- Home

- »

- Plastics, Polymers & Resins

- »

-

Refillable Packaging Market Size, Industry Report, 2030GVR Report cover

![Refillable Packaging Market Size, Share & Trends Report]()

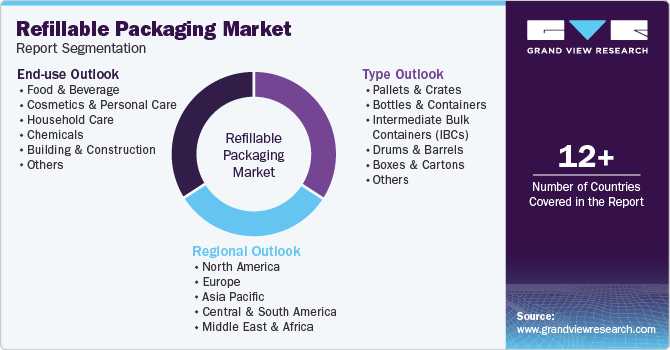

Refillable Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Pallets & Crates, Bottles & Containers), By End Use (Food & Beverage, Cosmetics & Personal Care, Household Care, Chemicals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-548-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Refillable Packaging Market Summary

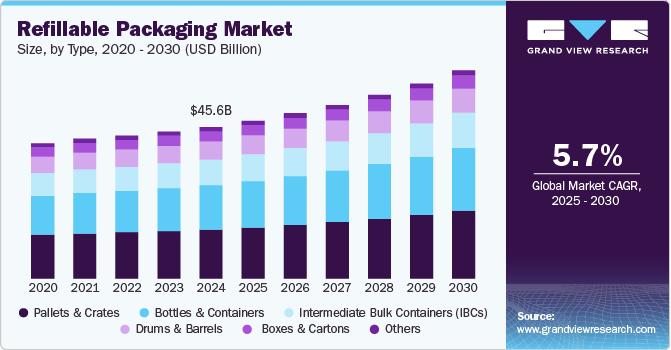

The global refillable packaging market size was estimated at USD 45.59 billion in 2024 and is projected to reach USD 62.60 billion by 2030, growing at a CAGR of 5.7% from 2025 to 2030. One of the primary drivers of the refillable packaging industry is the growing consumer awareness of environmental issues, particularly related to plastic pollution and waste generation.

Key Market Trends & Insights

- The Asia Pacific refillable packaging market held the largest revenue share of 46.2% in 2024.

- The refillable packaging market in China growth can be attributed to the production sector in the country.

- By type, the pallets and crates type segment held the largest revenue share of 32.4% in 2024.

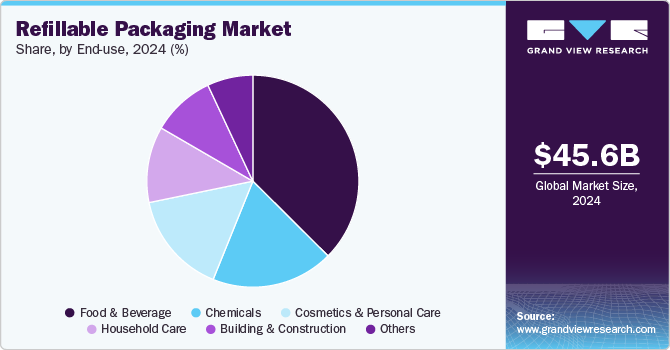

- By end use type, the food & beverage segment held the largest revenue share of 37.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 45.59 Billion

- 2030 Projected Market Size: USD 62.60 Billion

- CAGR (2025-2030): 5.7%

- Asia Pacific: Largest market in 2024

Consumers are actively seeking eco-friendly alternatives to traditional single-use packaging, leading brands and retailers to adopt refillable packaging models as a sustainable solution. With the rise of conscious consumerism, people are making purchasing decisions based on packaging sustainability, recyclability, and reusability. This shift in consumer behavior is driving the demand for refill stations, refillable bottles, and refill pouches, particularly in sectors such as personal care, household cleaning, and food & beverage.Many governments and organizations are also conducting awareness campaigns to educate consumers about the benefits of refillable and refillable packaging, further encouraging adoption. In addition, refill-on-the-go stations in supermarkets, retail stores, and specialty stores are gaining popularity, allowing customers to reuse their existing packaging instead of purchasing new plastic containers, which significantly reduces waste generation and carbon footprints.

The personal care, beauty, and household cleaning industries are at the forefront of the refillable packaging revolution, with major brands transitioning to refillable and refillable solutions. Consumers are increasingly drawn to products that offer sustainability without compromising convenience, making refillable models highly attractive. Leading beauty and skincare companies like L’Oréal, Unilever, and P&G have introduced refill stations, refillable aluminum bottles, and compostable refills for products such as shampoo, conditioner, body wash, and facial creams.

Similarly, in the household cleaning segment, brands are launching concentrated refill pods and refill pouches that significantly reduce plastic waste compared to conventional single-use bottles. Products like dishwashing liquids, detergents, and surface cleaners are now available in waterless or concentrated formats, allowing consumers to reuse their original containers multiple times, thereby cutting down on plastic production and disposal. This shift toward refillable household and personal care products is expected to continue growing as consumers demand more environmentally friendly options from manufacturers.

Governments worldwide are enforcing strict regulations and sustainability initiatives to curb plastic waste and promote circular economy models. Several countries have introduced bans or restrictions on single-use plastics, driving industries to adopt alternative packaging solutions such as refillable containers, refillable glass bottles, and compostable packaging. For instance, Europe’s Single-Use Plastics Directive (SUPD) and Extended Producer Responsibility (EPR) programs encourage businesses to switch to eco-friendly packaging formats and invest in closed-loop refill systems. Similarly, in the United States and Canada, many states and provinces have introduced plastic waste reduction policies, urging companies to offer refillable or refillable packaging to meet regulatory compliance.

In Asia-Pacific, countries like Japan, China, and India are also witnessing growing governmental pressure to reduce plastic consumption and encourage sustainable alternatives. Several brands in these regions are launching refillable packaging solutions to align with the United Nations’ Sustainable Development Goals (SDGs) and regional waste management policies. As regulations continue to tighten, businesses across various industries are investing in refill stations, bulk dispensers, and durable packaging materials to comply with these mandates and maintain market competitiveness.

Type Insights

Based on type, the pallets and crates type segment led the market with the largest revenue share of 32.4% in 2024. Pallets and crates are essential components of global supply chains, playing a crucial role in the transportation, storage, and distribution of goods across various industries. As global trade and e-commerce continue to expand, the demand for efficient, durable, and refillable packaging solutions has surged, with pallets and crates emerging as the preferred choice due to their high load-bearing capacity, easy handling, and compatibility with automated logistics systems. These packaging types facilitate bulk shipping and optimized space utilization, making them indispensable for warehousing, freight transport, and cargo management.

Unlike other types of packaging, such as bottles or cartons, pallets and crates allow for the safe stacking and efficient movement of heavy and oversized goods, significantly reducing handling time and transportation costs. The rise of automated warehouses and conveyor-based logistics systems has further fueled the demand for standardized, refillable pallets and crates that integrate seamlessly with forklifts, automated guided vehicles (AGVs), and robotic picking systems. This growing reliance on efficient and sustainable transport solutions has cemented the dominance of pallets and crates in the global refillable packaging industry.

Moreover, pallets and crates provide a cost-effective and long-term packaging solution compared to single-use alternatives such as boxes, cartons, or shrink-wrapped packages. Wooden and plastic pallets can withstand multiple reuse cycles, significantly reducing packaging costs over time for industries that handle large volumes of shipments. Unlike Intermediate Bulk Containers (IBCs) or barrels, which are primarily used for liquid and chemical storage, pallets and crates are versatile and can be used across multiple industries, from retail to automotive and pharmaceuticals.

End Use Type Insights

Based on end use type, the food & beverage segment led the market with the largest revenue share of 37.5% in 2024, and is forecasted to grow at a rapid CAGR over the forecast period. The Food & Beverage (F&B) industry is the largest end-use segment in the global refillable packaging industry due to its high demand for durable, cost-effective, and hygienic packaging solutions. Refillable packaging such as crates, pallets, trays, and bulk containers plays a crucial role in food distribution, processing, and retail supply chains, ensuring efficient handling and transportation of perishable goods.

Supermarkets, grocery stores, and food distributors are increasingly adopting returnable plastic crates (RPCs), wooden pallets, and bulk bins to enhance the efficiency of their supply chains while minimizing single-use packaging waste. These packaging formats provide better protection for fresh produce, dairy, meat, and baked goods, ensuring extended shelf life and reduced spoilage. Unlike disposable cardboard boxes, refillable food crates offer superior ventilation and stackability, making them a preferred choice for farm-to-retail logistics.

Furthermore, sustainability concerns are driving the transition from single-use to refillable packaging in the food & beverage sector. Governments worldwide are implementing strict regulations on single-use plastics, encouraging businesses to switch to recyclable and refillable alternatives. Companies are increasingly investing in circular packaging systems, where refillable containers, bottles, and crates are collected, sanitized, and reintroduced into the supply chain, reducing overall waste and carbon emissions.

For instance, many beverage brands are reintroducing refillable glass bottles and aluminum cans, reducing reliance on disposable plastic bottles. Similarly, the rise of zero-waste grocery stores and bulk refill stations is further propelling demand for returnable packaging formats, including stainless steel, glass, and refillable plastic containers. As sustainability continues to be a top priority for food and beverage brands, the dominance of this segment in the refillable packaging industry is expected to persist.

Region Insights

The refillable packaging market in North America is growing due to the rise of e-commerce, increasing corporate sustainability goals, and consumer-driven preferences for eco-friendly alternatives. Major retail and FMCG brands are investing in closed-loop packaging systems and sustainable supply chains to meet environmental commitments. The expansion of bulk refill stations in grocery stores, along with the adoption of returnable transport packaging (RTP) in logistics and warehousing, is contributing to market growth. In addition, industries like automotive, agriculture, and pharmaceuticals are increasingly shifting toward durable, refillable containers and bulk bins to optimize efficiency and reduce waste.

U.S. Refillable Packaging Market Trends

The refillable packaging market in the U.S.demand is primarily driven by regulatory pressures, corporate sustainability initiatives, and consumer demand for waste reduction. Many states, such as California, New York, and Oregon, have implemented plastic bans and extended producer responsibility (EPR) laws, encouraging businesses to transition to refillable, returnable, and recyclable packaging models. The growth of sustainable e-commerce packaging solutions, along with the increasing popularity of subscription-based refill programs, has fueled demand in sectors like food & beverage, cosmetics, and household care. In addition, logistics and retail giants such as Amazon and Walmart are exploring refillable pallet pooling systems and collapsible bulk containers to enhance supply chain efficiency while minimizing environmental impact.

Asia Pacific Refillable Packaging Market Trends

Asia Pacific dominated the refillable packaging market with the largest revenue share of 46.2% in 2024 and is anticipated to grow at the fastest CAGR of 6.0% over the forecast period. The demand for refillable packaging in Asia Pacific is growing rapidly due to urbanization, e-commerce expansion, and increasing government initiatives to reduce plastic waste. With rising industrial activity and global trade, businesses in the region are prioritizing cost-effective and sustainable packaging solutions, particularly in logistics, food & beverage, and consumer goods. Countries like India, Japan, and South Korea are implementing stricter regulations on single-use plastics, encouraging the use of returnable crates, pallets, and bulk transport packaging. In addition, the increasing penetration of e-commerce platforms and automated supply chains is driving the adoption of durable, refillable packaging formats that ensure efficient storage, transportation, and reduced environmental impact.

The refillable packaging market in China growth can be attributed to the production sector in the country. As the largest manufacturing and consumer market in Asia Pacific, China is leading the shift toward refillable packaging through strict waste management policies, rapid industrialization, and corporate sustainability commitments. The government's ban on single-use plastics and emphasis on a circular economy have pushed industries—especially food & beverage, retail, and logistics—toward refillable alternatives like pallets, crates, and refillable bottles. In addition, China's booming e-commerce sector, dominated by giants like Alibaba and JD.com, is investing heavily in returnable transport packaging (RTP) and smart logistics systems that prioritize durability and reusability. The large-scale adoption of refillable industrial packaging in automotive and electronics manufacturing further contributes to the growing market demand.

Europe Refillable Packaging Market Trends

The refillable packaging market in Europe has been at the forefront of refillable packaging adoption due to strict sustainability regulations and increasing consumer awareness about environmental impact. The European Union's Circular Economy Action Plan (CEAP) and Single-Use Plastics Directive have placed significant restrictions on disposable packaging, encouraging industries to shift towards refillable and returnable solutions. Many European companies, especially in the food, beverage, and cosmetics sectors, have adopted deposit-return schemes (DRS), bulk dispensing models, and refillable packaging pools to comply with regulatory mandates and meet sustainability goals. Moreover, retailers and e-commerce platforms are promoting zero-waste shopping experiences, further driving the demand for refillable bags, containers, and secondary packaging materials.

The Germany refillable packaging market is driven by sustainability and packaging innovation. The country has well-established deposit-return schemes (DRS) for beverage packaging, significantly increasing the use of refillable glass and PET bottles. In addition, Germany’s strict waste disposal laws and emphasis on circular economy practices have encouraged businesses across industries to invest in refillable transport and bulk packaging solutions. Large retailers and supermarket chains have introduced refill stations for household and personal care products, while industrial sectors such as automotive and logistics are expanding their use of returnable crates, pallets, and collapsible bulk containers to optimize costs and environmental impact.

Key Refillable Packaging Company Insights

The global refillable packaging industry is highly competitive, with key players focusing on innovation, material advancements, and sustainability-driven solutions to gain a competitive edge. Key players operating in the industry include Amcor, Sem Plastik, Double H Plastics, Greiner Packaging, Tek Pak, RPC Group, Reynolds Group, ORBIS Corporation, Sanpaca, and Plastipak Industries Inc.

These companies leverage advanced material technology, automation, and smart tracking systems to enhance the efficiency and lifespan of refillable packaging. The market is also witnessing increased strategic partnerships, mergers & acquisitions, and investments in circular economy models to strengthen market positioning. Regional players and emerging companies are focusing on customized, industry-specific refillable packaging to cater to the growing demand for sustainability, while e-commerce giants and FMCG brands are adopting closed-loop packaging systems and refill models to align with global sustainability goals. Regulatory policies, shifting consumer preferences, and advancements in smart packaging technologies are key factors intensifying competition, making innovation and scalability critical for market leadership.

Key Refillable Packaging Companies:

The following are the leading companies in the refillable packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Sem Plastik

- Double H Plastics

- Greiner Packaging

- Tek Pak

- RPC Group

- Reynolds Group

- ORBIS Corporation

- Sanpaca

- Plastipak Industries Inc.

Recent Development

-

In December 2022, PepsiCo declared a global packaging objective to increase from 10% to 20% by 2030 the proportion of beverage servings it sells that are supplied in refillable models. This goal is a component of PepsiCo Positive (pep+), the company's end-to-end, strategic business transformation that centers on people and sustainability as the primary means of generating growth and value. In order to radically change the way that people drink beverages, it will be necessary to provide refillable and refillable solutions that are widely available and easy for customers.

-

In February 2023, An international pioneer in creating and manufacturing environmentally friendly packaging solutions invested $250,000 in the third Lift-Off initiative winner from Amcor, circulation, a smart refillable food packaging start-up. Launched in April 2022, Amcor Lift-Off seeks breakthrough, state-of-the-art solutions that will further advance Amcor's objective to make the future of packaging more sustainable.

Refillable Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 47.49 billion

Revenue forecast in 2030

USD 62.60 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 – 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Amcor; Sem Plastik; Double H Plastics; Greiner Packaging; Tek Pak; RPC Group; Reynolds Group; ORBIS Corporation; Sanpaca and Plastipak Industries Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Refillable Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global refillable packaging market report based on type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pallets and Crates

-

Bottles and Containers

-

Intermediate Bulk Containers (IBCs)

-

Drums and Barrels

-

Boxes and Cartons

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food and Beverage

-

Cosmetics and Personal Care

-

Household Care

-

Chemicals

-

Building and Construction

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global refillable packaging market was valued at USD 45.69 billion in 2024 and is expected to reach USD 47.49 billion in 2025

b. The global refillable packaging market is forecasted to grow at a CAGR of 5.7% from 2025 to 2030 to reach USD 62.60 billion by 2030

b. Based on End-Use type, the Food and beverage (F&B) industry is the largest end-use segment, with a market share of 37.5% in the global refillable packaging market, due to its high demand for durable, cost-effective, and hygienic packaging solutions.

b. Some of the major players operating in the global refillable packaging market include Amcor, Sem Plastik, Double H Plastics, Greiner Packaging, Tek Pak, RPC Group, Reynolds Group, ORBIS Corporation, Sanpaca and Plastipak Industries Inc.

b. One of the primary drivers of the refillable packaging market is the growing consumer awareness of environmental issues, particularly related to plastic pollution and waste generation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.