- Home

- »

- Next Generation Technologies

- »

-

Regenerative Agriculture Market Size, Industry Report, 2033GVR Report cover

![Regenerative Agriculture Market Size, Share & Trends Report]()

Regenerative Agriculture Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Agriculture Type, By End User, By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-062-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Regenerative Agriculture Market Summary

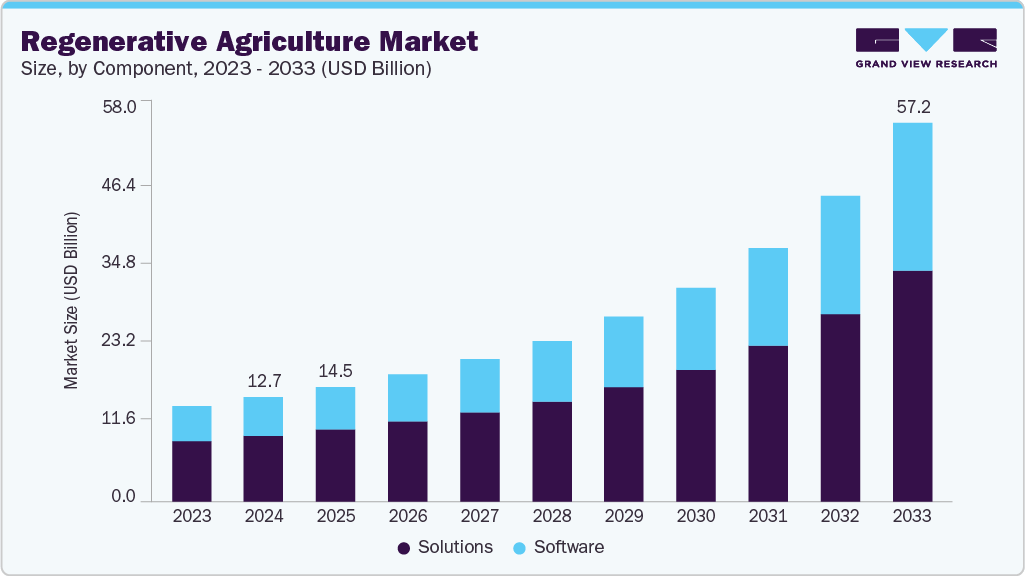

The global regenerative agriculture market size was valued at USD 12.66 billion in 2024 and is projected to reach USD 57.16 billion by 2033, growing at a CAGR of 18.7% from 2025 to 2033. The rise in support from governments, organizations, and farmer welfare associations drives the regenerative agriculture market.

Key Market Trends & Insights

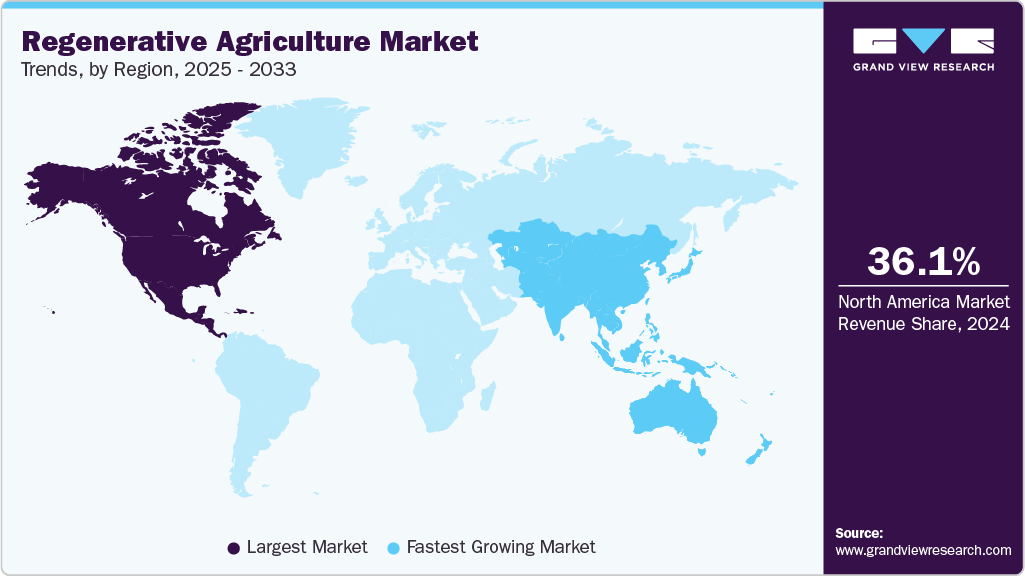

- North America held a 36.1% revenue share of the global regenerative agriculture market in 2024.

- In the U.S., rising demand from local, decentralized, and circular food systems is accelerating the demand for the regenerative agriculture market.

- By component, the solutions segment held the largest revenue share of 62.9% in 2024.

- By agriculture type, the agroforestry segment held the largest revenue share in 2024.

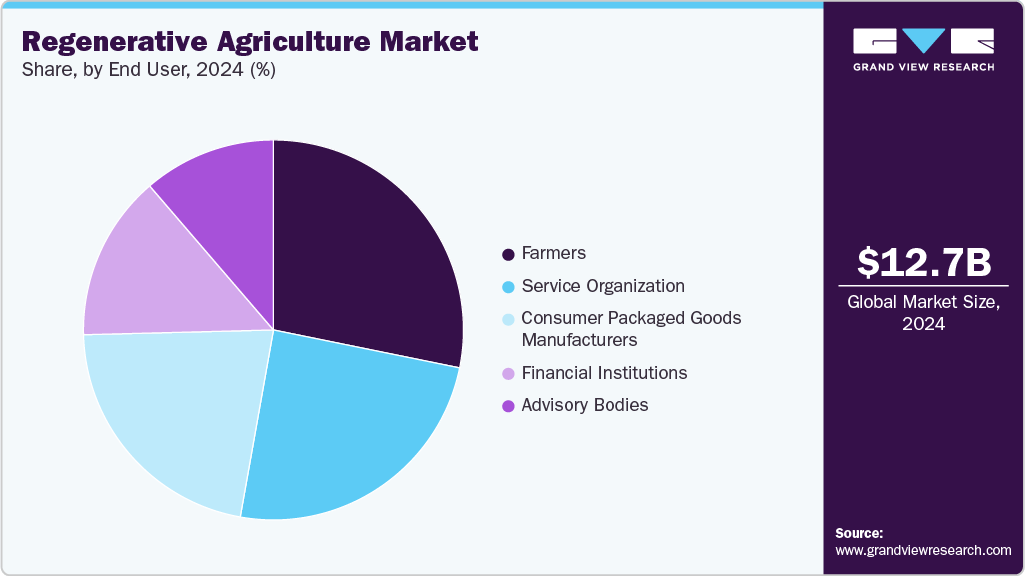

- By end user, the farmers segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.66 Billion

- 2033 Projected Market Size: USD 57.16 Billion

- CAGR (2025-2033): 18.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market in 2024

The development of technology and data analytics tools is facilitating the adoption of regenerative farming practices on a large scale. Innovations in remote sensing, soil health monitoring, and digital farm management platforms allow farmers to measure outcomes such as carbon sequestration, water retention, and biodiversity more accurately. These tools not only help validate the environmental benefits of regenerative agriculture but also play a critical role in enabling access to carbon markets, certification schemes, and performance-based incentives. As digital agriculture becomes more accessible and cost-effective, it is lowering the barriers for smaller and medium-sized farms to transition toward regenerative models.The rise in support from governments, organizations, and farmer welfare associations drives market growth. Regenerative agriculture is an approach to farming that focuses on enhancing and improving soil health, biodiversity, ecosystem services, and community well-being. It is gaining popularity worldwide as a sustainable alternative to conventional farming practices that often rely on synthetic inputs and heavy tillage. Governments worldwide recognize the importance of this market in mitigating climate change, enhancing soil health, and improving food security. They provide incentives, subsidies, and support programs encouraging farmers to adopt regenerative farming practices. For example, in the U.S., the Department of Agriculture has launched several initiatives to promote this market, such as the Environmental Quality Incentives Program, the Conservation Stewardship Program, and the Regional Conservation Partnership Program. In recent years, regenerative agriculture has gained traction among farmers as they recognize its benefits.

Farmers can reduce their input costs, improve soil health, and increase yields by implementing regenerative practices. In addition, it can help mitigate the impacts of climate change by sequestering carbon in the soil. Governments are also providing incentives to farmers who adopt such practices. In the U.S., for example, the Natural Resources Conservation Service (NRCS) provides financial assistance to farmers who implement conservation practices on their land, including regenerative agriculture practices. Similarly, the European Union’s Common Agricultural Policy (CAP) includes provisions for supporting farmers who adopt agroecological and regenerative practices.

Furthermore, the benefits of these practices are not limited to the farm level. Healthy soil and diverse ecosystems can help improve water quality, reduce erosion, and support wildlife habitats. Therefore, governments and other stakeholders recognize regenerative agriculture’s potential to contribute to broader sustainability goals beyond farming. There has been a growing awareness among consumers about the importance of regenerative practices. This has led to a shift in consumer preferences towards food products produced using these practices. Consumers are looking for food that is not only healthy and nutritious but also made in a way that is environmentally sustainable and supports local communities.

Component Insights

The solutions segment dominated the regenerative agriculture market with a market share of 62.9% in 2024. The rise of data-driven agriculture and digital transformation in farming drives the segment growth. Technologies such as remote sensing, AI-driven soil analysis, satellite imaging, and IoT-based field monitoring are embedded into regenerative agriculture platforms to track outcomes like organic carbon levels, biodiversity, water retention, and crop resilience. These tools enhance decision-making for farmers and provide robust data that can be used to verify the ecological benefits of regenerative practices. This verification is essential for participating in carbon credit markets, qualifying for regenerative certifications, and demonstrating ESG performance to buyers or investors. The growing emphasis on quantifiable, evidence-based sustainability has created a surge in demand for technology-enabled solutions that can capture and report regenerative outcomes in real-time.

The services segment is projected to be the fastest-growing segment from 2025 to 2033. The increasing importance of measurement, reporting, and verification (MRV) in regenerative systems drives the demand for specialized service providers. Farmers, agribusinesses, and project developers seek expert services to assess soil organic carbon levels, biodiversity indicators, water retention improvements, and other ecological metrics demonstrating regeneration over time. These services are essential for certification schemes, participation in carbon markets, and performance-based finance models. While digital tools and satellite technologies play a role in data collection, human expertise is still needed to design appropriate monitoring frameworks, interpret results, and advise on course correction.

Agriculture Type Insights

The agroforestry segment dominated the regenerative agriculture market in 2024. The surge in corporate interest in regenerative supply chains is driving the agroforestry segment’s growth. Many multinational food, beverage, and cosmetics companies are turning to agroforestry as a scalable and measurable way to regenerate the landscapes from which they source raw materials like coffee, cocoa, palm oil, and spices. Agroforestry systems reduce deforestation pressure and support pollinators, stabilize microclimates, and improve overall land health, all of which align with ESG goals. These companies increasingly invest in agroforestry-based sourcing programs and enter long-term partnerships with farming communities to build resilient and ethical supply networks, thereby providing stable market demand for regenerative agroforestry products.

The aquaculture/ ocean farming segment is projected to be the fastest-growing segment from 2025 to 2033. The growing integration of regenerative aquaculture into blue carbon markets and environmental finance mechanisms drives segment growth in the regenerative agriculture market. As governments and conservation organizations explore ways to meet emissions targets and biodiversity restoration goals, ocean-based carbon sequestration through seaweed and shellfish farming is gaining attention. While measurement protocols are still being refined, the potential of ocean farms to act as carbon sinks is opening doors to financial incentives, climate funds, and private-sector investment. Companies seeking to offset their emissions or meet ESG targets are beginning to partner with regenerative ocean farms, providing funding in exchange for measurable ecological benefits. This linkage between environmental impact and economic value is accelerating investment in developing, scaling, and verifying regenerative marine practices.

End User Insights

The farmers' segment dominated the market in 2024. The rising cost and volatility of synthetic inputs like fertilizers, pesticides, and herbicides drive the segment growth. Global supply chain disruptions, energy price hikes, and tightening regulations on agrochemicals have made these inputs less accessible and less desirable. Regenerative agriculture provides an alternative by promoting biological fertility, natural pest suppression, and reduced dependency on external inputs. This input reduction lowers operational costs over time and increases profit margins for farmers, especially in regions where subsidies are limited or sustainability practices influence market access.

The consumer packaged goods manufacturers segment is projected to be the second fastest-growing segment from 2025 to 2033. Developing traceability systems and regenerative certification programs enables CPG brands to communicate their regenerative sourcing efforts to consumers and regulators. Labels like Regenerative Organic Certified (ROC), Land to Market, and others provide standardized frameworks that companies can adopt to validate their claims. These certifications add credibility and allow for clear differentiation in packaging, especially in premium markets. In addition, advances in digital traceability, satellite monitoring, and soil carbon tracking enable companies to verify outcomes across vast supplier networks, facilitating performance-based sourcing.

Regional Insights

North America dominated the regenerative agriculture market with a market share of 36.1% in 2024. Regenerative agriculture is a growing movement in North America aimed at improving soil health, biodiversity, and overall sustainability of agricultural practices. One indicator of the growth of regenerative agriculture in North America is the increase in certification programs and labels that indicate adherence to regenerative principles. Another sign of the development of regenerative agriculture is the increasing number of companies and investors focusing on regenerative practices. Major food companies, such as General Mills and Danone, have committed to regenerative agriculture, and many investment funds are dedicated to supporting regenerative agriculture practices.

U.S. Regenerative Agriculture Market Trends

The U.S. regenerative agriculture industry is projected to grow during the forecast period. Grassroots farmer movements, indigenous land stewardship models, and educational networks are driving the adoption of a regenerative agriculture market across diverse farming communities. Organizations like the Regenerative Agriculture Foundation, the Savory Institute, and local conservation districts offer training, mentorship, and field demonstrations showing how regenerative practices can be economically viable and ecologically transformative. These efforts are being reinforced by academic research from institutions like Iowa State University, UC Davis, and the Rodale Institute, which generate science-backed evidence of regenerative methods' long-term benefits on soil health, yield stability, and farm profitability.

Asia Pacific Regenerative Agriculture Market Trends

The Asia Pacific regenerative agriculture industry is expected to be the fastest growing segment, with a CAGR of 17.9% over the forecast period. The rise of conscious consumerism and domestic markets for sustainable food is beginning to influence agricultural practices across urban and peri-urban Asia. As middle classes grow and awareness of environmental and health issues increases, more consumers are seeking food that is locally grown, chemical-free, and linked to ethical land use. Regenerative agriculture meets this demand and is gaining traction in food labeling, farm-to-table movements, organic markets, and certification schemes. This consumer shift, although still emerging, is helping to establish market-driven incentives for farmers to adopt regenerative methods and differentiate their products based on sustainability credentials.

The regenerative agriculture industry in China is projected to grow during the forecast period. The severe degradation of farmland across major agricultural regions, where intensive monocropping, overuse of chemical fertilizers and pesticides, and unsustainable irrigation have led to declining soil fertility, water contamination, and reduced biodiversity. Northern and central China are experiencing significant topsoil loss and desertification. Regenerative agriculture is being explored as a restorative approach that can rebuild soil health, increase organic matter, and reduce chemical dependence. Through practices such as intercropping, cover cropping, and agro ecological livestock integration, regenerative farming is emerging as a potential solution to restore environmental balance while maintaining productivity in a country with limited arable land and immense food security needs.

Europe Regenerative Agriculture Market Trends

The regenerative agriculture industry in Europe is expected to grow during the forecast period. Europe’s strong network of research institutions, innovation hubs, and farmer-led movements is facilitating the growth of the regenerative agriculture market. Universities and agri-research centers across Europe are conducting region-specific studies on the effectiveness of regenerative practices, providing farmers with localized data and recommendations. Simultaneously, grassroots initiatives, cooperatives, and NGOs promote regenerative education, peer-to-peer learning, and field trials. This bottom-up momentum complements top-down policy support, creating a robust ecosystem that supports the adoption, innovation, and scalability of regenerative agriculture throughout the continent.

The regenerative agriculture industry in the UK is expected to grow during the forecast period. The increasing urgency of climate adaptation and net-zero commitments also pushes regenerative agriculture to the forefront of national land use discussions. As the UK government works toward its legal obligation to reach net-zero emissions by 2050, agricultural emissions, particularly those related to fertilizer use, soil carbon loss, and livestock, are under intense scrutiny. Regenerative practices are being recognized as critical tools for carbon sequestration, methane reduction, and improved natural carbon sinks. Soil-based carbon offsetting and nature-based solutions are part of wider carbon accounting strategies, and farmers practicing regenerative methods are well-positioned to benefit from emerging carbon markets and sustainability-linked finance schemes.

Key Regenerative Agriculture Company Insights

Some of the key companies operating in the market include Cargill and Ecorobotix SA, which are among the leading participants in the regenerative agriculture market.

-

Cargill, Incorporated is a global agribusiness and food-production conglomerate. Through its RegenConnect program, Cargill offers regenerative agriculture. Through RegenConnect, farmers in the U.S., Europe, Canada, Brazil, Australia, India, and beyond receive one-on-one agronomy support, payments for sequestered carbon, and flexible multi-year commitments that help them transition toward healthier soils and climate-smart operations.

-

Ecorobotix SA is a Swiss agritech company. Ecorobotix’s offering includes an ARA ultra‑high precision sprayer. This system uses real-time camera vision and AI Plant‑by‑Plant algorithms to detect individual crops and weeds, delivering targeted sprays with a remarkable accuracy of roughly 6×6 cm. This precision dramatically reduces herbicide, pesticide, and fertilizer use by 70 % to 95 %, increases crop yields by approximately 5 %, curtails chemical drift, and lowers CO₂ emissions substantially.

Indigo Ag, Inc., and Carbon Robotics are some of the emerging market participants in the regenerative agriculture market.

-

Indigo Ag, Inc. is a Boston-based agricultural technology company aimed at transforming farming through integrated microbial and digital innovations. Indigo’s business model is its Planet Positive vision, which combines biological seed coatings under its biotrinsic brand with a digital agronomy platform and a carbon-credit marketplace. The company supports farmers across some 20 million acres globally, helping them transition to regenerative practices like cover cropping, reduced tillage, optimized nutrient management, and diversified rotations.

-

Carbon Robotics is an AI-powered agricultural robotics company. The company’s flagship product, LaserWeeder, combines advanced computer vision, deep learning, and high-powered CO₂ lasers to autonomously detect and eliminate weeds at the plant meristem with sub-millimeter accuracy while leaving crop and soil untouched. This no-till, chemical-free approach aligns directly with regenerative agriculture principles: it preserves soil structure, protects microbiology, and reduces reliance on herbicides, a critical step toward healthier, carbon-rich ecosystems.

Key Regenerative Agriculture Companies:

The following are the leading companies in the regenerative agriculture market. These companies collectively hold the largest market share and dictate industry trends.

- Agreed.Earth

- Aker Technologies, Inc.

- Astanor Ventures

- Biotrex

- Carbon Robotics

- Cargill, Incorporated

- Continuum Ag

- Ecorobotix SA

- Indigo Ag, Inc.

- Ruumi

- SATELLIGENCE

- Terramera Inc.

- Tortuga Agricultural Technologies, Inc.

- Vayda

Recent Developments

-

In March 2025, Indigo Ag partnered with Google to accelerate the adoption of regenerative agriculture practices, aiming to replenish nearly 1.5 billion gallons of water over the next seven years. As part of this initiative, Google has contributed USD 1.5 million to support the implementation of regenerative farming methods on enrolled farms in Oklahoma. This effort is expected to enhance soil moisture and improve water retention. Farmers are incentivized to adopt sustainable practices such as cover cropping and no-till farming through Indigo Ag's regenerative agriculture program, backed by Google.

-

In December 2024, Mars, Incorporated formed multi-year partnerships with suppliers, including ADM and Cargill, to advance regenerative agriculture within its pet nutrition operations across Europe. These collaborations aim to support farmers in countries such as Poland, Hungary, and the UK in adopting regenerative practices like crop rotation, reduced tillage, and cover crops. Through these initiatives, farmers will gain access to training, resources, and support, helping them build expertise and confidence while overcoming common barriers to implementation.

-

In April 2024, Nestlé Purina partnered with Cargill to advance the use of regenerative agriculture within its soy and corn supply chains. This collaboration is focused on improving soil health and significantly cutting the carbon footprint of Purina’s dry pet food products across North America. This initiative will implement regenerative farming practices across over 200,000 acres of corn and soy fields in the Midwest.

Regenerative Agriculture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.55 billion

Revenue forecast in 2033

USD 57.16 billion

Growth rate

CAGR of 18.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, agriculture type, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Cargill, Incorporated; Vayda; Terramera Inc.; Agreed.Earth; Biotrex; Ecorobotix SA; Ruumi; Continuum Ag; Aker Technologies, Inc.; Indigo Ag, Inc.; Tortuga Agricultural Technologies, Inc.; Astanor Ventures; SATELLIGENCE; Carbon Robotics;

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Regenerative Agriculture Market Report Segmentation

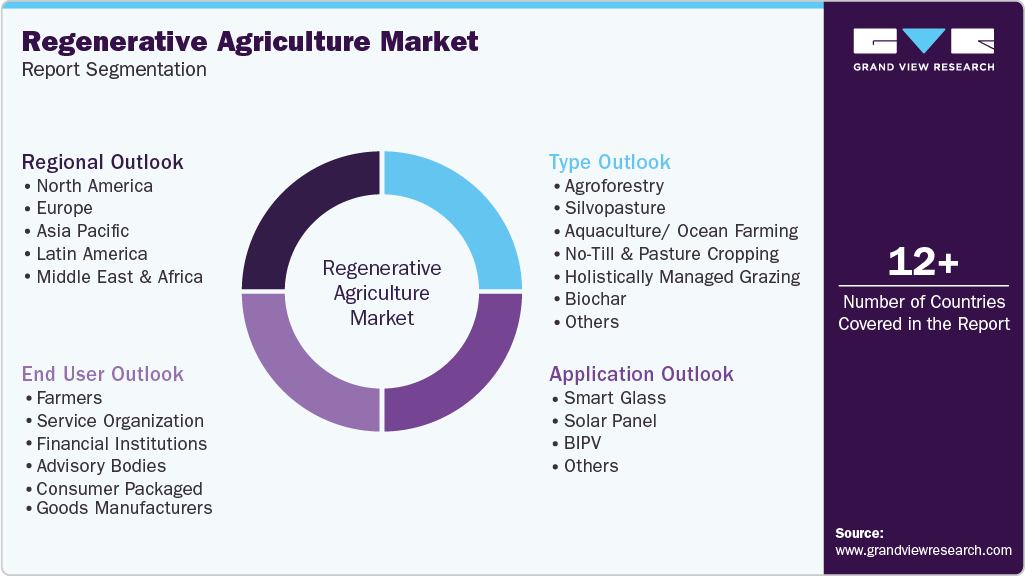

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the regenerative agriculture market report based on component, agriculture type, end user, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solutions

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Agroforestry

-

Silvopasture

-

Aquaculture/ Ocean Farming

-

No-Till and Pasture Cropping

-

Holistically Managed Grazing

-

Biochar

-

Others

-

-

End User Outlook (Revenue, USD Billion, 2021 - 2033)

-

Farmers

-

Service Organization

-

Financial Institutions

-

Advisory Bodies

-

Consumer Packaged Goods Manufacturers

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global regenerative agriculture market size was estimated at USD 12.66 billion in 2024 and is expected to reach USD 14.55 billion in 2025.

b. The global regenerative agriculture market is expected to grow at a compound annual growth rate of 18.7% from 2025 to 2033 to reach USD 57.16 billion by 2033.

b. The solutions segment dominated the regenerative agriculture market with a market share of 62.9% in 2024. The rise of data-driven agriculture and digital transformation in farming is driving the segment growth.

b. Some key players operating in the regenerative agriculture market include Vayda; Terramera Inc.; Agreed.Earth; Biotrex; Ecorobotix SA; Ruumi; Continuum Ag; Aker Technologies, Inc.; Indigo Ag, Inc.; Tortuga Agricultural Technologies, Inc.; Astanor Ventures; and SATELLIGENCE.

b. Key factors that are driving the market growth include the rise in support from governments, organizations, and farmer welfare associations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.