- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Reconstituted Milk Market Size, Share & Trends Report, 2030GVR Report cover

![Reconstituted Milk Market Size, Share & Trends Report]()

Reconstituted Milk Market (2023 - 2030) Size, Share & Trends Analysis Report By Source (Skimmed, Whole), By Application (Milk, Yogurt, Cheese), By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-105-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

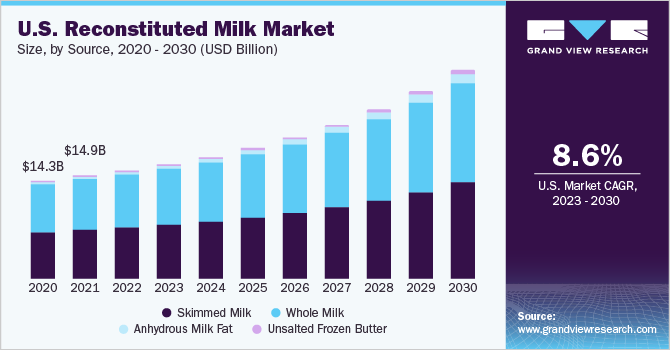

The global reconstituted milk market size was estimated at USD 214.41 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.5% from 2023 to 2030. The growth of the market is largely driven by factors such as convenience and longer shelf life compared to regular milk. Additionally, reconstituted milk is a practical choice for consumers living in areas with limited access to fresh milk. Reconstituted milk, with its extended shelf life, is an important resource for emergency preparedness, especially in disaster-prone areas or regions with limited access to fresh milk. It serves as a dependable source of nutrition during emergencies, ensuring a reliable milk supply when fresh options are scarce.

Additionally, individuals residing in remote locations where regular access to fresh milk is challenging can benefit from the long-lasting nature of powdered milk. Its extended shelf life guarantees availability and consumability over an extended period, making it a practical choice in such circumstances. Furthermore, reconstituted milk is more affordable compared to fresh milk. It provides a cost-effective alternative for consumers on a low budget. The production process of powdered milk involves removing the moisture content from fresh milk, resulting in a lightweight product that is less expensive to transport and store. This cost savings is often passed on to consumers, making reconstituted milk a more economical choice.

Source Insights

The skimmed milk segment held the largest share of 46.9%, in terms of revenue, in 2022. The demand for skimmed milk-based reconstituted milk is primarily driven by the growing health consciousness among consumers seeking lower-fat alternatives. Skimmed milk, with its reduced fat content, is widely perceived as a healthier option compared to whole milk. Skimmed milk retains essential nutrients, including protein, vitamins, and minerals, making it an appealing choice for health-conscious consumers. As a result, the market for skimmed milk-based reconstituted milk experiences notable growth as consumers actively seek out healthier dairy options to support their well-being.

The anhydrous milk fat segment is expected to showcase the fastest CAGR of 15.9% during the forecast period. the demand for anhydrous milk fat (AMF) -based reconstituted milk is driven by factors such as its longer shelf life, low moisture content, expanding consumer markets, and its applications in the fast-food industry.The longer shelf life and low moisture content of AMF make it a favorable choice for storage and long-distance transportation. Its extended shelf life allows for efficient inventory management and reduces the risk of spoilage, making it a reliable option for businesses operating in several geographic regions. In January 2023, a U.S.-based provider of milk ingredients, Valley Milk LLC announced the expansion of 10,000 square foot facility to produce anhydrous milk fat.This expansion is a response to the growing demand for high-quality anhydrous milk fat from customers in the ice cream and confectionary industries.

Application Insights

The milk segment held the largest share of 24.01%, in terms of revenue, in 2022. Reconstitution plays a crucial role in the food processing industry. Concentrated milk solids can be used as ingredients in a wide range of products, including dairy-based desserts, ice creams, baked goods, confectionery, sauces, and beverages. The versatility of reconstituted milk in various food applications contributes to its demand in the industry.Additionally, reconstituted milk retains most of the nutritional properties of fresh milk, including vitamins, minerals, and proteins. It provides a reliable source of essential nutrients. In May 2021, Lactalis Ingredients announced the launch of organic whole milk powder which can be used in reconstituted milk products such as milk-based drinks and yogurts.

The yogurt segment is expected to showcase the fastest CAGR of 8.9% during the forecast period. Reconstituted yogurt caters to a range of dietary preferences and restrictions. There are several options available for consumers who follow vegan or dairy-free diets, as reconstituted yogurt can be made from plant-based sources such as soy, almond, or coconut milk. This allows a wider consumer base to enjoy the taste and benefits of yogurt.

Further, supportive initiatives by governments worldwide are favoring the demand for the segment. For instance, in June 2021, the U.S. Food and Drug Administration (FDA) issued an updated standard of identity for yogurt. This revised standard promotes greater innovation in yogurt production while preserving its fundamental characteristics. The updated standard specifies minimum milkfat content, milk solids, and acidity levels for yogurt. It also broadens the range of allowable ingredients and permits the use of reconstituted dairy ingredients.

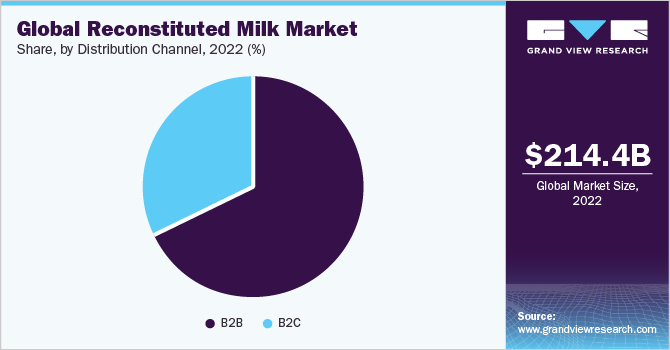

Distribution Channel Insights

The distribution channel segment is bifurcated into the B2B and the B2C segment. The B2B segment held the largest share of 68.07 % in 2022. The utilization of reconstituted milk in the B2B distribution channel enhances supply chain efficiency. Its non-perishable nature eliminates the requirement for temperature-controlled storage and transportation, resulting in reduced logistical complexities and cost savings. The extended shelf life of reconstituted milk also reduces the frequency of replenishment, streamlining the supply chain operations and ensuring a consistent and dependable milk supply. Further, the versatility of reconstituted milk enables its integration into a wide range of industries, including food manufacturing, hospitality, and catering, thereby expanding its demand in the B2B distribution channel.

The B2C segment is anticipated to grow at a CAGR of 8.1 % during the forecast period. Wholesale stores serve the needs of customers who prefer purchasing products in bulk quantities. Reconstituted milk is frequently offered in larger packaging options, providing a convenient solution for those seeking to stock up on an ample supply of milk. The availability of reconstituted milk in bulk quantities in wholesale stores specifically caters to the requirements of businesses, institutions, and households with high levels of milk consumption.

Regional Insights

The Asia Pacific region held a dominant revenue share of 45.1% in 2022. The convenience and extended shelf life of reconstituted milk make it a compelling option for the fast-paced lifestyles commonly observed in numerous Asian countries. Powdered or UHT (ultra-high temperature) reconstituted milk, which can be stored without refrigeration for extended periods, provides businesses and consumers with a readily accessible milk supply both at home and during travel.

India’s reconstituted milk market is expected to showcase a significant CAGR of 9.63% over the forecast period. The growing utilization of reconstituted milk by dairy producers during periods of reduced production capacity is propelling the demand for recombined milk in the country.

The Middle East & Africa reconstituted milk market is expected to grow at a CAGR of 9.3% from 2023 to 2030. The increasing demand for convenient food solutions in the region, fueled by rapid urbanization and evolving consumer lifestyles is driving the market growth. Factors such as ease of storage, preparation, and consumption, coupled with its versatile nature, align perfectly with the shifting lifestyle preferences in these regions. This market trend opens avenues for businesses to capitalize on the demand for convenient reconstituted milk products.

Key Companies & Market Share Insights

The global reconstituted milk market is characterized by intense competition, mainly attributed to several players operating in the market. Various companies operating in the market are innovative products to cater to consumer demand. In May 2022, Arla Foods invested nearly USD 213 million for the expansion of its dairy in Pronsfeld, Germany. This production plant has a robust processing capability, capable of handling 685 million kilograms of milk each year. The plant generates an output of approximately 90,000 tons of premium-grade milk powder. Some prominent players in the global reconstituted milk market include:

-

Nestle

-

Lactalis

-

Fonterra

-

Dairy Farmers of America

-

Arla Foods

-

Saputo

-

Pine Hill Dairy

-

Schreiber Foods

-

Mengniu Dairy

-

Meiji Holdings

-

Sodiaal

Reconstituted Milk Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 226.51 billion

Revenue forecast in 2030

USD 411.90 billion

Growth rate

CAGR of 8.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilo tons, revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Source, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Argentina; Brazil; South Africa; UAE

Key companies profiled

Nestle; Lactalis; Fonterra; Dairy Farmers of America; Arla Foods; Saputo; Pine Hill Dairy; Schreiber Foods.; Mengniu Dairy; Meiji Holdings; Sodiaal

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

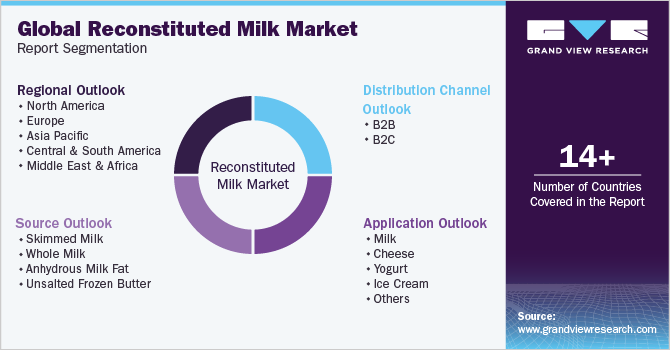

Global Reconstituted Milk Market Report Segmentation

This report forecasts volume & revenue growth and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global reconstituted milk market report based on source, application, distribution channel, and region:

-

Source Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Skimmed Milk

-

Whole Milk

-

Anhydrous Milk Fat

-

Unsalted Frozen Butter

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Milk

-

Cheese

-

Yogurt

-

Ice Cream

-

Others

-

-

Distribution Channel Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

B2B

-

B2C

-

Online

-

Hypermarkets/Supermarkets

-

Wholesale Stores

-

Others

-

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global reconstituted milk market size was estimated at USD 214.42 billion in 2022 and is expected to reach USD 226.52 billion in 2023

b. The global reconstituted milk market is expected to grow at a compound annual growth rate of 8.5% from 2023 to 2030 to reach USD 411.90 billion by 2030.

b. Asia Pacific region market held a dominant revenue share of 45.1% in 2022 owing to the rise in a number of health-conscious consumers coupled with high demand for organic foods

b. Some market players include Nestle, Lactalis, Fonterra, Dairy Farmers of America, Arla Foods, Saputo, Pine Hill Dairy, Schreiber Foods., Mengniu Dairy, Meiji Holdings, and Sodiaal.

b. The rising popularity of plant-based diets coupled with the popularity of reconstituted milk in the food service industry is supporting the demand for the market.

b. Growing awareness of the nutritional benefits and versatility of reconstituted milk in India has led to rising demand for reconstituted milk among consumers in the country

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.