- Home

- »

- Medical Devices

- »

-

Red Light Therapy Beds Market Size, Industry Report, 2033GVR Report cover

![Red Light Therapy Beds Market Size, Share & Trends Report]()

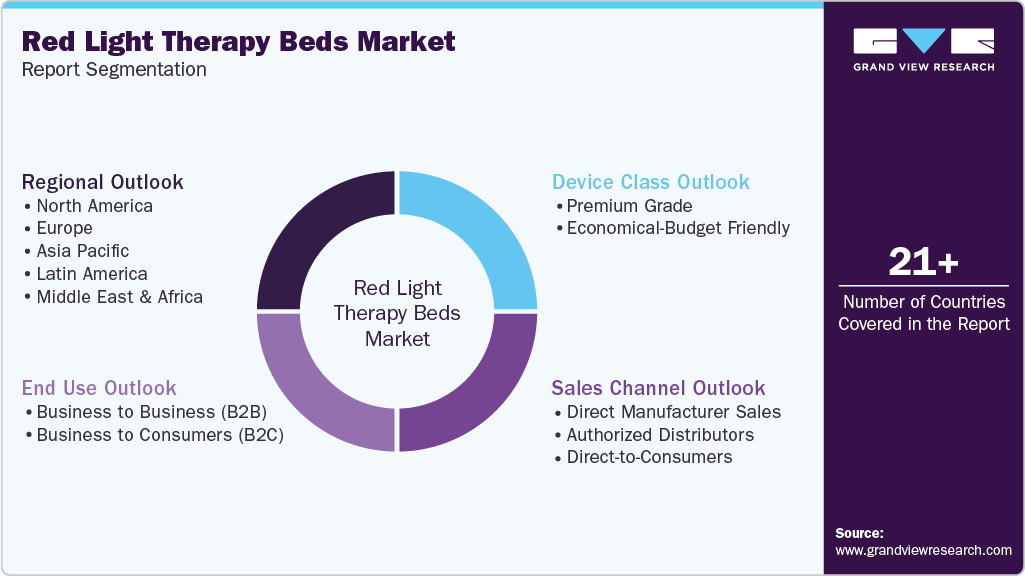

Red Light Therapy Beds Market (2025 - 2033) Size, Share & Trends Analysis Report By Device Class (Premium Grade, Economical-Budget Friendly), By Sales Channel (Direct Manufacturer Sales, Authorized Distributors), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-806-3

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Red Light Therapy Beds Market Summary

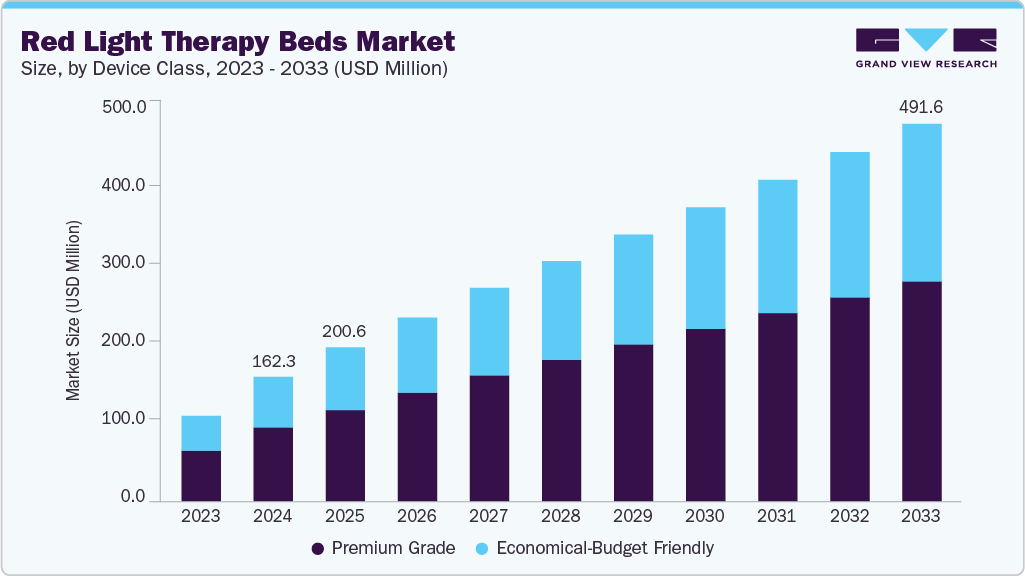

The global red light therapy beds market size was estimated at USD 162.3 million in 2024 and is projected to reach USD 491.6 million by 2033, growing at a CAGR of 11.9% from 2025 to 2033. This growth is attributed to the growing consumer interest in non-invasive, at-home wellness solutions, as well as clinics and spas adding light-based services to meet client demand.

Key Market Trends & Insights

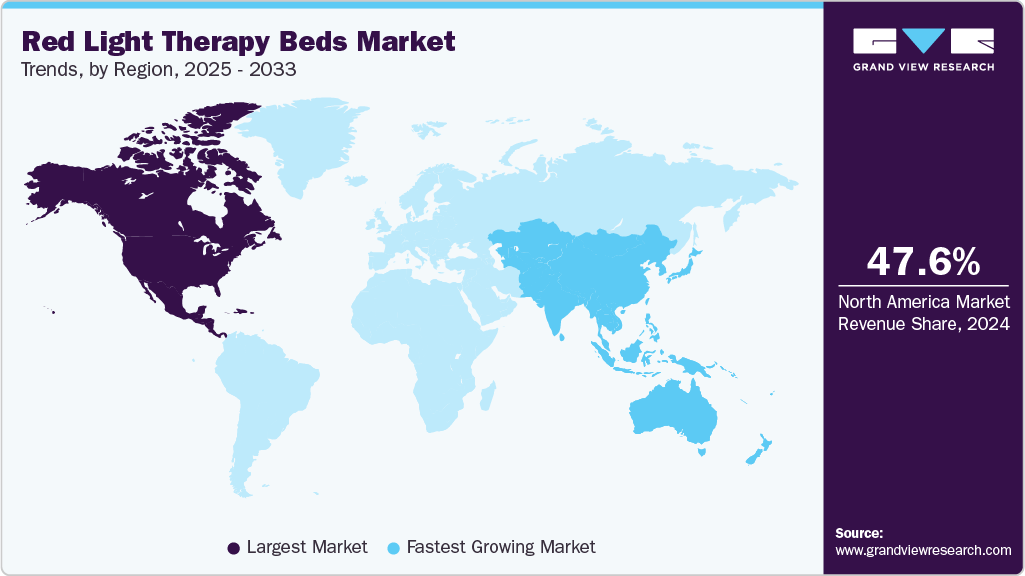

- North America dominated the global red light therapy beds market with the largest revenue share of 47.60% in 2024.

- The red light therapy beds industry in the U.S. accounted for the largest market revenue share in North America in 2024.

- By device class, the premium grade segment led the market with the largest revenue share of 59.40% in 2024.

- By sales channel, the direct manufacturer sales segment accounted for the largest market revenue share in 2024.

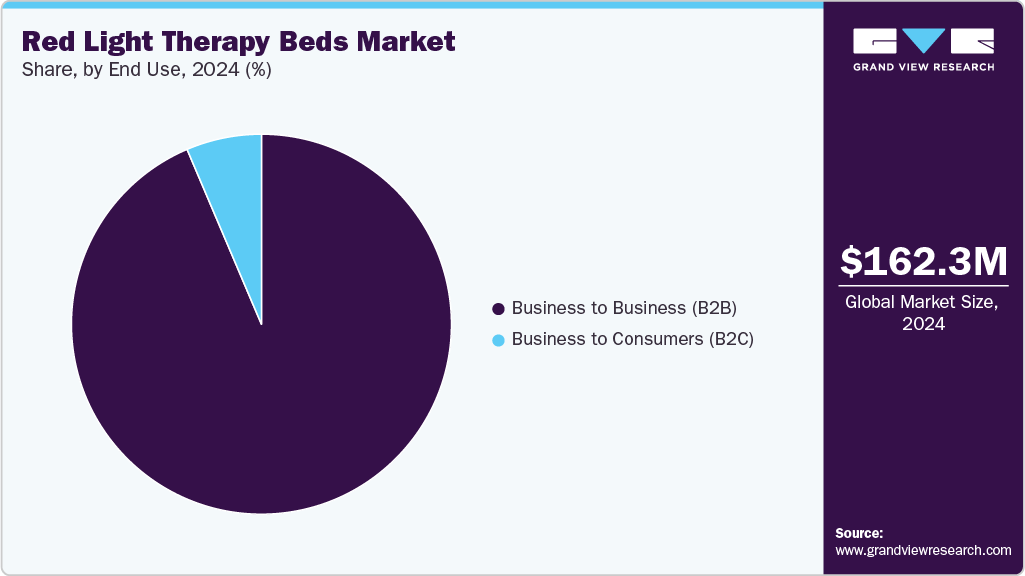

- Based on end use, the business-to-business (B2B) segment accounted for the largest market revenue share in 2024

Market Size & Forecast

- 2024 Market Size: USD 162.3 million

- 2033 Projected Market Size: USD 491.6 million

- CAGR (2025-2033): 11.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Manufacturers and wellness brands are increasingly offering consumer-grade beds and panels through e-commerce and specialty retailers, which is accelerating adoption beyond professional settings.Growing clinical interest in light-based wellness solutions continues to underscore the broad potential of red light therapy. For instance, in March 2025, News-Medical.net published a report stating that red and near-infrared light therapy (600–1000 nm) enhances mitochondrial activity and ATP production, which in turn leads to improved circulation, collagen synthesis, and tissue repair, as well as reduced inflammation. The article also highlighted benefits such as skin remaining more elastic, sleeping better, and muscles recovering faster.

In the same way, the fast-paced growth of the medical aesthetics industry is a sign that more and more consumers are trusting and investing in advanced wellness technologies. According to the American Med Spa Association (AmSpa) 's 2024 Medical Spa State of the Industry Executive Report Recap, released in November 2024, the number of medical spas increased from 8,899 in 2022 to approximately 10,488 in 2023. This steep increase not only demonstrates the continuous demand for aesthetic treatments but also the strong trust of entrepreneurs and medical professionals in the decision to embrace innovative care solutions.

Rising promotional initiatives coupled with seasonal marketing strategies are providing consumers with more engagement, which in turn is driving the adoption of the products by consumers in the market. For instance, BestQool launched its "Seasonal Care Campaign" in October 2025, offering a 20% discount on a red-light therapy device for a limited time. The campaign positions red-light therapy as the ultimate self-care solution for skin and muscle recovery during the seasonal changes and, at the same time, introduces the customer to the BQ60, Pro100, and Pro300 models as the front line of BestQool's innovative and clinically verified wellness technologies. These types of initiatives are estimated to raise consumer awareness levels, which will subsequently lead to the expansion of the red-light therapy bed industry.

The expansion of service diversification in the wellness and grooming sectors is leading to new growth opportunities for the adoption of red-light therapy. For instance, in August 2025, Corporate Image Barbershop in downtown Roanoke introduced a red-light therapy bed, expanding its offerings beyond traditional haircuts to include wellness-focused treatments. This move is a clear indication of the growing trend of the integration of red-light therapy in non-medical wellness and lifestyle sectors.

Market Concentration & Characteristics

The red-light therapy beds industry is growing steadily due to improvements in LED technology and increasing preference for non-invasive wellness treatments. Increasingly, more people are utilizing these beds for healthcare, beauty, and fitness purposes. Growth is also supported by the rise of wellness tourism and easier approval processes from regulators like the U.S. FDA, which increases trust and the use of these therapies. The market is moderately concentrated, with leading companies utilizing advanced technology, FDA approvals, and extensive distribution to maintain their market position. At the same time, many small and medium businesses are entering specialized areas such as beauty, sports recovery, and wellness centers. This creates more competition and broadens the range of products available in the market.

The red-light therapy beds industry is advancing quickly as companies introduce newer models equipped with high-performance LEDs and multi-wavelength options, including 660 nm and 850 nm. Many beds now come with app controls and customizable settings, so users can easily track and adjust their treatments. Ongoing improvements in technology and design are making red-light therapy beds a key part of the global wellness market. For instance, in May 2025, TheraLight, LLC introduced TheraLight 360i, a cutting-edge therapy bed that combines three treatments: Photobiomodulation (PBM), Pulsed Electromagnetic Field (PEMF), and Acoustic Resonance Therapy (ART). It features over 45,000 LEDs and additional wellness features to aid in recovery, reduce inflammation, and enhance overall health.

Strategic partnerships are playing an increasingly important role in the red-light therapy beds industry, enabling companies to expand their reach, enhance credibility, and deliver integrated wellness solutions. For instance, American Wellness Authority offers collaboration models with hospitality brands, gyms, spas, and affiliate networks to deploy red-light therapy systems into new service channels. Similarly, Scandilabs LLC has partnered with Logan University for research and education related to its red-light products, adding clinical validation and strengthening business partnerships. Together, these types of collaborations help manufacturers and service providers accelerate adoption by combining device innovation with service delivery, brand alignment, and market access.

Regulatory oversight plays a crucial role in the red-light therapy beds industry, as devices marketed for health claims must meet rigorous standards. For instance, the U.S. Food & Drug Administration (FDA) classifies many light-therapy systems as Class I or II medical devices, requiring a 510(k) clearance that demonstrates the equipment is substantially equivalent to an existing, legally marketed device. For manufacturers, achieving this clearance supports market entry, fosters consumer trust, and enables broader use in clinical, wellness, and sports recovery settings.

In the market for red-light therapy beds, several substitute products are gaining traction and influencing competitive dynamics. Portable red-light panels, handheld photo-biomodulation (PBM) devices and other light-therapy formats provide more accessible, lower-cost options compared to full-body beds.

The red-light therapy beds industry is experiencing notable expansion, driven by growing consumer demand for wellness, recovery, and clinical applications. For instance, in October 2024, TheraLight extended its presence to 21 countries, including Australia, Canada, Germany, Spain, and India, offering full-body LED light therapy systems such as TheraLight 360 and FIT. This international growth underscores increasing acceptance of red and near-infrared therapies for cellular recovery, pain relief, and overall well-being.

Device Class Insights

The premium grade segment led the market with the largest revenue share of 59.40% in 2024. The segment's growth was primarily attributed to factors such as higher light output and coverage, advanced multi-wavelength technology, improved build quality, and an enhanced user experience. Such devices are the most preferred ones by high-end clinics, wellness centers, and luxury sports facilities, which are the ones that usually prioritize clinically proven performance and faster treatment sessions. The rise in the use of red-light therapy for pain relief, muscle recovery, and skin rejuvenation, as well as the employment of smart, connected, and high-power systems in the professional sector, is also leading to an increase in demand.

For instance, in 2024, manufacturers across North America and the Asia-Pacific region were able to increase their production capacity by 12% as a result of more customization options and advancements in wavelength technology. All these factors together serve not only to maintain the dominance of the premium-grade segment but also to significantly increase the growth rate of the red-light therapy beds market segment.

The economical-budget friendly segment is anticipated to grow at the fastest CAGR of 12.20% during the forecast period. Increasing consumer demand for non-invasive wellness solutions, particularly in home-use and small-studio applications, where cost-sensitive buyers seek affordable yet effective options, is a key factor driving segment growth. In addition, the cost barrier has led manufacturers to offer lower-priced full-body beds or modular systems to expand their accessibility.

According to Healthlighten Far Infrared Equipment Technology Co., Ltd., the basic red-light therapy bed home model ranges between USD 3,000 and USD 7,000. This indicates that the market is expanding beyond high-end spas and clinics to include users who are economically and budget-friendly. These trends are reinforced by the rising awareness of the skincare, pain-relief, and recovery benefits of light therapy, as well as the proliferation of direct-to-consumer channels that enable lower cost entry.

Sales Channel Insights

The direct manufacturer sales segment accounted for the largest market revenue share in 2024. The growth is driven by manufacturers by increased focus on direct sales of clinically & commercially efficient and home-grade beds directly to buyers to ensure device certification, clear technical specifications, and end-to-end support including installation, training, and warranties. This model reduces costs by eliminating intermediaries, making devices more accessible while fostering long-term customer relationships. Direct engagement also enables tailored product design and community-building, enhancing user confidence and driving market adoption across wellness centers, clinics, and homes. These factors are driving the growth of the direct manufacturer sales segment in the market.

The direct-to-consumers segment is anticipated to witness at the fastest CAGR during the forecast period, driven by rising demand for home-focused or dual-use devices. The manufacturers' rising focus on eliminating intermediaries, related costs, and developing consumer-centric products also contributes to the segment growth. Direct engagement with consumers helps manufacturers to gather insight into their demands, which act as key insights to the new product development strategies. Moreover, online channels provide lower costs, convenience, and rapid access to innovations such as adjustable panels, app integration, and foldable designs. Enhanced digital experiences, including virtual demos, AR previews, and influencer endorsements, reduce purchase risk, making high-value red light therapy beds more accessible and appealing to individual consumers.

End Use Insight

The business-to-business (B2B) segment accounted for the largest market revenue share in 2024. The clinics, wellness centers, sports recovery facilities, medi-spas, and other commercial spaces are adopting red light therapy beds in bulk. This growth is attributed to the rising influence of non-invasive photobiomodulation solutions in skin rejuvenation, chronic pain relief, athletic recovery, and aesthetic treatments. In addition, businesses are investing heavily in advanced red light therapy beds due to their clinical efficacy, which includes improvements in psoriasis, arthritis, and pain relief treatments.

The business-to-consumer (B2C) segment is expected to grow at the fastest CAGR during the forecast period. The growth is driven by a growing interest in holistic well-being and non-invasive therapeutic options; more people today are discovering the benefits of red-light therapy. Consumers are increasingly using these devices at home to promote skin renewal, alleviate physical discomfort, and support faster muscle recovery. A July 2025 survey featured in Practical Dermatology revealed that 90% of respondents were open to purchasing their own red-light therapy systems, highlighting the surging enthusiasm for self-care technologies. Adding to this trend, public figures such as Kendall Jenner have showcased their own red-light therapy setups, bringing what was once a clinical or spa luxury into everyday wellness routines. These factors are expected to drive the growth of the segment and contribute to the development of the red light therapy bed industry.

Regional Insights

North America dominated the global red light therapy beds market with the largest revenue share of 47.60% in 2024, primarily driven by the region's growing demand for solutions to address skin and mood-related health issues. The demand for such non-invasive, at-home treatment procedures is steadily increasing, as consumers seek convenient treatment options with greater efficacy. The increasing number of people suffering from diseases like psoriasis and eczema, as well as the growing acknowledgment of seasonal affective disorder and sleep disturbances, are factors that keep this trend moving forward. According to a report published by Johnson & Johnson in October 2025, approximately 8 million Americans are estimated to have psoriasis. As a result, there will be a high demand for red-light therapy beds all over the region. These factors are expected to drive the growth of the market across the region.

U.S. Red Light Therapy Beds Market Trends

The red light therapy beds market in the U.S. is experiencing steady growth, driven by increasing health awareness and demand for non-invasive wellness treatments. Advances in LED, near-infrared, and photobiomodulation technologies have made these therapies more widely available across spas, clinics, and even at-home devices. The growing popularity of wellness tourism, luxury spa projects, and personalized healthcare services is further boosting adoption across the country. For instance, the 2024 redevelopment of Pier Sixty-Six by Tavistock Development Company in Fort Lauderdale has been announced as a USD 1 billion project, which includes the new Zenova Spa & Wellness, featuring nine treatment rooms equipped with LED and red-light therapies. These developments reflect how investments in wellness destinations and consumer demand for experiential recovery and aesthetics are further catalyzing the market’s expansion.

Europe Red Light Therapy Beds Market Trends

Thered light therapy beds market in Europe is witnessing significant growth. The increasing demand for non-invasive and drug-free wellness solutions drives this. LED and near-infrared devices are gaining popularity in skincare, pain management, and sports recovery, supported by an advanced healthcare infrastructure and a favorable regulatory framework that enables wider access for home use. For instance, in September 2025, AesthetiSupply reported that clinics in Eastern Europe, including those in Bulgaria, Romania, and Hungary, were heavily investing in full-body red-light therapies to meet the rising demand from the wellness tourism and sports recovery sectors. This is expected to drive the adoption of red-light therapy beds across the region.

The UK red light therapy beds market is steadily growing. The increasing recognition of the benefits of photobiomodulation and its use in physiotherapy and dermatology clinics are the main factors contributing to its expansion. The growing trend of at-home therapy devices is also becoming increasingly accessible to a wider range of people. For instance, in April 2025, Cryoclinix announced its transition to photobiomodulation, a reflection of the widespread adoption of advanced light-based treatments in clinical wellness settings.

Asia Pacific Red Light Therapy Beds Market Trends

The red light therapy beds market in the Asia Pacific is expanding steadily as awareness of health and wellness grows alongside rising disposable incomes. The increasing presence of wellness studios, fitness centers, and aesthetic clinics offering advanced LED-based red-light therapy equipment has also made these treatments more accessible and trustworthy. Social media trends and the rise of wellness tourism are further encouraging urban consumers to explore such therapies. Reflecting this trend, in January 2025, The Circuit at 10x Longevity in Hong Kong introduced a 2.5-hour session that combines hyperbaric oxygen therapy, infrared sauna, and red-light therapy, showing the region’s movement toward integrated, science-backed wellness experiences.

The China red light therapy beds marketis growing extensively fast as more clinics and medspas are utilizing this technology for acne treatment, skin rejuvenation, and post-recovery care. Similarly, advanced at-home devices are turning red-light therapy into a more convenient treatment for consumers. The increased use in sports medicine and rehabilitation centers is, therefore, the main reason for its rising popularity in the country. Moreover, China has become a major player in the production of LED-based therapy equipment, especially the models that use 660 nm and 850 nm wavelengths. As consumers are looking for easy self-care methods and clinics are focusing on delivering effective, non-invasive treatments, the red-light therapy bed market is still very active, and it is spreading to the wellness and aesthetics industries across the country.

Latin America Red Light Therapy Beds Market Trends

The red light therapy beds market in Latin America has been experiencing consistent growth. The growth is fueled by the wellness culture in the region and the rising demand for beauty and recovery treatments. Brazil and Argentina are witnessing the trend of clinics, spas, and gyms extending their services with red light therapy beds and devices in different applications. The growing accessibility of e-commerce is also contributing to the popularity of home-use devices, as they are easily accessible and convenient to use.

The Brazil red light therapy beds market is growing. The rising awareness of non-invasive, drug-free treatments in aesthetics and rehabilitation, particularly for skin rejuvenation, pain relief, and muscle recovery, is driving growth. The country’s strong sports and wellness culture is accelerating the adoption of photobiomodulation technologies, while affordable, compact home-use devices are expanding accessibility. The clinical validation is also a key factor that the Brazilian red light therapy market becoming stronger. For instance, in May 2022, a FAPESP article reported that Brazilian scientists had developed combined laser, ultrasound, and suction protocols to treat muscle, joint, skin, neurological, and lung damage in long-COVID patients, thus indicating the increasing medical relevance of red light-based therapies and devices.

Middle East & Africa Red Light Therapy Beds Market Trends

The red light therapy beds market in the Middle East & Africa is witnessing steady expansion as more and more consumers opt for non-invasive beauty and wellness treatments. Approximately 70% of adults in the UAE have tried red-light therapy, and nearly a third of them use it regularly to alleviate sleep problems and improve the skin condition. Technology is widely accepted in dermatology centers and fitness facilities, where red and near-infrared radiation are used for skin rejuvenation, muscle recovery, and pain relief. The spread of information about light-based treatments, the rise of aesthetic consciousness, and the growing preference for natural, tech-enabled wellness solutions are the primary factors driving this trend across the entire region.

The Saudi Arabia red light therapy beds market is expected to grow at a significant CAGR during the forecast period. The growth is driven by healthcare and wellness infrastructure upgrades under Vision 2030, promoting tech-enabled care and wellness tourism. Advancements in LED and photobiomodulation technologies offering improved wavelength control, full-body coverage, and dual aesthetic and therapeutic benefits are boosting adoption across clinics, spas, and luxury homes. The increasing integration of these systems in dermatology and wellness centers underscores the growing professional and consumer demand, shaping a dynamic, multi-channel growth trend

Key Red Light Therapy Beds Company Insights

The red-light therapy beds industry is highly competitive, with key players such as THOR PHOTOMEDICINE LTD (NovoThor), TheraLight, Prism Light Pod, Red Light Wellness, and Ammortal. The major companies undertake various organic and inorganic strategies, such as product introduction, collaborations, and regional expansion, to serve the unmet needs of their customers.

Key Red Light Therapy Beds Companies:

The following are the leading companies in the red light therapy beds market. These companies collectively hold the largest Market share and dictate industry trends.

- THOR PHOTOMEDICINE LTD (NovoThor)

- TheraLight

- Prism Light Pod

- Red Light Wellness

- Ammortal

- Body Balance System

- Mito Red

- LightStim

- NEO Science

- Spectra Red Light LLC (Vasindux)

- Vital Red Light

- Precor

- ARRC LED

Recent Developments

-

In May 2024, JK Wellness launched the Revive Pro IR Laydown, a full-body LED red-light therapy bed featuring three wavelengths for skin rejuvenation and collagen stimulation. The product combines red and near-infrared light to target multiple tissue depths.

-

In May 2025, TheraLight, LLC, launched the TheraLight 360i, a multi-modality whole-body red-light therapy bed that combines PBM, PEMF, and acoustic resonance technologies. The device provides 360° LED coverage, aiming to enhance recovery, anti-aging, and overall wellness.

Red Light Therapy Beds Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 200.6 million

Revenue forecast in 2033

USD 491.6 million

Growth rate

CAGR of 11.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device class, sales channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

THOR PHOTOMEDICINE LTD (NovoThor); TheraLight; Prism Light Pod; Red Light Wellness; Ammortal; Body Balance System; Mito Red; LightStim; NEO Science; Spectra Red Light LLC (Vasindux); Vital Red Light; Precor; ARRC LED

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Red Light Therapy Beds Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global red light therapy beds market report based on the device class, sales channel, end use, and region:

-

Device Class Outlook (Revenue, USD Revenue, 2021 - 2033)

-

Premium Grade

-

Economical-Budget Friendly

-

-

Sales Channel Outlook (Revenue, USD Revenue, 2021 - 2033)

-

Direct Manufacturer Sales

-

Authorized Distributors

-

Direct-to-Consumers

-

-

End Use Outlook (Revenue, USD Revenue, 2021 - 2033)

-

Business to Business (B2B)

-

Business to Consumers (B2C)

-

-

Region Outlook (Revenue, USD Revenue, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.