Residential Lighting Fixtures Market Trends

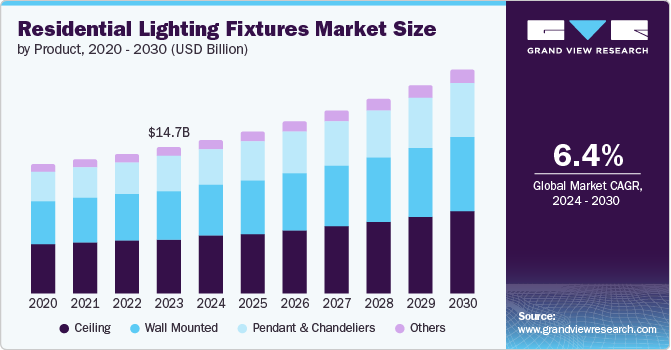

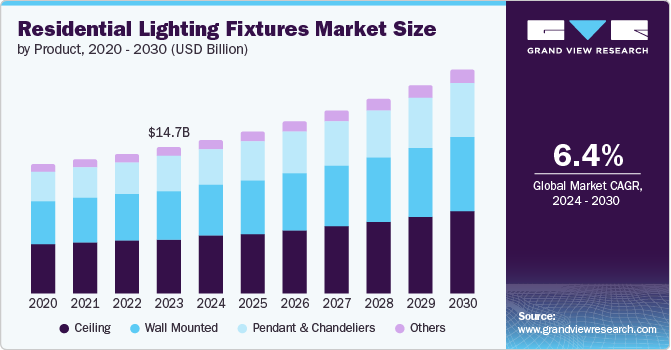

The global residential lighting fixtures market size was valued at USD 14.66 billion in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030. Growing demand for energy-efficient & economical lighting fixtures and rising urbanization & population growth are driving the market growth. As the spending power of consumers increases, there is an increase in willingness to spend on lighting fixtures. Furthermore, high demand for LED lighting fixtures and availability of different designs is fueling the residential lighting fixtures market growth.

Increasing demand for smart lighting solutions at global level and incorporation of advanced technologies such as the Internet of Things (IoT) with lighting solutions is creating opportunities for lighting fixture companies. Adaptive lighting, remote control, and energy optimization are some features of smart lighting that are driving the market growth.

A rising focus on sustainability is expected to drive the adoption of energy-efficient lighting solutions, which is expected to boost the lighting fixture market growth. Increasing demand for energy-efficient LEDs offers new opportunities to the market players.

The global lighting market is shifting from traditional technologies such as incandescent and fluorescent lighting to more advanced LED lighting technology. Consumers have been increasingly spending more on home décor due to the increasing purchasing power. In addition, the availability of affordable and attractive lights is projected to fuel the product demand.

Product Insights & Trends

The ceiling segment accounted for the largest share of 38.0% in 2023. The increase in smart homes has boosted the demand for ceiling lighting fixtures that can be easily integrated with smart technologies, allowing users to control their lighting remotely with smartphones or voice commands. Ceiling lighting fixtures are available in various designs, shapes, and sizes, offering homeowners a wide range of options to enhance their interior decor and create different atmospheres in living spaces, which makes them a popular option for residential lighting solutions.

The pendant & chandeliers segment is projected to witness the fastest CAGR of 7.1% over the forecast period. Pendant lights are known for their energy-efficient nature, consuming less electricity than traditional lighting fixtures. Chandeliers add a touch of luxury and elegance to home interiors, making them a popular option for homeowners seeking upscale decor.

Source Insights & Trends

The LED & OLED segment dominated the market with 69.3% of revenue share in 2023. The rise in demand for LED & OLED lighting fixtures can be attributed to their energy efficiency, affordability and extended lifespan. These lights use much less energy compared to traditional incandescent bulbs, leading to reduced electricity bills for consumers.

The fluorescent segment is anticipated to grow at a CAGR of 1.2% over the forecast period. Fluorescent lights are known for their high efficiency and brightness which makes them suitable for range of indoor lighting applications. The affordability of fluorescent fixtures makes them a popular option for budget-conscious consumers looking for energy-efficient lighting solutions.

Distribution Channel Insights & Trends

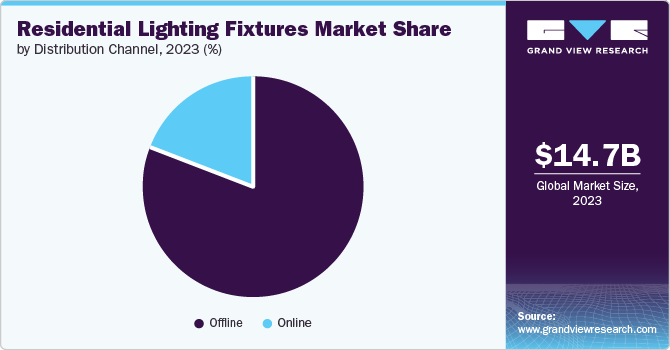

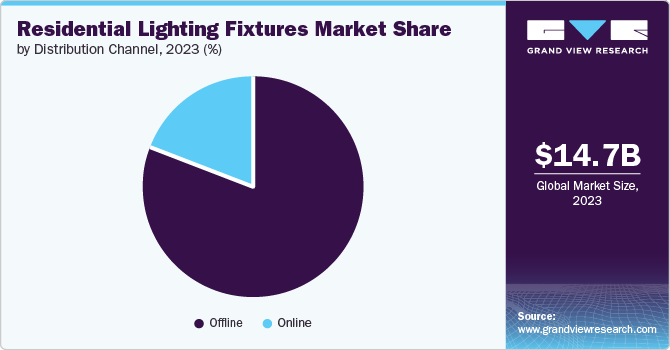

The offline segment dominated the market with a share of 81.4% in 2023. Consumers prefer to physically touch and feel the products before making a purchase decision. Furthermore, offline stores provide customers with the opportunity to consult with sales representatives which can help them make better choices based on their specific requirements and preferences.

The online segment is projected to grow at the fastest CAGR of 8.6% over the forecast period. Online platforms also provide a level of flexibility, such as accessible for 24/7 and the convenience to shop from anywhere with an internet connection, that offline stores may not offer. Customers can easily view a variety of products from different brands, compare prices, read reviews, and buy items all from the comfort of their own homes with minimal effort.

Regional Insights & Trends

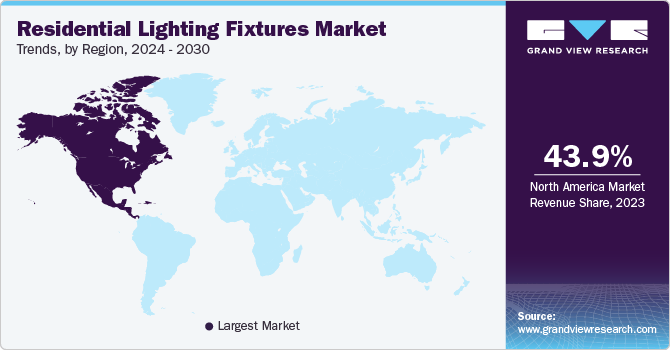

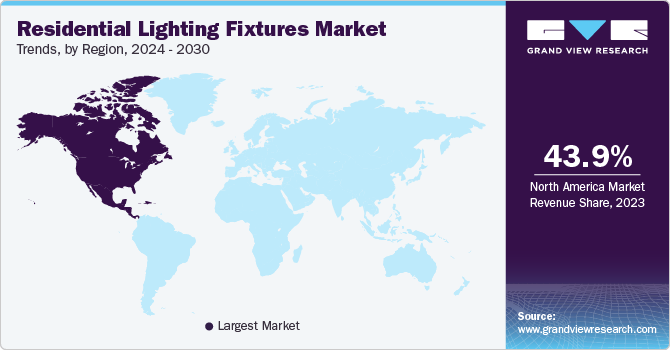

North America residential lighting fixtures market held 43.9% share in 2023. It is expected to grow rapidly in the coming years due to the rising trend of smart homes in this region.

U.S. Residential Lighting Fixtures Market Trends

The residential lighting fixtures market in the U.S. dominated the North American residential lighting fixtures market with a share of 89.4% in 2023. It is attributed to its strict energy efficiency regulations and a growing awareness of sustainability among consumers.

Europe Residential Lighting Fixtures Market Trends

Europe residential lighting fixtures market was identified as a lucrative region in 2023 due to the increasing focus on energy efficiency and sustainability. Furthermore, strict regulations and initiatives focused on reducing carbon emissions and promoting energy-efficient practices are encouraging the adoption of environment friendly lighting solutions in residential buildings across Europe.

The UK residential lighting fixtures market is expected to grow rapidly in the coming years due to the increasing awareness among consumers about the importance of quality indoor lighting for enhancing living spaces.

The Germany residential lighting fixtures market held a substantial share in 2023. This is due to the country’s robust infrastructure development projects along with an increasing focus on smart building solutions, which has created opportunities for manufacturers to introduce innovative lighting products tailored to modern architectural designs and smart home applications.

Asia Pacific Residential Lighting Fixtures Market Trends

The Asia Pacific market is anticipated to witness significant growth in the coming years owing to the rapid urbanization and industrialization in the region. With a large population and ongoing urbanization trends, there is a continuous demand for new residential properties, leading to a surge in the installation of lighting fixtures.

The India residential lighting fixtures market held a substantial share due to several factors including country’s expanding middle-class population with higher purchasing power.

Key Residential Lighting Fixtures Company Insights

Some of the key companies in the residential lighting fixtures market include Koninklijke Philips N.V.; Hubbell Incorporated; Vorlane; Cree Lighting and Kichler Lighting LLC. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

- Panasonic Corporation offers a wide range of lighting solutions for residential spaces, focusing on energy efficiency, design aesthetics, and technological innovation.

Key Residential Lighting Fixtures Companies:

The following are the leading companies in the residential lighting fixtures market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V.

- Hubbell Incorporated

- Vorlane

- Cree Lighting USA LLC.

- Kichler Lighting LLC.

- Cooper Lighting LLC.

- General Electric Company

- ACUITY BRANDS, INC

- Eaton.

- Panasonic Corporation

Recent Developments

-

In March 2023, Signify acquired Intelligent Lighting Controls, Inc. (ILC), a wired control systems manufacturer. The acquisition is expected to add to Signify’s well established technology and energy-saving solutions in North American market.

Residential Lighting Fixtures Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 15.40 billion

|

|

Revenue forecast in 2030

|

USD 22.41 billion

|

|

Growth Rate

|

CAGR of 6.4% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, source, distribution channel, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, South Africa

|

|

Key companies profiled

|

Koninklijke Philips N.V.; Hubbell Incorporated; Vorlane; Cree Lighting; Kichler Lighting LLC; Cooper Lighting, LLC; General Electric; Acuity Brands, Inc.; Eaton Corporation; Panasonic Corporation

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Residential Lighting Fixtures Market Report Segmentation

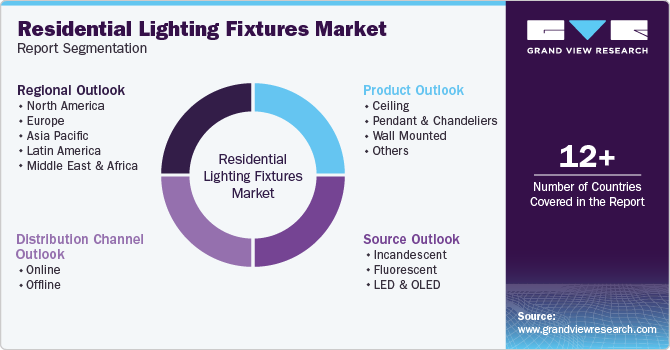

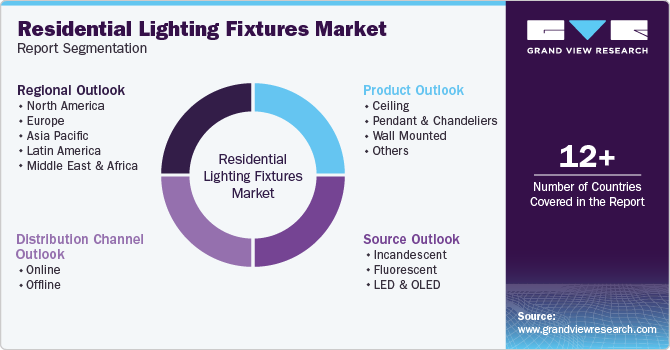

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the residential lighting fixtures market report based on product, source, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceiling

-

Pendant & Chandeliers

-

Wall Mounted

-

Others

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Incandescent

-

Fluorescent

-

LED & OLED

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Latin America

-

MEA