- Home

- »

- Pharmaceuticals

- »

-

Remicade Market Size, Share, Growth, Industry Report, 2030GVR Report cover

![Remicade Market Size, Share & Trends Report]()

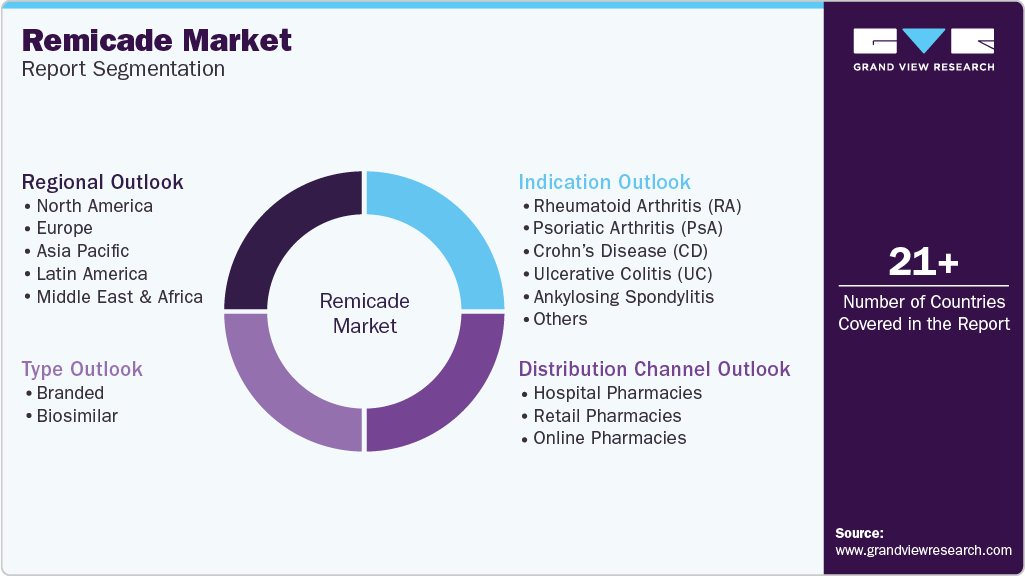

Remicade Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Branded, Biosimilar), By Indication (Rheumatoid Arthritis, Psoriatic Arthritis, Crohn’s Disease), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-584-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Remicade Market Size & Trends

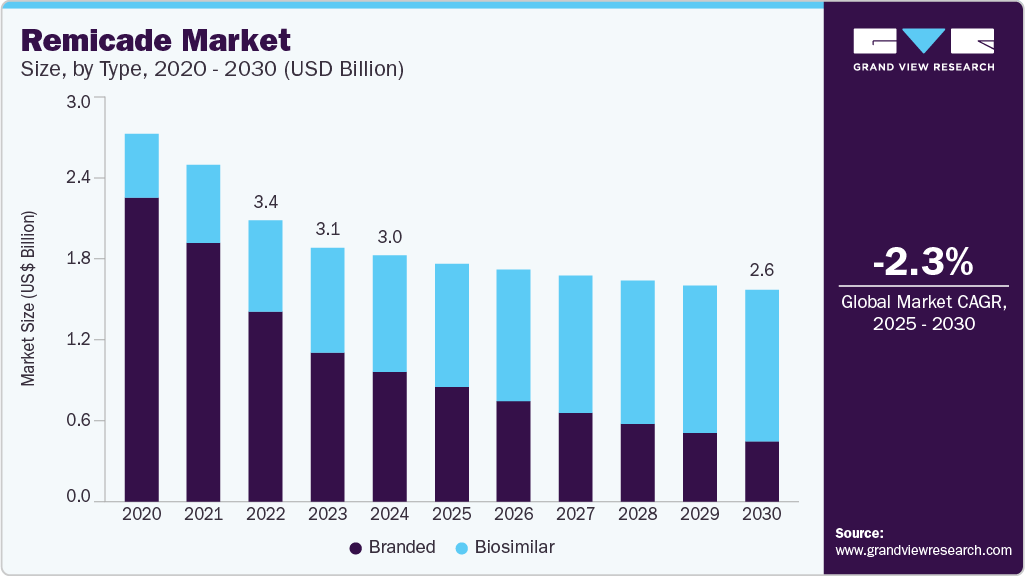

The global remicade market size was estimated at USD 3.04 billion in 2024 and is projected to decline at a CAGR of -2.28% from 2025 to 2030, primarily due to the rise of cost-effective biosimilars following patent expirations and growing preference for newer biologic therapies. While remicade remains a key treatment option for diseases such as ulcerative colitis, ankylosing spondylitis, rheumatoid arthritis, and psoriasis, its market share is under pressure from increasing competition, pricing challenges, and changing patient choices.

Key Highlights:

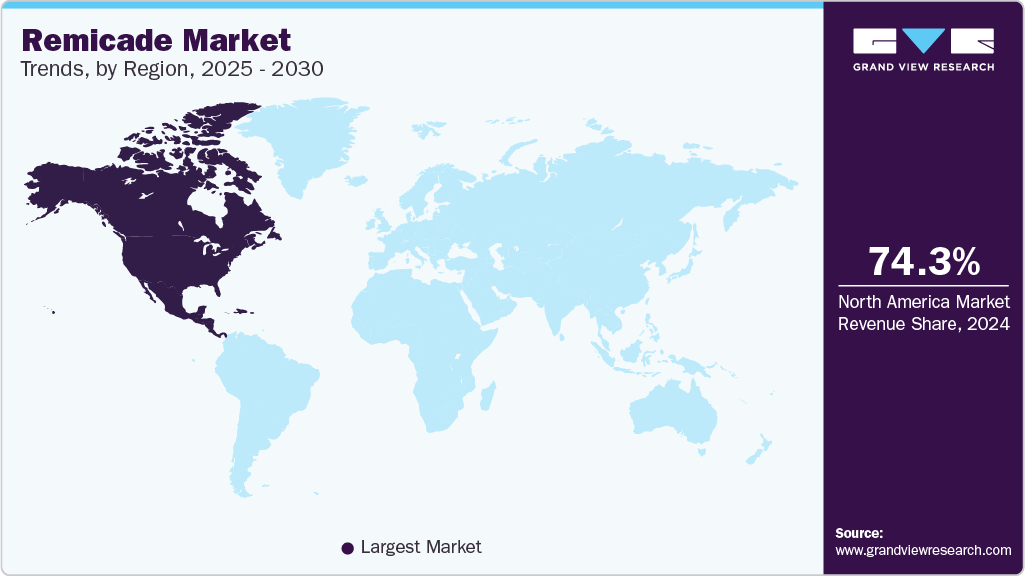

- North America dominated the remicade market with the largest revenue share of 74.29% in 2024.

- The remicade market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By type, the branded segment led the market with the largest revenue share of 52.8% in 2024.

- By indication, the rheumatoid arthritis (RA) segment led the market with the largest revenue share of 20.8% in 2024.

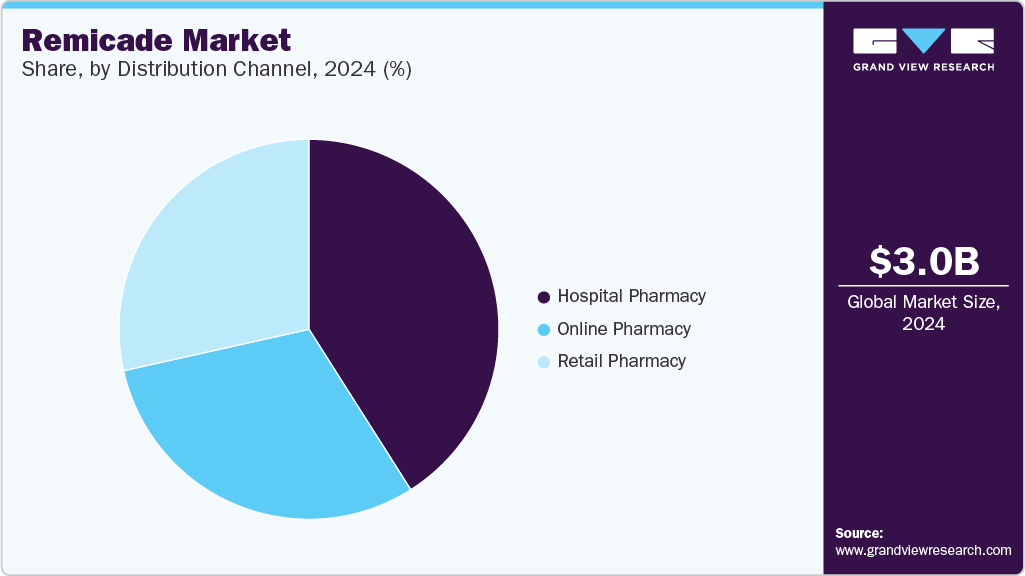

- By distribution channel, the hospital pharmacy segment led the market with the largest revenue share of 41.0% in 2024.

Evolving healthcare policies, reimbursement models, regional biosimilar acceptance variations, and biologic therapy innovations are expected to shape the remicade's market dynamics. There is a growing competition from biosimilar versions and biological drugs developed by other manufacturers that closely resemble remicade. These biosimilars are generally priced lower than Remicade, making them a more cost-effective option for healthcare providers and patients. For instance, in March 2024, Celltrion launched Zymfentra, a biosimilar to Remicade in the U.S. market, marking a significant expansion of its regional product portfolio. Zymfentra received FDA approval, offering a more convenient and affordable treatment alternative. The availability of these alternatives has increased the pressure on market share, as both the cost factor and growing preference for biosimilars remain key influencers of treatment decisions.

The growing prevalence of psoriasis, particularly in its moderate to severe forms, further contributes to the demand for biologic therapies like Remicade. For instance, according to data published in Healthline in February 2024, about 2% to 3% of the world’s population has some form of psoriasis. With the growing awareness of autoimmune diseases and treatment needs, the demand for Remicade is expected to rise.

While Remicade faces a decline in market value due to increasing biosimilar competition and patent expirations, the demand for the drug remains resilient due to several key factors. The global increase in autoimmune diseases, including rheumatoid arthritis, psoriasis, and Crohn's disease, supports the demand for biologic treatments. As a result, the market value is contracting, and the overall utilization of Remicade is supported by underlying drivers such as the growing prevalence of autoimmune conditions, which helps stabilize market volumes despite pricing pressures and increased competition.

Pipeline Analysis

The Remicade pipeline includes several ongoing clinical trials to expand the therapeutic indications and enhance treatment options for autoimmune and inflammatory disorders. These trials primarily focus on Crohn's disease and other Inflammatory Bowel Diseases (IBD). The pipeline reflects the ongoing efforts of key collaborators and organizations to improve treatment outcomes through phase 3 studies, which are crucial steps before regulatory approval. Below is an overview of the current pipeline analysis for Remicade, highlighting the conditions being studied, the phase of development, and estimated launch timelines.

Table: Pipeline Drugs

NCT Number

Conditions

Phase

Collaborators

Estimated Launch

NCT05660746

Crohn Disease

Phase 3

National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), Janssen Scientific Affairs, LLC

2029

NCT06059989

Inflammatory Disease, Crohn's Bowel Disease

Phase 3

Celltrion

2027

NCT06274294

Inflammatory Bowel Diseases

Phase 3

Paris IBD Center, Celltrion HealthCare France

2027

Source: Clinical Trial

Market Concentration & Characteristics

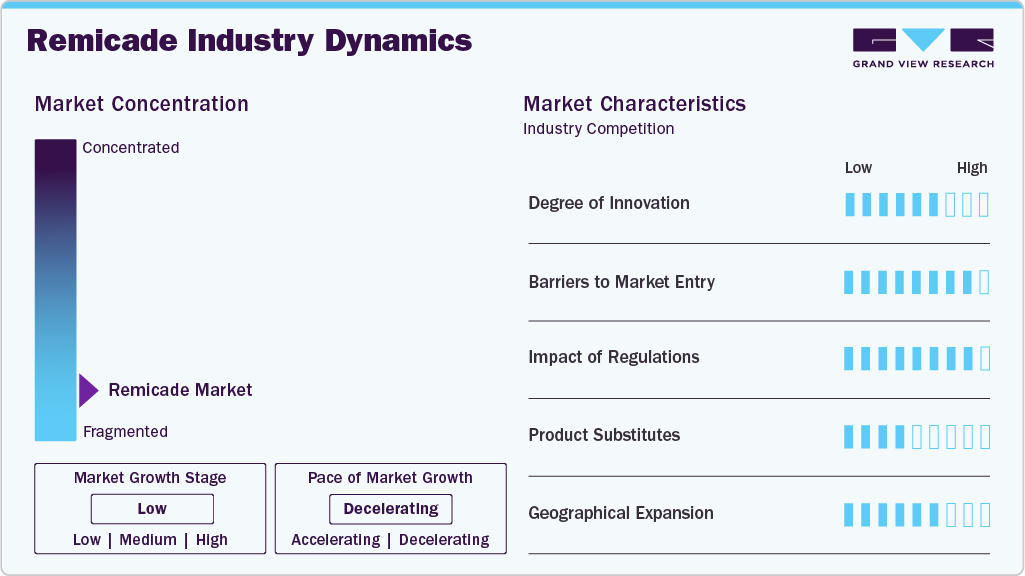

The Remicade industry is advancing with innovations driven by the expanding biosimilar landscape. In March 2025, Celltrion's infliximab, the first monoclonal antibody biosimilar, was launched as Remdantry. This milestone expanded access to affordable biologic treatments for autoimmune diseases. Such innovations increase competition, reduce treatment costs, and improve patient access to therapies for autoimmune diseases. Intravenous and subcutaneous administration options enhance patient convenience and compliance, revolutionizing biologics by making life-saving treatment more affordable and accessible.

The Remicade industry presents significant barriers to entry, primarily due to the complex nature of biologic drug development, strict regulatory requirements, and Janssen’s historic patent protections. Developing biosimilars to Remicade involves substantial R&D investment, complex manufacturing processes, and extensive clinical testing to ensure they meet safety and efficacy standards.

Regulations play a critical role in shaping the Remicade industry by governing the approval, manufacturing, and marketing of the original biologic and biosimilars. The complex and rigorous regulatory frameworks set by agencies such as the Food and Drug Administration (FDA) and European Medicines Agency (EMA) ensure that biosimilars meet strict safety, efficacy, and quality standards, often requiring extensive clinical trials to demonstrate equivalence to the reference product. These regulations are designed to protect patients and maintain the integrity of biologic treatments.

Product substitutes primarily include biosimilars and alternative biologics that target similar indications. Biosimilars like Renflexis and Inflectra, which are approved alternatives to Remicade, serve as key substitutes. These biosimilars offer identical efficacy and safety profiles as Remicade but at a lower cost, enhancing accessibility for patients and healthcare systems. For example, Inflectra costs around USD 1,100 per 100 mg, compared to approximately USD 1,400 per 100 mg for Remicade. Although these alternatives have competitive prices and comparable therapeutic value, the market is still dominated by Remicade's well-established brand presence and Janssen's strong brand reputation, which continue to shape the market dynamics.

Geographical expansion plays a key role in the growth of the Remicade industry, with Janssen extending its reach into emerging markets across Asia Pacific, Latin America, and Africa. The demand for biologic treatments for autoimmune diseases is increasing in these regions, driven by improving healthcare infrastructure. The availability of biosimilars further supports market expansion by offering more affordable alternatives to Remicade, increasing accessibility. Strategic partnerships with local healthcare providers and regulatory bodies help Janssen navigate these markets, ensuring continued growth and broader patient access to effective treatments globally.

Type Insights

The branded segment led the market with the largest revenue share of 52.8% in 2024, due to Janssen's strong market position. This share can be attributed to its established product efficacy in treating autoimmune conditions like Crohn's disease and ulcerative colitis. The product's wide clinical data, brand name, and established relationships with healthcare professionals place it in a preferred position in the branded segment. Remicade has faced increasing competition from biosimilars in the branded market. However, it has established a strong position, ensuring it remains a key player in the autoimmune biologics market.

The biosimilar segment is projected to experience at the fastest CAGR of 4.19% during the forecast period, driven by the expanding global biosimilar landscape, regulatory approval of new alternatives, and increasing patient access to biologic treatments. As healthcare systems worldwide prioritize reducing healthcare expenditure, biosimilars offer a sustainable solution for providing biologic therapies at a lower cost. For instance, a study published in the Journal of Gastroenterology and Hepatology in February 2025 provided positive results for long-term data on the safety and efficacy of switching from originator infliximab to biosimilar in patients with IBD. In addition, introducing biosimilars resulted in substantial cost savings, further reinforcing the economic advantages of biosimilars in the Remicade industry.

Indication Insights

The rheumatoid arthritis (RA) segment led the market with the largest revenue share of 20.8% in 2024. The condition is driving demand for effective biologic treatments such as Remicade, which targets Tumor Necrosis Factor (TNF) to reduce inflammation, especially among the aging population. As per data published by the WHO, in 2023, approximately 18 million people worldwide lived with RA in 2019, with women making up about 70% of those affected and 55% being over the age of 55. As autoimmune disorders continue to rise, especially among the elderly, the demand for disease-modifying treatments increases, and biologics such as Remicade become vital in treating symptoms, avoiding joint damage, and enhancing patient outcomes. This trend will drive long-term demand for the Remicade industry and comparable treatments in the future.

The psoriatic arthritis (PsA) disease segment is projected to experience negative growth in the Remicade industry, primarily due to the growing penetration of biosimilars and alternative biologic therapies offering comparable efficacy at lower costs. Although awareness of PsA is increasing and biologic treatment options continue to expand, these developments are contributing to heightened competition rather than supporting Remicade’s market retention. According to a study published in StatPearls in January 2024, the prevalence of PsA in patients with psoriasis is 19.7%, with 21.6% in adults and 3.3% in children. However, this disease prevalence has not translated into proportional growth for Remicade, as prescribers increasingly opt for newer therapies with favorable pricing, improved administration profiles, or differentiated mechanisms of action. While Remicade benefits from a well-established clinical history, its market share in the PsA segment is declining due to erosion from cost-effective alternatives.

Distribution Channel Insights

The hospital pharmacy segment led the market with the largest revenue share of 41.0% in 2024, driven by the high demand for Remicade in hospital settings where it is frequently used for treating complex autoimmune diseases such as rheumatoid arthritis, Crohn's disease, and PsA. Administration of Remicade involves specialized practice settings and healthcare professionals to deal with dosing and monitoring patients for possible adverse effects, making hospital pharmacies an essential channel for distribution. In addition, health care professionals educated in hospitals ensure accurate handling and administration of biologic medications such as Remicade, adding to their dominance in this category.

The online pharmacy segment is anticipated to grow at the fastest CAGR during the forecast period, due to the increasing demand for convenient and accessible treatment options, particularly as patients and healthcare providers seek more flexible ways to manage chronic autoimmune conditions. The growing shift toward digital healthcare services, along with improved patient support programs offered by online platforms, drives the expansion of online pharmacies in the remicade industry.

Regional Insights

North America dominated the remicade market with the largest revenue share of 74.29% in 2024. This leadership is driven by robust healthcare infrastructure, high demand for biologic treatments, and the growing prevalence of autoimmune diseases. In January 2024, a University of North Carolina study found infliximab biosimilars comparable to Remicade in gastroenterology and rheumatology clinics across the U.S., showing similar efficacy and safety profiles. Although competition from biosimilars may increase, North America's well-established regulatory and reimbursement systems continue to support the widespread use of Remicade, ensuring its continued market dominance. The drug remains a primary treatment option for RA and Crohn's disease, backed by strong clinical support and a solid market presence.

U.S. Remicade Market Trends

The remicade market in the U.S. accounted for the largest market revenue share in North America in 2024, driven by high demand for biologic treatments. The presence of leading healthcare providers and research institutions ensures continued usage and innovation. As per the pharmaletter in May 2025, Celltrion launched Zymfentra in the U.S. market as the first FDA-approved subcutaneous infliximab. This was achieved through Celltrion’s strategic partnerships with major Pharmacy Benefit Managers (PBMs) and health plans, which facilitated rapid market access. The company announced the commercial availability of Zymfentra in the U.S. in March 2024. While the popularity of biosimilars is growing, Remicade remains a key treatment option due to its proven clinical efficacy and long-term market presence. The country's advanced healthcare infrastructure supports the widespread use of Remicade, and its established regulatory and reimbursement systems facilitate patient access to the drug.

Europe Remicade Market Trends

The remicade market in Europe benefits from strong healthcare infrastructure and established healthcare systems, which support the ongoing use of biologic treatments such as Remicade. Regulatory frameworks across European countries enable broad access to the drug, contributing to its continued adoption and driving the remicade industry expansion in the region.

The UK remicade market is expanding due to increasing awareness and diagnosis of autoimmune diseases, alongside greater patient access to biologic treatments like Remicade. The National Health Service (NHS) has facilitated the adoption of effective therapies through established reimbursement and treatment guidelines. Moreover, ongoing clinical support and the presence of experienced healthcare providers contribute to the growth of remicade use. For instance, in October 2024, Johnson & Johnson (J&J) announced the addition of infliximab (Remicade) and golimumab (Simponi) to its immunology portfolio in the UK.

The remicade market in Germany led the regional market due to its advanced biopharmaceutical manufacturing and robust healthcare system. Hospital formularies have been optimized to include cost-effective biosimilar versions, supported by government incentives and electronic prescription systems that streamline biologic therapies. Moreover, the presence of leading medical research institutions and healthcare providers ensures that Remicade remains a key treatment option for conditions such as RA and Crohn’s disease.

The France remicade market is witnessing rapid expansion, driven by the rising prevalence of IBD. According to the EPIMAD study Group, in December 2024, a total number of 22,879 new cases of IBD were recorded over a 30-year study period in Northern France, with 59% being Crohn's disease, 38% ulcerative colitis, and 3% unclassified IBD. This increase in disease incidence highlights the growing demand for effective biologic therapies such as Remicade. As a result, France is emerging as a key market for continued investment and therapeutic innovation in treating IBD, reinforcing the need for advanced biologic solutions.

Asia Pacific Remicade Market Trends

The remicade market in Asia Pacific is rapidly expanding, driven by increasing access to biologics, government funding for chronic disease treatment, and growing partnerships with multinational biopharma companies. For instance, the government expanded reimbursement for biologic therapies in South Korea, improving access to medicines for autoimmune diseases in hospital and outpatient settings. This initiative, part of a broader strategy to enhance healthcare access, has contributed to the increased adoption of advanced biologic treatments. Such policies foster the growth of biologic therapy, such as Remicade, in the market across the region.

The Japan remicade market is expanding due to initiatives such as the “Healthy Aging” strategy, emphasizing chronic disease control in the elderly. As part of this trend, biologics such as infliximab are being used more widely in the outpatient setting, where long-term control of autoimmune diseases is essential. Domestic pharmaceutical firms are actively launching biosimilar versions of infliximab, specifically adapted to meet domestic regulatory and clinical requirements, enhancing affordability and access. At the same time, digital health platforms are being widely adopted to support treatment monitoring, adherence, and physician decision-making, contributing to more efficient, patient-centered care.

The remicade market in China is rapidly evolving due to the introduction of biosimilars, supportive government policies, and growing demand for cost-effective chronic disease treatments. For instance, in March 2022, Genor Biopharma announced the approval of GB242 (infliximab) by China's National Medical Products Administration (NMPA), its first commercial drug. It targets multiple autoimmune diseases. Local pharmaceutical companies have launched several biosimilars priced considerably lower than the originator, expanding patient reach. While regional adoption varies and some barriers remain, policy momentum and healthcare infrastructure improvements are positioning China's Remicade industry for sustained growth.

Latin America Remicade Market Trends

The remicade market in Latin America shows moderate but steady growth, with Brazil and Argentina leading due to the introduction of biosimilars and an increasing focus on making biologic treatments more affordable. For instance, in August 2023, an article in Expert Opinion on Biological Therapy discussed the emerging role of biosimilars in Latin America. The study highlighted the region's growing interest in biosimilars as cost-effective alternatives to originator biologics, emphasizing the need for regulatory frameworks, healthcare infrastructure improvements, and stakeholder education to facilitate their integration into national healthcare systems. With these efforts, Latin America is expected to expand access to essential biologics and improve treatment outcomes for patients with autoimmune diseases.

The Brazil remicade market is expanding, fueled by the rising prevalence of autoimmune diseases and the increasing acceptance of biosimilars. Ongoing educational initiatives for healthcare providers and patients, as well as further regulatory support, will be crucial to ensure broader adoption and integration of Remicade into the healthcare system.

Middle East & Africa Remicade Market Trends

The remicade market in the Middle East and Africa is an emerging market for Remicade, led by Saudi Arabia and the UAE. Government initiatives like Vision 2030 (Saudi Arabia) and healthcare digitalization (UAE) support biologics infrastructure. Local distributors are increasingly partnering with global biosimilar producers to ensure affordability and access.

The Saudi Arabia remicade market is expanding due to significant biopharma investments and rising rates of autoimmune and metabolic diseases. Health insurance reforms and government funding facilitate biosimilar adoption. E-pharmacy platforms and telemedicine services broaden access across urban and rural areas.

Key Remicade Company Insights

The remicade industry is undergoing significant transformation following the loss of exclusivity in key global markets. In 2024, the competitive dynamics intensified, with more biosimilars gaining regulatory approvals and entering various markets. This change is redefining the competitive landscape by lowering the cost of treatment for healthcare systems and enhancing accessibility for patients with autoimmune and inflammatory diseases.

New biosimilar entrants employ innovative strategies, such as high-concentration formulations and interchangeable approvals, to differentiate their products. Many companies also form strategic partnerships with global pharmaceutical leaders, leveraging established manufacturing capabilities, distribution networks, and market expertise. These trends contribute to a more competitive and patient-accessible biologics market, driving greater affordability and treatment options for patients worldwide.

Key Remicade Companies:

The following are the leading companies in the remicade market. These companies collectively hold the largest market share and dictate industry trends.

- Janssen Pharmaceuticals (Johnson & Johnson)

- Celltrion

- Pfizer Inc.

- Samsung Bioepis.

- Novartis AG

- Amgen Inc.

- Boehringer Ingelheim International GmbH

- Teva Pharmaceutical Industries Ltd.

Recent Developments

-

In March 2025, as per an article in BioSpace, Pfizer's IXIFI, a biosimilar to Remicade, will be available in Canada from April 2025. This launch expanded Pfizer’s portfolio of biosimilars, offering a cost-effective alternative for treating autoimmune diseases.

-

In October 2023, Novartis completed the spin-off of Sandoz, creating two independent companies. This move aimed to sharpen Novartis' focus on innovative medicines while Sandoz continues as a global leader in generics and biosimilars.

-

In August 2022, Amgen acquired ChemoCentryx, expanding its portfolio in autoimmune diseases and strengthening its position in the U.S. market with new therapeutic opportunities.

Remicade Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.94 billion

Revenue forecast in 2030

USD 2.62 billion

Growth rate

CAGR of -2.28% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Janssen Pharmaceuticals (Johnson & Johnson); Celltrion; Pfizer Inc.; Samsung Bioepis; Novartis AG; Amgen Inc.; Boehringer Ingelheim International GmbH; Teva Pharmaceutical Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Remicade Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global remicade market report based on type, indication, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Branded

-

Biosimilar

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Rheumatoid Arthritis (RA)

-

Psoriatic Arthritis (PsA)

-

Crohn’s Disease (CD)

-

Ulcerative Colitis (UC)

-

Ankylosing Spondylitis

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global remicade market size was estimated at USD 3.04 billion in 2024 and is expected to reach USD 2.94 billion in 2025.

b. The global remicade market is expected to decline at a compound annual growth rate of -2.28% from 2025 to 2030 to reach USD 2.62 billion by 2030.

b. Based on type, Branded Remicade segment dominated the remicade market, accounting for 52.8 % of the share in 2024, due to Janssen's strong market position. This share can be attributed to its established product efficacy in treating autoimmune conditions like Crohn's disease and ulcerative colitis.

b. Key players operating in the market are Janssen Pharmaceuticals (Johnson & Johnson), Celltrion, Pfizer Inc., Samsung Bioepis, Novartis AG

b. The growth of the Remicade market is primarily driven by the rise of cost-effective biosimilars following patent expirations, as well as the growing preference for newer biologic therapies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.