- Home

- »

- Healthcare IT

- »

-

Regulatory Information Management System Market Report, 2030GVR Report cover

![Regulatory Information Management System Market Size, Share & Trends Report]()

Regulatory Information Management System Market Size, Share & Trends Analysis Report By End-use (Pharmaceutical Sector, Medical Device Sector), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-971-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

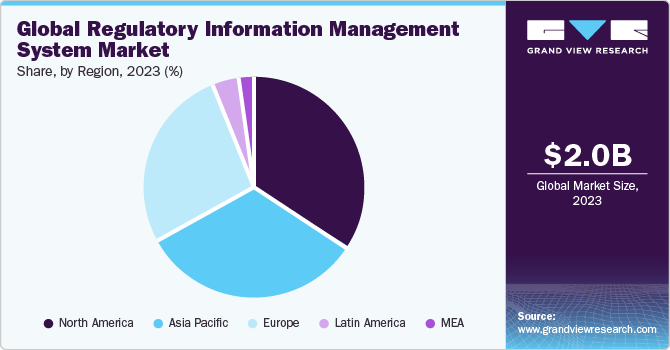

The global regulatory information management system market size was estimated at USD 2.02 billion in 2023 and is projected to grow at a CAGR of 10.4% from 2024 to 2030. The increasing complexity of healthcare regulations and the growing emphasis on compliance & data security are significant growth drivers for the RIMS market. Furthermore, the growing volume of regulatory data coupled with continuous technological advancements is expected to accelerate the market growth over the forecast period.

Implementing regulatory compliance software within an organization ensures data security and privacy, maintaining the reliability & credibility of information used in the regulatory process. Companies such as Freyr, with their advanced Integrated Regulatory Management System (IRMS), emphasize their commitment to upholding the highest data security and regulatory compliance standards. This dedication increases trust and reliability in client relationships. This demonstrates the growing appeal of RIM software, which is in accordance with the primary's input, which specifically states that conventional RIM is no longer in use:

“In order to comply with the requirements for drug approval, traditional methods of RIM are not possible to follow because they take a lot of time, and time is crucial in the pharmaceutical industry. If we compromise on timing, we risk losing the drug's royalties or experiencing other similar consequences, so adopting such technological advancements as Veeva Vaults RIM software gives us the leverage of working effectively.”

- Pharmaceutical companies market expert, India.

For instance, a well-known pharmaceutical business noted in its customers' feedback for Veeva's Vault RIM Suite that RIM is one of the change and digitalization strategies that they are continually forcing themselves to think about when exploring the data-driven regulatory information solution.

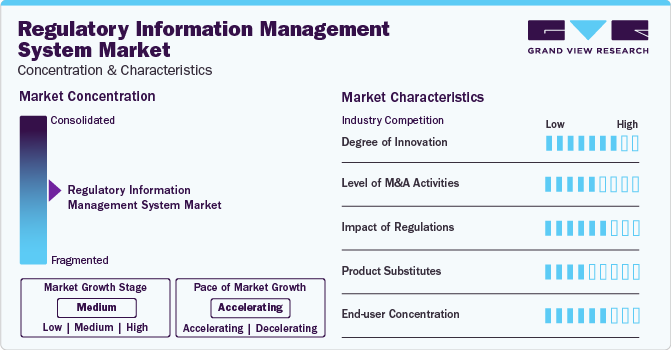

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The RIMS market is characterized by a high degree of innovation owing to the integration of artificial intelligence (AI) for automated analysis and diagnosis and launch of end-to-end integrated RIM systems. These advancements led to the real time update of regulation changes and allow companies to rapidly adjust their submission data. According to a report published by Kalypso, almost 85-90% of the data required for regulatory submission for any country is captured frequently making the regulatory process easy and efficient.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. Key players are implementing strategic initiatives, such as geographical expansion, collaborations, partnerships, and joint ventures, to strengthen their market presence. For instance, in May 2023, LexisNexis Reed Tech, a provider of data management and analytics solutions for the life sciences industry, expanded its collaboration with RegDesk, a RIMS platform provider, to support global medical device companies in effectively managing the increasing complexity of complying with ever-changing global regulations.

The market is subject to increasing regulatory scrutiny. The increasing complexity of regulations in both pharmaceutical and medical device sectors drive the adoption of RIMS. For example, the implementation of ICH Q12 guideline (currently in draft stage) impacts Pharmaceutical companies Quality and Regulatory systems. The RIM system allow to manage and track such changes in the regulatory scenarios and helps to track and plan the regulatory submission on time.

Threat of substitute product is expected to be low in global market over the forecast period. The specialized nature of RIMS minimizes the threat, given the limited availability of alternatives offering comprehensive regulatory compliance features.

With ever-evolving regulatory requirements and standards, managing regulatory information efficiently has become crucial for end-users. For instance, in response to the challenges presented by the complex global regulatory environment & financial constraints faced by life sciences companies, IQVIA introduced RIM Smart in February 2019.

“Life sciences companies are challenged by an increasingly complex, rapidly changing global regulatory environment within challenging financial constraints.”

- Tal Rosenberg, Senior Vice President, Global Technology Solutions for IQVIA.COVID-19 Impact and Related Case Study

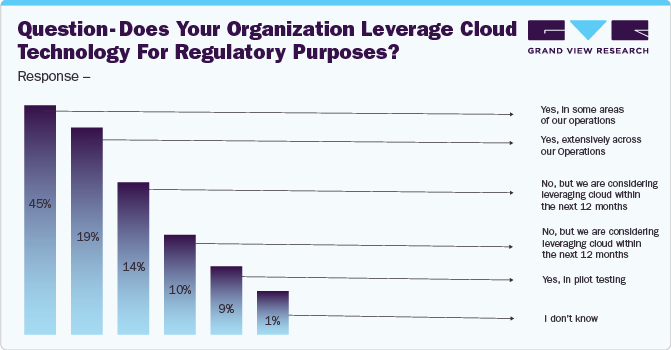

The COVID-19 pandemic has inevitably led to the use of digital technologies, positively impacting the global market. The pandemic accelerated the adoption of RIMS worldwide through regulatory flexibility. In response to the COVID-19 pandemic, life sciences companies began utilizing cloud-based technologies, including RIMS, for regulatory activities.

For instance, a survey published in August 2020 by Informa Pharma Intelligence in partnership with IQVIA provides insights into this trend. The survey indicates a significant increase in the use of cloud technology in regulatory activities. According to the statistics below, 64% of respondents reported utilizing the cloud in some or all of their regulatory activities:

The ability of RIM to uniquely cover several regulatory components is what initially caught the attention of manufacturers. The table below shows the RIMS-inclusive components.

RIMS COMPONENTS LIST

Components of RIM

1) Submission Forecasting and Resource Planning

9) Regulatory Archive

2) Dossier Management

10) Label Management (Content Control and also Compliance Tracking)

3) Submission Production

11) Analytics. Reporting. Dashboard

4) Submission Document Management

12) Data Standards and Governance Management

5) Submission Planning and Tracking

13) Design History File - Medical Device

6) Product Registration Management

14) Regulatory Intelligence

7) Health Authority Commitment Management

15) Ad / Promo

8) Health Authority Interactions

In addition, the need for RIM systems with streamlined, encrypted, unified, and compatible platforms is increasing as a result of the pharmaceutical and related healthcare industry's requirement to manage enormous quantities and diversity of data types. Furthermore, as the consumer's goals for development are realized and the RIM suppliers are able to ensure more advanced technologies, automated information merging, and data performance monitoring, thus the market is also anticipated to grow throughout of the forecast period.

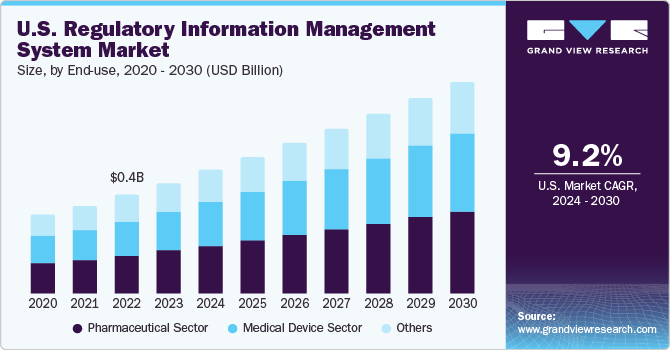

End-use Insights

Based on end-use, the pharmaceutical segment led the market with the largest revenue share of 36.30% in 2023. The pharmaceutical industry faces numerous regulations and compliance requirements, necessitating robust Regulatory Information Management (RIM) systems. In addition, increasing number of clinical trials and regulatory approval submissions in the pharmaceutical sector is a potential growth driver. For instance, in August 2023, Calyx's RIM system played a crucial role in a global pharmaceutical company's successful submission to the FDA during an eCTD 4.0 implementation pilot program.

The medical device segment is expected to grow at significant CAGR over the forecast period. RIM systems offer a centralized platform for efficient data management and regulatory documentation, leading many medical device companies to shift to these applications. For instance, in October 2022, Veeva Systems announced that over 350 companies have adopted Veeva Vault RIM Suite apps, showcasing its presence in the market.

Furthermore, growing emphasis on product safety and quality control is propelling the adoption of RIM systems. In sectors such as biologics, stringent regulatory oversight is crucial for patient safety while manufacturing complex biological products. Similarly, in the cosmetics and food sectors, adherence to regulatory guidelines is vital for consumer safety and satisfaction. RIM systems offer an effective solution for managing regulatory submissions, product registrations, and compliance documentation, enhancing quality control and risk management. For instance, in October 2022, China reinforced safety and technical standards for cosmetics, significantly impacting the demand for RIM systems in the cosmetics industry.

Regional Insights

North America dominated the regulatory information management system market with the revenue share of over 34.06% in 2023. Given the well-established and technologically advanced pharmaceutical enterprises in the U.S. and Canada, alongside the expanding medical device sector, North America is expected to have a significant presence in the global regulatory information management system market in 2023. Moreover, the region benefits from numerous suppliers offering integrated regulatory solutions such as RIM and regulatory submissions.

U.S. Regulatory Information Management System Market Trends

The regulatory information management system market in the U.S. dominated in 2023. The complexity of adhering to regulatory changes, gathering, organizing, and communicating product information across multiple countries poses a challenge due to dynamic global regulations, manual procedures, complex enterprise ecosystems, and resource constraints.

Notable life sciences companies like Novartis and GSK are adopting RIMS to integrate, assess, and oversee regulatory data worldwide, including submission planning, activity status, agency correspondence, and obligations. RIMS, coupled with advanced analytics, machine learning, extended reality, and robotic process automation, establishes a robust digital regulatory framework, offering connectivity, traceability, automation, and predictive insights.

Increasing adoption of RIMS, particularly in the pharmaceutical sector, has led to enduring partnerships between manufacturers and RIM providers, fostering market growth. For example, in October 202, Calyx announced that a top-ten pharmaceutical company has extended its contract to utilize the Calyx Regulatory Information Management (RIM) system for critical clinical trial data submissions to international regulators until 2026.

Europe Regulatory Information Management System Market Trends

The regulatory information management system market in Europe is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the changing regulatory scenarios in the life science industry and increasing adoption of advanced technologies and automation in regulatory frameworks is expected to drive demand for RIMS in the region. Companies such as Rimsys, Calyx, and Kalypso offer solutions to streamline regulatory processes. For example, Rimsys, a global provider of RIM systems, implemented its regulatory management software to automate the European Union In Vitro Diagnostics Regulation (EU IVDR) General Safety and Performance Requirements (GSPRs) for a global player in the IVD market.

The UK regulatory information management system market held the largest revenue share in 2023. This can be attributed to the increasing adoption of software and related technologies in the manufacturing sector along with the strict regulatory requirements. Such factors would likely drive the demand for RIMS solutions over the forecast period.

Asia Pacific Regulatory Information Management System Market Trends

The regulatory information management system market in Asia Pacific is expected to grow at the significant CAGR over the forecast period. In the Asia Pacific region, for instance, in Japan, there is no substitute for compliance and since how businesses approach compliance has a direct bearing on their ability to compete, the installation of regulatory information management software has grown significantly. In addition to the pharmaceutical industry, other industries where compliance management software is being used are also contributing to Japan's growth. For instance, UL LLC, a U.S.-based firm, offers exclusive chemical management software in Japan as well, demonstrating its presence in the market.

The China regulatory information management system market is expected to grow at the significant CAGR over the forecast period. Factors such as adoption advance technologies and increasing demand for drugs and medicines owing to growing number of chronic diseases would significantly fuel the market growth in the country over the anticipated period.

Key Regulatory Information Management System Company Insights

Some of the key players in the market include Veeva Systems, Korber AG, and ArisGlobal. Emerging participants include Kalypso, LORENZ Life Science Group, and Rimsys are also making strides in the RIMS market. These companies are employing diverse marketing strategies to penetrate the market, such as offering regulatory-related software solutions designed to attract manufacturers' attention.

Currently, there is a wide array of regulatory software products available in the market. For instance, Freyr Solutions provides regulatory solutions through the products like Freyr SPAR, a RIM Solution that enables Health Science managers to improve information more effectively from monitoring product enrollment to trying to generate periodic data.

Key Regulatory Information Management System Companies:

The following are the leading companies in the regulatory information management system market. These companies collectively hold the largest market share and dictate industry trends.

- Veeva Systems

- Kalypso (Rockwell Automation)

- DDi

- Körber AG

- ArisGlobal

- PhlexGlobal

- AmpleLogic

- Calyx

- Amplexor Life Sciences

- Ennov

- MasterControl

- Rimsys

- Ithos Global Inc. (Cordance Group)

- LORENZ Life Sciences Group

Recent Developments

-

In April 2023, Ennov acquired Samarind, a provider of RIM solutions. The aim behind the acquisition was to strengthen its global position in the RIM software market

-

In May 2023, ArisGlobal acquired SPORIFY, a provider of Regulatory Data Solutions. The acquisition aims to enhance ArisGlobal LifeSphere Regulatory solutions with advanced data governance capabilities for its life sciences customers

-

In February 2023, ArisGlobal launched a new RIM solution named Investigational Product RIMS. The launch aims to cater to the increasing demands of the life sciences and medical device companies

Regulatory Information Management System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.3 billion

Revenue forecast in 2030

USD 4.12 billion

Growth rate

CAGR of 10.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Report updated

April 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Spain; Switzerland; Sweden; Italy; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; Kuwait; South Africa

Key companies profiled

Veeva Systems; Kalypso (Rockwell Automation); DDi; Körber AG; ArisGlobal; PhlexGlobal; AmpleLogic; Calyx; Amplexor Life Sciences; Ennov; MasterControl; Rimsys; Ithos Global Inc. (Cordance Group); LORENZ Life Sciences Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Regulatory Information Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global regulatory information management system market report based on end-use, and region:

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Pharmaceutical Sector

-

Medical Device Sector

-

Others (Biologics, Cosmetics, Foods, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Switzerland

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global regulatory information management system market size was estimated at USD 2.02 billion in 2023 and is expected to reach USD 2.3 billion in 2024.

b. The global regulatory information management system market is expected to grow at a compound annual growth rate of 10.4% from 2024 to 2030 to reach USD 4.12 billion by 2030.

b. North America dominated the regulatory information management system market with a share of 37.1% in 2023. Given the well-established and technologically advanced pharmaceutical enterprises in the U.S. and Canada, alongside the expanding medical device sector, North America is expected to have a significant presence in the global regulatory information management system market in 2023. Moreover, the region benefits from numerous suppliers offering integrated regulatory solutions such as RIM and regulatory submissions.

b. Some of the prominent players in the regulatory information management system market include: Veeva Systems, Kalypso (Rockwell Automation), DDi, Körber AG, ArisGlobal, PhlexGlobal, AmpleLogic, Calyx, Amplexor Life Sciences, Ennov, MasterControl, Rimsys, Ithos Global Inc. (Cordance Group), LORENZ Life Sciences Group

b. Key factors driving the market growth include advancement in the pharmaceutical, medtech, and related sectors, increasing complexity of healthcare regulations, and the growing emphasis on compliance & data security.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."