- Home

- »

- Next Generation Technologies

- »

-

Reconciliation Software Market Size, Industry Report, 2033GVR Report cover

![Reconciliation Software Market Size, Share & Trends Report]()

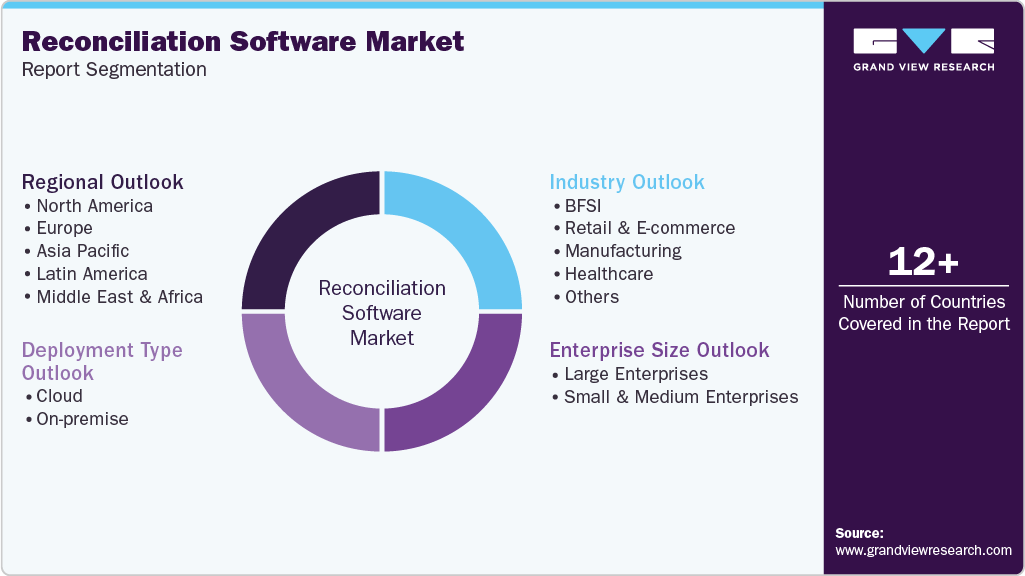

Reconciliation Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Deployment Type (Cloud, On-premise), By Enterprise Size (Large Enterprises, SME), By Industry (BFSI, Retail & E-commerce, Manufacturing, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-743-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Reconciliation Software Market Summary

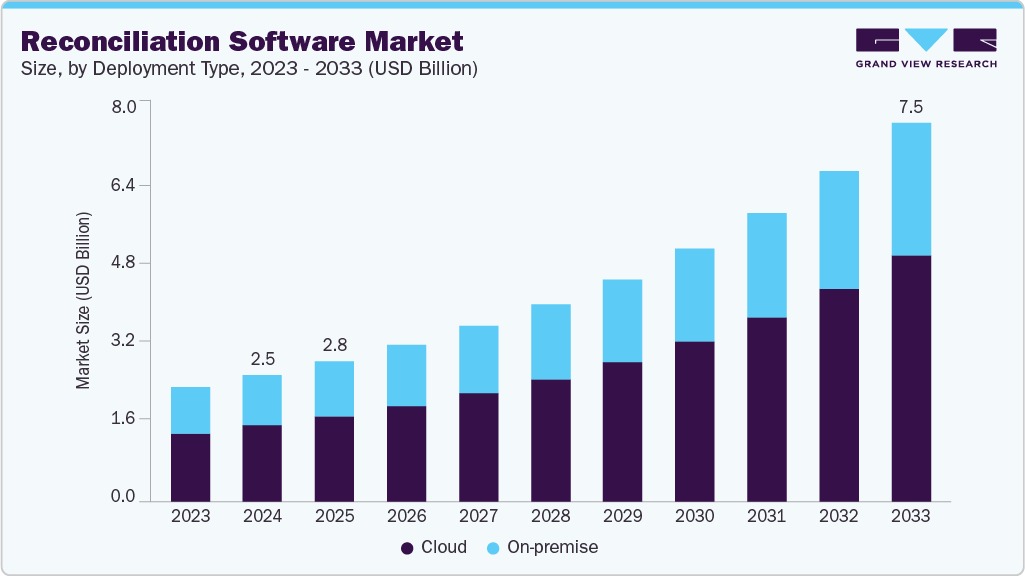

The global reconciliation software market size was estimated at USD 2.53 billion in 2024 and is projected to reach USD 7.54 billion by 2033, growing at a CAGR of 13.1% from 2025 to 2033. The reconciliation software market has been driven by increasing transaction volumes, the growing need for financial accuracy, and the rising demand for automation in accounting operations.

Key Market Trends & Insights

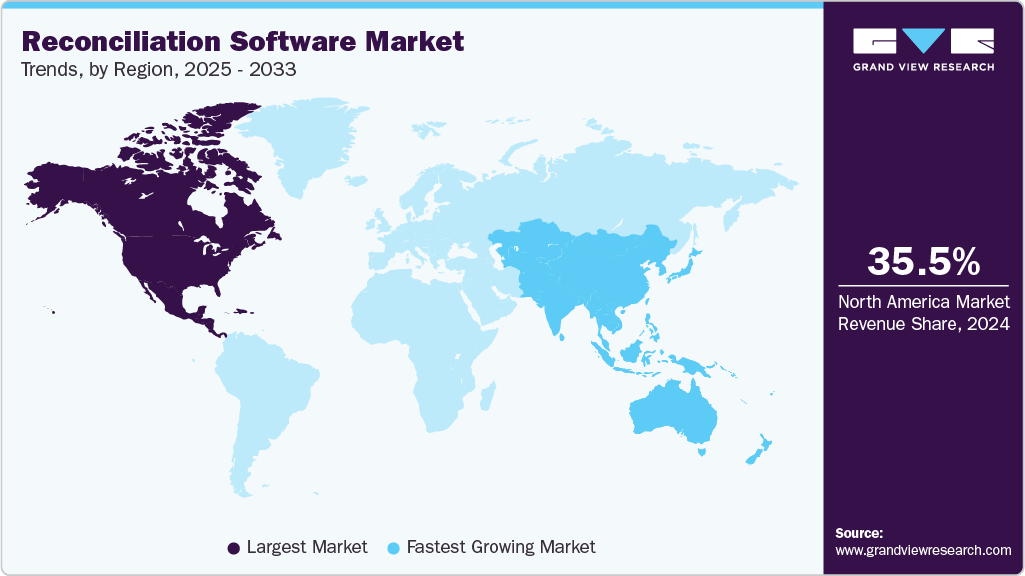

- North America dominated the reconciliation software industry and accounted for a share of 35.5% in 2024.

- The U.S. reconciliation software market held a dominant position in the North America region in 2024.

- By deployment type, the cloud segment accounted for the largest share of 60.2% in 2024 and is expected to grow at the fastest CAGR from 2025 to 2033.

- By enterprise size, the large enterprises segment dominated the market in 2024.

- By industry, the BFSI segment dominated the market in 2024 with a share of 47.2%.

Market Size & Forecast

- 2024 Market Size: USD 2.53 Billion

- 2033 Projected Market Size: USD 7.54 Billion

- CAGR (2025-2033): 13.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

With the growing volume and complexity of financial transactions, manual reconciliation processes have become increasingly inefficient and prone to errors. Organizations are turning to reconciliation software to automate workflows, enhance data accuracy, and meet compliance standards. This adoption is being accelerated by widespread digital transformation efforts across industries. The trend is particularly prominent in the banking, financial services, and insurance (BFSI) sector, where accuracy and regulatory compliance are critical.The growing integration of advanced technologies into reconciliation software is expected to drive market growth. The integration of artificial intelligence (AI) and machine learning (ML) into reconciliation software has enhanced its ability to detect anomalies, match transactions across complex datasets, and predict future reconciliation risks. AI-powered tools can flag inconsistencies in real time, learn from recurring errors, and optimize matching algorithms based on historical performance. This level of automation reduces the dependency on manual labor and improves the speed and accuracy of financial close cycles. Organizations prioritizing operational efficiency and data-driven decision-making are driving increased demand for AI-enabled reconciliation platforms across industries.

The integration of reconciliation software with enterprise resource planning (ERP) and accounting systems is further driving the market’s growth. Modern reconciliation tools are being designed to integrate directly with ERP, treasury, and core banking systems. This allows for real-time data synchronization, automatic journal entry reconciliation, and end-to-end visibility across accounting workflows. Integration eliminates the need for manual data entry and significantly reduces the risk of errors, which is crucial in high-transaction environments. Businesses seeking to unify financial operations in a single digital ecosystem are widely adopting reconciliation software supporting plug-and-play integration across various ERP platforms.

Despite its growth, the market has been restrained by factors such as high implementation costs, resistance to automation in traditional sectors, and cybersecurity concerns associated with cloud-based solutions. Smaller organizations often face challenges in justifying ROI from advanced reconciliation tools, particularly when manual processes are still deemed sufficient. Moreover, integration complexities with legacy systems and a lack of skilled personnel to manage software platforms have further limited adoption in some segments. These barriers must be addressed for the market to achieve broader penetration across industries.

Deployment Type Insights

The cloud segment accounted for the largest share of 60.2% in 2024 and is expected to grow at the fastest CAGR from 2025 to 2033. Increasing adoption of cloud-based reconciliation software by small, medium and large organizations due to its flexibility, scalability, and cost-efficiency can be attributed to the growth of the segment. Organizations are increasingly opting for cloud solutions to avoid high upfront infrastructure costs and to gain remote accessibility. In addition, cloud platforms also allow for seamless updates, enhanced data security through centralized protocols, and faster onboarding of new users, which in turn drives its demand.

The on-premise segment is expected to register a moderate CAGR of 11.5% during the forecast period. The on-premise segment continues to experience steady demand, particularly among large enterprises and highly regulated industries such as banking, insurance, and government. Organizations operating in these sectors often require strict control over sensitive financial data and prefer in-house deployment to meet internal security, compliance, and customization requirements. On-premise solutions offer greater flexibility in configuring software to specific legacy systems and internal workflows, which is a key advantage in complex IT environments. While cloud adoption is accelerating, the on-premise model remains a preferred choice in scenarios where data sovereignty, auditability, and tailored system integration are prioritized.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024. Reconciliation software is being increasingly adopted by large enterprises to manage complex financial operations, handle high transaction volumes, and meet strict compliance requirements. These organizations often operate across multiple geographies, currencies, and business units, making manual reconciliation impractical and risky, thereby driving the demand for reconciliation software. In addition, large enterprises prioritize solutions offering customizable workflows, robust data security, and real-time reporting capabilities. Continued investments in digital finance transformation and internal controls are expected to sustain strong demand for reconciliation software within this segment.

The small and medium enterprises segment is expected to witness the fastest CAGR over the forecast period. SMEs are increasingly adopting reconciliation software to enhance efficiency, reduce errors, and improve cash flow visibility. With limited internal finance teams, SMEs benefit significantly from automation features that simplify daily reconciliation tasks and eliminate manual workloads. The availability of cloud-based and subscription-based solutions has lowered entry barriers, allowing SMEs to access sophisticated financial tools without large capital expenditure. This segment is expected to witness high growth, driven by rising awareness of financial automation and the proliferation of easy-to-deploy SaaS offerings.

Industry Insights

The BFSI segment dominated the market in 2024. Financial institutions process vast volumes of transactions each day, demanding precise accuracy and strong reporting capabilities. In this environment, reconciliation software plays a critical role by automating complex tasks and supporting compliance with stringent regulatory standards. Thus, financial institutions rely on reconciliation solutions to match and verify transactions across multiple systems, such as bank statements, ledgers, payment platforms, and trading systems, ensuring accurate financial reporting and minimizing the risk of errors or fraud.

The retail & e-commerce segment is expected to witness the fastest CAGR over the forecast period. In the retail and e-commerce industry, narrow profit margins and high transaction volumes require accurate financial oversight. Reconciliation software enables retailers to manage complex inventory systems, align sales data from multiple channels, both online and in-store and efficiently reconcile payments. This enhances inventory accuracy, minimizes discrepancies, and offers better visibility into overall profitability.

Regional Insights

North America dominated the reconciliation software industry and accounted for a share of 35.5% in 2024, due to its advanced financial infrastructure and high adoption of automation technologies. Enterprises across banking, insurance, healthcare, and retail sectors have widely integrated reconciliation platforms to enhance accuracy, reduce operational risk, and ensure compliance with evolving regulatory frameworks. The region’s emphasis on digital transformation, paired with strong vendor presence and innovation in AI-powered financial solutions, continues to drive demand.

U.S. Reconciliation Software Market Trends

The U.S. reconciliation software market held a dominant position in the region in 2024, driven by strong regulatory oversight, complex financial operations, and early technology adoption. Financial institutions, fintech companies, and enterprises across industries are deploying advanced reconciliation systems to support real-time processing, audit readiness, and integration with ERP platforms. Demand is particularly strong in the BFSI and healthcare sectors, where compliance and data accuracy are mission critical.

Europe Reconciliation Software Market Trends

Europe reconciliation software market is expected to register a moderate CAGR from 2025 to 2033. European enterprises are adopting reconciliation solutions to enhance transparency, reduce manual workloads, and align with strict financial reporting standards. The region’s strong focus on data governance and risk management has accelerated demand for integrated platforms that support audit trails and real-time reporting. Cloud adoption is also growing steadily across Europe, further supporting market expansion.

The UK reconciliation software market is expanding rapidly, driven by a well-established financial services industry and the country’s emphasis on regulatory compliance and financial transparency. The UK is also witnessing increased adoption of AI-enabled reconciliation platforms, particularly in retail and e-commerce, where transaction complexity has intensified.

The Germany reconciliation software market held a substantial market share in 2024, supported by its robust banking sector and strong manufacturing base, both of which require high levels of financial accuracy and control. Enterprises in Germany are implementing reconciliation tools to automate manual processes, improve auditability, and comply with financial regulations.

Asia Pacific Reconciliation Software Market Trends

The Asia Pacific reconciliation software market is anticipated to grow at a CAGR of 15.4% during the forecast period. The region’s market growth is driven by its expanding digital economy and increasing adoption of automated financial systems. The region’s strong economic development and rising transaction volumes, particularly in emerging markets, are expected to fuel further adoption.

India’s reconciliation software market is expected to grow at the highest growth rate during the forecast period. The country’s growth is supported by the government’s push for digital payments, widespread adoption of cloud technologies, and regulatory reforms in the financial sector. The increasing number of fintech startups and digital-first enterprises are turning to reconciliation solutions to manage complex payment ecosystems and ensure regulatory compliance.

The China reconciliation software market held a substantial market share in 2024, driven by the need to manage vast transaction volumes across e-commerce, mobile payments, and cross-border trade. Local vendors and global players are increasingly targeting the Chinese market with localized, AI-driven platforms to meet evolving operational needs.

Key Reconciliation Software Company Insights

Some of the key companies in the reconciliation software industry include Trintech, SolveXia, and Prophix Software Inc. among others. These companies offer highly scalable, cloud-based solutions integrated with AI and automation capabilities. Market competitiveness is further heightened by increasing demand from SMEs and growing interest in industry-specific solutions, prompting vendors to invest heavily in product innovation, partnerships, and regional expansion.

-

Trintech is a prominent provider of cloud-based financial reconciliation and close management software, catering to mid-sized to large enterprises across various industries. Headquartered in Dallas, Texas, Trintech operates globally and is recognized for its strong integration capabilities with ERP systems and its focus on enhancing financial governance and transparency.

-

Prophix Software Inc. is a provider of corporate performance management solutions, including budgeting, planning, reporting, and financial consolidation, with growing relevance in the reconciliation software market. Its solutions are cloud-enabled and tailored for mid-market to enterprise-level organizations across various industries. The company continues to expand its footprint through a strong focus on innovation, data integration, and automation-driven financial workflows.

Key Reconciliation Software Companies:

The following are the leading companies in the reconciliation software market. These companies collectively hold the largest market share and dictate industry trends.

- SolveXia

- Prophix Software Inc.

- Xero Ltd.

- Zoho Corporation

- Intuit, Inc.

- Trintech

- ReconArt, Inc.

- OneStream

- bluecopa

- AutoRek

Recent Developments

-

In June 2025, SmartStream, a prominent company in Transaction Lifecycle Management solutions, expanded its AI-driven reconciliation platform, SmartStream Air, into the insurance sector to support firms in managing fragmented data, reducing operational expenses, and enhancing compliance. The platform is designed to handle and reconcile high volumes of data, encompassing payments, claims, reimbursements, policyholder transactions, and investment-related activities.

-

In March 2024, Otelier, introduced Otelier Rec, a solution designed to automate financial reconciliation workflows and help hotels save thousands of dollars each month. As the latest addition to Otelier’s unified optimization suite, Otelier Rec streamlines reconciliation processes, offering significant cost savings and enhanced operational accuracy for hotel operators.

Reconciliation Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.81 billion

Revenue forecast in 2033

USD 7.54 billion

Growth rate

CAGR of 13.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment type, enterprise size, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

SolveXia; Prophix Software Inc.; Xero Ltd.; Zoho Corporation; Intuit, Inc.; Trintech; ReconArt, Inc.; OneStream; bluecopa; AutoRek

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Reconciliation Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global reconciliation software market report based on deployment type, enterprise size, industry, and region:

-

Deployment Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

Industry Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Retail & E-commerce

-

Manufacturing

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global reconciliation software market size was estimated at USD 2.53 billion in 2024 and is expected to reach USD 2.81 billion in 2025.

b. The global reconciliation software market is expected to grow at a compound annual growth rate of 13.1% from 2025 to 2033 to reach USD 7.54 billion by 2033.

b. The cloud segment accounted for the largest share of 60.2% in 2024 and is expected to grow at the fastest CAGR from 2025 to 2033. Increasing adoption of cloud-based reconciliation software by small, medium and large organizations due to its flexibility, scalability, and cost-efficiency can be attributed to the growth of the segment.

b. Some key players operating in the reconciliation software market include SolveXia, Prophix Software Inc., Xero Ltd., Zoho Corporation, Intuit, Inc., Trintech, ReconArt, Inc., OneStream, bluecopa, and AutoRek.

b. The reconciliation software market has been driven by increasing transaction volumes, the growing need for financial accuracy, and the rising demand for automation in accounting operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.