- Home

- »

- Medical Devices

- »

-

Refractive Surgery Devices Market Size, Share Report, 2030GVR Report cover

![Refractive Surgery Devices Market Size, Share & Trends Report]()

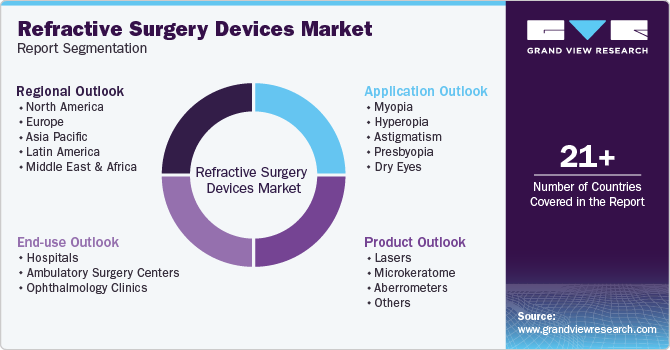

Refractive Surgery Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Myopia, Astigmatism), By Product (Lasers, Aberrometers), By End- use (Hospitals, Ambulatory Surgery Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-300-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Refractive Surgery Devices Market Summary

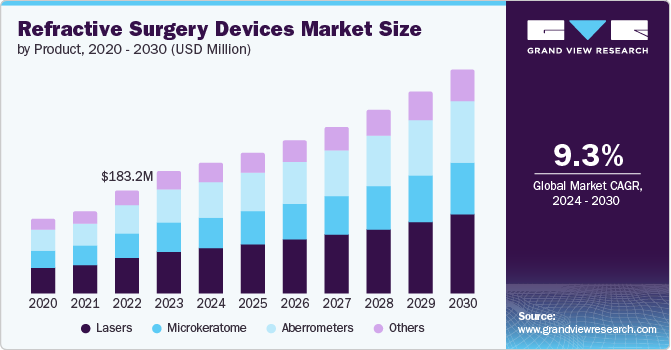

The global refractive surgery devices market size was estimated at USD 217.6 million in 2023 and is projected to reach USD 396.7 million by 2030, growing at a CAGR of 9.3% from 2024 to 2030. The increasing geriatric population and higher screen time are anticipated to boost the demand for refractive surgeries.

Key Market Trends & Insights

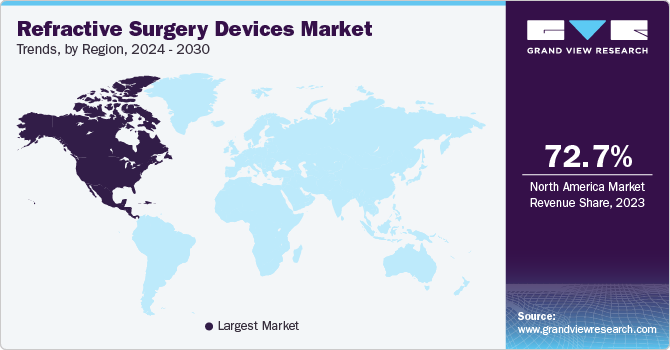

- In terms of region, North America was the largest revenue generating market in 2023.

- The Asia Pacific market is growing due to rising myopia rates, extended screen time, and an increasing geriatric population.

- In terms of product, lasers accounted for the largest revenue share of 35.1% in 2023.

- In terms of application, the myopia segment accounted for the largest share of 26.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 217.6 Million

- 2030 Projected Market Size: USD 396.7 Million

- CAGR (2024-2030): 9.3%

- North America: Largest market in 2023

JAMA Ophthalmology reports that myopia, worsened by increased screen use during the pandemic, is a growing concern, especially among the youth.

The World Health Organization projects that 52 percent of the global population will be affected by myopia by 2050. Additionally, older adults are more prone to refractive errors and often need immediate surgical intervention for visual impairment. According to the National Institute on Aging (NIA), the senior population is expected to reach 72 million by 2030.

Refractive surgery enhances independence by reducing reliance on glasses or contact lenses and facilitates the treatment of eye conditions that could lead to blindness. The WHO reports that uncorrected refractive errors cause vision impairment and blindness, affecting around 88.4 million people globally. This growing need for vision correction is anticipated to drive demand for refractive surgeries.

The recent WHO data and the introduction of the "WHO SPECS 2030" initiative are crucial for the growth of the market. The data highlights that globally, only 36% of individuals with vision impairment from refractive errors have access to quality spectacles, indicating a significant unmet need for vision correction. The World Health Assembly's endorsement of a 40-percentage point increase in effective coverage reflects a strong commitment to addressing this gap.

The "WHO SPECS 2030" initiative, set to launch in 2023, aims to enhance global refractive error coverage. WHO’s consultation with stakeholders on this initiative suggests a coordinated effort to improve access to vision correction solutions, including refractive surgeries. This global focus on expanding vision care access will likely drive increased demand for advanced refractive surgery devices, such as lasers and imaging systems, as part of broader efforts to meet the target. Consequently, the initiative is expected to create substantial growth opportunities for the market by promoting innovation and improving patient access to effective treatments.

Numerous collaborations and initiatives are underway to address refractive errors and expand the market. These efforts include government-funded research, advancements in laser technology, and partnerships between industry leaders and academic institutions, all aimed at improving precision, accessibility, and innovation in vision correction. For instance, in July 2022, SCHWIND eye-tech solutions are spearheading innovation in corneal refractive surgery with a groundbreaking research initiative aimed at developing a novel procedure for correcting refractive errors. SCHWIND is investing over USD 1.73 million in this basic research, with approximately 52% funded by the German Federal Ministry of Education and Research (BMBF).

This funding highlights the growing focus on advancing laser technologies in refractive surgery. The project aims to create innovative laser systems to improve precision and effectiveness in vision correction. These advancements could enhance surgical outcomes, reduce recovery times, and broaden treatment options, potentially increasing patient demand for refractive surgeries. The support from a major government body not only validates these technologies but also promotes further research and development, likely leading to wider adoption of advanced laser systems and stimulating growth in the market.

Nova Eye Medical's recent success with the iTrack Advance glaucoma device indicates a promising trend for the market in August 2023. The positive reception of this innovative device reflects an increasing interest in advanced ophthalmic technologies. Such successes underscore the potential for novel products to drive market growth and attract investment. This progress supports the continued development and adoption of advanced refractive surgery devices, fostering market growth and innovation.

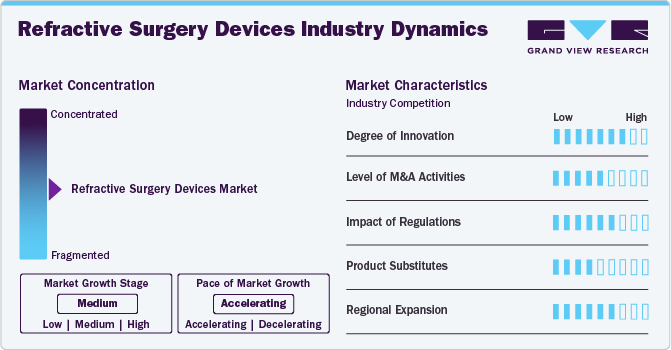

Market Concentration & Characteristics

The refractive surgery devices market is characterized by moderate industry concentration, with key players like Alcon, Johnson & Johnson, and Bausch + Lomb leading the sector. The market features high technological innovation, driven by advancements in laser systems and imaging technologies. It is marked by significant R&D investments, regulatory requirements, and competitive pressures. The sector also experiences strong demand from increasing myopia rates and a growing preference for less invasive vision correction options. Characteristics include a focus on precision, efficacy, and patient outcomes, with continuous development aimed at improving surgical techniques and expanding treatment options.

The industry exhibits a high degree of innovation, driven by continuous advancements in laser technology and imaging systems. Innovations include developments in femtosecond lasers, wavefront-guided treatments, and improved diagnostic tools for precision. For instance, in July 2024, Johnson & Johnson Vision’s investment in TECLens, through Series A funding, supports the development of a new non-incisional refractive correction method. TECLens uses corneal cross-linking (CXL) technology to reshape the cornea, reflecting J&J Vision’s dedication to innovative eye care solutions.

Regulations in the refractive surgery devices industry shape product development and market dynamics by enforcing safety, efficacy, and quality standards. Regulatory bodies, such as the FDA and CE, set stringent approval processes that impact market entry and device innovation timelines. For instance, in March 2023, Johnson & Johnson Vision received CE Mark approval for its new corneal refractive technology, marking a significant advancement in vision correction. This approval allows the company to market its innovative device in Europe, enhancing their portfolio with cutting-edge solutions for treating refractive errors. Compliance with these regulations ensures that devices meet high safety and performance benchmarks, which builds consumer trust and enhances market credibility. While navigating regulatory requirements can be complex and costly, it ultimately supports the development of reliable, effective technologies and drives industry growth by ensuring that only well-tested, high-quality products reach the market.

Mergers and acquisitions in the refractive surgery devices industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in April 2024, Zeiss has completed its acquisition of DORC, a leading provider of ophthalmic surgical technologies. This strategic move strengthens Zeiss's portfolio in retinal surgery and enhances its position in the ophthalmic market, broadening its range of advanced solutions for eye care professionals.

In the refractive surgery devices industry, product substitutes include traditional vision correction methods like glasses and contact lenses. While these options do not offer the permanent correction that surgical devices do, they remain widely used due to their accessibility and lower initial cost. Additionally, emerging technologies such as implantable contact lenses and orthokeratology (corneal reshaping with specialized lenses) serve as alternatives to surgical solutions. These substitutes can appeal to patients who prefer non-invasive options or are ineligible for certain types of refractive surgery. The presence of these alternatives influences market dynamics and drives innovation in refractive surgery devices.

Regional expansion in the industry is driven by rising demand for vision correction in emerging markets. Companies are increasingly investing in regions like Asia-Pacific, the Middle East, and Latin America, where growing middle-class populations and increasing healthcare access fuel market growth. Expansion efforts include establishing local manufacturing facilities, forming strategic partnerships, and tailoring products to meet regional needs. For instance, in October 2023, Alcon is considering a USD 100 million manufacturing expansion in South Fort Worth. This investment aims to enhance production capabilities, reflecting Alcon's commitment to meeting growing demand for ophthalmic products. The expansion could boost local employment and reinforce Alcon's position in the global market.

Product Insights

The lasers segment accounted for the largest market share of 35.1% in 2023 and is expected to garner the fastest CAGR over the forecast period, driven by advancements in laser technology and their critical role in vision correction procedures. Lasers, particularly excimer and femtosecond lasers, are integral to popular refractive surgeries like LASIK and SMILE, which reshape the cornea to correct vision issues such as myopia, hyperopia, and astigmatism.

Excimer lasers, known for their precision, enable surgeons to remove corneal tissue with minimal damage to surrounding areas, enhancing patient outcomes and reducing recovery times. Femtosecond lasers, used for creating corneal flaps and lenticules, offer exceptional accuracy and safety, further boosting their adoption in refractive surgeries.

The dominance of the lasers segment is also attributed to ongoing technological innovations, such as wavefront-guided and topography-guided laser treatments, which provide customized solutions tailored to individual patients' eye anatomy. These advancements improve surgical outcomes and patient satisfaction, driving demand for laser-based procedures.

Application Insights

The myopia segment accounted for the largest market share of 26.8% in 2023. This dominance is driven by the high and growing prevalence of myopia worldwide. According to recent studies, it is estimated that nearly 30% of the global population is affected by myopia, a figure that is projected to rise to 50% by 2050. Myopia, or nearsightedness, affects a significant and increasing portion of the global population, with particularly high rates observed in Asia-Pacific regions among children and young adults.

Refractive surgery devices, including excimer and femtosecond lasers, play a crucial role in correcting myopia. Procedures such as LASIK, SMILE, and PRK use these advanced lasers to reshape the cornea, enabling light to focus correctly on the retina and thereby improving vision. The effectiveness, safety, and precision of these procedures have made them highly popular, contributing to the dominance of the myopia segment.

The astigmatism segment is expected to witness the fastest CAGR over the forecast period. This rapid growth is driven by increasing awareness of astigmatism correction options and advancements in laser technologies, such as femtosecond and excimer lasers. These innovations enhance the precision and effectiveness of surgeries like LASIK and SMILE for astigmatism correction. Additionally, rising disposable incomes and greater access to advanced eye care in emerging markets contribute to the segment's expansion, as more patients seek permanent solutions for their vision issues.

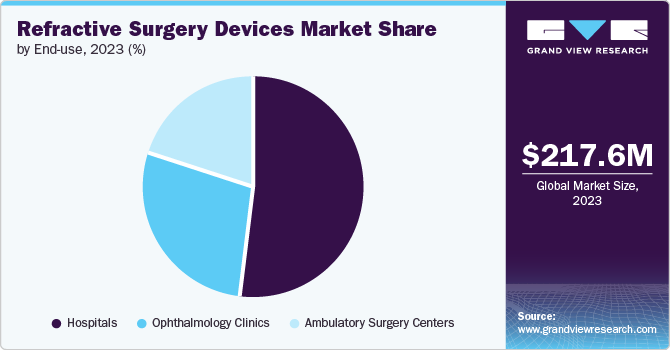

End-use Insights

The hospitals segment accounted for the largest revenue share of 36.6% in 2023. This dominance is attributed to hospitals' comprehensive facilities, advanced technology, and skilled professionals, enabling them to perform a high volume of refractive surgeries. Hospitals often have the latest laser systems and diagnostic tools, ensuring high precision and safety. Additionally, hospitals' capacity to handle complex cases and provide postoperative care attracts a more extensive patient base. Increasing investments in healthcare infrastructure and the rising prevalence of vision disorders further bolster the revenue share of hospitals in this market.

The ambulatory surgical centers segment shows the fastest CAGR over the forecast period. This rapid growth is driven by the increasing preference for outpatient procedures, cost-effectiveness, and shorter recovery times offered by ASCs. These centers provide advanced surgical technologies and personalized care, making them attractive for patients seeking convenient and efficient vision correction options. The expansion of healthcare infrastructure and rising awareness of refractive surgeries further contribute to the segment's growth, positioning ASCs as a significant player in the market.

Regional Insights

North America market dominated the overall global market and accounted for 72.7% revenue share in 2023. The market in North America is driven by the high prevalence of refractive errors, the presence of major market players, and favorable reimbursement policies. WHO statistics project that the population aged 65 and older will reach 78 million by 2035, boosting product demand. Additionally, advancements in surgical technologies are expected to further enhance market growth in the region.

U.S. Refractive Surgery Devices Market Trends

The market in the U.S. held a significant share of North America market in 2023. The high prevalence of myopia and its significant increase over 30 years in the U.S., with nearly 13 million people affected by high myopia, underscores a growing need for refractive surgery devices. This substantial demand highlights the importance of innovative treatments and drives the market for advanced refractive surgery technologies. The data suggests a robust market potential as the number of individuals seeking solutions for myopia continues to rise, supporting the growth and investment in refractive surgery devices in the U.S.

Europe Refractive Surgery Devices Market Trends

The European market has experienced notable expansion. According to Eurostat data published in February 2024, the growing senior population in Europe, with over 21% of the 448.8 million people aged 65 and older as of January 2023, is likely to drive increased demand for refractive surgeries. Older adults often experience age-related vision issues such as presbyopia, which can be effectively managed with advanced refractive surgery devices. This demographic trend highlights a significant market opportunity for companies offering refractive solutions. As the elderly population expands, the need for innovative and effective refractive treatments will grow, propelling the demand for these devices in the European market.

The UK refractive surgery devices market is expanding due to the fact that Brits spend an average of 1 hour and 52 minutes daily on social media, according to Independent UK data published in June 2024. This increased screen time elevates the risk of digital eye strain and worsening vision issues, driving demand for refractive surgery devices. Conditions such as myopia and digital eye strain linked to prolonged screen use prompt more individuals to seek corrective solutions. This trend reveals a growing market opportunity as people seek ways to address vision problems caused by extended social media use. Consequently, companies providing advanced refractive treatments may experience increased demand.

The France refractive surgery devices market is driven by the increasing prevalence of vision disorders, with approximately 30% of the population affected by myopia. Technological advancements, such as femtosecond lasers, have improved surgical outcomes and patient safety. Additionally, rising awareness and acceptance of refractive surgeries contribute significantly to market growth.

The refractive surgery devices market in Germany is significantly growing, attributed to German manufacturers' strong reputation for high-quality medical devices. The country’s stringent quality control and strict adherence to safety regulations bolster this reputation, earning the trust of healthcare providers and driving sales and market dominance. Notably, Staar Surgical reports that the EuroEyes clinic group performed the highest number of ICL surgeries in Germany in 2021.

Asia Pacific Refractive Surgery Devices Market Trends

The Asia Pacific market is growing due to rising myopia rates, extended screen time, and an increasing geriatric population. Technological advancements and significant investments by leading companies like Alcon further drive market expansion, enhancing accessibility and innovation in the region. For instance, Alcon showcased advanced ophthalmic surgical products in June 2024 during the 36th APACRS and the 24th CSCRS Annual Meetings in Chengdu. The convergence of expertise at such events underscores the commitment to advancing eye care and supporting market growth.

The refractive surgery devices market in Japan is set for rapid growth. In March 2024, the Japan International Eye Hospital received the Vietnam SMILE Ambassadors award from Carl Zeiss, celebrating 12,500 successful ReLEx SMILE surgeries. This advanced laser treatment preserves corneal tissue, offering significant benefits to patients. Additionally, STAAR Surgical Company announced a strategic cooperation agreement with Senshinkai Eye Institute (SEI) in February 2020. SEI, which operates Japan's second-largest number of refractive surgery clinics, further bolsters the market with its extensive network and expertise.

The refractive surgery devices market in China is expanding rapidly, driven by rising myopia rates, advances in technology, and increased consumer demand. Aier Group’s report, based on over 1 million myopia surgeries, shows strong market growth and highlights opportunities for new innovations. Released on May, 2021, the report covers data from 520,000 patients across 29 provinces, providing key insights for improving surgery quality and guiding future advancements in the field.

The refractive surgery devices market in India is expanding significantly. Recent advancements in minimally invasive surgery (MIS) are pivotal for this market in India. Enhanced MIS techniques improve the precision and effectiveness of refractive surgeries, driving their popularity and demand. As these techniques advance, the need for sophisticated refractive devices like lasers and imaging systems is expected to grow. The rise in MIS highlights a shift toward less invasive procedures, offering opportunities for innovation and market growth in India's refractive surgery sector, reflecting the overall expansion in vision care.

Latin America Refractive Surgery Devices Market Trends

The Latin American market is fueled by the growing elderly demographic. Aging brings about heightened vulnerability to numerous chronic ailments, prompting the need for refractive surgery devices as a treatment option. This, coupled with the demand for medications, is propelling market growth in the region.

Saudi Arabia Refractive Surgery Devices Market Trends

The market in Saudi Arabia is expected to grow during the forecast period. A key driver for this growth is the increasing geriatric population, which is more prone to vision issues. According to the Saudi Arabian Monetary Agency (SAMA), the percentage of Saudis aged 60 and older is projected to reach 25% by 2050, boosting demand for refractive surgeries.

Key Refractive Surgery Devices Company Insights

The competitive scenario in the market is highly competitive, with key players such as Johnson & Johnson Services, Inc., Bausch & Lomb Incorporated and Alcon holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Refractive Surgery Devices Companies:

The following are the leading companies in the refractive surgery devices market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc.

- Carl Zeiss Meditec AG

- Alcon

- Bausch & Lomb Incorporated

- Quantel Medical

- TOPCON CORPORATION

- Essilor

- NIDEK CO., LTD.

- SCHWIND eye-tech-solutions

- STAAR Surgical Company

Recent Developments

-

In May 2024, CIME highlights advancements in refractive surgery, intraocular lens (IOL) technology, and genetic research. The event showcases the latest innovations, techniques, and studies in these fields to improve patient outcomes and treatment methods. Experts share insights on cutting-edge developments, enhancing the future of optometry and vision care.

-

In January 2024, The FDA approved the new TENEO device for LASIK vision correction surgery. This advanced technology aims to improve precision and outcomes in vision correction procedures. Developed by Bausch + Lomb, TENEO offers enhanced customization and efficiency for surgeons, potentially benefiting patients with quicker and more accurate visual improvements.

-

In June 2024, Alcon and the World Council of Optometry (WCO) have renewed their two-year collaboration, updating the Dry Eye Wheel to educate optometrists on identifying and managing dry eye disease (DED). According to a news release, the enhanced resource is accessible on a dedicated website featuring a series of dry-eye webinars.

Refractive Surgery Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 233.0 million

Revenue forecast in 2030

USD 396.7 million

Growth rate

CAGR of 9.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Johnson & Johnson Services, Inc.; Carl Zeiss Meditec AG; Alcon; Bausch & Lomb Incorporated; Quantel Medical; TOPCON CORPORATION; Essilor; NIDEK CO., LTD.; SCHWIND eye-tech-solutions; STAAR Surgical Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Refractive Surgery Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global refractive surgery devices market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Lasers

-

Microkeratome

-

Aberrometers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Myopia

-

Hyperopia

-

Astigmatism

-

Presbyopia

-

Dry Eyes

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgery Centers

-

Ophthalmology Clinics

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global refractive surgery devices market size was estimated at USD 217.6 million in 2023 and is expected to reach USD 233.0 million in 2024.

b. The global refractive surgery devices market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030 to reach USD 396.7 million by 2030.

b. North America dominated the refractive surgery devices market with a share of 30.0% in 2023. This is attributable to the growing number of product launches in the U.S. and the presence of key market players in the region.

b. Some key players operating in the refractive surgery devices market include Johnson & Johnson Services, Inc., Carl Zeiss Meditec AG, Alcon, Bausch & Lomb Incorporated, Quantel Medical, TOPCON CORPORATION, Essilor, NIDEK CO., LTD., and SCHWIND eye-tech-solutions.

b. Key factors that are driving the market growth include the rising geriatric population, increased screen time, and technological advancements in refractive surgery devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.