- Home

- »

- Advanced Interior Materials

- »

-

Release Liner Market Size And Share, Industry Report, 2033GVR Report cover

![Release Liner Market Size, Share & Trends Report]()

Release Liner Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (Silicone, Non-silicone), By Application (Labels, Pressure-sensitive Tapes, Hygiene, Industrial, Medical), By Region, And By Segment Forecasts

- Report ID: GVR-4-68040-355-4

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Release Liner Market Summary

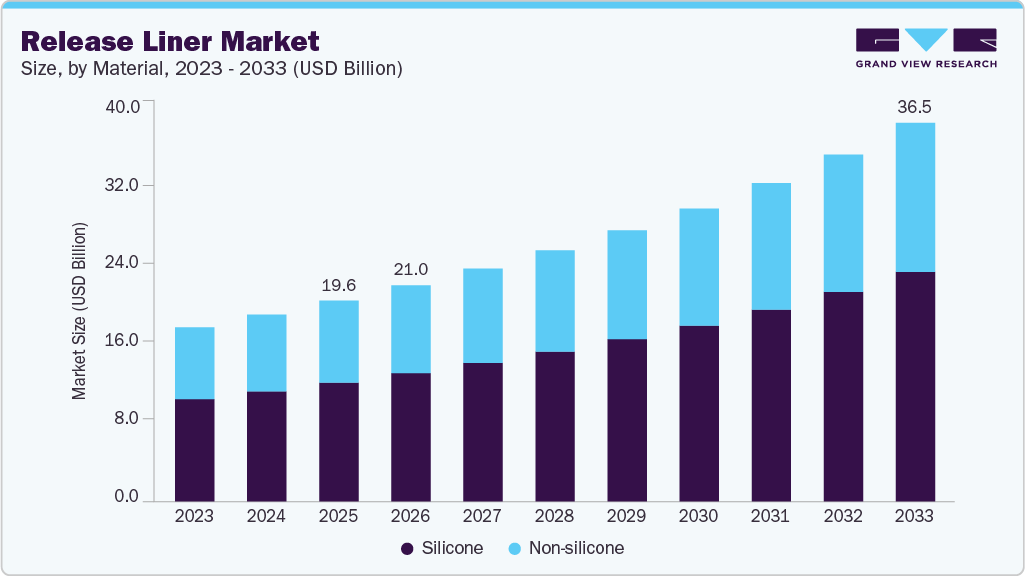

The global release liner market size was estimated at USD 19.59 billion in 2025 and is projected to reach USD 36.52 billion by 2033, growing at a CAGR of 8.2% from 2026 to 2033. This growth is attributed to the rising demand for the product from end use industries such as medical, industrial, packaging & labelling, and hygiene.

Key Market Trends & Insights

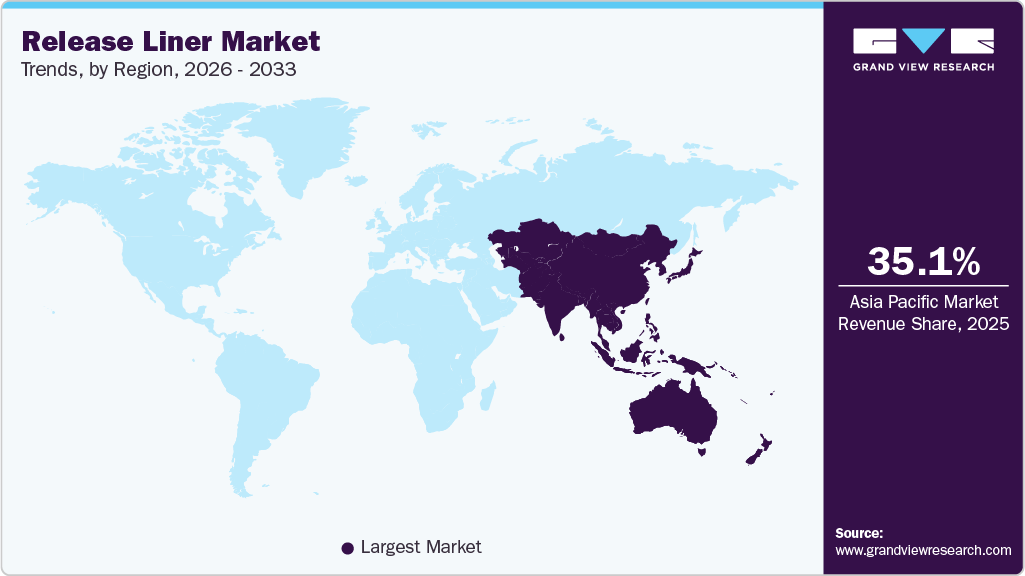

- Asia Pacific dominated the release liner market with the largest revenue share of 35.1% in 2025.

- By material, the non-silicone segment is expected to grow at the fastest CAGR of 8.6% over the forecast period.

- By application, the labels segment is expected to grow at the fastest CAGR of 8.7% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 19.59 Billion

- 2033 Projected Market Size: USD 36.52 Billion

- CAGR (2026-2033): 8.2%

- Asia Pacific : Largest market in 2025

The increasing need for labels in various sectors such as food & beverages, pharmaceuticals, and logistics is driving demand for release liners over the years. In addition, notable demand for advanced wound care products and medical adhesives is boosting market growth.

The use of release lines is further increasing in the automotive, electronics, and construction industries due to the demand for pressure-sensitive tapes and other adhesive products. Economic development in regions such as the Asia Pacific is leading to increased construction activities and industrial activities, such as automotive and electronics. This is leading to higher demand for release liners globally.

Shift towards pressure-sensitive labels in packaging, logistics, and branding applications is boosting the market for the product. These labels are preferred for their ease of application and versatility, driving demand for high-quality release liners. Furthermore, a surge in e-commerce activities has significantly increased the demand for packaging and labeling solutions. This product plays a crucial role in ensuring the quality and durability of these solutions, thereby driving market demand.

Fluctuating prices of raw materials, such as silicone and paper, can impact production costs and profitability for product manufacturers. Furthermore, the disposal and recycling of release liners pose significant environmental challenges. Increasing regulatory pressures to minimize waste and improve recyclability can be a constraint. Besides, the rise of digital labeling and printing technologies may reduce the demand for traditional release liners in certain applications and industries.

The development of new materials that enhance the performance and durability of release liners is providing new growth opportunities for the market. In addition, the industry is witnessing advancement in eco-friendly and recyclable liner materials as industries move towards sustainable practices. Therefore, the development and adoption of biodegradable and recyclable release liners offer significant growth opportunities, driven by increasing environmental awareness and regulatory mandates around the globe.

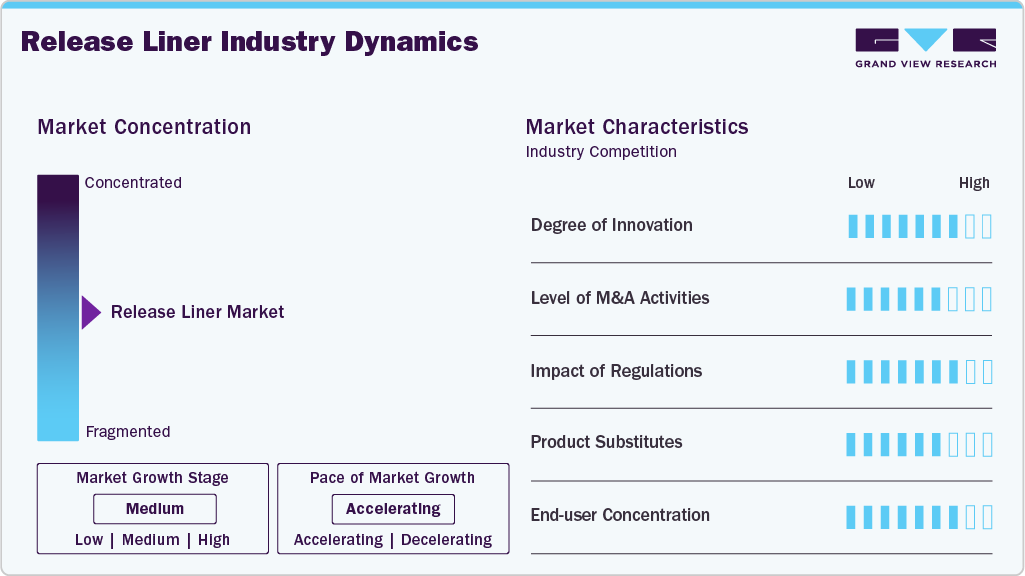

Market Concentration & Characteristics

The release liner industry is moderately consolidated, with a mix of large multinational players and regional manufacturers. Global companies hold a significant share due to advanced coating technologies, extensive distribution networks, and strong relationships with adhesive and label producers. However, regional players remain competitive in price-sensitive markets and customized applications. Strategic collaborations, capacity expansions, and long-term contracts with adhesive manufacturers contribute to competitive strength. Entry barriers remain moderate due to the capital-intensive nature of coating processes and the technical expertise required.

The primary substitute threat comes from linerless labels, which eliminate the need for release liners entirely. Growing adoption of linerless technology in logistics and retail labeling poses a long-term challenge to traditional liners. However, linerless solutions face limitations related to adhesive handling, application compatibility, and cost, restricting widespread adoption. Other substitutes include reusable carrier films, though their use remains niche. Performance reliability and compatibility with existing labeling equipment continue to favor conventional release liners. As a result, the threat of substitutes is moderate but increasing with sustainability-driven innovations.

Material Insights

Based on material, the market is segmented into silicone and non-silicone materials. Silicone dominated the market with a revenue share of 63.4% in 2025 and is expected to continue growing at a significant rate over the forecast period. Silicone offers consistent and reliable release properties, making it suitable for a wide range of adhesives. Furthermore, these silicone liners can withstand high temperatures and are resistant to chemicals, making them ideal for applications involving heat. This type of material is used in pressure-sensitive labels and adhesive tapes and is also used in medical adhesive products due to its stability and hypoallergenic properties.

Non-silicone materials include polyethylene (PE)-coated, fluoropolymer-coated, and wax-coated materials. Non-silicon material is anticipated to grow at the fastest rate of 8.6% over the forecast period. Non-silicone release liners are generally more cost-effective than silicone-based ones. They can be designed to be compatible with specific adhesives where silicone might not be suitable. Furthermore, this material is ideal for applications where silicone contamination is a concern, such as in electronics or sensitive manufacturing processes.

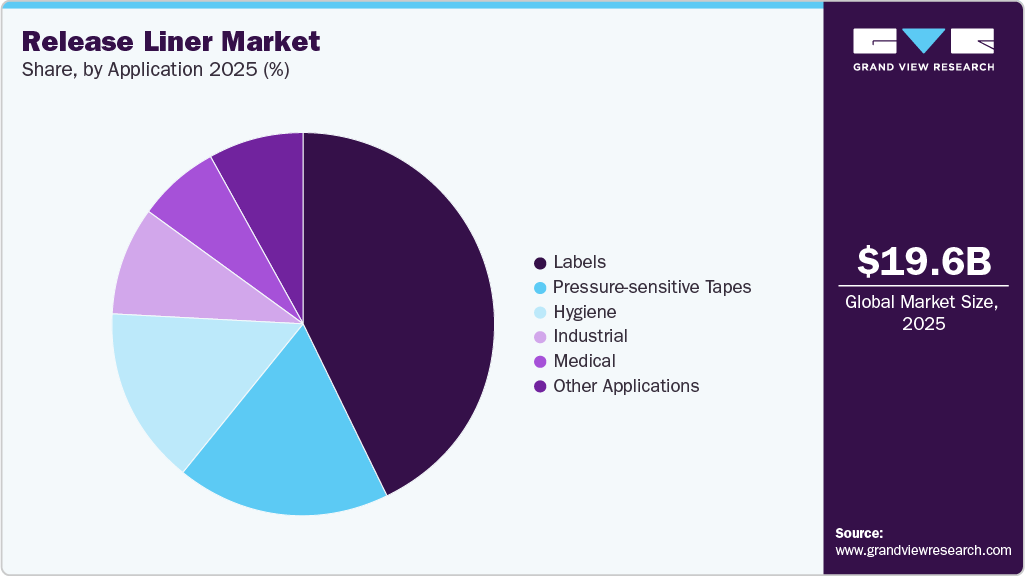

Application Insights

On the basis of application, the release liner market is segmented into labels, pressure-sensitive tapes, hygiene, industrial, medical, and others. Among these, label application accounted for the largest revenue share of 42.7% in 2025 and is further expected to grow at the fastest rate over the forecast period. Release liners are widely used for product labeling in various sectors, including food and beverages, personal care, and household products. The demand is driven by the need for clear, durable, and attractive labels that can withstand various environmental conditions. Furthermore, release liners help maintain the integrity of labels during storage and application.

Pressure-sensitive tapes are a significant application for release liners and are expected to grow at a significant rate over the forecast period. These tapes rely on this product to keep the adhesive surface protected and ready for use. Furthermore, industrial application often involves more specialized uses where products serve as carriers for adhesives and coatings. In medical applications, release liners are used in products like bandages and dressings, where they protect the adhesive part until application to ensure sterility and effectiveness.

Regional Insights

The release liner industry in the Asia Pacific dominated the global market in 2025 with a revenue share of 35.1% and is further expected to grow at a significant rate over the forecast period. The region's increasing emphasis on infrastructure development and technological innovation has led to higher consumption of release liners for applications ranging from self-adhesive products to high-performance films.

The China release liner industry remains a key market driven by large-scale packaging, electronics, and logistics industries. High demand for pressure-sensitive labels in consumer goods and export packaging supports strong liner consumption. Domestic manufacturers are expanding capabilities to meet rising quality and sustainability standards. Increasing automation in labeling processes further fuels demand for high-performance liners. Government's focus on recycling and environmental compliance is pushing innovation in recyclable liner materials. China is expected to maintain steady growth due to strong industrial fundamentals.

Europe Release Liner Market Trends

The release liner industry in Europe is characterized by a high demand for eco-friendly and recyclable release liners, driven by stringent regulatory standards and a growing consumer preference for sustainable products. Industries such as automotive, electronics, and healthcare are major contributors to this demand, as these sectors increasingly utilize products for applications, including product labeling, adhesive bonding, and medical device manufacturing.

The Germany release liner industry leads the European market due to its advanced manufacturing base and strong industrial sector. Automotive labels, industrial tapes, and high-quality packaging drive demand. Emphasis on precision, performance, and sustainability shapes product development. German manufacturers invest heavily in R&D and process efficiency. Regulatory compliance strongly influences material innovation. The market reflects steady growth, supported by robust industrial demand.

North America Release Liner Market Trends

The release liner industry in North America is expected to grow at a significant pace over the forecast period. This demand is supported by a robust manufacturing base and the rising adoption of digital technologies that require specialized release liner products for effective and efficient production processes. Furthermore, the rise is largely attributed to the expansion of the e-commerce sector and the increasing utilization of advanced packaging solutions in the region.

U.S. Release Liner Market Trends

The U.S. release liner industry is projected to grow at a CAGR of 8.3% during the forecast period. The growth of online retail has significantly amplified the need for efficient and reliable packaging materials in the country, where release liners play a crucial role in ensuring the integrity of products during transit. Furthermore, the automotive and electronics industries, both prominent in the U.S., are heavily reliant on release liners for applications such as adhesive bonding and component protection, further boosting market demand.

Central & South America Release Liner Market Trends

The release liner industry in Central & South America is experiencing gradual growth driven by expanding food & beverage packaging and retail labeling. Increasing urbanization and demand for consumer goods support market development. Cost-effective paper-based liners dominate the region, though film liners are gaining traction. Infrastructure development and rising industrial activity further contribute to demand. The market remains price-sensitive with growing emphasis on quality improvements. Regional growth prospects remain moderate.

Middle East & Africa Release Liner Market Trends

The release liner industry in the Middle East & Africa is growing due to increasing demand for packaging in the food, pharmaceutical, and logistics sectors. Expansion of retail and e-commerce activities supports label consumption. Infrastructure development and rising industrialization contribute to market growth. Adoption of advanced liner technologies remains limited but is gradually increasing. The region relies partly on imports, offering opportunities for global manufacturers. Growth is expected to remain steady over the forecast period.

Key Release Liner Company Insights

Some of the key players operating in the market are 3M, Dow, and Ahlstrom, among others.

-

3M operates through four business segments, namely safety and industrial, transportation and electronics, healthcare, and consumer. It has regional sales and manufacturing units in over 70 countries across North America, Europe, Asia Pacific, and the Middle East & Africa. It was established in 1929 and has its headquarters in the U.S.

-

Dow manufactures chemicals, plastic & agricultural products and provides services across the consumer market. Dow Chemical comprises 32 subsidiaries. Some of which include Arabian Chemical Company Ltd., Blue Cube Holding LLC., CD Polymers, DOCOMO, Inc., Dow Business Services, and Dow Chemical China Holdings Pte. Ltd. The markets served by the company include agriculture, automotive, building & construction, energy & water, electronic materials, packaging, industrial, and infrastructure.

Mondi and Felix Schoeller are some of the emerging participants in the market.

-

Mondi is a producer of a wide range of containerboard and converted corrugated solutions. The product line includes flexible packaging, bags, and pouches, release liners, functional films, corrugated solutions, industrial bags, barrier coatings, specialty kraft paper, sack kraft paper, containerboard, and office and professional printing papers.

-

Felix Schoeller is involved in the production, marketing, and development of specialty papers for digital printing systems, self-adhesive applications, photographic applications, and the packaging market. The company’s products cater to the wallpaper, wood-based panel, and furniture industry. Its product portfolio includes decor papers, photographic & digital printing papers, release liner, sublimation papers, packaging, and other specialty papers.

Key Release Liner Companies:

The following are the leading companies in the release liner market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- Loparex

- 3M

- Mondi

- Ahlstrom

- Elkem ASA

- Felix Schoeller

- Gascogne Group

- LINTEC Corporation

- Sappi Group

Recent Developments

-

In February 2024, Mondi announced the collaboration with Soprema, Veyzle, and WEPA to combat the siliconized and coated paper waste produced at its release liner production sites situated in the Netherlands and Germany. This is expected to increase the circularity of material flow in the release liner production facility. Furthermore, it will allow for the use of 95% of waste as a secondary raw material for other industries.

Release Liner Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 21.04 billion

Revenue forecast in 2033

USD 36.52 billion

Growth rate

CAGR of 8.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Dow; Loparex; 3M; Mondi; Ahlstrom; Elkem ASA; Felix Schoeller; Gascogne Group; LINTEC Corporation; Sappi Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Release Liner Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the industry trends in each of the segments from 2021 to 2033. For this study, Grand View Research has segmented the global release liner market report on the basis of material, application, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Silicone

-

Non-silicone

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Labels

-

Pressure-sensitive Tapes

-

Hygiene

-

Industrial

-

Medical

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global release liner market size was estimated at USD 19.59 billion in 2025 and is expected to reach USD 21.04 billion in 2026.

b. The global release liner market is expected to grow at a compound annual growth rate (CAGR) of 8.2% from 2026 to 2033 to reach USD 36.52 billion by 2033.

b. Labels accounted for the largest revenue share of 42.7% in 2025 and is further expected to grow at the fastest rate over the forecast period. Release liners are used extensively for product labeling in sectors like food and beverages, personal care, and household products.

b. Some key players operating in the release liner market include Dow, Loparex, 3M, Mondi, Ahlstrom, Elkem ASA, Felix Schoeller, Gascogne Group, LINTEC Corporation, and Sappi Group

b. The key factors that are driving the release liner market growth is the growing demand for the product from end use industries such as medical, industrial, packaging & labelling, and hygiene.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.