- Home

- »

- Advanced Interior Materials

- »

-

Recycled Composites Market Size, Industry Report, 2033GVR Report cover

![Recycled Composites Market Size, Share & Trends Report]()

Recycled Composites Market (2025 - 2033) Size, Share & Trends Analysis Report By End Use (Automotive & Transportation, Aerospace, Construction & Infrastructure, Industrial End Uses), By Fiber Type (rCF, rGF), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-828-7

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Recycled Composites Market Summary

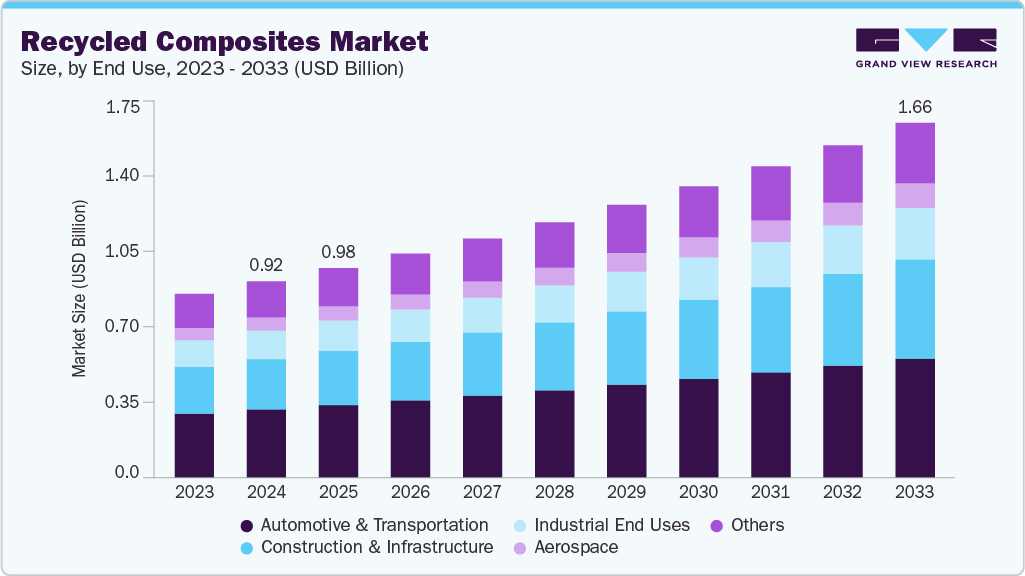

The global recycled composites market size was estimated at USD 920.6 million in 2024 and is expected to reach USD 1664.3 million by 2033, expanding at a CAGR of 6.8% from 2025 to 2033, driven by the rising emphasis on sustainability across industrial sectors. Governments and regulatory bodies are increasingly implementing strict guidelines to minimize waste generation and reduce carbon footprints.

Key Market Trends & Insights

- Asia Pacific dominated the recycled composites market with the largest revenue share of 31.3% in 2024.

- By filter type, the recycled carbon fiber (rCF) segment is expected to grow at fastest CAGR of 7.3% over the forecast period.

- By end use, the construction & infrastructure segment is expected to grow at fastest CAGR of 7.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 920.6 Million

- 2033 Projected Market Size: USD 1664.3 Million

- CAGR (2025-2033): 6.8%

- Asia Pacific: Largest market in 2024

As a result, manufacturers are shifting toward recycled composite materials to meet environmental compliance standards. This transition is further supported by corporate sustainability initiatives and circular-economy strategies adopted by major industry players. Together, these factors create a strong policy- and value-driven foundation for market expansion. Growing demand from end-use industries such as automotive, aerospace, construction, and consumer goods also contributes significantly to market growth. Lightweight, durable, and energy-efficient materials are essential for improving performance and reducing fuel consumption, especially in transportation. Recycled composites offer these advantages at a lower cost than virgin materials, making them an attractive alternative. Their increasing use in non-structural and semi-structural End Uses reflects the market’s widening acceptance. As industries prioritize efficiency and cost reduction, the demand for recycled composites continues to accelerate.

Technological advancements in recycling processes are further propelling the market forward. Innovations in mechanical and chemical recycling enable higher material recovery rates and improved quality of recycled fibers and resins. Enhanced processing techniques have made it possible to produce composites with performance characteristics comparable to virgin materials. These improvements reduce technical barriers and broaden end-use possibilities. Consequently, technology-driven enhancements strengthen the overall value proposition of recycled composite products.

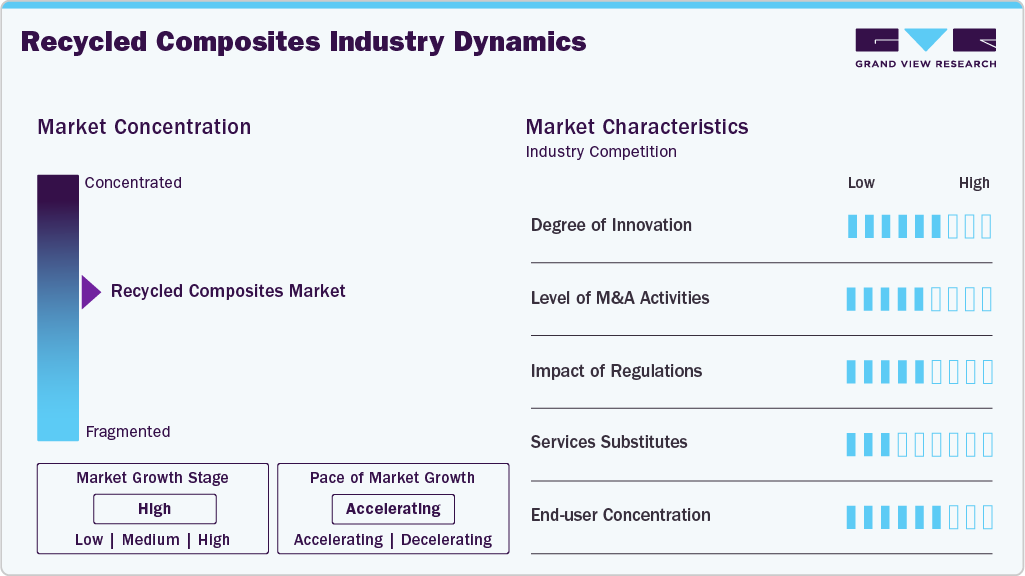

Market Concentration & Characteristics

Market concentration in the recycled composites sector remains moderate, shaped by a mix of established material manufacturers, specialized recycling firms, and emerging technology providers. The degree of innovation is notably high, driven by advancements in fiber recovery, resin compatibility, and closed-loop manufacturing systems. However, the market has experienced an increasing number of mergers, acquisitions, and strategic alliances as companies seek to secure feedstock, enhance processing capabilities, and expand regional presence. Regulatory frameworks play a decisive role, with stringent waste-management and sustainability policies encouraging investment in recycling technologies while raising compliance obligations for market participants.

Market characteristics are further influenced by the availability of service substitutes and the distribution of end-user demand. While virgin composites and alternative lightweight materials continue to act as substitutes, their higher cost and environmental impact strengthen the value proposition of recycled composites in many End Uses.

End-user concentration is moderately high, with sectors such as automotive, aerospace, construction, and consumer goods accounting for the majority of consumption. This focused demand profile drives specialized product development while making market performance sensitive to trends in these industries.

End Use Insights

The automotive & transportation segment led the market and accounted for the largest revenue share of 34.9% in 2024, driven by the industry’s push toward lightweighting to improve fuel efficiency and reduce emissions. Recycled composites offer a cost-effective alternative to virgin materials while maintaining adequate performance for non-structural and semi-structural components. Increasing adoption of electric vehicles further boosts demand for lightweight materials to enhance battery range. Automakers are also aligning with sustainability targets, encouraging the integration of recycled fibers into interior and exterior components.

The construction & infrastructure segment is expected to grow at the fastest CAGR of 7.9% over the forecast period, driven by the growing use of sustainable building materials and the need for long-lasting, corrosion-resistant components. Recycled composites are increasingly used in decking, cladding, rebar alternatives, and utility structures due to their durability and low maintenance. Government incentives promoting green building standards further support adoption. Additionally, the shift toward climate-resilient infrastructure enhances the appeal of recycled composite solutions.

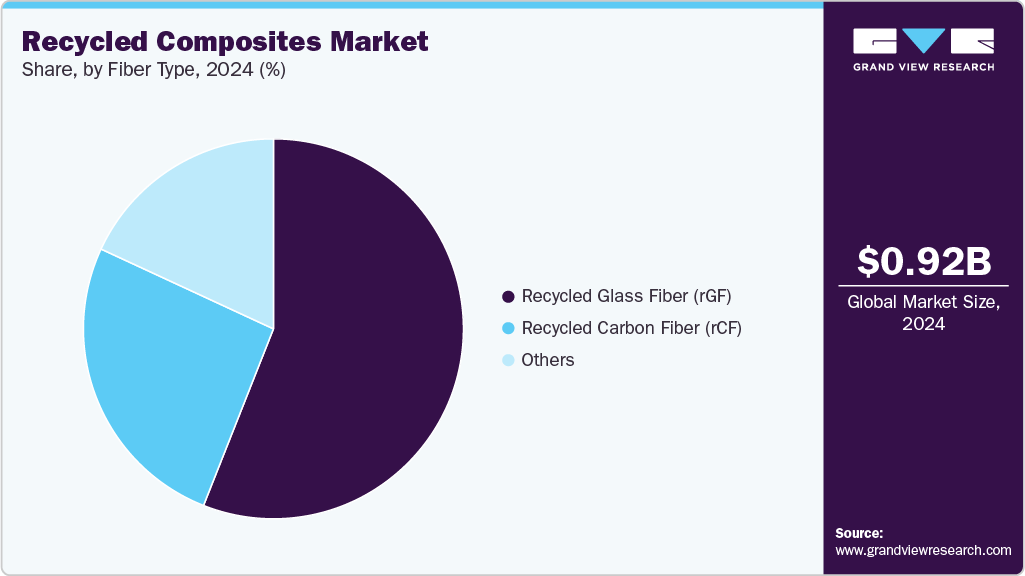

Fiber Type Insights

Recycled glass fibers (rGF) dominated the market and accounted for the largest revenue share of 56.0% in 2024, driven by their cost competitiveness and suitability for high-volume applications. Industries such as automotive, consumer goods, and construction favor recycled glass fiber for its balanced mechanical properties and affordability. Advances in fiber recovery processes have improved material consistency, encouraging broader use. The availability of large feedstock from end-of-life composite products also supports a steady supply for rGF manufacturing.

The recycled carbon fiber (rCF) segment is expected to grow at the fastest CAGR of 7.3% over the forecast period, driven by the growing need for high-performance lightweight materials in aerospace, automotive, sports equipment, and industrial End Uses. Recycled carbon fiber provides significant strength-to-weight advantages at a lower cost compared to virgin carbon fiber, making it attractive for broader market penetration. Technological improvements in fiber reclamation have enhanced quality and uniformity. Sustainability commitments within high-tech industries further accelerate the shift toward rCF-based components.

Regional Insights

North America recycled composites market is driven by strong sustainability mandates and increasing corporate commitments to carbon reduction. Growth is further supported by advanced recycling infrastructure and technological expertise across key industries. The region’s automotive and aerospace sectors actively promote lightweight materials to enhance fuel efficiency and performance. Federal and state-level initiatives encourage the adoption of recycled materials in construction and manufacturing. Rising landfill diversion goals also stimulate demand for high-quality recycled composites. Collectively, these factors create a favorable ecosystem for market expansion.

U.S. Recycled Composites Market Trends

The recycled composites market in the U.S., the market is propelled by robust R&D investments and active commercialization of high-performance recycled composite materials. Regulatory pressure to improve waste management and promote circular manufacturing practices remains a significant driver. The automotive and renewable energy sectors increasingly incorporate recycled composites to reduce material costs and environmental impact. Consumer preference for sustainable products further accelerates adoption across consumer goods and sporting equipment. Additionally, public-private partnerships enhance collection and recycling capabilities. These combined elements reinforce the U.S. position as a leading market.

Asia Pacific Recycled Composites Market Trends

The recycled composites market in Asia Pacific held the largest revenue share of 31.3% in 2024, driven by rapid industrialization and growing environmental awareness across major economies. Expanding automotive and electronics manufacturing sectors create substantial demand for lightweight, cost-efficient materials. Governments across the region are implementing stricter waste-management policies, enhancing the attractiveness of recycled composites. Rising construction activity also boosts the use of recycled materials in infrastructure and building End Uses. Increasing investment from multinational firms strengthens local production capabilities. As a result, the region demonstrates accelerated market momentum.

China’s market growth is influenced by ambitious circular-economy policies and nationwide efforts to reduce industrial waste. The country’s expansive manufacturing sector generates high composite waste volumes, supporting large-scale recycling initiatives. Strong government incentives encourage the use of recycled materials in automotive, infrastructure, and renewable energy projects. Rapid advancements in recycling technologies also enhance the quality and availability of recycled composites. Growing export demand for sustainable products further stimulates innovation. Together, these factors consolidate China’s role as a major market contributor.

Europe Recycled Composites Market Trends

The recycled composites market in Europe benefits from stringent environmental regulations and the European Green Deal’s sustainability targets. The region strongly emphasizes circular-economy practices, driving demand for recycled materials in transportation, construction, and consumer End Uses. Europe’s established recycling networks and technological sophistication ensure efficient material recovery. Increasing investments in renewable energy infrastructure also boost the use of recycled composites in wind energy and related sectors. Consumer and corporate sustainability priorities reinforce market growth. This regulatory and societal alignment sustains Europe’s leadership in material circularity.

Germany’s market is supported by advanced engineering capabilities and a strong commitment to industrial sustainability. The automotive sector, particularly focused on lightweighting, remains a primary driver of recycled composite adoption. National regulations on waste minimization and resource efficiency accelerate innovation in recycling technologies. The country’s highly developed manufacturing ecosystem facilitates integration of recycled composites into high-performance End Uses. Research institutions and industry collaborations further improve material quality and process efficiency. These dynamics position Germany as a central hub for recycled composite development in Europe.

Central & South America Recycled Composites Market Trends

The recycled composite market in Central & South America is driven by increasing environmental regulations and rising demand for cost-effective materials across construction and transportation sectors. Governments are expanding waste-management initiatives, promoting recycling infrastructure and material recovery programs. The growth of automotive assembly operations in countries such as Brazil and Mexico encourages the use of lightweight recycled composites. Industrial modernization and public sustainability campaigns enhance awareness of recycled material benefits. Foreign investment in recycling technologies also strengthens local capabilities. Together, these factors support gradual yet steady regional market development.

Middle East & Africa Recycled Composites Market Trends

The recycled composites market in the Middle East & Africa is influenced by expanding construction activity and government-led sustainability initiatives. Countries in the region are beginning to diversify their economies, encouraging the adoption of resource-efficient materials. Infrastructure development projects create opportunities for incorporating recycled composites in non-structural End Uses. Environmental regulations are tightening, gradually motivating investment in recycling technologies and waste-management systems. Industrial sectors, including automotive and marine, are exploring lightweight materials to improve performance in harsh climates.

Key Recycled Composites Companies Insights

Key players operating in the recycled composites market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in market include Trex Company, Inc., Fiberon.

-

Trex is a leading manufacturer of wood-alternative composite decking, railing, cladding and related outdoor building materials made largely from recycled inputs. Its composite decking products are made from up to 95% recycled materials, diverting large volumes of plastic and scrap wood from landfills annually.

-

Fiberon produces wood-plastic composite decking, railing, and cladding made from recycled wood fibers and high-density polyethylene (HDPE). Their composite products consistently contain around 94% recycled content, combining sawdust and waste plastic to create durable, low-maintenance alternatives to traditional lumber.

UPM, SGL Carbon are some of the emerging market participants in the market.

-

The European firm UPM (through its UPM Biocomposites division) offers recycled and bio-based composites under product lines such as UPM ProFi (for decking and outdoor use) and UPM Formi (granulates for injection moulding and extrusion).

-

SGL Carbon is a key player in the recycled carbon fiber composites segment, specializing in recycled carbon- and graphite-based composites for industrial, automotive, and aerospace End Uses. The company invests in recycling technology to recover high-performance carbon fibers suitable for structural and high-specification uses.

Key Recycled Composites Companies:

The following are the leading companies in the recycled composites market. These companies collectively hold the largest market share and dictate industry trends.

- Trex Company, Inc.

- Fiberon

- UPM

- SGL Carbon

- Toray Industries, Inc.

- Vartega Inc.

- Carbon Conversions Inc.

- Solvay

- Mitsubishi Chemical Corporation

Global Recycled Composites Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 983.2 million

Revenue forecast in 2033

USD 1664.3 million

Growth rate

CAGR of 6.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

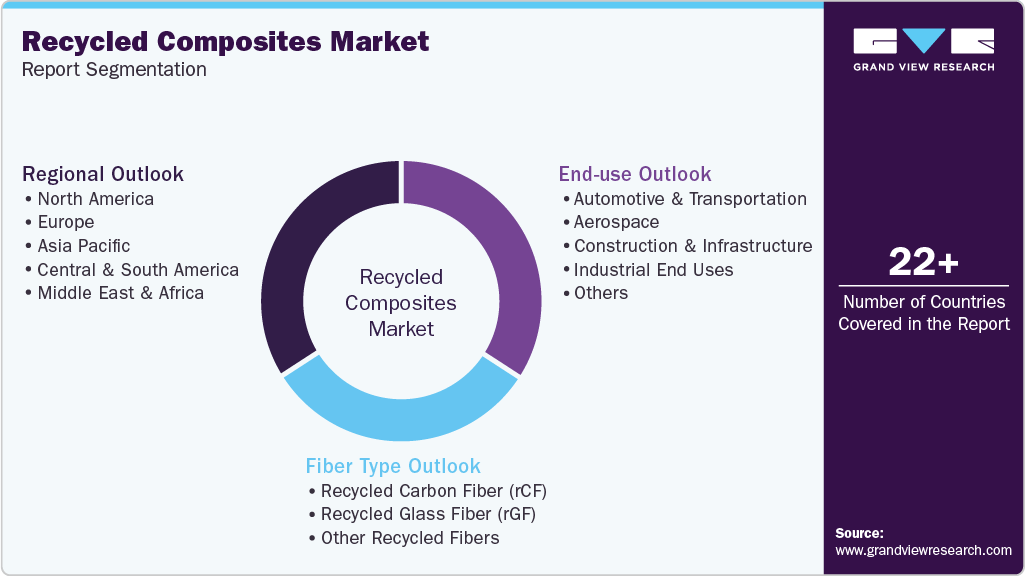

Segments covered

Fiber type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan

Key companies profiled

Trex Company, Inc.; Fiberon; UPM; SGL Carbon; Toray Industries, Inc.; Vartega Inc.; Carbon Conversions Inc.; Solvay; Mitsubishi Chemical Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycled Composites Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global recycled composites market report based on end use, fiber type and region.

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive & Transportation

-

Aerospace

-

Construction & Infrastructure

-

Industrial End Uses

-

Others

-

-

Fiber Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Recycled Carbon Fiber (rCF)

-

Recycled Glass Fiber (rGF)

-

Other Recycled Fibers

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East & Africaa

-

Frequently Asked Questions About This Report

b. The global recycled composites market size was estimated at USD 920.6 million in 2024 and is expected to reach USD 983.2 million in 2025.

b. The global recycled composites market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2033 to reach USD 1664.3 million by 2033.

b. Automotive & transportation segment led the market and accounted for the largest revenue share of 34.9% in 2024, driven by the industry’s push toward lightweighting to improve fuel efficiency and reduce emissions.

b. Some of key players in the recycled composites market are Trex Company, Inc., Fiberon, UPM, SGL Carbon, Toray Industries, Inc., Vartega Inc., Carbon Conversions Inc., Solvay, Mitsubishi Chemical Corporation

b. The key factors driving the recycled composites market include rising sustainability mandates, increasing demand for lightweight materials, advancements in recycling technologies, cost advantages over virgin composites, and expanding adoption across automotive, construction, and industrial sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.