- Home

- »

- Medical Devices

- »

-

Radiation Detection, Monitoring And Safety Market Report, 2030GVR Report cover

![Radiation Detection, Monitoring And Safety Market Size, Share & Trends Report]()

Radiation Detection, Monitoring And Safety Market Size, Share & Trends Analysis Report By Product (Personal Dosimeters), By Detection Type, By Protection Type, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-239-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

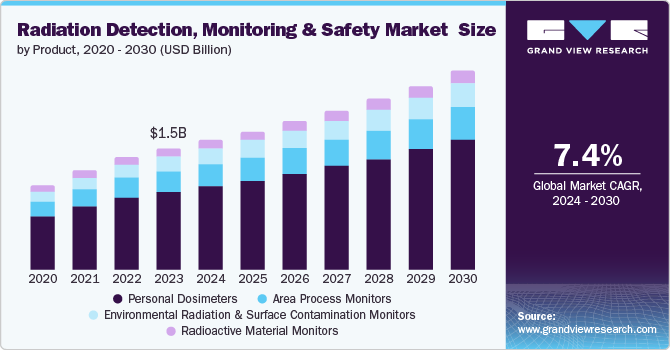

The global radiation detection, monitoring and safety market size was valued at USD 1.53 billion in 2023 and is projected to grow at a CAGR of 7.4% from 2024 to 2030. The rising adoption of nuclear medicine and radiation therapy as a consequence of the increasing global incidences of cancer is expected to drive the market growth over the forecast period. According to the data published by WHO in February 2024, the International Agency for Research on Cancer (IARC) estimated around 20 million cancer cases and 9.7 million cancer-related deaths in the year 2022. Research shows that every 1 in 5 individuals is diagnosed with cancer in a lifetime. The global hike in the estimates is expected to increase the demand for radiation therapy for cancer diagnosis during the forecast period.

Moreover, the application of nuclear medicine, wherein radioactive tracers are employed to enable early cancer detection and monitor disease progression through the visual tracking of the radiopharmaceuticals, yields tangible information related to the molecular nature of the problem causing bodily disturbances. These systems, being far more effective than other conventional medical imaging procedures that solely indicate the anatomical location of the issue, are expected to propel industry growth over the forecast period.

Furthermore, the need for safety in radiation & government's focus on the same issue generates demand for safety instruments in this market. For instance, the U.S. Food and Drug Administration (FDA) has been amending new regulations to recommend performance standards for diagnostic X-ray systems, laser therapies, and radiation protection during various other medical procedures to protect public health. Moreover, other government agencies such as the CDC for radiation emergency training and education & International Atomic Energy Agency (IAEA) that ensure the usage of nuclear energy in ways that protect lives from getting affected are the factors expected to drive the industry demand for safety instruments shortly.

Product Insights & Trends

Personal dosimeters dominated the market and accounted for a share of 64.5% in 2023 and is expected to grow at the fastest CAGR over the forecast period. The evolution of technology has spurred the creation of advanced personal dosimeters with features such as real-time monitoring, data logging, wireless connectivity for remote tracking, and increased precision in dose measurement. These technological upgrades enhance the reliability and user-friendliness of personal dosimeters, fueling their adoption across various industries. For instance, in June 2024, Thermo Fisher Scientific Inc. announced the NetDose Pro digital dosimeter, a compact wearable device that is connected and intended for monitoring radiation exposure. This innovative tool is specifically designed to track and communicate radiation exposure risks for individuals employed in various industries, such as healthcare, aiding companies in adhering to stringent regulatory standards.

The environmental radiation & surface contamination monitors segment is expected to grow at the significant rate over the forecast period. Radiation detection equipment is not limited to nuclear facilities but has expanded to various industries such as healthcare, environmental monitoring, defense, mining, and research laboratories. The diverse applications of radiation monitors across different sectors contribute to market growth. For instance, in March 2024, Cambodia launched seven new gamma dose rate monitoring stations in its capital and border provinces to enhance its environmental radiation monitoring capabilities. This initiative aims to strengthen the country's ability to monitor and manage radiation levels effectively.

Detection Type Insights & Trends

Gas-filled detectors accounted for the largest market revenue share in 2023, owing to increasing applications in Geiger-Muller counters, ionization chambers, radiation survey meters, and proportional counters. In addition, the user-friendly nature of these detectors, such as portability, durability, and economics, further augment the demand. Moreover, the high usage rate in nuclear power plants and manufacturing industries contributes to the segmental growth. For instance, in May 2024, by adding real-time connectivity, Blackline Safety Corp. upgraded its G6 single-gas detector with advanced data and reporting analytics, an emergency SOS feature, and sophisticated indoor location technology, aligning it with the G7 product line. New service plans, Protect and Protect Plus, starting at USD 10 per month, package these features to enhance organizational safety regimes.

Solid-state detectors is expected to register the fastest CAGR over the forecast period. These detectors are widely adopted in several applications due to their advantages over other radiation detectors. These include their compact size, which makes them feasible to be used in vivo2 dosimetry, low power requirements, insensitivity to magnetic fields, good radiation damage resistance, and ability to operate over a wide temperature range. Increasing availability and adoption of these detectors can boost market growth in the coming years. For instance,

Protection Type Insights & Trends

The full-body protection segment accounted for the largest market revenue share in 2023. This is attributable to its extensive applications in the form of aprons, barriers & shields. In addition, the advancement in the instrument such as hygroscopic aprons, radiation protection, and apron storage, neutron shielding, leaded glass, ceiling, and floor shielding are the factors further augmenting the growth in coming years. Moreover, the associated high prices in lead barriers such as mobile lead barrier costs from USD 5,260 to USD 7,820 thereby, are expected to boost the radiation detection, monitoring, and safety market growth over the forecast period. For instance, in September 2021, Trivitron Healthcare launched its SpaceD radiation protection aprons under the Kiran brand, marking a breakthrough in medical radiation protective wear. Using Outlast technology initially developed for NASA, these aprons incorporate phase change materials (PCM) to absorb, store, and release heat, ensuring optimal thermal comfort.

Face and hand protection segment is anticipated to register the fastest CAGR during the forecast period. An increasing number of studies in radiology, extensive research in the field, and rapidly increasing applications of radiation technology demand the protection of individuals from this exposure. This leads to rising demand for Personal protective equipment (PPE) such as gloves, eye protection, face shields, etc. For instance, according to a report published in Innovative Healthcare in December 2022, the CT examinations from 2006-2016 increased by 20% in the U.S. alone. Globally, this percentage has almost doubled. This data was collected from the U.S. National Council on Radiation Protection and Measurements (NCRP). It was also noted that the effective radiation dose had declined over the decade. This ratio of increasing radiology examinations and decreasing radiation exposure depicts the adoption of radiation safety products, thus driving the market.

End Use Insights & Trends

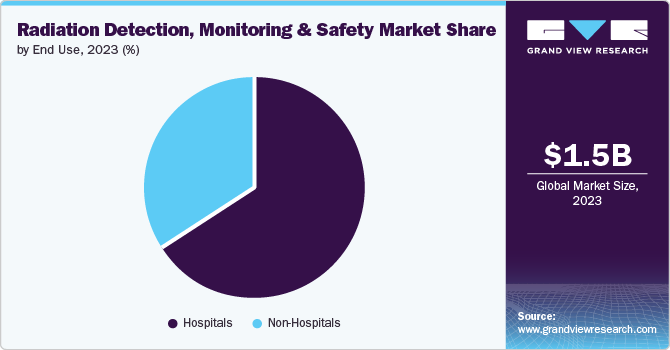

The hospitals segment dominated the market with a share of 65.7% in 2023 mainly due to the increasing adoption rate of the dosimeters and detectors in radiology, emergency care, dentistry, nuclear medicine, and therapy. Moreover, enhanced meters are utilized to ensure that patients and medical personnel are exposed to radioactive emission at optimal levels, within the permissible limits prescribed by the respective authorities. These are particularly required in medical procedures, such as angiography, fluoroscopy, computed tomography (CT), and radiographic imaging, employing the more harmful ionizing radioactive rays to perform clinical diagnosis and monitoring. The rise in these interventional applications is expected to stimulate the growth of this sector over the forecast period.

The non-hospital segment is expected to grow at the fastest CAGR. This is due to technological advancements in various sectors such as metallurgy, research, atomic centers, mining, food, and many more. The demand for radiation detection, monitoring, and safety devices is increasing; to meet these, companies are coming forward with different solutions. For instance, per the news published by Berthold Technologies GmbH & Co.KG in May 2022, their new product, “Becquerel Monitor LB 201,” detects gamma activities in eatables to ensure their safe consumption.

Regional Insights & Trends

North America radiation detection, monitoring and safety market dominated the market in 2023. It is attributable to favorable government initiatives encouraging the adoption of radiation detection, monitoring and safety across various industries. For instance, the U.S. Environmental Protection Agency (EPA) announced its annual budget for the year 2023. The radiation protection sector had a budget of 15.7 million to support measurement, assessment, and remediation technologies. Furthermore, the fact that major vendors in this industry are based in the U.S. is expected to boost the market growth during the forecast period.

U.S. Radiation Detection, Monitoring And Safety Market Trends

The radiation detection, monitoring and safety market in the U.S. dominated North America with a share of 77.4% in 2023 due to the increasing emphasis on safety and protection of individuals while being exposed to radiations. Several institutions and hospitals in the U.S. are increasing awareness amongst people about radiation dose and its effects so as to propelling the market growth. For instance, at Stanford University and affiliated health systems, strict adherence to federal, state, and local regulations on ionizing radiation is mandatory for all users. Compliance is essential to protect investigations, laboratories, and the institution. This document outlines radiation safety procedures to ensure the safety of patients, students, the public, and staff.

Canadian radiation, detection, monitoring and safety market had a significant market share in 2023. This is due to the strong regulatory framework of the country to follow the guidelines for the safe and secure use of radioactive sources provided by the International Atomic Energy Agency (IAEA). Canadian Nuclear Safety Commission (CNSC) ensures a robust regulatory framework and looks forward to implementing the protocols.

Europe Radiation Detection, Monitoring And Safety Market Trends

Europe's radiation detection, monitoring, and safety market has been identified as a lucrative region in this industry. Established players in this market have a strong presence in Europe. Many strategic partnerships and initiatives by such companies contribute to market growth. For instance, in April 2024, GE HealthCare partnered with Elekta, a Sweden-based company with expertise in radiation oncology. This collaboration was expected to help both companies provide comprehensive radiation therapies, including imaging and treatment. Remarkable progress in treatment planning is expected with the use of software.

Germany's radiation detection, monitoring and safety market is anticipated to witness significant growth in the upcoming years. This growth can be attributed to frequent product approvals by the government and the increasing use of safety products to reduce the harmful effects of radiation. For instance, in August 2022, Mirion Technologies, Inc. announced that the German Federal Ministry approved their OSL finger ring dosimeter for the Environment, Nature Conservation, Nuclear Safety and Consumer Protection (BMU) product.

The UK radiation detection, monitoring and safety market significantly contributes to the 2023 market share. This share is owed to established players in the region, such as Amray Group and Raybloc (X-ray Protection) Ltd.

Asia Pacific Radiation Detection, Monitoring And Safety Market Trends

The Asia Pacific radiation detection, monitoring, and safety market is anticipated to witness the fastest growth. This growth is due to the emergence of nuclear power hubs such as India and China, which will render high growth in this region.

India's radiation detection, monitoring and safety market is expected to grow rapidly in the coming years due to increasing awareness about radiation protection through extensive research in the field and emerging applications in various sectors. For instance, according to the news published by Bhabha Atomic Research Centre (BARC), Department of Atomic Energy (DAE), Government of India in the year 2020, BARC developed a Radiation Monitoring Watch (RMW). It shows the accumulated dose and alerts the user if it exceeds the threshold.

China's radiation detection, monitoring, and safety market held a substantial market share in 2023 due to the adoption of new regulatory protocols for radioactive technologies. Increasing research activities in the country are also reasons for market growth. For instance, as per the report published in June 2023, China performed an experiment by exposing model organisms to space radiation outside the Mengtian lab.

Middle East And Africa (MEA) Radiation Detection, Monitoring And Safety Market Trends

MEA radiation detection, monitoring and safety market is expected to grow significantly in the forecast year owing to partnerships, investments, and government initiatives in the region. For instance, in April 2024, in Dubai, UAE, the Occupational Radiation Monitoring Laboratory at the Radiation Protection Centre, part of Emirates Health Services (EHS), earned an ISO certificate for its outstanding measurement and calibration performance. This international recognition highlights the lab's crucial role in delivering reliable occupational radiation monitoring services and significantly advancing radiation protection efforts in the country.

South Africa radiation detection, monitoring and safety market is anticipated to grow in the forecast period. This is attributable to several government initiatives to raise awareness about the topic and promote the use of radiation detection, monitoring, and safety products. For instance, in 2022, Botswana opened its first public radiotherapy center. The initiative helped the center develop bunkers to house radiation treatment equipment, adhering to IAEA safety standards.

Key Radiation Detection, Monitoring And Safety Company Insights

Some of the key companies in the radiation detection, monitoring and safety market include LANDAUER, Mirion Technologies, Inc., Ludlum Measurements, Inc., Thermo Fisher Scientific Inc., Radiation Detection Company, Arrow Tech., Centronic Limited, Amray Group, ATOMTEX. Players in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Mirion Technologies, Inc. provides numerous products, including spectroscopy and scientific analysis systems, health physics and radiation safety instruments, radiation monitoring systems, reactor instrumentation and control, measurement systems for fuel cycle, safeguards and decontamination & decommissioning, etc. The company has active partnerships in the industry to provide safer workplaces and support patient care.

- LANDAUER offers comprehensive radiation dosimetry services to medical hospitals, dental offices, national laboratories, universities, nuclear facilities, and other industries with potential radiation risks. In addition, it provides imaging physics services in the countries where it operates.

Key Radiation Detection, Monitoring And Safety Companies:

The following are the leading companies in the radiation detection, monitoring and safety market. These companies collectively hold the largest market share and dictate industry trends.

- LANDAUER

- Mirion Technologies, Inc.

- Ludlum Measurements, Inc.

- Thermo Fisher Scientific Inc.

- Radiation Detection Company

- Arrow Tech.

- Centronic Limited

- Amray Group

- ATOMTEX

Recent Developments

-

In February 2024, ADM Systems introduced the SMP3 meter to measure electromagnetic fields. It has applications in industries such as railways, chemicals, medical, manufacturing, defense, and telecommunications.

-

In November 2023, according to the National Technology and Engineering Solutions of Sandia, LLC., Sandia National Laboratories they partnered with Patrick Feng to create organic glass scintillators and detect radioactive materials.

-

In April 2023, Tracerco announced the launch of its next-generation personal electronic dosimeters. This was expected to revolutionize radiological safety as it effectively monitors, measures, and manages radiation exposure.

Radiation Detection, Monitoring And Safety Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.64 billion

Revenue forecast in 2030

USD 2.52 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, detection type, protection type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

LANDAUER; Mirion Technologies, Inc.; Ludlum Measurements, Inc.; Thermo Fisher Scientific Inc.; Radiation Detection Company; Arrow Tech.; Centronic Limited; Amray Group, ATOMTEX

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Radiation Detection, Monitoring And Safety Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global radiation detection, monitoring and safety market report based on product, detection type, protection type, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal dosimeters

-

Environmental radiation & Surface contamination monitors

-

Area process monitors

-

Radioactive material monitors

-

-

Detection Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gas-filled detectors

-

Solid-state detectors

-

Scintillators

-

-

Protection Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Full-body protection

-

Face & hand protection

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Hospitals

-

Hospitals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."