- Home

- »

- Catalysts & Enzymes

- »

-

Catalyst Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Catalyst Market Size, Share & Trends Report]()

Catalyst Market (2026 - 2033) Size, Share & Trends Analysis Report By Raw Material (Chemical compounds, Metals, Zeolites), By Application (Heterogeneous Catalyst, Homogeneous Catalyst), By Region, And Segment Forecasts

- Report ID: 978-1-68038-228-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Catalyst Market Summary

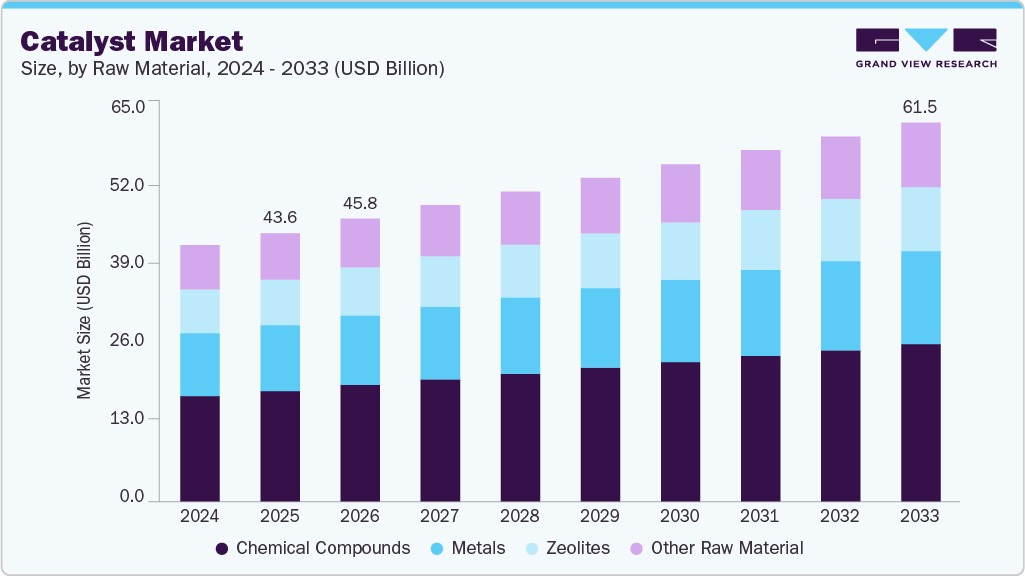

The global catalyst market size was estimated at USD 43.6 billion in 2025 and is projected to reach USD 61.5 billion by 2033, growing at a CAGR of 4.3% from 2026 to 2033. Demand for catalysts rises as chemical, refining, and environmental processes require higher efficiency, lower emissions, and improved selectivity; innovators deliver tailored materials and formulations that enable process intensification, resource conservation, and compliance with tightening environmental standards, making catalysts central to decarbonization and circularity efforts across heavy industries worldwide industrial ecosystems.

Key Market Trends & Insights

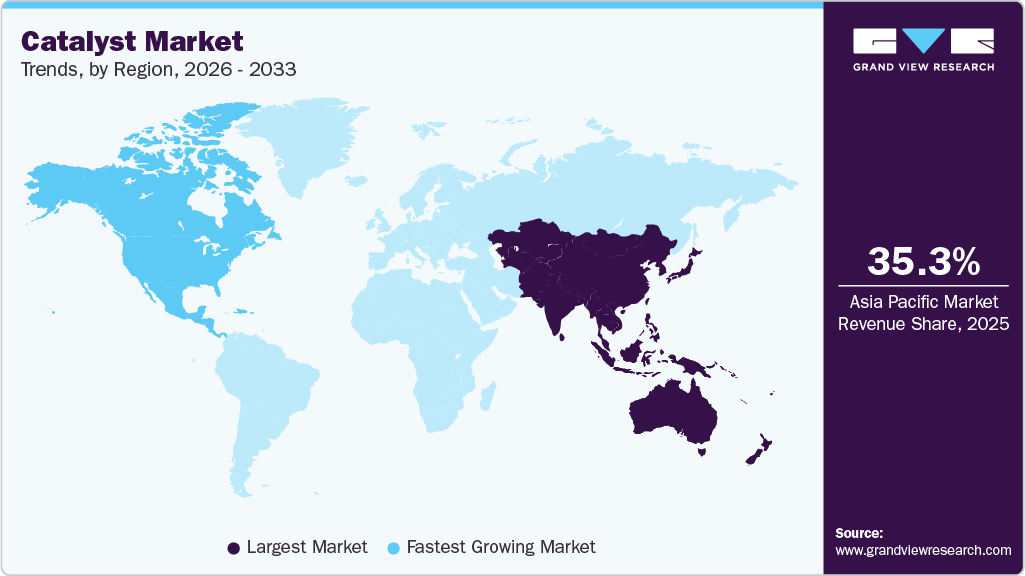

- Asia Pacific dominated the market and accounted for the largest revenue share of 35.3% in 2025.

- China held over 44.6% revenue share of the Asia Pacific catalyst market.

- The metals segment is expected to grow fastest with a CAGR of 4.3% from 2026 to 2033.

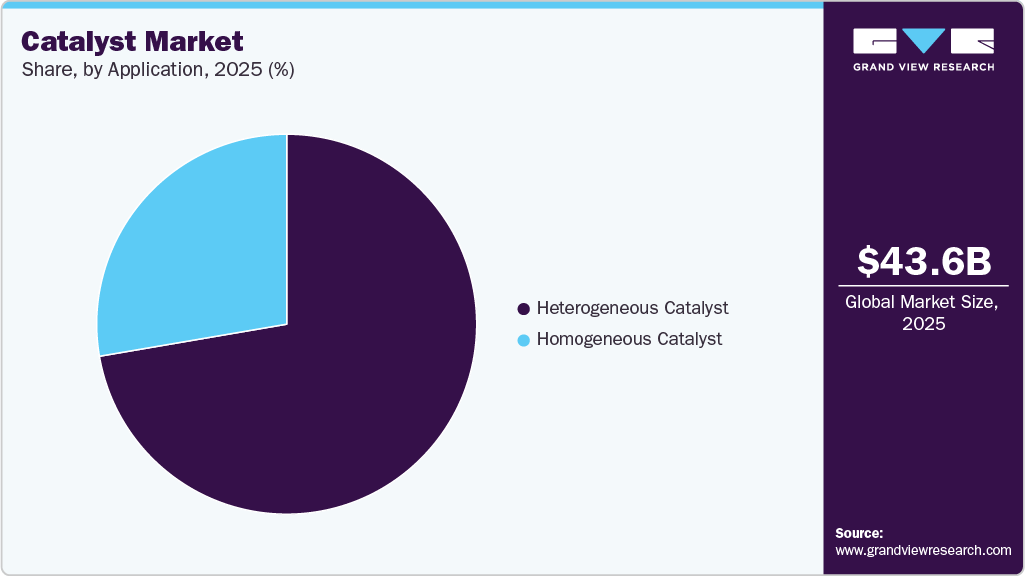

- The heterogenous segment dominated the market and accounted for the largest revenue share of 72.3% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 43.6 Billion

- 2033 Projected Market Size: USD 61.5 Billion

- CAGR (2026-2033): 4.3%

- Largest Region: Asia Pacific

Growth reflects expanding petrochemical throughput, refinery modernization, and a transition toward lower-carbon feedstocks that demand specialized catalytic chemistry. Stricter emissions protocols and higher purity expectations in pharmaceuticals and specialty chemicals increase preference for catalysts that minimize by-products while boosting yield. Material science efforts in supports, alloying, and recyclability have reduced total ownership costs, and the industry’s move to continuous manufacturing favors engineered particle sizes and structured media that improve reactor performance and process integration.The sector faces challenges from volatile precious-metal markets and feedstock price swings that pressure margins and encourage substitution strategies. Long qualification timelines slow adoption in risk-averse plants, and regional regulatory divergence fragments demand patterns, forcing more tailored commercial approaches. Strong intellectual property protections and proprietary formulations preserve competitive differentiation, prompting collaborative research with industrial partners. At the same time, advances in regeneration and lifetime extension reduce downtime and improve lifecycle economics, reshaping procurement and service models across applications.

Opportunities concentrate around low-carbon process routes where catalysts enabling hydrogen production, CO₂ conversion, and electrified chemistries attract investment. Circularity initiatives expand the need for catalysts that support polymer depolymerization, chemical recycling, and material recovery from waste streams. Pharmaceutical and fine-chemical makers adopting continuous flow processes demand high-selectivity systems and supported precious-metal grades. Emerging areas such as bio-derived chemicals and fuel cells require bespoke materials and long-term development partnerships, while policy support for clean fuels and emissions reduction encourages pilot projects and early commercial deployments, positioning catalyst developers for steady, innovation-led expansion.

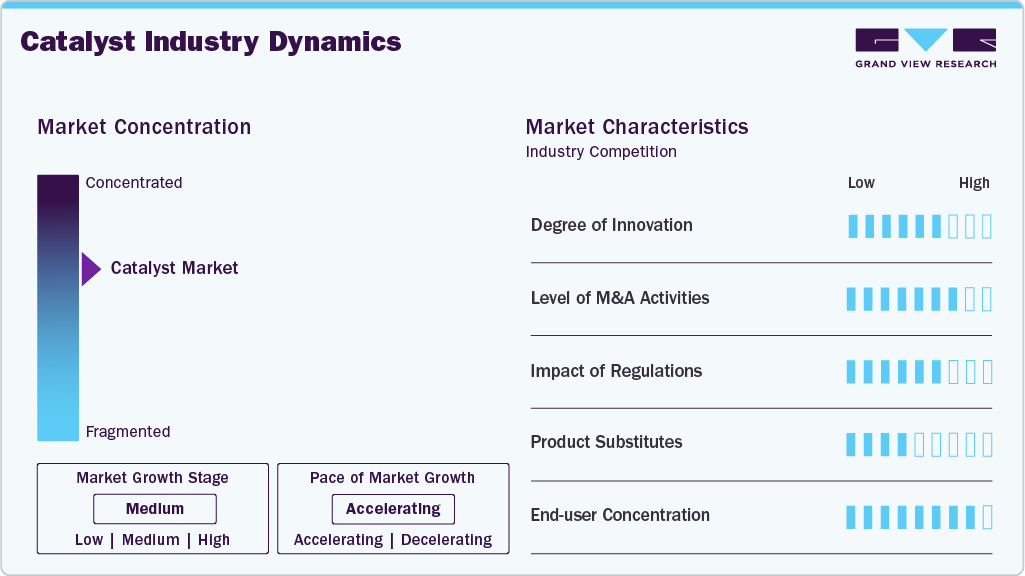

Market Concentration & Characteristics

The catalysts market is characterized by a mix of long-established global producers and specialized innovators, creating a moderately concentrated environment where a handful of major companies exert strong influence through broad portfolios, proprietary technologies, and deep customer relationships. These firms typically compete on performance, reliability, and the ability to tailor catalysts for refining, petrochemicals, environmental applications, and a growing range of sustainable processes. Despite the presence of dominant players, the market also includes niche manufacturers that succeed by offering unique formulations or highly customized solutions, contributing to steady innovation across catalyst families.

Market dynamics are shaped by close collaboration between catalyst suppliers and end users, since catalyst performance directly affects efficiency, cost, and sustainability in chemical production. This interdependence encourages long-term partnerships, frequent product upgrades, and continuous optimization. Regulatory trends, decarbonization goals, and the adoption of cleaner technologies further drive demand for catalysts that enhance energy efficiency, reduce emissions, and improve resource utilization. As a result, innovation cycles remain active, and competition centers on technological differentiation rather than price alone.

Raw Material Insights

The chemical compounds segment dominated the market and accounted for the largest revenue share of 41.1% in 2025. The chemical compounds segment led the market due to its versatility, widespread availability, and compatibility with a broad range of catalytic processes. Peroxides, acids, and amines are essential precursors in chemical synthesis, polymer production, and environmental applications, making them indispensable across industries. Their ability to provide consistent performance, support scalable formulations, and offer cost-effective processing advantages strengthened their adoption. This broad utility helped the segment capture the largest revenue shares in 2025.

The metals segment is expected to grow fastest with a CAGR of 4.3% from 2026 to 2033. The metals segment is projected to expand rapidly as demand rises for high-activity catalysts used in refining, petrochemicals, emission control, and emerging sustainable technologies. Precious and base metals provide superior selectivity and stability, enabling higher conversion efficiency and lower operational costs. Growth is further supported by advancements in recycling, improved metal recovery techniques, and increasing adoption of metal-based catalysts in hydrogen, syngas, and clean-energy applications, collectively driving the segment’s accelerated CAGR outlook.

Application Insights

The heterogeneous segment dominated the market and accounted for the largest revenue share of 72.3% in 2025. The heterogeneous catalyst segment led the market because of its extensive use in large-scale industrial operations, including refining, petrochemicals, polymer production, and environmental treatment. These catalysts offer strong advantages such as ease of separation, higher thermal stability, and compatibility with continuous processing, making them ideal for high-throughput facilities. Their long operational life and lower handling complexity also reduce operational costs. As industries increasingly prioritize efficiency, waste reduction, and scalable production, heterogeneous catalysts maintained a commanding share in 2025.

The homogeneous segment is expected to grow with a CAGR of 4.4% from 2026 to 2033. The homogeneous catalyst segment is set for steady growth due to rising demand for high-selectivity catalysts used in specialty chemicals, fine chemicals, pharmaceuticals, and emerging bio-based processes. These catalysts provide superior molecular-level control, enabling precise reaction pathways and higher product purity-critical in value-added applications. Advances in ligand design, improved recyclability, and the development of greener homogeneous systems are further expanding their relevance. These technological improvements position the segment for consistent growth through 2033.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 35.3% in 2025. Asia Pacific led the catalysts market because of its strong concentration of chemical production, refining capacity, and rapidly expanding petrochemical infrastructure. Countries like China, India, South Korea, and Japan continued investing heavily in large-scale manufacturing facilities, creating sustained demand for high-performance catalysts across polymers, fuels, and specialty chemicals. The region’s growing environmental regulations also spurred the adoption of emission-control catalysts in vehicles and industries. Combined with lower production costs and rising domestic consumption, these dynamics solidified Asia Pacific’s leading market share in 2025.

China Catalyst Market Trends

China held over 44.6% revenue share of the Asia Pacific catalyst market. China remains one of the world’s largest consumers of catalysts due to its massive petrochemical, refining, and polymer production capacity. The country’s ongoing industrial expansion, rapid urbanization, and strong manufacturing base continue to drive demand for catalysts in fuels, chemicals, and materials. Additionally, China’s increasingly stringent environmental regulations have accelerated adoption of automotive and industrial emission-control catalysts. Government-backed investments in clean energy, including syngas, hydrogen, and battery materials, also support continued catalyst market growth.

North America Catalyst Market Trends

North America is expected to grow fastest with a CAGR of 4.1% from 2026 to 2033. North America is projected to achieve the fastest growth due to technological leadership, strong investment in clean energy, and modernization of refining and chemical assets. The region’s focus on low-carbon hydrogen, carbon capture, and advanced petrochemical processes is boosting demand for next-generation catalysts. Additionally, stringent environmental regulations continue to drive adoption of automotive and industrial emission-control catalysts. Growth is further supported by robust R&D ecosystems, shale-derived feedstock advantages, and increasing onshoring of specialty chemical production, positioning North America for the highest CAGR through 2033.

The U.S. catalysts market benefits from a technologically advanced chemical and refining sector, strong investment in sustainable manufacturing, and rapid adoption of low-carbon technologies. Growth is supported by the country’s large automotive fleet, driving demand for sophisticated emission-control catalysts, as well as ongoing modernization of petrochemical facilities driven by abundant shale-based feedstocks. Expanding hydrogen production, carbon capture projects, and pharmaceutical manufacturing further strengthen catalyst consumption across high-value applications.

Europe Catalyst Market Trends

Europe’s catalysts market is shaped by strict environmental policies, strong regulatory pressure on emissions, and a mature but innovation-driven chemical industry. The region’s commitment to decarbonization, circular economy goals, and the transition to renewable feedstocks strengthens demand for catalysts that improve energy efficiency and support recycling-oriented processes. Growth is also fueled by Europe’s leadership in green hydrogen, advanced automotive technologies, and specialty chemical production, where high-performance catalysts are essential for meeting sustainability and performance criteria.

Latin America Catalyst Market Trends

Latin America’s catalyst demand is primarily driven by its expanding refining sector and growth in petrochemical production, especially in Brazil and Mexico. Many facilities in the region are undergoing upgrades to improve fuel quality and operational efficiency, increasing the need for modern refining and hydrotreating catalysts. Rising vehicle ownership supports adoption of emission-control catalysts, while developing chemical manufacturing capabilities and resource-rich economies contribute to steady uptake across industrial applications despite economic variability.

Middle East & Africa Catalyst Market Trends

The Middle East & Africa market is influenced by the region’s large refining and gas processing base, particularly in Gulf countries that continue investing in high-throughput downstream facilities. Demand for catalysts is driven by efforts to diversify beyond crude exports, improve refining efficiency, and expand petrochemical capacity. Additionally, modernization projects in emerging African economies and rising adoption of emission-control technologies contribute to market growth. The region’s focus on cleaner fuels and integrated industrial hubs further boosts catalyst utilization.

Key Catalyst Company Insights

The two key dominant manufacturers in the market are BASF SE and Johnson Matthey.

-

BASF SE is a leading global catalyst manufacturer recognized for its extensive portfolio spanning environmental, chemical, and refinery applications. The company leverages deep expertise in materials science and process engineering to develop advanced catalytic technologies that improve efficiency and reduce environmental impact across industrial operations. Its focus on innovation, sustainability, and continuous optimization enables it to serve diverse end-use sectors with catalysts designed to enhance performance, durability, and operational reliability. BASF’s global R&D network further strengthens its position in next-generation catalytic solutions.

-

Johnson Matthey is a prominent manufacturer known for its long-standing leadership in emission-control, process, and hydrogen-related catalysts. The company emphasizes advanced precious-metal chemistry and engineered catalytic systems that support cleaner mobility, efficient chemical processing, and emerging energy technologies. Its strong commitment to sustainability and circular practices underpins ongoing development of catalysts that enable lower emissions and improved resource utilization. With a history of scientific excellence and strong technical capabilities, Johnson Matthey continues to shape the evolution of high-performance catalytic solutions across global industries.

Key Catalyst Companies:

The following are the leading companies in the catalyst market. These companies collectively hold the largest market share and dictate industry trends.

- Albemarle Corporation

- Haldor Topsoe A/S

- BASF SE

- Evonik Industries AG

- LyondellBasell Industries Holdings B.V.

- Arkema

- The Dow Chemical Company

- Haldor Topsoe A/S

- W. R. Grace & Co.-Conn.

- Johnson Matthey

- Axens

- Honeywell UOP

- Zeolyst International

- Clariant

- Umicore

- Exxon Mobil Corporation

Recent Developments

-

In October 2025, Evonik introduced its Noblyst® F catalyst portfolio for flow applications, offering precious metal catalysts in two particle sizes with a sample kit and application table, supporting pharma and fine-chemical customers shifting toward continuous processing with enhanced catalytic performance.

-

In September 2025, BASF’s SYNSPIRE® G1-110 catalyst enabled Nan Ya Plastics’ 2-EH plant to cut annual steam use by 40,000 metric tons and reduce CO₂ emissions by 38,000 metric tons, delivering significant OPEX savings through improved methane-reforming efficiency.

-

In October 2025, Clariant introduced titanium-based AddWorks catalyst solutions for polyester polymerization, offering a sustainable alternative to antimony catalysts and improving PET recycling, while enabling high-performance production across PET, PETG, PBT, PTT, PBAT, PEF, and other polyester materials.

Catalyst Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 45.8 billion

Revenue forecast in 2033

USD 61.5 billion

Growth rate

CAGR of 4.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2023

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Brazil; Argentina; Germany; UK; Italy; Spain; France; China; India; Japan; South Korea; Saudi Arabia; South Africa

Key companies profiled

Albemarle Corporation; Haldor Topsoe A/S; BASF SE; Evonik Industries AG; LyondellBasell Industries Holdings B.V.; Arkema; The Dow Chemical Company; W. R. Grace & Co.-Conn.; Johnson Matthey; Axens; Honeywell UOP; Zeolyst International; Clariant, Umicore; Exxon Mobil Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Catalyst Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global catalyst market report based on raw material, application, and region

-

Product Outlook (Revenue, USD Billion; Volume, Kilotons; 2021 - 2033)

-

Chemical compounds

-

Peroxides

-

Acids

-

Amines & others

-

-

Metals

-

Precious metals

-

Base metals

-

-

Zeolites

-

Other Raw Material

-

-

Application Outlook (Revenue, USD Billion; Volume, Kilotons; 2021 - 2033)

-

Heterogeneous Catalyst

-

Chemical synthesis

-

Chemical catalysts

-

Adsorbents

-

Syngas production

-

Others

-

-

Petroleum refining

-

FCC

-

Alkylation

-

Hydrotreating

-

Catalytic Reforming

-

Purification

-

Bed grading

-

Others

-

-

Polymers and petrochemicals

-

Ziegler Natta

-

Reaction Initiator

-

Chromium

-

Urethane

-

Solid Phosphorous Acid catalyst

-

Others

-

-

Environmental

-

Light-duty vehicles

-

Motorcycles

-

Heavy-duty vehicles

-

Others

-

-

-

Homogeneous Catalyst

-

Chemical synthesis

-

Chemical catalysts

-

Adsorbents

-

Syngas production

-

Others

-

-

Petroleum refining

-

FCC

-

Alkylation

-

Hydrotreating

-

Catalytic Reforming

-

Bed grading

-

Purification

-

Others

-

-

Polymers and petrochemicals

-

Ziegler Natta

-

Reaction Initiator

-

Chromium

-

Urethane

-

Solid Phosphorous Acid catalyst

-

Others

-

-

Environmental

-

Light-duty vehicles

-

Motorcycles

-

Heavy-duty vehicles

-

Others

-

-

-

-

Regional Outlook (Revenue, USD Billion; Volume, Kilotons; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Latin America

-

Brazil

-

Argentina

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global catalyst market size was estimated at USD 43.6 billion in 2025 and is expected to reach USD 45.8 billion in 2026.

b. The catalyst market is expected to grow at a compound annual growth rate of 4.3% from 2026 to 2033, reaching USD 61.5 billion by 2033.

b. The chemical compounds segment accounted for the largest share of the Catalyst Market, driven by its broad applicability across synthesis, polymers, and environmental processes, along with consistent performance and cost-effective formulation advantages.

b. Some of the key players operating in the catalyst Market include Albemarle Corporation, Haldor Topsoe A/S, BASF SE, Evonik Industries AG, LyondellBasell Industries Holdings B.V., Arkema, The Dow Chemical Company, W. R. Grace & Co.-Conn., Johnson Matthey, Axens, Honeywell UOP, Zeolyst International, Clariant, Umicore, Exxon Mobil Corporation.

b. Rising demand for cleaner fuels, stricter emission standards, expanding petrochemical and chemical production, increased adoption of continuous processing, and advancements in catalyst design that enhance efficiency, selectivity, and sustainability collectively drive the growth of the global Catalyst Market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.