- Home

- »

- Medical Devices

- »

-

Global Radiodermatitis Market Size & Share, Industry Report, 2030GVR Report cover

![Radiodermatitis Market Size, Share & Trends Report]()

Radiodermatitis Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Topical, Dressings), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-857-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Radiodermatitis Market Size & Trends

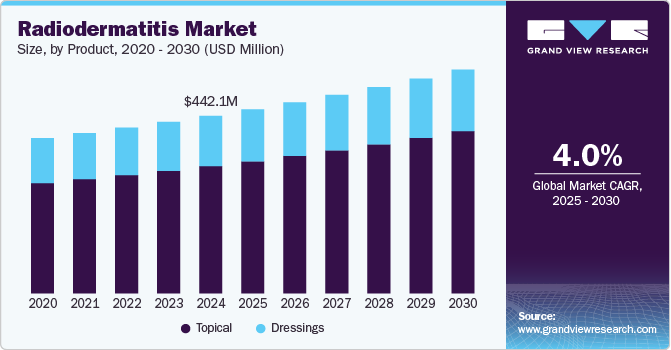

The global radiodermatitis market size was estimated at USD 442.1 million in 2024 and is projected to grow at a CAGR of 4.0% from 2025 to 2030. The increasing prevalence of cancer and the rising adoption of radiotherapy for treatment globally are primary drivers of the market growth. The growing geriatric population further fuels the market growth as older individuals are more likely to develop cancer and require radiation therapy.

A February 2024 article in Anais Brasileiros de Dermatologia noted that 98.2% of cases had this condition, with each additional BMI point increasing the risk of grades II to IV by 14%. Radiodermatitis, which includes symptoms like erythema and desquamation, affects 95% of cancer patients undergoing radiation, and 85-95% of breast cancer patients specifically experience it to varying degrees.

The rising prevalence of cancer globally is a significant driver for the radiodermatitis industry. As more patients undergo radiation therapy as part of their treatment regimen, the incidence of radiodermatitis, a common side effect, increases. This growing patient population necessitates effective management solutions and products to alleviate skin reactions caused by radiation exposure. In February 2024, an article in CA: A Cancer Journal for Clinicians projected that there would be 2,001,140 new cancer cases and 611,720 cancer deaths in the U.S. in 2024.

Continuous research and development in dermatological treatments have led to innovative therapies and products to prevent and manage radiodermatitis. New formulations, such as advanced topical agents and protective dressings, are being introduced to enhance patient comfort and improve skin healing during radiation therapy. In October 2024, Health Rounds highlighted that more than 90% of the four million U.S. patients receiving radiation therapy develop radiation dermatitis. Researchers studied this condition in 60 diverse breast cancer patients over a year using a spectrophotometer commonly used in color analysis. The standard screening method, approved by the National Cancer Institute, looks for reddened skin.

There is an increasing focus on educating healthcare professionals and patients about the risks associated with radiation therapy, including radiodermatitis. Enhanced awareness leads to better prevention strategies and treatment protocols, driving demand for specialized products designed to manage skin toxicity effectively. In October 2024, Scientific Reports highlighted that radiation therapy is crucial for over 50% of cancer patients in the U.S. However, about 95% of these patients experience moderate-to-severe radiation-induced dermatitis, which can range from mild skin irritation to severe ulceration. This causes pain and anxiety and increases the risk of long-term complications such as fibrosis and necrosis.

Market Concentration & Characteristics

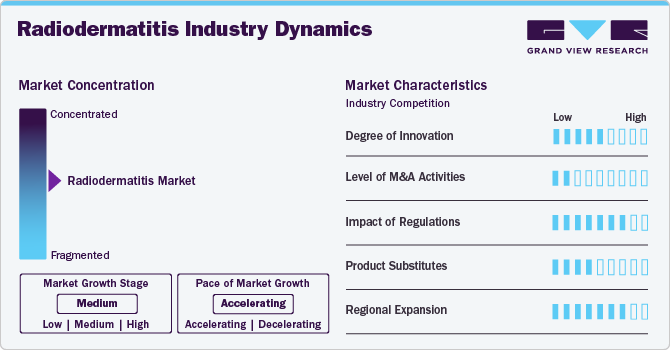

The degree of innovation in the radiodermatitis industry is moderate. Companies actively enhance their product offerings, particularly in developing advanced wound dressings and topical treatments incorporating biocompatible and biodegradable materials. Innovations such as self-healing properties and the use of herbal ingredients in corticosteroid creams reflect a growing trend toward more effective and patient-friendly solutions

The level of M&A activities in the radiodermatitis industry is low. While occasional mergers and acquisitions exist, the overall trend shows limited consolidation among companies targeting this niche area. This suggests that firms are more inclined to focus on organic growth rather than aggressive acquisition strategies.

The impact of regulation on the radiodermatitis industry is high. Strict regulatory frameworks govern medical product approval and safety standards, significantly influencing market dynamics. Compliance with these regulations is crucial for maintaining product integrity and fostering innovation, as companies must ensure their offerings meet stringent safety requirements before reaching consumers.

Product substitutes in the radiodermatitis industry are medium. While alternative treatments are available, such as herbal and traditional medicine, the specialized nature of radiation dermatitis treatments limits direct substitutes. However, increasing consumer preference for non-steroidal options may encourage competition from alternative therapies.

Regional expansion opportunities in the radiodermatitis industry are high, particularly in emerging markets like Asia Pacific. The growing prevalence of cancer and rising demand for effective treatment options are driving companies to explore new geographical areas. This trend is supported by favorable government initiatives aimed at enhancing healthcare infrastructure and increasing access to treatments.

Product Insights

The topical product segment held the largest market share in 2024 at nearly 71.7%. A significant aspect of the appeal of topical products lies in their numerous advantages, such as user-friendliness, accessibility, and cost-effectiveness. Topical formulations mitigate the risk of microbiological transmission while providing a protective barrier against abrasive substances. This segment includes corticosteroids, hydrophilic creams, antibiotics, and others. In September 2024, an article in Applied Sciences discussed a study exploring using plant-origin additives from the Boswellia species in topical formulations for skin care post-radiotherapy. The research aimed to address skin damage caused by free radicals during treatment by incorporating antioxidant-rich plant extracts. Various cosmetic preparations were developed, and their stability, properties, and antioxidant capacity were evaluated alongside sensory analysis to assess their effectiveness.

The dressings segment is anticipated to attain significant growth over the forecast period owing to a wide array of products in the market. These products include foam-based, hydrogel & hydrocolloid, silicone-coated, silver-leaf dressings, and others. Dressings are sufficient for effectively treating various grades of radiation burns, which is anticipated to fuel their adoption over the coming years. Because of the advantages, hydrogel and hydrocolloid dressings are used more frequently to treat radiation burns. These advantages include quick healing, little discomfort, and high protection against infection and bacterial growth. In August 2024, researchers reported in the American Chemical Society (ACS) that an aspirin-infused hydrogel mimics the nutrient-rich fluid between cells, accelerating the healing of radiation-damaged skin in animals. This treatment could provide quick and effective human wound healing with further advancements.

Distribution Channel Insights

In 2024, retail pharmacies had the greatest share of the distribution channel segment, accounting for 39.4%. The significant percentage can be attributed to their widespread accessibility, allowing patients easy access to necessary treatments. They provide a range of products specifically formulated for skin conditions, including radiodermatitis, which enhances consumer choice. Retail pharmacies have established relationships with healthcare providers, facilitating patient referrals and recommendations. The convenience of purchasing medications without a prescription further drives sales through these channels.

Due to numerous benefits, including more convenience for customers who do not want to buy medications from retail or hospital pharmacies, online pharmacies are expected to grow exponentially throughout the projection period. Furthermore, there is a gap between the supply and demand of important pharmaceuticals due to the increasing frequency of chronic diseases. During the projected period, these factors will increase demand for online pharmacies. With the help of online pharmacies, order procurement and tracking by the customer becomes convenient. In addition, associated supply chain management (SCM) eliminates some of the market intermediaries, which reduces the overall drug price, hence driving the inclination of customers toward online medicine purchases.

Regional Insights

The North America radiodermatitis market is anticipated to grow significantly over the forecast period. This market is predominantly driven by high R&D investment deployed by global players and their focus on attaining a competitive position in the market. In addition, high disposable income and the presence of sophisticated healthcare infrastructure are responsible for the significant growth opportunities across the region.

U.S. Radiodermatitis Market Trends

The U.S. radiodermatitis market held the largest share in the North American region in 2024 and is expected to grow rapidly over the forecast period. Advancements in treatment modalities and the growing awareness regarding skin care during radiation therapy contribute to market growth. In April 2024, a study in the Journal of Radiotherapy in Practice examined using KeraStat Cream (KC) for radiation dermatitis in head and neck cancer patients undergoing radiotherapy. The pilot study involved 24 patients and showed that treatment adherence was similar between KC and standard care, with no significant differences in radiation dermatitis observed. It concluded that a larger trial is needed to evaluate KC's effectiveness.

Europe Radiodermatitis Market Trends

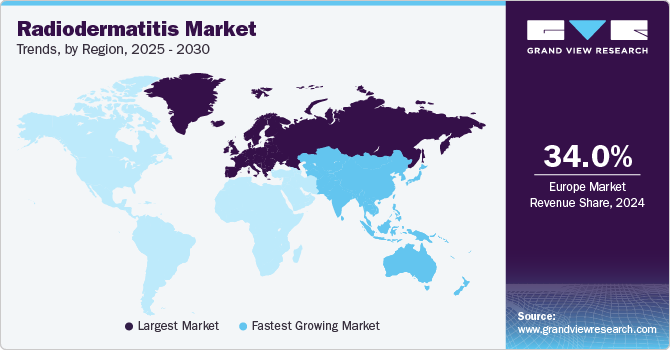

The Europe radiodermatitis market dominated the industry with a 34.0% share in 2024. In Europe, the market for radiodermatitis is influenced by a rising cancer patient population undergoing radiation therapy. Regulatory support for innovative dermatological products and therapies enhances market opportunities. Furthermore, increasing public health initiatives to educate patients about skin care during cancer treatment significantly drive demand for radiodermatitis products across various European countries.

The UK radiodermatitis market is projected to expand in the future due to the increasing incidence of cancer cases requiring radiation therapy, which leads to a higher prevalence of skin-related side effects. For instance, more than 130,000 people receive radiotherapy annually in the UK as a treatment for cancer. In addition, advancements in treatment modalities and the growing awareness of skin care management among healthcare professionals contribute to market growth. The well-established healthcare infrastructure and supportive government policies further enhance the market dynamics.

The France radiodermatitis market is expected to grow rapidly during the forecast period. In France, the market is propelled by a rising number of patients undergoing radiotherapy as part of their cancer treatment regimen. According to an article published by Institut Care in March 2023, more than 190,000 patients are treated with radiotherapy annually in France. The emphasis on improving patient quality of life by effectively managing radiation-induced skin reactions has increased demand for specialized products. Furthermore, ongoing research and development initiatives aimed at innovative therapeutic solutions are also significant regional drivers.

The German radiodermatitis industry is influenced by a robust healthcare system that supports advanced cancer treatment options, leading to a higher incidence of radiodermatitis cases. Increased investment in dermatological research and product development tailored to radiation therapy patients is crucial for market expansion. In February 2024, a pilot study by the University of Augsburg, Helmholtz Munich, and the Technical University of Munich (TUM) highlighted the crucial role of skin bacteria. Breast cancer patients with significantly altered skin flora all faced severe dermatitis during their radiotherapy. These results indicate the possibility of a test that could aid in the early identification of at-risk patients.

Asia Pacific Radiodermatitis Market Trends

Asia Pacific radiodermatitis market is anticipated to witness the fastest CAGR over the forecast period. The growing number of cancer patients in this area is a major factor in the significant share this area has gained. The larger share that this region has acquired is also due to substantial collaborations made by key businesses to increase their product range. In addition, well-known pharmaceutical firms in this region are heavily involved in selling their goods and promoting end-user adoption. Key growth drivers for this region include favorable government efforts that boost research activity and increased outsourcing by industrialized economies.

The increasing cancer incidence and the rising number of radiation therapy procedures primarily drive the radiodermatitis industry in China. Advancements in healthcare infrastructure and technology and a growing skincare awareness among patients undergoing radiation treatment contribute to market growth. A February 2024 article in Protein & Cell discussed radiation injury (RI), which affects multiple body parts and currently has limited treatment options. The study highlights the role of gut microbiota in developing and preventing radiation injury (RI), summarizing ten common types and their mechanisms.

The radiodermatitis market in Japan is expected to grow over the forecast period. In Japan, the aging population significantly drives the radiodermatitis industry, as older adults are more susceptible to cancers requiring radiation therapy. A September 2023 article in the Journal of Personalized Medicine highlighted that patients struggling with self-care during treatment are more likely to develop severe dermatitis. It emphasizes the need for multidisciplinary collaboration and support when self-care declines. Future studies with larger, more uniform groups are essential to determine if supportive care can prevent acute radiation dermatitis.

Latin America's Radiodermatitis Market Trends

Latin America's radiodermatitis market is expected to grow gradually. The radiodermatitis industry in Latin America is influenced by increased cancer cases and a growing emphasis on improving patient care during radiation treatments. Economic growth in several countries has led to better access to healthcare services and technologies, facilitating the adoption of advanced skincare products. Public health campaigns educating patients about skin care during cancer treatments are also significant drivers.

The radiodermatitis market in Brazil is expected to grow over the forecast period due to the rise in cancer prevalence and subsequent use of radiation therapy. The country's expanding healthcare sector and government initiatives to enhance oncology services foster an environment conducive to market growth. In addition, increasing awareness among healthcare professionals regarding skin management during radiation therapy contributes positively to product demand.

Middle East & Africa Radiodermatitis Market Trends

Middle East & Africa radiodermatitis market was identified as a lucrative region in this industry. The market in the Middle East and Africa is primarily driven by the increasing incidence of cancer, which necessitates radiation therapy, leading to a higher prevalence of radiodermatitis among patients. In addition, healthcare infrastructure and technology advancements enhance treatment options and patient care, further propelling radiodermatitis industry growth. However, the involvement of various Middle Eastern countries in the war hinders market growth.

The radiodermatitis market in Saudi Arabia is anticipated to grow steadily over the forecast period. In Saudi Arabia, the market is influenced by a growing population and an increase in cancer cases, particularly skin cancers, due to environmental factors. The government's investment in healthcare facilities and initiatives to improve cancer treatment services are also key drivers. Furthermore, the cultural emphasis on skincare and beauty among the population fosters demand for effective radiodermatitis management solutions.

Key Radiodermatitis Company Insights

Key players employ sustainability initiatives widely in the competitive context. These businesses continuously prioritize tactics like mergers and acquisitions, new product development projects, and regional expansion to strengthen their market share.

Key Radiodermatitis Companies:

The following are the leading companies in the radiodermatitis market. These companies collectively hold the largest market share and dictate industry trends.

- Stratpharma AG

- Smith & Nephew

- Molnlycke Health Care AB

- Derma Sciences Inc.

- ConvaTec Inc.

- BMG Pharma S.R.L.

- Acelity (3M)

- Alliqua BioMedical

Recent Developments

-

In October 2024, Lutris Pharma finished enrollment for its Phase II trial of LUT014, a topical B-Raf inhibitor for acneiform rash caused by EGFR inhibitors. The study enrolled 117 metastatic colorectal cancer patients at 20 sites, including Memorial Sloan Kettering and MD Anderson. This double-blind, placebo-controlled trial will evaluate the efficacy and safety of 0.03% and 0.10% concentrations of LUT014 gel, applied daily for four weeks.

-

In August 2024, RepoCeuticals announced that Melatonin is in Phase II clinical trials for radiodermatitis. This repurposed drug is also being explored for radiation cystitis, radiation proctitis, radiation vaginitis, low anterior resection syndrome, and actinic keratosis. It can be administered through various routes, including intravenous, rectal, intravesical, vaginal, oral, inhalational, transdermal, and cutaneous. It was previously under development for radiation pneumonitis.

-

In February 2024, Lutris Pharma's new topical BRAF inhibitor LUT014 gained FDA orphan drug status for treating acneiform rash caused by EGFR inhibitors. Its unique natural formula effectively alleviated radiodermatitis symptoms, resulting in high sales and strong demand from patients and healthcare providers.

Radiodermatitis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 458.4 million

Revenue forecast in 2030

USD 557.1 million

Growth rate

CAGR of 4.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 – 2023

Forecast period

2025 – 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stratpharma AG; Smith & Nephew; Molnlycke Health Care AB; Derma Sciences Inc.; ConvaTec Inc.; BMG Pharma S.R.L.; Acelity (3M); Alliqua BioMedical

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Radiodermatitis Market Report Segmentation

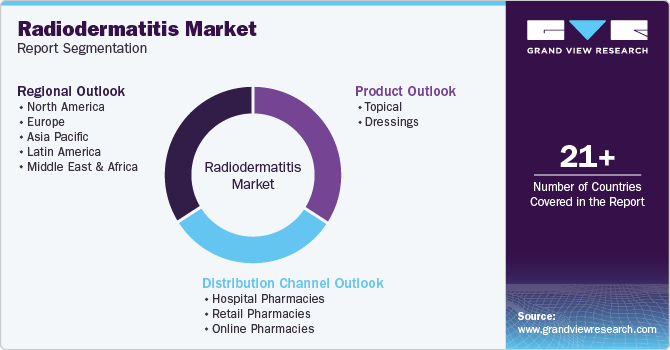

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global radiodermatitis market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Corticosteroids

-

Hydrophilic Creams

-

Antibiotics

-

Others

-

-

Dressings

-

Hydrogel & Hydrocolloid dressings

-

No Sting Barrier Film

-

Honey-impregnated Gauze

-

Silicone Coated Dressings

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global radiodermatitis market size was estimated at USD 442.1 million in 2024 and is expected to reach USD 458.4 million in 2025.

b. The global Radiodermatitis market is expected to grow at a compound annual growth rate of 4.0% from 2025 to 2030 to reach USD 557.1 million by 2030.

b. Europe dominated the Radiodermatitis market with a share of 34% in 2024. This is attributable to expanding cancer patient base in the region, extensive collaborations by key players, favorable government initiatives and an increase in outsourcing in the region.

b. Some key players operating in the Radiodermatitis market include 3M Healthcare; ConvaTec, Inc.;Mölnlycke Health Care AB; and Smith & Nephew.

b. Key factors that are driving the market growth include the prevalence of radiodermatitis due to radiotherapy treatment, Rising number of public & private healthcare organizations, and rising number of clinical studies conducted to expand the product pipeline.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.