- Home

- »

- Advanced Interior Materials

- »

-

Radiation Shielding Glass Market Size & Share Report, 2030GVR Report cover

![Radiation Shielding Glass Market Size, Share & Trend Report]()

Radiation Shielding Glass Market (2025 - 2030) Size, Share & Trend Analysis Report By Type (Lead Glass, Lead Free Glass), By Application (Medical, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-339-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Radiation Shielding Glass Market Trends

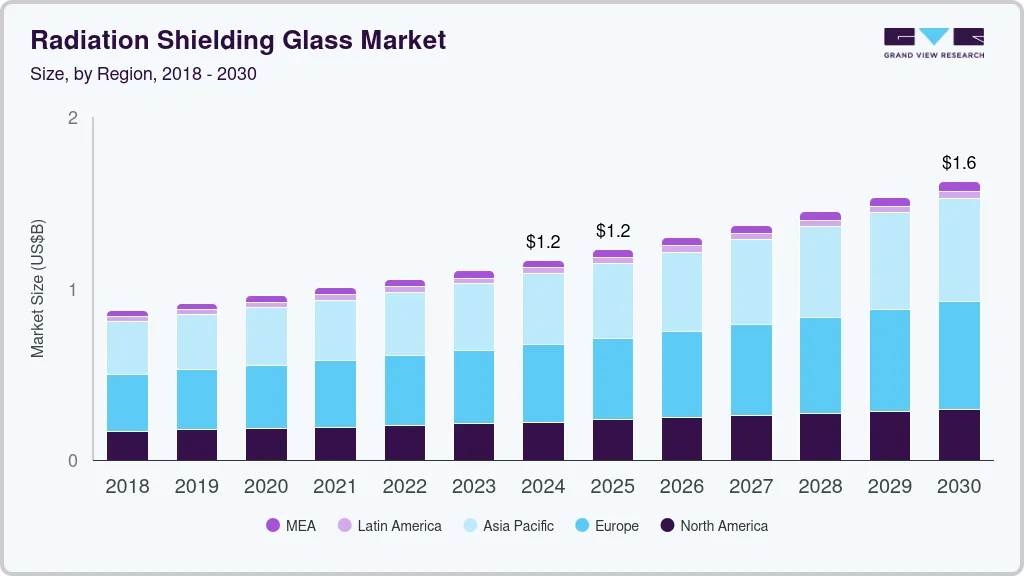

The global radiation shielding glass market size was estimated at USD 1,162.9 million in 2024 and is estimated to grow at a CAGR of 5.8% from 2025 to 2030. The increasing adoption of radiation shielding glass is driven by stringent safety regulations across industries such as healthcare, nuclear power, and industrial sectors. Radiation shielding glass is favored for its ability to effectively reduce ionizing radiation, primarily X-rays and gamma rays, due to its composition typically including lead oxide or barium oxide. Its unique properties ensure minimal radiation penetration, reducing exposure risks for personnel and patients in medical imaging facilities, enhancing safety in nuclear power plants, and safeguarding sensitive equipment in industrial settings.

Additionally, the glass maintains transparency, allowing visual inspection and clear communication, thereby combining safety with operational efficiency. These characteristics underscore its broad adoption and preference across diverse applications where radiation protection is paramount.

Drivers, Opportunities & Restraints

The increasing focus on occupational safety regulations globally is a significant driver for the radiation shielding glass market. Stringent mandates aimed at reducing radiation exposure in healthcare, industrial, and nuclear sectors compel businesses to invest in advanced shielding solutions to ensure compliance and protect workers and the public. For instance, the International Atomic Energy Agency (IAEA) has established the Radiation Protection and Safety of Radiation Sources: International Basic Safety Standards (BSS), which provide guidance on radiation protection measures for various industries. Compliance with these standards has driven the adoption of radiation shielding glass in medical facilities, nuclear power plants, and research laboratories across the globe.

High initial costs associated with radiation shielding glass installation and maintenance represent a notable restraint for market growth. The upfront investment required for specialized glass materials and installation expertise can be expensive for some organizations, especially smaller enterprises or those in emerging markets, potentially limiting adoption rates. High costs of radiation shielding glass could hinder its widespread adoption in developing economies, where budgets for safety measures may be limited.

The expanding applications of radiation shielding glass in emerging markets present a promising growth opportunity. As healthcare infrastructure develops in regions like Asia-Pacific and Latin America, coupled with increasing awareness of radiation hazards, there is a growing demand for reliable radiation protection solutions. This trend opens avenues for market players to expand their footprint and cater to new customer segments seeking advanced safety measures.

Type Insights

“Lead glass dominated the radiation shielding glass in terms of revenue in 2023.”

The lead glass application segment is anticipated to continue its dominance over the forecast period owing to its high lead oxide content, and is renowned for its exceptional ability to block radiations. This property makes lead glass highly effective in shielding against harmful radiation while maintaining optical clarity, essential for medical imaging devices, nuclear facilities, and industrial applications where precise visualization and safety are paramount.

The lead-free glass segment is experiencing rapid growth driven by increasing environmental and health concerns associated with lead exposure. Regulatory mandates in various regions, such as Europe's Restriction of Hazardous Substances (RoHS) directive and stringent guidelines in healthcare settings, promote the adoption of lead-free alternatives.

Lead-free glass substitutes, typically composed of barium oxide or other heavy metals, offer comparable radiation shielding effectiveness while addressing environmental and health safety concerns associated with lead. The market is growing rapidly as manufacturers focus on developing innovative lead-free solutions to meet the increasing demand for sustainable and safer radiation protection products.

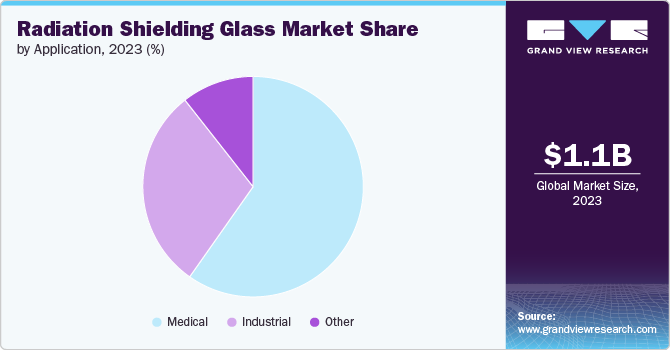

Application Insights

“Medical held the largest revenue share of over 59.0% in 2023.”

In the medical sector, radiation shielding glass plays a crucial role in ensuring patient and personnel safety during diagnostic imaging procedures such as X-rays, CT scans, and fluoroscopy. As healthcare regulations continue to emphasize radiation safety standards, the demand for reliable and high-performance radiation shielding solutions like lead glass remains robust, solidifying its dominant position in the medical market.

For instance, a report by the U.S. Nuclear Regulatory Commission in 2023 highlighted the widespread use of radiation shielding glass in medical facilities for radiation shielding, particularly in areas where diagnostic imaging equipment is operated. The report emphasized the importance of lead glass in protecting healthcare workers and patients from unnecessary radiation exposure while maintaining clear visibility during procedures.

In industrial settings, radiation shielding glass finds widespread application in environments where radiation sources are used or handled, such as nuclear power plants, research laboratories, and industrial radiography facilities. These glasses are employed to protect workers, equipment, and the surrounding environment from radiation exposure hazards.

Industrial-grade radiation shielding glass, often customized to meet specific shielding requirements and environmental conditions, ensures operational safety and regulatory compliance in sensitive industrial processes. Its usage extends to shielding windows, doors, and viewing ports in containment areas, control rooms, and hot cells, where maintaining clear visibility and stringent radiation protection are critical.

Regional Insights

“China held over 30% revenue share of the overall Asia Pacific radiation shielding glass market.”

Asia Pacific is witnessing the fastest growth owing to robust developments in healthcare infrastructure and increasing awareness of radiation safety measures. Countries such as China and India are leading this expansion, supported by rising healthcare expenditures and government initiatives to upgrade medical facilities. In addition to healthcare, the expansion of nuclear power generation in countries like Japan and South Korea further boosts demand for radiation shielding glass in reactor containment and research applications.

North America Radiation Shielding Glass Market Trends

North America remains a mature market for radiation shielding glass, characterized by stringent regulatory standards and high adoption rates across healthcare and industrial sectors.

U.S. Radiation Shielding Glass Market Trends

The U.S. drives consumption in North America due to its advanced healthcare facilities and ongoing upgrades in radiation therapy and diagnostic imaging technologies. The Canada radiation shielding glass market follows closely, focusing on nuclear power and industrial applications where radiation shielding glass is critical for safety and regulatory compliance.

Europe Radiation Shielding Glass Market Trends

Europe dominates in radiation shielding glass consumption, supported by stringent environmental and safety regulations across the region. Its innovations in glass technology focus on enhancing radiation attenuation properties while adhering to sustainability standards, reflecting the region's commitment to safety and technological advancement in radiation shielding applications.

Key Radiation Shielding Glass Company Insights

Some of the key players operating in the market include Schott and Corning Incorporated.

-

Schott specializes in specialty glass and glass-ceramics, offering a wide range of radiation shielding glass products for healthcare, nuclear, and industrial applications. Schott provides lead glass variants and lead-free glass alternatives that meet stringent regulatory standards globally.

-

Corning Incorporated is a leading player in materials science and glass technology, providing advanced radiation-shielding glass solutions for the healthcare, industrial, and scientific sectors. Its products offer robust protection against ionizing radiation while ensuring clear visibility for diagnostic imaging and industrial processes. Its portfolio includes both lead-based and lead-free glasses.

Key Radiation Shielding Glass Companies:

The following are the leading companies in the radiation shielding glass market. These companies collectively hold the largest market share and dictate industry trends.

- British Glass

- Corning Incorporated

- ELECTRIC GLASS BUILDING MATERIALS CO., LTD.

- H V Skan Ltd

- Lead Glass Pro.

- MAVIG GmbH

- MidlandLead

- Nippon Electric Glass Co., Ltd.

- Ray-Bar Engineering Corporation

- Raybloc Ltd.

- Schott

- Wolf X-Ray

Recent Developments

-

In April 2024, STERIS announced the expansion of its Chonburi I facility in Thailand, equipped with X-ray processing capabilities. The addition complements existing gamma irradiation services at Chonburi I and Chonburi II facilities. It is expected to bolster demand for radiation shielding glass, as facilities enhance their capabilities to ensure effective and safe handling of X-ray equipment and processes.

-

In December 2023, Carestream Health unveils the DRX-Rise Mobile X-Ray System, an advanced digital imaging solution providing a cost-effective pathway for customers to adopt or enhance their digital X-ray capabilities. This system's deployment is set to increase the demand for radiation shielding glass, as facilities upgrade to meet modern imaging standards.

Radiation Shielding Glass Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,226.8 million

Revenue forecast in 2030

USD 1,623.3 million

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Russia; China; India; Japan; Australia; Brazil; GCC

Key companies profiled

British Glass; Corning Incorporated; ELECTRIC GLASS BUILDING MATERIALS CO., LTD.; H V Skan Ltd; Lead Glass Pro.; MAVIG GmbH; MidlandLead; Nippon Electric Glass Co., Ltd.; Ray-Bar Engineering Corporation; Raybloc Ltd.; Schott; Wolf X-Ray

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Radiation Shielding Glass Market Report Segmentation

This report forecasts revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global radiation shielding glass market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lead Glass

-

Lead Free Glass

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The global radiation shielding glass market size was estimated at USD 1.10 billion in 2023 and is expected to reach USD 1.16 billion in 2024.

b. The global radiation shielding glass market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 1.62 billion by 2030.

b. By application, medical dominated the market with a revenue share of over 59.0% in 2023.

b. Some of the key vendors of the global radiation shielding glass market are British Glass, Corning Incorporated, ELECTRIC GLASS BUILDING MATERIALS CO., LTD., H V Skan Ltd, Lead Glass Pro., MAVIG GmbH, MidlandLead. Nippon Electric Glass Co., Ltd., Ray-Bar Engineering Corporation, Raybloc Ltd., Schott, Wolf X-Ray, among others.

b. The key factor driving the growth of the global radiation shielding glass market is attributed to the growing adoption of the radiation shielding glass in medical and industrial sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.