- Home

- »

- Automotive & Transportation

- »

-

Retail Logistics Market Size, Share & Growth Report, 2030GVR Report cover

![Retail Logistics Market Size, Share & Trends Report]()

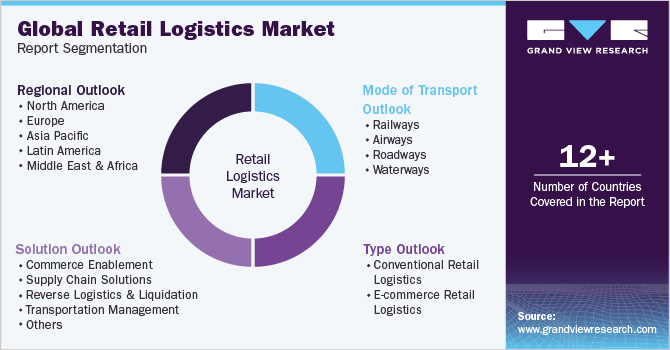

Retail Logistics Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Conventional Retail Logistics, E-commerce Retail Logistics), By Solution, By Mode Of Transport, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-288-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Retail Logistics Market Summary

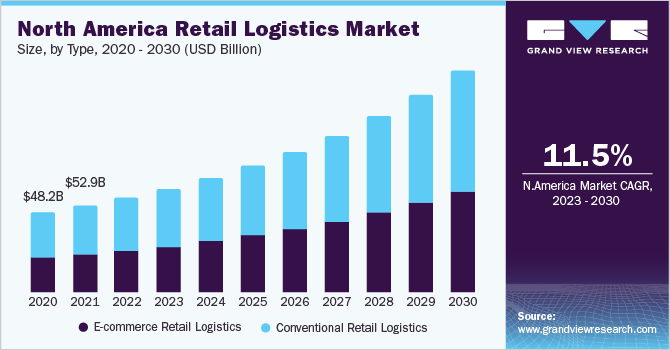

The global retail logistics market size was estimated at USD 246.85 billion in 2022 and is projected to reach USD 626.59 billion by 2030, growing at a CAGR of 12.5% from 2023 to 2030. The market is expected to experience gradual growth as a result of heightened global trade, especially in developing economies, and the expansion of global transportation infrastructure.

Key Market Trends & Insights

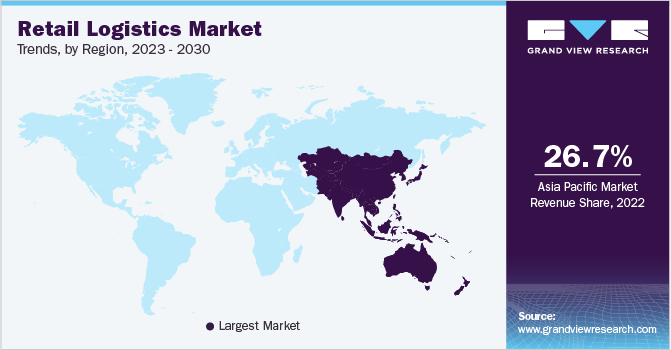

- Asia Pacific dominated the global retail logistics market with the largest revenue share of 26.7% in 2022.

- By type, the conventional retail logistics segment led the market with the largest revenue share of 56.1% in 2022.

- By solution, the supply chain solution segment led the market with the largest revenue share of 35.5% in 2022.

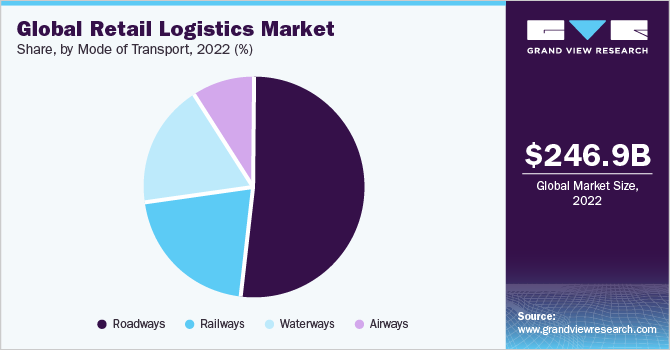

- By mode of transport, the roadways segment is expected to register at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 246.85 Billion

- 2030 Projected Market Size: USD 626.59 Billion

- CAGR (2023-2030): 12.5%

- Asia Pacific: Largest market in 2022

For instance, according to the World Trade Organization (WTO) in 2022, the value of worldwide goods trade increased by 12% to USD 25.3 trillion, owing in part to rising global commodity prices. The retail logistics system plays a crucial role in facilitating the efficient movement of both durable and non-durable goods to the end-users. Additionally, logistics has led to faster delivery times, reduced fulfillment expenses, and increased potential for prioritizing customer satisfaction over administrative tasks within the retail sector.

The retail logistics industry is witnessing a profound transformation fueled by advancements in big data analytics and artificial intelligence (AI). The integration of these technologies presents unprecedented opportunities for retailers to optimize supply chain operations, enhance customer experiences, and drive business growth. Accurate demand forecasting is critical for efficient retail logistics. Machine learning algorithms may change forecasts dynamically depending on real-time data, allowing for proactive inventory management and decreasing stockouts or overstock situations. Retailers may enhance working capital utilization, reduce carrying costs, and provide improved customer experiences by optimizing inventory levels.

The adoption of multimodal transportation has experienced considerable growth as a result of reduced vehicle costs, decreased cargo handling time, and streamlined customs controls. Embracing multiple modes of transportation has emerged as a notable trend in the market, involving the utilization of trucks, ships, railcars, or aircraft. Integrating multimodal transportation not only reduces inventory costs but also empowers inventory operators to exercise control over merchandise expenses. By efficiently and cost-effectively transferring goods during outbound logistics, multimodal transportation supports merchants in their logistical operations.

Furthermore, the last-mile delivery strategy is anticipated to drive the growth of the market in the coming years. With the ability to access products from various online sources, customers have the advantage of comparing delivery time, prices, features, specifications, and compatibility requirements. This puts traditional distributors and brick-and-mortar businesses at a disadvantage, as e-commerce platforms offer superior advantages. These advantages, which include the ability to compare and evaluate products, are propelling the retail e-commerce industry forward, and this trend is expected to persist in the years to come.

The COVID-19 outbreak has taken a severe toll on the global economy in three ways:

-

Drying up financial reserves and cash flows

-

Suppressing profitability

-

Affecting production and demand directly

Retail logistics companies have been largely affected by the COVID-19 pandemic. Due to a lack of manpower and supply chain disruptions during the pandemic's early stages (Q1 and Q2), the industry faced a temporary dip. Later, as consumers eschewed in-store purchases favoring internet shopping, the rise in online purchases increased the burden on retail logistics companies' distribution and logistical services.

Type Insights

The conventional retail logistics segment dominated the market, accounting for a revenue share of 56.1% in 2022. The segment’s growth is attributed to the growing usage of conventional retail logistics services by customers who have limited reliance on the Internet and hence prefer to shop in conventional retail establishments. Furthermore, it has been discovered that approximately 36% of shoppers prefer to purchase things from traditional retail outlets after researching them online. Moreover, buyers can pick up and check a product in a retail store. It also delivers immediate gratification because customers can purchase a thing without waiting for it to be delivered.

The e-commerce retail logistics segment is estimated to grow at the highest CAGR of 13.2% over the forecast period. The growth is primarily attributable to the global spread of the coronavirus, which resulted in a surge in sales for e-commerce portals. Furthermore, rising internet penetration, combined with perks such as easy and free returns/exchanges, fast delivery, lower shipping costs, and a vast product selection, contribute to e-commerce retail's rapid rise.

As a result, logistics companies invest in enhancing and diversifying their services to meet the fast-rising e-commerce sector. For instance, in October 2022, Aramex PJSC recently declared that it had successfully acquired Access USA Shipping, LLC (MyUS), a technology-focused worldwide platform facilitating cross-border e-commerce. Aramex obtained all required regulatory authorizations and finalized the acquisition, paying a total cash amount of approximately USD 265 million.

Solution Insights

The ‘supply chain solutions segment was valued at USD 87.80 billion in 2022 and held the largest revenue share of 35.5% in 2022. This segment is expected to continue its dominance over the forecast period. The supply chain ensures personalized kitting & order fulfillment, on-time delivery, optimizes omnichannel operations, and manages customer returns efficiently. It also allows quick direct-to-consumer and direct-to-store shipment, boosting warehouse efficiency and inventory management. Furthermore, the segment is expected to rise at the fastest CAGR of over 14.0% from 2023 to 2030, owing to the growing usage of cloud-based supply chain systems, which assist in tracking and optimizing transportation and managing returns.

Over the projection period, the reverse logistics and liquidation segment is expected to increase significantly. The booming e-commerce business, combined with an increase in the number of e-shoppers, is driving up demand for reliable reverse logistics services. Customers are increasingly favoring simple and quick returns/exchanges, so retailers aim to ease the process of replacing online goods that are simple and convenient for customers. Companies such as FedEx plan to launch a return solution for merchants in the U.S. marketplace. For instance, FedEx Corp. announced the debut of FedEx Consolidated Returns in the United States, a service that provides a low-cost, simple e-commerce returns alternative for merchants to pass on to customers. The extended solution will be available in early 2023.

Mode of Transport Insights

The roadways mode of transport segment held the largest market share of 51.9% in 2022 in terms of revenue and is expected to dominate over the forecast period. Increasing demand for roadway vehicles to transport retail goods over long distances, especially in domestic regions, has increased the growth of the roadways segment. Trucks and cargos with large carrying capacities make a better choice for retail companies to opt for road transport. Moreover, several government measures encourage sector growth. For instance, the Federal Motor Carrier Safety Administration's recent regulations promote the use of cameras to substitute rearview mirrors to increase the safety of truck drivers.

Furthermore, the demand for the roadways mode of transportation segment is driven by the improved road connectivity in developing countries and the excellent road infrastructure in developed nations. This enhanced connectivity plays a vital role in facilitating the delivery and pick-up of products for retail logistics companies in numerous tier 2 and tier 3 cities across different countries. With ongoing advancements in road transportation systems and the continuous improvement of highways globally, this trend is expected to persist and grow in the years to come.

Regional Insights

Asia Pacific accounted for the largest revenue share of 26.7% in 2022. The region is home to a vast customer base and has witnessed significant adoption of e-commerce channels by individuals. China, Japan, Australia, and India are among the leading item exporters, accounting for a considerable share of worldwide retail e-commerce sales. As a result, the region's promising e-commerce growth prospects are the primary drivers of regional retail logistics market expansion.

Additionally, various government initiatives such as Digital India and the implementation of the Goods and Services Tax (GST) have created a conducive environment for e-commerce growth. These initiatives have aimed to digitize various sectors, simplify taxation processes, and promote a digital economy, further supporting the expansion of e-commerce in India. Such initiatives offer significant opportunities for market growth over the forecast period.

Other factors projected to enhance regional market expansion include a growing focus on transportation methods and ongoing logistics infrastructure upgrades in emerging countries. For instance, in August 2022, the Ministry of Road Transport & Highways (MoRTH) is developing multimodal logistics parks to solve underdeveloped road and material handling infrastructure as part of the Indian Government's Logistics Efficiency Enhancement Program (LEEP).

In addition, North America is expected to have a significant share in 2022. The presence of numerous prominent competitors such as United Parcel Service of America, Inc., XPO Logistics, Inc., FedEx, Ryder System Inc., C.H. Robinson Worldwide, Inc., and Expeditors International of Washington, Inc. is helping to drive regional market growth.

Key Companies & Market Share Insights

Major players operating in the retail logistics market include XPO Logistics, Inc.; Nippon Express; C.H. Robinson Worldwide, Inc.; DSV; and Kuehne + Nagel International. Key corporations are expanding their service portfolios, forming partnerships, and merging and acquiring small and medium-sized businesses to expand their customer base.

For instance, in October 2022, DHL Supply Chain, a contract logistics company and a part of Deutsche Post DHL Group, headquartered in Germany, was selected by Boohoo Group plc to oversee its inaugural distribution center in the United States. Boohoo, a fashion retailer based in the UK with annual sales exceeding USD 2.4 billion, will receive warehousing solutions from DHL Supply Chain to facilitate its projected expansion in the U.S. market. Some prominent players in the global retail logistics market include:

-

XPO Logistics, Inc.

-

DSV

-

Kuehne + Nagel International

-

C.H. Robinson Worldwide, Inc.

-

Nippon Express

-

FedEx

-

Schneider

-

United Parcel Service

-

APL Logistics Ltd

-

DHL International GmbH

-

A.P. Moller - Maersk

Retail Logistics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 274.31 billion

Revenue forecast in 2030

USD 626.59 billion

Growth rate

CAGR of 12.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, solution, mode of transport, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Australia; Brazil; Mexico

Key companies profiled

XPO Logistics, Inc.; DSV; Kuehne + Nagel International; C.H. Robinson Worldwide, Inc.; Nippon Express; FedEx; Schneider; United Parcel Service; APL Logistics Ltd; DHL International GmbH; A.P. Moller - Maersk

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retail Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global retail logistics market report based on type, solution, mode of transport, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Conventional Retail Logistics

-

E-commerce Retail Logistics

-

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Commerce Enablement

-

Supply Chain Solutions

-

Reverse Logistics & Liquidation

-

Transportation Management

-

Others

-

-

Mode of Transport Outlook (Revenue, USD Billion, 2017 - 2030)

-

Railways

-

Airways

-

Roadways

-

Waterways

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global retail logistics market size was estimated at USD 246.85 billion in 2022 and is expected to reach USD 274.31 billion in 2023.

b. The global retail logistics market is expected to grow at a compound annual growth rate of 12.5% from 2023 to 2030 to reach USD 626.59 billion by 2030.

b. The conventional retail logistics segment accounted for the largest revenue share of 56.13% in 2022 and is expected to remain dominant over the forecast period in the market.

b. Some key players operating in the retail logistics market include XPO Logistics, Inc., DSV, Kuehne + Nagel International, C.H. Robinson Worldwide, Inc., Nippon Express, among others.

b. Key factors that are driving the retail logistics market growth include an increase in global trade activities, especially in emerging economies, and development in logistics infrastructure globally.

b. The supply chain solutions segment accounted for the largest revenue share of 35.57% in 2022 and is expected to continue its dominance over the forecast period in the retail logistics market.

b. The roadways mode of transport segment accounted for the largest revenue share of 51.90% in 2022 and is expected to continue its dominance over the forecast period in the retail logistics market.

b. The Asia Pacific region accounted for the largest revenue share of 26.76% in 2022 in the retail logistics market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.