- Home

- »

- Medical Devices

- »

-

Regulatory Affairs Market Size, Share, Industry Report, 2030GVR Report cover

![Regulatory Affairs Market Size, Share & Trends Report]()

Regulatory Affairs Market (2025 - 2030) Size, Share & Trends Analysis Report By Services (Regulatory Consulting, Legal Representation), By Categories, By Type, By Company Size, By Product Stage, By Indication, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-065-9

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Regulatory Affairs Market Summary

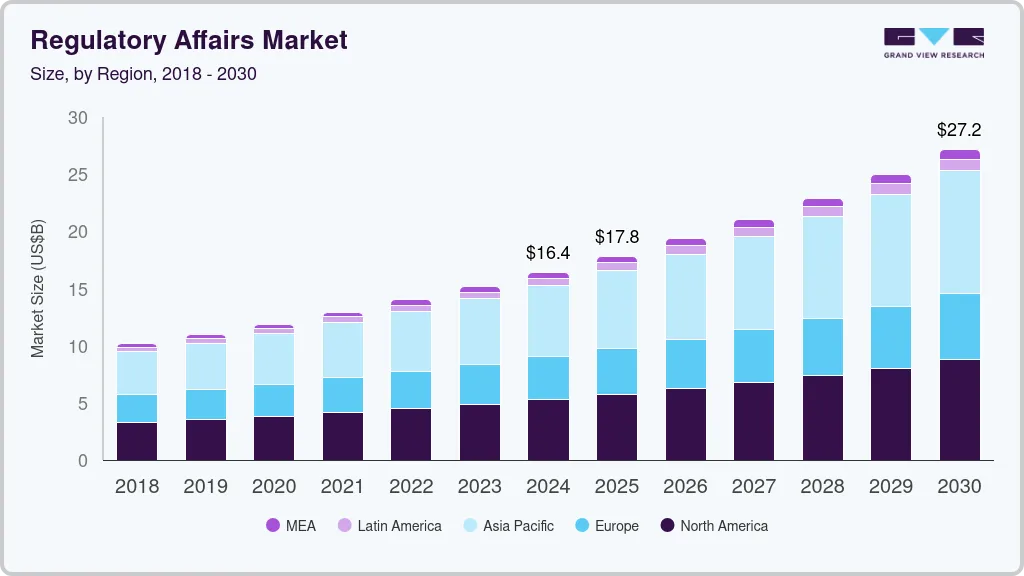

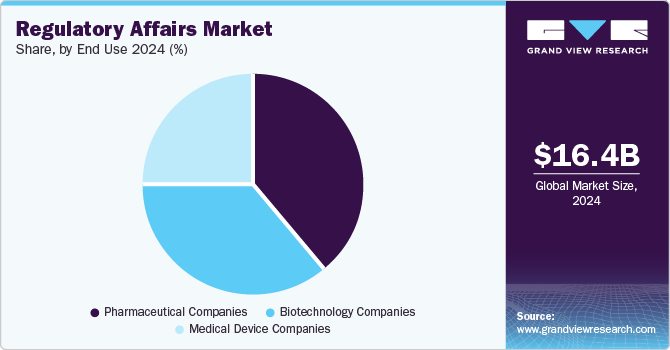

The global regulatory affairs market size was estimated at USD 16.43 billion in 2024 and is projected to reach USD 27.18 billion by 2030, growing at a CAGR of 8.8% from 2025 to 2030. The growth of the industry is due to advancements in the field of immunotherapies, orphan drugs, specialty therapies, and personalized medicines coupled with continuous changes in the regulatory requirements.

Key Market Trends & Insights

- The regulatory affairs market in Asia Pacific dominated the global industry and accounted for a 38.03% share in 2024.

- North America regulatory affairs market is anticipated to witness the lucrative growth from 2025 to 2030.

- Based on categories, the drugs segment dominated the regulatory affairs market in 2024.

- In terms of company size, the medium company size segment dominated the market in 2024.

- Based on end-use, the pharmaceutical companies segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.43 Billion

- 2030 Projected Market Size: USD 27.18 Billion

- CAGR (2025-2030): 8.8%

- Asia Pacific: Largest market in 2024

Moreover, the increasing prevalence of chronic diseases which requires effective therapies and vaccines, is driving the need for proper guidelines to maintain effectiveness, safety, and quality. Furthermore, the growing focus of market players to take several strategic initiatives such as collaborations, partnerships, mergers and acquisitions is further contributing to the growth of the market. For instance, in March 2023, PROMETRIKA, LLC. expanded its strategic regulatory consulting services, which aim to offer guidance and support to clinical plans and ensure a high level of efficiency and quality.

Life sciences companies have to deal with continuous changes in regulatory requirements, which can differ based on business activities and geographies. Noncompliance with the changing regulatory requirement can result in penalties and delays, which may lead to loss of revenue. Furthermore, regulatory departments often face the burden of handling multiple tasks simultaneously and have to ensure compliance with stringent regulatory standards at all times. An increase in efforts by companies to expand their geographical reach and gain rapid approvals in global markets is expected to further contribute to the adoption of outsourcing models for regulatory services. Regulatory approval procedures are becoming increasingly stringent, and market players aim to receive product approvals in their first attempt to gain market share.

Government support, especially in developed economies, has resulted in a significant increase in the development of orphan drugs. According to the data published by Health Affairs in January 2024, there were 491 novel orphan drugs were approved between 1990 and 2022, with 65% targeting a single rare disease and 20% addressing both rare and common diseases, highlighting a significant growth area in the pharmaceutical industry. This trend reflects the increasing focus on personalized medicine and orphan drugs, which are tailored to treat specific genetic mutations or rare diseases. As more orphan drugs gain approval, including those with subsequent pediatric indications, they are driving the expansion of specialized treatments. This growth in emerging areas, such as orphan drugs, biosimilars, and personalized medicine, is fueling demand for regulatory affairs outsourcing services to ensure timely approvals, compliance with evolving regulations, and the ability to navigate complex market landscapes. For instance, in April 2024, the FDA announced to grant accelerated approval to tovorafenib for patients with relapsed or refractory BRAF-altered pediatric low-grade glioma. Such approvals are anticipated to increase the demand for specialized regulatory services, which can enable companies to identify more niche areas and expedite market entry.

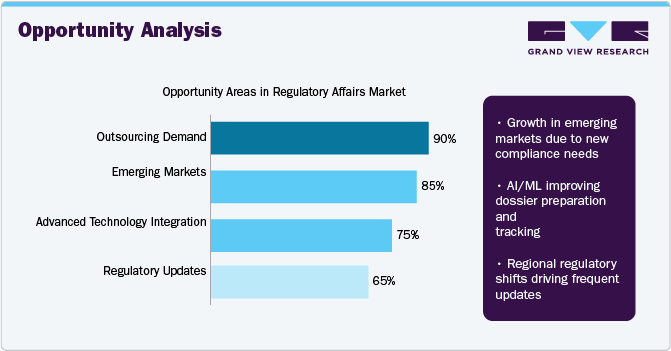

Opportunity Analysis

The industry is witnessing significant opportunity across multiple fronts, driven by evolving industry demands and technological advancements. As illustrated, outsourcing demand leads the opportunity areas with a 90% rating, reflecting the growing reliance on external regulatory experts to navigate complex and dynamic compliance requirements. Emerging markets follow closely with an 85% opportunity level, fueled by increasing regulatory stringency and the need for localized compliance solutions. These markets are rapidly evolving, offering substantial potential for companies that can provide active, region-specific regulatory support.

Furthermore, technology integration is emerging as a key growth enabler. Innovations in artificial intelligence and machine learning are streamlining dossier preparation, submission tracking, and lifecycle management, thereby enhancing efficiency and accuracy. Regulatory updates remain a crucial area as regional regulatory shifts require frequent documentation revisions and adaptive compliance strategies. Such factors highlight a robust outlook for the regulatory affairs sector, particularly for players offering tech-enabled, scalable, and globally aligned services

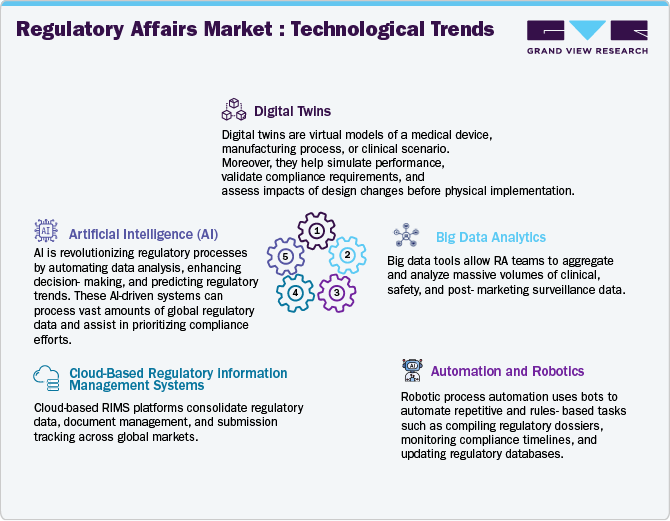

Technological Advancements

The industry is witnessing a significant technological evolution driven by the integration of advanced digital solutions designed to improve compliance accuracy, operational efficiency, and agility. Among the emerging technologies, Digital Twins are gaining momentum for their ability to simulate regulatory workflows and product performance in real-time. This assists proactive compliance oversight and enhances risk management. Big data analytics is allowing stakeholders to extract actionable intelligence from large volumes of clinical and regulatory datasets, thereby accelerating informed decision-making throughout the product development and approval lifecycle.

Automation and robotics are further improving the regulatory function by automating repetitive and manual tasks such as data entry, validation, and document processing. These technologies are demonstrating particularly favorable in streamlining dossier preparation and lifecycle management, ultimately improving submission accuracy and reducing turnaround times. In addition, the adoption of Cloud-Based Regulatory Information Management Systems (RIMS) is expanding rapidly, offering centralized, scalable platforms that support seamless document collaboration and compliance across global regulatory frameworks.

The application of Artificial Intelligence (AI) is also transforming regulatory affairs by enabling intelligent content management, predictive analytics, and automation of compliance checks. AI-driven tools enhance the efficiency and precision of submission processes, particularly in highly regulated or complex markets. As digital transformation accelerates, the regulatory affairs domain is becoming increasingly data-centric and interconnected. Thus, such innovations highlight the strategic importance of technology in navigating evolving regulatory landscapes and achieving accelerated market entry while maintaining robust compliance standards.

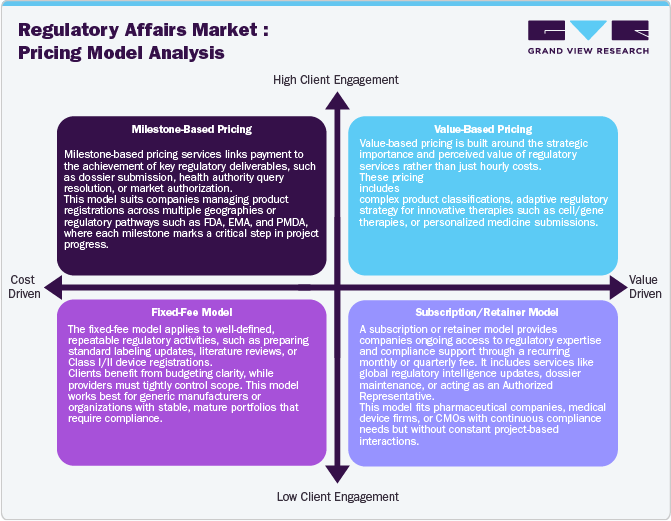

Pricing Analysis

The pressure to reduce costs by life sciences companies is very high. A shift toward outcome-based models, an increase in the use of generics, patient demand for low-cost drugs & medical devices due to increased out-of-pocket expenses, uneven economic growth across regions, and measures taken by various governments to curtail drug pricing are expected to contribute to the economic and competitive pressure on these companies. According to the data published by Tallahassee Democrat in October 2024, the federal government is increasingly focused on imposing price caps on 10 prescription drugs under Medicare to help lower costs. This initiative aligns with the broader goal of making medications more affordable, particularly by promoting competition and making lower-cost alternatives more accessible.

Furthermore, the shift from volume- to value-based care in the U.S. is expected to increase the pressure on life sciences companies to reduce costs, which may lead to an increase in outsourcing of noncore functions, thereby driving the regulatory affairs market. The National Institute for Health and Care Excellence (NICE) is a special health authority that can provide recommendations to the Nation Health Service (NHS) for treatments to be made available. NICE evaluates treatment options based on the Quality of Adjusted Life Year and cost-effectiveness of the product. The decisions made by NICE can affect reimbursement approvals and patient access to therapies. Such regulations demand that companies work in tandem with NICE and NHS to obtain reimbursement approvals and fulfill all required regulatory needs, thereby increasing the demand for regulatory services.

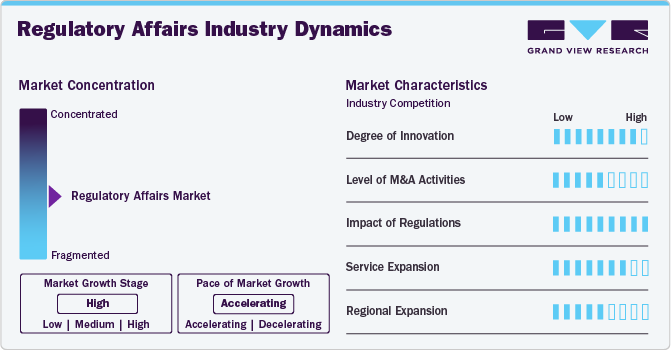

Market Concentration & Characteristics

The regulatory affairs industry is experiencing increasing innovation, primarily driven by digital transformation. The integration of AI, RPA, cloud-based RIMS, and real-world evidence platforms is reshaping how regulatory intelligence, submissions, and compliance monitoring are managed.

M&A activity is prominent in this space as larger CROs and consultancy firms acquire specialized regulatory consultancies to offer end-to-end services across drug development, device registration, and lifecycle management.

Providers are expanding services to cover a broader range of regulatory functions which —to include post-marketing surveillance, regulatory strategy, labeling compliance, and pharmacovigilance integration. Some firms are adding digital submission management tools and automated regulatory intelligence monitoring as value-adds.

Many service providers are expanding into emerging markets (Southeast Asia, LATAM, MENA) to support companies entering those regions and to serve local firms seeking global approvals. Expansion is often driven by the need to navigate localized regulatory procedures, language requirements, and agency interactions, especially in markets with high growth in generic drugs, medical devices, or biosimilars.

Type Insights

The outsourcing segment dominated the market with a share of 59.05% in 2024. The growth of the segment is mainly due to the growing focus of the pharmaceutical and medical device companies to outsource their activities as it allows access to specialized expertise and resources that they may not have in-house. In addition, outsourcing provides flexibility for companies to scale their operations based on project needs without the fixed costs associated with maintaining an in-house team. Thus, these factors are contributing to market growth.

The in-house segment is projected to witness considerable growth during the forecast year owing to large pharmaceutical/biotechnology and medical device firms having strong in-house teams for regulatory affairs due to their varied product portfolio, pipelines, and the ability to attract skilled & experienced professionals, which makes it a feasible and practical option

Service Insights

The regulatory writing & publishing segment held a significant share of the market in 2024. The growth of the segment is attributed to several pharmaceutical or biopharmaceutical companies reducing costs, prioritizing strategic projects, reducing staff training time, and improving overall efficiency, as well as providing greater flexibility. Moreover, the availability of various outsourcing models suitable for different company sizes is also anticipated to boost the outsourcing market. For instance, the Functional Service Provider (FSP) model is suitable for large biotechnology & pharmaceutical companies, while the hybrid model is generally suitable for medium-sized companies and end-to-end service model is suitable for small-sized companies. The different models cater to the customized needs of the clients, thereby boosting the adoption of outsourcing by pharmaceutical and biotechnology firms.

The legal representation segment is expected to witness the highest CAGR over the forecast period owing to constant changes in the regulatory scenario in the healthcare industry and the introduction of healthcare reforms majorly in emerging countries. Continuous changes in these activities are driving the need for outsourcing its legal activities as it becomes challenging for the companies to keep up with the current regulations. For instance, to conduct clinical trials in Europe, a sponsor should have their registered entity in the EU. Furthermore, several companies are focusing on expanding their geographic footprint which will further contribute to the segment’s growth. For instance, in February 2023, Freyr entered into a contractual agreement with Avicenna.AI,a medical device company. The company aims to outsource its registration and legal representation services to Avicenna.AI in the Argentina market.

Categories Insights

The drugs segment dominated the regulatory affairs market in 2024. The growth of the segment can be attributed to various regulations and related regulatory submissions/documentation at each of the steps involved in the process. A clear understanding of these regulations enables timely and cost-effective product launches and can also help pharmaceutical companies gain the first-mover advantage. Furthermore, local variations in drug scheduling are anticipated to result in the demand for product registrations, labeling, approvals, and other related services. For instance, according to the United States Drug Enforcement Administration (U.S. DEA), drugs are classified into five main schedules—I, II, III, IV, and V—whereas, the Drug and Cosmetic Act, India, has drug schedules ranging from A to Z. Each of these schedules has specific standards and regulations critical for distribution, labeling, commercialization, manufacturing, and other related activities.

The biologics segment is projected to witness the fastest growth during the forecast period. The growth of the segment is mainly attributed to factors such as increasing research and development activities by pharmaceutical and biotechnology companies which require proper environmental conditions for product development. Product manufacturing is an important process where a small change in environmental conditions can highly affect the cells and structure of a biological product. Therefore, proper outsourcing services are required to maintain a zero-error margin in the process, which will further contribute to the segment’s growth.

Indication Insights

The oncology segment dominated the market in 2024. The growth of the segment is due to the increasing prevalence of cancer, which requires effective and safe treatment options. According to the data published by the American Cancer Society in 2024, approximately 2 million new cancer cases were registered in the U.S. in 2024. Thus, increasing cases of cancer would increase the demand for better treatment options which will further boost the research and development activities by the pharmaceutical companies. Merck is constantly working towards developing new cancer therapies and expanding its existing oncology product portfolio. Thus, the aforementioned factors would increase the product pipeline of the companies further increasing the demand for efficient regulatory affairs services.

The immunology segment is projected to witness the highest CAGR from 2025 to 2030. The increasing focus on immunotherapy as a promising treatment option for various diseases, including cancer and autoimmune disorders, led to a surge in the development and regulatory approval of immunotherapeutic drugs. Moreover, advancements in immunology research have resulted in the development of innovative cell and gene therapies and biologics, which will further boost the demand for regulatory affairs. These cutting-edge technologies necessitate specialized knowledge and strategic planning to facilitate market authorization and commercialization. Thus, these factors are contributing to the segment’s growth.

Product Stage Insights

Clinical studies dominated the market in 2024. The increasing prevalence of chronic diseases coupled with the emergence of new diseases will increase the demand for better treatment options, further growing the number of clinical trials conducted globally to meet the growing needs of the patients. Thus, a growing number of clinical trial activities would boost the demand for proper regulations to make sure that studies are carried outtransparently,the trials are authenticated and effectively exposed to humans, and they exhibit credible data.

The preclinical segment is projected to witness the highest CAGR from 2025 to 2030. The preclinical product stage is a significant phase in the development of new drugs, biologics, and medical devices, where regulatory affairs play an important role in ensuring compliance with all the necessary requirements. The increasing demand for new product development would increase the need for innovative treatments and therapies. These factors further contribute to the growth of the preclinical product stage segment.

Company Size Insights

The medium company size segment dominated the market in 2024. The growth of the market is mainly due to the strong presence of several mid-sized established firms, mainly which are privately held. The increasing need for scalable, cost-effective compliance solutions among expanding product pipelines and global market entries are key factors driving segmental growth. These organizations often lack extensive in-house regulatory infrastructure, prompting higher adoption of outsourced services and digital technologies such as cloud-based RIMS, AI-enabled compliance tools, and automated document management systems. Their agility in integrating new technologies, combined with rising regulatory complexity across multiple regions, positions medium-sized companies as key contributors to market growth, particularly in emerging markets and specialized therapeutic areas.

The large-scale segment is projected to witness the highest CAGR from 2025 to 2030. The growth of the segment is mainly due to the large biopharmaceutical and medical device companies outsourcing their activities to these service providers as they offer a wide range of regulatory affairs services, and they have their presence across several countries, which makes it easy to operate the business in every region. Moreover, large pharma companies prefer to enter a long-term collaboration with the usages to avoid disruptions in their operations. Thus, such factors are contributing to market growth.

End-use Insights

The pharmaceutical companies segment dominated the market in 2024. The growth of the segment is due to growing research and development activities coupled with an increase in the number of approved pharmaceutical products. For instance, according to the U.S. FDA, in 2024, 50 novel drugs received approval from CDER in the U.S. Therefore, the growing number of product launches and commercialization is projected to increase the demand for registration,licensing, product approval, and others.

The biotechnology segment is projected to witness the highest CAGR over the forecast period. The growth of the segment is mainly due to significant demand for biologics, growing investment in biologics manufacturing, and advanced healthcare infrastructure. These factors would require proper regulatory affairs services such as GMP practices, patent filings, audit & validation, and quality & assurance, which will further boost the demand for outsourcing services.

Regional Insights

North America regulatory affairs market is anticipated to witness the lucrative growth from 2025 to 2030. The region’s regulatory affairs market growth is mainly due to constant research and development by the market players in the region and growing product pipelines and their subsequent approval would contribute to the region’s market growth. Moreover, Stringent processes and growing R&D expenditure in North America are anticipated to increase the demand for outsourcing regulatory affairs services by large biopharmaceuticals.

U.S. Regulatory Affairs Market Trends

The regulatory affairs market in the U.S. is anticipated to experience significant growth over the forecast period. The healthcare technologies and treatments in the U.S. is highly dynamic and companies are constantly innovating new therapies and products that require regulatory approval. This is one of the factors which is driving the regulatory affairs services in the U.S.

Asia Pacific Regulatory Affairs Market Trends

The regulatory affairs market in Asia Pacific dominated the global industry and accounted for a 38.03% share in 2024. The growth in the region is attributed to the factors such as enhanced regulatory landscape, increasing number of clinical trials, growing number of pharmaceutical companies and availability of skilled workers in the region. Furthermore, growing demand for medical devices and biosimilars is also projected to contribute to market growth. For instance, Biocon is constantly working towards the development of new therapeutic drugs which are projected to launch in the coming years. This would increase the demand for regulatory assistance further contributing to market growth.

China regulatory affairs market is anticipated to experience significant growth over the forecast period.China is one of the most attractive markets for the biopharmaceutical industry. Growing geriatric population and presence of a large pool of population belonging to the middle-income group are further increasing the demand for innovative and cost-effective medicines, which is expected to attract major biopharmaceutical and medical devices companies in this region. Thus, these factors would contribute to the region’s market growth.

The regulatory affairs market in Japan is growing due to the rising demand for new and cost-effective medicines, which may attract investments from biopharmaceutical companies in this region. Rising demand for generics due to government support and improvement in approval processes are expected to result in an increase in market entrants, thereby propelling the demand for regulatory affairs services in this region.

India regulatory affairs market is anticipated to experience considerable growth over the forecast period.The growth is mainly attributed to the growing number of clinical trials in the country due to its diverse population and cost-effective research opportunities. The number of clinical trials registered in India has been on the rise, leading to an increased demand for regulatory affairs services to assist the complex approval processes.

Europe Regulatory Affairs Market Trends

The regulatory affairs market in Europe is anticipated to grow over the forecast period owing to the presence of major pharmaceutical companies, ongoing drug discoveries, and the increasing demand for CROs in the region. Several CROs specializing in drug discovery have established centers in countries like the UK, Germany, and France, leveraging the robust research infrastructure and skilled workforce in these countries. Moreover, these CROs play an important role in managing complex regulatory requirements for clinical trials, new drug applications, and compliance with stringent European Medicines Agency (EMA) standards. As pharmaceutical companies focus on innovation and efficiency, they increasingly rely on outsourcing regulatory tasks to streamline processes, reduce costs, and accelerate time-to-market for new drugs. This growing collaboration between pharmaceutical companies and specialized CROs is expected to significantly boost the regulatory affairs outsourcing market in Europe.

The UK regulatory affairs market is projected to witness the fastest growth in the forthcoming years. The demand for generic products has also grown considerably owing to growing government support for generics over branded drugs. This trend is attracting various small- and mid-size biopharmaceuticals and medical device companies to enter the UK, thereby increasing the demand for regulatory support services.

The regulatory affairs market in Germany is expected to grow at a considerable rate over the forecast period. The presence of a skilled and experienced workforce is also one of the primary factors expected to drive the Regulatory affairs market in Germany as productivity rates are much higher than the average of EU15 countries.

MEA Regulatory Affairs Market Trends

The regulatory affairs market in the Middle East & Africa is projected to grow at a lucrative rate owing to the increasing prevalence of chronic diseases such as cardiovascular diseases and cancer, among others. The increasing cases would drive the demand for better treatment options which would further drive the need for more robust regulatory frameworks to ensure the safety and efficacy of new treatments and diagnostic tools. Thus, the aforementioned factors would drive the demand for regulatory affairs services in the region.

Saudi Arabia regulatory affairs market is projected to witness the fastest growth rate owing to growing government support such as increasing investment in the country’s healthcare infrastructure as part of its Vision 2030 initiative. This includes enhancing regulatory frameworks to ensure compliance with international standards, which is crucial for attracting foreign investment and improving local manufacturing capabilities.

Key Regulatory Affairs Company Insights

Key players operating in the regulatory affairs market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Key strategies include geographic expansions, strategic partnerships, service innovation, and acquisitions aimed at strengthening regulatory expertise and global reach. These efforts support the compliance needs of pharmaceutical, biotechnology, and medical device companies and drive overall market growth by improving service delivery across diverse regulatory environments.

Key Regulatory Affairs Companies:

The following are the leading companies in the regulatory affairs market. These companies collectively hold the largest market share and dictate industry trends.

- Accell Clinical Research, LLC

- Genpact

- Criterium, Inc.

- ICON plc

- iuvo BioScience, LLC.

- WuXi AppTec

- Medpace

- Charles River Laboratories.

- Laboratory Corporation of America Holdings

- Parexel International (MA) Corporation

- Freyr

- AmerisourceBergen

- NDA Group AB

- Pharmexon

- Qvigilance

- BlueReg

- Cambridge Regulatory Services

- VCLS

Recent Developments

-

In January 2024, iuvo BioScience acquired Promedica International to expand its ophthalmic clinical CRO services. The expansion aimed to support every aspect of ophthalmic clinical research.

-

In September 2023, Freyr entered into a partnership agreement with the PKG Group LLC. The partnership aided in navigating stringent regulatory procedures and accelerating submission activities in a quick turnaround time.

-

In January 2023, AmerisourceBergen Corporation acquired PHARMALEX GMBH to advance its specialty services and pharma manufacturer service offerings.

Regulatory Affairs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.83 billion

Revenue forecast in 2030

USD 27.18 billion

Growth Rate

CAGR of 8.80% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, services, categories, indication, stage, company size, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Norway; The Netherlands; Switzerland; Sweden; India; Japan; China; Australia; South Korea; Indonesia; Malaysia; Singapore; Thailand; Taiwan; Brazil; Mexico; Argentina; Colombia; Chile; South Africa; Saudi Arabia; UAE; Egypt; Israel; Kuwait

Key companies profiled

Accell Clinical Research, LLC; Genpact; Criterium, Inc.; ICON plc; iuvo BioScience, LLC.; WuXi AppTec; Medpace; Charles River Laboratories.; Laboratory Corporation of America Holdings; Parexel International (MA) Corporation; Freyr; AmerisourceBergen; NDA Group AB; Pharmexon; Qvigilance; BlueReg; Cambridge Regulatory Services; VCLS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Regulatory Affairs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global regulatory affairs market report based on services, categories, indication, stage, type, company size, end-use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

In-house

-

Outsourced

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Writing

-

Publishing

-

-

Product Registration & Clinical Trial Applications

-

Other Services

-

-

Categories Outlook (Revenue, USD Billion, 2018 - 2030)

-

Drugs

-

Innovator

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

Generics

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

-

Biologics

-

Biotech

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

ATMP

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

Biosimilars

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

-

Medical Devices

-

Diagnostics

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

Therapeutics

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

-

-

Indication Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oncology

-

Neurology

-

Cardiology

-

Immunology

-

Others

-

-

Product Stage Outlook (Revenue, USD Billion, 2018 - 2030)

-

Preclinical

-

Clinical studies

-

Post Market Approval (Pre-Market Approval (PMA) )

-

-

Company Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small

-

Medium

-

Large

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Medical Device Companies

-

Pharmaceutical Companies

-

Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Netherlands

-

Switzerland

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Indonesia

-

Malaysia

-

Singapore

-

Thailand

-

Taiwan

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Israel

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global regulatory affairs market size was estimated at USD 16.43 billion in 2024 and is expected to reach USD 17.83 billion in 2025.

b. The global regulatory affairs market is expected to grow at a compound annual growth rate of 8.8% from 2025 to 2030 to reach USD 27.18 billion by 2030.

b. The Asia Pacific dominated the regulatory affairs market with a share of 38.03% in 2024. This is attributable to a relatively lower cost for outsourcing, a skilled workforce with technical expertise, and expansion of life sciences companies in countries such as India & China.

b. Some of the players operating in the regulatory affairs market are Accell Clinical Research, LLC.; GenPact Ltd.; Criterium, Inc.; PRA Health Sciences; Promedica International; WuXi AppTec, Inc., and Freyr.

b. The entry of life sciences companies in the global regulatory affairs market and the evolution of new areas such as orphan drugs, biosimilars, ATMP’s and personalized medicine are relatively new factors expected to contribute to the market growth, as new areas would require advanced technical expertise for compliance with regulatory requirements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.