- Home

- »

- Clinical Diagnostics

- »

-

Rapid Tests Market Size, Share & Growth Analysis Report 2030GVR Report cover

![Rapid Tests Market Size, Share & Trends Report]()

Rapid Tests Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Consumables), By Technology (Immunoassay, Molecular Diagnostics), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-028-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Rapid Tests Market Summary

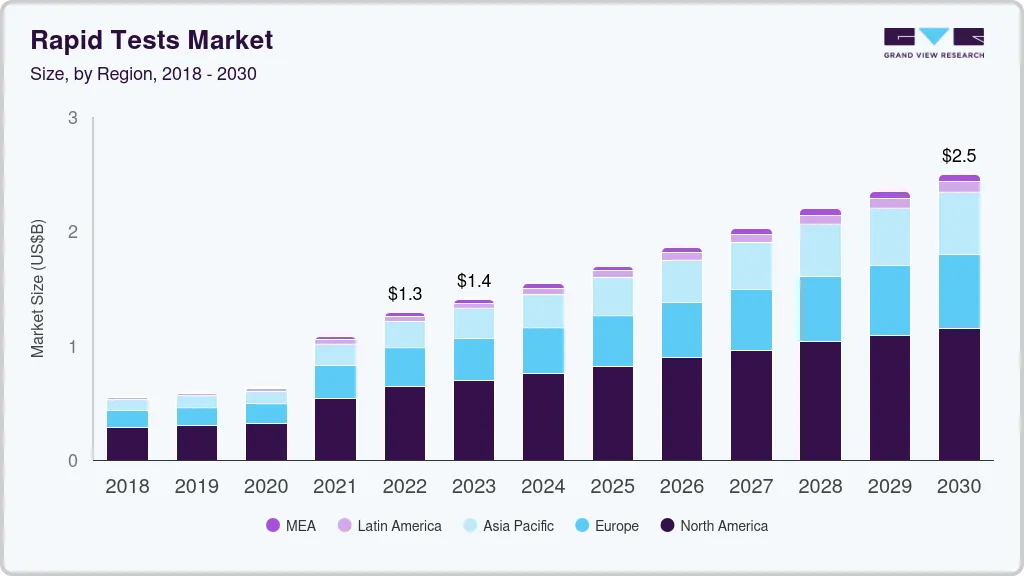

The global rapid tests market size was estimated at USD 1.29 billion in 2022 and is projected to reach USD 2.50 billion by 2030, growing at a CAGR of 8.6% from 2023 to 2030. The growing geriatric population, rising target disease burden, and increasing adoption of self-testing & point-of-care products are the major factors driving the market growth.

Key Market Trends & Insights

- North America dominated the overall rapid tests market in terms of revenue, with a share of 48.89% in 2022.

- By product, the consumables segment dominated the rapid tests market with a revenue share of 68.08% in 2022.

- By technology, the immunoassay segment held a 52.45% revenue share in the rapid tests market.

- By application, the upper respiratory tract infections segment dominated the rapid tests market with a revenue share of 58.65% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1.29 Billion

- 2030 Projected Market Size: USD 2.50 Billion

- CAGR (2023-2030): 8.6%

- North America: Largest market in 2022

Furthermore, the space is developing due to the introduction of technologically advanced products which is boosting the market growth. However, quality assurance is the key challenging aspect associated with rapid diagnostics products, which is anticipated to restrain the market growth. The globally rising geriatric population is increasing the risk of several diseases, including cardiovascular diseases, neurological disorders, cancer, obesity, and diabetes. As per a UN report, globally, there were about 727.0 million people aged 65 and above in 2020. Moreover, the number of individuals aged 80 and above is estimated to cross more than 1.5 billion by 2050. Therefore, the growing aging population is increasing the demand for the rapid diagnostics space and driving market growth.Rapid technological advancements are leading to innovative products with improved accuracy, portability, and cost-effectiveness, which are expected to support market growth in the coming years. For instance, in July 2021, Abbott launched its COVID-19 home test kit in India at a price point of around USD 4.07; this strategic price point enabled it to target the majority of the population in the country. Moreover, in March 2021, BD received an FDA EUA grant for a rapid antigen test that can detect influenza A & influenza B and SARS-CoV-2, in a single test.

Furthermore, the introduction of mobile applications, such as cobas infinity point-of-care from Roche Diagnostics, to satisfy the requirements of the POC coordinator and aid in enhancing productivity by completing the task on the smartphone irrespective of the destination, can be expected to drive the adoption of POC molecular diagnostic products during the forecast period.

Key players have shifted their focus to commercializing home-based self-testing products in recent years and the COVID-19 outbreak has propelled this trend. Amid government-imposed lockdowns, such products addressed clinical needs while promoting self-quarantine practices. Companies, such as Abbott, have products like BinaxNOW Card rapid test for influenza and COVID-19 that deliver results at home in 15 minutes. This product comes with a virtual guide and application to enable the testing process and display test results.

Product Insights

The consumables segment dominated the rapid tests market with a revenue share of 68.08% in 2022. This can be attributed to high testing rates for the diagnosis of upper respiratory diseases and the commercialization of several PoC assays. Moreover, growing product launches and R&D initiatives pertaining to molecular diagnostic technologies, and rising demand for the Point-of-Care (POC) & self-test products, are expected to boost market growth in the coming years.

Antibiotic-resistant infections are a major issue in the world, thereby boosting demand for consumables globally. Organizations are actively involved in addressing the issue. For instance, in April 2021, BD MAX’s Molecular Multi-Drug Resistant Tuberculosis (MDR-TB) Assay was included by WHO in its moderate complexity automated NAAT MDx technologies, recognized for high accuracy in TB testing, and included under the updated guidelines on TB diagnostic tests.

The others segment includes instrument-related services and software, such as program interfaces used for operating diagnostic instruments, conducting analysis, and interpreting results that are employed to run the instrumentation process and analyze results. Some companies frequently update their software to facilitate the smooth running of diagnostic procedures and easy data management, which is boosting the growth rate of this segment.

Technology Insights

In 2022, the immunoassay segment held a 52.45% revenue share in the rapid tests market. Multiple rapid immunoassays that offer high efficacy are available in the market. Immunoassay-based rapid diagnostics for RSV include Directigen, QuickVue, Sofia, and BD Veritor, which are next-generation lateral flow Digital Immunoassay (DIA) techniques for the qualitative detection of RSV viral antigens. In addition, rapid RSV antigen is the most widely used test. RSV antigen testing is usually performed on-site, in a doctor's office, or in an emergency department, with the majority of results available within an hour.

The technology market for the molecular diagnostics segment is anticipated to progress at the highest CAGR during the forecast period. In the rapid tests market, there has been a substantial presence of molecular diagnostics products, which is expected to drive the market during the coming years. The FDA has approved RT-PCR-based POC assays, such as Focus Diagnostics' Simplexa Flu A/B & RSV, BioFire’s Film Array RVP, and Cepheid's GeneXpert Flu A/B, for the detection of pneumonia or streptococcus infections.

Application Insights

The upper respiratory tract infections segment dominated the rapid tests market with a revenue share of 58.65% in 2022. This can be attributed to the high incidences of infectious diseases that affect the lungs, along with the increase in product approvals. However, the antibiotic-resistant infections segment is expected to exhibit the fastest growth during the forecast period owing to the increased government focus and R&D funding for the development of diagnostics.

Upper respiratory tract infections are more commonly associated with influenza and Para influenza virus, respiratory syncytial virus, streptococcus family of pathogens, and now the COVID-19 infection. Rising incidences of upper respiratory tract infections and the introduction of novel rapid diagnostics are among the primary factors fueling the market.

The antibiotic-resistant infections segment is expected to expand at the fastest CAGR during the forecast period. The growing incidence of Tuberculosis (TB) and drug-resistant TB, which require portable and immediate diagnosis, is estimated to propel the demand. Factors such as the delivery of quick results can strengthen the POC diagnostics market, as a faster diagnosis can enable rapid patient management. WHO reported TB to be the second-largest cause of infectious diseases and related annual adult deaths across the globe. In addition, Multidrug-Resistant Tuberculosis (MDR-TB) takes up more than 4.0% share of new TB cases.

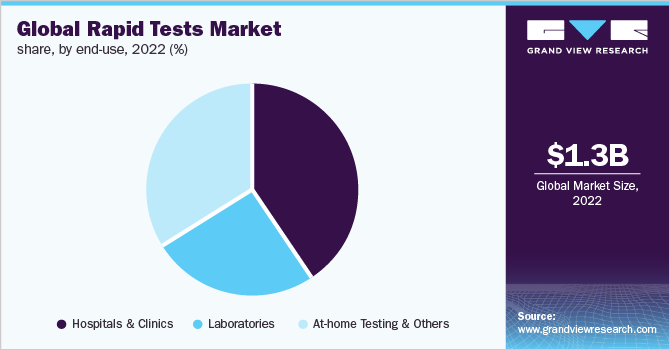

End-Use Insights

The hospitals and clinics segment dominated the market with a 40.93% revenue share in 2022 and is anticipated to maintain its share in the coming years, owing to the high demand for POC tests in physicians’ offices. POC diagnosis in hospitals is a patient-centric system that helps doctors efficiently track the health of the patients. It is beneficial for healthcare personnel as it provides mobility to the diagnosis system and allows it to reach the patient effectively. The development of wireless communication and miniaturized devices can benefit hospital-based POC diagnostics, as they can provide single-level access throughout the hospital and further drive market growth.

Laboratories, including pathology & diagnostic laboratories, involve the usage of POCT products. Government-based diagnostic laboratories are involved in the diagnosis of several infections and chronic ailments by the adoption of bench-top POC analyzers and instruments. Furthermore, this segment is expected to be driven by the rising need for early identification of several life-threatening conditions, such as sepsis. Each year, more than 7.0 billion clinical laboratory examinations are performed in the U.S., as per an article published by the American Clinical Laboratory Association.

Regional Insights

North America dominated the overall rapid tests market in terms of revenue, with a share of 48.89% in 2022, owing to the high incidences of upper respiratory diseases & antibiotic-resistant infections, high healthcare expenditure, and the launch of technologically advanced products. Furthermore, supportive government initiatives and a rise in awareness about the use of PoC & rapid diagnostics for the diagnosis of various diseases in the region are fueling the market growth. For instance, in April 2021, Chembio Diagnostics, Inc. launched a rapid point-of-care COVID-19/Flu A&B test in the U.S. market.

Europe is one of the leading regions due to its high revenue share in the rapid tests market. This can be attributed to the presence of developed economies such as Germany and Italy, and advanced R&D infrastructure along with the rising patient pool. In addition, Europe’s large geriatric population of 90.4 million is further fueling the growth. Moreover, Europe is witnessing new regulations regarding IVD and medical devices, which are likely to be updated by end of 2022, which is expected to offer a more sustainable and robust framework for compliance with diagnostic devices.

Key Companies & Market Share Insights

Key players in the rapid diagnostics space are undertaking strategic initiatives such as new launches, collaborations, and mergers and acquisitions, which are further driving the market growth. For instance, in August 2022, BD entered a commercial collaboration with Accelerate Diagnostics. Through this strategic initiative, BD would offer Accelerate Diagnostics’ antibiotic resistance and susceptibility rapid diagnostics solutions across the globe. Some of the prominent key players in the global rapid tests market include:

-

BD (Becton, Dickinson and Company)

-

bioMérieux SA

-

Thermo Fisher Scientific, Inc.

-

F. Hoffmann-La Roche Ltd.

-

Danaher Corporation

-

DiaSorin S.P.A

-

Abbott

Rapid Tests Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.40 billion

Revenue forecast in 2030

USD 2.50 billion

Growth Rate

CAGR of 8.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BD (Becton, Dickinson and Company); bioMérieux SA; Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche Ltd.; Danaher Corporation; DiaSorin S.P.A; Abbott

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rapid Tests Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rapid tests market report based on the product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Consumables

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassay

-

Molecular Diagnostics

-

Other Technologies

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Upper Respiratory Tract Infections

-

Influenza And Parainfluenza Virus

-

Streptococcus

-

Respiratory Syncytial Virus

-

-

Antibiotic Resistant Infections

-

Sepsis

-

Bacterial Sepsis

-

Fungal Sepsis

-

Others

-

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Laboratories

-

At-home Testing And Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of LATAM

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global rapid tests market size was estimated at USD 1.29 billion in 2022 and is expected to reach USD 1.40 billion in 2023.

b. The global rapid tests market is expected to grow at a compound annual growth rate of 8.6% from 2023 to 2030 to reach USD 2.50 billion by 2030.

b. Based on technology, the immunoassay segment dominated the market with a share of 68.08% in 2022, owing to the availability of multiplex tests for the simultaneous diagnosis of flu, RSV, and Covid-19.

b. Some key players in the rapid tests market include bioMérieux SA; Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche Ltd.; Danaher Corporation; DiaSorin S.P.A; and Abbott amongst others.

b. Key factors driving the rapid tests market growth include the rising incidence of target diseases and increasing demand for rapid diagnosis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.