- Home

- »

- Semiconductors

- »

-

Retail Automation Market Size & Share Analysis Report, 2030GVR Report cover

![Retail Automation Market Size, Share & Trends Report]()

Retail Automation Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Camera, PoS), By Implementation (In-store, Warehouse), By End-use (Fuel Stations, Supermarkets), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-219-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Retail Automation Market Summary

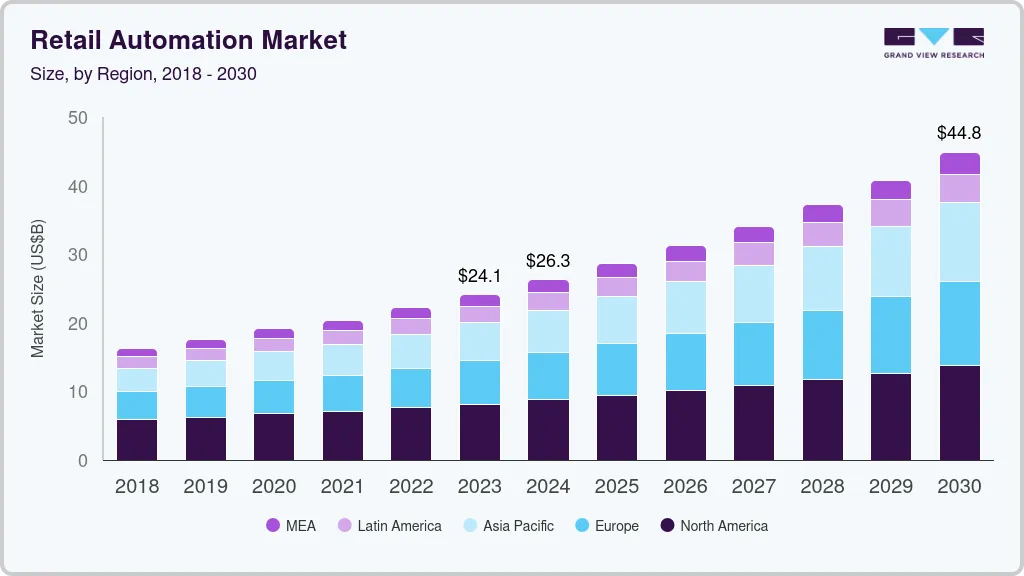

The global retail automation market size was estimated at USD 24,117.1 million in 2023 and is projected to reach USD 44,837.1 million by 2030, growing at a CAGR of 9.3% from 2024 to 2030. The demand for streamlining retail operational workflows to improve business processes, better transparency and visibility in supply chains, and improve organizational efficiency in the long run are driving market growth.

Key Market Trends & Insights

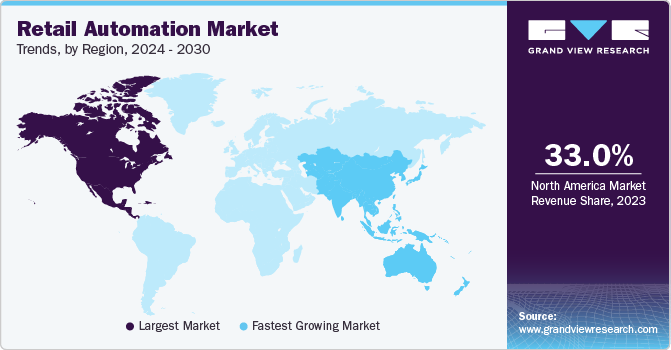

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Brazil is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, in-store accounted for a revenue of USD 14,313.5 million in 2023.

- Warehouse is the most lucrative implementation segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 24,117.1 Million

- 2030 Projected Market Size: USD 44,837.1 Million

- CAGR (2024-2030): 9.3%

- North America: Largest market in 2023

Furthermore, retail automation software provides end-to-end visibility, eliminates redundancies, and integrates automation technologies, such as the Internet of Things (IoT) and Machine Learning (ML), which are also expected to contribute to market growth. Retailer operators are updating their point-of-sale (POS) systems to enhance the convenience and transparency of the shops.

In addition, small retail stores are seen implementing POS systems due to their cost-effectiveness. The POS system offers secure functionality in an integrated, user-friendly platform that helps users manage every part of the business due to its enhanced hardware and advanced technology. For instance, in January 2023, Markt POS, a retail solutions provider, announced unified cloud-based POS software for SMEs, groceries, and supermarkets. The POS providers offer their users a seamless experience by integrating all crucial elements of the grocery business into one platform, including payments, POS, loyalty features, e-commerce, and analytics.

Therefore, the adoption of an integrated cloud-based POS system is expected to drive market growth. Advanced technology platforms, such as robotics process automation (RPA), artificial intelligence (AI), and ML, are expected to reduce expenses by increasing process automation across the retail industry. For instance, in November 2023, Brain Corporation, a robotics AI software provider, expanded its partnership with Dane Technologies, a logistics solutions provider, to develop inventory-scanning systems for retailers built on Brain Corporation's robotics platform. The companies would combine Brain Corporation's expertise in autonomous systems and AI with Dane Technologies’ experience in deploying retail and manufacturing technologies.

Thus, increasing adoption of robotics automation across the retail industry is expected to drive market growth. Using automation technologies can reduce the need for human intervention to complete repetitive tasks, such as maintaining retail products across the shop. Automation is the quickest and most accurate way to perform an operation and repeat the process, allowing the business to run smoothly, efficiently, and consistently. Retail automation fastens retail transactions and allows browsing merchandise using a touchscreen interface. Retail automation lets customers select the product of their choice and pay with a credit or debit card.

Thus, increasing consumer preference for online retail transactions is expected to drive retail software providers to innovate retail solutions, driving market growth. The expansion of multiple products has increased the demand for efficient warehouse and inventory management systems. Various prominent companies in the e-commerce sector, such as Amazon and Walmart, have begun deploying robots to handle the labor shortage and increasing demand. Thus, in the future, startups are also expected to enter the market. In addition, as the focus shifts to the convenience and customization of shopping experiences, technologies, such as automated inventory management and self-checkout systems, are witnessing high demand.

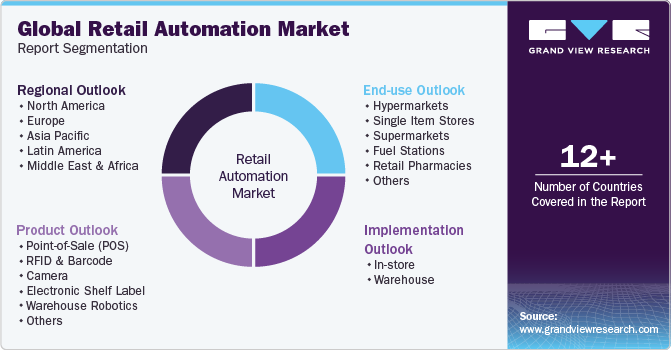

Implementation Insights

The in-store segment accounted for the largest revenue share of nearly 60% in 2023. The segment growth is attributed to factors, such as the growing emphasis on omnichannel retailing, robotics and AI developments, and rising need for contactless & self-service technologies. Furthermore, operators facilitate lower maintenance costs related to routine inspections by automating retail locations and utilizing cloud-based solutions. Notifications sent and received in real-time via the cloud platforms allow quick problem-solving. Thus, all these factors collectively contribute to segment growth.

The warehouse segment is expected to register a considerable CAGR of 10% over the forecast period. Due to the increasing use of autonomous guided vehicles (AGV) and autonomous mobile robotics (AMR) in the retail industry, automation has become more prevalent. It is expected to drive demand for retail automation over the projected period. In addition, organizations in the industry benefit from utilizing cognitive technology and modifying their warehouse storage. Therefore, these factors are expected to drive segment growth.

Product Insights

The point-of-sale (POS) segment accounted for the largest revenue share of 25% in 2023. The factors driving the segment growth include an increase in the demand for merchandise optimization, a rise in the adoption of the Internet of Things (IoT), application programming interface (API), and robotics process automation. Moreover, the emergence of logistic warehousing, the growing trend of e-commerce and m-commerce retail, improvements in real-time data analytics, and the evolution of virtual marketing are driving segment growth.

The camera segment is expected to exhibit a significant CAGR of over 10% from 2024 to 2030. Compared to other commercial properties, retail stores, and malls are more vulnerable to security risks like theft and inventory loss. Long-term benefits of investing in cameras as a retail solution include increasing store profits, lowering retail losses, lowering thefts, assessing employee tasks, and comprehending customer purchasing patterns. Thus, end-users use camera products for retail automation process, driving segment growth.

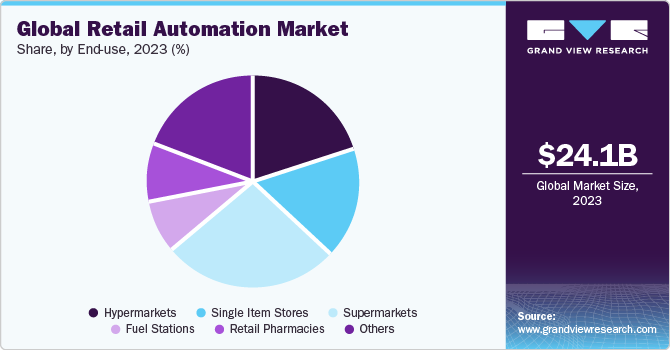

End-use Insights

The supermarket segment held the highest market share of around 27% in 2023. Supermarkets are increasingly implementing retail automation to enhance customer satisfaction, shorter shopping trips, less waste, and cost savings, contributing to better customer experiences and increased recurring business. In addition, the market has the potential for growth in emerging economies. Businesses are changing quickly, and supermarkets are adapting to stay one step ahead of their rivals. Prioritizing the simplification of business processes, supermarkets are rapidly adopting retail automation software and solutions.

The hypermarket segment is expected to register a CAGR of more than 10% from 2024 to 2030. Due to the wide variety of products available in hypermarkets, streamlining the store can reduce bookkeeping costs, thereby protecting profit margin. Various processes, such as shelf stocking, inventory management, and checkout operations, can be automated with retail automation. Automating routine tasks allows employees to focus on more complex and customer-centric activities, enhancing productivity. Automated stores also experience significant cost savings. These factors collectively drive the demand for retail automation in the segment.

Regional Insights

North America held the highest share of more than 33% in 2023. Factors, such as the higher rate of automation technology adoption by significant businesses, increasing e-commerce market, and growing labor expenses, are driving market growth in this region. Furthermore, many manufacturers have relocated to the region due to a large customer base and to achieve economies of scale.Local retailers in the region are starting to offer more concrete benefits to customers, like loyalty programs, to encourage digital payments, thereby, driving the demand for retail automation platforms.

Asia Pacific is expected to register the fastest CAGR of more than 11.0% from 2024 to 2030. Asia Pacific has observed a rising number of small- and medium-sized enterprises, and they are widely adopting automation technology. There are numerous ways to increase operational efficiency with emerging technologies, from the loading dock to the checkout line. Furthermore, mobile checkout devices in developing countries have made it possible to sell goods anywhere, including at events, pop-up stores, kiosks, and other public areas. Due to this, new automation technologies are going to have an impact on the retail industry in this region.

Key Companies & Market Share Insights

Key players maintain an exhaustive product portfolio. They maintain a competitive edge in the market, their product offerings, the applications segment they serve, the sophistication of their technology, their strategy to differentiate their products, and their industry impact. Some of the strategies undertaken by these players include collaborations, partnerships & agreements, new product developments, capability expansion, mergers & acquisitions, and research & development initiatives.

For instance, in November 2023, Datalogic S.p.A., an industrial automation technology provider, launched intralogistics solutions that integrate safety technology and barcode reading to support supply chain applications and end-users' intralogistics by combining safety technology with barcode reading. Robotics, palletizing, automated warehousing for crates and pallets, automated guided vehicles, vertical storage carousels, and end-of-line packaging are applications of intralogistics solutions.

Key Retail Automation Companies:

- 6 River Systems LLC

- Amazon Web Services, Inc.

- Casio Computer Co. Ltd.

- Datalogic S.p.A.

- Diebold Nixdorf, Incorporated.

- E&K Automation GmbH

- ECR Software Corporation

- Honeywell Scanning and Mobility

- Kiosk & Display LLC

- Kuka AG

- NCR Corporation

- Pricer AB

- Toshiba Global Commerce Solutions Inc.

- Wincor Nixdorf AG

- Zebra Technologies Corporation

Retail Automation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.26 billion

Revenue forecast in 2030

USD 44.84 billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Implementation, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

6 River Systems LLC; Amazon Web Services, Inc.; Casio Computer Co. Ltd.; Datalogic S.p.A.; Diebold Nixdorf, Inc.; E&K Automation GmbH; ECR Software Corporation; Honeywell Scanning and Mobility; Kiosk & Display LLC; Kuka AG; NCR Corp.; Pricer AB; Toshiba Global Commerce Solutions Inc.; Wincor Nixdorf AG; Zebra Technologies Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retail Automation Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global retail automation market report on the basis of implementation, product, end-use, and region:

-

Implementation Outlook (Revenue, USD Billion, 2018 - 2030)

-

In-store

-

Warehouse

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Point-of-Sale (POS)

-

RFID & Barcode

-

Camera

-

Electronic Shelf Label

-

Warehouse Robotics

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets

-

Single Item Stores

-

Supermarkets

-

Fuel Stations

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global retail automation market size was estimated at USD 24.12 billion in 2023 and is expected to reach USD 26.26 billion in 2024.

b. The global retail automation market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030 to reach USD 44.84 billion by 2030..

b. North America dominated the retail automation market with a share of 33% in 2023. This is attributable to the increasing e-commerce market, and growing labor expenses.

b. Some key players operating in the retail automation market include 6 River Systems LLC; Amazon Web Services, Inc.; Casio Computer Co. Ltd.; Datalogic S.p.A.; Diebold Nixdorf, Incorporated; E&K Automation GmbH; ECR Software Corporation; Honeywell Scanning and Mobility; Kiosk & Display LLC; Kuka AG; NCR Corporation; Pricer AB; Toshiba Global Commerce Solutions Inc.; Wincor Nixdorf AG; and Zebra Technologies Corporation.

b. Key factors that are driving the market growth include the demand for streamlining retail operational workflows to improve business processes, better transparency and visibility in supply chains, and improve organizational efficiency in long run and adoption of integrated cloud-based POS system.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.