- Home

- »

- Catalysts & Enzymes

- »

-

Refinery Catalysts Market Size, Industry Report, 2033GVR Report cover

![Refinery Catalysts Market Size, Share & Trends Report]()

Refinery Catalysts Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Zeolite, Metallic, Chemical Compounds), By Application (FCC Catalyst, Alkylation Catalysts, Catalytic Reforming, Hydrocracking Catalysts), By Region, And Segment Forecasts

- Report ID: 978-1-68038-572-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Refinery Catalysts Market Summary

The global refinery catalysts market size was estimated at USD 10,096.57 million in 2025 and is projected to reach USD 14,249.26 million by 2033, growing at a CAGR of 4.3% from 2026 to 2033. The market growth is driven by a convergence of structural shifts in the refining industry, evolving fuel regulations, and the push toward cleaner, higher-value product streams.

Key Market Trends & Insights

- Asia Pacific dominated the refinery catalysts market with the largest revenue share of 30.9% in 2025.

- The China refinery catalysts industry held the largest revenue share of Asia Pacific in 2025.

- By product, the zeolite segment led the market with the largest revenue share of 28.7% in 2025 and is expected to continue to dominate the industry from 2026 to 2033.

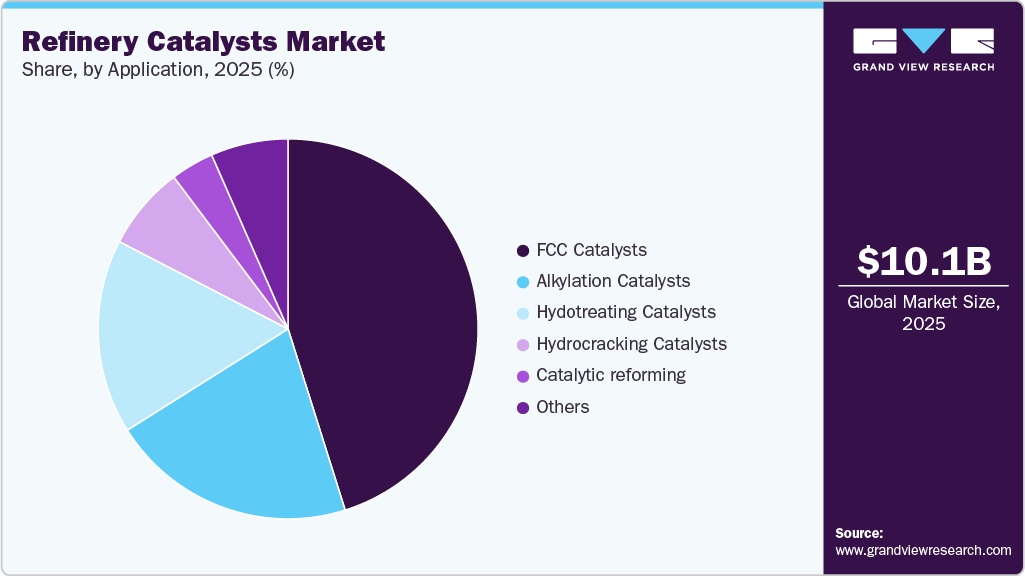

- By application, the FCC catalysts segment led the market with the largest revenue share of 42.9% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 10.10 Billion

- 2033 Projected Market Size: USD 14.25 Billion

- CAGR (2026-2033): 4.3%

- Asia Pacific: Largest Market in 2025

- Middle East & Africa: Fastest Growing Market

One of the strongest drivers for the growth of the refinery catalyst industry is the tightening of fuel-quality standards across major markets. Ultra-low sulfur diesel (ULSD), low-sulfur gasoline, and IMO 2020 marine fuel standards continue to elevate demand for hydrotreating, hydrodesulfurization (HDS), and hydrocracking catalysts. As refiners optimize operations to reduce sulfur, nitrogen, aromatics, and other impurities, catalyst consumption increases both in volume and complexity.Another major driver is the industry’s transition toward higher conversion and higher-value product yields. As fuel demand patterns shift-especially with the rise of petrochemical integration-refiners are investing in FCC, reforming, and alkylation catalysts to maximize propylene, aromatics, and high-octane components. This is reinforced by the global trend of processing heavier, sourer, and opportunity crudes, which require more sophisticated catalysts to maintain throughput and unit reliability.

Additionally, the growing emphasis on energy efficiency and emissions reduction is pushing refiners toward catalysts that offer longer cycles, lower coke formation, reduced CO₂ footprint, and overall better unit economics. Emerging demand for renewable fuels, such as renewable diesel and sustainable aviation fuel (SAF), is also creating new opportunities for hydrotreating and isomerization catalysts tailored to bio-feedstocks.

Stringent regulations, coupled with increasing demand for petroleum and petroleum-derived products/chemicals, are likely to steer market growth. Refinery catalysts are used in the petroleum refining industry to enhance the operational efficiency of petroleum.

In addition, the increasing demand for high-octane fuel, particularly in countries such as the U.S., Japan, Germany, the UK, and India, due to stringent regulations, is expected to positively influence the growth of the market for refinery catalysts positively. Furthermore, the shift towards renewable energy sources has prompted oil refineries to optimize their operations and improve their efficiency, leading to an increased demand for advanced refinery catalysts. The market is also expected to benefit from the growing adoption of new and advanced technologies in the refining industry, which require specialized catalysts to ensure optimal performance.

Refinery catalysts are widely used to counter issues such as metal contamination and heat balance effects in tight oil processing. The increasing production of tight oil in the U.S., Russia, China, and Argentina is expected to drive market growth over the forecast period. Stringent government regulations, including those related to Ultra-Low Sulfur Diesel (ULSD) and strict emission standards in mature economies, are anticipated to remain the major factors steering demand for refinery catalysts in the petroleum refining sector. The availability of alternative fuels such as biofuels, coupled with the adoption of “Go Green” campaigns and environmental policies by several nations, is expected to restrain the market growth for refinery catalysts.

Different types of materials used in the manufacturing of refinery catalysts include zeolites, chemical compounds, and metals. These materials, when used in various compositions or in combination with other chemicals, enable manufacturers to produce fluid catalytic cracking refinery catalysts, alkylation refinery catalysts, hydrotreating refinery catalysts, and hydrocracking refinery catalysts.

Global manufacturers of refinery catalysts are highly focused on designing catalysts that can handle a wide range of feedstocks and ensure stable, reliable, easy, and profitable hydrotreating and hydrocracking applications. For the same reason, the adoption of superior process designs, proprietary equipment, and innovation of performance refinery catalysts has helped the manufacturers gain a competitive edge over others. Furthermore, a combination of technical expertise and sustainable production approaches is increasingly being adopted by manufacturers.

The global refinery catalysts market has witnessed a significant growth rate over the past few years, owing to the benefits it has received from high-value product segments. For instance, the application of catalysts in an automobile reduces carbon emissions that are harmful to the environment, and thus, their application is highly promoted by governments globally. Favorable government regulations have, in turn, increased the demand for catalysts in the automotive industry across regions.

Drivers, Opportunities & Restraints

The global demand for transportation fuel is likely to drive growth in the refinery catalysts industry. Stringent fuel norms and standards, coupled with increasing consumption of petroleum derivatives, are expected to steer the market growth. Government rules governing ultra-low sulfur diesel (ULSD) and stringent emission standards in developed markets are expected to continue driving catalyst demand in the petroleum refining industry. Furthermore, the rising demand for high-octane fuel, particularly in major cities such as those in the U.S., Japan, Germany, the UK, and India, is likely to boost market growth.

Stringent emission control regulations globally are one of the major factors driving the requirement for conservative and efficient refining processes with high yields. This has further resulted in a surged in refinery catalyst demand to improve overall process efficiency. Stringent regulations concerning emissions have been introduced by many countries to reduce sulfur content in diesel and gasoline, as well as to lower the levels of sulfur, nitrogen oxide, and mercury emissions from refineries. Thus, environmental regulations are driving the demand for environmental catalysts for reducing emissions in refineries.

Increasing energy demand, coupled with growing stress on green technologies, has resulted in catalysts playing an important role in petroleum refining operations. They are useful in various processes, including reforming, hydroprocessing, and cracking operations in refineries. Increasing emission control regulations globally are driving the need for efficient and conservative processes with high yield, which has steered catalysts demand in different applications to improve process efficiency.

Product Insights

The zeolite segment led the refinery catalysts market with the largest revenue share of 28.7% in 2025 and is expected to continue to dominate the industry over the forecast period. This is attributed to their widespread usage as adsorbents and catalysts owing to their porosity and large surface area. The porous structure of zeolites accommodates a variety of cations, including potassium (K+), sodium (Na+), calcium (Ca2+), and magnesium (Mg2+). Naturally, zeolites are formed by the reaction of volcanic rocks and ash layers with alkaline water. Natural zeolites are impure owing to the presence of other minerals, metals, and quartz. On the contrary, zeolites are commercially manufactured through the slow crystallization of silica-alumina gel, with multiple other atoms incorporated to enhance activity and performance in a particular process.

The growing demand for noble and other metals in emerging economies of Chile, China, and South Africa, on account of favorable regulatory support for FDI in mineral production, is expected to ensure a robust raw material supply for the manufacturers of metal catalysts. However, the growing demand for these metals in other applications is expected to put additional pressure on raw material supply. It may create obstacles to the growth of the refinery catalyst industry over the forecast period.

Application Insights

The FCC catalysts segment led the refinery catalysts industry, with the largest revenue share of 42.9% in 2025. The growth in this segment can be attributed to the growing demand for gasoline as a fuel for its use in automotive vehicles across the globe. Other application-based segments include fluid catalytic cracking (FCC) catalysts, hydrotreating catalysts, hydrocracking catalysts, and catalytic reforming.

Fluid catalytic cracking is the most preferred method used by refineries to convert heavy and high-boiling hydrocarbons into lower-value fractions. Gasoline is the primary material obtained from the process, along with other fractions such as diesel and C3 and C4 gaseous fractions. This process helps produce an additional quantity of gasoline to cater to the robust demand for automotive vehicles. The lighter fractions formed during the process are fed to the alkylation unit to produce a high-octane gasoline component called alkylate. The heavier fractions are used as a blender and an additive in diesel.

The hydrotreating segment is expected to grow at the fastest CAGR of 4.7% from 2026 to 2033. The hydrotreating process, also known as the hydrodesulfurization process, is used to separate chemically bound sulfur compounds from various petrochemical materials. This is done using a variety of refinery catalysts that are selected based on the feed. The process also aids in the removal of other impurities such as metals, oxygen, and nitrogen. This unit is used at multiple stages in the refinery for hydrotreating various products, including jet fuel, pyrolysis gas, catalytic feed, reformer feed, and other distillates.

Hydrotreating is carried out before processes such as catalytic reforming to avoid the contamination of the catalyst by crude feedstock. Additionally, hydrocracking is employed before catalytic cracking to reduce sulfur content, enhance yields, and increase the production of middle distillate petroleum fractions, which are used in heating fuel oil, kerosene, and diesel fuel.

Regional Insights

The refinery catalysts market in North America is mature and technologically advanced, driven by stringent environmental regulations and the need for high-efficiency fuel refining. Key applications include fluid catalytic cracking (FCC), hydrocracking, and hydrotreating, which reduce the sulfur and nitrogen content in fuels. The growing demand for cleaner transportation fuels and shale oil processing is driving catalyst innovation and adoption. The region benefits from strong R&D capabilities and the presence of major catalyst producers like Albemarle, BASF, and W.R. Grace.

U.S. Refinery Catalysts Market Trends

The U.S. refinery catalysts industry led North America, with the largest revenue share of 77.7% in 2025, backed by its large refining capacity, complex refineries, and significant shale oil output. Regulations by the EPA and Department of Energy continue to push refiners to adopt advanced catalyst systems to meet Tier 3 and ultra-low sulfur fuel standards. Innovation in FCC and hydrotreating catalysts is particularly prominent, with a focus on improving fuel yield and reducing emissions. The presence of global catalyst manufacturers and strategic R&D investment further strengthens the U.S. market.

Asia Pacific Refinery Catalysts Market Trends

Asia Pacific dominated the refinery catalysts industry, with the largest revenue share of 30.9% in 2025. An increasing number of private sector companies play a crucial role in promoting the refining industry in the aforementioned countries, especially in India. The Reliance-operated Jamnagar refinery complex in Gujarat had a capacity of 1.2 million barrels per day in 2019, making it the largest refinery in the world. The government of India has approved the Petroleum, Chemicals, and Petrochemicals Investment Region (PCPIR) policy for promoting FDI investments in the oil and gas sector. This regulatory move is expected to accelerate the petrochemicals and polymer production in India, thus contributing to the demand for refinery catalysts over the forecast period.

The refinery catalysts market in China accounted for the largest market revenue share in Asia Pacific in 2025. In China, the presence of substantial oil reserves is likely to contribute to the growth of the Asia Pacific market. As a result, key market players are focusing their efforts on expanding capacity in the Asia Pacific region and meeting the growing demand across regions.

Europe Refinery Catalysts Market Trends

The refinery catalysts industry in Europe is anticipated to grow at a CAGR of 3.7% during the forecast period. Refineries in Europe are struggling with low margins due to high manufacturing costs and stringent environmental regulations. This regulatory move in Russia is expected to fuel demand for catalysts in refining applications. In addition, technological developments related to enhanced oil recovery and the deployment of hydraulic fracturing activities in countries such as Russia and Ukraine are expected to lead to an increase in the availability of tight oil and shale gas. The increasing availability of shale gas and tight oil is expected to facilitate access to raw materials for refineries operating in Germany, France, and Italy. This is likely to have a positive impact on the European market.

Key Refinery Catalysts Company Insights

Some of the key players operating in the market include Dow and Linde Plc.

- BASF SE is a chemical manufacturing company with a presence across Asia Pacific, North America, Central & South America, Europe, and the Middle East & Africa. The company operates through six business segments, namely chemical, material, industrial solutions, surface technologies, agricultural solutions, and nutrition & care. The chemical segment encompasses petrochemicals and their intermediates. The material segment comprises performance polymers and monomers. The Solutions segment includes performance chemicals and dispersions, as well as pigments. The agricultural solution segment includes products for farming, landscape management, and pest control. The Nutrition & Care segment is further sub-segmented into Nutrition & Health and Care. The company provides a wide range of surfactants for textile, paint & coatings, homecare, and food processing industries.

Key Refinery Catalysts Companies:

The following are the leading companies in the refinery catalysts market. These companies collectively hold the largest Market share and dictate industry trends.

- Albemarle Corporation

- BASF SE

- Johnson Matthey Plc

- W. R. Grace

- Clariant International Ltd.

- Arkema

- Zeolyst International

- Chevron Corporation

- Exxon Mobil Corporation

- Evonik Industries AG

- DuPont

- Haldor Topsoe A/S

Recent Developments

-

In May 2025, Johnson Matthey agreed to sell its “Catalyst Technologies” business to Honeywell for £1.8 billion (cash and debt-free basis). The deal enables Honeywell to integrate JM’s catalyst technologies with its existing Energy & Sustainability Solutions (ESS) business, broadening its offerings in refining and petrochemical catalysts - including those for lower-emission fuels, sustainable aviation fuel (SAF), blue hydrogen, and ammonia.

-

In August 2024, BASF launched Fourtiva, a new fluidized catalytic cracking (FCC) catalyst designed to enhance the production of high-octane gasoline blending components. The catalyst leverages BASF’s latest Advanced Innovative Matrix (AIM) and Multiple Frameworks Topology (MFT) technologies to deliver a tailored solution that prioritizes higher butylene output, improved naphtha octane, and increased LPG olefinicity, while reducing the formation of coke and dry gas. This advanced formulation enables refiners to boost the yield of high-value products, enhance overall profitability, and lower the FCC unit's environmental impact.

Refinery Catalysts Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 10.62 billion

Revenue forecast in 2033

USD 14.25 billion

Growth rate

CAGR of 4.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; China; India; Japan; South Korea; Indonesia; Australia; Brazil; South Africa; Saudi Arabia

Key companies profiled

Albemarle Corporation; BASF SE; Johnson Matthey Plc; W. R. Grace; Clariant International Ltd.; Arkema; Zeolyst International; Chevron Corporation; Exxon Mobil Corporation; Evonik Industries AG; DuPont; Haldor Topsoe A/S

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Refinery Catalysts Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global refinery catalysts market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Zeolite

-

Metallic

-

Chemical Compounds

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

FCC Catalysts

-

Alkylation Catalysts

-

Hydrotreating Catalysts

-

Hydrocracking Catalysts

-

Catalytic Reforming

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global refinery catalysts market is expected to grow at a compound annual growth rate of 4.3% from 2026 to 2033 to reach USD 14,249.26 million by 2033.

b. Asia Pacific region dominated the refinery catalysts market with a share of 30.9% in 2025. This is attributable to the increasing demand for hydrotreating and catalytic cracking catalysts, especially in China.

b. Some key players operating in the refinery catalyst market include Albemarle Corporation; BASF SE; Johnson Matthey Plc; W. R. Grace; Clariant International Ltd.; Arkema; Zeolyst International; Chevron Corporation; Exxon Mobil Corporation; Evonik Industries AG; DuPont; Haldor Topsoe A/S

b. Key factors that are driving the refinery catalyst market growth include increasing environmental concerns and stringent government regulations for the production of clean high octane gasoline coupled with increasing efforts to improve refinery throughput.

b. The global refinery catalyst market size was estimated at USD 10,096.57 million in 2025 and is expected to reach USD 10,620.0 billion in 2026.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.