- Home

- »

- Homecare & Decor

- »

-

Residential Heat Pump Market Size, Share, Industry Report, 2019-2025GVR Report cover

![Residential Heat Pump Market Size, Share & Trends Report]()

Residential Heat Pump Market Size, Share & Trends Analysis Report By Technology (Air to Air, Water Source), By Power Source (Electric Powered, Gas Powered), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-723-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2015 - 2017

- Forecast Period: 2019 - 2025

- Industry: Consumer Goods

Industry Insights

The global residential heat pump market size was valued at USD 8.2 billion in 2018. People have been focusing on clean and green energy for sustainable heating solutions and minimizing fossil fuel consumption due to rising awareness regarding rapidly increasing global warming and climate change. Moreover, increasing the importance of sustainable and cost-effective HVAC solutions, coupled with the implementation of government initiatives aimed at reducing carbon emissions, is expected to promote the scope for residential heat pumps in the residential sector.

Over the past few years, governments around the world have been focusing on reducing carbon footprints and eliminating the predominant use of fossil fuels in generating energy and other related purposes. According to the data provided by the European Commission, the heating and cooling solutions accounted for approximately half of the European Union's (EU)’s energy consumption. In the residential sector of the EU, hot water and heating alone accounted for more than 75% of total energy consumption. According to the statistics provided by Eurostat, in 2018, 75% of the energy required for heating and cooling solutions is still produced from fossil fuels and the rest of the energy is generated from renewable sources.

Greenhouse gases produced during the production of energy, which is majorly consumed by the HVAC systems in the residential buildings, can only be cut down by using advanced technologies such as pumps running in renewable energy. Besides, the governments of various countries including the U.S., Germany, and India are taking initiatives to promote the use of these residential heat pumps in the residential sector.

According to the New York State Energy Research and Development Authority (NYSERDA), the greenhouse gas emissions due to cooling and heating in residential buildings contributed around 32% in New York, the U.S. The government of the state has decided to cut down the greenhouse gas emissions by minimizing it by 40% by 2030 and 80% by 2050. To achieve this target, in February 2017, the government drafted an integrated, long-term policy framework to encourage the adoption of clean heating and cooling technologies, which will reduce the reliability of fossil fuels. This is anticipated to drive the demand for residential heat pumps in the forecast period.

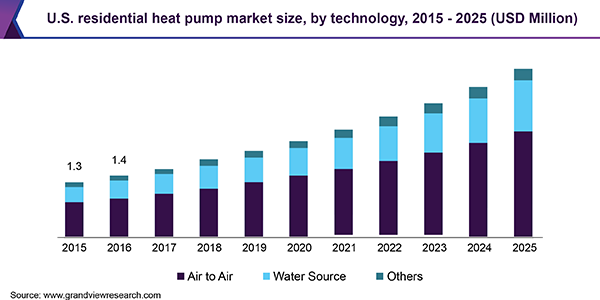

Technology Insights

The air to air segment held the largest share of more than 60.0% in 2018 owing to its less requirement of energy, coupled with higher outputs. These pumps with air as a source can generally deliver approximately three times more energy than the amount of electricity they consume. This is one of the key factors that are responsible for the significant growth of these air source pumps. Furthermore, these air sourced residential heat pumps can be powered by wind or even solar power in place of conventionally produced electricity.

These technological advantages of air sourced heat pumps are opening new avenues across the globe. Major manufacturers including Daikin Industries, Ltd., Emerson Electric Co., Carrier Corporation, Vaillant Group, Stiebel Eltron, and Trane are launching new air sourced products to cater to the increasing demand in the market. For instance, in June 2017, Stiebel Eltron, a German manufacturer, pioneering in central heating products such as heat pumps, introduced its technologically advanced plug and play version of one of its popular WPL air source heat pumps. This heat pump has qualities including quiet running, modern compact design, and active cooling. Also, it meets all the modern household requirements by using innovative inverter compressor technology to provide home heating.

Power Source Insights

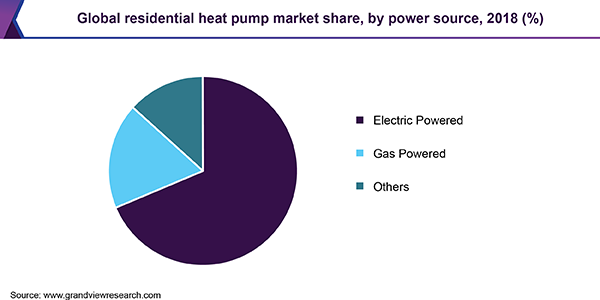

Electric powered residential heat pumps dominated the market, accounting for a share of more than 65.0% in 2018 owing to their least or no greenhouse gas emissions. According to the data provided by the International Energy Agency (IEA), electric heat pumps still meet less than 3% of heating requirements in residential buildings across the globe. These electrically powered equipment have the potential of supplying more than 90% of global water and space heating with the least greenhouse gas emissions. Increasing renewable electricity production across the globe is promoting the scope for this electrically powered equipment. For instance, according to the Ministry of Power, Government of India, the ministerial body has set a target to produce 175 GigaWatt of electricity by 2022. These government initiatives are expected to open new avenues for these types of residential pumps across the globe.

Gas sourced residential heat pumps provide affordable heating with the least amount of carbon dioxide emissions. These residential heat pumps are so environmentally friendly, that the U.K. government even offers incentives for installing them in the house. The U.K. government has introduced the Renewable Heat Incentive (RHI) scheme under which people are eligible for cash payments by the government in seven years for installing renewable technology such as heat pumps. The U.K. Government anticipated that the RHI scheme will help to contribute towards the 2020 ambition. 12% of the energy required for heating solutions in-household would be provided from renewable sources. These initiatives are expected to boost the demand for residential heat pumps over the foreseeable future.

Regional Insights

The Asia Pacific was the largest regional market for residential heat pumps, accounting for more than 40.0% share of the overall revenue in 2018. The growth is attributed to a large consumer base in various countries including China, Japan, and South Korea. According to the International Energy Agency (IEA), in 2017, approximately 80% of new installations of household heat pumps were done in the U.S., China, and Japan, collectively. Moreover, the purchase of water heaters (primarily for sanitary hot water utilization) has increased by three times since 2010, largely driven by significant demand from China. These consumer trends are expected to contribute to the regional residential heat pump market growth over the foreseeable future.

Europe is expected to be the fastest-growing region in the market, expanding at a CAGR of 12.2% from 2019 to 2025 as a result of increasing awareness regarding climate change and global warming. According to the International Energy Agency (IEA), in 2017, around one million households installed the pumps including heat pumps for sanitary hot water production. Moreover, Germany, Estonia, Sweden, Finland, France, and Norway accounted for the maximum penetration rate, with over 25 heat pumps sold per 1,000 households annually.

Residential Heat Pump Market Share Insights

The global market is consolidated in nature as a result of the presence of a large number of players across the globe and a major share of the market is held by a few strong players with a global presence. Major manufacturers include Daikin Industries, Ltd., Emerson Electric Co., Carrier Corporation, Vaillant Group, Mitsubishi Electric Corporation, and Robert Bosch LLC. Moreover, these players are manufacturing compact and technologically advanced pumps with higher efficiency to cater to the increasing demand for clean and green cooling solutions in the residential sector.

Furthermore, key manufacturers are adopting various strategies such as innovative product launch and mergers & acquisitions to gain the maximum market share. For instance, in June 2019, Nortek Global HVAC, a U.S. based manufacturer of HVAC equipment, introduced the new W-Series of heat pump and air conditioning equipment primarily for the residential sector and light commercial applications. These product launches are expected to open new avenues for residential heat pumps over the forecast period.

Report Scope

Attribute

Details

The base year for estimation

2018

Actual estimates/Historical data

2015 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Million & CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Report coverage

U.S., Germany, Sweden, France, China, Japan, South Korea, and Saudi Arabia

Country scope

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For this study, Grand View Research has segmented the global residential heat pump market report based on technology, power source, and region:

-

Technology Outlook (Revenue, USD Million, 2015 - 2025)

-

Air to Air

-

Water Source

-

Others

-

-

Power Source Outlook (Revenue, USD Million, 2015 - 2025)

-

Electric Powered

-

Gas Powered

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

Sweden

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."