- Home

- »

- Medical Devices

- »

-

Reprocessed Medical Devices Market Size Report, 2030GVR Report cover

![Reprocessed Medical Devices Market Size, Share & Trends Report]()

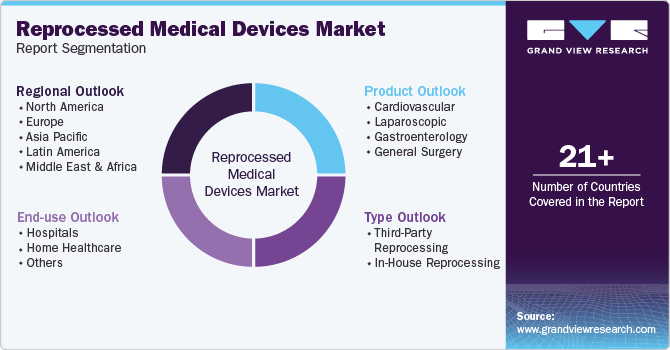

Reprocessed Medical Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Cardiovascular, Laparoscopic), By Type (Third-party, In-house), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-848-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Reprocessed Medical Devices Market Summary

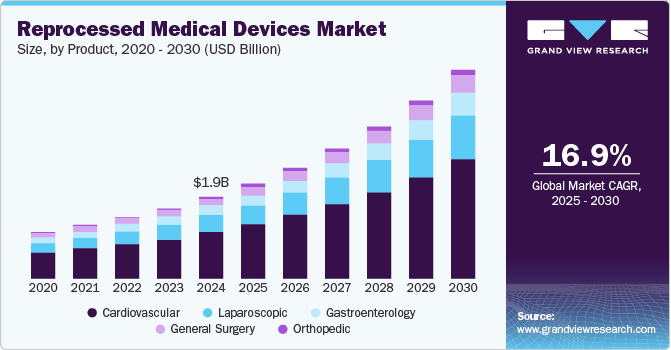

The global reprocessed medical devices market size was estimated at USD 1,991.0 million in 2024 and is projected to reach USD 5,080.0 million by 2030, growing at a CAGR of 16.95% from 2025 to 2030. The growing need to reduce medical waste in healthcare settings, along with the cost benefits and increased awareness of the advantages of reprocessed devices, is driving the market growth.

Key Market Trends & Insights

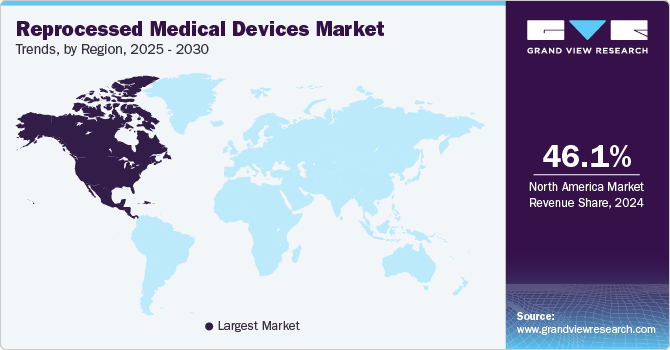

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, cardiovascular accounted for a revenue of USD 1,317.8 million in 2024.

- Cardiovascular is the most lucrative product type segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,991.0 Million

- 2030 Projected Market Size: USD 5,080.0 Million

- CAGR (2025-2030): 16.95%

- North America: Largest market in 2024

In addition, the growing prevalence of cardiovascular disorders, a rising geriatric population, and improving healthcare infrastructure are factors contributing to market growth. Furthermore, government initiatives to promote equipment reprocessing are expected to create significant market demand.

The healthcare industry produces a sizable amount of medical waste each year, with reusable medical equipment and supplies being needlessly disposed of in landfills or burned due to single-use labeling by manufacturers. The primary objective of the healthcare sector is compromised by this practice, which has been connected to threats to the environment and public health. For instance, as per the article published by AMDR in January 2024, Hospitals contribute to the loss of 388,000 disability-adjusted life years due to pollution-related factors. In addition, climate change is projected to cause an estimated direct damage cost of USD 4 billion per year to health by 2030. These statistics highlight the significant impact of environmental factors on public health and the associated economic costs. However, hospitals and care facilities can avoid harming the environment with millions of pounds of medical waste each year by using remanufactured equipment, thereby supplementing market growth.

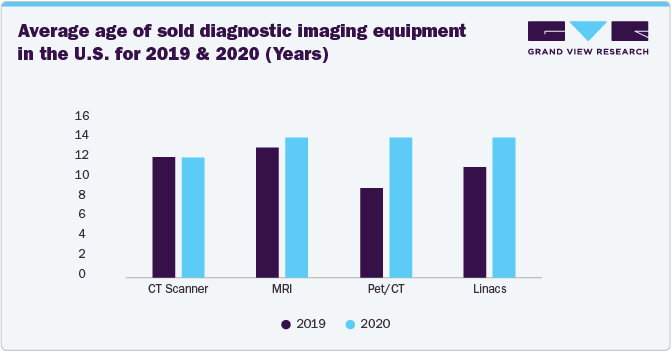

Moreover, increasing awareness about the advantages of reprocessed devices is particularly relevant in the diagnostic imaging sector, where a large and aging installed base of equipment requires consistent maintenance to remain operational. With hospitals and imaging centers facing budget constraints, rising interest rates, and high costs associated with new equipment, they are increasingly turning to refurbished and reprocessed imaging systems as a cost-effective solution. The growing acceptance of used and refurbished diagnostic imaging equipment, such as CT scanners, MRI machines, PET/CT systems, and linear accelerators, is driving their ability to deliver reliable performance at a fraction of the cost of new devices.

The above chart indicates that healthcare facilities are holding onto their equipment for longer, driven by cost pressures, supply chain challenges, and the growing acceptance of refurbished and reprocessed medical devices. As providers recognize that properly refurbished imaging systems can deliver high-quality diagnostics while extending equipment lifespan, demand for repair and refurbishment services is increasing.

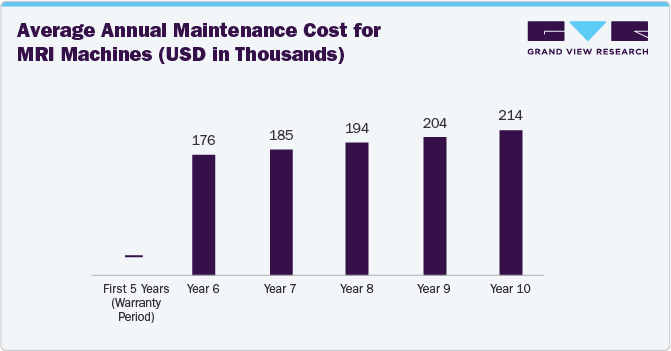

The healthcare industry is under constant pressure to reduce costs while maintaining high-quality patient care. The significant area where cost savings can be achieved is through the supply chain management of devices. As healthcare facilities increasingly recognize the financial benefits associated with reprocessing medical devices, they are driving growth in the reprocessed medical devices industry. Reprocessing involves cleaning, sterilizing, and refurbishing single-use devices for safe reuse, which leads to substantial cost reductions. For instance, a study by the Association of Medical Device Reprocessors (AMDR) indicated that hospitals could save between 30% to 50% on device costs by opting for reprocessed alternatives instead of purchasing new ones.

As per the Medical Device Repair and Refurbishment Segment Spotlight Fall Report 2023, after 10 years of use, the average MRI machine requires nearly USD 100 K in annual maintenance costs. Moreover, the financial impact of COVID-19 and the current capital financing environment have led hospitals to pursue lower-cost solutions, including used and refurbished equipment, temporary equipment options, and services that extend the useful life of their equipment.

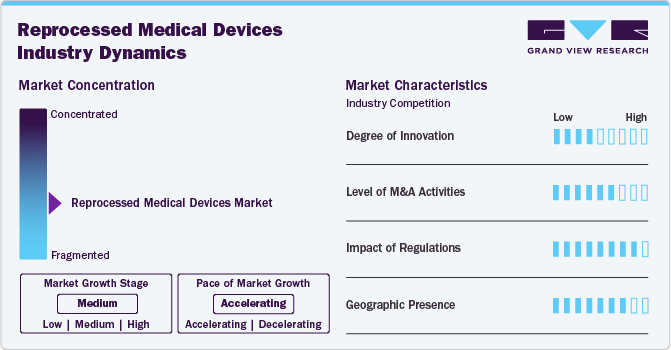

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, impact of regulations, level of partnership & collaboration activities, and geographic expansion. The reprocessed medical device industry is highly fragmented, with the presence of a few major players and many small & medium-sized medical device providers.

The degree of innovation in the reprocessed medical devices industry is considerable, driven by advancements in sterilization techniques, material durability, and tracking systems. One notable example is the adoption of RFID (Radio Frequency Identification) tagging, which enables hospitals to track each device’s usage cycle and ensure compliance with reprocessing limits. In addition, market players are adopting various organic and inorganic strategies to foster market growth. In October 2023, GE Healthcare announced a collaboration with Relink Medical, a company focused on improving the management of medical equipment. This partnership aims to address the challenges associated with medical device utilization and inventory management in healthcare settings.

Several key market players are devising business growth strategies in the form of mergers and acquisitions. Through M&A activity, these companies can expand their business geographies. For instance, in December 2024, Innovative Health, Inc. publicly expressed its strong support for Prestige AmeriTech’s acquisition of S2S Global from Premier Inc. This merger is set up to establish one of the largest medical sourcing firms in the nation that is owned by diverse individuals. The combination of Prestige AmeriTech’s manufacturing capabilities and S2S Global’s established presence in reprocessed single-use cardiology devices can enhance product offerings and improve supply chain resilience.

Regulation has a significant and complex impact on the reprocessed medical devices industry. In the U.S., the FDA mandates that reprocessed single-use devices meet the same safety and performance standards as new devices through the 510(k)-clearance process, including stringent requirements for cleaning, sterilization, functionality, and labeling. Similarly, the EU Medical Device Regulation (MDR) imposes strict controls, requiring traceability, risk assessments, and technical documentation for reprocessing. These regulatory frameworks enhance safety, increase hospital confidence, and legitimize the practice of device reuse. However, they also raise the cost and complexity of compliance, limiting participation to highly capable manufacturers and hindering access in low-resource settings where regulations may be unclear or lacking.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. In August 2024, Arjo announced the opening of a new reprocessing facility. This facility is designed to enhance the company’s capabilities in reprocessing single-use medical devices, which is a significant step towards sustainability in healthcare. The primary purpose of this new facility is to support Arjo’s commitment to sustainability by reducing waste generated from single-use medical devices.

Product Insights

The cardiovascular segment dominated the market in 2024 with the largest revenue share of 56.62% and is also anticipated to register the fastest CAGR of 17.20% over the forecast period owing to the extensive utilization of reprocessed products in cardiovascular surgeries and diagnostics. The adoption of reprocessed cardiovascular devices enables healthcare facilities to achieve cost savings without compromising patient care or safety. For instance, the cost of a new coronary sinus catheter is approximately USD 500, while the reprocessed alternative is priced at around USD 250. Similarly, the steerable sheath is priced over USD 900, whereas the reprocessed version is available for approximately USD 460, resulting in a substantial cost reduction of nearly 50%.

The laparoscopic segment is anticipated to register a considerable CAGR over the forecast period. The reprocessing of laparoscopic devices has gained significant traction in recent years due to cost savings, environmental sustainability, regulatory backing, and technological advancements. The reprocessing of laparoscopic instruments includes techniques such as Vaporized Hydrogen Peroxide (VH2O2) and Low-Temperature Steam and Formaldehyde (LTSF). Both methods have their benefits and drawbacks, which can affect the decision based on various factors such as the types of instruments being sterilized, compatibility with materials, user-friendliness, and overall efficacy. The methods comply with guidelines set forth by regulatory bodies such as the FDA and ISO, ensuring safety for patients, devices, and staff involved in the reprocessing procedures. These developments lowered procurement costs and aligned with broader sustainability goals within healthcare systems.

Type Insights

The third-party reprocessing segment dominated the market in 2024 with the largest revenue share of 66.47%. Third-party is mainly carried out by specialized companies that are equipped to handle the complexities involved in ensuring that these devices meet safety and efficacy standards before being reintroduced into the healthcare system. The primary goal of third-party reprocessing is to reduce waste and conserve resources while maintaining patient safety. As per the Medical Device Repair and Refurbishment Segment Spotlight Report 2023, hospitals and medical facilities are increasingly turning to third-party providers for the repair and refurbishment of medical devices for several important reasons. By outsourcing these services, healthcare institutions can focus their resources on core patient care activities instead of diverting valuable personnel and time toward equipment maintenance.

The in-house reprocessing segment is anticipated to register a considerable CAGR over the forecast period. The growth of in-house reprocessing within the reprocessed medical devices industry has been significantly influenced by healthcare facilities’ desire to reduce costs and improve sustainability. In-house reprocessing allows hospitals and surgical centers to manage their own used medical devices, which can lead to substantial savings compared to purchasing new devices. For instance, a hospital may choose to reprocess single-use devices such as catheters or surgical instruments internally, thereby cutting costs. This helps in reducing the overall expenditure on medical supplies and minimizes medical waste generated from discarded devices.

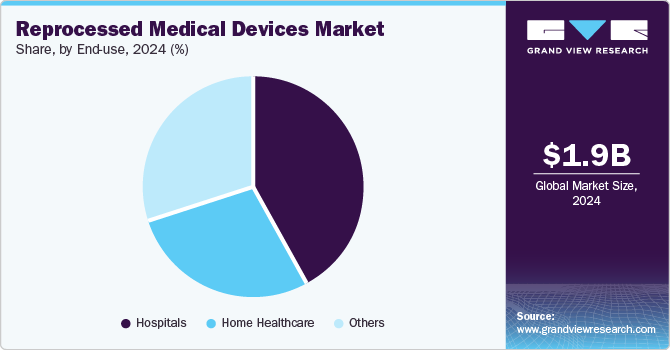

End-use Insights

The hospitals segment dominated the market in 2024 with the largest revenue share of 42.57%. The market for reprocessed medical devices in hospitals is experiencing significant growth due to the increasing need to reduce medical waste and costs associated with healthcare. This can be attributed to the high requirement and utilization of reprocessed medical devices to reduce the cost and medical waste generation associated with the original medical equipment. According to the AMDR’s 2019 survey, 8,622 hospitals and outpatient care centers saved more than 18 million pounds of medical waste and attained over 20 million U.S. dollars in savings from disposing of waste. This generated collective savings of around USD 544 million and over 2,000 jobs. Apart from the environmental implications, healthcare leadership also prioritizes the quality of reprocessed devices - studies have highlighted that re-used medical instruments can be more reliable than new medical devices.

The home healthcare segment is anticipated to register a considerable CAGR over the forecast period. Home healthcare settings allow patients to receive ongoing treatment and monitoring without the need for hospitalization. Devices such as blood glucose monitors, infusion pumps, and respiratory equipment can be effectively reprocessed and reused. This ensures that patients receive high-quality care while minimizing waste. Having these devices available for home use enhances patient comfort and supports better health outcomes by enabling consistent monitoring and management of chronic conditions.

Regional Insights

The North America reprocessed medical devices industry dominated globally in 2024 with the largest revenue share of 46.11%. Major factors contributing to the growth of this region include increasing preference among healthcare professionals regarding the use of improvised reprocessed medical devices coupled with increasing chronic diseases in countries such as the U.S., Canada, and Mexico.

U.S. Reprocessed Medical Devices Market Trends

The reprocessed medical devices industry in the U.S. held the largest share regionally in 2024 due to technological advancements and the recent approval of many reprocessed medical devices. Increasing healthcare expenditure and a high per capita income are key factors driving market growth. Moreover, in recent years, there has been a significant increase in the number of surgical procedures, largely due to the growing incidence of chronic diseases worldwide. For instance, as per the National Institutes of Health report published in April 2024, in the U.S., 1 in 9 individuals living in households reported having at least one surgical procedure in the past year.

Europe Reprocessed Medical Devices Market Trends

Europe reprocessed medical devices industry is anticipated to register a significant CAGR over the forecast period. The UK, France, Germany, Italy, and Spain are the main markets in this region. Growing R&D activities in the pharma and biotech sector. in developed countries, such as the UK, Germany, Italy, & France, and the presence of high unmet needs in Eastern Europe are some of the factors anticipated to drive growth over the forecast period. The increasing prevalence of chronic diseases due to lifestyle changes is one of the major factors likely to drive market growth.

Germany reprocessed medical devices industry is anticipated to register a significant growth rate during the forecast period. Germany is one of the European countries with the highest senior population due to the increasing stability and continuity of reprocessed devices, which reduces uncertainty and promotes sustainable healthcare practices. For instance. in February 2025, the Bundesrat, which is the federal council of Germany, made a significant decision regarding the Medical Devices Operator Ordinance. The withdrawal of the proposal to amend this ordinance indicates that there will be no changes to the current regulations governing the reprocessing of single-use medical devices in German hospitals. This decision has been welcomed by Vanguard AG, a company likely involved in the medical device sector, as it aligns with their interest in promoting sustainable healthcare practices and economic prudence.

The UK reprocessed medical devices industry is anticipated to register a considerable growth rate during the forecast period. Rising incidence & prevalence of chronic diseases are some of the major factors contributing to this growth. The geriatric population in the UK has significantly increased in the past five decades. According to a report by the UK parliament, over one-fifth of the people in the country are above 65 years of age. Furthermore, according to the Office of National Statistics (ONS) UK, the old-age dependency ratio accounted for 280 per 1,000 people in 2020 and is expected to rise to 352 per 1,000 people by 2041. The increasing geriatric population is a vital impact-rendering driver for the reprocessed medical devices industry.

Asia Pacific Reprocessed Medical Devices Market Trends

Asia Pacific reprocessed medical devices industry is anticipated to be the fastest-growing region globally in the market. Technological advancements in patient monitoring devices and increasing geriatric population coupled with growing prevalence of lifestyle diseases, such as cardiovascular diseases. According to Australian Institute of Health and Welfare (AIHW), approximately 5.6% (1.2 million) of Australian adults aged 18 and over had one or more conditions related to vascular or heart disease, including stroke, from 2017 to 2018. As a result, the increasing prevalence of these diseases is expected to drive the demand for reprocessed medical devices for cardiac monitoring over the forecast period.

China reprocessed medical devices industry held the largest share in 2024. Increasing prevalence of chronic disorders and growing geriatric population are some of the major factors contributing to the growth of China reprocessed medical devices market. As a result of these factors, the demand for reprocessed medical devices in China has increased over time.

India reprocessed medical devices market is anticipated to register a significant growth during the forecast period. India is facing a significant healthcare challenge, particularly with the rising incidence of cancer. It is projected that one in nine Indians will receive a cancer diagnosis in their lifetime, making it imperative to enhance access to effective medical care. The limited availability of medical equipment, especially in Tier 2 and Tier 3 cities, has severely impacted on the quality of healthcare services. This situation necessitates innovative solutions to bridge the gap in healthcare infrastructure. To effectively combat India’s growing cancer burden healthcare systems adopts comprehensive strategies which include awareness campaigns, early screening initiatives, and improved treatment options facilitated by refurbished medical devices.

Latin America Reprocessed Medical Devices Market Trends

Latin America reprocessed medical devices industry is anticipated to register a lucrative growth during the forecast period. Latin America market is primarily driven by Brazil, Mexico, Argentina, and Colombia. Growing investments by market players in the region, proximity to North America, and free-trade agreements with major countries such as the U.S., Canada, Japan, and several European countries are among the factors anticipated to boost the Latin America market during the forecast period.

Brazil reprocessed medical devices industry accounted for a major share regionally in 2024. Its dominance can be attributed to availability of various products in the local market, increasing awareness of sustainable and environmental solutions, cost saving, prevalence of chronic diseases, and growing geriatric population.

MEA Reprocessed Medical Devices Market Trends

MEA reprocessed medical devices industry is anticipated to register considerable CAGR during the forecast period due to the increase in chronic disease prevalence and rapidly aging population as well as growing demand for reprocessed medical devices.

The reprocessed medical devices industry in South Africa is experiencing rapid growth during the forecast period. The growing adoption of reprocessing practices in both public and private healthcare sectors marks the evolution of the market. South Africa's healthcare system, recognized as one of the most advanced in Africa, has played a crucial role in promoting medical device reprocessing technologies. Healthcare facilities in the country are increasingly acknowledging the economic and environmental advantages of reprocessing single-use devices. The availability of local reprocessing service providers and their collaborations with international firms has contributed to the market's advancement.

Key Reprocessed Medical Devices Company Insights

Stryker, Arjo, Medline Industries, LP, Medline Industries, LP., GE Healthcare are some of the leading players in the reprocessed medical devices industry. GE Healthcare and Medline Industries, LP. hold leading positions in terms of market presence. Companies are focusing on market expansion through new facility launches to strengthen their market presence.

Key Reprocessed Medical Devices Companies:

The following are the leading companies in the reprocessed medical devices market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker

- Innovative Health

- NEScientific, Inc.

- Medline Industries, LP.

- Arjo

- Cardinal Health

- SureTek Medical

- Soma Tech Intl

- Johnson & Johnson MedTech

- GE Healthcare

Recent Developments

-

In December 2024, GE Healthcare made significant strides in integrating sustainability into its operations and product offerings. The company recognizes the dual responsibility it holds: to provide high-quality healthcare solutions while also minimizing its environmental impact. This commitment is reflected in their innovative practices that aim to enhance patient care while promoting ecological sustainability.

-

In July 2024, Innovative Health Inc. entered into a partnership agreement with MC Healthcare. This collaboration aims to promote the reprocessing of medical devices as a sustainable practice within healthcare settings. The primary objective of this agreement is to enhance awareness and implementation of device reprocessing in hospitals and healthcare facilities.

-

In April 2024, GE HealthCare announced the establishment of a new refurbishing unit in Bangladesh specifically dedicated to its A1 Sure ultrasound systems. This initiative is part of GE Healthcare’s broader strategy to enhance healthcare accessibility and improve medical imaging services in the region. The refurbishing unit aims to provide high-quality, cost-effective ultrasound systems that can meet local healthcare demands.

-

In February 2024, GE Healthcare partnered with Biofourmis to enhance patient monitoring capabilities beyond traditional hospital settings. This collaboration aims to leverage advanced technologies to provide virtual care solutions for patients at home, thereby improving health outcomes and patient engagement.

Reprocessed Medical Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.32 billion

Revenue forecast in 2030

USD 5.08 billion

Growth Rate

CAGR of 16.95% from 2025 to 2030

Actual data

2018 - 2023

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stryker; Innovative Health; NEScientific, Inc.; Medline Industries, LP; Arjo; Cardinal Health; SureTek Medical; Soma Tech Intl; Johnson & Johnson MedTech; GE Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Reprocessed Medical Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global reprocessed medical devices market report based on product, type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular

-

Blood Pressure Cuffs

-

Positioning Devices

-

Cardiac Stabilization Devices

-

Diagnostic Electrophysiology Catheters

-

Deep Vein Thrombosis Compression Sleeves

-

Electrophysiology Cables

-

-

Laparoscopic

-

Harmonic Scalpels

-

Endoscopic Trocars

-

-

Gastroenterology

-

Biopsy Forceps

-

Others

-

-

General Surgery Devices

-

Pressure Bags

-

Balloon Inflation Devices

-

- Orthopedic

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Third-party Reprocessing

-

In-house Reprocessing

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global reprocessed medical devices market size was estimated at USD 1.99 billion in 2024 and is expected to reach USD 2.32 billion in 2025.

b. The global reprocessed medical devices market is expected to grow at a compound annual growth rate of 16.95% from 2025 to 2030 to reach USD 5.08 billion by 2030.

b. North America dominated the reprocessed medical devices market with a share of 46.11% in 2024. Major factors contributing to the growth of this region include growing preference among healthcare professionals regarding the use of improvised reprocessed medical devices coupled with increasing chronic diseases.

b. Some key players operating in the reprocessed medical devices market are Stryker, Innovative Health, NEScientific, Inc., Medline Industries, LP., Arjo, Cardinal Health, SureTek Medical, Soma Tech Intl, Johnson & Johnson MedTech, GE Healthcare.

b. Key factors that are driving the reprocessed medical devices market growth include clinical urgency to reduce the generation of medical waste in hospitals and other healthcare settings and rising adoption of reprocessed medical devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.