- Home

- »

- Next Generation Technologies

- »

-

Random Access Memory Market Size, Industry Report, 2033GVR Report cover

![Random Access Memory Market Size, Share & Trend Report]()

Random Access Memory Market (2025 - 2033) Size, Share & Trend Analysis Report By Type (Traditional RAM, Next-Generation RAM), By End Use (Computing Devices, Consumer Electronics, Data Centers & HPC), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-784-4

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Random Access Memory Market Summary

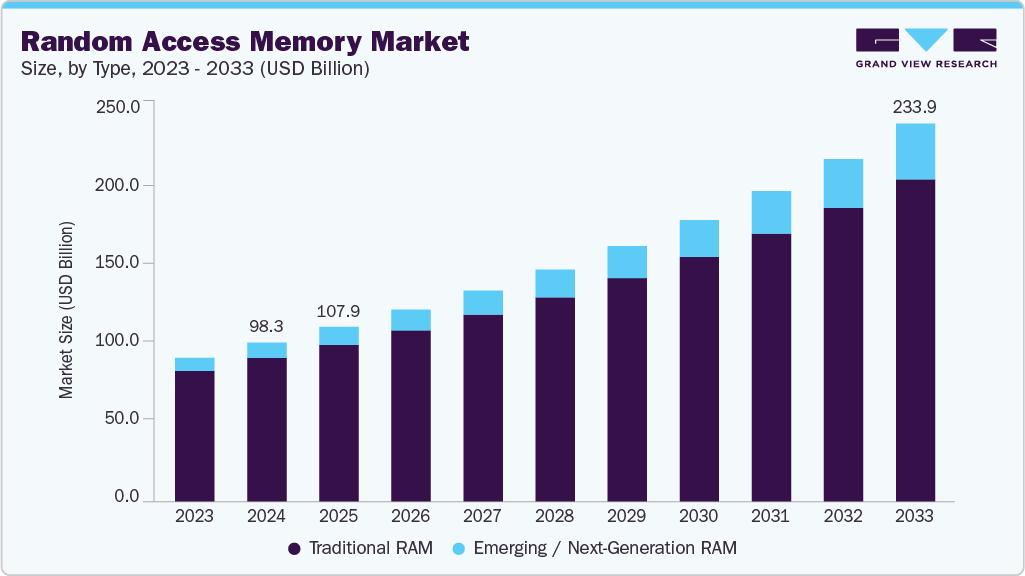

The global random access memory market size was estimated at USD 98.32 billion in 2024 and is projected to reach USD 233.86 billion by 2033, growing at a CAGR of 10.1% from 2025 to 2033. The global Random Access Memory (RAM) market is experiencing steady growth.

Key Market Trends & Insights

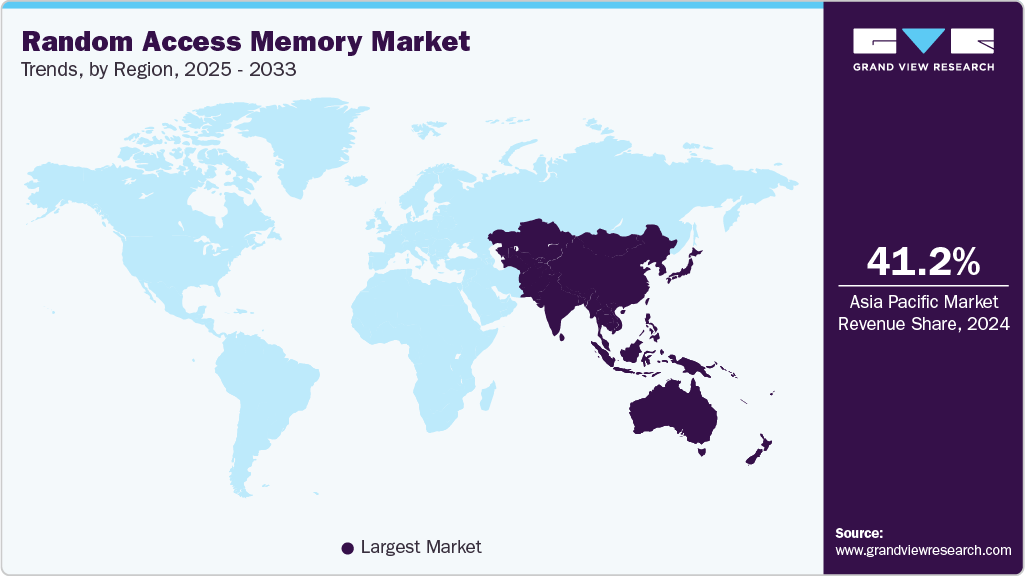

- Asia Pacific Random Access Memory dominated the global market with the largest revenue share of 41.2% in 2024.

- The Random Access Memory market in U.S. led the North America market and held the largest revenue share in 2024.

- By Type, Traditional RAM led the market and held the largest revenue share of 90.3% in 2024.

- By End Use, the Data Centers & HPC segment is expected to grow at the fastest CAGR of 15.2% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 98.32 Billion

- 2033 Projected Market Size: USD 233.86 Billion

- CAGR (2025-2033): 10.1%

- Asia Pacific: Largest market in 2024

Rising demand for high-performance computing and mobile devices is driving this expansion. Advances in memory technologies are fueling market adoption across industries. This growth is expected to continue in the coming years. There is a growing demand for memory solutions that are energy-efficient and support real-time processing. This trend is driven by the rise of compact devices such as wearables, IoT gadgets, and edge computing systems. Users and manufacturers increasingly require high-performance memory with minimal power consumption. Advanced memory technologies are meeting these needs by delivering higher bandwidth and lower energy usage. Several companies are actively developing and launching such solutions to capture this growing demand. The market for low-power, high-performance RAM is projected to expand rapidly. For instance, in September 2025, AP Memory, a fabless semiconductor in Taiwan, launched ApSRAM, an advanced low-power, high-performance PSRAM optimized for edge computing, IoT, and wearable applications. The new memory offers up to four times the bandwidth of conventional PSRAM, reduces dynamic power consumption to one-fifth.The RAM market is increasingly focusing on AI-optimized memory solutions. This trend is driven by the growing need for devices capable of on-device intelligence. High-speed and high-capacity memory is increasingly in demand to support complex computations efficiently. Energy efficiency has become a critical requirement for modern memory solutions. Advanced memory technologies are being developed to meet these performance and power demands, fueling market growth. Companies are adopting AI-optimized, high-performance, and energy-efficient memory solutions to meet growing market demands. For instance, in September 2025, Samsung Electronics Co., Ltd. developed a low-power LPDDR5X DRAM chip, specifically designed to enhance performance for AI applications with speeds up to 10.7 Gbps and over 30% higher capacity than previous generations. This launch aims to support on-device AI features by delivering high performance with energy efficiency.

The RAM industry is increasingly focusing on miniaturization and advanced process technology. Smaller process nodes are being adopted to enhance performance while reducing the physical size of memory chips. Compact designs allow high-performance RAM to fit into devices with limited space, such as smartphones and wearables. These advancements help improve energy efficiency by lowering power consumption. Smaller chips also generate less heat, which contributes to better device reliability. Miniaturization enables manufacturers to increase memory density without expanding the footprint. Advanced fabrication techniques allow for faster data transfer and improved overall performance. The push toward smaller, high-performance memory supports the growth of edge computing and IoT devices. Companies are expanding heavily in research and development to optimize these compact designs.

Type Insights

The Traditional RAM segment dominated the Random Access Memory (RAM) market in 2024, accounting for a 90.3% share. This dominance highlights that consumers and manufacturers continued to prefer Traditional RAM. The segment benefited from its widespread adoption in various computing devices. Its reliable performance made it a popular choice across the industry. High demand from PCs, laptops, and servers supported its strong market presence. Manufacturers valued it for cost-effective and efficient memory solutions. Its compatibility with emerging technologies further strengthened its appeal. The segment maintained steady growth throughout the year.

Emerging and next-generation RAM is experiencing significant growth in the market. This category includes advanced memory types such as MRAM, ReRAM, PRAM, which offer unique advantages over traditional RAM. These memory solutions are gaining traction due to their low power consumption, high speed, and non-volatile capabilities, making them suitable for IoT, edge computing, and AI applications. Increasing demand for energy-efficient and high-performance memory in modern electronics is driving their adoption. Manufacturers are investing in research and development to enhance performance, density, and reliability of these next-generation solutions.

End Use Insights

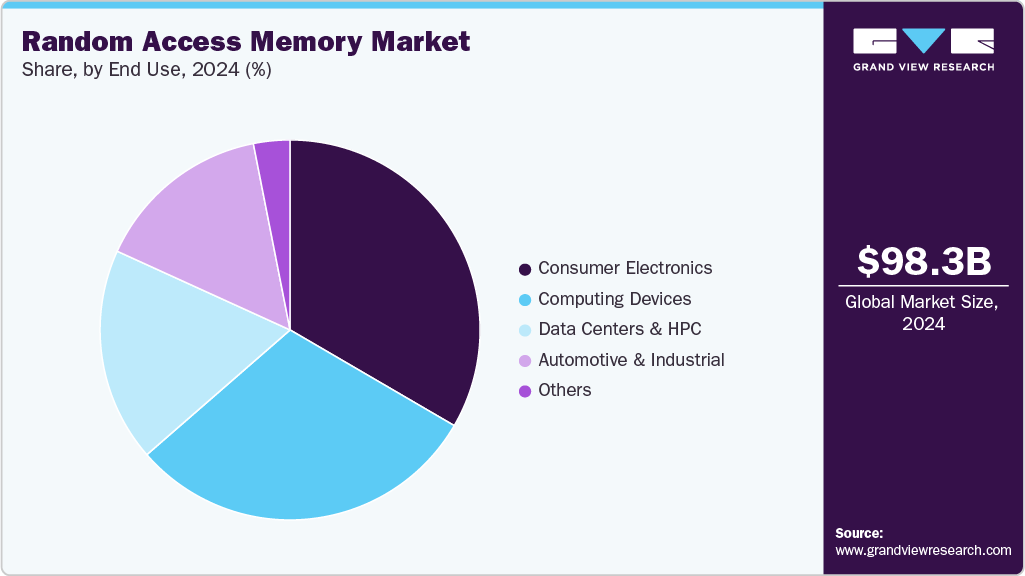

Consumer Electronics holds the largest share in the RAM market in 2024, due to high demand for smartphones, tablets, and laptops. The widespread adoption of advanced features like high-resolution displays and multitasking capabilities increased memory requirements. Manufacturers focused on optimizing performance and energy efficiency, further driving RAM consumption. Continuous product launches and upgrades fueled recurring demand for memory modules. Brand differentiation and user experience became key factors influencing purchasing decisions. This segment maintained steady growth as global consumer electronics sales remained robust. Rising disposable incomes and expanding smartphone penetration in emerging markets further supported RAM demand.

Data centers and high-performance computing (HPC) applications are emerging as significant contributors to RAM market growth. The expansion of cloud services, AI workloads, and virtualization increased memory requirements for servers. Enterprises are investing in high-capacity and high-speed RAM to improve processing efficiency and reduce latency. Technological advancements in DDR5 and other next-gen memory standards supported this growth. Scalability and reliability are critical factors for adoption in these environments. As digital transformation accelerates, demand from data centers and HPC is expected to continue rising. Growing investments in AI, machine learning, and big data analytics are further boosting RAM requirements in these sectors.

Regional Insights

Asia Pacific holds the largest share in the Random Access Memory market at 41.2%, driven by strong demand from consumer electronics and computing devices. Rapid smartphone adoption, PC upgrades, and gaming hardware consumption fueled memory requirements across the region. Major manufacturing hubs in countries such as China, South Korea, and Japan ensured robust supply chains and competitive pricing. Expansion of data centers and cloud infrastructure further increased demand for high-performance RAM. Growing technological investments and increasing disposable incomes supported sustained market dominance in Asia Pacific.

U.S. Random Access Memory Market Trends

The U.S. RAM market is witnessing steady growth driven by rising demand from data centers, cloud computing, and AI workloads. Adoption of high-performance memory like DDR5 is accelerating across enterprise and consumer segments. Increasing investments in gaming, PC upgrades, and workstation hardware are boosting memory consumption. Supply chain resilience and domestic manufacturing initiatives support consistent availability of RAM products.

Europe Random Access Memory Market Trends

The European RAM market is growing steadily, supported by demand from consumer electronics, industrial automation, and IT infrastructure. Adoption of high-speed memory modules, including DDR5, is increasing across enterprise servers and HPC systems. Government initiatives promoting digitalization and smart manufacturing are boosting memory requirements. Supply chains remain concentrated in key countries such as Germany, France, and the UK, ensuring stable product availability.

North America Random Access Memory Market Trends

The North American RAM market is expanding due to strong demand from data centers, cloud services, and AI-driven applications. High-performance memory adoption, particularly DDR5, is increasing in enterprise and consumer computing. The gaming and PC upgrade markets are contributing significantly to overall RAM consumption. Investments in advanced manufacturing and R&D support technology innovation and supply chain stability. Energy-efficient and high-speed memory solutions are becoming key factors influencing purchasing decisions across the region.

Key Random Access Memory Company Insights

Some of the key companies in the RAM industry include Bosch Rexroth AG, KEB Automation KG, Omron Corporation, Siemens, Schneider Electric, WAGO, Yaskawa Electric Corporation, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Micron Technology is advancing its RAM portfolio to meet growing demand from AI and high-performance computing. The company will begin mass production of DRAM chips using Extreme Ultraviolet (EUV) lithography in 2025. This technology improves performance and energy efficiency, marking a major step in memory manufacturing. Micron has launched DDR5-9200 memory modules with its 1γ process technology, offering higher speeds and better power efficiency.

-

Samsung Electronics is driving innovation in high-performance RAM technologies. It has completed development of its sixth-generation DRAM, 1c DRAM, and plans mass production of HBM4 in 2025. Samsung is also advancing LPDDR6 memory to stay competitive in the global market. The company plans to phase out DDR4 production to focus on DDR5, LPDDR5, and high-bandwidth memory solutions.

Key Random Access Memory Companies:

The following are the leading companies in the random access memory market. These companies collectively hold the largest market share and dictate industry trends.

- ADATA Technology Co., Ltd.

- Apacer Technology Inc.

- CORSAIR

- G.SKILL International Enterprise Co., Ltd.

- Kingston Technology

- Micron Technology, Inc.

- PATRIOT MEMORY, INC.

- Samsung Electronics

- SK HYNIX INC.

- Transcend Information, Inc.

Recent Developments

-

In September 2025, SK HYNIX INC., a Semiconductor company in South Korea, completed the development and is ready for mass production of HBM4, the world’s first next-generation High Bandwidth Memory designed for ultra-high-performance AI. The chip offers double the bandwidth and over 40% better power efficiency than the previous generation, using advanced MR-MUF and 1bnm technologies.

-

In June 2025, Cadence Design Systems, Inc. strengthened its partnership with Samsung Foundry through an IP agreement to expand interface IP and memory solutions across Samsung’s advanced SF4X, SF2P, and SF5A nodes for automotive, AI, and RF applications. This alliance focuses on expediting the development of advanced SoCs and 3D-ICs by merging Cadence’s AI-powered design capabilities with Samsung’s advanced manufacturing technologies.

Random Access Memory Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 107.95 billion

Revenue forecast in 2033

USD 233.86 billion

Growth rate

CAGR of 10.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Type, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

ADATA Technology Co., Ltd.; Apacer Technology Inc.; CORSAIR; G.SKILL International Enterprise Co., Ltd.; Kingston Technology; Micron Technology, Inc.; PATRIOT MEMORY, INC.; Samsung Electronics; SK HYNIX INC.; Transcend Information, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Random Access Memory Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global Random Access Memory (RAM) market in terms of type, end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Traditional RAM

-

DRAM (Dynamic RAM)

-

SRAM (Static RAM)

-

VRAM (Video RAM)

-

-

Emerging / Next-Generation RAM

-

MRAM (Magnetoresistive RAM)

-

ReRAM (Resistive RAM)

-

PRAM (Phase-Change RAM)

-

FRAM (Ferroelectric RAM)

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Computing Devices

-

Consumer Electronics

-

Data Centers & HPC

-

Automotive & Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.