- Home

- »

- Healthcare IT

- »

-

Real World Evidence Solutions Market, Industry Report, 2033GVR Report cover

![Real World Evidence Solutions Market Size, Share & Trends Report]()

Real World Evidence Solutions Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Services, Data Sets), By Application, By End Use (Healthcare Payers, Healthcare Providers), By Therapeutic Area (Oncology, Cardiology), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-808-0

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Real World Evidence Solutions Market Summary

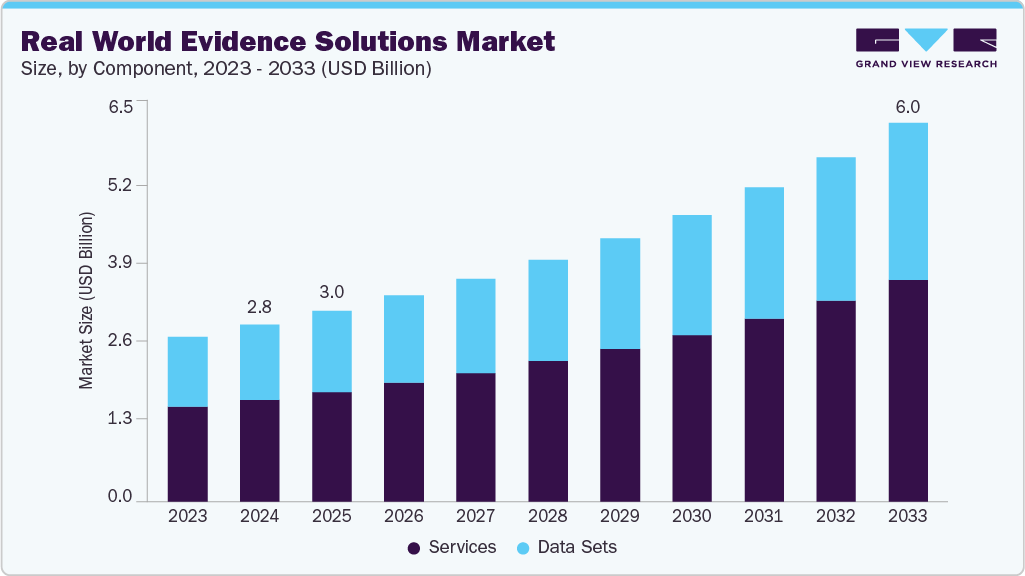

The global real world evidence solutions market size was estimated at USD 2.81 billion in 2024 and is projected to reach USD 6.01 billion by 2033, growing at a CAGR of 8.94% from 2025 to 2033. This growth is attributed to the increase in R&D spending, rising applications of real-world evidence (RWE) in various fields, support from regulatory bodies for using real world evidence (RWE) solutions and growing volume of real-world data are anticipated to boost the market growth.

Key Market Trends & Insights

- North America dominated the market for real-world evidence solutions with a share of 43.17% in 2024.

- Asia Pacific is estimated to be the fastest-growing region over the forecast period.

- Based on component, the services segment held the largest market share of 57.73% in 2024.

- By application, the drug development and approvals segment dominated the market with the largest revenue share in 2024.

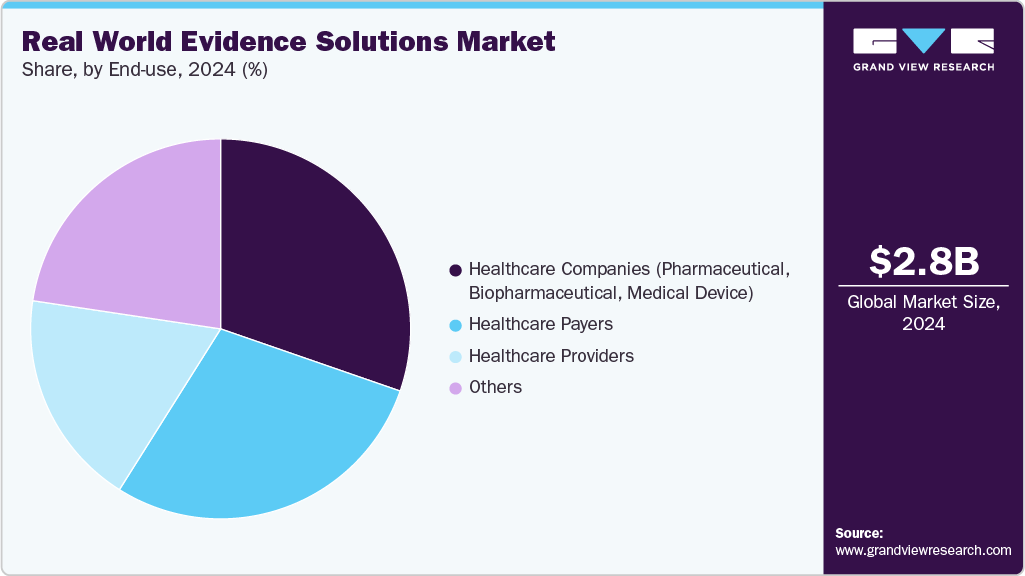

- Based on end use, healthcare companies held the dominant market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.81 Billion

- 2033 Projected Market Size: USD 6.01 Billion

- CAGR (2025-2033): 8.94%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing regulatory acceptance of real-world evidence is a major driving factor for market expansion, as global agencies now provide clearer rules on when and how RWD can support approvals, label expansions, and post-market decisions. This increasing clarity reduces compliance uncertainty and motivates pharma and biotech to invest in robust RWE platforms. Key regulatory initiatives enabling RWE adoption includes:

-

FDA (U.S.) - Through the 21st Century Cures Act and dedicated RWE guidance, the FDA clearly defines how EHR, claims, and registry data can support regulatory submissions and how data quality and methodologies should be validated.

-

EMA (EU) - EMA’s DARWIN EU network, RWE Roadmap, and Data Quality Framework standardize RWD use across Europe, enabling consistent integration of RWE into lifecycle assessments.

-

MHRA (UK) - MHRA provides practical guidance on RWD-based studies and RCTs using RWD, outlining acceptable sources, endpoints, and safety processes, supported by its RWE Scientific Dialogue pathway.

-

PMDA (Japan) - PMDA emphasizes strong data reliability and analytic accuracy while increasingly accepting registry-based evidence for approvals and label updates, especially in rare and pediatric conditions.

Such regulatory efforts are strengthening industry’s trust in real-world evidence approaches, thereby driving broader global uptake of RWE solutions.

The growing volume of real-world data is a key driver for the Real-World Evidence (RWE) solutions market, as the volume of health-related data continues to grow at a compound annual rate of 36%. Data from electronic health records, insurance claims, disease registries, wearables, and patient-reported outcomes is increasing in both scale and granularity. Advances in data integration, interoperability, and analytics enable RWE platforms to transform these vast datasets into meaningful, actionable insights. This allows pharmaceutical companies, payers, and healthcare providers to generate more accurate, representative, and timely evidence, supporting drug development, regulatory submissions, and value-based care initiatives.

Integration of AI in Real-World Evidence Market

Integration of AI in the real-world evidence (RWE) enables healthcare and life sciences companies to rapidly analyze complex, large-scale real-world datasets from electronic health records, claims, patient registries, and digital health sources. AI-powered platforms can identify patterns, predict patient outcomes, optimize clinical trial design, and generate actionable insights for regulatory submissions and post-market surveillance, improving decision-making and operational efficiency.

Some of the leading patient access solutions providers are leveraging AI and automation to streamline workflows, enhance patient engagement, and optimize revenue cycles. The table below highlights key AI-driven capabilities of major market players.

AI-driven Capabilities

Vendor

Real-World Evidence

AI/Automation Capabilities

Saama

RWE analytics, clinical data integration, and insights generation

AI/ML-driven data curation, predictive analytics, automated reporting

SAS Institute Inc.

RWE data analysis and modeling for clinical and commercial insights

Advanced analytics, AI-powered predictive modeling, automated data visualization

Veradigm LLC

Real-world data aggregation and patient insights

AI/ML for patient stratification, trend analysis, and automated outcome reporting

IQVIA

RWE analytics and predictive modeling for clinical and commercial decision-making

AI-driven predictive algorithms, data integration, automated insights generation

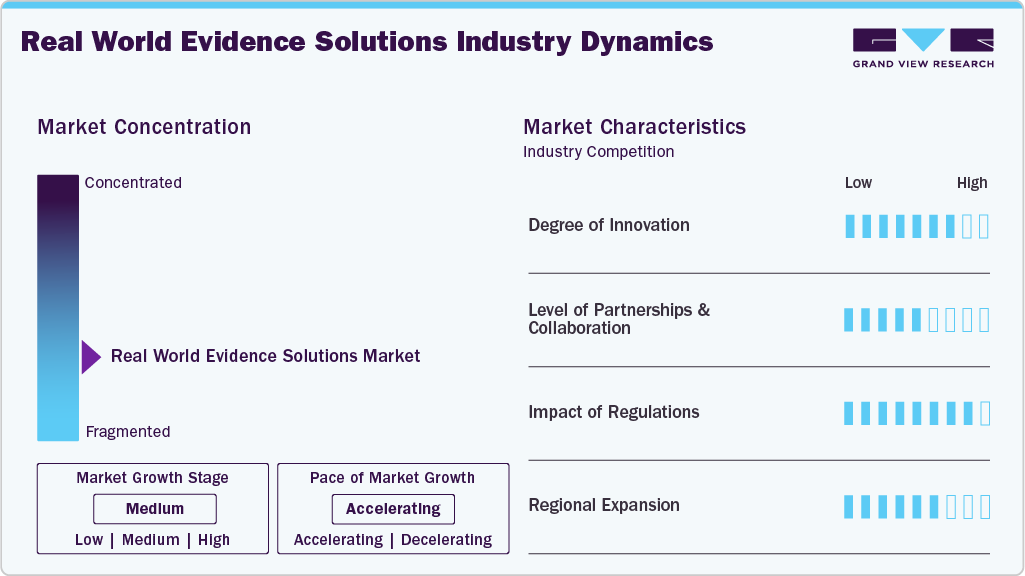

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the real-world evidence market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry is high. However, the regional expansion observes moderate growth.

The degree of innovation in the market is high, driven by the need to reduce claim denials, streamline workflows, and enhance patient engagement. Vendors are rolling out AI-powered platforms that automate eligibility checks, prior authorizations, and digital scheduling, helping providers cut delays and improve accuracy. For instance, in October 2025, Atropos Health launched its new AI-driven platform, the Atropos Evidence Agent, at Stanford Health Care, and is collaborating with Microsoft to integrate real-world evidence directly into clinical workflows via ambient AI and EHR systems.

“Utilizing agentic AI to embed real-world evidence (RWE) into workflows with patient-specific insights will enable providers to proactively address patient questions with speed and accuracy. This example shows how ambient AI, ChatEHR, and agentic AI are putting technology to work for the benefit of both providers and patients.”

- Dr. Michael Pfeffer, Chief Information and Digital Officer at Stanford Medicine.

The level of partnerships and collaborations in the Real-World Evidence (RWE) solutions market is moderate, aimed at enhancing data access, integration, and actionable insights. Vendors collaborate with healthcare providers, life-science companies, and technology partners to expand interoperability, incorporate AI-driven analytics, and streamline real-world data generation and utilization across clinical and commercial decision-making. For instance, in October 2025, HealthVerity and Claritas Rx announced a strategic partnership combining HealthVerity’s large-scale, de-identified real-world data (claims, EMR, lab) with Claritas Rx’s specialty pharmacy, hub, and co-pay program insights. The collaboration aims to provide pharma commercial, RWE, and HEOR teams with an integrated dataset that offers deeper visibility into treatment access, patient journeys, and outcomes.

The impact of regulations on the real-world evidence solutions industry is significant, as clear regulatory guidance from agencies like the FDA, EMA, MHRA, and PMDA establishes standards for data quality, study design, and methodological rigor. This reduces uncertainty for life-science companies, encouraging wider adoption of RWE platforms to support drug development, regulatory submissions, post-market surveillance, and value-based care.

Regional expansion is driving growth in the market as vendors extend their presence across North America, Europe, and Asia-Pacific to tap into rising healthcare digitization, regulatory support, and demand for data-driven insights. Expanding into new geographies allows providers, pharma, and payers to access localized real-world datasets. For instance, in March 2025, OM1 is expanding into Europe to bring its AI‑powered real‑world evidence (RWE) solutions to life sciences firms, helping them generate high-quality, observational data to support drug development, market access, and regulatory needs.

Case Study: Real-World Evidence Enables Regulatory Pathway For Label Expansion

This case study highlights how IQVIA partnered with a pharmaceutical sponsor to support a label expansion using real-world evidence (RWE), bypassing the need for traditional randomized controlled trials (RCTs). The approach combined scientific rigor with strategic regulatory engagement to align with the U.S. FDA's evolving expectations for RWE in submissions.

Challenge:

The sponsor faced the complex task of securing label expansion for an approved therapy without conducting new RCTs, which are often time-consuming, costly, and infeasible in certain patient populations. Demonstrating the scientific robustness and regulatory acceptability of RWE posed a significant challenge, requiring a clear and structured strategy to meet FDA standards.

Solution:

IQVIA deployed a multi-phase regulatory support strategy:

-

Developing a comprehensive protocol synopsis to outline study design, endpoints, and objectives.

-

Preparing a detailed Type B meeting request and briefing package to justify the use of real-world data and present the regulatory rationale to the FDA.

-

Addressing agency feedback through a Type D meeting briefing package, which allowed for ongoing dialogue with the FDA-marking one of the first Type D meetings focused on RWE.

-

Attending both meetings alongside the sponsor, IQVIA ensured expert guidance and alignment throughout the regulatory interactions.

Result:

The collaborative effort led to successful regulatory alignment with the FDA, validating the use of RWE to support the product’s label expansion. The engagement demonstrated IQVIA’s pioneering approach in leveraging real-world data for regulatory decision-making. The sponsor continues to work with IQVIA to supply regulatory-grade data, enabling a more efficient, cost-effective path toward expanded approval and market reach.

Component Insights

Based on component, the services segment dominated the market with the largest revenue share of 57.73% in 2024. The segment growth is attributed to the high adoption of real world services by pharmaceutical and biotechnology companies and healthcare providers. Moreover, business initiatives undertaken by market players are among the key factors driving market growth. For instance, in February 2024, Gilead Sciences, Inc. announced its plans to present RWE and new clinical data from its antiviral research and development programs at the 31st Conference on Retroviruses and Opportunistic Infections (CROI 2024)

However, the data sets segment is expected to grow at a significant rate during the forecast period. Real-World Data (RWD) is data collected outside the context of clinical trials from sources such as Electronic Medical Records (EMRs), insurance claims, patient-reported results, and biometric devices. Growth in this segment is primarily due to the increasing need for further understanding of real-world compliance, epidemiology, costs, large amounts of medical data generated in hospitals, and the reliance on results-based research.

Application Insights

Based on application, the drug development and approvals segment accounted for the largest revenue share of 28.61% in 2024. Real world evidence solutions allow pharmaceutical companies and healthcare providers and payers for efficient management of operations and acceleration of the process of drug development and its approval. This fuels market growth. Furthermore, governments are undertaking various initiatives to promote the use of RWE in medical device development and approvals. For instance, in December 2023, the FDA published draft guidance outlining its assessment of RWD in medical device clearance or approval decisions, along with anonymized examples of its RWE utilization.

The reimbursement/coverage and regulatory decision-making segment is expected to grow at the fastest CAGR during the forecast period. Most nations in the recent past have leveraged RWE for conducting pharmacovigilance activities and post marketing effectiveness assessments, however, RWE frameworks that address the usage of RWE during the product lifecycle, comprising premarketing activities & post marketing labeling changes for effectiveness, have only recently been issued.

Therapeutic Insights

Based on therapeutic area, the oncology segment held the largest market share of 22.93% in terms of revenue in 2024. This growth is attributed to several applications of RWE in cancer drug development processes, such as decreasing cost of clinical trials, improving the probability of regulatory success, and increasing product approval rates in a shorter timeline. According to GLOBOCAN, in 2022, approximately 10.0 million new cancer cases were detected and around 9.7 million cancer-related deaths were recorded globally. According to the Indian Council of Medical Research (ICMR), the incidence of cancer in the country increased from 1.39 million cases in 2020 to 1.46 million cases in 2022. Therefore, the growing demand for effective drug development in the oncology therapeutic space has further increased the deployment rate of RWE solutions to expedite the pace of drug discovery.

The cardiology segment is expected to grow at a significant CAGR during the forecast period. RWE solutions offer a potentially rich source of information from clinical trial experiments conducted at different locations and set-ups. In the therapeutic area of cardiology, RWE solution correlates with the evaluation of the potential risks or benefits of an intended drug, using real-world patient data from several other sources. This information helps researchers in clinical decisions revolving around a diverse patient population encountered in the comparison studies. The benefits of RWE in cardiology have been evaluated by the American College of Cardiology Foundation (ACCF), which indicated that about 64% of U.S. cardiologists were very interested in the educational programs regarding RWE software, considering its varied applications.

End Use Insights

On the basis of end use, the healthcare companies segment accounted for the largest revenue share in 2024. The growth can be attributed to the rising significance of RWE studies in drug approvals, the necessity to avoid expensive drug recalls, and increasing need to evaluate drug performance in real-world settings. For instance, in February 2024, PINC AI Applied Sciences (PAS), Premier, Inc.'s division, and Datavant expanded their collaboration to enhance healthcare research, improve clinical trial operations, and promote trial diversity & equity.

The healthcare payers’ segment is expected to grow at the fastest CAGR during the forecast period due to increasing awareness among payers regarding the importance of medical device/drug safety & their adverse effects and favorable reimbursement scenario, especially in developed countries. RWE has been used in nearly 16% of all the clinical findings cited by payers in specialty drug decisions, with HER data being the most often cited data set used to derive these insights. RWE solutions help payers in reimbursement assessments. RWE also supports patients in budget management and assessing risk-benefit of interventions. The incorporation of RWE in value evaluation frameworks, used for determining drug value, can assist payers in making informed evidence-based reimbursement assessments.

Regional Insights

The North America real world evidence solutions industry accounted for the largest share of the global market in 2024, which can be attributed to significant support from regulatory bodies for using Real-world Evidence (RWE) solutions, and an increase in R&D spending is also anticipated to boost market growth. Furthermore, the shift from volume to value-based care is expected to fuel market growth. In addition, the high share of the region can be attributed to the presence of key players in the U.S. and Canada. Favorable government regulations and increasing number of RWE service providers in the region are anticipated to drive the market further

U.S. Real World Evidence Solutions Market Trends

The real world evidence solutions industry in the U.S. is being driven by the increasing number of payers using Real World Data (RWD), a favorable regulatory environment, an increasing number of RWE service providers, and a rising number of pharmaceutical companies adopting RWE solutions for drug approval processes. For instance, in October 2022, the FDA announced its Advancing Real World Evidence Program initiative. This program aims to enhance the quality and acceptance of RWE-based methodologies for supporting new labeling claims, including approving new applications for existing medical products or meeting post approval study obligations. This initiative is part of the FDA's commitment outlined in the Prescription Drug User Fee Act VII, included in the FDA User Fee Reauthorization Act of 2022.

Europe Real World Evidence Solutions Market Trends

The real world evidence solutions industry in Europe is expected to grow significantly during the forecast period. The market growth can be attributed to increase in hospital visits due to the rising prevalence of chronic & infectious diseases and the rapid rise in geriatric population across the region. Major market players are focused on various business strategies, such as product launches, to expand their product portfolios and other initiatives. For instance, ICON plc, based in Ireland, acquired PRA Health Sciences for USD 12 billion and USD 80 per share in cash in July 2021. In addition, increasing R&D investments and rising demand for RWE solutions & RWD are anticipated to fuel market growth over the forecast period.

The real world evidence solutions industry in the UK is expected to grow significantly during the forecast period. The increasing government support in the form of initiatives aimed at promoting the adoption of RWE is driving market growth in the country. For instance, in October 2022, the National Institute for Health and Care Excellence (NICE) conducted a virtual workshop as a part of the IMI-funded project, the European Health Data and Evidence Network (EHDEN), in collaboration with the GetReal Institute. The initiative aims to establish a network of healthcare databases across Europe, each adhering to the Observational Medical Outcomes Partnership Common Data Model (OMOP CDM).

The real world evidence solutions industry growth in Germany can be attributed to the increasing partnerships among market players. In November 2023, Cegedim Health Data, a supplier of clinical RWE and RWD, expanded its European database, THIN, to incorporate German RWD. With data from the UK, France, Spain, Italy, Belgium, and Romania, the database now integrates German electronic health records. This expansion makes the database accessible to healthcare stakeholders, such as academic researchers and health authorities.

Asia Pacific Real World Evidence Solutions Market Trends

Asia Pacific real world evidence solutions industry is anticipated to register the fastest CAGR over the forecast period, owing to the rising government initiatives for the adoption of RWE studies and the presence of many contract research and manufacturing organizations in countries, such as China and India. The rising demand for better healthcare services is also expected to fuel market growth. Moreover, major players are contributing to the region's market growth by entering into partnerships or expanding their product portfolios. These include Medpace; Cegedim Health Data; Parexel International Corporation; IQVIA, Inc.; and IBM.

The real world evidence solutions industry in Japan has a significant market share in 2024. The market is expected to be driven by the increasing adoption of RWE solutions by local pharmaceutical companies. Key players in the market are developing devices that integrate RWD to deliver patient-centric care. For instance, in February 2024, ZimVie, Inc., a global player in the life sciences sector specializing in dental and spine markets, introduced the TSX Implant in Japan. This implant integrates design elements supported by over 20 years of clinical and RWD, aiming to provide benefits such as peri-implant health, sustained osseointegration, crestal bone preservation, and prosthetic stability.

The real world evidence solutions industry in India is expected to grow significantly during the forecast period. Increasing government initiatives to digitize healthcare infrastructure are expected to drive the market growth. For instance, the National Digital Health Mission seeks to build a unified digital healthcare infrastructure that links healthcare practitioners to patients, allowing them to access real-time health records. This would enable healthcare providers to trace patients' medical histories and provide quality care.

Latin America Real World Evidence Solutions Market Trends

Latin America’s real‑world evidence solutions industry is gradually gaining traction, fueled by growing interest from health technology assessment bodies and life-science firms to use locally generated RWD for decision-making. While public databases from Brazil, Argentina, Colombia, and Chile are expanding into claims and registry data, fragmented data governance and a lack of formal RWE guidelines remain barriers.

Middle East & Africa Real World Evidence Solutions Market Trends

The Middle East & Africa real‑world evidence solutions industry is increasingly exploring Real-World Evidence (RWE) solutions as governments and healthcare systems in countries such as Saudi Arabia, the UAE, and Israel invest in digital health and data infrastructure to support value-based care and informed decision-making. In August 2025, the Saudi Food and Drug Authority (SFDA) released a draft framework outlining how real-world data (RWD) and RWE can support marketing authorization of medicines, emphasizing “fit-for-purpose” data, methodological quality, and use-cases such as external comparators and evidence transportability. While RWE’s role in reimbursement and clinical policy is gaining recognition, challenges remain, including fragmented health systems, limited local data generation, and trust in data.

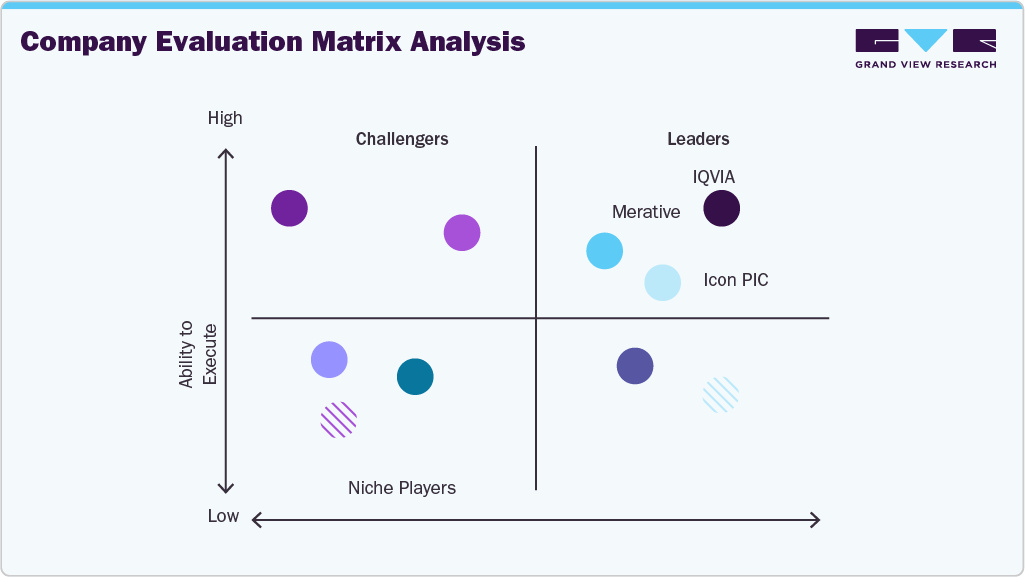

Key Real World Evidence Solutions Company Insights

Key players in the Real-World Evidence (RWE) solutions industry are leveraging innovative strategies by offering AI-powered data analytics, predictive modeling, patient stratification tools, and automated outcomes reporting to enhance decision-making and research efficiency. Integration with interoperable healthcare IT systems, electronic health records, claims databases, and partnerships with biopharma companies, payers, and research organizations are further driving adoption and expanding the reach of RWE solutions.

(The final report will provide a detailed analysis of the company evaluation matrix, highlighting notable, emerging players and innovators 15+ market players positioned within the matrix.)

Key Real World Evidence Solutions Companies:

The following are the leading companies in the real world evidence solutions market. These companies collectively hold the largest market share and dictate industry trends.

- IQVIA

- Merative

- PPD Inc. (now part of Thermo Fisher)

- Parexel International Corporation

- NTT DATA, Inc.

- Icon Plc

- Oracle

- Syneos Health

- Cegedim Health Data

- Medpace

- Optum Inc. (UnitedHealth Group)

- SAS Institute Inc.

- Cognizant

- Aetion, Inc. (acquired by Datavant in May 2025)

- Flatiron Health

- Cytel Inc.

- Trinity

Recent Developments

- In November 2025, Datavant and AWS have launched Datavant Connect powered by AWS Clean Rooms, a cloud‑first solution that enables life-science companies to securely discover and analyze fit‑for‑purpose real‑world data across multiple sources without moving raw data. This joint platform, validated by four top-20 pharma firms and 15 major RWD sources, streamlines data discovery and accelerates evidence generation, while preserving privacy.

“Life sciences leaders are under pressure to deliver insights faster, but the tools to do so have historically been slow, fragmented, and hard to scale. Cloud-first insights generation is now transforming how pharmaceutical organizations source fit-for-purpose data outputs more efficiently, accelerating how our industry approaches end-to-end evidence generation.”

-Arnaub Chatterjee, GM and President of Life Sciences at Datavant.

- In October 2025, LyfeSci Research & Innovation, a new physician‑led CRO, has launched with a strong emphasis on outcomes‑focused research, offering integrated services from pre‑clinical through to real‑world data (RWD) and real‑world evidence (RWE) studies. Their patient‑and‑site‑centric model aims to streamline operations, enhance study quality and accelerate insights that matter to both sponsors and healthcare providers.

“Our goal is to revolutionize the clinical research experience by placing patients at the heart of everything we do, By delivering value that reflects site needs-which in turn address patient priorities and clinical realities-we aim to improve study timelines and elevate the quality of research outcomes by leveraging our scientific expertise and technology capabilities.”

- Tapan Parikh, MD, CEO and Founder.

- In March 2025, Aetion has made its Aetion EvidencePlatform available on AWS Marketplace, enabling life‑science, payer and regulatory organizations to more easily access its cloud‑based, analytics‑driven real‑world‑evidence solutions. The integration simplifies procurement, enhances scalability and compliance (with HIPAA, GDPR and 21 CFR Part 11), and accelerates insights derived from real‑world‑data (RWD).

"By integrating with AWS, we offer our new and existing customers a seamless path to deploy and scale real-world evidence studies with enhanced efficiency and security. This is the first step in our vision to expand our collaboration with AWS to bring more value to our customers. Ultimately, our goal is to deliver an end-to-end real-world evidence platform that fully integrates with the customer's AWS-owned instances."

-Jay Podence, senior vice president of Commercial Partnerships at Aetion

-

In April 2024, IQVIA announced an expansion of its strategic partnership with Salesforce, aiming to expedite the advancement of Life Sciences Cloud of Salesforce. This initiative represents a next-gen customer interaction platform for the life sciences sector. Through these strategic partnerships, IQVIA aims to advance the development of technological solutions designed to accelerate decision-making processes across various domains, including RWE, discovery, clinical development, medical affairs, and patient safety.

-

In April 2024, Parexel partnered with Palantir Technologies Inc. to leverage AI for accelerating & enhancing the delivery of effective and safe clinical trials for global biopharmaceutical clients. The partnership facilitates enhanced clinical trial processes and expands capabilities of Paraxel in advanced analytics, RWE, and Health Outcomes.

Real World Evidence Solutions Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.03 billion

Revenue forecast in 2033

USD 6.01 billion

Growth rate

CAGR of 8.94% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Market Value in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end use, therapeutic area, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

IQVIA; Merative; PPD Inc. (now part of Thermo Fisher); Parexel International Corporation; NTT DATA, Inc.; Icon Plc; Oracle; Syneos Health; Cegedim Health Data; Medpace; Optum Inc. (UnitedHealth Group); SAS Institute Inc.; Cognizant; Aetion, Inc. (acquired by Datavant in May 2025); Flatiron Health; Cytel Inc.; Trinity

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Real World Evidence Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global real world evidence solutions market report based on component, application, end use, therapeutic area, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Services

-

Data Sets

-

Clinical Settings Data

-

Claims Data

-

Pharmacy Data

-

Patient-Powered Data

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug Development & Approvals

-

Medical Device Development & Approvals

-

Reimbursement/Coverage and Regulatory Decision Making

-

Post Market Safety & Adverse Events Monitoring

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Healthcare Companies (Pharmaceutical, Biopharmaceutical, Medical Device)

-

Clinical research

-

Commercial (inclusive of marketing, etc.)

-

HEOR

-

Others (market access, etc.)

-

-

Healthcare Payers

-

Healthcare Providers

-

Others

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Cardiology

-

Neurology

-

Diabetes

-

Psychiatry

-

Respiratory

-

Other Therapeutic Areas (Immunology, Gastroenterology, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global real world evidence solutions market size was estimated at USD 2.81 billion in 2024 and is expected to reach USD 3.03 billion in 2025.

b. The global real world evidence solutions market is expected to grow at a compound annual growth rate of 8.94% from 2025 to 2033 to reach USD 6.01 billion by 2033.

b. North America dominated the RWE solutions market with a share of over 43.2% in 2024. This is attributable to the rising number of RWE service providers and favorable government regulations in the region.

b. Some key players operating in the real world evidence solutions market include IQVIA; Merative; PPD Inc. (now part of Thermo Fisher); Parexel International Corporation; NTT DATA, Inc.; Icon Plc; Oracle; Syneos Health; Cegedim Health Data; Medpace; Optum Inc. (UnitedHealth Group); SAS Institute Inc.; Cognizant; Aetion, Inc. (acquired by Datavant in May 2025); Flatiron Health; Cytel Inc.; Trinity

b. Key factors driving RWE solutions market include rising applications of real-world evidence (RWE) in various fields, support from regulatory bodies for using real world evidence (RWE) solutions and growing volume of real-world data are anticipated to boost the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.