Radiant barriers are particularly effective in reducing heat gain in attics, leading to significant cooling cost savings, especially in warmer climates. Government incentives and building codes promoting energy-efficient construction have further propelled the adoption of radiant barriers in residential buildings. Additionally, the relatively low installation cost and the ease of retrofitting existing homes make radiant barriers an attractive option for homeowners seeking to enhance indoor comfort and reduce energy bills.

The commercial segment is experiencing robust growth in the radiant barrier insulation market, driven by the increasing emphasis on energy efficiency and sustainability in commercial buildings. Large commercial structures, such as offices, retail spaces, and warehouses, often face significant cooling demands, leading to high energy consumption. Implementing radiant barriers helps in reducing heat gain, thereby lowering cooling loads and operational costs. Furthermore, the pursuit of green building certifications and compliance with stringent energy codes have encouraged the integration of radiant barriers in commercial construction projects. The long-term cost savings and improved occupant comfort associated with radiant barrier insulation make it an appealing choice for commercial property owners and developers aiming to enhance building performance and sustainability.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of about 38.8% in 2024, driven by increasing urbanization, infrastructure development, and rising energy costs. Countries like India, Japan, and South Korea are focusing on sustainable construction practices and energy-efficient buildings, boosting demand. The region’s hot and humid climate makes radiant barriers particularly effective, especially in densely populated cities where cooling demand is high. Growing government initiatives for green buildings and smart cities further contribute to market expansion.

China Radiant Barrier Insulation Market Trends

China is emerging as a key player in the radiant barrier insulation market due to its aggressive push for energy-efficient urban development and massive residential and commercial construction activity. The government’s emphasis on reducing carbon emissions and integrating energy-saving technologies into new developments is accelerating adoption. Additionally, domestic manufacturers are scaling up production capacity and technological capabilities, making radiant barriers more accessible and affordable within the region.

North America Radiant Barrier Insulation Market Trends

North America, particularly the United States, holds a significant share of the global radiant barrier insulation market. High energy consumption in residential and commercial buildings has led to a strong demand for insulation solutions that reduce HVAC costs. Consumers are increasingly aware of energy efficiency standards, and tax incentives for energy-efficient retrofitting have encouraged adoption. The market is mature but continues to grow steadily due to renovation trends and stringent building energy codes.

The U.S. market is a major driver of radiant barrier demand, fueled by high air-conditioning usage and rising energy bills in southern states like Texas, Florida, and California. The Department of Energy’s recommendations for energy-efficient building materials, along with a well-established DIY home improvement culture, support the widespread use of radiant barriers in homes. Growth is also seen in commercial segments such as warehouses, schools, and retail chains seeking to reduce operational costs.

Europe Radiant Barrier Insulation Market Trends

Europe’s radiant barrier insulation market is growing steadily, albeit at a slower pace compared to other regions due to its generally cooler climate, where traditional insulation materials are more commonly used. However, rising energy prices, increasing awareness of carbon footprint reduction, and strict EU regulations on building energy performance are pushing demand. Countries like France, the UK, and Italy are seeing increased use of radiant barriers in hybrid insulation systems for both retrofits and new builds.

Germany leads innovation in energy-efficient construction in Europe and is gradually integrating radiant barriers into high-performance building envelopes. The country’s strict energy efficiency laws, such as the Energieeinsparverordnung (EnEV), and a strong commitment to sustainability have created a favorable environment for radiant insulation solutions. Although fiberglass and mineral wool remain dominant, radiant barriers are increasingly used in combination with other materials to meet passive house standards.

Central & South America Radiant Barrier Insulation Market Trends

Central & South America shows growing potential for radiant barrier insulation, especially in warmer countries like Brazil and Mexico where cooling loads are high. Urban expansion, increased awareness of energy efficiency, and demand for cost-effective building solutions are fueling interest in reflective insulation. However, the market is still in an early stage, constrained by low public awareness and the limited presence of large-scale manufacturers. Government programs promoting energy-efficient housing could act as a catalyst for future growth.

Middle East & Africa Radiant Barrier Insulation Market Trends

The Middle East & Africa region, with its extremely hot climate, presents a strong case for radiant barrier insulation, particularly in countries like the UAE, Saudi Arabia, and South Africa. In the Gulf Cooperation Council (GCC) countries, high energy demand for cooling and increasing environmental regulations are prompting greater use of reflective insulation materials in residential, commercial, and industrial buildings. While the market is still developing, investment in infrastructure and mega real estate projects offers significant growth opportunities.

Key Radiant Barrier Insulation Company Insights

Some of the key players operating in market include DuPont and Reflectix Inc.

-

DuPont is a global leader in advanced materials, offering innovative radiant barrier and reflective insulation solutions that enhance building energy efficiency. Their products are designed to meet stringent sustainability and energy codes in residential and commercial construction. DuPont continues to drive innovation with a focus on durability and environmental impact.

-

Reflectix Inc. specializes in reflective insulation and radiant barrier products known for their bubble-pack technology that effectively reduces heat transfer. Their insulation solutions are widely used across residential, commercial, and industrial sectors to improve energy savings. Reflectix emphasizes ease of installation and long-term performance in its product design.

Innovative Insulation Inc., Dunmore Corporation are some of the emerging market participants in radiant barrier insulation market.

-

Innovative Insulation Inc. produces high-performance radiant barriers and reflective insulation materials aimed at maximizing thermal comfort and reducing cooling costs. Serving both residential and commercial markets, their products are recognized for durability and high reflectivity. The company focuses on delivering energy-efficient solutions that comply with evolving building standards.

-

Dunmore Corporation manufactures metallized films that play a vital role in radiant barrier insulation and other reflective applications. Their advanced materials are used in construction and industrial sectors to improve energy efficiency and thermal management. Dunmore is known for innovation, quality, and supporting sustainable building practices globally.

Key Radiant Barrier Insulation Companies:

The following are the leading companies in the radiant barrier insulation market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont

- Reflectix Inc.

- Innovative Insulation Inc.

- Dunmore Corporation

- Fi-Foil Company

- BMI Group

- LP Building Solutions

- Covertech Fabricating

- RadiantGUARD

- Kingspan Group

Recent Developments

-

In December 2021, Balcan Innovations, the parent company of rFOIL, acquired Reflectix Inc., a leader in reflective insulation and radiant barriers. This acquisition brought two top reflective insulation and radiant barrier manufacturers under one umbrella at Balcan Innovations.

Radiant Barrier Insulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.56 billion

Revenue forecast in 2030

USD 6.16 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

DuPont; Reflectix Inc.; Innovative Insulation Inc.; Dunmore Corporation; Fi-Foil Company ; BMI Group ; LP Building Solutions; Covertech Fabricating; RadiantGUARD; and Kingspan Group

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Radiant Barrier Insulation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global radiant barrier insulation market report based on product, end use and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Foil-Based Radiant Barrier

-

Metalized Film Radiant Barrier

-

Spray-On Radiant Barrier

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global radiant barrier insulation market size was estimated at USD 4.29 billion in 2024 and is expected to reach USD 4.56 billion in 2025.

b. The global radiant barrier insulation Market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030 to reach USD 6.16 billion by 2030.

b. The foil-based radiant barrier segment led the market and accounted for the largest revenue share of 55.9% in 2024, driven its superior ability to reflect radiant heat, significantly improving energy efficiency in hot climates.

b. DuPont, Reflectix Inc., Innovative Insulation Inc., Dunmore Corporation, Fi-Foil Company , BMI Group , LP Building Solutions , Covertech Fabricating, RadiantGUARD, and Kingspan Group are prominent companies in the radiant barrier insulation market.

b. Key factors driving the market include rising energy efficiency regulations, increasing demand for sustainable construction, advancements in reflective materials, and growing awareness of cost-saving benefits in hot climates.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.